Growth Scare Sell-Off Seems Overdone with Consumer Spending Momentum Still Solid, Buy This Dip in Equities

Color on Markets, Economy, Policy, and Geopolitics

Increasing weakness in the economy, seen in today’s jobs report, yesterday’s ISM Manufacturing PMI and claims data, as well as elsewhere, is showing that bad economic news will be bad for markets as the Fed increasingly looks behind the curve

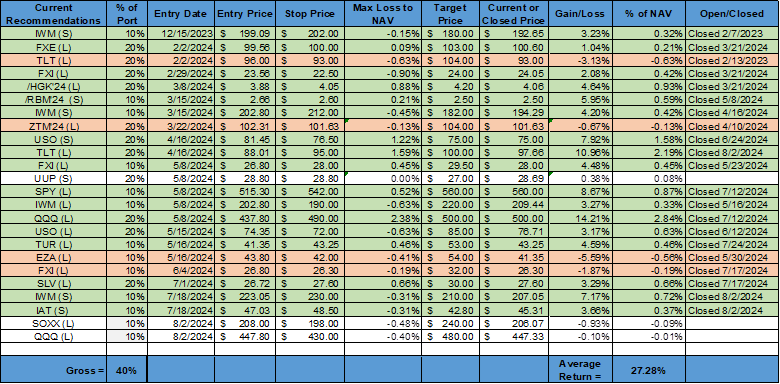

With our view that the economy is cooling, not crashing, and the VIX spiking today, we see this as an opportunity to close our defensive positions and add risk given our expectations for a stronger service sector reading Monday and a lack of new data or Fed speakers for the rest of next week

We favor large-cap tech over small-cap value, adding a semiconductor sector and Nasdaq long position on the recent pullback and closing our Russell and regional banks’ short positions, as well as our long long-end Treasuries position

What a week! Wednesday’s bounce back in large-cap tech on the combination of better earnings, a more dovish-sounding Powell, an inline BoJ, and a continuation in yields falling quickly reversed, with growth scares now dominating price action and key earnings missing the mark, albeit often slightly.

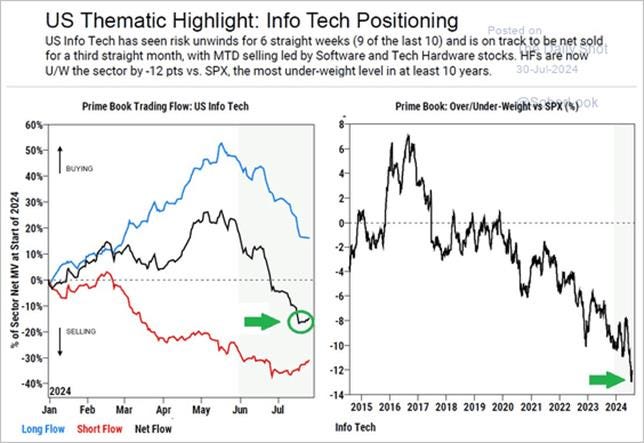

The recent “rotation” out of large-cap tech into small-caps and more rate-sensitive sectors already seemed overdone going into this week, given the weakening growth backdrop. The rise in equity volatility and widening of credit spreads also made us weary that the riskier parts of the market would outperform.

Further, systematic selling of equities by Risk Parity and CTA funds provided consistent pressure, with retail, discretionary, and L/S also having negative flows and generally waiting on the sidelines.

Goldman’s Volatility Panic Index encapsulated the mood well, spiking higher even before the VIX itself spiked today.

Stepping back, this earnings season isn’t particularly bad. More companies are beating their estimates than average but by less than usual. The market reaction has seen lower rewards for positive surprises than usual and higher punishments for disappointments, especially if the guidance was weak.

The market was priced for perfection, and although actual Q2 results have been fine, firms are realistically reflecting the higher uncertainty in the second half of this year by guiding more defensively, which is not being received well.

We question the severity of this week’s weaker economic data…

Despite the BLS saying Hurricane Beryl had “no discernible” effect on the NFP report, the 436K people were reported “not at work due to bad weather in July.” This is ten times the number of people not at work due to bad weather compared to the average in July over the prior five years, meaning Beryl disrupted the labor market in July.

This is always a more negative seasonal period for claims, with the nonseasonal adjusted data showing a more upbeat picture. This negative seasonality adjustment drag becomes more positive throughout Q3, meaning this week’s higher initial claims print could be more of a one-off.

July’s U.S. Manufacturing PMIs (both ISM and regional Fed) were broadly weaker, but with an inventory restocking cycle ending and regionals showing a pick up in future outlook, as well as the July regional Fed service PMIs improving (Dallas +4, Richmond +12, NY +0.2), likely meaning ISM services will mirror the stronger July S&P Service PMI reading.

Today’s June factory orders were weaker at the headline level, but ex-transports were positive, mirroring the June durable goods data and showing the negative effects of the current Boeing drama. With core durable goods higher by 0.4% MoM in June, following a 0.5% MoM gain in the prior month, the actual demand for goods does not match the negative manufacturing PMI sentiment reading.

Elsewhere, the Conference Board’s consumer confidence index rose on better job expectations but remained in its recent range, while the Challenger Job Cuts Announcements data showed layoffs remain low as firms are reluctant to let go of hard-found skilled workers given the past pains.

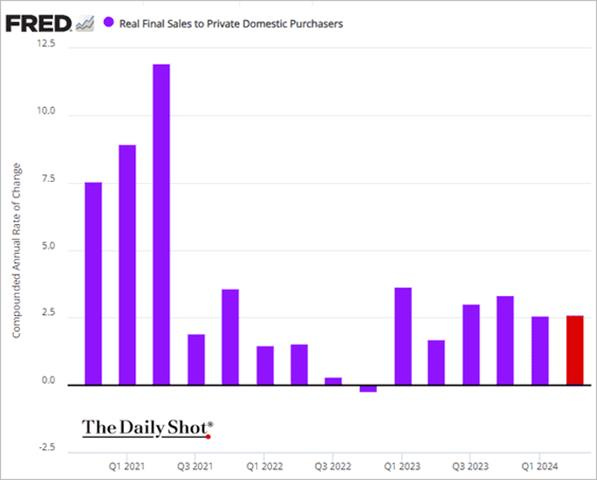

The bottom line is there are no real red flags that the economy is uncontrollably hurdling into a recession (yet). Final domestic demand in Q2 was solid, as was the most recent consumer spending data.

Yes, the economy is cooling, with everyone knowing that lower income is tapped out while middle income is under increasing pressure. Discretionary spending should slow with excess savings now depleted and job security less certain. However, the U.S. consumer has shown itself more resilient than expected for multiple quarters, and spending momentum remains positive, albeit more price-conscious.

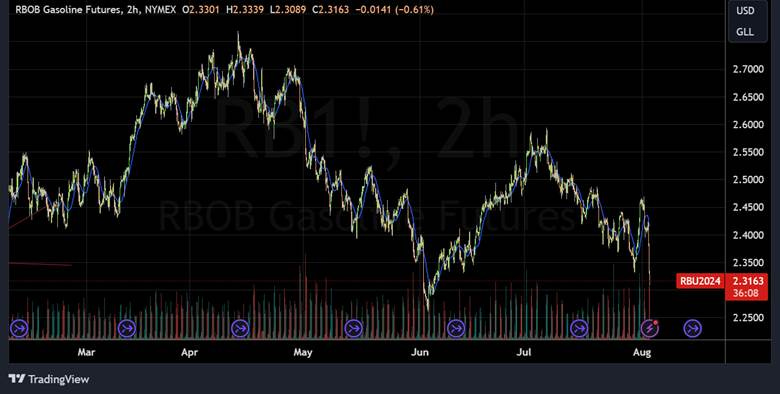

The recent rise in geopolitical tensions out of the Middle East is also weighing on risk sentiment…

However, it looks like Israel is escalating to de-escalate with peace negotiations still our modal expectations. We question Iran and its proxy’s real ability to respond in a nonproportional way that would lead to a larger counter-response and, hence, create a larger conflict in the region.

Although driven by the weaker growth outlook, we take some comfort that oil continues to trend lower today, indicating some reduction in geopolitical risk premium is also occurring. A higher oil price, and hence “tax at the pump,” is exactly what the U.S. consumer doesn’t need right now.

Relief rally likely next week…

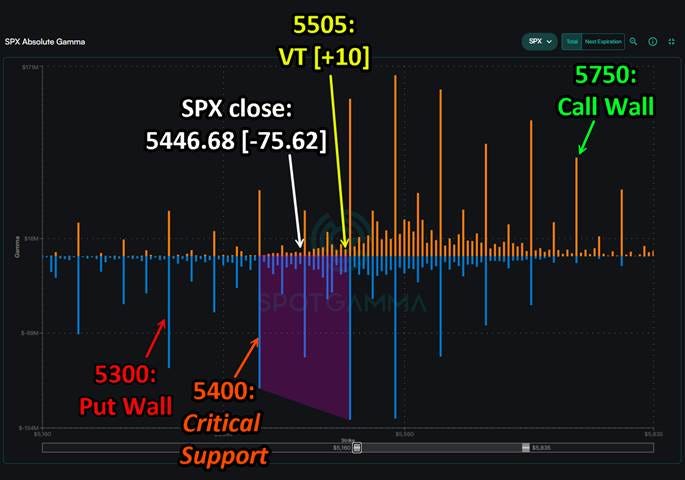

Turning specifically to equities, we have entered a negative “Gamma Trap,” with the SPX now likely pinned between 5,500 and 5,300. We see the lack of catalyst next week following the ISM Service PMI Monday as leading to a cooling in implied vol and hence allowing a Vanna-driven relief rally.

As a result, we are entering long positions in semiconductors ($SOXX ETF) and the Nasdaq ($QQQ ETF), fully aware it will be hard for both to reach new highs until the August OPEX cleans up the more negative gamma tilt. However, we see stronger support for the SPX, and hence, overall equities, at today’s low of around 5,300. The $SOXX ETF is also at its 200dma, which should act as support, and it is currently in a positive technical daily candle if it were to end the day around $209.

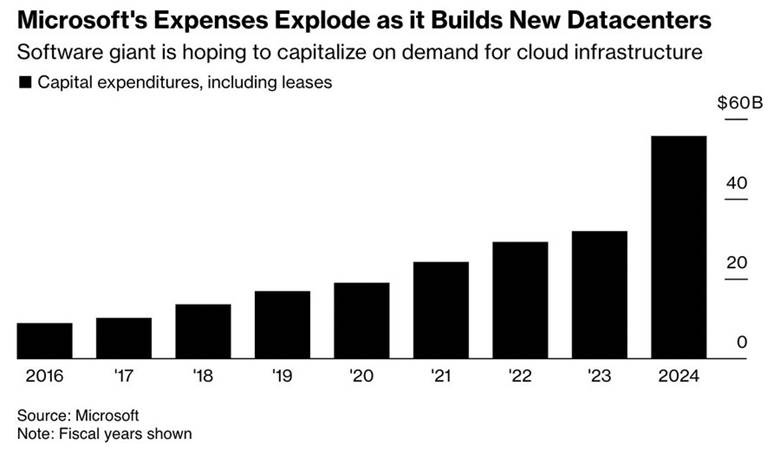

Further, recent earnings calls from technology companies indicate the AI capex cycle still has further to go. We see semiconductors as still a sector poised to benefit from this, as well as the general digitalization of all things, and hence, we want to be a buyer of this dip with valuation now more reasonable.

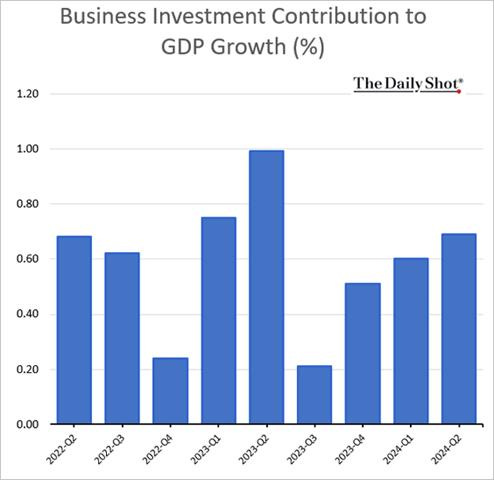

Recent productivity data showed this investment may be starting to return gains.

More generally, the high level of business investment in Q2 shows firms are somewhat confident in the future, even with the added uncertainty on where policy may go due to the coming election and the increased uncertainty seen in some business survey-based data.

Fixed investment has been increasing at a notable pace for six quarters now, with equipment up by 11.6% in Q2. Higher labor costs have driven owners to look to physically and digitally automate to improve productivity and defend margins.

“The reality right now is that while we’re investing a significant amount in the AI space and in infrastructure, we would like to have more capacity than we already have today. I mean, we have a lot of demand right now. And I think it’s going to be a very, very large business for us” – Andy Jassy, CEO of Amazon

“I’d rather risk building capacity before it is needed rather than too late given the long lead times for spinning up new inference projects” – Mark Zuckerberg, CEO of Meta

“When you go through a curve like this, the risk of underinvesting is dramatically greater than risk of overinvesting” – Sundar Pichai, CEO of Google

And on a broader more upbeat note:

“The jump in spending on equipment and intellectual property affirms our conjecture that the American economy is in the midst of a productivity boom that in turn will result in an improved standard of living across the economy for all cohorts,” RSM economist Joe Brusuelas wrote in a note.

In summary, the current overarching more negative skew to markets started last week when Bill Dudley spooked markets with his “policy error” oped (Thanks, Bill!). The sell-off increasingly became driven by a build in negative gamma and a breakdown in technicals.

This sparked a regime change in equities from buying dips (the regime since the April 7% pullback ended) to selling bounces. This manifested in some of the most substantial selling flows over the last two months, increasing volatility and driving more systematic and trend-driven strategies to de-lever. It is cumulating with today’s weaker NFP report, driving a spike in the VIX to near 30.

We now believe this negative sentiment has reached a peak, which is why we are tactically going long the most oversold parts of the equity market.

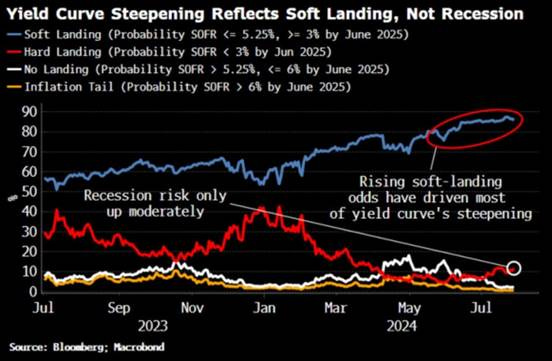

Switching to rates markets, the bear-steepening “Trump trade” has become a bull-steepening growth scare one.

Although the election very much matters, it is now too close to trade on (unlike before Kamala entered), and as a result, we don’t expect to see too much more movement based on changing views there.

Given our belief that we are at a tactical peak “growth worry” level and that we will see some relief next week from this negative sentiment, we closed our long-end Treasury longs ($TLT) following the jobs report with a nice gain.

We would also fade the recent steepening, believing the Fed will not cut rates 50bps in September, and instead do a more methodical 25bps cut then and each following meeting until they reach a mid 3% level on the Fed funds rate.

In conclusion, we see the current market narrative as too negative.

We have a long track record of writing about our belief the economy would enter a below-trend period of growth in the second half of this year, and we teased two weeks ago (before it suddenly became gospel) that the Fed could be behind the curve.

However, the current sentiment and price action are increasingly indicating a recession is imminent, and that is not our read on the economy.

The labor market is cooling, but with layoffs still subdued, it is far from becoming a meaningful drag on consumption. Instead, things are just normalizing to levels that markets forgot about.

Consumers are more price-savvy and less discretionary-focused. Yes, excess savings are all but gone for most. However, balance sheets are still relatively healthy, and household net wealth is high for the upper half cohorts, who drive the majority of spending.

However, with real disposable income improving as prices fall for many things, we believe that even a below-trend period of growth means 1-2% consumer spending growth level and more of a winners-and-losers scenario regarding goods and service sectors/firms (not an outright decline across the board), something we have seen in the divergence of Q2 earning call comments/results.

We will leave it there with our hope to delve more into the good, bad, and ugly regarding the consumer next week.

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.