MIDDAY MACRO - DAILY COLOR – 9/28/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

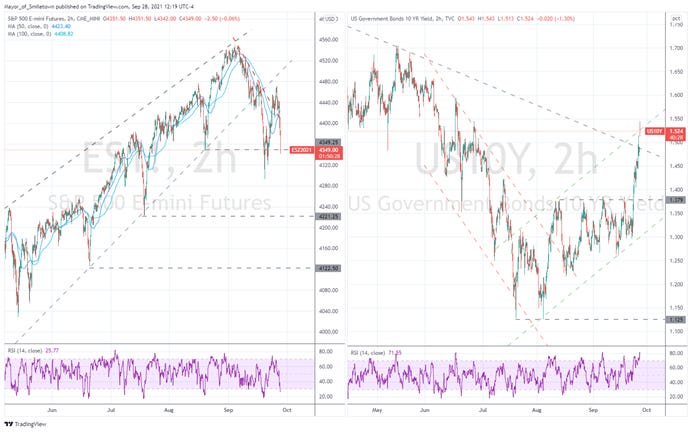

Equities are lower, as the S&P broke below key support levels at the NY-open following an already weak overnight for global equities more generally

Treasuries are lower, as rates globally came under pressure given views that central bank support will soon be diminished

WTI is lower, after the continuation of a multi-day rally overnight finally fizzled post-NY-open due to the generally more risk-off tone

Analysis:

Equities are seeing weakness across the board (except the energy sector) as continued supply-side disruptions (China power-outages) are causing renewed inflationary fears, while D.C. uncertainties are also contributing to a global risk-off tone today.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Value and High Dividend Yield factors, and Energy, Real Estate, and Industrial sectors all outperforming.

S&P optionality strike levels have the zero gamma level at 4426 while the call wall is at 4430, while technical levels have support 4330 and resistance at 4365 followed by 4400.

Treasuries are significantly lower, although bouncing off this morning’s lows with the 5s30s curve steeper by 3.8bps.

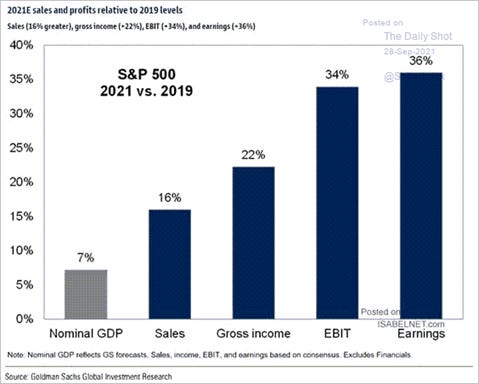

Despite the notably risk-off day, we still have conviction in our year-end outlook that growth will beat expectation and reflation/reopening themed trades outperform, as we believe markets have priced in peak supply-side disruptions while the drag from Delta continues to fall and the re-opening continues to gain momentum.

The economy's fundamentals are simply too strong, and although shortages (of materials and labor) continue to cap growth and bolster inflation, causing business and consumer sentiment/activity to waiver, the underlying level of demand continues to be very strong, pushing unrealized activity into the 4th quarter and now increasingly into the first half of next year.

Economists have been caught off guard by the recent bought of better than expected real data while markets are beginning to warm up to the growing reopening momentum, with the Citi Economic Surprise Index turning higher and the “re-opening basket” outperforming while other reflationary favorites such as energy and Treasury yields are breaking into new ranges.

*Citi Surprise Index turned higher in September

However, the speed of change (in rates and energy) has temporarily spooked markets, made worse because we are still in a seasonally weak part of the year (buybacks ending) with both technicals (trend support broken) and optionality (negative gamma pull) currently working against broader equity indexes, increasing volatility.

As a result, we reconfirm our current mantra of disciplined dip buying and rally selling while staying the course of a further reflationary melt-up during a period of elevated volatility as we continue to get stronger than expected actual economic activity (not survey-based emotional data) and pass through the current uncertainties emanating from D.C.

