The Fed is “Proceeding Carefully,” But Further Hikes Likely if Growth Continues to Stay Strong – Midday Macro – 8/25/2023

Color on Markets, Economy, Policy, and Geopolitics

The Fed is “Proceeding Carefully,” But Further Hikes Likely if Growth Continues to Stay Strong

Midday Macro – 8/25/2023

Market’s Weekly Narrative and Headlines:

The S&P is ending the day and the week higher but well below levels seen immediately following NVDA’s earnings report, as momentum and breadth are still being weighed on by higher yields, although Tech and Growth did outperform on the week. Retail earnings results from Macy, Nordstrom, and others raised some concerns regarding the consumer's health, but overall, results elsewhere drove aggregate forward earnings estimates higher. This was best seen in Nvidia, which massively beat revenue and earning expectations and guided higher only to see its share price drop yesterday, given everyone was already overweight it. 0DTE option activity also led to the massive reversal seen in Thursday's price action and has been a key driver of intraday volatility. On the data front, we continue to see a tale of two cities in housing, with new home sales beating expectations while existing home sales suffer from a lack of inventory as no one wants to give up their 3% mortgage. New durable goods orders were flat in July in real terms, excluding the volatile transportation equipment part, showing further cooling in manufacturing activity. Today’s final August University of Michigan Consumer Confidence reading declined further while one-year-ahead inflation expectations ticked higher to 3.5%. Elsewhere, a slew of regional Fed surveys for manufacturing and service sector activity gave a mixed picture, although “totality” showed a move towards a more neutral growth level. This was echoed by the S&P PMI readings for August, with the overall composite moving lower to 50.

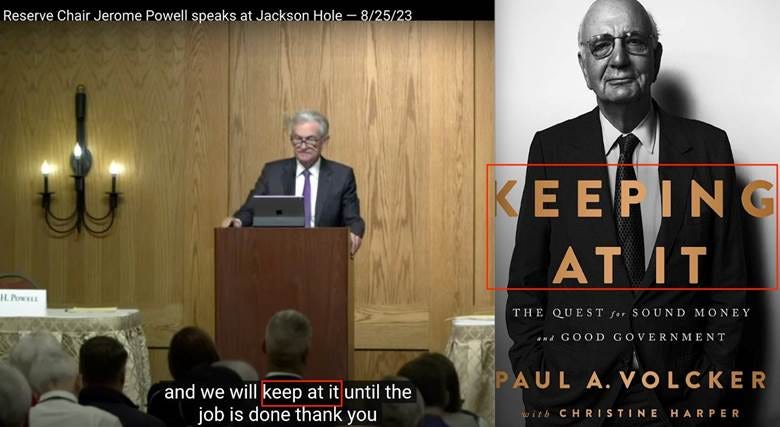

The Fed continued to discount this slowing PMI data, with Powell and company mostly staying the hawkishly tilted course and indicating that although progress had been made, there was more to do. However, unlike his wraith of god J-Hole speech last year, he struck a more even tone that could be summarized by saying the Fed plans to proceed cautiously. However, with labor markets still seen as tight and the Atlanta Fed GDPNow forecasting a rate of growth in Q3 far above trend, a further rate hike later this year is still very much on the table. Turning to energy, oil is ending the week lower, although rallying this afternoon, with eyes on Iraq and Venezuela for additional supply, while inventory levels in the U.S. fell further. Copper continued to recover this week, but markets still are unsure if Xi is serious about supporting the economy, and the constant drip of stimulus measures has yet to improve sentiment toward the property sector there. Finally, the dollar continues its grind higher, with the $DXY looking to end the week above 104 as weaker growth in the U.K. and Eurozone are increasingly weighing on forward rate differentials in favor of King Dollar.

Deeper Dive:

Now that Powell has given his long-awaited Jackson Hole speech, which we cover in greater depth below, markets can breathe a sigh of relief as, although he struck a cautiously hawkish tone, Powell indicated that progress in fighting inflation was being made. Further, he reiterated that the Fed is not considering changing the 2% inflation target level and that the always-existing complexities and uncertainties regarding how the lagged effects of policy changes will hit the real economy along with the uniqueness of the current inflationary wave due to the pandemic shock make estimating the appropriate level of restrictiveness currently harder than normal. As a result, in his words, “risk-management considerations are critical,” and the Fed continues to treat each meeting as a live one, assessing the “totality of the data” and “proceeding carefully.” The problem is that the Fed is discounting any better-than-expected progress in official inflationary readings moving forward by changing the “goals” and connecting the need for a below-trend growth period and further loosening of labor markets to achieve its objectives.

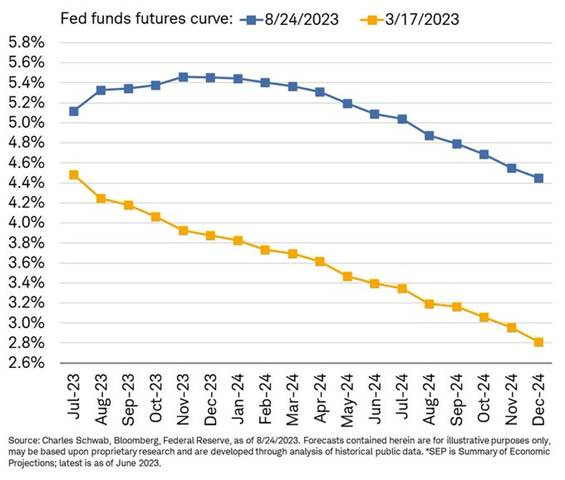

*Market expectations were much more aligned with policymakers going into this Jackhole meeting versus last year, reducing the need for a more hawkish tone

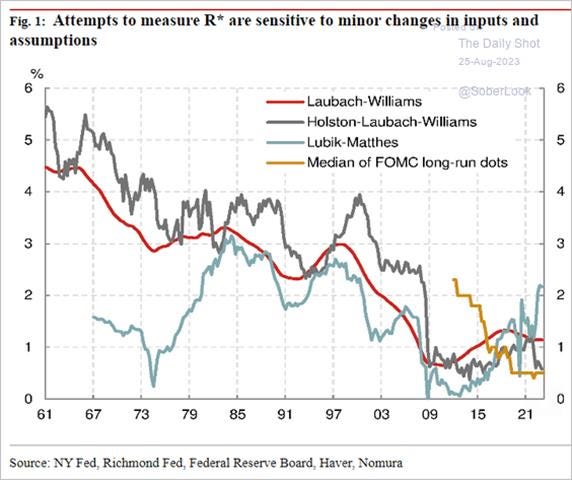

*There are many models to estimate r*, which may be why Powell simply says it is unknown

We still view the current inflationary pulse as mainly supply-side impaired cost-push driven due to the exogenous shock of first the pandemic and later the war in Ukraine and Zero-Covid lockdowns in China. This is opposed to some structural change in labor’s bargaining power, creating a wage spiral feedback loop. Further, the drivers of the increased demand-pull dynamics on inflation are fading as the consumer is increasingly hitting a period of increased headwinds, something we discussed in recent writings. We continue to see leading inflation indicators suggesting a better supply and demand balance. However, we acknowledge a firming in PPI, import/export prices, and business survey readings recently due to rises in energy costs. However, this looks to be fading in August, reducing our worry that headline inflation increases will pull up core again. Firms are also indicating reduced inflation expectations, both for the overall consumer, their products, and labor compensation costs. As a result, we are still reluctant to fully believe this common narrative that “the last mile” of getting inflation back to target is the hardest. There has been notable progress on inflation, with three-month averages for headline, core, and super core now near 2%, 3%, and 1%, respectively. At the same time, the UER has not moved higher over that time, and GDP measures continue to indicate an above-trend period of growth is upon us. Productivity measures have also picked up, negating fears that wage increases are bad for the inflation backdrop, as improved capacity (per unit of capital and labor) reduces shortages and rising real wages are non-inflationary. Simply put, inflation seems uncorrelated with other readings of the economy currently, and may remain so for the remainder of this cycle.

