Midday Macro - 7/20/2022

Color on Markets, Economy, Policy, and Geopolitics

Midday Macro – 7/20/2022

Market Recap:

Price Action and Headlines:

Equities are higher, although falling off post-NY-open highs (due to concerns regarding Italian politics?), with growth and higher beta sectors outperforming, keeping the current relief rally continues

Treasuries are higher, but generally little changed as today's housing data failed to elicit much of a reaction while traders wait for next week's FOMC and other coming central bank meetings

WTI is lower, with today’s EIA inventory data showing greater draws than expected and reversing deeper overnight weakness while gasoline demand continues to fall, pushing the national average price towards $4.50

Narrative Analysis:

The overall narrative has become a little more hopeful, with Netflix’s “good enough” results and post-earnings bounce being a good summarization of the market’s current mantra. Much of the more shunned sectors/factors continue to outperform as the inflation to recession fear rotation continues. The S&P has moved above its 50 DMA for the first time since April, and optionality and technicals are becoming more neutral/supportive. With earnings so far being more positively received, we are now seeing the continuation of a multi-day rally despite this week’s housing data continuing to paint a picture of slowing demand. Treasuries are gravitating around 3% across the curve with expectations for a 75 bp hike from the Fed next week now gospel. Instead, eyes are turning to other central banks that look to be further behind the curve than the Fed despite even greater growth challenges. A lot is going on in the world of energy, but like rates, WTI seems to be sticking close to the psychologically important level of $100. The dollar is off highs seen last week thanks to a recovery in the Euro, but the $DXY remains over 107, an increasingly punishing level for financial conditions and corporate earnings.

The Nasdaq is outperforming the Russell and S&P with Growth, Small-Cap, and Value factors, and Communication, Consumer Discretionary, and Technology sectors are outperforming on the day.

@KoyfinCharts

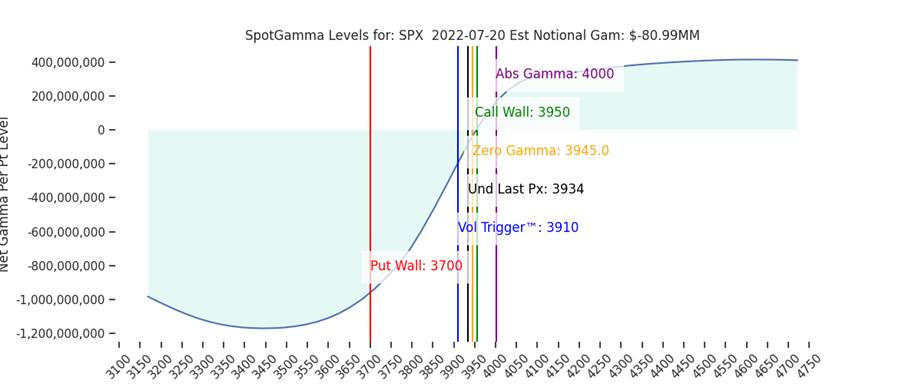

S&P optionality strike levels have the Zero-Gamma Level at 3945 while the Call Wall is 3950. Yesterday's strong rally was helped by this morning's VIX expiration. Option positioning indicates that if we hold above 3900, volatility should shrink sharply, giving the Bulls an edge now. As we move toward next Wednesday’s FOMC meeting, any higher implied vol (due to positioning/hedging for the event) becomes a headwind for equities with major overhead resistance at 4000.

@spotgamma

S&P technical levels have support at 3920, then 3890, and resistance at 3955, then 3985. The S&P had been coiling into a textbook triangle pattern since late June and finally broke out to the upside yesterday. In addition to a technical breakout, the S&P is also clearing its 50-day moving average for the first time since it was lost in April. The days after a breakout are critical, as they are when the most violent reversals occur (failed breakouts/traps) or successful backtests that start long trend legs (higher). So far, today’s price action looks to confirm the positive move, with the next major resistance being the 4030 area.

@AdamMancini4

Treasuries are higher, with the 10yr yield at 3.02%, lower by around 1.1 bps on the session, while the 5s30s curve is flatter by -1.1 bps, moving to 1 bps.