Econ Data:

The Conference Board Consumer Confidence Index declined again in September, following decreases in both July and August. The Index now stands at 109.3, down from 115.2 in August. The Present Situation Index fell to 143.4 from 148.9, while the Expectations Index fell to 86.6 from 92.8. The labor market differential held in fairly well at 42.5, down only modestly from 44.4 in August. The 12-month inflation expectation eased only slightly to 6.5% from the 13-year high reading of 6.7% in August.

Why it Matters: Delta certainly dampened confidence in September further, keeping a three-month negative trend going. Consumer’s assessment of the current labor market was mixed with an increase in respondents saying jobs were “plentiful” and “hard to get.” However, consumers’ optimism about the future outlook saw the most significant drop in the labor market outlook. Short-term inflation concerns eased somewhat but remained elevated. Consumer confidence is still high by historical levels, but the Index has now fallen 19.6 points from the recent peak of 128.9 reached in June.

The Richmond Fed Manufacturing Index dropped to -3 in September, its lowest level since May 2020. The indexes for shipments and new orders declined to -1 and -19, respectively, also the lowest readings in 16 months. Meanwhile, the gauge for employment rose 2 points to +20. Manufacturers continued to see low inventories, lengthening lead times, and backlogs of orders. In addition, firms reported weakening local business conditions, but they were optimistic that conditions would improve in the next six months.

Why it Matter: A particularly weak report out of the Fifth District. The future outlook is holding up as firms believe there will be an end to the Delta and supply-side disruptions eventually, but current conditions are fully reflecting their drag. In a worrying sign for future profit margins, Prices Paid outpaced Prices Received further, while there was a significant decline in New Orders.

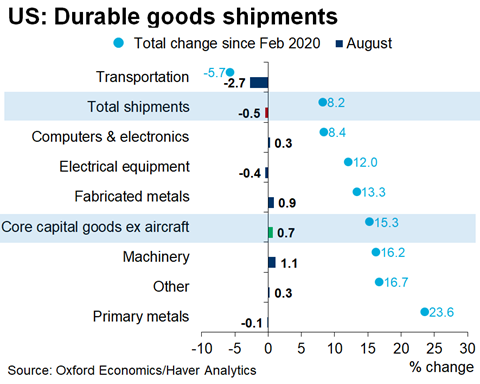

New Orders for US Durable Goods rose 1.8% in August, beating market expectations of a 0.7% increase. Total new orders were helped by increases in nondefense aircraft and parts (77.9%), capital goods (6.7%), transportation (5.5%), and manufacturing (3.3%). Orders excluding transportation gained a modest 0.2% in August but are up a solid 6.9% at an annual rate over the last three months. Orders for nondefense capital goods excluding aircraft, a closely watched proxy for business spending plans, rose 0.5%. Thus far in the third quarter, core capital goods shipments have risen 9.8% at an annual rate, while orders of these capital goods are up 6.8% on the same basis. Showing the effects of the continued supply-side disruptions, unfilled orders grew 1.0% MoM in Aug and are up 4.0% YoY, while Total Shipments were down -0.5% MoM. Primary metals, fabricated metal products, machinery, motor vehicle, and electrical equipment unfilled orders all up double-digits annually.

Why it Matters: Business investment continues to be strong (something we highlighted earlier in the month), providing an important gauge that business confidence in future demand is stronger than current sentiment surveys are indicating. So far, the emphasis post-recovery has been on information processing and software investments, something that does not bode particularly well for labor hiring intentions (more with less) but increases productivity and profitability in the long run. However, yesterday’s continuation of increasing core capital goods demand shows that fixed asset investment is still positively trending despite the late summer slowdown due to Delta and supply-chain disruptions more generally.

The Dallas Fed’s Manufacturing Index decreased by 4.4 points from the previous month to +4.6 in September. The production index, a key measure of state manufacturing conditions, rose 3.4 points to +24.2. However, the various sub-index measures were mixed. Shipments and Capacity Utilization edged up while the demand fell with New Orders and the Growth Rate of Orders dropping, although both still above the historical averages. The future perceptions of General Business Conditions also fell, both now below the historical average, while labor market measures indicated faster employment growth and longer workweeks.

Why it Matters: The majority of future expectation indicators fell in September, with the exception being Delivery Times, Prices Received, Employment and CAPEX. The future production index edged down to 41.8 but remained elevated, while the future general business activity index slipped four points to 11.5, a reading slightly below average. This perfectly encompasses the current negative supply-side continuation theme (priced in) while re-enforcing our view that things will improve and growth will exceed expectations. One comment from a Nonmetallic Mineral Product Manufacturing firm said it best, “We still cannot hire or find enough employees to be able to meet increasing demand. We would hire 20 today if we could. Demand just keeps increasing. Prices and lead times for shipments are at company historical highs.” This echoes comments we have posted here for months and shows there is still no meaningful reprieve to disruptions, although (again) we believe the worse case is now priced into markets.

Policy Talk:

Fed “characters” Brainard, Williams, Evans all spoke yesterday, allowing the doves to have their post-September FOMC meeting rebuttal. We say “characters” given we lost two yesterday to early “retirement”, with Kaplan and Rosengren, more hawkish voices in the mix, deciding a life of event speaking and buy-side advising would better continue their PA’s PnL positive trajectory than a seat at the table. Remember, it’s a game of confidence in the fiat currency world, and your local central bank can’t look corrupt, or it could topple the whole house of cards. Turning back to “Team Dove,” the general message attempted to separate tapering from rate hikes as yes, the immediate crisis was ending, but the road to normalcy was still long and windy.

Why it Matters: Governor Brainard noted she expected “growth this year and next will be sufficient such that by the end of next year, average annual growth since the onset of the crisis should exceed pre-crisis trend growth.” She highlighted that the lower EPOP level from lagging participation was still negatively affected by COVID constraints but had not been structurally altered. NY Fed President Williams echoed this sentiment. He highlighted the uniqueness of the situation, saying, “conditions reflect the extraordinary nature of the pandemic, and also illustrate that we still have a long way to go until we achieve the Federal Reserve’s maximum employment goal. Participation cycles lag unemployment cycles as job openings take time to fill, certainly a dovish interpretation of employment dynamics. Chicago Fed President Evans finished the trio's dovish message by focusing on well-anchored inflation expectations being the critical difference today verse past bouts of sustained structural inflation. Bottom line, yesterday was a fairly dovish day for the Fed with the loss of two hawks and a united message that there is still work to be done on the labor front while inflation remains transitory.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week, with the value factor higher again today as higher yields are hurting growth

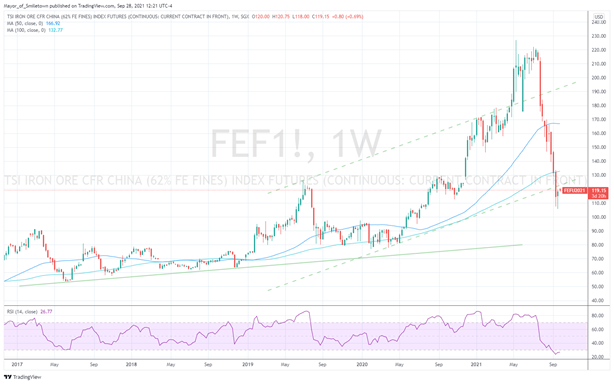

Chinese Iron Ore Future Price: Iron Ore futures are flat on the week, with industrial metals generally under pressure due to China’s power outages

5yr-30yr Treasury Spread: The curve is steeper on the week as we believe a new trend may be emerging

EUR/JPY FX Cross: The euro is stronger on the week as the passage of the German election and rising real-yields are supporting the currency despite a more risk-off tone globally

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

The Whole World: From Nairobi to Ningbo: See the Supply Shocks Spanning Globe - Bloomberg

From high-class problems to difficulties finding life’s necessities, the pandemic has convulsed global supply chains on such a scale that few industries, socio-economic classes, or regions are immune. Most experts see at least another six months before any return to normal. The blame lies in several places, but Covid-19 has essentially robbed the global economy of its rhythm.