*Long-run Fed funds expectations have been stable since rising during the initial phase of the current inflation pulse

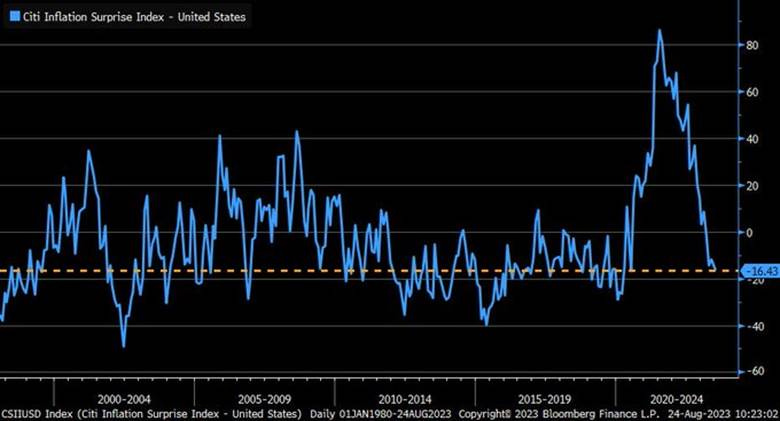

*The U.S. Inflation Surprise Index from Citi is sitting at its lowest since April 2020

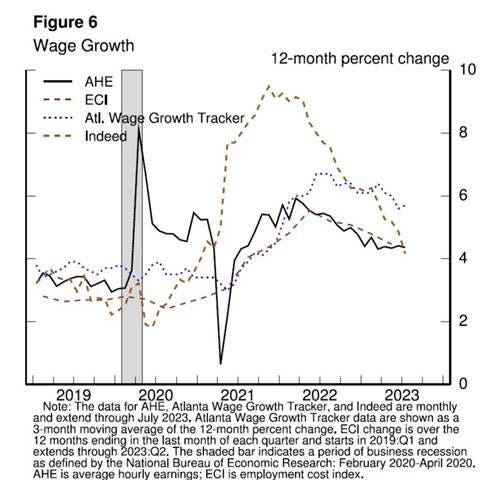

*Wages are trending lower, just not fast enough, and a Phillips Curve mentality keeps policymakers worried that core-service inflation will remain sticky

Putting it all together, we continue to be in a unique inflationary cycle more detached from economic growth and policy than expected. It’s also a global story, which adds to the uncertainty as some central banks are beginning to declare victory and cut rates while others indicate a more hawkish stance will continue. We have entered a period of regional decoupling after the pandemic syned-up growth and policy cycles over the last few years. Turning specifically to the Fed, we continue to believe that policy is restrictive enough and a more patient approach is warranted. However, with that said, we increasingly believe that they will hike rates again in November, given where the totality of the data is. Further, there will be no meaningful shift to indicate a shorter period of time at the terminal rate in the September SEPs, with the growth forecast upgraded, and UER estimates lowered for ’23 and ’24. Of course, much could change quickly, and as a result, our conviction and risk appetite is low. As we have often indicated in our writings here, we believe the headwinds are growing, and a resilient consumer will increasingly become pragmatic. But with labor markets the biggest lagging indicators of the cycle and now increasingly what the Fed is looking at, it will be too late to change course by the time they indicate that policy is too restrictive. We continue to watch the curve for signs that the narrative is changing, with a sustained period of bull steepening indicating that the below-trend period of growth is upon us, and markets recognize it as meaningful enough to change the Fed’s policy intentions.

*With growth stronger, unemployment more resilient, and inflation improving slightly more than expected currently, it will be hard to lower the expected Fed funds rate next year

*U.S. data has come in much better than expected for most of this year, but that may now be changing just as economists/strategist have raised their expectations

We are keeping it shorter this week due to it being the slower period of the year, and hopefully, most of our readers are on holiday. We will not be writing next week as we travel south for some beach time with the family. We will still be delivering further thoughts on our short Mexico ETF position, along with general views on EM, when we return. Our bias is still to be short U.S. and European equities during a seasonally weak period of the year and with expectations that the Fed will remain hawkishly positioned, even as the ECB and BoE become more neutral. Until yields have peaked (we believe somewher around a 4.5% to 4.7% area on the 10yr) we see no reason for a meaningful rally in risk assets generally, and this will not happen until the data cools further globally, especially in the U.S. However, weaker growth in the Eurozone could actually lead to European risk assets getting a better bid, and as a result, we are moving our stop to ensure no losses in our short position there. We have also moved our stops for our homebuilder and transportation sector shorts to capture gains and moved lower our targets. Currently, all our positions are in the green, and we want to ensure we don’t incur losses if central banks change their tune suddenly due to economic growth falling faster than expected, as seems to be the case overseas. Finally, we continue to have high conviction in our dollar long, now up 4%, as it does look like the Fed’s “higher for longer” narrative will continue to grow versus the ECB, BoE, and BoJ, which have increasingly less hawkish intentions. Further, any increase in the general global risk-off tone will also benefit the dollar, and as stated, we see several regions now increasingly seeing economic surprise indexes falling as growth cools faster than expected. In summary, we remain defensively positioned and look to be this way until the end of September before seasonals improve and new incoming weaker data possibly changes the Fed’s hawkish resolve, altering real rate expectations lower and reducing headwinds to earnings growth and multiple expansion.

