Midday Macro - Semi-weekly Color – 6/8/2022

Overnight and Morning Market Recap:

Price Action and Headlines:

Equities are lower, but remain in their recent range, with an overnight rally reversing on increased inflationary fears with little new economic data today and a lack of Fed speakers (blackout period)

Treasuries are lower, with the curve little change as traders are seeing the increasing energy costs as likely increasing the level of central bank tightening coming

WTI is higher, with weekly inventory data again supporting prices, although natural gas is down over -8% due to an explosion at an LNG export terminal

Narrative Analysis:

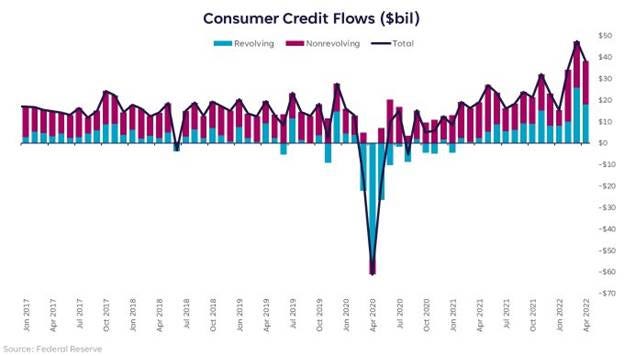

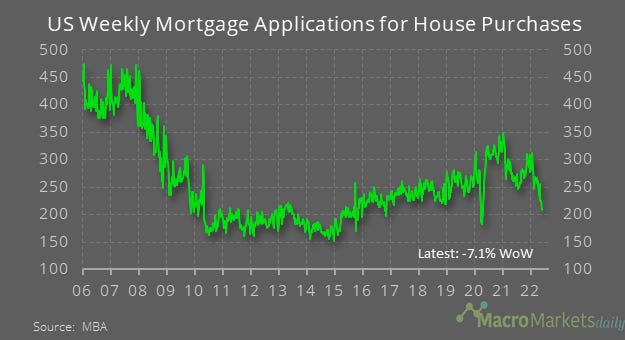

Equities are lower, after a more positive overnight session, and NY open, eventually reversed into a more sustained pullback. However, the now well-defined multi-week range continues to hold as markets brace for Friday’s CPI print (and its implication on next week's FOMC meeting), something expected to show an 0.6% monthly increase in the core inflation rate due to rising shelter costs. Speaking of housing, weekly mortgage applications fell to a multi-decade low as housing activity is slowing faster than expected. Yesterday’s consumer credit data showed that credit card debt is back above pre-pandemic levels as rising prices have forced greater use there. Treasuries have reversed much of yesterday’s relief rally, with the ten-year yield back above 3% largely thanks to the persistent creep higher in oil as WTI got a boost to around $123 after weekly inventory draws were again more significant than expected. The dollar is stable in today’s session, with the $DXY at 102.5, despite the free fall in the Japanese Yen, which is now approaching 135.

The Nasdaq is outperforming the S&P and Russell with Growth, Momentum, and Low Volatility factors, and Energy, Communications, and Consumer Discretionary sectors are outperforming.

@KoyfinCharts

S&P optionality strike levels have the Zero-Gamma Level at 4204 while the Call Wall is 4200. The 4100 area continues to be major support, with 4150-4160 primary resistance. The volatility reduction since Memorial Day has been significant, with many 1% moves being unable to move the S&P out of its 4100-4160 range. There continues to be a large level of open interests (calls & puts). Still, trading volumes in options are falling, supported by the drop in implied volatility, which suggests traders are happy with their positions going into Friday’s CPI print and June’s FOMC meeting.

