Calmer Markets in “Wait and See” Mode Ahead of Next Week’s Heavy Data Deluge

Color on Markets, Economy, Policy, and Geopolitics

Following a perfect storm of risk-off narratives to start the week, markets have now calmed slightly, albeit with still higher implied vol, as a lower-than-expected initial claim reading cooled growth fears

Next week’s economic data will confirm if disinflationary progress continues and/or growth worries are justified with the sustainability of any bounce/rally in question until then

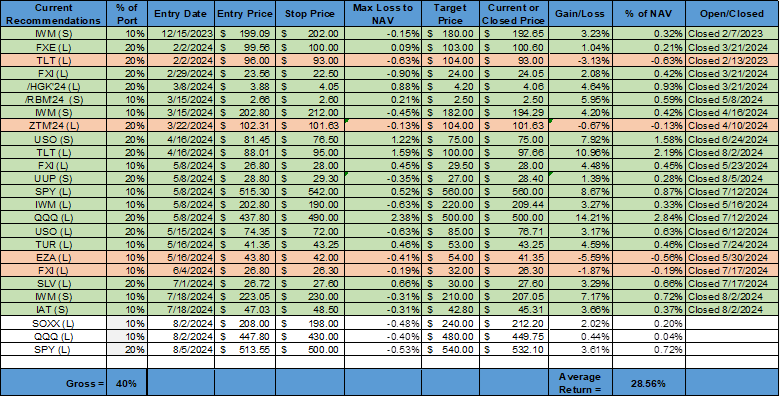

We continue to see recent price action as driven by more emotional and mechanical selling than fundamentals, and as a result, added additional risk

Greed drives markets the majority of the time, but every so often, fear takes over, and when it does, chaos ensues. During these times, it is important to step back, take stock of the fundamentals, and be patient for cooler heads to prevail, assuming the world isn’t really ending (which it never truly is).

We continue to see the recent “markets in turmoil” episode as disconnected from economic fundamentals. However, this does not mean the end is near. Wednesday’s slide in municipal bonds represented growth worries expanding across different markets, given that increased volatility there falls out of the realm of traditional carry-trade, risk-parity, or CTA selling.

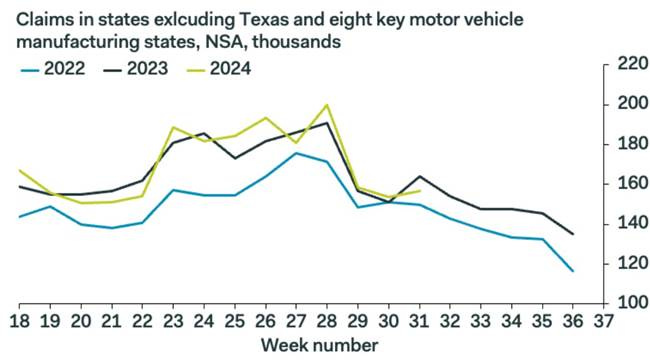

Looking at the economic fundamentals, broader indicators suggest the labor market remains solid despite Friday’s weaker-than-expected July U.S. jobs report (which increasingly looks weather-affected).

This week’s initial claims calmed nerves a little, but August’s job report will ultimately determine whether growth worries control the macro narrative further.

We will likely be in a higher volatility regime until August’s jobs report, where rallies will likely be sold for equities and rates.

Next week’s CPI and retail sales data will either support the current tactical relief rally from Monday’s lows or send equities and rates back into a more “panicked” range. We see the areas around 5,300 on the SPX and 4% on the ten-year treasury yield as dividing the risk-on/risk-off ranges.

Q2 earnings results indicate a more cautious consumer, but the picture is far from dire…

In many ways, the Q2 earnings picture for the U.S. consumer has played out as predicted with a more “winners and losers” narrative than any broader consumer “falling off a cliff” scenario. Although firms, on aggregate, certainly indicated a more challenging environment, there were still some signs of strength, with a contradicting picture among industry peers sometimes occurring.

Travel and Hospitality: Airbnb warned of slowing demand, while Expedia noted July presented a more challenging macro environment. However, Marriot and Hilton reported solid Q2 results, along with Norwegian Cruise Lines and Royal Caribbean. Further, Live Nation noted a rebound in demand.

Fast-Food Dining Out: McDonald’s and Restaurant Brands International had negative same-store sales, while Yum! Brands, Wendy’s, Chipotle, and Shake Shack delivered more solid results.

Gig-economy Delivery and Transport: Uber noted its customers for ride and delivery were in “great shape,” while Lyft and Doordash also had good Q2 results.

Luxury: LVMH noted the aspirational customer was weaker, and nobody felt like drinking champagne, while Kering noted a decrease in traffic. However, Hermes produced strong results while Prada Group met expectations despite a “tougher environment.” Further, Ferrari upgraded its guidance, and Porche sales in North America were solid.

Snacks and Sodas: Hershey saw its consumer pulling back, as did Mondelez. Coke and Pepsi noted that lower-income consumers were going out less, but “overall...consumer sentiment in aggregate is actually pretty strong, pretty resilient.”

Credit Cards: Visa saw stability in the high-spend consumer segment but a moderation in the lower-spend one, while Mastercard noted its results were supported by “healthy consumer spending.”

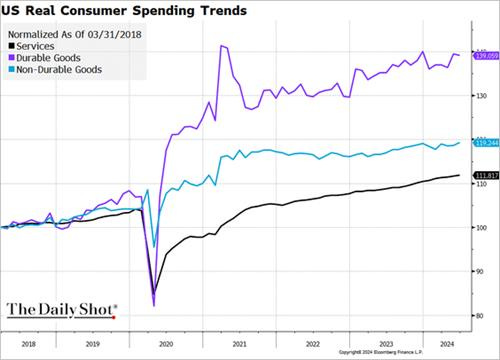

We will stop there as the list goes on. Our main point is that household spending is cooling, especially on discretionary goods, and certainly among lower-income, but on aggregate, the current state of the U.S. consumer is still stable and healthier than the current market narrative suggests.

Put another way, the trend in spending was unsustainable (complicated by inflation), and now the level is normalizing back to its longer-term sustainable trend.

This makes us dubious that an imminent recession is on the horizon, instead seeing the slowdown more as an air pocket due to normalizing labor markets, diminished pandemic-era savings, and the added uncertainty from the coming election.

Since we are making a bullish case for the U.S. consumer, let’s bring in a few more points:

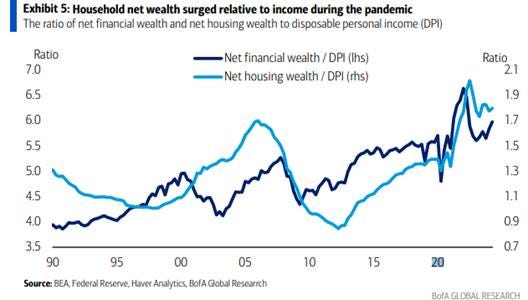

Household net wealth is still historically strong despite excess savings falling, suggesting the wealth effect pulse remains positive, especially for upper-income cohorts, which drive most spending.

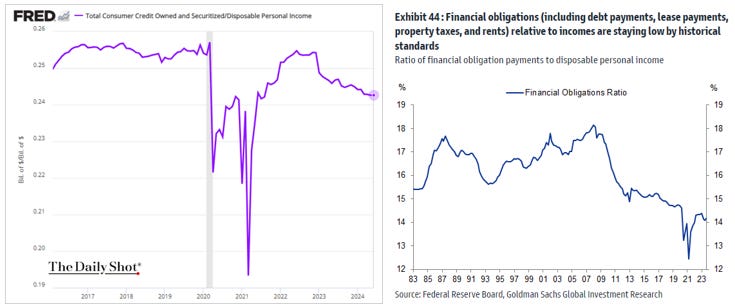

Income derived from financial assets (stocks, bonds, and money markets) has grown notably, while household debt as a share of GDP is near a multi-decade low. Despite the highly discussed increase in delinquencies, credit card losses are normalizing, with consumers facing third-party collection at record lows. Revolving credit usage is slowing, keeping the financial obligation ratio trending lower and bankruptcy levels near historic lows.

Broader labor market measures still look healthy…

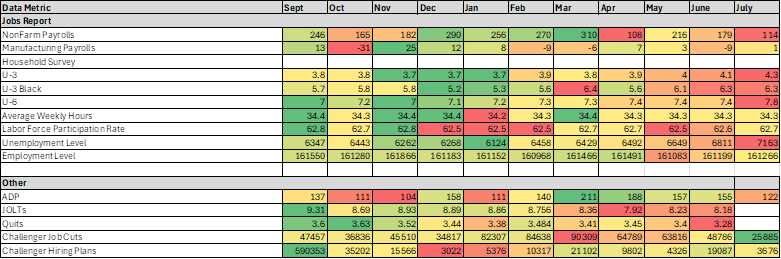

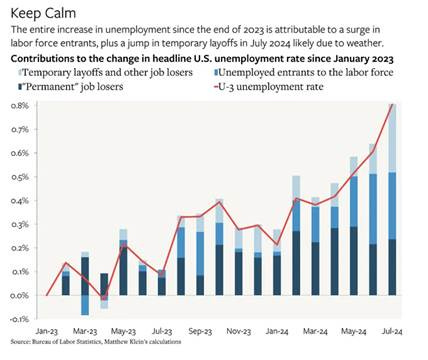

As we highlighted last week, the weather did affect the July jobs report. On further inspection, it’s still too early to connect loosening labor markets to any coming outright slowdown in household spending.

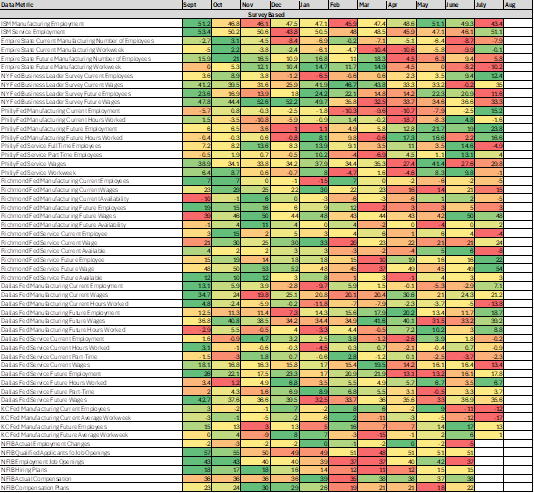

Unlike during the February to April period, where business survey data showed a notable cooling in employment-related readings, the June/July period has shown better stability, albeit in a mixed fashion, especially for ISM Service employment and NFIB hiring plans (which we give greater weight to).

This more jumbled mosaic of softer survey-based labor data readings contrasts with the harder data, which weakened in July.

It is our view that the leading weaker hiring intention readings that occurred earlier in the year have now stabilized, and as a result, the lagged more negative readings in the harder data may also stabilize moving forward (although the uncertainty caused by the election and Fed certainly are not helping).

We would also highlight that actual job cuts have still been meaningfully missing, with firms still holding on to hard-found skilled labor, choosing to accept margin pressures rather than reduce variable costs.

Finally, although it is taking longer for unemployed workers to find work, as seen in continued claims and elsewhere, the majority of the increase in the UER is being driven by the entry of new participants in the workforce more than anything else. This is why the trigger of Sahm’s rule may prove to be wrong.

Growth momentum was solid coming out of Q2, but next week will set the tone…

With the Q2 GDP readings now old news, showing personal consumption expenditures accelerating, supporting a solid final domestic demand growth picture (along with business investment increases), we now look to more current data on hand to gauge whether the growth scare narrative we are increasingly seeing is warranted.

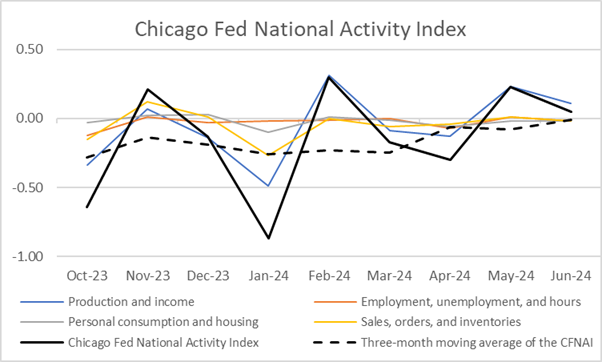

At the most basic level, the Atlanta Fed’s GDPNow model’s Q3 estimate is at 2.9%, but it is still too early to give that too much weight. Further, the Chicago Fed’s National Activity Indexes’ rising three-month average reading is a positive to support the GDPNow’s momentum-driven forecast but is itself lagged (only representing June’s data currently as we haven’t gotten all of July’s).

So far, for July, we have seen a stronger ISM service PMI reading negate a weaker manufacturing one. We are a strong believer that manufacturing downturns lead to broader economic weakness. However, softer manufacturing PMI survey readings from the ISM and regional Feds haven’t correlated well with actual industrial production and new orders for factory/durable goods, especially at the core level.

As a result, we need more proof in July’s harder manufacturing data (Industrial Production 8/15, Durable Goods 8/26) before we give any weight to the weaker PMI readings.

Again, to be clear, bouts of manufacturing PMI weakness have caused several false flag negative growth scares since the pandemic, and as a result, the old adage that a contracting manufacturing sector will ultimately drive the economy into recession is more nuanced in the current environment.

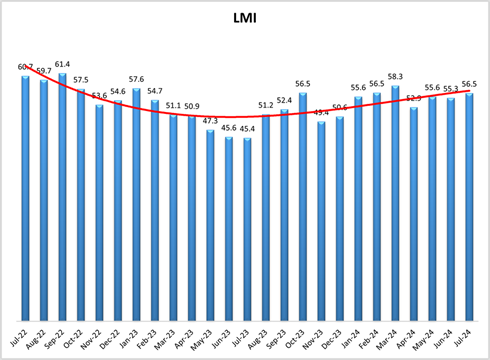

We will highlight that July’s Logistics Manager Index turned higher, something we see as a positive given the trend but nuanced, with retailers still running light inventories while wholesalers stocked up for end-of-year demand. The outlook among respondents was positive (albeit off highs seen in prior months), countering weaker current demand sentiment seen in manufacturing PMIs.

Next week will give us a better picture with a slew of data to help determine growth and inflation trends.

Our view is that the growth scare that sparked the sell-off in risk assets over the last two weeks is overblown, but let’s see.

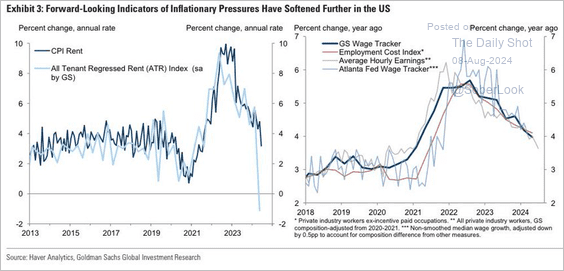

Next week’s CPI results will likely allow a more dovish Jackson Hole setup, but 25bp rate cuts at each of the remaining three FOMC meetings this year is the most likely path…

It doesn’t sound like the Fed is too worried about the weaker jobs report and increased market volatility, according to the few speakers we have heard from this week, making the likelihood of a 50bps rate cut at the September FOMC meeting highly unlikely (as we stand).

The Fed could claim recent market volatility has tightened financial conditions (despite real rates falling and the recovery this week), and this needs to be countered by an additional rate cut this year (at the Oct/Nov meeting) to keep policy at the same restrictive level, given a presumable continuation in disinflationary progress into year-end. Otherwise, it would take a weaker August labor report, which would again cause a risk-asset sell-off, to scare Fed officials enough to act more aggressively.

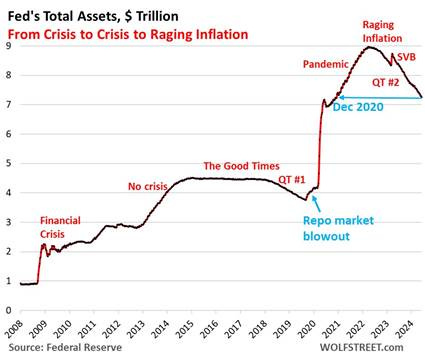

The Fed could also announce plans to end QT earlier than expected at the Jackson Hole gathering in support of its desire to reduce the restrictiveness of policy. This is not our modal outlook, but we do believe that Jackson Hole will be used to signal whether rate cuts moving forward are meant to keep policy at the current restrictive level or, in fact, ease the stance in order to better risk-manage the full employment side of their dual mandate.

Final Thoughts on Equity Markets…

We increased our equity-long position Monday morning. We believe the current growth scare tantrum is overdone and added a long position in the S&P, in addition to our Nasdaq and Semiconductor index longs.

Currently, given this week’s recovery, it may look like we are using hindsight to manipulate our returns, but we promise we are doing the same things in our PA. Further, next week’s slew of economic data will be the real test of whether we grind higher as volatility shifts into a lower regime or markets retest and break Monday lows.

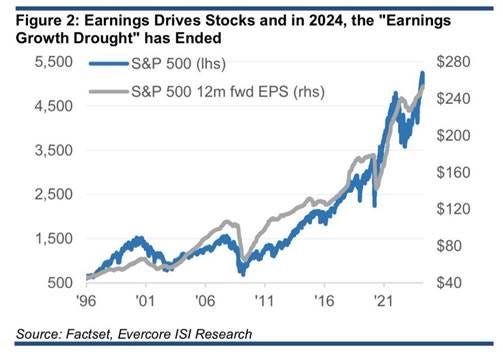

In the end, we believe that although growth should cool, it is still supportive of earning expectations.

We haven’t seen glaring red flags in the results of Q2 earnings (instead, a market nit-picking non-perfection), and, as highlighted, we believe the economy still has positive momentum that will support final domestic demand in Q3.

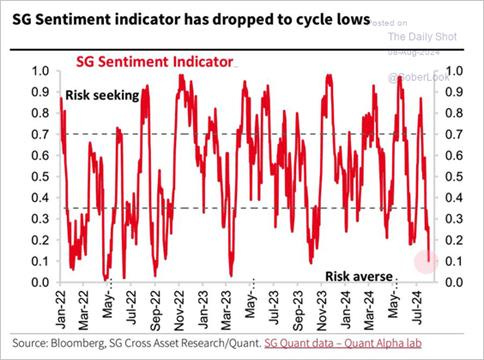

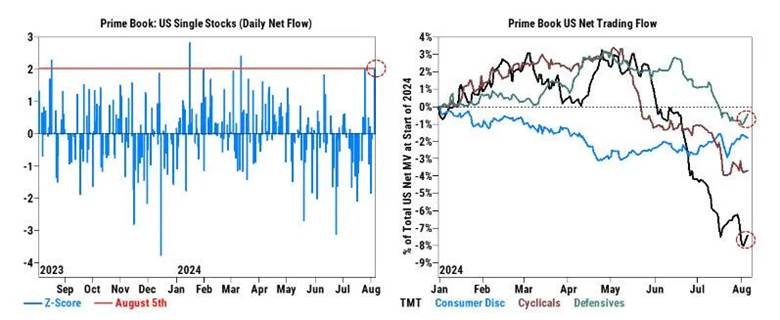

Further, in our opinion, sentiment will unlikely get much worse than it did on Monday, given the perfect storm that hit markets all at once. We could certainly be wrong here, and equity ownership is still historically high. Still, positioning is now more balanced with reduced leverage among actors that are forced to sell due to increased vol or breakdowns in corr.

Although the end of this week still saw forced selling from certain market actors (risk parity, carry-trade, and CTAs) we were encouraged that dealers reported discretionary hedge funds buying the dip.

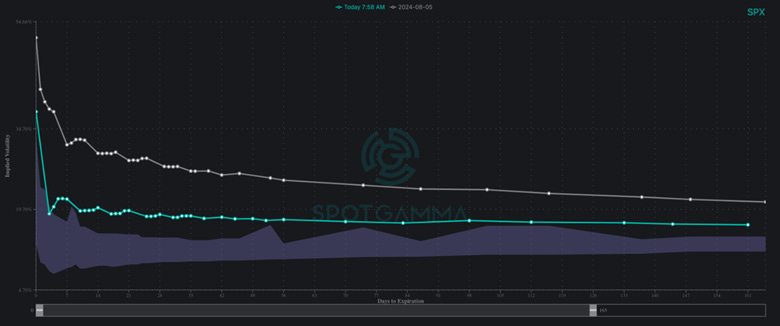

Moving into next week, there is now less stress in vol markets, with dealers more neutral gamma in the VIX complex and less short skew in S&P positioning. Less risk-taking ability from dealers was shown in the Friday-Monday meltdown, but with the SPX over 5,315 and VIX closer to 20, risk appetite is rising again.

We will be watching VVIX to see if dealers become stressed to cover short gamma again if next week’s data challenges the disinflation narrative or renewed growth worries. A spike there again will drive a rush into long Vix and short equity positions.

We still need to see hedges unwind and vol sellers re-emerge for the “all clear” signal. It will take time before risk appetite increases enough to allow systematic actors to short vol again (as was the popular trade up until the recent blowup), with risk budget across the street now under increased scrutiny.

However, there are still actors that have to be out there selling vol due to the products they support, driving vega lower. Dealers will get long gamma again on that, helped as trailing vol windows normalize. It will take time for vol to settle down for buying to come back in and a sustained period of time, but given our views on the economy, we believe it will occur and drive equities higher again.

Finally, we closed our dollar short for a slight gain. We will cover our reasons for this in our next writing, but generally, we have lost conviction the DXY will meaningfully move lower into the election period.

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.