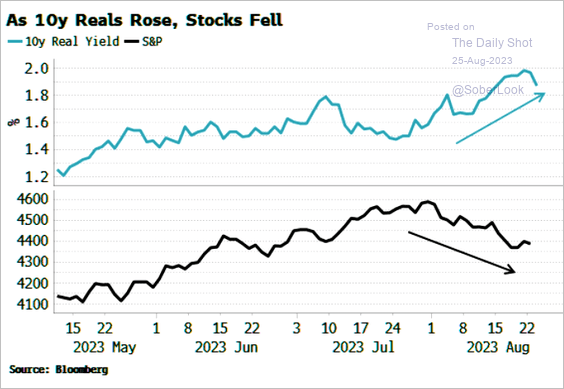

*Rising real rates will increasingly bite in our opinion

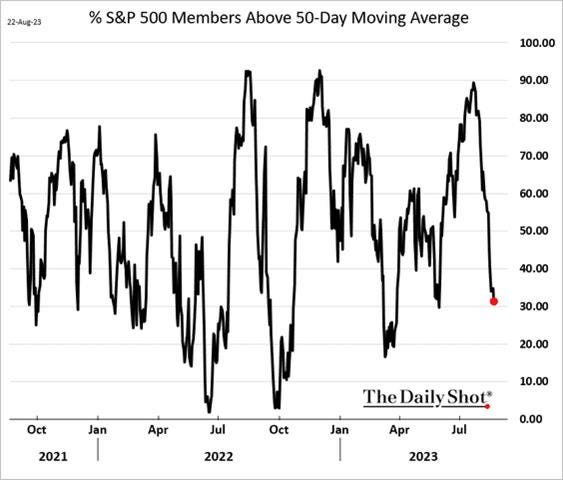

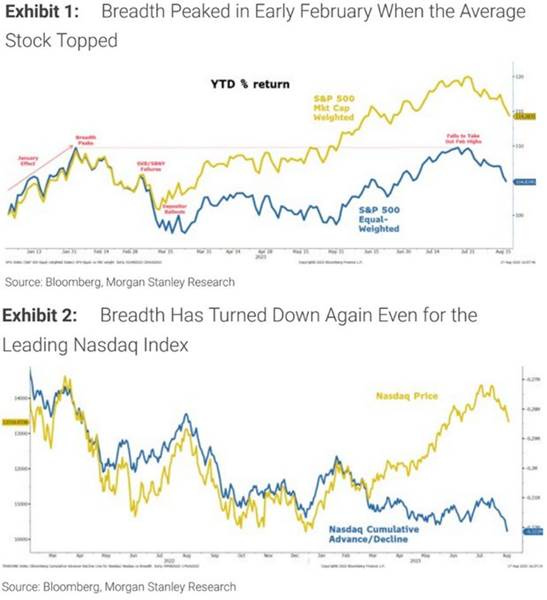

*Breadth has weakened again, and given the price reversal seen after NVDA earnings release, we see market technicals and positioning as skewing bearishly

*We have moved our stops and targets but continue to want to be short and defensive, with the average return of the portfolio now at 8.37%

Thank you for reading, and please share our newsletter. Feel free to reach out with any questions or comments. - Michael Ball, CFA, FRM

Policy Talk:

Chairman Powell delivered his highly awaited Jackson Hole speech titled “Inflation: Progress and the Path Ahead” today, where he reviewed the progress made on inflation and his outlook moving forward, with the background theme of the symposium this year being “Structural Shifts in the Global Economy.” Although not as short as last year’s historically hawkish speech, the message was only slightly changed, with greater progress being made in realigning demand and supply to a level consistent with the Fed’s inflation target, but “the process still has a long way to go.” Powell focused on core inflation, breaking down his analysis of inflation into goods, services, and shelter. He highlighted that the auto sector served as a good example of how overall goods inflation was now reversing, with production and inventories growing while higher financing costs weighing on demand. He did, however, note that the level of core goods inflation remained above pre-pandemic levels, and there needed to be further progress there. Turning to the more interest rate-sensitive housing sector, he acknowledged the well-known lag of lower rents and leases seen over the last year, starting to only now feed through into overall inflation measures. He saw nonhousing services as showing some signs of improvement. Still, less interest rate sensitivity in this sector, as well as continued labor market tightness, has reduced the supply and demand rebalancing needed to give the Fed comfort that inflation is not sticky there. Powell believes the now restrictive policy level will increasingly weigh on inflationary pressures. He highlighted the large rise in real rates and tightening of financial conditions resulting in slower economic growth moving forward, citing lower industrial production and residential investment levels. He did, however, acknowledge growth has been stronger than expected, and there was a new risk of renewed housing market activity.

Powell indicated he expected labor markets to loosen further, highlighting a list of things he sees to indicate supply and demand are better aligned. As a result, he indicated he expected wage pressures to continue to slow, although real wage growth would improve. He concluded by reiterating that the 2% inflation target would not change, and policy was now well above a neutral level. He also said the Fed cannot identify with certainty the neutral rate of interest (r*), and hence, there is always uncertainty over the appropriate level at any given time. This is further complicated by the uncertainty over the lags at which policy changes/levels affect the real economy. Finally, he noted that the uniqueness of the current situation made things even more complicated and harder to understand. As a result of all this, Powell ended his speech by reiterating that the Fed will proceed carefully as they “decide whether to tighten further or, instead, to hold the policy rate constant and await further data.”

“The slowing growth in rents for new leases over roughly the past year can be thought of as "in the pipeline" and will affect measured housing services inflation over the coming year. Going forward, if market rent growth settles near pre-pandemic levels, housing services inflation should decline toward its pre-pandemic level as well.”

“Twelve-month inflation in this sector (nonhousing services) has moved sideways since liftoff. Inflation measured over the past three and six months has declined, however, which is encouraging. Part of the reason for the modest decline of nonhousing services inflation so far is that many of these services were less affected by global supply chain bottlenecks and are generally thought to be less interest rate sensitive than other sectors, such as housing or durable goods. Production of these services is also relatively labor intensive, and the labor market remains tight.”

“Two percent is and will remain our inflation target. We are committed to achieving and sustaining a stance of monetary policy that is sufficiently restrictive to bring inflation down to that level over time. It is challenging, of course, to know in real-time when such a stance has been achieved. There are some challenges that are common to all tightening cycles. For example, real interest rates are now positive and well above mainstream estimates of the neutral policy rate. We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation. But we cannot identify with certainty the neutral rate of interest, and thus, there is always uncertainty about the precise level of monetary policy restraint.

Elsewhere in “Fed Policy World” this week, Philly Fed President Harker reiterated his belief that rates are high enough to bring inflation down over the next few years, giving this message on CNBC and today at J-Hole. Contrasting this, Boston Fed President Collins said skipping meetings, or “taking more time,” doesn’t mean that the Fed is less committed to bringing inflation down, and she indicated that there could be further rate hikes. She also noted that rates will need to stay high, or “restrictive,” for some time. “People should not expect these rates to come down anytime soon,” Collins stressed. Former St. Louis Fed President Bullard came back into the conversation, stating this week that stronger economic activity over the summer could delay plans for the Fed to stop raising rates and require a “higher for longer” policy stance.

U.S. Economic Data:

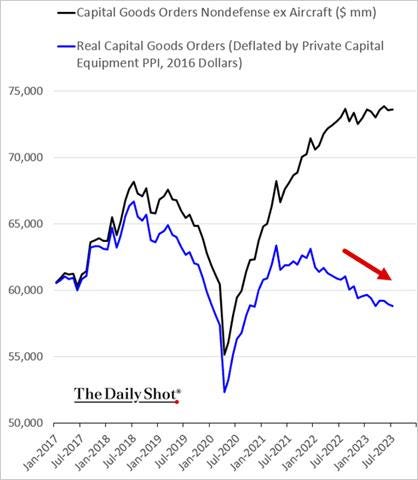

New orders for manufactured durable goods declined by 5.2% in July, following a downwardly revised growth of 4.4% in June and exceeding market expectations for a -4.0% MoM decline. Orders for transport equipment saw a decline of -14.3% MoM, following four consecutive months of increases, due to reduced demand for both civilian aircraft (-43.6% MoM vs. 71.1% MoM in June) and defense aircraft (-10.9% MoM vs. 2.0% MoM). Orders also decreased for computers and electronic products (-0.1% MoM vs. 1.2% MoM), while they increased for machinery (1.1% MoM vs. -0.6% MoM), electrical equipment, appliances, and components (1.0% MoM vs 0.4% MoM), and fabricated metal products (0.7% MoM vs. 1.0% MoM). Meanwhile, orders for non-defense capital goods, excluding aircraft, a closely watched proxy for business spending plans, edged up 0.1% in July. Shipments were flat on the month, the same as in June, and lower for core goods by -0.2% in July.

Why it Matters: It was the sharpest monthly decrease in headline durable goods orders since the aftermath of the COVID-19 outbreak in April 2020, driven by a significant drop in demand for transport equipment. Further, growth has not been in capital goods, where order growth has run below the increase in producer prices for these goods, but until this month, mainly in transportation equipment. As a result, there is a clear cooling in real demand for durables, and one needs to look through transports at the core as a gauge for where business sentiment and future demand are heading. Finally, shipments were flat again, but countering this was further firming in unfilled orders while inventories have remained unchanged for three months.

*Excluding transports, new orders were slightly higher, with core goods up 0.1% MoM, but flat in real terms

*Real capital good new orders continue to trend lower

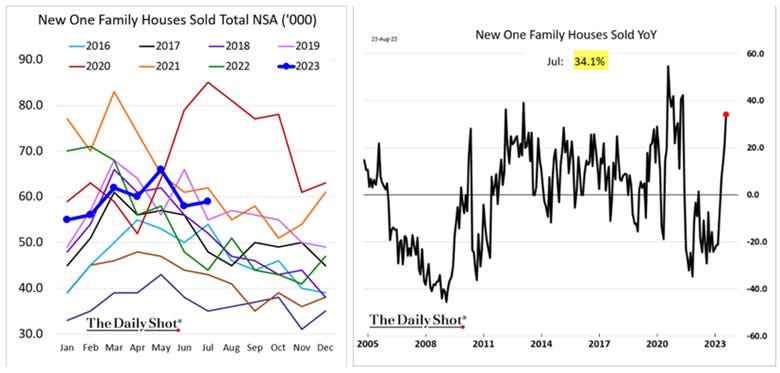

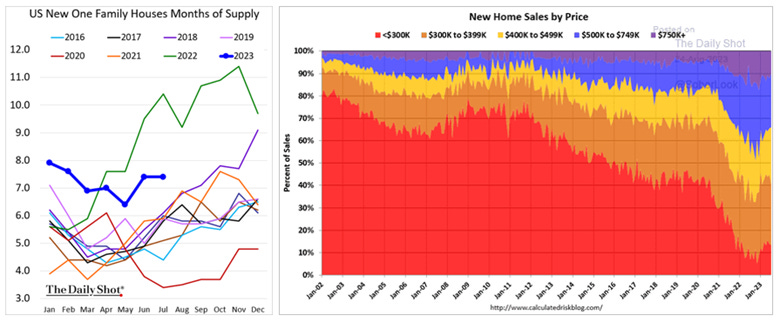

Sales of new single-family houses rose 4.4% to 714K in July, reaching the highest level since February 2022 and surpassing the market consensus of 705K. Sales rose in the West by 21.5% MoM to a rate of 181K, while those in the Midwest surged 47.4% MoM to 84K. On the other hand, sales in the South declined by 6.3% MoM to 416K, and those in the Northeast declined by 2.9% MoM to 33K. The median price of new houses sold was $436.7K, and the average sales price was $513K, down from $478.2 and $564.9, respectively, a year ago. There was an inventory level of 437K houses left to sell at the end of July, corresponding to 7.3 months of supply at the current sales rate.

Why it Matters: The tale of two cities continues in housing with the existing home supply still impaired by higher mortgage rates, forcing would-be buyers to purchase new homes due to a lack of alternatives. The month of supply moved sideways on the month and remained well above its pre-pandemic average level. Interestingly, homes more in the middle of the price range ($300k - $500k) are seeing the largest increase in sales. As is commonly heard, until mortgage rates fall and existing homeowners are more willing to sell, new home sales will benefit, but there is a limit as higher rates are increasingly weighing on new mortgage applications.

*New home sales continue to be a bright spot in the housing market, with YoY increases going parabolic

*Inventory levels moved sideways on the month while sales of middle-level homes grew

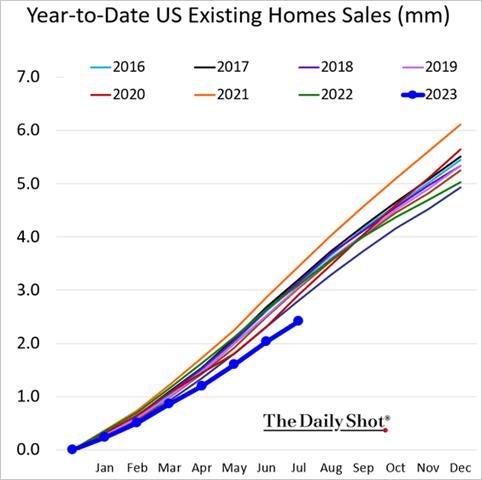

Existing-home sales dropped by -2.2% to 4.07 million units in July, following a -3.3% decline in June, the lowest level since January and falling below the market's expectations of 4.15 million. Year-over-year, sales have fallen by -16.6%. Sales of single-family homes decreased by -1.9% MoM to 3.65 million, while multi-units fell by -4.5% MoM to 0.42 million. Across the four major regions, sales weakened in the Northeast, Midwest, and the South but grew in the West. Simultaneously, the inventory of unsold existing homes increased 3.7% from the previous month to 1.11 million in July, or the equivalent of 3.3 months’ supply at the current monthly sales pace. On the cost front, the median existing-home sales price rose 1.9% from one year ago to $406.7K, the fourth time it has topped $400K.

Why it Matters: A lack of options and worsening affordability continue to weigh on existing home sales. However, there was an increase in first-time home buyers. Further, all-cash buyers increased, but “investor or second-home buyers” decreased. Distressed sales are stable at 1%. “Two factors are driving current sales activity – inventory availability and mortgage rates,” said NAR Chief Economist Lawrence Yun. “Unfortunately, both have been unfavorable to buyers.” Yun further noted that “retreating mortgage rates will bring more buyers and sellers to the market and get Americans moving again.”