@spotgamma

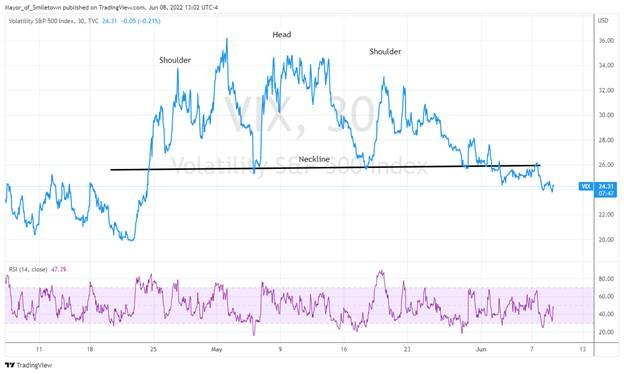

S&P technical levels have support at 4090-4100, then 4070, and resistance at 4135, then 4165. The range is coiling, and since the May 30th high, the S&P has made higher lows and lower highs, building a picture-perfect triangle. The last triangle like this was around Oct 1st, 2021, which resulted in a 500-point upside move. It is likely the market will continue to chop until the two coming catalysts (CPI and June FOMC) drive it out of the triangle. Finally, there is an inverse head and shoulder pattern forming (red circles below), a bullish pattern.

@AdamMancini4

Treasuries are lower, with the 10yr yield at 3.026%, higher by around 4.8bps on the session, while the 5s30s curve is little changed, sitting at 14.7bps.

Deeper Dive:

We want to take a step back and do a quick “Good, Bad, and Ugly” review on the macro backdrop. With this Friday’s coming CPI print likely to set the tone for next week's FOMC meeting (and odds on whether the Fed will hike 50 or 25 basis points at their September meeting), it is worth reviewing where we currently stand. We continue to believe that inflationary pressures (as seen through the core rate) will continue to decelerate over the next few months, but the persistence of rising energy costs (and, to a lesser extent, food) will likely leave any slowing/deflation short-lived as headline inflation eventually pulls the core rate higher again (a head fake so to speak). This, however, leaves a window for Fed tightening expectation to fall, and hence the desired amount of financial tightening the Fed is targeting to be reduced before a more hawkish tone has to be eventually restruck in 2023. This assumes no material changes to the current macro backdrop, which will 100% change given how volatile/uncertain many of the macro variables are. With that all said, today, we will take a look at the “good” things still currently occurring in the economy, with the bad and ugly to follow in subsequent writings.

The Good: Although there is much to be worried about, the overall financial health of consumers and businesses is still historically strong. Demand is slowing and changing due to the reopening and effects of sustained high levels of broad inflation, but neither the consumer nor firm have yet to roll over in a way that indicates a prolonged deeper recession is inevitable.

The Consumer: Yes, sentiment/confidence continues to be weighed on by geopolitical developments and persistent inflation; however, overall consumption remains solid, with the consumer not materially stepping back but instead changing preferences (Goods ► Services, Discretionary Goods ► Staples). Real consumer spending is on track to increase 5% in Q2, according to Evercore ISI.

*Real PCE remains above trend even with personal savings falling and revolving credit use rising, all while real disposable income is increasingly taxed by inflation, showing a resilient consumer

This real activity is supported by a strong labor market with the now well-known saying that there are two openings for every one worker, which has resulted in rising nominal wages & benefits. Although there is a growing/long list of companies announcing freezes to hiring or outright cuts, and business surveys are noting a cooling in intentions to hire, there is still a long way to go before this stops being a “tight” labor market.

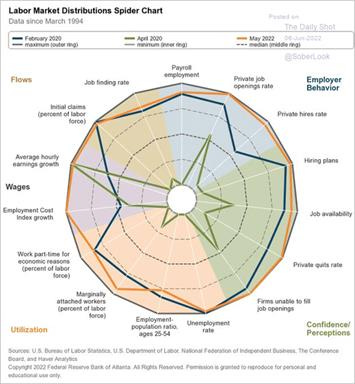

*Labor markets are in better shape than they were before the pandemic by many measures, with the above spider chart showing only the EPOP is in worse shape

*Openings (and quits) look to be plateauing and likely to fall given the outlook for end-demand is weakening, but, again, there is a long way to go before this is a more normal labor market

Household wealth, off recent highs, is still considerably elevated, and although there is much to say about the depth/distribution of wealth/savings, and we don’t want to oversimplify, the U.S. aggregate household's net worth is around $150 trillion with cash bank accounts close to $3.5 trillion. Unlike during the GFC recession, where net worth had already been dropping for some time (before quarterly GDP growth sequentially contracted), the pullback in equities that occurred in Q1 was buffered by housing and other asset appreciation. We would need to see subsequent drops across all categories to give us the conviction that aggregate demand would meaningfully fall quickly.

