Beijing Goes Big, But Is It Enough?

Midday Macro - Color on Markets, Economy, Policy, and Geopolitics

In a slew of monetary and fiscal actions this week, Beijing pivoted its policy approach and acknowledged the urgency of the situation

Whether due to expected further weakness or/and a need to shore up its economy due to rising geopolitical tensions, it is still unclear if it will be enough to address the deeper structural issues weighing on growth

The sleeping dragon awakens, and now the world shakes…

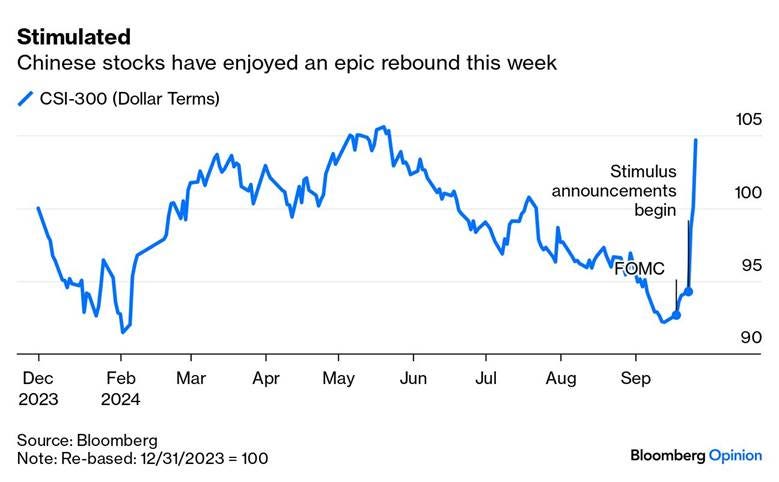

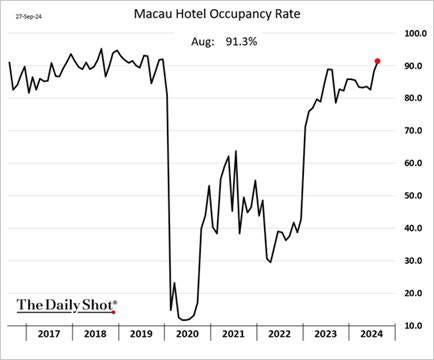

Chinese equities capped their biggest weekly rally since 2008 following a “thorough” easing of overall policy. This week’s unscheduled Politburo meeting, resulting in numerous fiscal policy “edicts” to directly support consumption and ease home ownership combined with monetary policy easing actions by the PBOC, shows Xi and company are (finally) fully on board with supporting the economy.

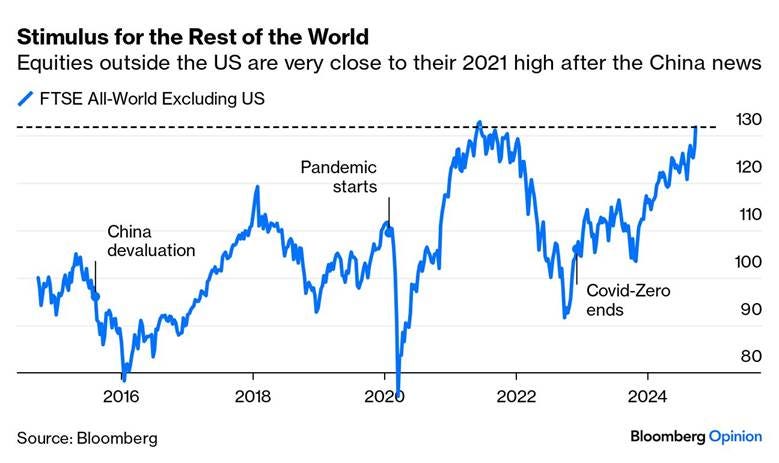

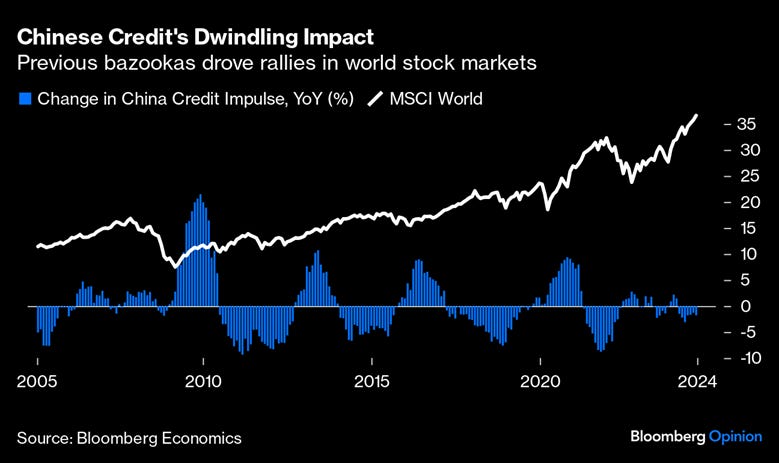

Global equities, already trending more bullishly following the Fed’s 50bps cut in the prior week, took the more “bazooka-ish” approach from Beijing as a positive sign that the worst may be over for the second-largest economy in the world. The combination of policy actions was unique in that the message markets received was that Beijing finally realized the urgency of the problem and is now fully committed to using an old-school Keynesian approach to boost demand.

Policy error no more in China?

There is a long list of “stimulative” policy changes out of Beijing this week:

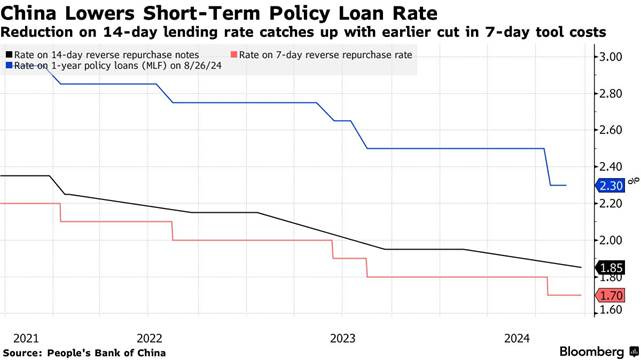

PBOC cut short-term rates for its various lending facilities while reducing the bank’s reserve requirement ratio to the lowest level since 2018, the first time both had been reduced at the same time since 2015.

PBOC also announced a package to support the property market, lowering mortgage rates on existing mortgages and minimum downpayment requirements and easing rules for second-home purchases. The PBOC will also cover 100% of loans for local governments that are buying unsold homes with cheap funding.

PBOC will provide at least 800 billion yuan ($113 billion) of liquidity support while Beijing is studying setting up a market stabilization fund.

China’s Security Regulator publishes guidance to encourage listed companies to conduct M&A, hoping to improve the efficiency of restructuring and support corporate transformation towards “new quality productive forces.”

PBOC also pushed banks to make it easier for corporations to borrow to buy back their own stock, while it is allowing some banks to pay less interest on deposits to encourage consumer spending.

The Politburo pledged to “issue and use” government bonds to implement better “the driving role of government investment,” announcing a new round of $284 billion during an unusual economic session in September, suggesting an increased sense of urgency and a shift to stimulate consumption (over just investment).

The Politburo pledged to support the unemployed, especially college graduates, as well as the disabled through one-off cash handouts while subsidizing childcare/birth costs (more details coming).

Still with us? Clearly, alarm bells (or red phones) began ringing in Beijing, and Xi decided to pause his longer-term power consolidation plans and make being wealthy acceptable again. It also indicates China’s growing geopolitical strife with the West (over supporting Russia and issues elsewhere) is leading Beijing to want a healthier economy.

What Now?

We have been spending the last three days trying to sort through the mosaic and think about how this policy pivot will support a domestic Chinese economy that is still structurally impaired from too much debt and past zero-COVID and Common Prosperity policy effects.

In the end, this combo of monetary and fiscal actions does send a strong signal to Chinese firms and households that the government sees the problems and is increasingly committed to fixing them, indicating a notable change in policy signaling.

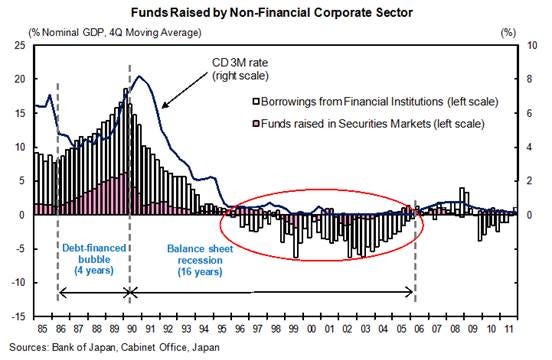

However, it is unclear how long this policy blitz will take to turn the tide, given the severity of the problem. Balance sheet recessions are significantly harder to fix. Just look at Japan, which needed almost two decades to recover.

Xi’s draconian zero-COVID effectively stopped growth, while the Common Prosperity crackdown deeply scared business and consumer confidence, making profitability and success bad things and ultimately weighing heavily on discretionary spending. Much of this has reversed, but it likely still weighs on the psyche of the consumer.

As a result, it will take time to reverse the negative momentum to growth that high levels of leverage and weak confidence have created. With the geopolitical backdrop also highly problematic (to say the least), Beijing looks to be buying time, and more actions will ultimately be needed (and is expected).

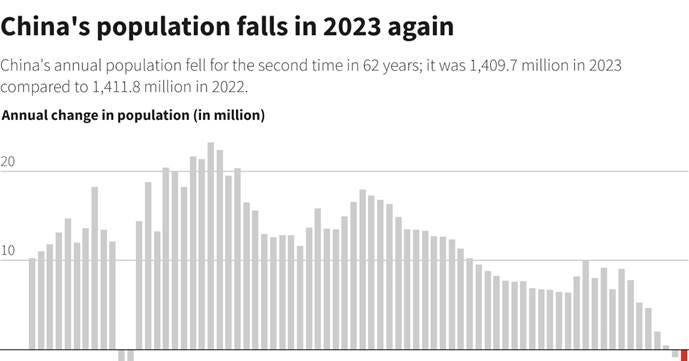

Further, high levels of youth unemployment also signal that household formation, one of the strongest drivers of consumption, is unlikely to accelerate as twenty/thirty-year-olds delay major life decisions due to financial insecurity. Even if direct cash handouts and subsidies are forthcoming, the increasingly ingrained view that “tomorrow will be worse than yesterday” that many Chinese youth have will not quickly reverse, leaving the demographic drag in place.

Are things worse than they seem, or is this a preemptive national security policy move…

As a final thought and taking a more alarming view, one could conclude that the recent flurry of policy changes indicates that a much deeper problem is afoot. Given the opaqueness of the Chinese economy, we are sympathetic that economic troubles are deepening more than official data indicates, and the country is already in a recession that needs a U.S.-style bank bailout and considerable direct support for the consumer.

It could also indicate a more aggressive posture on the global stage is forthcoming. China’s support for Russia has grown, and so has its aggressiveness towards Taiwan and in the South China Sea. A Trump presidency will almost certainly bring further Tariffs against them.

We are not sure about either of these points, but they need to be acknowledged as potential risks.

This week’s actions won’t hurt risk sentiment…

In the end, we do have confidence that this increased policy support will build confidence (among market and real economic actors) and foster wealth creation or, at the very least, prevent further wealth destruction.

Secondly, it points to a tradable rally in Chinese equities. Onshore stocks are a policy- and momentum-driven market, and policy signals don’t get much more precise than this. Further global equities will also benefit (outside India, which has been a benefactor of weak Chinese risk sentiment) from a better growth pulse moving forward.

The preciseness and the magnitude also feel like a meaningful policy pivot away from the previous incrementalism to what now feels more like what the economy and markets have been asking for, more of a bazooka approach. This is also the first time where there was very clear articulation that the government will do what it takes to ensure that GDP growth will be on track at 5%, indicating more direct consumer policy support is coming.

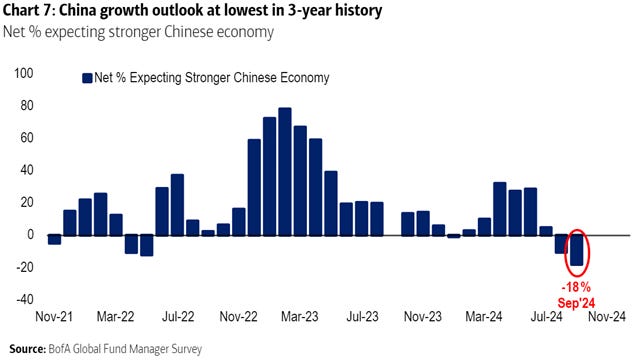

The bottom line is that China’s problems appear too deep to fix with the kind of credit stimulus that it used in the past. China Beige Book says companies aren’t gloomy due to a lack of credit supply or because credit is too expensive. Rather, they’ve been unwilling for years to borrow, regardless of credit conditions, because corporate sentiment is so poor. This is also applicable to the consumer.

This week’s actions are the first convincing sign that Beijing is intent on meaningfully reversing this negative sentiment.

Turning back to the U.S…

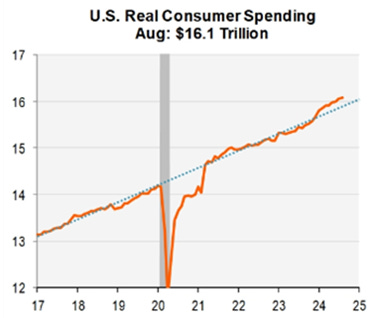

This week’s final Q2 GDP data showed that the growth momentum in the U.S. is still solid. However, despite today’s personal spending and income data coming in slightly weaker than expected when combined with more anecdotal data received from firms and higher frequency transactional data, it is clear the consumer is stable.

Our go-to overall U.S. econ proxy, the Chicago Fed’s National Activity Index, moved into positive territory in September after two notably weaker months. Thirty-six of the eighty-five total indicators made positive contributions. In combination with the Atlanta Fed’s GDPNow estimate for third-quarter growth sitting at 3.1%, following this morning’s PCE data, things are still ok.

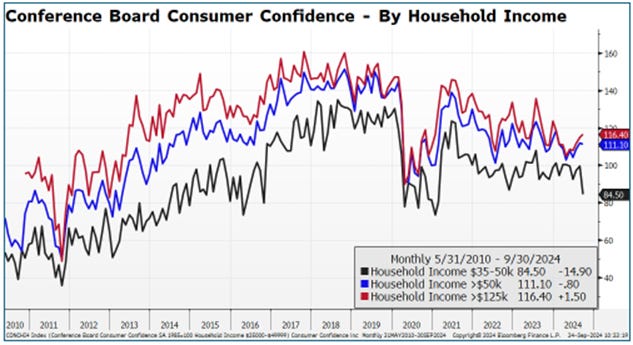

Clearly, there continues to be a K-shaped economic narrative at play, with lower-income cohorts feeling the weight of tighter policy. At the same time, middle- and upper-income ones enjoy higher real incomes, a more positive wealth effect, and are still sitting on excess savings.

This was seen in this week’s Conference Board’s consumer confidence index, which dropped 6.9 points to 98.7. The present situation sub-index primarily drove the decline due to the lower income group of respondents (households with incomes $35-50k). The recent slowdown in hiring, alongside persistently high costs of living, is weighing on consumer confidence heaviest there, keeping the overall gauge well below pre-pandemic levels.

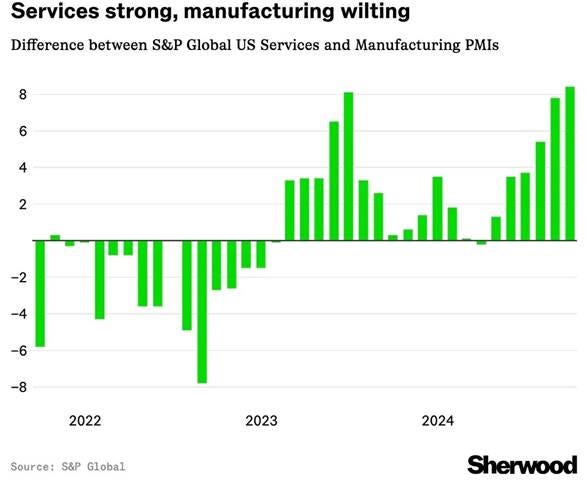

The stark contrast in S&P PMIs (again) also shows the bifurcation in the economy, with manufacturing sectors experiencing a rolling recessionary environment while the service sector powers on, very much a “tale of two cities.” So far, usually the canary in the coal mine, manufacturing doesn’t seem to be a harbinger of broader weakness.

“The early survey indicators for September point to an economy that continues to grow at a solid pace, albeit with a weakened manufacturing sector and intensifying political uncertainty acting as substantial headwinds. A reacceleration of inflation is meanwhile also signaled, suggesting the Fed cannot totally shift its focus away from its inflation target as it seeks to sustain the economic upturn.” - Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

A few thoughts on labor markets…

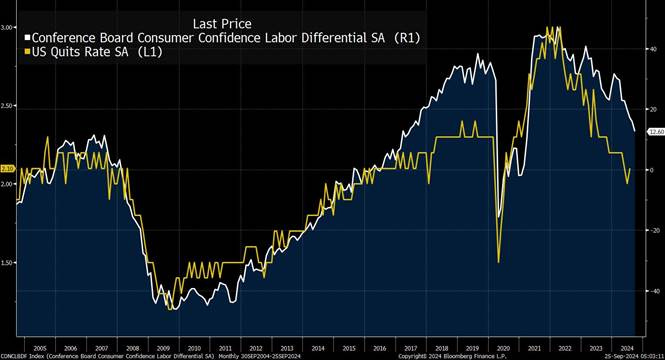

Labor remains sticky: So far this year, the average number of workers that have been laid off per month is 1.6 million, compared to an average of 1.9 million per month in 2019. As a result, despite weakening payroll additions and a rising UER, 2024 is still considered a very healthy year for the labor market. Companies have slowed hiring, but they’ve continued to be reluctant to let people go.

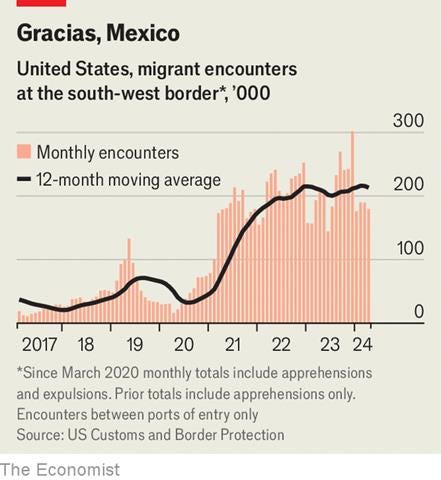

Population growth is slowing in the U.S.: With immigration now falling from higher levels seen last year and earlier this one, so will the average growth level for NFP. With weaker demand for new workers, it is unclear how this slowing flow of new entrants will affect the participation rate and ultimate UER level.

“.. labor supply growth is running around 150-180k per month. With monthly job growth running closer to 120k recently, it’s a close call whether labor demand will prove strong enough going forward to fully absorb new entrants ..“.. the path ahead for the unemployment rate remains more uncertain than usual.” – Goldman Sachs Research

There may be a structural change in unemployment benefit behavior: First-time applications for unemployment benefits hover near historic lows despite the majority of other labor market measures weakening. Continuing claims have also dropped in recent weeks (although this is seasonally normal) after reaching a two-year high in July.

People may have reduced access or incentives to claim UE benefits as many states have not adjusted benefits for inflation and made it harder to receive them. As a result, this may not be a reliable indicator of where labor markets are heading.

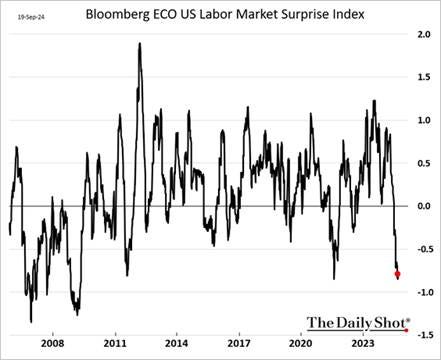

Finally, economists will adjust labor market expectations to skew on the weaker side now. The Bloomberg US Labor Market Surprise Index will now (mean) revert higher as expectations are lowered. With the Fed now in a more dovish stance and expectations potentially too pessimistic, risk appetite reactions to new labor data should skew more positively.

U.S. equities continue to melt higher while rates may have settled into a range…

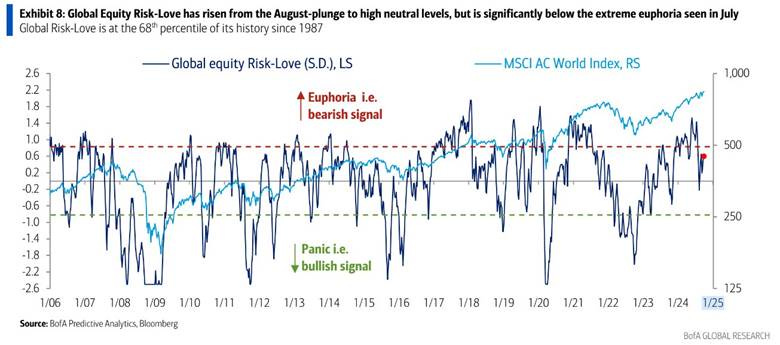

We will conclude by saying U.S. equities look to be a bullish story still, but the road ahead may be bumpier:

Breadth and sentiment improving/stable

Positive technicals and optionality

Still dry powder on the sidelines

Coming out of a seasonally weaker period largely unfazed thanks to the Fed (and China)

The expiration of the large JPM collar on Monday has the potential to open up the trading range and increase realized volatility. It also acted as an anchor. With the S&P having traded in a tight range for a few sessions, implied vol likely is too low, especially with NFP coming and the election looming in the background.

Treasuries look to be drifting in a range, especially in the long end, as Fed policy is now more apparent, but the growth outlook is still uncertain. NFP will also play an outsized role in determining if we retouch on 4% in ten-year yields, something we believe is likely given our more optimistic payroll interpretation view.

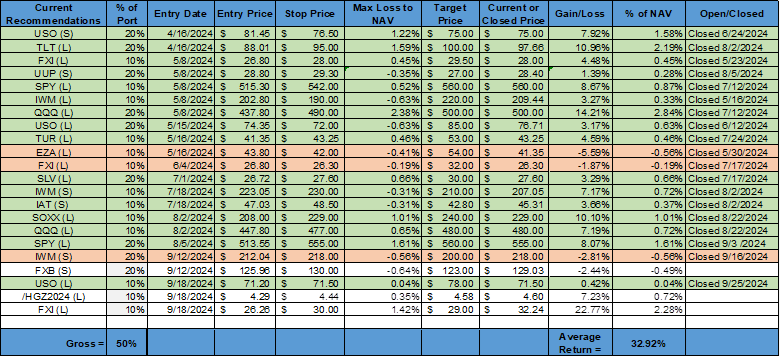

Stopped out of our oil long…

We thought the supply-side disruptions would continue for longer than expected. Instead, Libya looks to be coming back online sooner than expected, while hurricane disruptions were minimal.

Further, Saudi Arabia looks to be pivoting its production plans, not wanting to give up any more market share.

With global oil demand growth this year weaker than expected and next year looking worse, oil is not something we have a ton of conviction on right now. China’s better growth outlook post-policy pivot will also only marginally support their oil demand, given the reduced fossil-fuel intensity of their economy.

In conclusion…

Our mock portfolio currently includes long copper (+7.2%), Chinese equities (+22.7%), and short GBP (-2.44%), all positions we want to remain in.

Currently, we have a bias to be long equities (large growth over small value), short Treasuries (steepener), and long the dollar (vs. EUR, GBP, and JPY) tactically.

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.