Deeper Dive:

Markets continue to reflect a more positive tone despite only a slight improvement in the macro backdrop, with the current earnings season being generally well received so far. Investor sentiment is at historically low levels, and positioning still indicates a very defensive posture, but the narrative is becoming more neutral, allowing for technicals and optionality to become more supportive. Given our belief that inflation has finally peaked, growth is not falling off a cliff, and the Fed won’t need to restrict policy more than what is currently expected, it is our opinion that financial conditions will not tighten meaningfully further (given no exogenous shock). When coupled with the overly negative investor sentiment, the need for such investors to begin to change posture into year-end (to justify their jobs), and continued gradual improvements in other negative macro factors, we see this as an opportunity to add risk tactically. As a result, we increased two existing longs and added several new long positions to the mock portfolio yesterday that we believe will reflect where short covering and new flows are allocated in the third quarter.

To be clear, we are not out of the woods yet. Next week we will again see Powell playing chicken with the markets, jawboning demand lower by giving the illusion that the Fed wants a recession to rein in inflation. He is our modern-day James Dean in “Rebel Without a Cause,” a central banker forced to now wait to the last second to jump out of his car (policy tightening path) as it races towards a seaside cliff (recession). It’s ironic that he spoke about waiting to see the whites of inflation's eyes in the past. Today the Fed needs to see consistently lower core PCE prints, coupled with falling inflation expectations and wage pressures stabilizing. A still somewhat tall order, which is why we initially stated we are far from out of the woods yet.

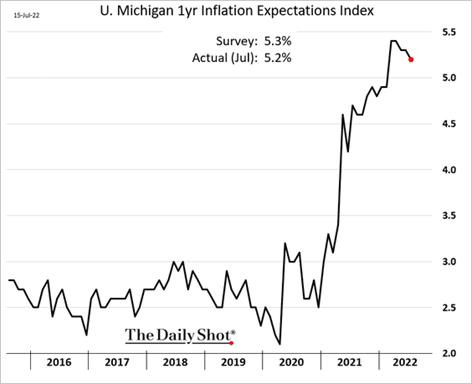

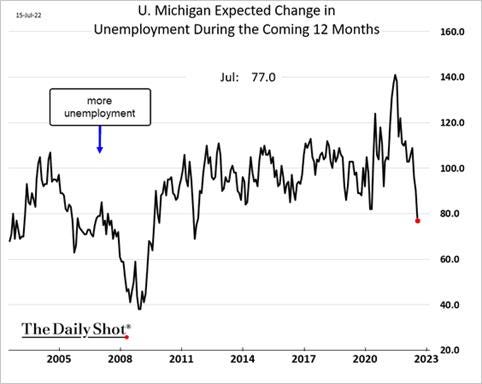

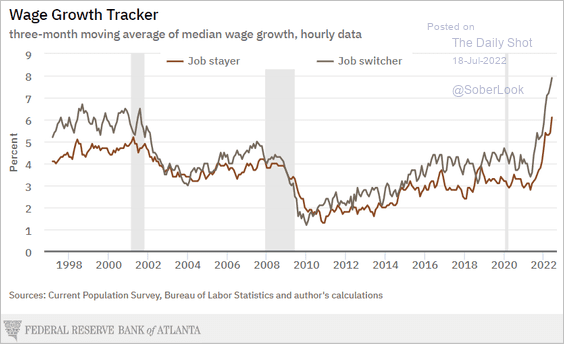

However, the good news is that many indicators suggest that those three inflation metrics should increasingly cool. Forget last week's high CPI and PPI. Scary, yes, watched, sure, but not critical for the FOMC decision process. Instead, more importantly, inflation expectations fell slightly last week. When coupled with intentions to buy and consumers’ “general outlook,” an argument can be made that the Fed has convinced everyone it is back on track to achieve price stability. This is further supported by lower market pricing of inflation expectations, which along with outright drops in commodity prices, is signaling a cooling in the current inflationary pulse. Elsewhere, the Atlanta Fed’s wage tracker notably ticked higher but was somewhat dismissed given the barrage of hiring reductions announced across corporate America, as well as the slowing in regional and small business survey readings for hiring/employment current activity and expectations. Demand is cooling, and firms and consumers are taking note and adjusting activity. It will no longer be as easy to find or change jobs, and as a result, openings and quits will increasingly fall, loosening the labor markets and reducing wage spiral fears.

*Still a long way to go before reaching a more normal level, but the market took some relief in the recent drop in the drop in one-year inflation expectation in the University of Michigan’s Consumer Confidence report

*The labor market remains tight, but as written before, we question the elasticity of demand for many of the openings if demand begins to fall more meaningfully

*Despite opening and quits still remaining at highly elevated levels, consumer sentiment indicates a more cautious view on future job opportunities

*As a result, it seems unlikely that wage pressure will remain at such elevated levels given it is driven primary by turnover; however, just like openings and quits, this will be slower to reflect the cooling economy

So with our view that inflation has peaked and the Fed has been successful in talking down demand, why are we not more worried a prolonged deeper recession is coming? As stated in prior writings, the economy is coming from a strong place, an overstimulated one, actually. Currently, the inflation tax has to be paid for the monetary and fiscal excesses, but there is a sound structural base underneath (Please refer to our “good” macro factor outlook written about in the past). Things are slowing, and buffers such as savings and credit are being used to maintain purchasing power while real disposable income falls. Still, on the aggregate level, income statements and balance sheets for both consumers and firms are not flashing red warning signs (yet). The hard data is simply not as bad as the soft data would have you believe. This leads us to believe, given no further deterioration in external macro factors, that a more prolonged risk asset rally can occur in Q3 as soft data indicates an improving outlook for 2023 (as inflation falls and confidence rebounds) while the hard data maintains some momentum. This belief is emboldened by likely coming political change in DC due to the midterms (split Congress). Historically this leads to a more positive psychological effect on investors. We also believe such investors will increasingly be under pressure to put money to work into year-end.

*Markets began to rally several months before Volcker ultimately declared victory over inflation, and if The Fed reaches its stated Fed Funds target around year-end, things may begin to get interesting in Q3

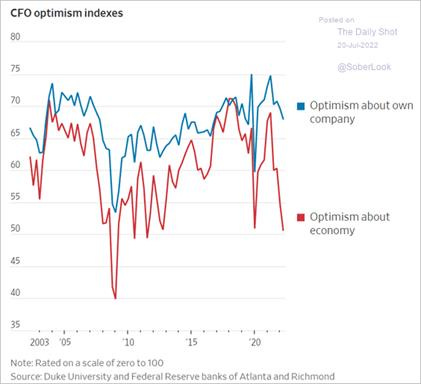

*Optimistic in yourself, just not everyone else? It seems like an odd dichotomy with emotional biases at play with CFO optimism

With that all being said, here’s what we added to our mock portfolio and why: We increased our long position in the S&P through the $SPY ETF to 15% to capture more market beta. We added a 5% long position in the Nasdaq through the $QQQ ETF as we believe that technology and growth will outperform due to short covering and investors being currently underweight. In staying with the short-covering rally theme, we added a long in the small-cap growth factor through the $VBK ETF. We want to be overweight growth (vs. value) and more U.S. revenue/earnings focused fundamentally, but this is generally a tactical play on short covering momentum. We added a 5% long to the Healthcare sector through the $IYH ETF and a 5% long to the Biotech sector through the $IBB ETF. We think the general healthcare area is fair valued (with biotech better valued than usual) and will receive significant institutional capital flows as well as having a longer-term, more structurally sound, positive fundamental story. Finally, we increased our copper long through the $JJC ETF to 20%. We have been preparing a more focused deeper dive on copper (and China) and plan to release it next week. This will fully explain our logic here, but the highly oversold condition, belief that China’s EV and renewable push is coming faster than expected, and continued longer-term supply and demand dynamics have us sticking to our guns here. In summary, we have added a lot of risk to our mock portfolio based on the fundamental macro reasons identified above and the sentiment and positioning we currently see. Wish us luck because we are still in a highly uncertain growth environment where the current level of market discounting and the ultimate level of the coming slowdown in the economy has yet to be confirmed/aligned.

*The portfolio is down -5.33% since its inception and is now 75% invested

Econ Data:

Existing home sales fell by -5.4% to a seasonally adjusted annual rate of 5.12 million in June, a new low since June of 2020 and well below market forecasts of 5.38 million. The median existing-home price for all housing types was $416K, up 13.4% YoY, and total housing inventory increased 9.6% from May to 1,260,000 units or the equivalent of 3 months at the current rate of sales. Single-family home sales declined by -4.8%, and those of existing condominiums and co-ops were down by -9.8% to 550,000 units.

Why it Matters: No improvement in affordability and fear as the word is out that the party is over. "Falling housing affordability continues to take a toll on potential home buyers," said NAR Chief Economist Lawrence Yun. "Both mortgage rates and home prices have risen too sharply in a short span of time." The good news is that inventory levels are slowly normalizing, which will create a more balanced supply and demand situation. The number of days houses stay on the market also fell further, showing that demand is not totally evaporating as price drops are likely helping move product.

*Weakness was most pronounced in the West, followed by the South, as seen in the starts data

Housing starts fell by -2% in June to an annualized rate of 1.559 million units, the lowest since September of last year. Figures were lower than the forecasted 1.58 million but followed an upwardly revised 1.591 million rate in May. Single-family housing starts fell by -8.1% to 982K, while starts for multi-units were higher by 15% to 568K Starts were lower in the South (-4.8%) and the Midwest (-7.7%) but rose in the Northeast (10.6%) and the West (3.7%). Building permits decreased by -0.6% to an annualized rate of 1.685 million in June, the lowest level since September of last year and compared to forecasts of 1.65 million. Single-family authorizations dropped by -8%, while multi-units climbed by 13.1%. Building permits declined in the Midwest (-15.7%) and the South (-2.1%) but increased in the Northeast (18%) and the West (5.8%).

Why it Matters: Despite the growing declines in single-family houses, which have been down for four months, there has been no material slowdown in multi-unit starts and permits (on aggregate). Of course, this makes up a smaller percentage by volume of starts and permits and is telling that the move to the suburbs brought on by the pandemic continues to end.

*There are still a lot of homes about to start or under construction, meaning the drag to the economy from any slowdown will initially be minimal given the existing capacity constraints/backlog

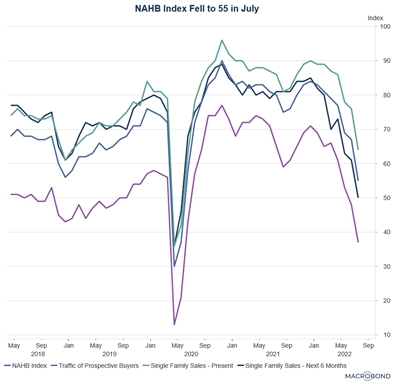

The NAHB housing market index fell to 55 in July, the seventh month of decline and the lowest reading since May of 2020, compared to 67 in June. The Current Sales subindex dropped 12 points to 64, Buyer Traffic fell to 37 from 48, and Sales Expectations in the Next Six Months declined 11 points to 50. Looking at the three-month moving averages for regional HMI scores, the Northeast fell six points to 65, the Midwest dropped four points to 52, the South fell eight points to 70, and the West posted a 12-point decline to 62.

Why it Matters: Activity in housing has gone from cooling to now potentially contracting into year-end. The supply-side impairments remain while demand is increasingly falling, as seen through decreasing levels of asking prices and other indicators. “Production bottlenecks, rising home-building costs, and high inflation are causing many builders to halt construction because the cost of land, construction, and financing exceeds the market value of the home. In another sign of a softening market, 13% of builders in the HMI survey reported reducing home prices in the past month to bolster sales and/or limit cancellations”, said NAHB Chairman Jerry Konter.

*According to NAHB, there has been a 46% decline in homebuyer traffic over the last six month

Policy Talk:

Although we are in the July FOMC meeting blackout period and no current Fed officials are speaking, there was an interesting interview of Randal Quarles by David Beckworth of the Mercatus Center on his “Macro Musings” podcast worth highlighting. Quarles starts the interview by recounting some of his earlier career and Fed Governor experiences. This eventually leads to a story about a security guard recognizing who Arthur Burns is, “the guy that let inflation get out of control.” This segues the conversation into how the Fed currently finds itself behind the curve and worried they are the next Arthur Burns crew. He noted that initially, in the spring of 2021, inflation was being driven by only a few things, primarily used car prices due to computer chip shortages. He argues that the Fed felt it couldn’t materially change the supply of needed inputs, so it didn’t raise the level of concern that would come later as supply chain disruptions increased and labor remained missing. Quarles also noted that he was caught off guard by how overstimulated demand became. He finished by saying that the need to slow purchases (to ensure there wasn’t another “taper tantrum”) was also a main driver in the delay in pivoting policy. He next discussed the Fed is unable to change the 2% target due to credibility concerns. He commented that he believes the Fed’s balance sheet will remain at post-pandemic levels due to changes in demand for reserves, although likely closer to $6 trillion. He doesn’t believe there will be much appetite by the Fed for a smaller balance sheet and instead worries about the political pressure on the institution to keep it large. He finishes the interview on how he sees regulation evolving, highlighting the success of stress tests and noting the difficulties in regulating the “non-bank financial intermediation” sector (or shadow banking).

“But one of the things that I had chosen to put on my walls was actually painted by Arthur Burns... But I had it on my wall as sort of a memento mori of, "Don't do this." Not the painting, but what Arthur Burns stood for at the Fed.”

“Randy, nobody wants a funny Federal Reserve governor, and B, you're not that funny. So tone it down."

“So given the information that we had, given what was a very logical narrative of expected inflation from supply chain disruption, the right response was to say, "Well, we shouldn't begin yet in trying to constrain this inflation."

“But my belief is that it's a separate element of the Fed religion that resulted in not moving in the fall, and it became clear that it was time to pivot to withdrawing accommodation, and it's a long-standing kind of Fed principle that you shouldn't step on the gas and the brake at the same time; meaning that you shouldn't be raising interest rates at the same time as you are still increasing the size of the balance sheet.

“If I had a clear solution to the right framework for macroprudential regulation of the non-bank system, I'd happily provide it to you. I don't.”

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the day and the week. Large-Cap Growth is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day and the week. Sentiment has soured towards the property sector as stopped mortgage payments and further credit concerns increase project cancelations

5yr-30yr Treasury Spread: The curve is flatter on the day, and the week as Treasuries with yields generally little changed on the day

EUR/JPY FX Cross: The Yen is higher on the day but lower on the week as the ECB and BoJ both have highly anticipated meetings approaching, with the Euro likely to get more hawkish support

Other Charts:

According to GS’s Sentiment Indicator, positioning is “Extremely Light.”

This was also confirmed by BofA’s Fund Manager Survey, which showed managers were the most underweight equities since October of 2008.

Not surprisingly, the BofA’s FMS also showed that cash holdings were at their highest levels over two decades.

Earnings growth is going to fall given what we are seeing in leading business cycle indicators, but how much continues to be the question given the robust demand and pricing power firms have experienced so far this year. Variant Perception’s model sees close to a -10% twelve-month EPS YoY trough coming.

“With commodity prices falling, the copper/gold ratio is declining. This suggests that bond yields may have peaked for the cycle.” - @TimmerFidelity

"The production capacity of the U.S. economy as a whole could be as much as 7% less now than it would have been without the pandemic. That’s a massive economic shock and explains why inflation is so high." - @BlackRock