*Existing home sales continue to trend below the average level of recent years

*Lack of supply continues to pressure prices higher despite lower volume levels

*Only the West saw an increase in activity

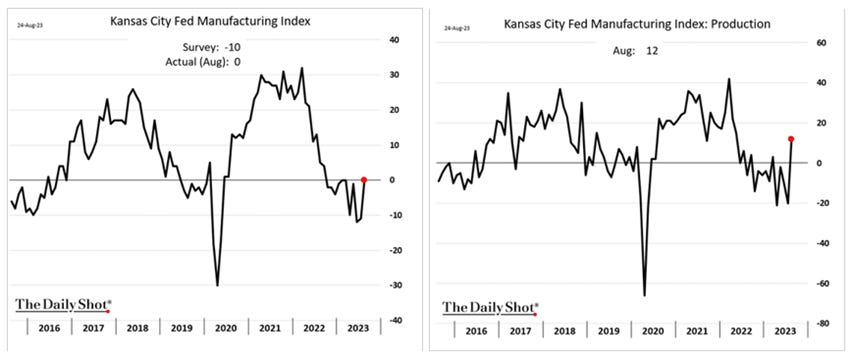

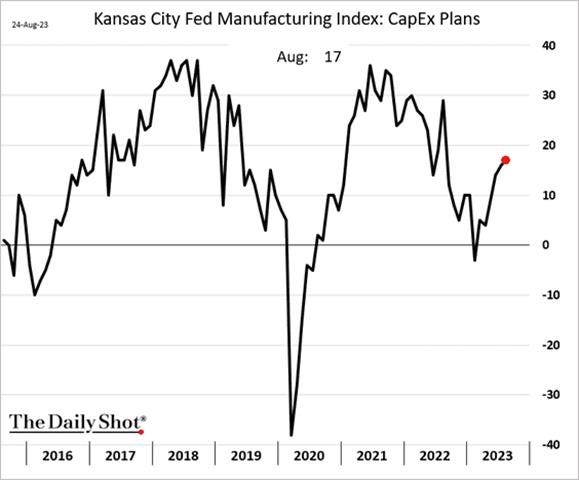

Kansas City Fed’s Manufacturing Index increased to 0 in August from -11 points in July of 2023. Demand and activity measures mostly improved, with Production (12 vs. -20), Shipments (1 vs. -24), New Orders (-3 vs. -20), and Backlog of Orders (-12 vs. -38) all improving, although averaging out to a more neutral reading, however New Exports (-8 vs. -3) worsened. Hiring intentions looked to move closer to neutral, with the Number of Employees (1 vs. 4) falling to near neutral while the Average Workweek (-6 vs. -20) contracting at a slower pace. Inventory readings were mixed with input Materials (-10 vs. -10) unchanged, still contracting, while Inventories of Finished Goods (6 vs. -3) moved back into expansionary territory. Price readings showed Prices Received (-6 vs. -7) still contracting while Prices Paid (13 vs. 9) expanded faster. Delivery Times (-6 vs. 2) moved higher, expanding again. Future expectations saw demand and activity measures improve, with a large jump in the expected six-month ahead backlog of orders reading. Future price readings also rose, with expected prices paid higher for a third month. Finally, capex intentions continue to tick higher, remaining in expansionary territory since March.

Why it Matters: Readings averaged out to neutral in August, with the overall composite index at 0. At the sub-index level, the majority of readings improved except for the number of employees, which cooled slightly while new orders for exports fell further. Note in the report highlighted that growth was seen in printing, wood production, and furniture manufacturing. Factory activity readings contracted at a faster pace, falling to -9 from -4 in July. This month’s special question was about changes in wages and prices. 44% of firms reported that wages have increased by 6-10% in the last year, while 10% said wages rose more than 10%. However, for the coming year, nearly three-quarters of firms expect wages to increase by less than 5%. Additionally, nearly a third of firms reported that prices for their company’s products or services have increased by less than 5%, while 29% reported a 6-10% increase. In the next 12 months, nearly half of all firms surveyed expect their prices to increase by less than 5%, while 28% expect a 6-10% increase.

*A sharp increase in production as well as a recovery in new orders and shipments to more neutral readings, drove the overall index higher

*Expectations in Six-Months for Capex activity has continued to expand for five months in a row

The Richmond Fed’s Manufacturing Index rose to -7 in August from -9 in July, in line with expectations. Demand and activity measures contracted at a reduced rate. New Orders (-11 vs. -20 in July) improved while the Backlog of Orders (-26 vs. -28) contraction rate stabilized. However, Capacity Utilization (-11 vs. -7) contracted at a faster pace. Shipments (-5 vs. -6) remained little changed; however, Lead Times (-17 vs. -8) indicated shorter periods. Finished Goods (21 vs. 8) and Raw Materials (17 vs. 12) inventories both increased, with the stock of final products jumping notably. Local Business Conditions (2 vs. -9) moved back into positive territory. Employment readings were mixed, as the Number of Employees (-3 vs. 5) contracted while Wages (22 vs. 19) remained well in the expansionary territory while firms indicated the Availability of Skills Needed (-10 vs. -12) remained negative. Price Trends continued to show a deflationary trend, with Prices Paid (3.17 vs. 4.07) and Prices Received (3.11 vs. 4.01) dropping lower. Finally, current investment plans on aggregate were neutral, as Capital Expenditures (4 vs. 8), Equipment & Software Spending (0 vs. 7), and Service Expenditures (-13 vs. -2) all declined. Expectation readings showed demand and activity outlook improving, increased hiring intentions, shorter supply times, mixed capex intentions, and stronger price pressures.

Why it Matters: Despite demand and activity readings remaining in contractionary territory, there was a broad improvement at the sub-index level in August’s report, with only outright hiring, investment-themed, and price sub-indexes falling. The decline in current and future investment measures negated the improvements in demand and activity expectations, effectively signaling that firms think business demand will improve but are not confident that their capacity needs to expand. Regarding inflationary pressures, rises in expected wages and prices paid and received align with other Fed surveys that showed a firming and increase in inflationary pressures is at least expected, if not currently occurring, as seen in the NY and Philly Fed surveys.

*The overall composite index rose due to increases in new orders and shipments, while employment fell

*Unlike other regional surveys, current price readings declined in the Richmond region in August

*Demand and activity subindexes broadly rose while caped measures broadly fell

The Richmond Fed’s Fifth District Survey of Service Sector Activity improved slightly in August. Measures of Revenue (4 vs. -2) and Demand (9 vs. 6) continued to expand, while Local Business Conditions (1 vs. -8) moved back to a more neutral reading. Investment activity was mixed during the month, with Capital Spending (0 vs. -3) neutral while spending on IT (5 vs. 11) and Services (2 vs. 5) expanded at a reduced rate. Employment measures showed a more neutral hiring picture, with the Number of Employees (1 vs. 7) falling, while Wages (27 vs. 25) remained expansionary and the Availability of Skills Needed (-2 vs. 1) contracted slightly. Current inflationary pressures fell, with Prices Paid (5.98 vs. 6.41) and Received (4.96 vs. 5.19) continuing to trend lower. Expectations broadly improved and painted a more optimistic outlook, although expectations for inflationary pressures rose while Capex spending intentions cooled but were still expansionary.

Why it Matters: August’s report painted a better picture regarding demand and sales but showed a more mixed picture regarding hiring and investment activity and intentions. Inflationary pressures continued to trend lower regarding current readings but turned higher regarding expectation readings for prices paid, received, and wages. In isolation, during August, the report showed resilience in activity and demand but improvement in disinflationary trends, including loosening in labor markets readings, something the Fed wants to see.

*Demand and Activity readings moved back to neutral in August

The Philadelphia Fed’s Nonmanufacturing Business Outlook Survey moved to -0.5 in August from 2 in July. Demand measures contracted further in the aggregate, with New Orders (-16 vs. -13.3 in July) contracting further while Unfilled Orders (-0.9 vs. -4.7) moved closer to neutral but remained negative. Sales (-5.7 vs. 4) moved into contractionary territory. Inventories (-10.7 vs. -12.6) were seen as less “too low.” Inflationary measures rose, with Prices Paid (46.2 vs. 39.6) and Prices Received (14.6 vs. 7.8) increasing. Labor measures showed full-time (8.1 vs. 11.9) and part-time (-0.7 vs. 3.9) headcounts falling, with the latter slightly contracting. The Average Workweek (-1.5 vs. 3.4) moved back into contractionary territory, while Wages (33.7 vs. 39.8) also fell but remained highly expansionary. Capex measures remained expansionary, but IT spending grew at a slower pace than in July. Expectations for general business activity in six months dropped notably but remained expansionary.

Why it Matters: The overall index moved to a near-neutral reading while expectations weakened significantly. Demand measures cooled while price pressures increased. Hiring intentions also weakened, with part-time worker growth now flat. Firms still expect growth in their own business over the next six months but at a reduced rate versus last month. The month’s special question showed respondents expect their own prices to increase by 4% over the next year, the same as when asked in May. Firms also expected wages to rise by 4%, the same as in May. When asked about the rate of inflation for U.S. consumers over the next year, the firms’ median forecast was 4.8%, down slightly from 5.0% in May, while longer-term expectations moved from 4% in May to 3%.

*Both current and future activity readings fell in August, with new orders and sales weakening

*Price pressures continued to pick up since hitting recent lows in June

*The overall sub-index readings were somewhat mixed, with inflationary pressures and capex activity expanding while demand and hiring activity contracted

Technicals, Positioning, and Charts:

The S&P is outperforming the Russell and Nasdaq on the day with Low Volatility, Growth, and High Dvd Yield factors, as well as Energy, Consumer Discretionary, and Health Care outperforming on the day. Leadership on the week favored tech and growth. However, leadership was generally mixed after that and did not indicate any strong market narrative, with most sectors little changed on the week.

S&P optionality strike levels have the Zero-Gamma Level at 4450 while the Call Wall is 4600 and the Put Wall is 4350. Significant levels of put buying drove the reversal yesterday and following Powell’s speech this morning. However, this looks to be reversing, with put buyers covering around the 4370 level. Late afternoon price moves have been driven by 0DTE action, with today looking like no exception, making price action into the close directional. Implied vol is ending the week lower, with the VIX in the mid-15s. It's notable that yesterday’s end-of-day sell-off didn’t send IV materially higher, with today’s decline making sense as the J-hole event risk passed. Spotgamma sees the lack of IV response as more bullish and sees a re-test of the 4500 possible next week.

@spotgamma

S&P technical levels have support at 4410, then 4390, with resistance at 4430, then 4450. Technicals have been unclear on an intraday basis due to the wider range of price action with lots of false breakouts/downs. Since 2003, 12 out of 18 Jackson Hole days have ended green, for a 66% win rate. Moreover, the week after Jackson Hole is typically even more bullish, with S&P green 83% of the time one week after. Regarding big-picture structures, the S&P is still below its white-up channel from March lows. This needs to be reclaimed for a real rally to resume, and instead was rejected mid-week. The green bull flag channel pattern is still in play, with resistance around 4430 and support at 4300. A breakout two days ago failed, and as a result, this is the strongest technical structure. Otherwise, 4407 is the bull/bear line currently and remains a magnate for price action.

@AdamMancini4

Treasuries are higher on the day, with the 10yr yield lower by 0.5 bps to 4.24%, while the 5s30s curve flatter on the session by 2.5 bps, moving to -13.6 bps.

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the day and the week, with Large-Cap Growth the best-performing size/factor on the week.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and the week.

5yr-30yr Treasury Spread: The curve is flatter on the day and the week.

EUR/JPY FX Cross: The Euro is stronger on the day and the week.

Other Charts:

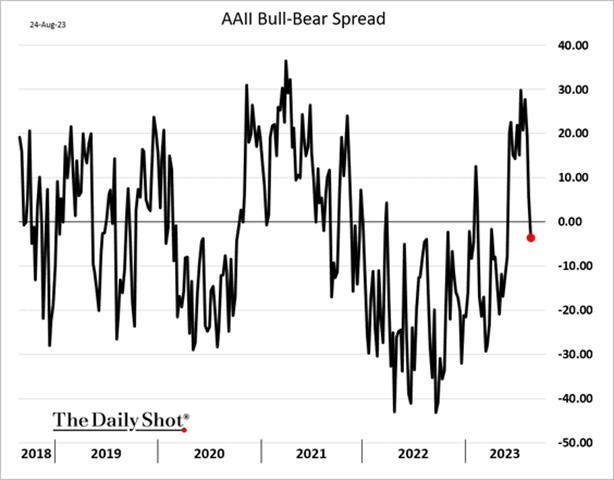

Things have changed quickly, with retail investors now more bearish after the YTD rally corrects.

This bearishness is also being seen in overnight (zero-days-until-expiration) options traders becoming more negative

Equity fund flows continue to be negative, with last week being the largest weekly equity outflow since March.

"After a brief attempt to recover in June, (the Nasdaq’s) breadth has rolled over again and remains weak, even within the strongest performing indices." - Mike Wilson, Morgan Stanley

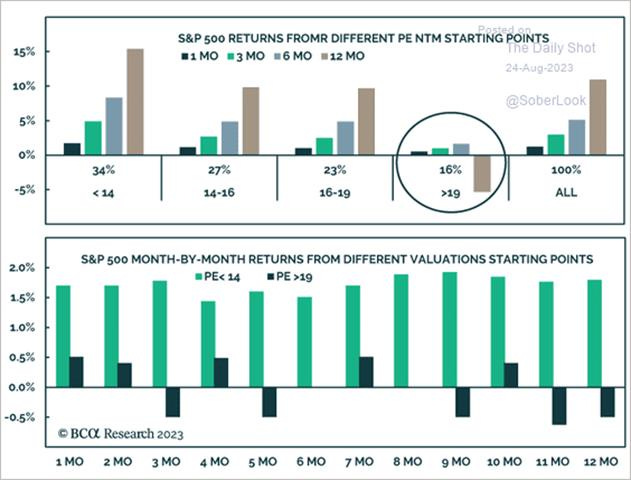

Historically, the currently high level of valuation for the S&P has meant poor returns moving forward.

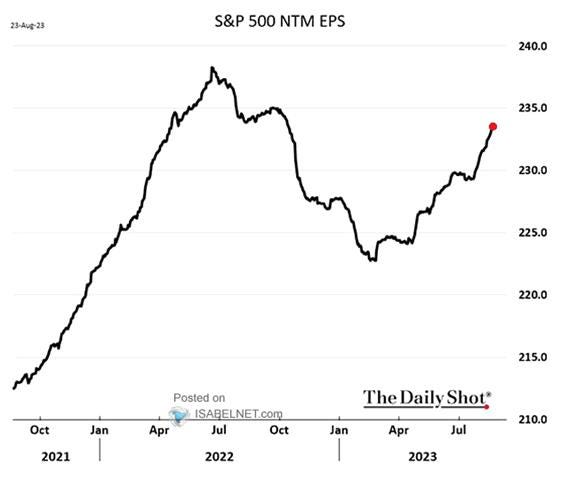

Earnings estimates for the S&P 500 earnings continue to rise this earnings season.

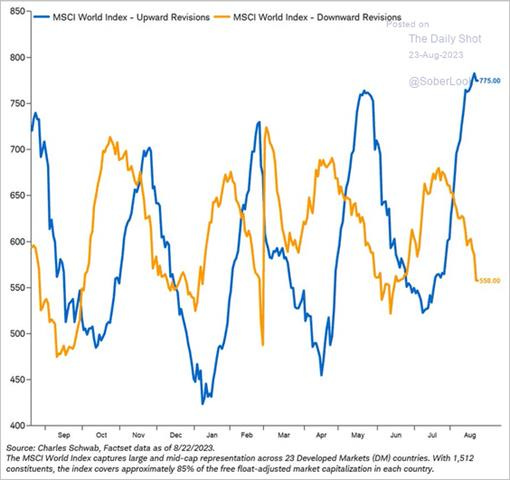

Further, global upward earnings revisions continue to outpace downgrades.

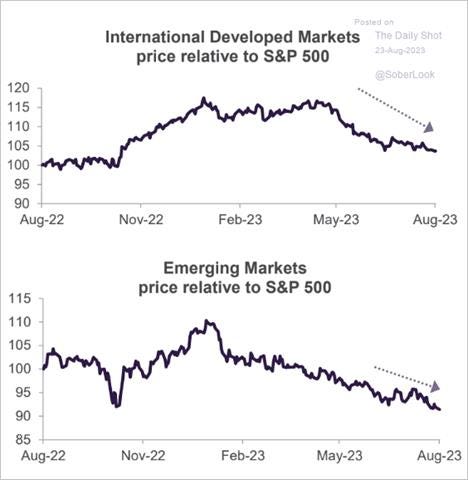

US equities are outperforming the rest of the world.

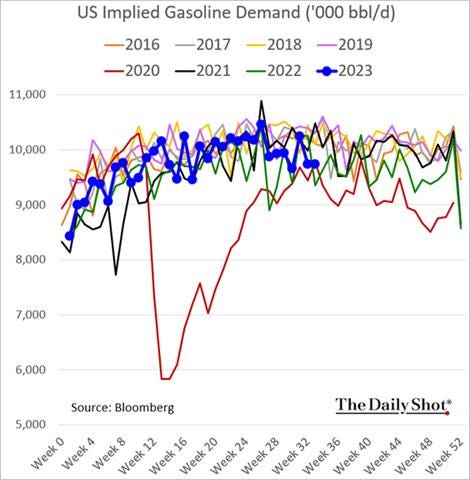

Gasoline demand in the U.S. so far this summer remains on the weaker side.

However, China’s oil demand has been resilient despite slower economic growth than expected.

Wage growth has fallen from its peak, surveys suggest continued moderation in wage growth - @MikeZaccardi

"…in the US, union membership in the private sector has dropped significantly since the 1970s. The available data show that 16.8% of private wage and salary employment was unionized in 1983. This percentage dropped to a record low of 6.0% during 2022. So we don’t expect that the headline-grabbing news about recent union settlements will be as likely to boost overall wage inflation as it did in the 1970s." - @yardeni

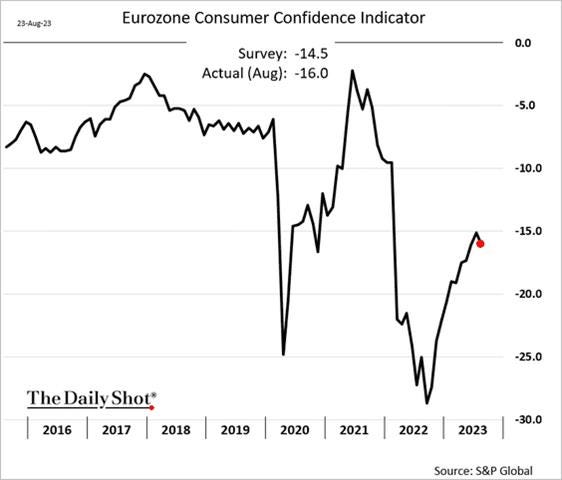

Consumer confidence in the Eurozone moved lower after trending higher since late last year.

Articles by Macro Themes:

Medium-term Themes:

Labor Markets Loosening?:

Gap Year: Many recent consulting hires got lucrative offers during last fall’s college recruiting season and were eager to start this summer. Now, with too little work to spread around, firms are delaying start dates to an extent not seen in years. Firms, including Deloitte, KPMG, Boston Consulting Group, and McKinsey aren’t bringing on some recent recruits until 2024. Some are even paying new graduate hires thousands of dollars to spend during their unanticipated gap year. KPMG said about two-thirds of the consulting campus hires it recruited over the past academic year will now start in 2024. Roughly half of that cohort won’t start until April or later. - New Hires Get Trapped in an Unplanned Gap Year – WSJ

China’s Post-Pandemic Life:

Timid Moves: China has cut a benchmark lending rate but defied market expectations for broader loosening as policymakers try to protect bank profits. The one-year loan prime rate, a reference for bank lending, was cut 0.10 percentage points to 3.45%, while the five-year rate, which is closely watched because of its relationship to mortgage lending, was kept steady at 4.2%. Economists polled by Bloomberg had unanimously projected 0.15 percentage point cuts to both the one-year and five-year rates. The outcome was “quite surprising and frankly it’s a bit puzzling”, said Hui Shan, chief China economist at Goldman Sachs. - China growth hopes fade after modest rate cut - FT

Above Benchmarks: The enormous amount of borrowing accumulated by China’s provinces, much of it through opaque local government financing vehicles investment companies that raise debt and build infrastructure on behalf of local governments, has become a huge problem for the world’s second-largest economy. Increased tension between local and central governments over the debt comes as Beijing searches for new models of regional economic growth. A near default by Guizhou’s second-largest city Zunyi in December fuelled concerns of a systemic financial crisis and hopes for central government bailouts. Beijing has decided to send teams of officials from the central bank, finance ministry, and securities watchdog to more than 10 of the financially weakest provinces to scrutinize their books and find ways to cut their debts. They will assess the governments’ balance sheets and decide how best to cut bad assets and reduce debt. - The local government debt that threatens China’s economy - FT

Longer-term Themes:

Energy’s Midlife Crisis:

Dependent on Putin: Western governments have avoided sanctioning Rosatom, the Kremlin-controlled nuclear group and the world’s biggest uranium enricher, because doing so risks damaging their own nuclear industries and economies more than Vladimir Putin’s. “We’re bearing the costs of an overreliance on Russia for nuclear fuel,” said Pranay Vaddi, a White House nuclear adviser at the National Security Council. “And it’s not just us; it’s the entire world.” However, reconstituting a North American uranium fuel cycle and boosting the capacity of European providers is a massive undertaking. Even with a full-court press, it still may take the West five years to wean itself off Rosatom, said Dan Poneman, a former deputy US secretary of energy. It looks like there may be a squeeze for uranium soon. - The Manhattan Project to Wean the World Off Russian Uranium - Bloomberg

Changing Habits: Demand for natural gas in Europe hasn’t bounced back despite lower prices. The region’s TTF benchmark price is down 85% compared with a year ago when Europe was rushing to fill its gas-storage facilities for winter after Russia cut off supply. Regarding this coming winter, Europe’s gas storage is already full, hitting 90% capacity target last week, more than two months ahead of a schedule set last year by the European Union. Weaker economic growth is one reason why gas use hasn’t recovered. Another may be that lower wholesale prices haven’t been passed on to end users yet. Other factors will be more permanent, notably new technologies. The European Heat Pump Association said sales of heat pumps rose 39% in 2022. They are now installed in 16% of Europe’s residential and commercial buildings, often replacing gas boilers. - Europe’s Gas-Guzzling Days Are Fading – WSJ

Food: Security, Innovations, and Climate Change Implications:

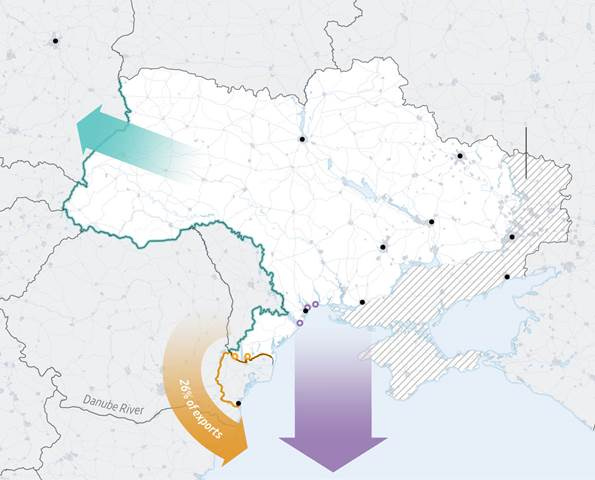

Kyiv is devising a plan with global insurers to reopen a crucial grain-export route for vessels navigating the Black Sea, a shipping lane blockaded by Russia for the past month. The Black Sea Grain Initiative had secured the wartime shipment of 32 million tons of food in less than a year until Moscow backed out of the deal in July and escalated attacks on the infrastructure underpinning the Ukrainian grain industry. Ukrainian officials are now in discussions with global insurance firms and commodity traders to create a government-backed program to enable ships to travel to Ukraine’s ports. The plan that is taking shape is for the Ukrainian government to shoulder the first losses in the case of a damaged grain ship. This is expected to encourage more companies to provide insurance to the ships traveling to Ukraine’s ports, reducing premiums. A few insurers have continued to offer coverage for the route but at a very high price. - Ukraine Hatches Plan to Reopen Black Sea Grain Route, Defying Russian Blockade – WSJ

Authoritarianism in Trouble?:

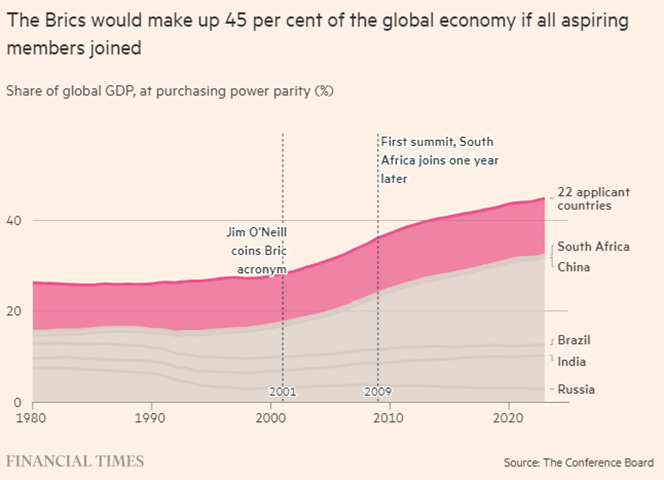

BRI vs. West: The key to China’s blueprint is to steadily institutionalize its leadership over the developing world by creating, expanding, and funding a raft of China-led groupings of countries, according to Chinese officials and commentators. They add that the aims of this strategy are largely two-fold: to ensure that a broad swath of the world remains open to Chinese trade and investment and to use the voting power of developing countries at the UN and in other forums to project Chinese power and values. “Xi’s showed his clearest intention yet to update the rules of global governance that were written by the collective west in the aftermath of World War Two,” says Yu Jie, senior research fellow at Chatham House, a think-tank in London. As a result of these goals, China is taking many different approaches to increasing its soft power and access to the rest of the world. - China’s blueprint for an alternative world order - FT

Cold Places (Deep Sea, Artic, and Space Colonization):

Space Threats: Chinese and Russian intelligence agencies are targeting American private space companies, attempting to steal critical technologies and preparing cyberattacks aimed at degrading U.S. satellite capabilities during a conflict or emergency, according to a new warning by American intelligence agencies. Space companies’ data and intellectual property could be at risk from attempts to break into computer networks, moles placed inside companies and foreign infiltration of the supply chain, officials said. “Foreign intelligence entities recognize the importance of the commercial space industry to the U.S. economy and national security, including the growing dependence of critical infrastructure on space-based assets,” the Counterintelligence Center warning said. “They see U.S. space-related innovation and assets as potential threats as well as valuable opportunities to acquire vital technologies and expertise.” - Intelligence Agencies Warn Foreign Spies Are Targeting U.S. Space Companies - NYT

Other Articles of Interest:

Goal Posts: Officially, the Fed’s target for inflation is 2%. With inflation running well above that number, officials are still focused on whether to raise rates one more time this year. But that is a relatively small consideration compared with the bigger question of how long to keep rates at that high level. What if getting to 2% isn’t worth the pain? Another strain of thinking says the Fed should accept a rate of around 3% as the new target. Powell and other Fed officials say moving the goalposts like that isn’t an option. Another camp suggests the central bank could take a lesson from former Fed Chair Alan Greenspan and get to its 2% target more leisurely. Greenspan, in the early 1990s charted an approach later dubbed “opportunistic.” Rather than push immediately for 2%, get there gradually over several years by holding rates at a level that could seem slightly higher than they need to be, and letting opportunities, such as the occasional economic slowdown, nudge inflation down bit by bit. - How Hard Should the Fed Squeeze to Reach 2% Inflation? – WSJ

BiPolarics: Welcome to the à la carte world. As the post-Cold War age of America as a sole superpower fades, the old era when countries had to choose from a prix fixe menu of alliances is shifting into a more fluid order. The stand-off between Washington and Beijing, and the west’s effective abandonment of its three-decade dream that the gospel of free markets would lead to a more liberal version of the Chinese Communist Party, are presenting an opportunity for much of the world not just to be wooed but also to play one off against the other and many are doing this with alacrity and increasing skill. - The à la carte world: our new geopolitical order – FT

Podcasts and Videos:

Zac Gross on the Past, Present, and Future of Australian Monetary Policy – Macro Musing

China’s Role in the U.S. Fentanyl Crisis: A Conversation with Vanda Felbab-Brown - CSIS

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION