MIDDAY MACRO - DAILY COLOR – 11/29/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Narratives/Price Action:

Equities are higher, with all sectors currently up, although there is still a considerable risk-off feel with Large-Cap Growth significantly outperforming

Treasuries are lower, with the belly better bid as traders weigh what another wave of Covid will mean for Fed tightening plans

WTI is higher, as an overnight bounce is attempting to hold post-NY-open with OPEC+ moving their meeting to Wednesday (to further assess the impact of the new strain) while JCPOA 2.0 negotiations with Iran begin today

Analysis:

The S&P is now attempting to regain key levels after bouncing overnight and consolidating much of the morning as uncertainty around Omicron is likely to last two weeks, although Biden says lockdowns are off the table, unlike in Europe who is already experiencing a spike. Today’s economic data showed continued strength in housing and manufacturing. Treasuries gave back some of their Friday gains but are now better bid with the dollar also strengthening.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Vol, and Momentum factors, and Technology, Consumer Discretionary, and Utilities sectors are all outperforming.

S&P optionality strike levels have the Zero-Gamma Level moved lower 4621 while the Call Wall is at 4750. Put interest and prices compared to calls have risen to levels not seen since January of ’21. As a result, the gamma flip point shifted down to 4600, which now acts as strong support, leaving the S&P with a bullish tilt above it.

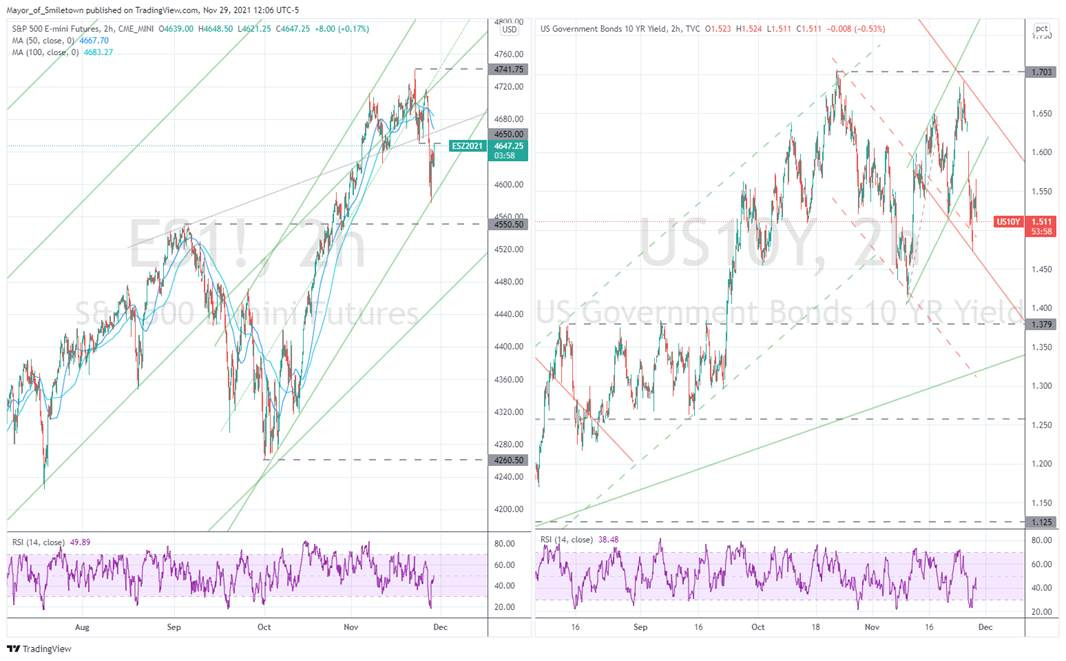

S&P technical levels have support at 4620ish, then 4580, and resistance at 4660 (current level), then 4700. The S&P was consolidating, forming a flag-type base in a 4630-50ish range, with getting above 4660 now being the real test for bulls to resume any type of longer-term rally.

Treasuries are lower, however off NY-open lows now with the 5s30s curve steepening by 2.6bps

*EM Equities are massively underperforming the S&P

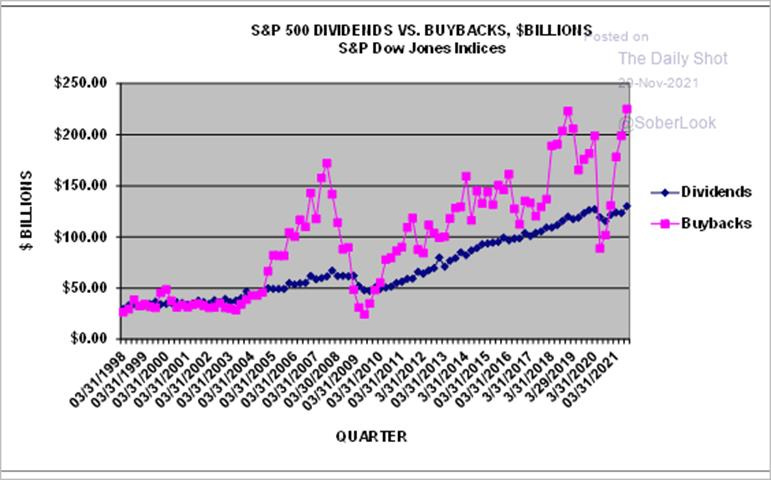

*2021 Q3 buybacks and dividend activity/payout hit record highs

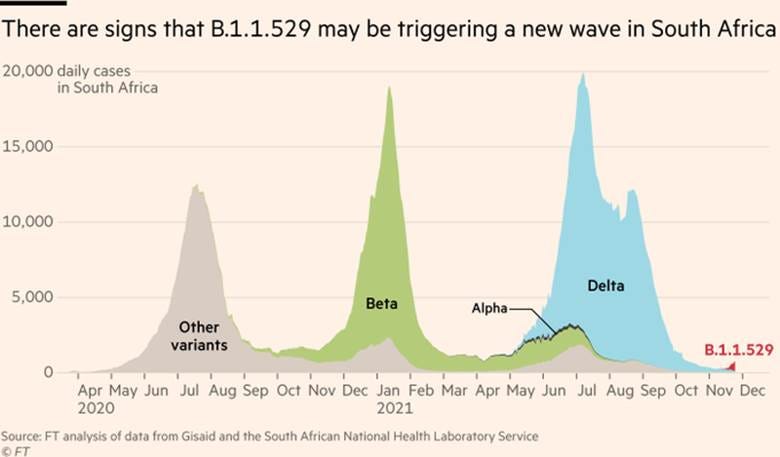

Initial data on Omicron is concerning, but we don’t have much information yet. Hence, Friday’s price action was more a knee-jerk reaction than informed de-risking. It will take two weeks to get the proper level of data for informed decision-making, leading markets to likely remain range-bound, reducing the odds of a year-end melt-up.

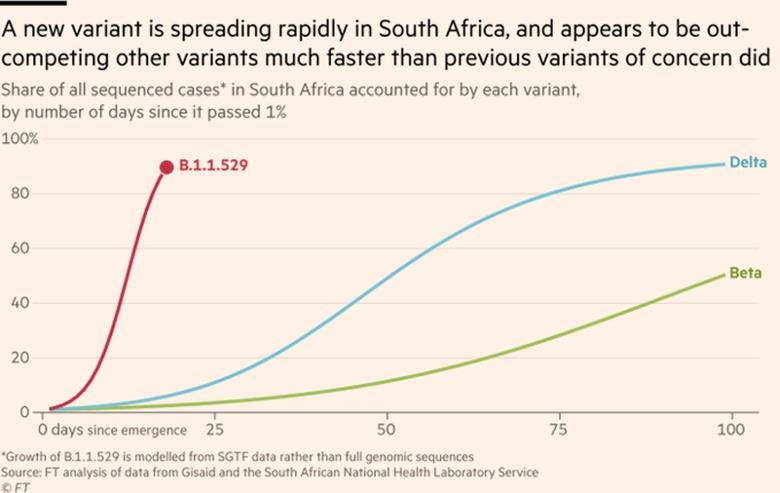

The specific mutations in Omicron’s spike protein suggest increased transmissibility and the potential for greater severity to develop, meaning it could become the dominant strain moving forward while opening up paths for further mutations. The early breakout speed in South Africa provides some real-world affirmation that this variant is one to keep a close eye on.

*Omicron’s speed to becoming 1% of cases occurred much quicker than previous variants in South Africa

With what is currently known, it looks like the effects of Omicron are not severe. In the past, vaccine efficacies remained high against other mutations, giving hope that it will also remain strong against Omicron. However, efficacy faded materially after four months, meaning boosters may become a reoccurring event.

*Markets are worried that there will now be an Omicron wave globally, pausing the reopening and capping growth

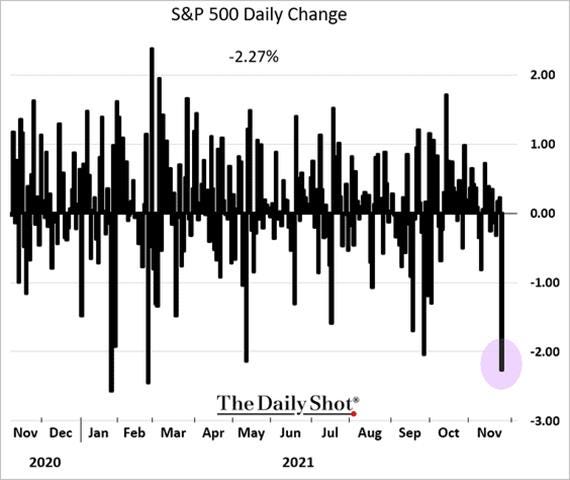

As we highlighted last Tuesday, the market was already losing momentum technically while optionality had increased the likelihood for greater volatility. Enter Omicron headlines and holiday trading conditions, and voilà, a mini correction quickly occurred for equities while oil saw a deeper dive.

*Friday was the S&P’s largest down day since February with reopening related stocks hardest hit while value and small-caps significantly underperformed

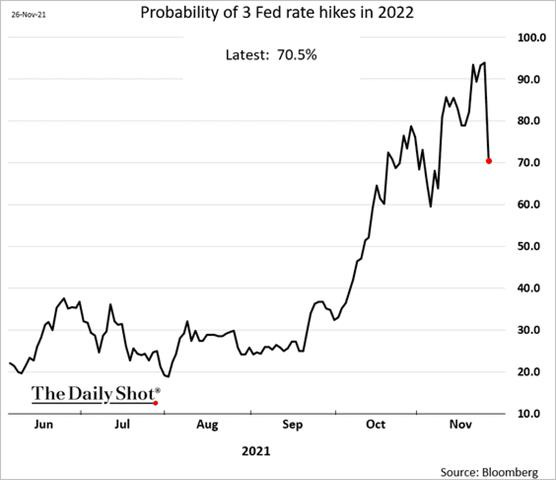

When we put it all together, we continue to advocate patience in holding existing positions and caution against dip-buying. Fear is still in control, as seen in the tepid initial bounce today. Until there is clarity in precisely what Omicron is and the threat it poses, risk assets will not meaningfully rally. At the same time, although Fed rate hike expectations for 2022 decreased Friday, there is still a bias among Fed officials to increase the pace of tapering.

*Probability of three rate hikes fell over 20% on Friday

The bottom line is the macro narrative, technical, and optionality backdrop is not currently supportive enough to give us a high level of conviction in a year-end rally. This, of course, could change quickly, especially in two weeks if further data reduces the risk Omicron possesses, and the focus goes back to the above trend domestic growth occurring and a resumption of the global reopening. Still, until then, you play the cards you're dealt.

*You can’t bluff the markets, so patience during times of uncertainty is always warranted

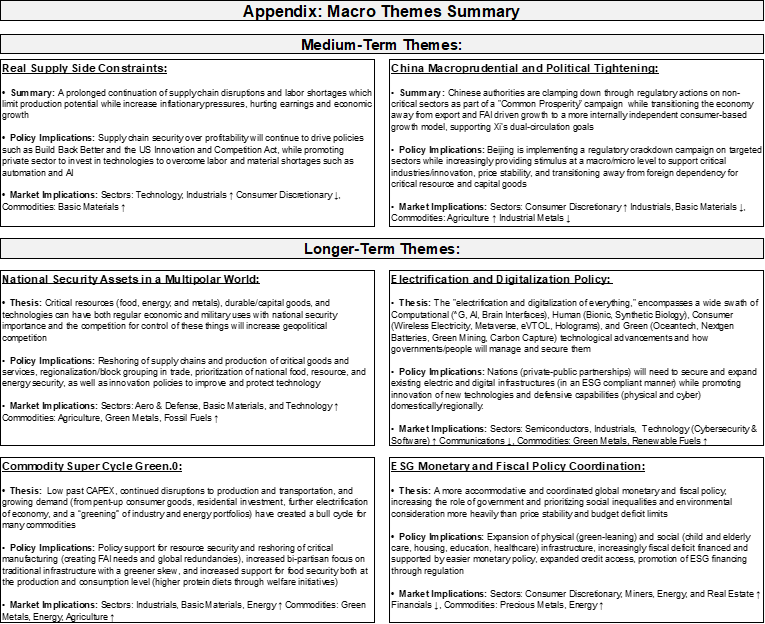

We are changing our two tactical themes to better represent what is now occurring on the ground. We believe that we have seen the worse of supply-side impairments/shortages and Beijing’s regulatory crackdown and deleveraging campaign.

Changing “Real Supply-Side Constraints” to “Real Supply-Side Improvements”:

Our global logistical systems linking factories to consumers weren’t designed to operate for long periods at peak capacity due to increased demand for durables because of the pandemic-driven stay-at-home lifestyle changes. The system reached its peak “problem” level in November, and though we believe the worst is over, it will take months more for normality to occur. We will highlight relevant articles showing improvement under this more optimistic theme now.

*Shortages of both materials and labor are beginning to decrease slowly, but it will still take some time before a level of normality is reached

Changing “China Macroprudential and Political Tightening” to “China Macroprudential and Political Loosening”:

Beijing is beefing up support to various industries to stabilize the economy, which is now in danger of contracting at a real rate in the fourth quarter. Steps range from numerous micro-targeted initiatives to help reduce input costs and promote growth to macro steps such as the PBOC boosting liquidity. We believe Beijing will increasingly become more supportive of the economy next year as the longer (than expected) duration of anti-Covid measures slow the transition to a domestic consumer-driven growth model while dual-circulation objectives receive increasing importance.

*Xi will want the economy in solid shape going into next November’s Fifth Plenum of the Nineteenth Communist Party Congress

Econ Data:

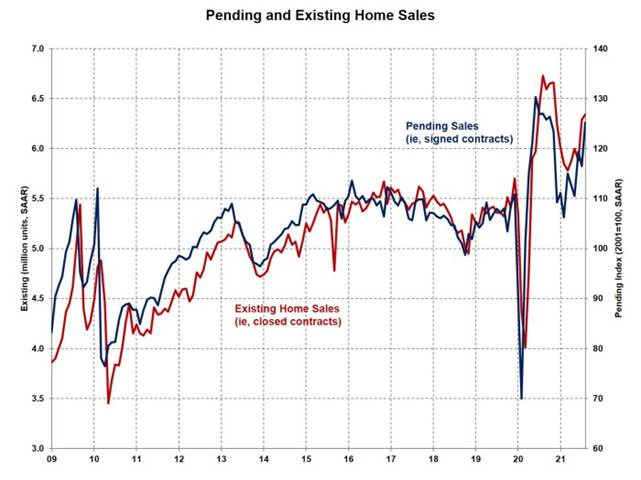

Pending home sales rose 7.5% in October, rebounding from a revised -2.4% decline in September and beating market expectations of a 0.9% increase. Contract activity rose month-over-month in each of the four major US regions, with signings rising at the strongest pace in the Midwest (11.8%) and South regions (8%). On a yearly basis, however, pending home sales are still down -1.4%.

Why it Matters: The strong activity in October means that total existing-home sales for 2021 will exceed 6 million, the highest rate in 15 years. Demand for housing was supported by fast-rising rents and the anticipated increase in mortgage rates amid low inventories. "Consumers that are on strong financial footing are signing contracts to purchase a home sooner rather than later," said Lawrence Yun, NAR's chief economist. While the market is expected to remain robust, Yun forecasts home prices will rise at a gentler pace over the course of the next several months and expects demand to be milder as mortgage rates increase.

*Pending and existing sales are approaching levels seen last year at the height of the home-buying frenzy

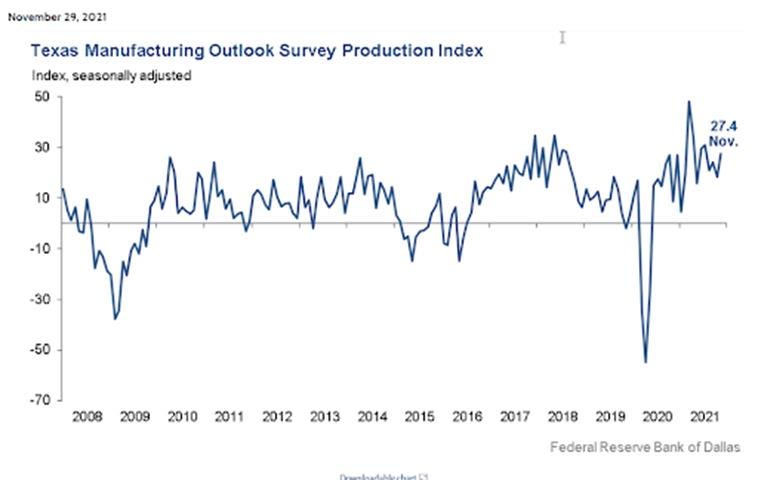

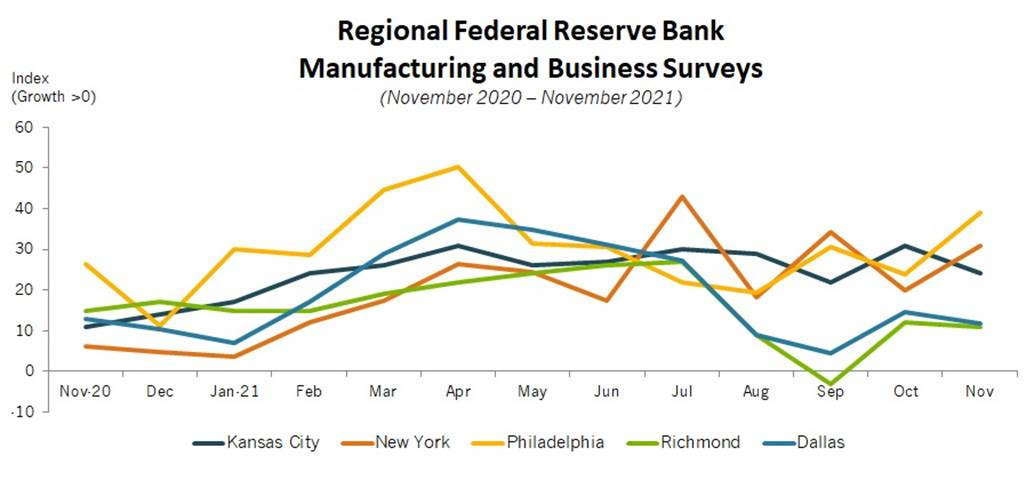

The Dallas Fed’s Manufacturing Index fell slightly to 11.8 in November, from a three-month high of 14.6 in October. The Production sub-index rose nine points to 27.4, a reading well above average and indicative of robust output growth. There were also notable increases in Capacity Utilization, New Orders, and Growth Rate of Orders. Delivery Times fell slightly despite Shipments increasing, showing some improvement in logistics. Inflationary pressures continued with Prices Paid and Wages and Benefits rising, although Prices Received declined. Employment sub-indexes were marginally better. The future outlook for General Business Activity increased significantly, helped by increased expectations for employment measures and Capital Expenditures.

Why it Matters: While the general business activity index fell, the underlying sub-indexes painted a more rosy current and future picture. However, there was little improvement in the supply-side related sub-indexes outside shipment times falling. Further, future expectations for inflation-related sub-indexes worsened, showing firms do not meaningfully believe inflationary pressures will decrease in six months. One Chemical Manufacturer commented, “Based on current data and information from suppliers, we have started to plan for much higher materials and logistics costs in the upcoming months.”

*Dallas Fed’s Manufacturing Headline Business Conditions Index number fell slightly, but the underlying components regarding output and demand remained solid

*Stronger rebounds from the two North-East Fed surveys while the other three were down slightly in November.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the week and today, as value and small-caps took the brunt of Friday’s sell-off, with high levels of uncertainty continuing to favor flows into large-cap growth

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week and the day, with Chinese industrial profit growth accelerated in October driven by mining, raw material manufacturing sectors, improving demand outlook for steel

5yr-30yr Treasury Spread: The curve is steeper on the week, and today, with the belly reflecting expectations the Fed may not be able to tighten as quickly as feared due to Omicron

EUR/JPY FX Cross: The Yen is stronger on the week and the day as the risk-off tone continues to be more prevalent in FX markets despite improvements in other risk-assets

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Slowing: Shipping Volumes Slow Ahead of Holidays on Bloomberg Trade Tracker - Bloomberg

Eight out of the ten gauges on the Bloomberg Trade Tracker were in a normal range in the final week of November. In October, shipments in Singapore, the world’s second-busiest port by volume, fell to an eight-month low. The ports of Los Angeles and Hong Kong saw similar annual declines.

Why it Matters:

There is still a long way to go before a more “normal” logistical environment takes hold, but there are signs that the “crisis” has peaked. However, despite volumes falling and shipping rates decreasing, global PPIs and import prices are still rising. There is also now the new threat (from Omicron) that border closures and lockdowns will again reduce labor and material availability, restarting the same cycle that was just starting to end.

China Macroprudential and Political Loosening:

Shrinking: China’s Record-Low Birth Rate Underscores Population Challenges – Bloomberg

China’s birth rate dropped to a new low in 2020, confirming the demographic challenge facing the government as it tries to deal with a shrinking labor force and growing population of older adults. According to the latest yearbook from the National Bureau of Statistics, there were 8.5 births per 1,000 people last year, the lowest in data back to 1978.

Why it Matters:

The government didn’t give reasons for the tumbling birth rate, but the new figures confirm population growth in the world’s No. 2 economy is slowing dramatically, with some demographers estimating it could start falling as soon as this year. If demographics become an increasing headwind, Beijing will likely have to compensate with population growth-enhancing policies, which would likely mean improving the social safety net and reducing child care burdens/costs.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Debtor Assets: Uganda Surrenders Airport for China Cash – AllAfrica

Ugandan officials have been boxed into a corner after lenders in China rejected their request to re-negotiate 'toxic clauses' in the $200m loans picked six years ago to expand Entebbe International Airport. Any proceedings against Uganda Civil Aviation Authority (UCAA) assets by the lender would not be protected by sovereign immunity since the Uganda government, in the 2015 deal, waived the immunity on airport assets. As a result of non-payment of debt obligations, all revenues associated with the airport will be put in escrow until the debt is paid in full.

Why it Matters:

This is an excellent example of China providing capital to emerging countries with clauses to appropriate sovereign assets if not paid. The revelation that the Uganda government signed an agreement and waived immunity for its sovereign assets has raised questions about the level of scrutiny and due diligence that bureaucrats conducted or if China helped push through the deal with illegal bribes. This is also not an isolated event. For instance, in December 2017, Sri Lanka lost its Hambantota Port to China for a 99-year lease after failing to show commitment in the payment of billions of dollars in loans.

Electrification and Digitalization Policy:

Laws of the Land: US banking regulators plan to publish crypto guidance throughout 2022 – The Block

Federal bank regulators in the United States issued a statement Tuesday summarizing the results of their inter-agency sprint towards clearer crypto regulations. The regulators, comprised of the Office of the Comptroller of the Currency, the Federal Reserve, and the Federal Deposit Insurance Corporation, have identified "a number of areas" they feel need to be publicly clarified, according to their joint statement. The stated plan is to issue additional communications on this front throughout 2022.

Why it Matters:

The topics that guided the review included: crypto asset custody, facilitation of buying and selling crypto, crypto-collateralized loans, payments, especially those involving stablecoins, and putting crypto on a banking organization's balance sheet. The review also focused on bank capital and liquidity standards for crypto, consulting with the Basel Committee on Banking Supervision. It will be important to watch regulatory developments here as it will help crypto become a more widely accepted asset class.

Commodity Super Cycle Green.0:

To the Moon: Skyrocketing Lithium Prices Unlikely to Stabilize Soon, Says Ganfeng Chairman – Caixin

Prices of battery-grade lithium carbonate have more than quadrupled this year in China, mainly driven by electric vehicle demand. Higher lithium prices aren’t likely to stabilize unless the new-energy vehicle industry begins to mass-produce alternative battery technologies or major recycling programs are put in place, according to the head of China’s largest miner of the metal. The launch of technologies such as sodium-ion batteries could complement lithium-ion batteries and help ease pressure on lithium supplies, said Li Liangbin, chairman of Ganfeng Lithium, which produced 13% of the world’s lithium last year, in the interview last month.

Why it Matters:

Sodium-ion batteries are evolving as a viable substitute for lithium-ion batteries due to the natural abundance of sodium, good low-temperature performance, and rapid charging. In July, battery giant Contemporary Amperex Technology unveiled its first-generation sodium-ion battery and a battery pack solution that can integrate sodium-ion cells and lithium-ion cells into one case. The Tesla supplier said it plans to form a basic industrial chain for producing sodium-ion batteries by 2023. We continue to closely watch developments here as it is our view there is not enough lithium supply to meet the coming demand.

Carbon Capture: BP unveils up to $3bn CCUS project in Indonesia, country's first – NikkeiAsia

Indonesia's first carbon capture, utilization, and storage (CCUS) project is part of larger development plans for the Tangguh gas block in eastern Indonesia operated by BP and partners, including Japan's Mitsubishi and Inpex, and China's CNOOC. BP Indonesia President Nader Zaki said that completion is targeted for 2026 or 2027 and, by that time, 4 million metric tons of carbon dioxide will be injected back into the reservoir annually, with the amount reaching a total of up to 25 million metric tons of carbon dioxide by 2035 and 33 million metric tons by 2045. “By doing this [the CCUS project], we are attacking the energy dilemma, increasing production and also lowering emission[s]," Zaki said.

Why it Matters:

The International Energy Agency has underscored the importance of CCUS technologies in achieving net carbon zero emissions, as they allow the capture of carbon dioxide from existing energy assets, fuel combustion, or industrial processes to then be used to create valuable products or permanently stored deep underground in geological formations. Samantha McCulloch, head of CCUS at the IEA, said in a note last week that this year has seen "unprecedented advances" for such technologies.

ESG Monetary and Fiscal Policy Expansion:

Stuck: WTO Postpones First Meeting in Four Years Amid Covid Variant Concerns – WSJ

The World Trade Organization has decided to postpone a ministerial meeting scheduled to start Tuesday in Geneva after dozens of nations restricted travel from southern Africa to prevent the transmission of a new coronavirus variant. At the top of the WTO agenda is the pandemic response, including how to increase the production and distribution of vaccines around the world by waving IP rights. Ironic that the pandemic response is now being slowed further by new developments in the pandemic.

Why it Matters:

The Biden administration, which in May surprised the world with an announcement that it supports an intellectual-property waiver for vaccines, has since largely remained on the sidelines without proposing a solution. On Friday, President Biden again called on countries to waive intellectual-property protections for vaccines following reports that the new variant could be more transmittable.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.