*Q1 2022 likely saw a decrease in net worth due to drops in equity valuation and an increase in liabilities due to rises in revolving debt; however, one-quarter of losses is not enough to raise red flags

*Post-pandemic gains in household wealth have been historically high and are giving the consumer a buffer (and likely the cause of) to the effects of inflation

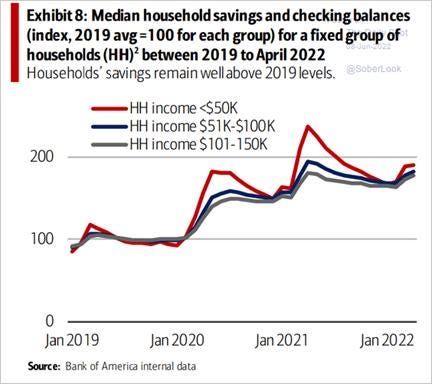

*Household savings and cash holdings remain well above pre-pandemic levels

The Firm: Real economic activity, as seen in production and sales data, as well as business activity gauges, as seen in PMI reports and regional/small business surveys, is not collapsing. A slowing of activity due to weakening demand has already begun, and the realization/expectations of this are increasingly reflected in business sentiment/outlook across sectors. We take comfort in this as businesses will be less likely to over-extend themselves moving forward, while many took advantage of the low rate environment over the last two years to shore up their balance sheets (reducing the odds of a credit crunch). Finally, if you did survive these last two years, your ability to manage supply-side disruptions and evolve to maintain productivity has likely left you in a much stronger position as a business, meaning any coming slowdown should be manageable.

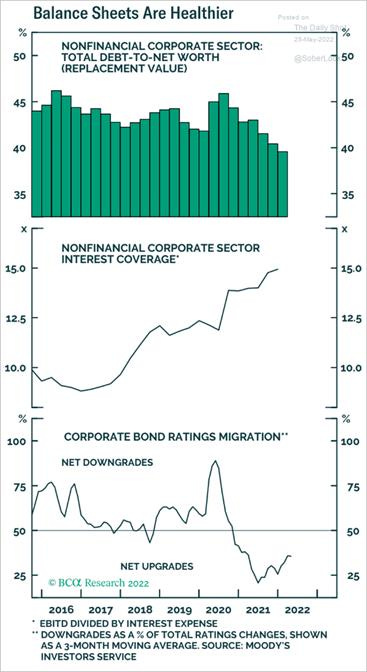

*Interest coverage ratios have improved for corporates, while the NFIB Small Business survey reported that only 2% of owners reported that all their borrowing needs were not satisfied

*Is the worst of the supply-chain constrained inflation over, and hence can businesses look forward to better conditions? We think so, but the effects of Chinese Covid-lockdowns have yet to be fully felt while there are other worries lurking, such as logistic sector labor strikes