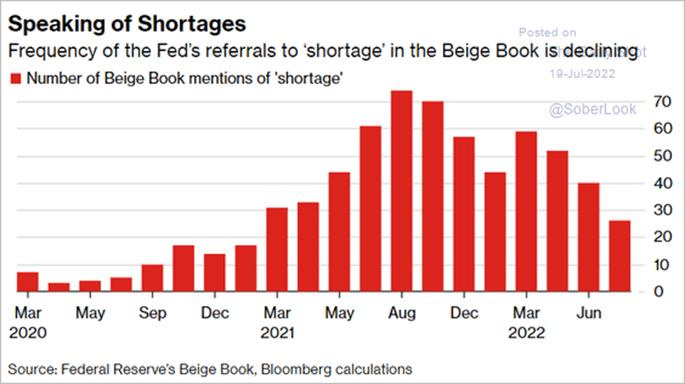

There has been a consistent drop in referrals to “shortages” in the Fed’s Beige Book over the last months, showing that the supply-side shortages are easing.

The level of price cuts for current homes for sale continues to rise as sellers rush to get out.

There has been a minimal decline in actual oil production in Russia, and more price-sensitive buyers such as India and China are increasingly buying more. Generally, Russian exports of other commodities are also increasing, as seen in normalizing commercial vessel activity to foreign ports, although this is still 15% below pre-invasion levels.

Article by Macro Themes:

Medium-term Themes:

Real Supply-Side Situation:

Another Year or Two: Supply Chains Unlikely to Stabilize Until 2024, Survey Finds – SupplyChainBrain

More than half of supply chain executives don’t expect a "return to normal" until the first half of 2024 or beyond, according to a new survey by Carl Marks Advisors. Meanwhile, 22% say they expect disruptions to continue until the second half of 2023. They also see a number of other factors preventing a return to supply chain stability, most notably the war in Ukraine (30%) and labor concerns (24%). Looking forward, more than two-thirds of supply chain executives said they are “very concerned” that the U.S. economy could tilt into a recession over the next 12 months as a result of rising interest rates, high inflation, and geopolitical uncertainty, and a resultant pull-back in consumer confidence.

Why it Matters:

According to the survey, 75% of supply chain executives said revenues at their company had been either negatively or very negatively impacted over the past year by supply chain issues. Ocean shipping was by far the leading broken transportation and logistics link, at 68%. The impact of the disruptions has been severe: 80% of respondents said their supply chain costs have risen by between 20-60% between December 2020 and December 2022.

China Macroprudential and Political Loosening:

Jobs and Inflation: China’s Premier Signals Flexible Growth Target, Stimulus Caution - Bloomberg

Chinese Premier Li Keqiang signaled flexibility on the growth target and reiterated caution on excessive stimulus, with a focus on employment, household income, and price stability. “China won’t roll out massive stimulus, issue an excessive amount of money, or overdraw the future for an overly high growth target,” Li was quoted as saying in a report by Xinhua News Agency. China’s stimulus rolled out since the pandemic first hit in 2020 has been “reasonable” in scale, and this has laid a foundation for preventing inflation, Li said. There’s still a lot of room for the previous round of support measures announced in May to take effect, he added.

Why it Matters:

Gross domestic product may expand about 4.8% this year, according to Liu Yuanchun, President of Shanghai University of Finance and Economics, citing pro-growth policies that could lift growth above 6% in the third quarter. Further economic support could come in the form of front-loading 2023 special local government bonds, raising the budget deficit, or issuing special sovereign debt, he said, all measures that could help China avoid a “policy cliff” in the fourth quarter. The key to maintaining economic and social stability will be ensuring the unemployment rate is contained under 5.5%, he said. The unemployment rate climbed as high as 6.1% earlier this year, just below the record.

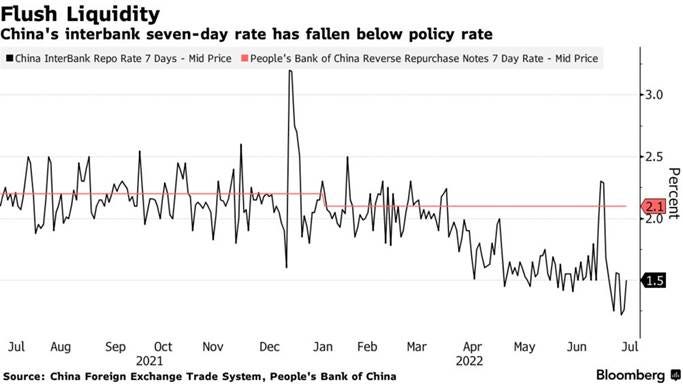

Certain Downward Pressure: China Central Bank Governor Pledges Stronger Support to Economy - Bloomberg

China’s central bank will step up the implementation of its prudent monetary policy to provide stronger economic support, Governor Yi Gang said. The economy is facing “certain downward pressures” due to the pandemic and external factors even as domestic inflation is relatively low, Yi said in a meeting of G-20 central bank governors and finance ministers. The People’s Bank of China released a statement on his comments Saturday.

Why it Matters:

The PBOC has taken a cautious easing path this year as aggressive rate hikes by the Federal Reserve widen its monetary policy gap with the U.S. and drive outflows. It kept the rate on its one-year policy loans unchanged at 2.85% on Friday while rolling over 100 billion yuan ($14.8 billion) of the maturing loans amid ample cash levels in the banking system. We need further actions to prove that the PBOC is serious about providing stronger support, but given the growth backdrop and inflationary picture, it is likely there will be additional actions coming in the second half and even a greater amount next year as the Fed pauses their rate hiking cycle.

Extend and Pretend: China raises loan-support efforts for developers amid mortgage boycott - Reuters

Chinese regulators stepped up efforts to encourage lenders to extend loans to qualified real estate projects as the beleaguered property sector faced fresh risks from a widening mortgage-payment boycott on unfinished houses. The China Banking and Insurance Regulatory Commission (CBIRC) told the official industry newspaper on Sunday that banks should meet developers' financing needs where reasonable.

Why it Matters:

The latest news helped banking and property stocks recover some of their recent losses. The rebound in Chinese banking stocks was also aided by news that China will accelerate the issuance of special local government bonds to help supplement the capital of small banks, part of efforts to reduce risks in the sector. China may also allow homeowners to temporarily halt mortgage payments on stalled property projects without incurring penalties, Bloomberg reported after the market closed on Monday, citing people familiar with the matter.

Longer-term Themes:

National Security Assets in a Multipolar World:

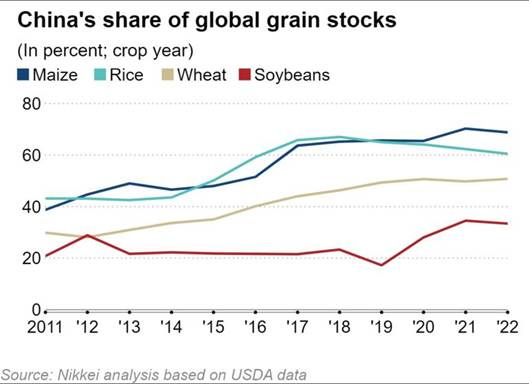

Boosting Food Reserves: China hoards over half the world's grain, pushing up global prices - NikkeiAsia

Less than 20% of the world's population has managed to stockpile more than half of the globe's maize and other grains. According to data from the U.S. Department of Agriculture, China is expected to have 69% of the globe's maize reserves in the first half of the crop year 2022, 60% of its rice, and 51% of its wheat. China is maintaining its food stockpiles at a "historically high level," Qin Yuyun, head of grain reserves at the National Food and Strategic Reserves Administration, told reporters in November. "Our wheat stockpiles can meet the demand for one and a half years. There is no problem whatsoever about the supply of food."

Why it Matters:

China spent $98.1 billion importing food (beverages are not included) in 2020, up 4.6 times from a decade earlier. In the January-September period of 2021, China imported more food than it had since at least 2016, which is as far back as comparable data goes. Over the past five years, China's soybean, maize, and wheat imports soared two- to twelvefold on aggressive purchases from the U.S., Brazil, and other supplier nations. Imports of beef, pork, dairy, and fruit jumped two- to fivefold. China is importing more grain and other food because domestic production is unable to keep up with consumption, and President Xi is stressing the importance of food security.

Go North: US Coast Guard calls for larger icebreaker fleet to compete in the Arctic – Defense News

During a hearing with the House Homeland Security Committee’s transportation and maritime security panel, Adm. Linda Fagan emphasized the need to build an icebreaker fleet capable of maintaining a strong presence in the Arctic region, specifically pointing to polar security cutters. The Coast Guard will eventually receive three heavy icebreakers, followed by three medium icebreakers.

Why it Matters:

The U.S. has in recent years run a stark PSC deficit against other Arctic powers, such as Russia. Russia now has more than 40 active icebreakers, including roughly ten nuclear-powered variants, according to the U.S. Coast Guard’s Office of Waterways and Ocean Policy. The U.S. operates two icebreakers, the heavy Polar Star and the medium Healy. That capability difference, Fagan argued, makes clear “why it is so critical” to close the gap in icebreaker capabilities. With the polar ice steadily decreasing, new resources are being unlocked, and given current relations with Russia and China, the region will become more critical to defend.

Electrification and Digitalization Policy:

Third Parties: Feds are tracking phone locations with data bought from brokers – The Verge

The Department of Homeland Security has paid millions of dollars since 2017 to purchase, without warrants, cell phone location data from two companies to track the movements of both Americans and foreigners inside the U.S., at U.S. borders, and abroad, according to a report released by the American Civil Liberties Union on Monday. The contracts, which purchased harvested data from apps on hundreds of millions of phones, allowed DHS to obtain more than 336,000 location data points across North America, including within Los Angeles, New York, Chicago, Denver, Toronto, and Mexico City. It is not clear whether ICE and CBP have used the data to make specific arrests of individuals.

Why it Matters:

The collection and use of this location data began under the Trump administration but has continued into the Biden administration, with CBP renewing a contract for $20,000 that ended in September 2021. ICE also reportedly signed another contract with Venntel in November, which is set to expire in June 2023. The ACLU said the documents are further proof that Congress needs to pass the bipartisan Fourth Amendment Is Not For Sale Act, proposed by Senators Ron Wyden (D-OR) and Rand Paul (R-KY), which would require the government to secure a court order before obtaining Americans’ data, such as location information from our smartphones, from data brokers.

Securing the Satellites: US-UK special relationship deepens in space - SpaceNews

U.S.-U.K. collaboration in space entered a new phase in April when the commanders of U.S. Space Command and U.K. Space Command signed an Enhanced Space Cooperation memorandum of understanding known as the ESC MOU. The ESC MOU is a non-legally binding framework for deeper military cooperation in the space domain. It calls for exchanging more information, harmonizing military space requirements, and identifying potential joint activities.

Why it Matters:

U.S. Space Command is a combatant command the Pentagon re-established in 2019 to oversee military operations in the space domain. The United Kingdom stood up U.K. Space Command in April 2021. Pepper said the enhanced MOU with the United Kingdom could serve as a model to enhance U.S. and U.K. partnerships with other nations. “We established a program called ‘pathway to partnership,’ which establishes a method for allies and partners to integrate with U.S. Space Command,” he said. “The pathway allows any space capable country to join at the appropriate level and then progressively deepen their integration with the U.S. over time.”

ESG Monetary and Fiscal Policy Expansion:

Union Support?: Biden names emergency board to mitigate railroad disputes – Port Technology

U.S. President Biden has appointed members to a Presidential Emergency Board (PEB) to help resolve ongoing disputes between freight rail carriers and unions. The action, signed through an Executive Order, triggers a “cooling-off” period to help parties reach a negotiated settlement. “The PEB will provide a structure for workers and management to resolve their disagreements,” reads the official statement from the White House.

Why it Matters:

Biden chose to intervene in railroad labor talks covering some 115,000 workers’ new contracts following an urgent call from the U.S. Chamber of Commerce. The President said the goal is to keep America’s freight rail system running without disruption. Averting a nationwide railroad strike is key as this threatens to have devastating effects on the US supply chain, said Chamber’s President Suzanne Clark. Negotiations between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) are still underway. Container dwell times are rising again because of the labor frictions.

Appendix:

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION