Labor Market Sentiment Is Too Negative Given Where Growth Is

Midday Macro - Color on Markets, Economy, Policy, and Geopolitics

Market volatility has risen due to increased geopolitical risks, the coming U.S. election, and growth worries, leaving positioning potentially wrong-footed for a stronger-than-expected payrolls report

A firmer jobs market narrative would change the expected path of policy for the Fed, supporting the dollar, weighing on the rotation in equities, and likely steepening the Treasury curve

Geopolitics are back in the driver’s seat for risk sentiment…

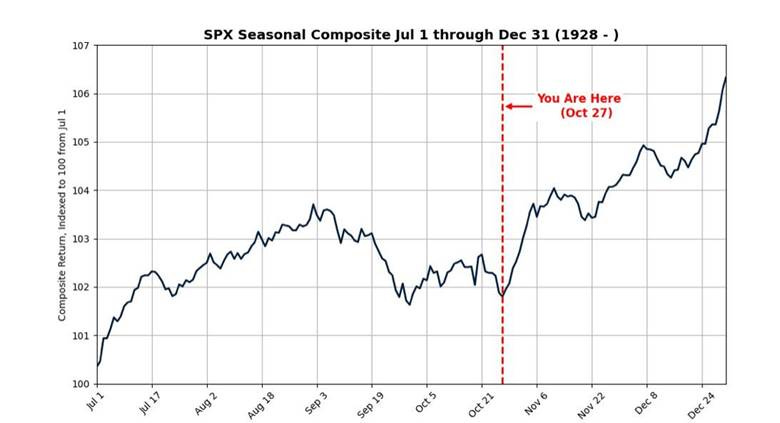

Despite the better economic data and the improving seasonal backdrop, equities have lost some momentum coming off the 50bp Fed cut and policy pivot out of China due to rising geopolitical fears.

All eyes are on the Middle East, where expectations are for a retaliation against Iran’s oil infrastructure following their attack on Israel earlier in the week. Oil is up over 10% since the initial attack despite longer-term bearish fundamental developments only increasing. Further, Israel’s leadership has little incentive to de-escalate the situation, given its precarious political situation.

The increased desire for downside protection following the attack was apparent in the VIX, increasing 14% immediately after, while the SPX was only down 1%, an outsized move indicating market participants are willing to pay a higher premium for puts.

There was a chance the VIX drifted closer to 15 (given that there was no attack on Israel) before we went into the final weeks before the election, where it is expected to rise and remain elevated into that event. However, the window for that is now closing, with sellers of vol likely to be more muted, leading to a larger, more choppy trading range.

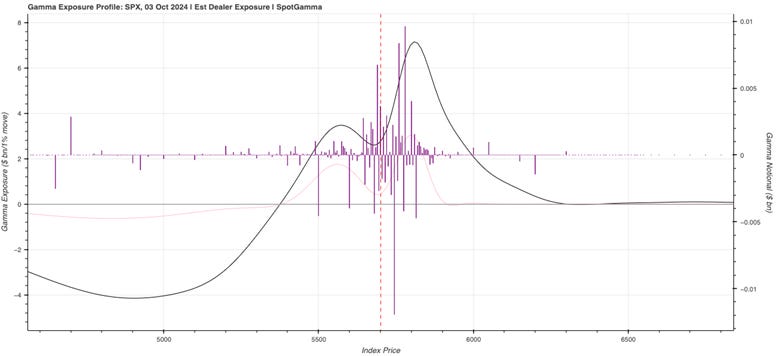

Further, with the JPM collar now restruck after Monday’s OPEX and positive gamma reduced, the areas of support and resistance have widened, allowing implied vol to remain elevated. This reduces vanna as a source of equity strength, leaving the SPX circling the current 5,700 area.

Are U.S. equities still priced for perfection?

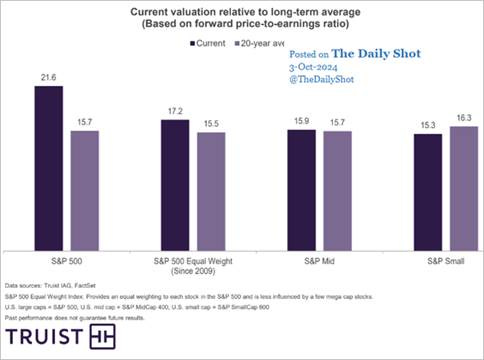

Market breadth has notably improved, and the recent broadening of performance has only increased the equally weighted P/E ratio for the S&P, and perceived “expensiveness” of the market. It’s no longer the case that the “Magnificent Seven” are responsible for the high index earnings multiple.

Until we get further earnings guidance, it will be hard for multiples and valuations to expand too much further, in our opinion.

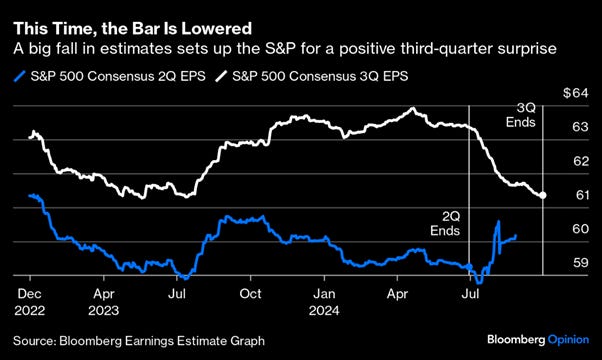

The bar is set low for Q3 earnings expectations…

The third quarter is now over, and another earnings season is fast approaching. The chances are that it will be positive for equities, given how low the bar to beat has been set.

That wasn’t the case for the second quarter, when earnings estimates barely moved as the end of June approached, which contributed to the selloff that followed in August.

Growth momentum is still solid…

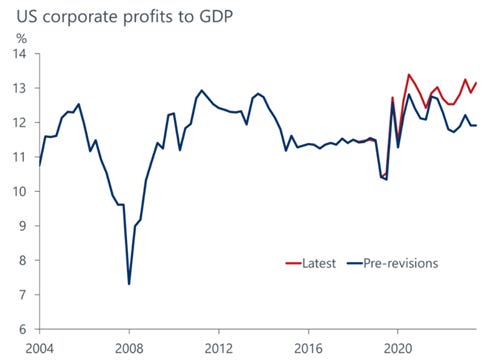

The recent GDP revisions showed that the US economy is growing faster than previously believed. Oxford Research’s Daniel Grosvenor highlighted that there was a “large upward revision to corporate profits with the latest estimate up 17%,” despite firms paying more in interest. This suggests that profit margins increased by 0.6% over the past year. Profit margins usually fall for two full years before a recession starts, indicating we are still on track for a soft landing.

Higher volatility into the election, but more supportive fundamentals moving beyond…

To reiterate, increased equity volatility tactically over the next few weeks, but the third quarter earnings season should ultimately be supportive of U.S. equities into year-end.

We also continue to expect a cooling but not crashing economic macro backdrop into year-end, cementing the soft-landing narrative.

However, if job markets firm while consumer spending reaccelerates, a stronger-than-expected earnings season could also bring back fears of a “no landing” overheating economy, reducing rate-cutting expectations in 2025 and moving markets back to a “good is bad” narrative as valuations/multiples are questioned.

As it stands, our baseline outlook is rising profits, rising margins, and an economic soft landing supporting risk sentiment into year-end (given no exogenous shock).

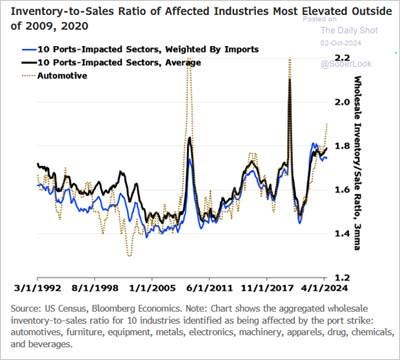

How much economic activity did the expected dock worker strikes and election bring forward?

It’s increasingly clear that inventory builds over the last few months in anticipation of logistical impairments (due to striking dock workers) or the desire to get things ahead of the election have “juiced” up third-quarter growth. We also see reports consumers are now loading up on goods, fearful for shortages.

There will likely be a payback for this real economic activity in the fourth quarter as wholesaler, retailers, and consumers draw down stocks.

Although this coming drawdown in stock will lead to a further slowing in manufacturing activity, the harder data (industrial production, durable goods, factory orders) still support a below-trend period of growth is coming (not a recession).

When combined with weaker construction data, likely due to increased rate sensitivity and a fading fiscal impulse, the economy continues to look bifurcated (something we covered last week) and further supported by today’s strong ISM Service Sector PMI (versus the weaker manufacturing one last week).

However, stepping back, the economic results in the aggregate have been better than expected, moving the Citi U.S. Economic Surprise Index back into positive territory, something we also predicted would happen weeks back, given its mean-reverting nature.

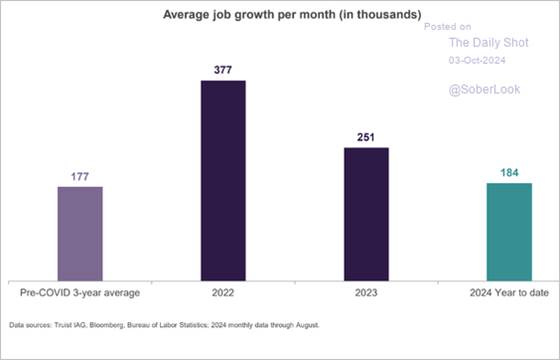

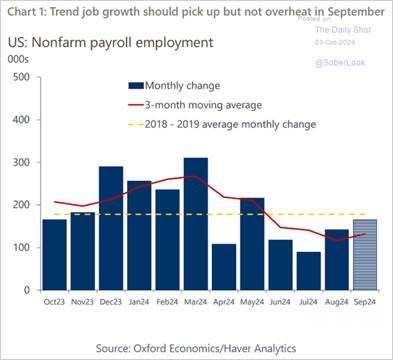

The biggest risk to market positioning is firmer labor market readings…

Despite the overall economic surprise index improving, labor market expectations are still very negative. As a result, a stronger NFP reading for September, say closer to 200K, could notably reset Fed expectations and shift rates to a higher range.

The current hurricane and dock worker strike disruptions will weigh on next month’s October jobs report reading, reducing the reaction around that release.

Still, tomorrow’s jobs report should be cleaner, with a more positive seasonal tailwind to it. As a result, we expect a better-than-expected NFP print and favor large-cap growth outperforming and the curve bear steepening.

The dollar will likely be the primary benefactor from a reduced Fed rate cutting path.

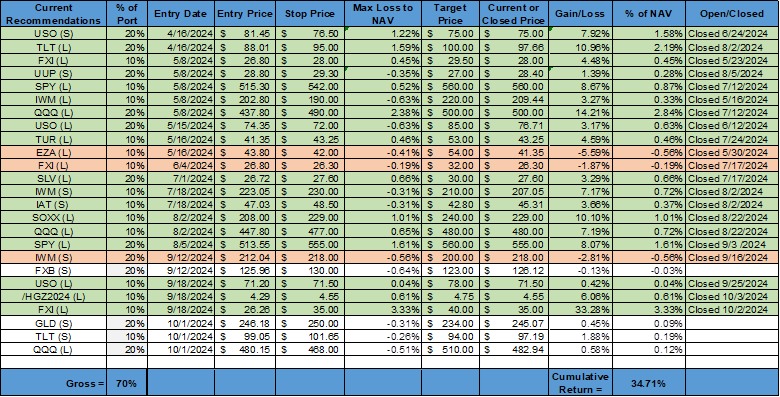

Taking profit on our China trades already…

We have seen this before and don’t want to get greedy. As a result, after trailing a tight stop that was subsequently hit on the recent pullback (last 24hrs), we are taking profit in our long Chinese equity position (through $FXI), realizing a 33.3% gain in three weeks.

We also hit our trailing stop for our copper long, realizing a 6% gain in the same time period.

Although we do maintain a view that Beijing is now more committed to reaching its growth target, the fundamental challenges are still daunting. Further, we’ve seen Chinese equity rallies reverse quickly and want to lock in gains given that a Trump victory would reverse the recent positive sentiment there quickly.

Adding some risk, negative on rates, and reinforcing our stronger dollar bias…

Our short GBP position is back to being flat after some more dovish comments out of the BoE overnight. We believe the U.S. outperformance, more generally, will lead to a shallower rate-cutting cycle and support the dollar against the pound, euro, and yen, as well as several other pairs.

We also find gold overbought and near completion of its wave 5. With geopolitical worries likely too high, given the actual capabilities of Iran and its proxies are limited and a stronger dollar bias due to rising real rates, we are willing to take a shot at shorting gold at its current level through the $GLD ETF.

We also want to be short the long-end in Treasuries, going into what we think will be a stronger-than-expected jobs report, on top of an election that looks like the fiscal deficit will worsen no matter the outcome. Further, with growth momentum still solid and disinflationary progress likely to be increasingly questioned, we believe there should be greater term-premium out the curve.

As a result, we are shorting the $TLT ETF, which represents 20+yr part of the curve, something we often use to express views on longer-term rates.

Finally, we are adding a Nasdaq long (through $QQQ) as, despite expectations of increased volatility in the short term, we believe it will benefit from the stronger-than-expected earning season ahead of us and have a more positive correlation to any selloff in rates (than small caps).

For those with lower risk tolerances (or tighter stops) we wouldn’t recommend a long U.S. equity position (yet), but given our views and gains to date, we are willing to ride out a more volatile period, believing in the end, the market will melt up further into year-end.

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it.

Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.