Why it Matters:

Nike’s announcement last week that it was revising down its earnings expectations due to shortages was peak “supply-chain disruption” fears for us. Meaning the story is out, it is priced in, and now the risk is more to the improvement comes faster than expected, or things don’t get worse. Of course, we say that as China is turning the power off to key manufacturing regions due to a growing energy shortage there.

China Macroprudential and Political Tightening:

In the Dark: China’s Power Crisis Moves From the Factory Floor to Homes – Bloomberg

China is facing power issues on two fronts. Some provinces have ordered industrial cuts in order to meet emissions and energy intensity goals, while others are facing an actual lack of electricity as sky-high coal and natural gas costs cause generators to slow output amid high demand. The power cuts will likely cut China’s growth rate by 0.1% to 0.15% in the third and fourth quarters, CICC economists said in a report. Nomura cut its full-year expansion estimate to 7.7% from 8.2% on Friday, and now sees a possibility of further cuts to the forecasts due to the power shortages.

Why it Matters:

China’s energy crisis is beginning to hit people where they live, adding the risk of social instability to an economic slowdown and global supply chain disruptions. The impact to people’s homes shows how quickly the power crisis is escalating, as China typically first asks large industrial users to curtail consumption when supply gets tight. The energy shortages would also force companies to raise prices of goods for Chinese consumers and quicken inflation. We see this recent turn of events as a further reason (beyond Evergrande) to expect more macro-policy support for the economy, something we are observing with increased liquidity injection by the PBoC.

Vows: PBOC Vows ‘Healthy’ Property Market Amid Evergrande Crisis – Bloomberg

The People’s Bank of China will work to safeguard the healthy development of the real estate market and protect homeowners’ lawful rights, the bank’s monetary policy committee said at its quarterly meeting Friday, according to a statement released Monday. However, this contrasts with the government steadily tightening restrictions in the property market to rein in financial risks recently, which have curbed investment and economic growth.

Why it Matters:

The PBOC is now pledging to push real lending rates lower and said China’s economic recovery is “still not solid and not balanced.” That outlook was largely a repeat of the monetary policy report released in August, turning more cautious from the committee’s second-quarter meeting when it said the economy was “operating in a stable manner with more strength and improvement.” The monetary policy committee, chaired by Governor Yi Gang, also said the central bank would step up coordination of monetary policy with fiscal policy as well as with industrial policies and regulations to achieve a balance between supporting the economy with finance and preventing risks.

LONGER-TERM THEMES:

Commodity Super Cycle Green.0:

Nuke’em: U.K. Set for Nuclear Funding Law That Would Underpin Sizewell C - Bloomberg

Britain plans to legislate as soon as next month for a funding mechanism to spur the construction of new nuclear power plants to replace its aging fleet of reactors. The nation’s existing reactors are scheduled to close by the end of the decade, and building replacements have been a struggle, with two major projects shelved because of financing issues.

Why it Matters:

The current energy crisis is clearly changing the way people think and accept nuclear power. Unfortunately, in a highly regulated and increasingly green world, getting a nuclear plant going or retrofitted is a big undertaking with many chefs in the kitchen. We expect the U.K. to be shortly joined by other G20 nations after this winter's coming energy crisis really shows its teeth.

ESG Monetary and Fiscal Policy Expansion:

X-Date: Janet Yellen warns US risks running out of money by October 18 - FT

Treasury secretary Janet Yellen has warned the US risks running out of money by October 18 ahead of her joint congressional hearing with Federal Reserve chair Jay Powell on Tuesday. “At that point, we expect Treasury would be left with very limited resources that would be depleted quickly,” she said in a letter to congressional leaders. “It is uncertain whether we could continue to meet all the nation’s commitments after that date.

Why it Matters:

Late on Monday, a bill to raise the US borrowing limit failed to pass the Senate’s 60-vote filibuster threshold, with Republicans in the upper chamber of Congress voting to reject the measure. Democrats, who control the Senate by the slimmest of margins, are now under pressure to raise the borrowing limit on their own and avert a government shutdown ahead of a 12.01 am Friday deadline.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.