Policy Error No More? Powell Gets His Way and Potentially Saves the Day

Midday Macro - Color on Markets, Economy, Policy, and Geopolitics

The Fed cut its policy rate 50bps and struck a more dovish tone through its official statement and projections, while Powell came across as more neutral in his press conference

Positive structural changes to the economy post-pandemic mean the cutting cycle may be less than markets are currently pricing, and Fed officials will have to focus on how to keep normalizing policy in a higher r* world

We happily got our Fed call wrong…

The Fed pleasantly surprised us with its 50bps cut and SEPs adjustments that, although wide in dispersion, delivered more dovish median projections. We have long written about our worry that the Fed had entered a policy error trap, having waited too long to hike rates and now waiting too long to cut due to emotional biases incurred from their experience. This week’s more aggressive action and dovish signaling have reduced that worry.

“With solid growth, relatively low unemployment, and the stock market near record highs, the Fed chose to cut from a position of strength to preserve that strength” – Claudia Sahm

We couldn’t have said it better. Although certainly skewing towards layoffs, labor markets are still definable as “cooling,” not crashing.

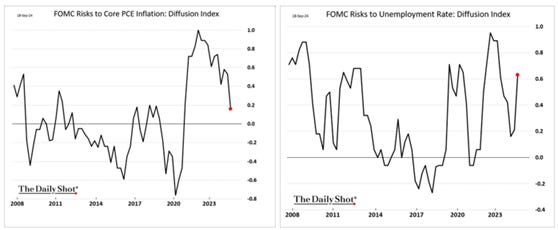

Further, although inflation readings and expectations have regained disinflationary momentum, they are still elevated, and recent increases in price readings in PMIs indicate progress could stall again (not our baseline case). When coupled with continued positive consumer spending momentum, the FOMC could have easily justified going only 25bps.

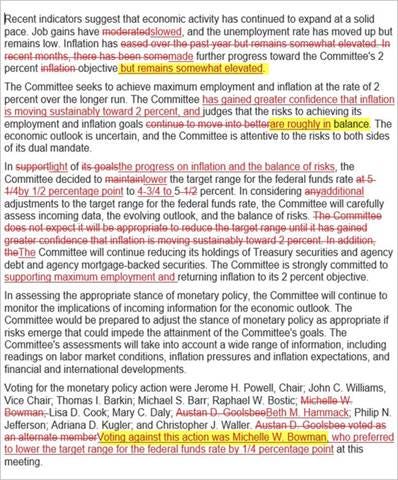

Instead, the committee notably changed its tune in the official FOMC statement and, to a lesser degree, the SEPs. However, Powell himself seemed more agnostic in the presser than expected, given these other signaling moves, with subsequent price action interpreting him as more hawkish than expected (as opposed to him usually being more dovish).

Powell characterized the change as a “recalibration” of policy, stressing that 50bps would not be the new pace given that the path of policy was “not on a preset course” as they are still data dependent. Overall, cutting 50bps while repeatedly stating the economy is in a “good place” during the presser looks like an acknowledgment that the FOMC should have started the cutting cycle in June or July, not a material deterioration in their overall outlook since then.

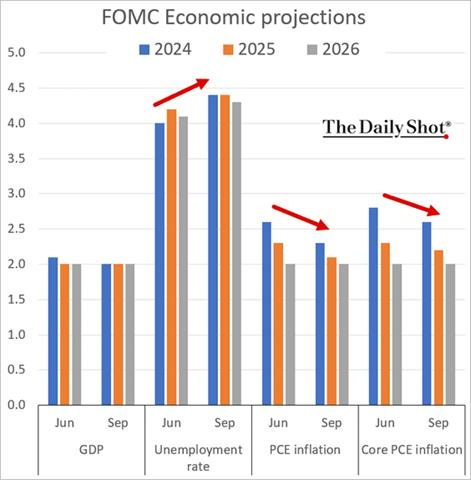

The lack of change in the SEPs GDP projections since the summer also suggests this (in fact, the final 2024 SEPs GDP median reading at the December FOMC meeting will likely rise, given the current Q3 momentum).

“So, again, the labor market is actually in solid condition. And our intention with our policy move today is to keep it there. You can say that about the whole economy. The U.S. economy is in good shape. It’s growing at a solid pace, inflation is coming down, the labor market is in a strong pace, and we want to keep it there. That’s what we’re doing.” – Chairman Powell during the September FOMC Press Conference

Differing views on where the U.S. economy’s potential now is post-pandemic…

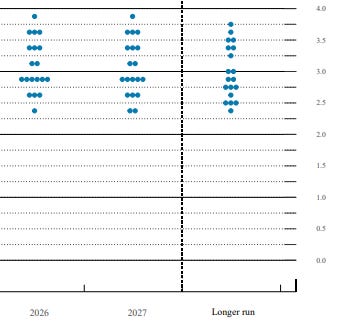

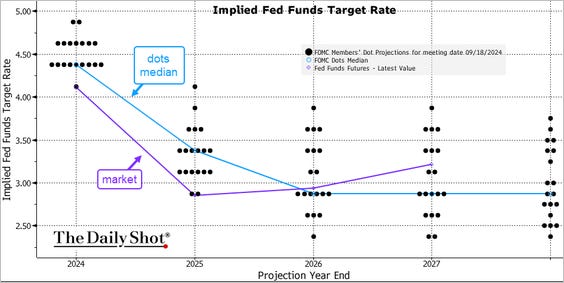

Stepping back, it’s clear there is a wide dispersion of views on where policy is going, with the median dot creating a false sense of consensus. There’s a spread of 1.75 percentage points within the FOMC members on where Fed fund rates are expected to be in 2026 and 2027 and a slightly smaller 1.5 percentage points for the longer run rate. This is important given the gradual creep higher in the long-run median dot, which means that this may be a much shallower cutting cycle than markets are currently pricing.

Should a higher r* weigh on current risk sentiment?

The Fed’s intention to keep signaling that the rate-cutting cycle may be shallower due to a higher longer run rate level is a positive development given that it is based on the now higher structural real growth potential of the economy.

As a result of the greater level of productivity and more supportive demographics, the over 200bps of cuts expected in this cycle seems off. If the final domestic demand is now more likely to grow between 2% and 3% instead of a lower prepandemic level, then the neutral policy rate must adjust equally.

Clearly, global markets and fiscal policy also have a role to play here. With the election presenting a bifurcated path forward, it is unclear whether the current factors supporting higher growth and lower inflation will stay intact. We, however, believe the post-GFC low interest rate period is over, with the new normal now being an r* nearer to 2% for the U.S.

The deleveraging that followed the GFC is over, with U.S. firms and households now having historically strong balance sheets. Equally importantly, long-term changes in the capital intensiveness of industry, geopolitics/global trade, fiscal policy, and demographics are all moving the global economy away from excess savings and secular stagnation toward higher investment and lower savings, something especially true for the U.S.

This all affects how far the Fed has to cut, and the general power monetary policy has in steering the economy…

In summary, the pandemic structurally changed the U.S. and the global economy. Ample levels of monetary and fiscal stimulus deleveraged private balance sheets (while increasing the leverage of the government BS) in the U.S., reducing the rate sensitivity of the economy. Supply-side impairments drove inflation higher but also forced firms to do more with less, and accompanied by higher levels of capex (and new technological innovations), increased productivity.

At the same time, the population of the nation grew, increasing household formation and driving domestic end demand higher (while alleviating supply-side shortages of labor). This seems to have created a more resilient organic economic cycle. As a result, policy no longer needs to be as stimulative (or actually even matters as much) to compensate for the prior weaker demographic and productivity trends.

Risk sentiment ended up being supported by the 50bps cut…

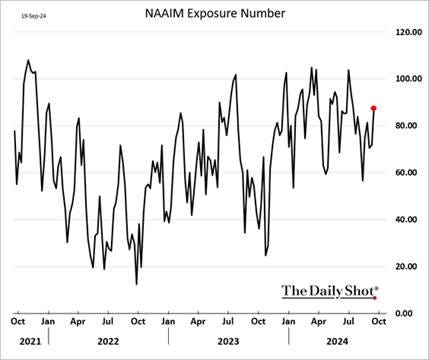

The S&P reached a record high (again) yesterday thanks to tech megacaps, with overall risk sentiment turning more bullish across global markets after some initial uncertainty and volatility following the Fed’s 50bps cut on Wednesday thanks to a notable decline in initial jobless claims.

Despite the more concentrated leadership, market breadth has remained positive, with 80% of S&P stocks above their 200-dma. Further, after pulling back at the beginning of the month, risk sentiment fund managers have improved despite weaker seasonality and the uncertainty from the fast-approaching U.S. election.

Today is also a “triple witching,” with option contracts tied to stocks, indexes, and futures all mature. The size of the expiration is in line with previous quarterly expirations. However, more interestingly, there are about three calls to every one put expiring. The recent rally in equities has produced an upside imbalance, and there should be some consolidation in price action following today’s OPEX. A move below 5650 for the SPX will likely open up further weakness as the level of negative gamma grows.

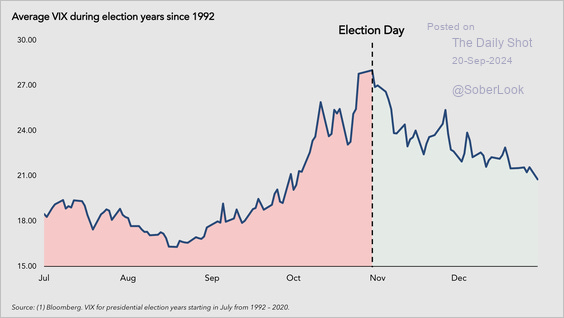

It’s also likely we see increased implied and realized equity volatility into the election. The passage of the highly uncertain September FOMC may prove to be only a temporary relief to volatility.

The BoE says it needs further evidence despite greater confidence, increasing the odds of a policy error…

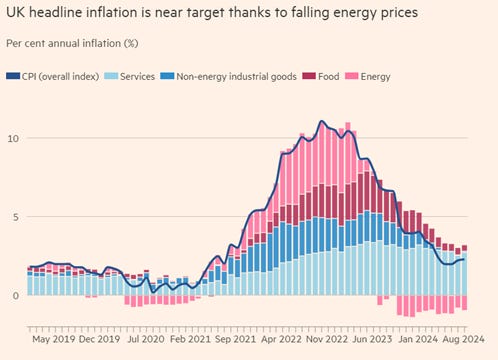

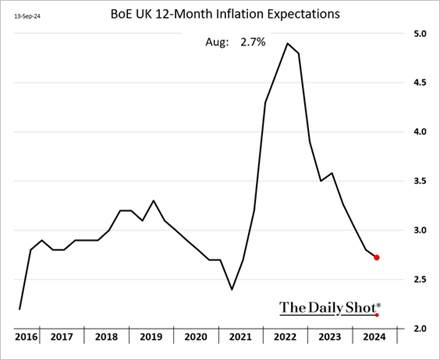

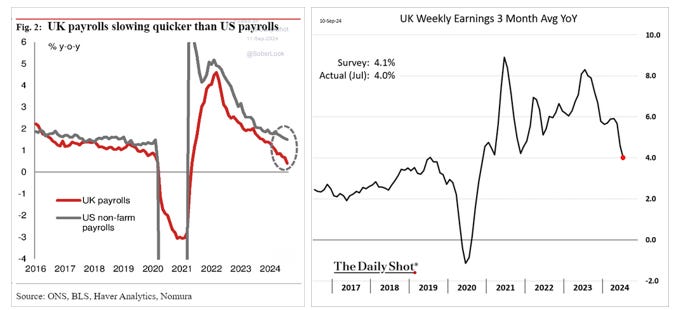

Changing gears and looking across the pond, the BoE may have made its own policy error this week. Although service inflation has been more sticky and labor market data more nuanced, we believe the more hawkish message out of this week’s MPC meeting was out of touch with where momentum is going for both growth and inflation.

As a result of their inaction, the BoE cutting cycle looks to be increasingly diverging from the Feds, with a more gradual approach that has around one 25bps cut a quarter expected. The worry from BoE policymakers is that there has been a structural change in price and wage-setting behavior.

We push back on this view. Recent service sector stickiness is due to more volatile components, while labor markets continue to cool, with wage bargaining power shifting back to a more neutral level. Firms and consumers have continued to lower their estimates of expected and realized price/wage growth, according to a recent monthly BoE survey.

Further, although the official UER rate fell in July, the ONS’s Labor Force Survey data diverged from other employment measures, including weaker payroll figures and the survey of workforce jobs. These non-LFS sources appeared more reliable, and both pointed to “a sustained moderation of growth in employment over the last year,” the ONS said.

As a result, we think the path of BoE rate cuts being expected by markets is too shallow, given what we see coming. Combined with our belief that U.S. labor market data will stabilize post-election, reducing expectations for Fed cuts in 2025, we want to be long the dollar versus the pound over the longer term, as we have expressed in our mock portfolio.

We maintain our bias to be short the pound. The potential completion of a “cup and handle” technical formation means we would look to re-enter a GBP short above 1.34. As it stands, the pause in GBP strength post-BoE due to stronger U.S. initial claims data still leaves the door open for further weakness, and, as a result, we remain in the trade.

Final thoughts elsewhere…

The Bank of Japan met overnight and, as expected, left rates unchanged. Governor Ueda said, “The upside risk to prices appears to be easing given the recent yen strength.” However, the BoJ upgraded its growth outlook and is still likely to hike again at its December meeting.

Beijing is signaling it may expand its support for the housing and financial markets. There looks to be a push to remove curbs on home buying. Officials are also mulling measures to shore up stock markets through “home team” buying.

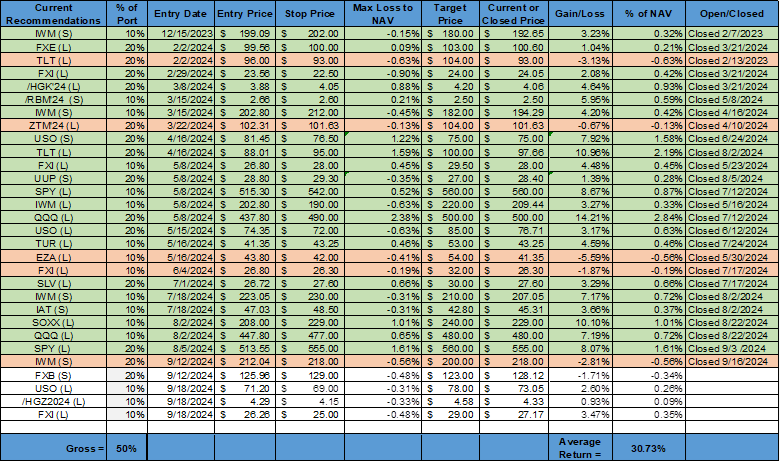

We were stopped out of our short Russell position prior to the FOMC meeting. We would have self-closed the position following the results either way. Further, we have opened long positions in copper, oil, and Chinese equities following the FOMC results. We will go into further detail on why we like these new positions next week.

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.

From <https://d.docs.live.net/aae6c8104beb7aa6/Documents/Daily%20Note/Midday%20Macro%20-%2009202024.docx>