You Reap What You Sow: Is Trump 2.0 Stagflationary?

Midday Macro - Color on Markets, Economy, Policy, and Geopolitics

The people have spoken, and Trump 2.0 may usher in a more stagflationary America versus the RoW if the majority of campaign-promised policies come to light

Risk sentiment has cooled this week as the growing level of policy uncertainty has weighed on the initial positive narrative due to the major macro regime shift

Markets will now have to contend with higher headline risk and a more data-dependent Fed despite still above trend growth momentum

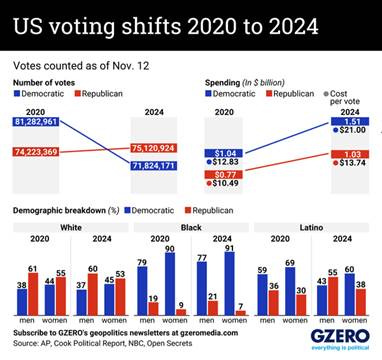

In case you haven’t heard, Trump and the GOP won the election…

Whether it was anger over sticky high prices or social issues such as immigration and transgender rights, or just wanting lower taxes, in the end, Trump’s fear and greed approach won over a more positive message of unity and tolerance, which the Harris campaign conveyed.

Trump’s first rise to the White House was driven by a nostalgic message: “Make America Great Again.” Trump once again used nostalgia to convince voters to back him. In fact, this recent campaign saw a higher frequency, in 9.5% of all paragraphs, than any other presidential candidate in a lifetime.

This broader electoral angst (to return to better times) led to the incumbent party losing the White House for the third straight time in a row, the first time this has happened since the 1800s. Given trends globally, something more profound is occurring as populism (both left and right) continues to dominate (global) election results due to a future that seems more uncertain and less bright.

The electoral landslide for Trump and the Republicans ends the uncertainty over which party will control the U.S. government for the immediate future but also begins uncertainty about how the Trump administration will actually govern.

Trump 2.0, here we go…

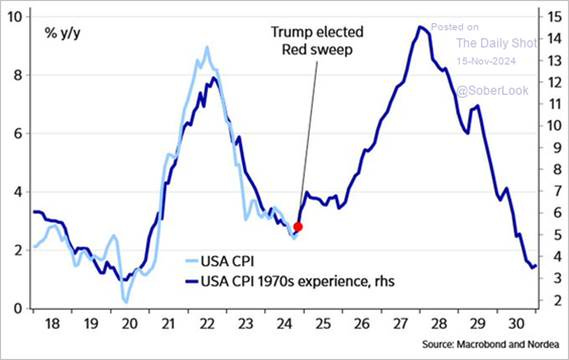

At this point, markets believe this second Trump administration will mean extended and expanded tax cuts. They see a continuation and expansion of tariffs, which are likely to be much wider-reaching than we saw in Trump’s first term. This will lead to greater inflationary pressures and will require fewer Fed rate cuts. Markets also agree it’s a disaster for Europe, China, and other trade partners that will now require more policy support both on the fiscal and monetary fronts.

As a result of these beliefs, U.S. equities initially reacted positively to the results since companies and investors are expecting a higher growth environment with a more pro-business administration. The dollar has broadly appreciated due to a more favorable trade balance and also a more robust growth outlook. At the same time, rates have priced in a more significant fiscal deficit and higher future inflation.

With much of the “Trump Trade” getting pulled forward (before the election even concluded) and White House cabinet personnel looking questionable, the honeymoon period for a more favorable risk sentiment looks to be ending, as seen in the recent pullback in U.S. risk appetite.

Can Trump deliver everything he promised, and is it actually pro-growth?

We question how much Trump can actually deliver, given his execution track record (from his first term) and a GOP Congress that will still have a large contingent of deficit hawks to contend with.

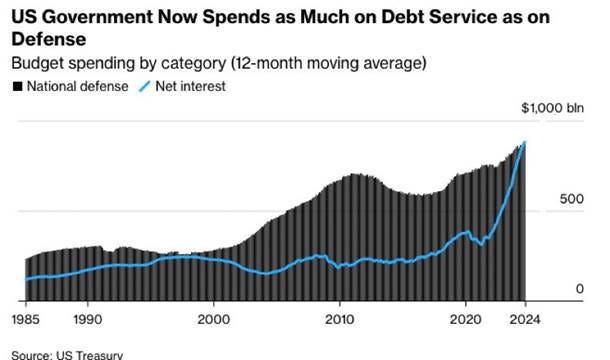

In his first term, tax cuts mainly offset the drag on growth from tariffs. But the larger/broader tariff intentions this time and likely watering down of the expansion of tax cuts will mean there may be greater headwinds to growth (than expected). Add in cuts to government spending/payrolls and a Fed that will likely have to stop its easing cycle sooner, and we are not worried about “runaway” growth, actually quite the opposite.

As a result, we see the current strong growth momentum (as best seen in the +3% YoY final domestic demand sales growth) likely to be near the high mark for this cycle. Why? Let’s break it down at a high level using a simple count of “+” and “-“ to indicate our expected impact on growth:

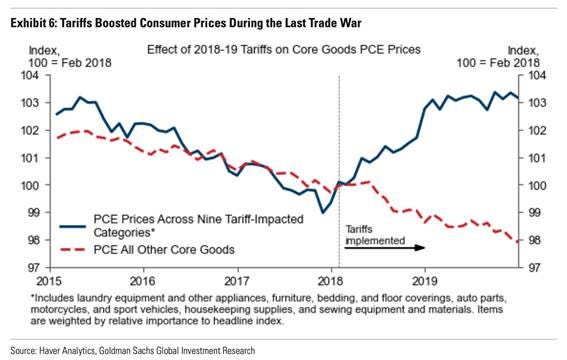

Tariffs (--): Increased tariffs on China to 60% and a 10% to 20% tariff on all other imports would increase inflation and reduce the country’s aggregate real disposable income. One study by the Peterson Institute calculated that Mr. Trump’s proposed tariff plans would increase costs for a typical American household by $2,600 a year. Tariffed countries will likely take retaliatory action that will lead to headwinds to growth, something we discuss in greater detail below. We see this as likely to happen given that Trump has significant power to impose tariffs unilaterally, and as a result, we give it a more significant negative impact rating.

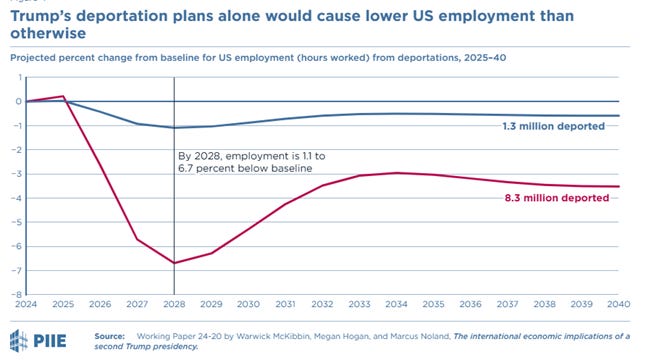

Deportation (--): Although the number of unauthorized immigrants that may be deportated is highly uncertain (1 to 8 million in the workforce), any deportations will shrink the economy mainly by reducing the number of potential workers and the demand for goods and services from them and their families. This would be more inflationary and negative for growth through the service sector channel, which often relies more on cheap labor, while weaker aggregate demand would be disinflationary for goods. Although it is unclear how significant the level of deportation will be, we see this as a likely and notable headwind to growth moving forward and, as a result, give it a more significant negative impact rating.

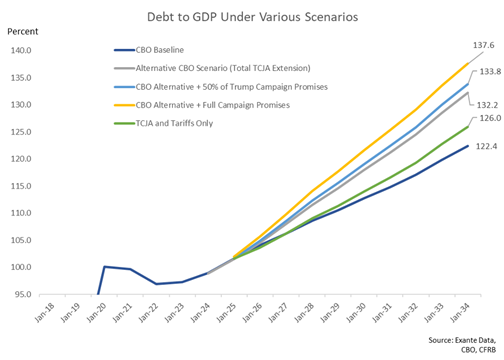

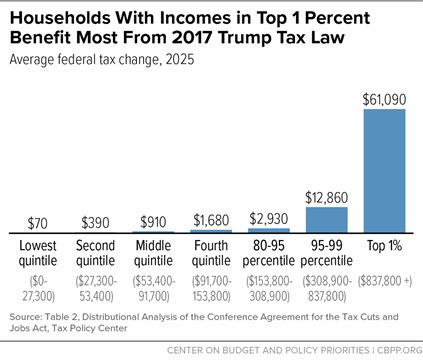

Tax Cuts (+): It seemed like Trump promised pretty much everyone a tax cut to win their vote during his campaign. It is unclear how much of these promises he can deliver given the Committee for a Responsible Federal Budget, a nonpartisan fiscal watchdog group estimates his plans would increase the federal deficit by $7.75 trillion, and we have to believe there are still some deficit hawks left in the GOP that may not like that. We believe the continuation of tax cuts from his first term will also not increase growth, instead keeping things status quo. We also think that if he had to compromise, it would be the lower- and middle-income workers who would be shorted, not corporations and upper-income households. As a result, any increase in growth through tax cuts will be limited, which is why we give this only a one plus impact rating.

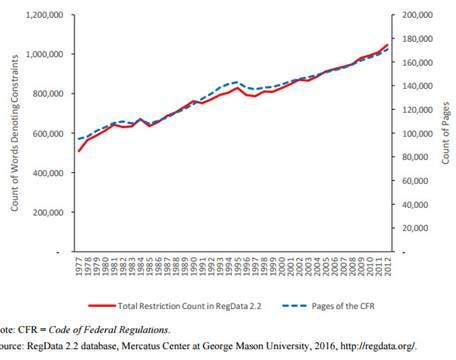

Deregulation (+): It’s hard for us to make a case that deregulation will meaningfully increase growth. Instead of increasing competition (by removing barriers to entry), there will likely be fewer anti-monopolistic actions, while M&A will increase, leading to greater pricing power by firms. Any operational cost reduction should lead to lower consumer prices and increased profits, but this will vary from industry to industry. As a result, we see deregulation as a positive for growth but a channel that will have mixed results, leading us to give this only a one-plus impact rating.

Reduced Fiscal Spending (-): Team DOGE (aka Elon and Vivek) wants to cut $2 trillion per year or around 30% of the federal budget. It is almost mathematically impossible to reach this target without cutting social security, medicare, and defense spending, things we assume will cause a notable backlash. However, although this is a consultancy group (with zero actual authority), we should assume that there will be some level of negative fiscal pulse through cuts to Federal spending offsetting some (maybe all) of any increased aggregate demand from additional tax cuts if even some of this target is reached. This leaves us to assign one negative rating to this channel as it will reduce aggregate demand in the economy and lead to increased levels of layoffs and reduced real aggregate income.

There are a number of other things we could discuss here, but we think the above five channels are the best way to frame how Trump’s second administration will directly impact real growth. Adding up the pluses and minus gives us a minus-three count. Again, as seen in the recent pullback in risk sentiment, we think markets are starting to realize that the coming policies may not be as pro-growth and more staglfationary than initially priced-in by risk assets.

Everyone is better prepared for Trump this time…

Finally, regarding Trump specifically, the world is prepared for Trump this time, unlike in 2016, which was a shock to the global world order. How will countries retaliate? They will sell U.S. financial assets and, to a lesser extent, implement their own tariffs given the trade surplus most have with the U.S.

World leaders are also now aware of the need to appease/placate his ego and his transactional manner in negotiating.

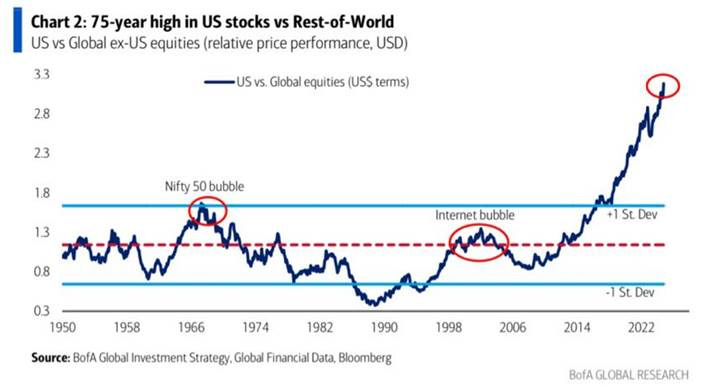

Finally, countries impacted by tariffs may increase their fiscal and monetary policy support. This leaves us wondering if the current outperformance in growth by the U.S. over the rest of the world will close quicker than expected on a longer-term basis.

Back to the economy…

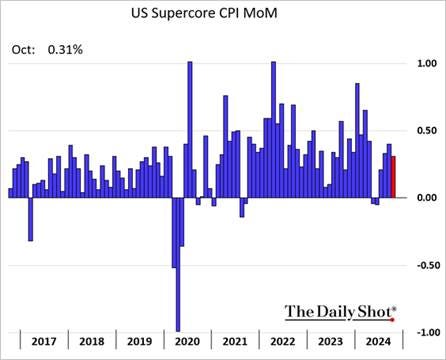

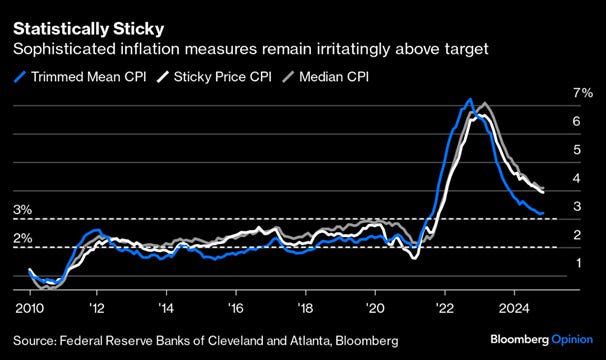

Although October’s CPI report was in line with expectations, the continued rise of core CPI (by 0.3% MoM for three months now) indicates a continued lack of disinflationary progress (in the official data).

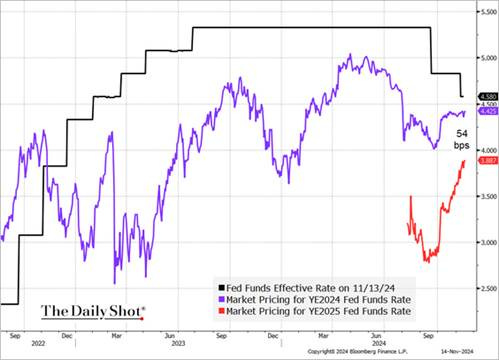

Powell has highlighted the three-month core CPI rate as his go-to gauge for measuring progress; however, that rate has now risen at its fastest pace since April. Powell also reinforced the view that it may be appropriate to slow the pace of rate cuts moving forward in a speech this week. As a result, November’s CPI report, coming before the December FOMC meeting, will be that much more important now as there is no doubt many policymakers are questioning whether policy is as restrictive as previously thought.

Core services, excluding OER, a Fed favorite measure currently, have risen at a 4.3% annualized rate over the last three months (also the fastest pace since April) and by 4.4% over the last year (compared to an average rate of 2.5% in 2018 and 2019).

Further, over the last three months, core commodities prices (in CPI) have risen at a 0.2% annualized rate, and while this might not sound like much, this is the first increase in core goods prices since June 2023 over a three-month period, marginally adding to inflationary pressures and making reaching the 2% target that much harder..

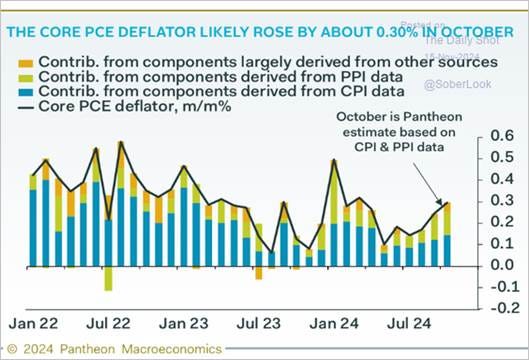

Combining October’s CPI and PPI reports, the latter showing higher medical service, portfolio management, and airline fares, estimates for October’s core PCE moved higher to 0.3% MoM (from 0.2% MoM), a monthly pace that, when annualized, would leave the Fed well above their official target.

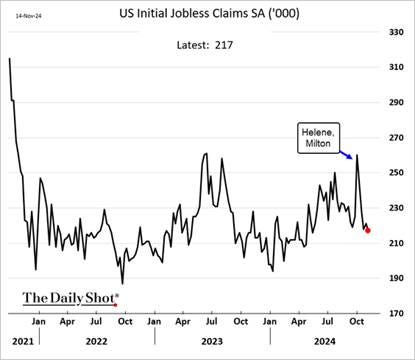

There are, of course, other considerations at play for the FOMC, with a cooler labor market being the primary other concern (than inflation). However, Fed speakers over the last two weeks did not seem overly concerned about the weaker October jobs report. Weekly claims data, which arguably is a cleaner read given that weather and labor strikes distorted October’s NFP, is not signaling any change in on-the-ground conditions.

“The economy is not sending any signals that we need to be in a hurry to lower rate.” – Fed Chairman Powell

Retail sales growth in October was slightly below expectations, while the pattern of spending in the third quarter was revised to boost September sales growth significantly but lower August’s growth. On balance, this points to a downward revision in real PCE growth for the third quarter.

Further, the core measure of retail sales (excluding autos, gasoline, and building materials) comprises about one-quarter of all spending in PCE and more than three-quarters of spending on goods in PCE, so the slightly weaker October retail sales report indicates some cooling in spending growth at the start of the fourth quarter, but no red flags.

Putting it all together, it makes sense the Fed will be slowing and likely stopping its rate-cutting path sooner than expected, given the current growth momentum and stickiness of inflation. At the same time, business sentiment will jump on the red sweep on election day, something NFIB and Empire State started to reflect this week (although NFIB was pre-election), potentially reducing layoffs as expectations for better business conditions rise. Although the Fed always tells us they are data dependent, it is especially true right now.

What does all this mean for markets..

There is clearly no sign of a looming recession, and corporate profits continue to grow (as a percentage of GDP). However, Trump’s policies are not as growth- and disinflation-friendly as advertised. The macro regime change that just occurred still has individual narratives that need to be vetted further.

Equity valuations, based on strong 2025 earning growth expectations (analysts expect 25% EPS growth by the end of 2025), indicate little room for error. Rates clearly are recalibrating the Fed, deficits,and inflation. The dollar’s parabolic move higher may be overestimating future growth and real rate differentials (which currently favor the U.S.). Commodity prices are also showing worries about global growth.

Buy the rumor, sell the news…

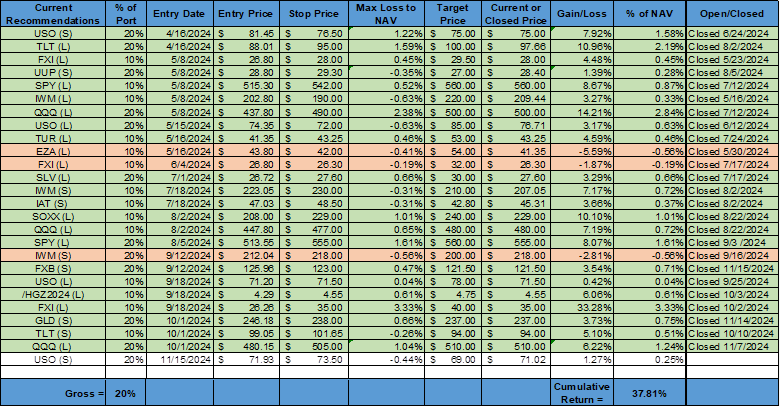

As a result of this tectonic macro regime shift, we have closed our existing mock portfolio positions (short GBP, short gold, long Nasdaq) with decent gains and opened a short in oil.

The dollar now seems overbought and needs consolidation. If our views on next year’s growth (which are more negative than consensus) prove to be correct, fundamentals don’t support further $DXY appreciation.

The vol compression that supported the rally in U.S. equities following the “election event” has run its course, while today’s OPEX will reduce stability and increase negative gamma.

We don’t expect a market crash, but price action this week makes a lot of sense to us.

We will delve more into oil next week, making a bullish and bearish case, but our preferred way to fade what we see as a growth outlook that is too optimistic is through oil currently, given where other proxies for that trade have already moved.

Looking further out…

As teased earlier, we see a potential scenario in the second half of 2025 where the rest of the world is stimulating their economies while Trump’s policies are slowing growth more than expected in the U.S. as higher inflation limits the Fed’s options while tariffs and deportation hurt aggregate demand.

There is still a high level of uncertainty here, given we don’t know what will actually be enacted. However, we want to flag this scenario now as market exuberance for Trump 2.0 seems to be waning.

In conclusion…

Momentum in the economy is still strong, but markets price forward, and the future is more uncertain.

Unrealistic candidates for key cabinet positions are once again reminding Americans (and the world) what they are in for over the next four years, which is increased headline chaos and potentially unproductive policies. Whether Trump will be able to continue the Biden administration’s economic momentum is uncertain, and we are entering the later part of the general economic cycle.

As a result, market sentiment should become more volatile, followed by, after an initial bounce higher, consumer and business sentiment.

Thank you to our regular readers for their patience as we have been absent for a few weeks. We plan to be more timely in our publication moving forward as our time away was due to a vacation and waiting for the dust to settle from the election.

As always, thank you for reading. Please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. We are now on Bluesky at @middaymacro.bsky.social – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.