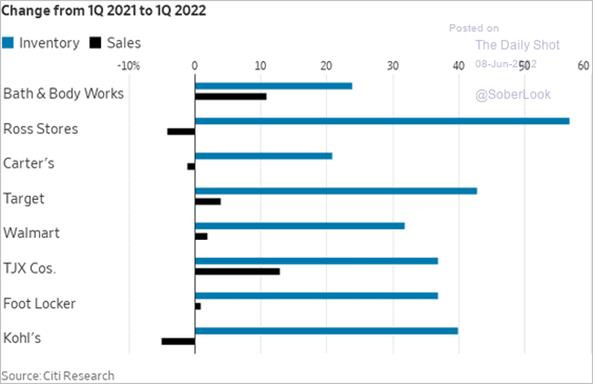

Furthermore, there are always winners and losers when significant changes in consumer behavior occur, as is happening now. Airline surveys continue to move higher as domestic leisure demand is strong and consumers have yet to show much price sensitivity. On the flip side, retailers look to be caught with the wrong inventory as management failed to predict the pushback that would result from continued price rises that have led to more disposable income being used on discretionary services rather than goods. At the same time, spending on staple goods has taken a more significant chunk of the paycheck more generally, helping retailers like Walmart and Target maintain revenue levels despite purchases going to lower margined goods, increasing worries regarding future earnings.

*Travel and hospitality orientated sectors continue to see strong activity as consumer mobility returns to pre-pandemic levels

*Although not to be ignored, we question whether the mismatch of inventories to sales recently reported by large retailers can be meaningfully extrapolated to other sectors/industries, and hence overall index level earnings forecast need to be materially lowered as they were for that sector

In summary, and as part of the “good” part of our three-part macro backdrop series, we wanted to highlight that despite the growing chorus of recession/stagflation calls, there are still some positives supporting consumers/households and businesses/firms which should keep growth from materially weakening quickly. Stepping back, we are increasingly worried about the tax higher energy and food costs are having across the (global) economy in the long run, persistently weighing on real disposable income/earnings and sentiment/confidence. If there is no meaningful reprieve to the recent increases in fuels and food costs (Things we will cover in the “bad” and “ugly” analysis of the current macro backdrop), then the outlook for growth and risk assets will eventually substantially deteriorate at some point in the second half of this year, leading us into a more prolonged deeper recession and risk assets to hit new lows into year-end. However as it currently stands, the consumer and business activity have remained resilient despite all the challenges and uncertainties, helping keep risk assets somewhat range-bound over the last two weeks, and why we think (along with our belief core inflation falls tactically) that the current rally has further to go despite the growing headwinds from rising energy prices and the back up in yields.

*Although not perfect, and we are always reluctant to use technicals on volatility measures, the VIX has put in a head and shoulder formation, dropping recently to the lower 20s, indicating equities may have a further leg up if the CPI print is in line with expectations, FOMC does not hawkishly surprise, and June’s OPEX widens the current trading range

Econ Data:

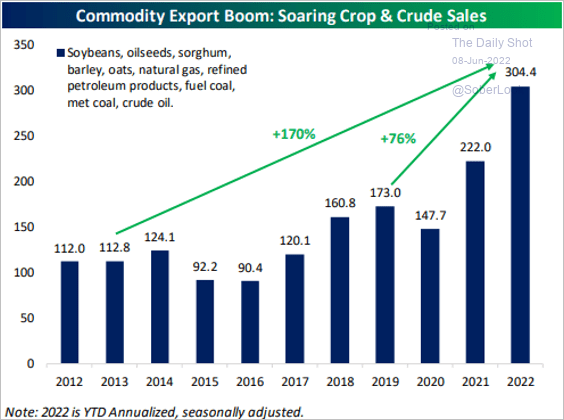

The trade deficit narrowed to a four-month low of $87.1 billion in April from a record of $107.7 billion in March and below market forecasts of an $89.5 billion gap. Exports were up 3.5% to a record high of $252.6 billion, led by natural gas, other petroleum products, soybeans, civilian aircraft, travel & transport. Imports declined 3.4% to $339.7 billion due to lower purchases of household goods, toys & games, sporting goods, industrial supplies & materials, capital goods, and computers. The deficit with China decreased from $8.5 billion to $34.9 billion, with imports falling by $10.1 billion, the most in seven years as China was under a covid lockdown. The shortfall with Mexico widened from $1.7 billion to $11.5 billion. The gap with Russia continued to narrow to $2 billion from $2.6 billion.

Why it Matters: The decline in imports represented a sharp turn from the trend of previous months when businesses added to their inventories at brisk paces following prolonged supply-chain disruptions triggered by the Covid-19 pandemic. With inventory levels improving and lockdowns in China limiting exports there, the monthly change was outsized but may represent a more sustained reversal in trend. The biggest increase in exports was industrial supplies and materials, which included energy products followed by goods, feeds, and beverages, which included soybean exports. This trend should continue given the food and energy shortages currently occurring, helping the balance of trade overall moving forward. However, export demand will continue to face strong headwinds from fragile economic conditions in Europe, said Mahir Rasheed, US economist at Oxford Economics. “We expect net trade to impose a sharp drag on GDP growth, but aggressive [Federal Reserve] tightening and moderating domestic demand will likely foster more balanced trade flows and imports cool and exports gradually improve,” said Rasheed.

*Drops in imported goods, either from falling demand or supply-chain impairments out of China, were the main reason why the balance of trade improved

*Exports of commodities continue to increase as protectionist calls seen elsewhere have yet to take root here

Consumer credit increased by $38.07 billion or 10.1% on an annualized basis in April, after a downwardly revised $47.34 billion gain or 12.7% rise in the previous month and above market expectation of a $35 billion increase. Revolving credit, which includes credit card debt, rose by $17.77 billion or 19.6% YoY, while non-revolving credit, which includes auto and student loans, went up by $20.3 billion or 7.1% YoY.

Why it Matters: A slowing in both revolving and non-revolving credit after significant increases in the prior months. The consumer is increasingly reacting to higher financing costs (and higher prices) as mortgage applications continue to fall, dropping by -6.5% last week according to MBA Mortgage Applications data, reducing new non-revolving credit. Clearly, the rise in credit card usage does not bode well for consumer demand to remain organically strong. Between this and the falling level of savings, it is clear that the consumer is running out of buffers to maintain its level of purchasing power. However, the household balance sheet is still historically strong, indicating that consumer spending is not likely to fall off a cliff, given that debt-fueled spending has its limits.

*After large increases in Q1, April showed some slowing of consumer credit growth, although the gains were still sizeable

*Revolving debt, mainly credit card balances, is back above pre-pandemic levels

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Growth is slightly higher on the day and the week. Large-Cap Growth is the best performing size/factor on the day

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day and higher on the week, with global steel demand expected to grow 0.4% in 2022 according to the World Steel Association

5yr-30yr Treasury Spread: The curve is little changed on the day and flatter on the week, with rising oil prices pressuring nominal yields higher globally

EUR/JPY FX Cross: The Euro is higher on the day and the week as the yen continues to be punished for the BoJ’s lack of policy reality as the there were no trades again in 10-year JGBs yesterday

Other Charts:

June’s OPEX is a big one and will likely (along with the direction set from CPI and FOMC meeting) be the ultimate catalyst to allowing equities to move out of their current range

With equity volatility slowly falling, it is likely that CTAs, Risk-Parity, and other leveraged/vol driven strategies will increasingly get more involved after exposures have fallen to low levels

There have been large outflows in short-term rate ETFs, with investors pulling $2.7 billion from the iShares Short Treasury Bond ETF and SPDR T-Bill ETF last week.

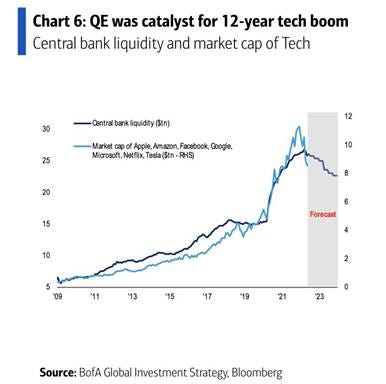

Tech’s market cap has correlated well to the size of the Fed’s balance sheet

Excluding the short-lived pandemic slump, mortgage applications have fallen to their lowest since 2016 - and if equities come under further pressure, cash buyers could become a dying breed - @macro_daily

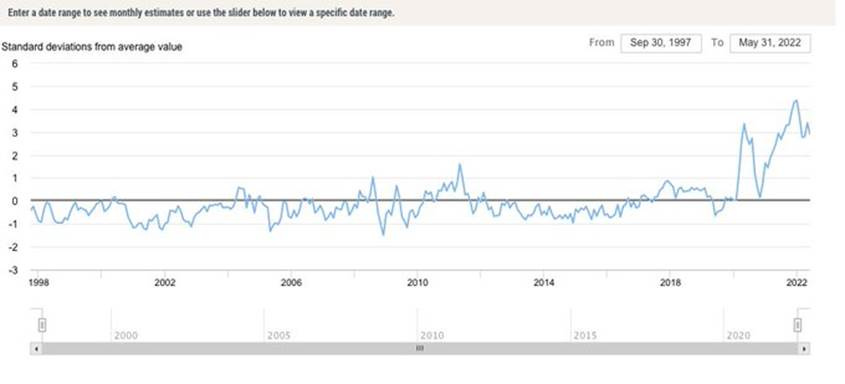

The New YorkFed’s Supply Chain Pressure Index has fallen off a recent uptick but still remains highly elevated

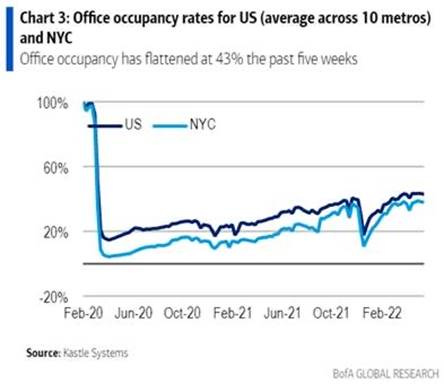

Office space occupancy has been flat for five weeks, hovering a little over 40% at the national level.

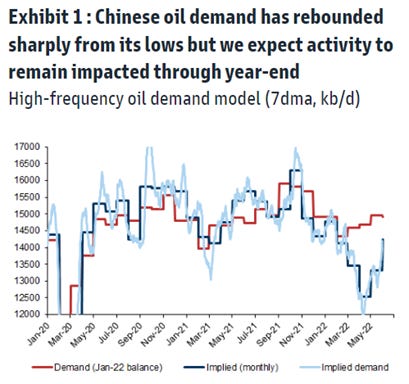

“Chinese oil demand rebounding. The machine is restarting. And it drinks a lot of oil” - @MenthorQpro

Article by Macro Themes:

Medium-term Themes:

Real Supply-Side Situation:

Now What: US Crackdown on Forced Labor in China Risks Further Supply Chaos – Bloomberg

The new law (due to take effect June 21) will bar imported goods partly or wholly made in the Chinese manufacturing hub of Xinjiang unless companies can prove the products have no ties to forced labor. Unusually, with the deadline less than three weeks away, the U.S. government isn’t giving businesses much of a heads-up about how the measure will be enforced. At a Customs briefing on Wednesday, the message was wait and see. That means nobody really knows how big a chunk of America’s $500 billion-plus in annual imports from China could get ensnared

Why it Matters:

The frontline regulators at Customs and Border Protection are warning of trouble ahead. Stepped-up scrutiny of imports under the law “will likely exacerbate current supply-chain disruptions,” the agency said in its latest budget request. They won’t be limited to goods coming from Xinjiang or even China. All U.S. imports “will be subject to delays in processing time,” as officials scrutinize what they estimate will be an additional 11.5 million shipments a year, more than 10 times the previous figure.

Dogged Pursuit: China lockdowns to keep freight rates elevated, logistics bosses say – NikkeiAsia

Freight rates will remain elevated as China's dogged pursuit of a zero-Covid strategy continues to hold up international trade, the chiefs of two global logistics companies said. One warned that the situation could pose an existential threat to manufacturers that produce goods with little room in the pricing to absorb higher transportation costs. "Even today, 10% of all container ships globally is actually delayed, waiting at anchor, or waiting for port labor," Jeremy Nixon, CEO of Singapore's Ocean Network Express, told Nikkei Asia. "We still have this capacity restriction at the moment, so still, supply and demand are tight."

Why it Matters:

The Chinese zero-Covid strategy has caused a shortage of labor at ports, preventing ships from quickly offloading cargo and sailing elsewhere. Labor issues have also clogged U.S. ports, where maritime companies and longshore unions are negotiating employment terms. Deliveries are being further delayed by ports' constantly changing requirements. "Systems take longer to change than regulations, and there's always a danger of what's going to happen if the regulation changes and the system can't support it," Tim Scharwath, CEO of DHL Global Forwarding, told Nikkei Asia in a separate interview. The bottom line is although things are improving on the shipping front, we still have a ways to go.

파업을 하다: South Korea Truckers Go on Strike at Ports as Fuel Costs Soar - Bloomberg

Thousands of truck drivers in South Korea have gone on strike at major ports and container depots, posing the latest threat to strained global-supply chains. The truckers union, which is seeking to prevent a change to wage rules, is holding protests at 16 locations across the country, according to the International Transport Workers’ Federation. Transport has slowed or stopped to the Busan New Port, Pyeongtaek Port, and Uiwang container depot in Gyeonggi province, the federation said Wednesday.

Why it Matters:

The first large-scale strike under newly elected President Yoon Suk Yeol comes as truck drivers push the government to not abolish current rules that guarantee a minimum wage for the drivers amid rising fuel prices. While not all of the nation’s drivers are taking part in the protests, the rallies threaten to slow South Korea’s exports of everything from steel to plastics and consumer goods if they go on for weeks. Busan is the world’s seventh-largest port, handling 23 million container boxes last year, according to Korea’s Ministry of Oceans and Fisheries.

China Macroprudential and Political Loosening:

Changing Tune: China to Conclude Didi Cybersecurity Probe, Lift Ban on New Users – WSJ

China is concluding a yearlong probe into ride-hailing giant Didi Global and preparing to lift a ban on adding new users. Chinese regulators plan as well to allow the mobile apps of Didi back on domestic app stores, the people said. The apps were removed last July when Chinese authorities opened a data-security probe into Didi, citing national security reasons. The lifting of the new user ban and app restorations could both happen as early as this week. Authorities are also lifting limits on registering new users on apps run by Chinese logistics platform Full Truck Alliance and online recruitment firm Kanzhun. Both were subject to similar cybersecurity reviews at the same time as Didi.

Why it Matters:

The cybersecurity probes of Didi, Full Truck Alliance, and Kanzhun came as Beijing was adopting a new data-security law that took effect in September last year. Just days after Didi’s listing on the New York Stock Exchange, Chinese regulators stunned investors by announcing their investigation into the company, concerned that IPO documents required by U.S. regulators might contain sensitive information and data. With concerns growing over a rapid deterioration in China’s economic outlook, Beijing has moved to pause its campaign to tighten its grip on homegrown tech giants and their troves of data.

Longer-term Themes:

Electrification and Digitalization Policy:

Working the System: Big Tech pulls out all the stops to halt ‘self-preferencing’ antitrust bill - FT

Amazon and Alphabet are spearheading what is shaping up to be the most intense political campaign by corporate America in recent history as part of a last-ditch attempt to stop Congress from passing laws to curb their market power. The companies are targeting a “self-preferencing” bill which would prevent large online platforms from using their dominance in one field to give other products an unfair advantage, for example, Alphabet using its Google search engine to promote its travel or shopping products.

Why it Matters:

If the bill goes through, it is likely to lend momentum to a wave of legislation aimed at strengthening America’s competition rules in what could be the biggest update of the country’s antitrust rules in a generation. Democrats and Republicans have found rare common cause in recent years in their attempts to rein in the corporate power enjoyed by Silicon Valley’s largest companies. Members of Congress have proposed a range of legislation to do so, including measures to limit when large technology companies can buy smaller rivals and stop them from acting as both buyers and sellers in the lucrative digital advertising market.

A Bridge Too Far?: Republican And Democratic Senators Release Bitcoin Bill That Would Bridge Crypto And Traditional Finance - Forbes

A long-awaited bipartisan crypto bill has finally emerged as U.S. Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) unveiled their Responsible Financial Innovation Act. The measure aims to create "regulatory clarity for agencies charged with supervising digital asset markets, provide a strong, tailored regulatory framework for stablecoins, and integrate digital assets into our existing tax and banking laws." Under the Lummis-Gillibrand bill, digital tokens that are sufficiently “decentralized” (a legally murky designation most often associated with bitcoin, the largest cryptocurrency) would be treated as commodities like gold or wheat.

Why it Matters:

Among other objectives, the bill seeks to carve some cryptocurrencies out of the Securities and Exchange Commission’s jurisdiction. It also would create new concepts in the nearly 90-year-old securities laws that would allow issuers of some digital tokens to meet lighter disclosure requirements than public companies face. The bill also addresses tax issues, especially for miners and transaction use. Up until now, there were only narrow pieces of legislation that sought to address the crypto landscape, like the recent push for stablecoin rules by Senator Pat Toomey (R-PA).

Commodity Super Cycle Green.0:

Rejected: Key climate proposals fail to pass European Parliament - Politico

In a series of dramatic votes, lawmakers refused to adopt positions on the EU's carbon market reform, the introduction of a carbon border tax, and the establishment of a Social Climate Fund following conservative-led efforts to water them down. MEPs rejected the final report on the expansion and revision of the Emissions Trading System, a key part of the European Commission's Fit for 55 climate legislation package. The move to kill the ETS report came after MEPs passed a series of amendments pushed by the center-right European People's Party and its allies that would have resulted in weaker emissions cuts than proposed by the environment committee last month and delayed the phaseout of free carbon credits.

Why it Matters:

The package proposed by the EU’s executive arm includes a dozen draft laws that will affect all sectors of the economy, from energy production to road and maritime transport, and will require support from member states and the parliament to enter into force. However, the war in Ukraine, and subsequent increased energy costs, have changed attitudes among many EU members as protecting economic growth becomes a greater priority than greening the economy. The rare outright rejection could delay the finalization of the law, something the EU is racing to do this year as it strives to cut emissions faster by the end of the decade.

ESG Monetary and Fiscal Policy Expansion:

Power over People: White House Set to Pause New Tariffs on Solar Imports for Two Years - WSJ

The Biden Administration plans to invoke emergency authorities to impose a two-year ban on new tariffs for panels imported from four Southeast Asia nations, neutralizing a threat of retroactive duties that had all but frozen construction on new U.S. solar projects. They are also using sweeping powers under the Defense Production Act to support domestic manufacturers and other U.S. clean-energy industries.

Why it Matters:

The moves are an attempt to balance Biden’s goals of rebuilding the U.S. manufacturing sector with his aggressive growth targets for the solar energy sector, which relies heavily on imports. The industry has been roiled by a Commerce Department investigation into whether companies based in four Southeast Asian countries have circumvented the tariffs on Chinese shipments of solar equipment to the U.S. That probe has slowed the development of large renewable projects needed to reach Biden’s goal of eliminating carbon emissions from the power sector by 2035. First Solar, a U.S. manufacturer of solar panels, reiterated in its own statement that the White House did not consult U.S. solar manufacturers and said the action would benefit China’s state-subsidized solar industry.

S & G: SEC Closes In on Rules That Could Reshape How Stock Market Operates – WSJ

Chairman Gary Gensler directed SEC staff last year to explore ways to make the stock market more efficient for small investors and public companies. While aspects of the effort are in varying stages of development, one idea that has gained traction is to require brokerages to send most individual investors’ orders to be routed into auctions where trading firms compete to execute them.

Why it Matters:

The most consequential change being discussed would affect how trades are handled after an investor places a so-called market order with a broker to buy or sell a stock. Market orders, which account for the majority of individual investors’ trades, don’t specify a minimum or maximum price the investor is willing to pay. Mr. Gensler has said he wants to ensure that brokers execute orders at the best possible price for investors, the highest price for when an investor is selling, or the lowest price if they are buying.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION