Uncertainty Continues for Markets, Fed, and Main Street as Credit Conditions Now Determine Policy Outlook – 3/24/2023

Color on Markets, Economy, Policy, and Geopolitics

Uncertainty Continues for Markets, Fed, and Main Street as Credit Conditions Now Determine Policy Outlook – 3/24/2023

Overnight and Morning Recap / Market Wrap:

Price Action and Headlines:

Equities are higher, ending the week flat but with a mix of sector/factor performance as the March FOMC’s rally failed to stick due to continued concerns over financial stability and little new economic data

Treasuries are higher, with the curve continuing to steepen on the week as markets further reduce Fed tightening expectations in light of further weakness in bank stocks internationally, moving two-year treasury yields to their lowest levels since September

WTI is lower, although rebounding off morning lows and higher on the week with no fresh developments driving prices as traders weigh Energy Secretary Granholm's comments that refilling the US Strategic Petroleum Reserve may take several years

Narrative Analysis:

Despite the continued headline-grabbing banking drama and numerous central bank meetings, including the Feds, where rates were hiked further, the S&P is ending the week slightly higher, not surprisingly near the psychologically, technically, and optionally important level of 4000. Sector and factor performance was mixed, not indicative of a clear risk on or off tilt, as one would have suspected going into the week. Instead, and although “uncertainty” remains high, made worse by Powell’s admission of it himself in the press conference, markets climbed the wall of worries to end the week on a positive note, although there were clear moments of taking the elevator down, especially when Yellen interrupted the more dovish message being delivered by the Fed by declaring no full depository backstop was in the works, something she later walked back. The week was also light on the data front, with today’s S&P PMIs improving while housing activity readings early in the week were seasonally robust. Treasuries continued to see inflows, with nominal yields lower across the curve and breakevens little changed on the week, helping the MOVE index fall from lofty highs recently seen. Oil was also slightly higher on the week after reaching new recent lows on continued inventory builds and uncertain demand (due to financial stability concerns), ending Friday a little under $70. Copper was one of the best performers in the commodity space, although cooling today. The agg complex got a bid as Russia announced it would be limiting exports of grains further, clearly still trying to use its resource production leverage to sway hearts and minds regarding its “special operation” in Ukraine. Finally, the dollar was slightly lower on the week, with the $DXY ending near 103, although it recovered from post-FOMC lows as the EUR weakened today.

The Russell is outperforming the S&P and Nasdaq with Low Volatility, Momentum, and Small-Cap factors, as well as Utilities, Real Estate, and Consumer Staples sectors all outperforming on the day. The week was a mess, with no clear tilt towards sectors and factors. Communication, Energy, and Materials were the best-performing sectors, while Momentum and Growth were the only factors higher on the week. Small-cap value remained the worst-performing size, with large-cap growth the best.

@KoyfinCharts

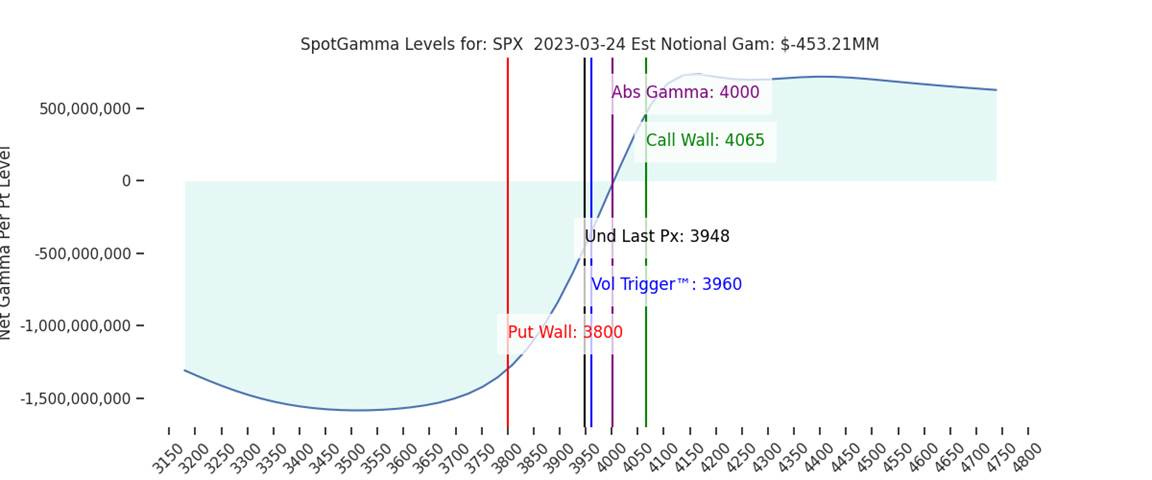

S&P optionality strike levels have the Zero-Gamma Level at 4015 while the Call Wall is 4065 and Put Wall is 3800. The 3950 level on the S&P remains a key support area with 4000 key resistance. These key levels have higher open interests and as a result, suppress vol in this range. Option traders have become more negative on tech, with more selling yesterday as the Nasdaq/QQQ reached 13,000/315. Spotgamma sees implied vol as fairly valued based on realized. Skew has come down from highs seen over the last several weeks but realized volatility is elevated due to the bank crisis. If the S&P can push over 4000, market volatility should stall out.

@spotgamma

S&P technical levels have support at 3950-55 (major), then 3935 (major), with resistance at 4000, then 4025 (major). Since the S&P is still holding its rising channel (tested at 3950 today), the general tone is positive, and a move above 4000 is possible. A failure of 3935 is a big warning shot that we are going to move lower, with the 3900 (2022 downtrend line) fail formally starting a new longer leg lower. Since the March low, all dips have been bought, forming a series of higher lows. We also bounced back above the 200 DMA today after dipping below overnight. As a result, technicals are still neutral to slightly bullish for the S&P.

@AdamMancini4

Treasuries are higher, with the 10yr yield at 3.38%, lower by 5 bps on the session, while the 5s30s curve is flatter by 2 bps on the session, moving to 24 bps.

Deeper Dive:

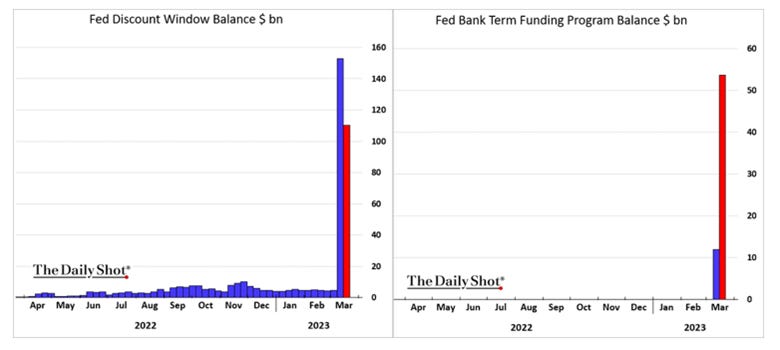

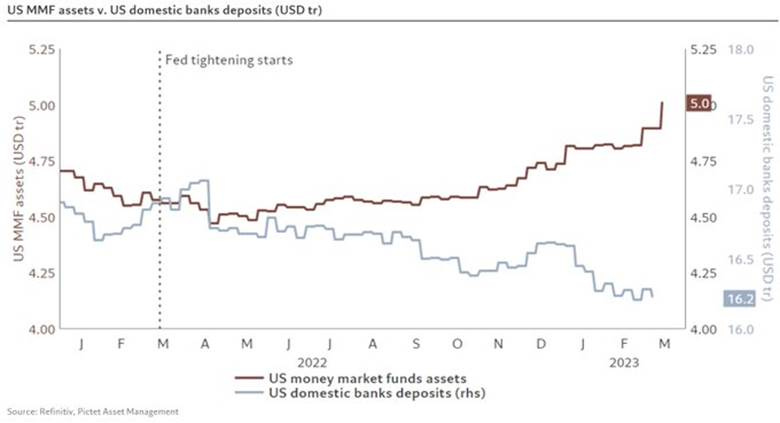

First and foremost, these are troubling times for central bankers and, as a result, financial markets. The current banking liquidity saga has spooked main street, leading them to question the safety of their banks while also educating them that they can earn more in money market funds than their (now perceived riskier) savings accounts. This means the risk of deposit flight which kicked this whole episode off, is potentially far from over. Couple this with central banks that appear confident they can continue their fight against inflation while still containing financial instability, and the recent relief to the asset side of banks’ balance sheets from lower rates (rising bond prices) may be short-lived if inflation remains persistent in the coming months. However, in some good news, this week’s Fed balance sheet data (H.4.1) showed borrowing from the Discount Window and BTFP facility were flat, suggesting that deposit stress across the banking industry was less severe than indicated by price action in bank stocks.

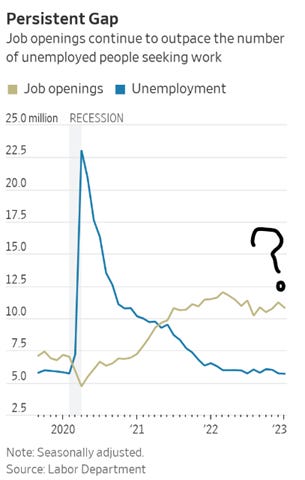

Furthermore, Powell’s presser highlighted that the increased financial instability due to the events of the last two weeks will “likely” result in some tightening of credit conditions for households and businesses, weighing on growth and inflation, and as a result, and “would work in the same direction as a rate tightening,” going as far to say “you can think of it as being the equivalent of a rate hike, or perhaps more than that.” He, however, was quick to say it was too early to know this and stressed that FOMC “participants don’t see rate cuts this year. They just don’t.” Markets sure do, with the odds of a hike in May now close to zero and rate cuts starting in June.

This makes sense, given the increased uncertainty about growth and inflation from tighter financial conditions and the potential for further financial instability contagion. This keeps us in this “bad is good” narrative that started in February. Not only do we now need to see loosening labor markets leading to falling wages reducing cost pressures to the sticky core-service ex-shelter inflation component. We now also need to see weakening credit availability, as seen in weekly bank lending data (H.8), the Senior Loan Officer data, and business and consumer sentiment survey’s like the NFIB Small Business and the University of Michigan Consumer surveys that directly ask respondents about the availability of credit. Finally, the flow of funds data (Z.1) will have increased importance as it will determine if the flight of deposits has indeed stopped/slowed. Only when it's clear that liquidity concerns won’t morph into insolvency ones (for banks) will bank equities base and stop pulling risk sentiment down. Stepping back, the last two weeks, culminating in the March FOMC meeting, have left us with more questions than answers. As a result, we are likely in for continued choppy range-bound market price action as we await confirmation of where the economy, and hence inflation, is going in Q2. We continue to hold our mock portfolio positions as is, happy to have reduced exposure and overweight non-western equities and debt, as well as long copper.

*Our mock portfolio cumulative returns rose to close to 4% this week thanks to a rebound in copper and EM due to a rally in Chinese tech, while our Nasdaq long also rose slightly

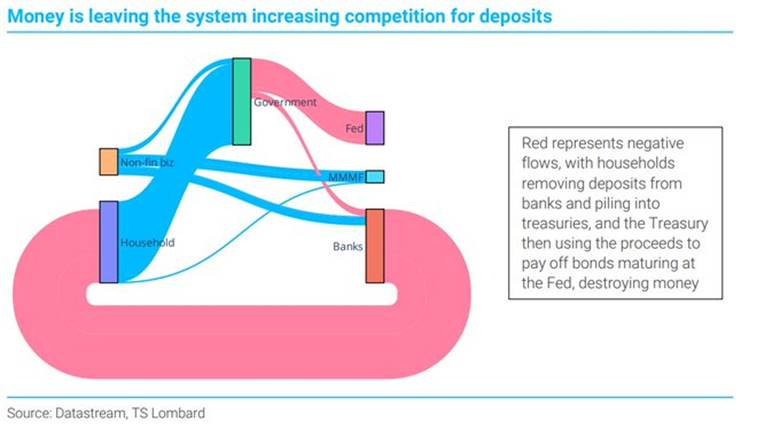

As a “101 economics” reminder, the financial system and the real economy are closely connected. If the financial system is in turmoil, the flow of funding for real economic activities seizes up. It’s currently unclear to what degree the financial system is impaired due to recent events, but markets are notably more volatile and pricing in a weaker growth outlook. Of course, this recent recovery from the “liquidity crisis” is the fifth phase/narrative to hit markets this year and could quickly change. We have gone from recession fears in early January, to soft-landing optimism entering February, to the “no-landing” reheating of the economy entering March, into fears of a banking crisis in the U.S. and Europe. We are now tip-toeing towards a more modest optimism that the banking crisis is contained to a few idiosyncratic institutions. However, with deposit flight likely still occurring, money is leaving the system, creating an earlier-than-expected exit of liquidity that QT and the restocking of the TGA would have delivered in the second half of the year.

*This change in preference towards money market funds can be expected to continue now that the “word is out” and rates may continue to rise further...

*However, it is unclear if the financial system can take any more tightening, with higher rates increasingly moving money out of the system

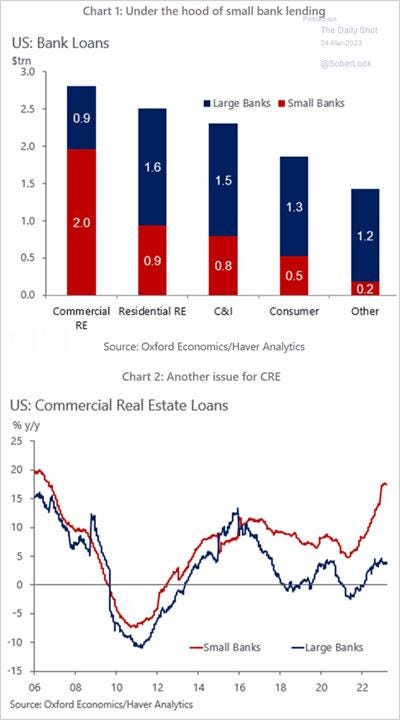

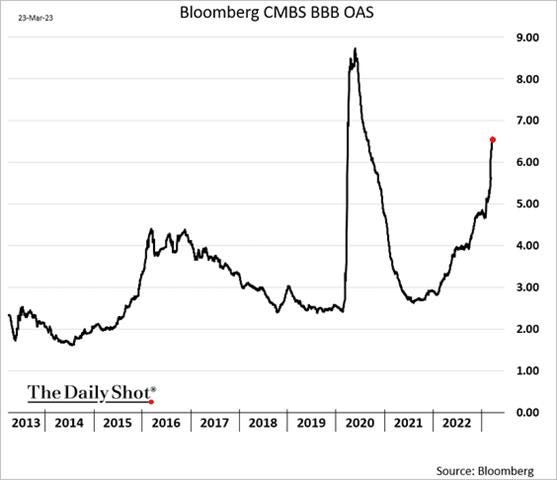

The Fed’s easy money period due to the pandemic once again opened the chase for higher returns. This was especially true in smaller and mid-sized banks, who, due to deregulation, now on aggregate, have higher levels of leverage and own riskier loans, particularly in commercial real estate, that will become increasingly problematic as those large amounts of credit continuously need to be refinanced at now higher costs. As the economy declines (from the effects of tighter policy), traditional lenders nurture loan losses and, therefore, are unable or unwilling to roll over existing debt to the same degree as before.

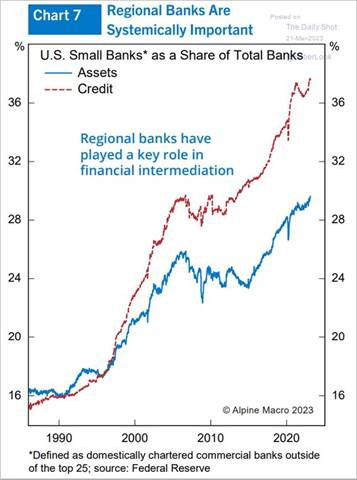

*Regional banks play an important role in credit intermediation and, although diverse and numerous, on aggregate, are systemically very important

*Total loan and lease levels were still rising into the recent liquidity turmoil, mainly due to lending from smaller banks, but this is now likely to change moving forward…

*…with bank deposits falling at smaller banks, there will be less capital to lend out, while an increased focus on risk management will require tighter lending standards.

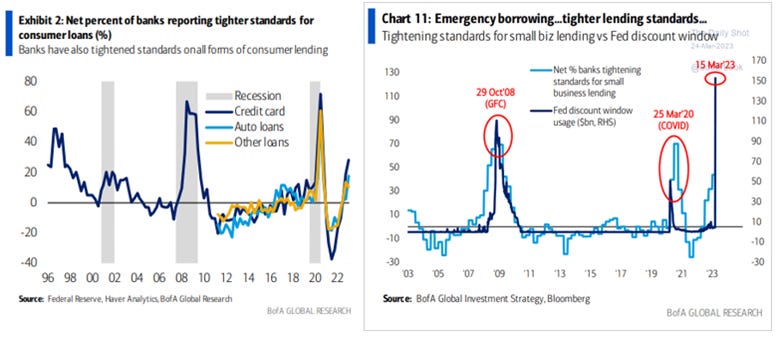

*…indeed credit standards were already tightening for some time, and with “emergency” lending from the Fed rising, are expected to tighten further…

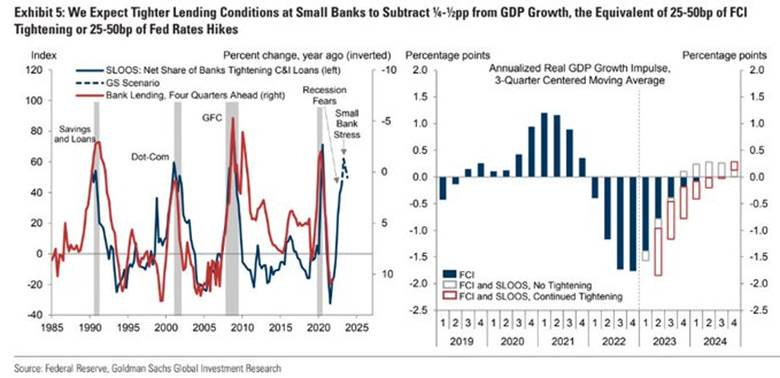

*… and these tighter lending conditions (at smaller banks) are expected to lower GDP growth by ¼ to 1/2 percentage point

Further, the economic decline that comes from tighter financial/credit conditions lowers earnings for corporate and income for households. Thus their creditworthiness is impaired. In summary, the first wave of failures was due to asset-liability duration mismatches at a few poorly managed financial institutions. If the economy deteriorates, a second wave of failures will emerge, driven by significant loan losses, particularly in commercial real estate, which is already vulnerable due to the structural changes to demand that working from home has brought. This is not our base case scenario, but we highlight it due to the growing probability it occurs and the severity a refinancing gap would have on the overall economy and, of course, markets. Without new credit, earnings and income deteriorate quickly, leading to a “Minsky Moment” requiring a drastic policy response to turn the tide and unclog the pipes.

*The concentration of lending (to certain industries/borrower types), such as commercial real estate, is problematic and creates a systemic risk channel for recent liquidity problems to spread to the broader economy

*CMBS markets have seen a notable widening in spreads indicating a worsening demand picture for commercial real estate loans

In summary, with financial stability, well, far from stable, as seen in the pressure European banks are still under today, as well as a lack of clarity on how the Fed views the current events in regard to future policy decisions, we continue to be in uncharted territory. When you add in the likelihood that core-service ex-shelter inflation is still being supported by a resilient consumer and an uptick in input costs in Q1 while not yet seeing a material decline in wage pressures, Fed officials will continue to prioritize the fight against inflation over financial stability concerns until more things “break.” This message, which will likely be repeated ad nauseam if today’s Fed speakers are any indicator, could reverse recent declines in yields, further tighten financial conditions, and cap any equity rallies. The bottom line is the potential for policy error only increased despite a clearer need for a more two-sided risk management framework by the Fed. As always, stay tactical and manage risk closely. We are still far from a more passive risk-on-tide-up environment that will eventually come when the Fed begins to ease and a flood of (money market) money comes back into equities.

Econ Data:

Total new orders for durable goods fell by -1% month-over-month in February, following an upwardly revised -5% fall in January and compared to market forecasts of a 0.6% increase. New orders for transportation equipment declined by -2.8%, mainly due to drops in nondefense aircraft and parts (-6.6%), defense aircraft and parts (-11.1%), while motor vehicles and parts were down by a more meager -0.9%. Excluding transportation, new orders were unchanged. However, new orders were down for capital goods (-2.2%), namely nondefense ones (-1.2%) and machinery (-0.5%). New orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, increased 0.2%, after a 0.3% rise in January. Total shipments fell by -0.6% MoM but were effectively flat when excluding transportation equipment. Total unfilled orders fell by -0.1% MoM, while total inventories rose by 0.2% MoM.

Why it Matters: The report was marginally weaker than expected but continues to show no rapid loss of momentum in the manufacturing sector. The important core capital goods data showed new orders gained 0.2% MoM, but January's 0.8% gain was revised down to 0.3% and shipments of these goods were flat, and January's 1.1% increase was revised down to 0.9%. As a result, some of the notable contractions in demand and activity seen in regional Fed and PMI manufacturing surveys have yet to translate into actual notable declines in what harder data series such as durable goods and factory orders are showing.

*Volatility in transportation equipment continues to weigh on the total new orders for durable goods but “core” readings remain positive

Sales of new single-family houses increased by 1.1% in February to a seasonally adjusted annualized rate of 640K, the highest level since August last year but below forecasts of 650K. It follows a downwardly revised 633K in January. Sales increased in the West (8.1%) and South (3%) while decreasing in the Midwest (-1.4%) and the Northeast (-40%). The median price of new houses sold was $438.2K, while the average sales price was $498.7K, compared to $427.4K and $522.2K, respectively, from a year ago. There were 436K houses “left to sell,” the lowest since April of 2022, corresponding to 8.2 months of supply at the current sales rate.

Why it Matters: There was strong sales activity in the West and South, which accounts for the largest amount of units sold by far, driving the national total higher. The Northeast saw notable weakness in February, while the Midwest was slightly down. The month’s of supply metric has again moved lower (to 8.2) after peaking slightly over ten last summer. This confirms what is being seen elsewhere; inventory levels remain low despite the high level of homes under construction and despite historically poor affordability due to higher financing costs and appreciated prices. The housing market remains tight. As a result, the weakness seen in residential investment over the past half a year may begin to stabilize as builders and buyers adjust to the new realities of a higher mortgage rate world while still working through the imbalances between supply and demand.

*Total houses sold were higher than expected, while the available inventory continues to fall at the current sales rate

*Recent drops in mortgage applications indicate that better-than-expected existing and new sales gains in February may be short-lived

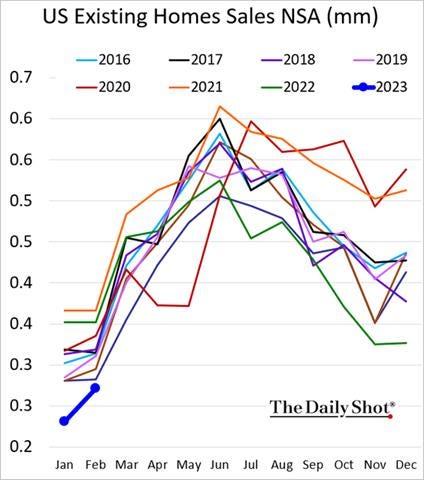

Existing-home sales jumped 14.5% in February to a seasonally adjusted annual rate of 4.58 million, snapping a 12-month slide and representing the largest monthly percentage increase since July 2020 (+22.4%). Compared to one year ago, however, sales are lower by -22.6%. The median existing-home sales price decreased by -0.2% from the previous year to $363K. The inventory of unsold existing homes was unchanged from the prior month at 980K at the end of February or the equivalent of 2.6 months' supply at the current monthly sales pace. Properties typically remained on the market for 34 days, up slightly from 33 days in January and 18 days in February 2022. Fifty-seven percent of homes sold in February were on the market for less than a month. First-time buyers were responsible for 27% of sales in February, down from 31% in January and 29% in February 2022. All-cash sales accounted for 28% of transactions, down from 29% in January but up from 25% in February 2022. Finally, distressed sales (foreclosures and short sales) represented 2% of sales, nearly identical to last month and one year ago.

Why it Matters: Unlike past reports, there were broad gains in both single-family and multi-unit, with single-family home sales up 15.3% on the month. Further, all four regions saw sales rise, with the West being the strongest. With the 30-year fixed-rate mortgage averaging 6.60% as of March 16th and with yields falling further since then, affordability has been improving. "Conscious of changing mortgage rates, home buyers are taking advantage of any rate declines," said NAR Chief Economist Lawrence Yun. "Moreover, we're seeing stronger sales gains in areas where home prices are decreasing and the local economies are adding jobs." The stabilization in “month’s supply” and “days on the market” also confirms that housing markets remain tight, supporting prices despite the fact that the median reported housing price declined (-0.2%) for the first time in 131 consecutive months. "Inventory levels are still at historic lows," Yun added. "Consequently, multiple offers are returning on a good number of properties."

*The non-seasonal adjusted rate is still below previous years as affordability weighs on activity despite low overall inventories and a notable jump in sales in February

*The NAR existing median price fell on an annual basis, with all categories well into double-digit annual declines now

The Kansas City Fed’s Manufacturing index was unchanged at 0 in March. Current activity measures, as seen in Production (3 vs. -9 in Feb) and Volume of Shipments (6 vs. -13), moved back into expansionary territory. Demand measures were more mixed, with New Orders (-13 vs. -6) contracting further while the Backlog of Orders (-18 vs. -22) and New Export Orders (3 vs. -5) improved, however still deeply contractionary and neutral, respectively. Labor intentions expanded with the Number of Employees (18 vs. 11) and Average Workweek (-10 vs. -13) both improving, although lower capacity needs from contracting new orders and backorders have hours worked still falling. Cost pressures worsened, as seen in Prices Paid (30 vs. 26), while Prices Received (13 vs. 17) fell further, indicating increased margin pressures on the month. Supplier Delivery Time (-6 vs. 2) fell back into contractionary territory, and inventory measures remained near neutral. The six-months-ahead readings were more positive, with the overall index slightly higher but still near neutral. There was a notable increase in expected shipments while new orders moved back into expansionary territory. Expected hiring also rose. There was little change in expected prices paid or received, with both remaining highly expansionary. Finally, Capex intentions moved back into positive territory.

Why it Matters: There was a broad, albeit mild, improvement in the KC Fed’s manufacturing survey, driven by activity, demand, and employment measures, while price and inventory measures were more mixed. There looks to be a basing in the overall composite after taking a notable fall into contractionary territory over the second half of last year. To be clear, demand still remains well in contractionary territory, but activity is again expanding, with production growing for the first time in six months. Price pressures have become further bifurcated, with a widening gap between a faster falling prices received verse prices paid. There was also a notable bounce back in inventories to a more neutral level than the prior month despite falling supplier delivery times. The future outlook remained more positive, especially for demand, but the persistent historically high price readings indicate firms do not see inflation falling soon. Along those lines, this month’s special questions asked about profit margins and changing prices. In March, given current price pressures, 56% of firms reported a decrease in profit margins since the beginning of the year, compared to last year, while 47% of firms reported changing prices more often. Finally, selective comments noted some stabilization/improvement in price pressures, but others showed continued problems with rising costs, supply chains, and finding qualified workers.

*The overall KC current manufacturing composite came in neutral again for a second month while the future outlook improved slightly

*Eight of the twelve sub-indexes improved on the month while declines in prices received and supplier deliver times bode well for reduced inflationary pressures

*The majority of firms noted a “slight decrease” in profit margins since the beginning of the year, while price change intentions were more mixed

Policy Talk:

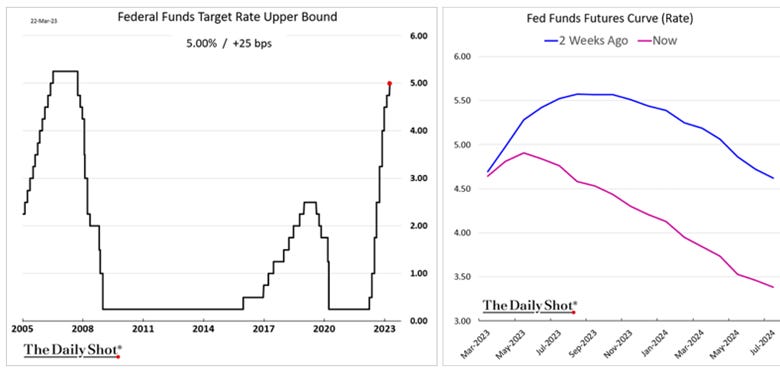

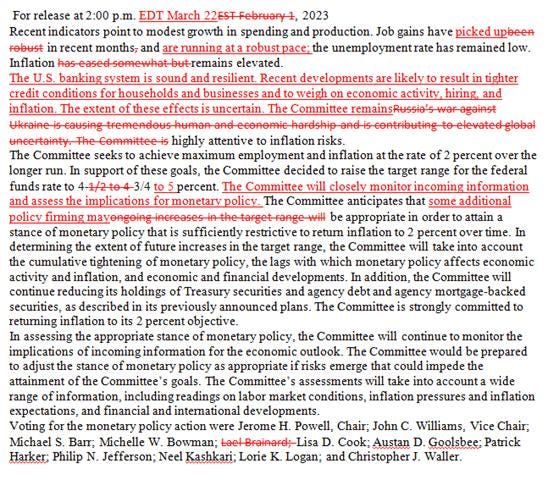

The Federal Reserve approved another quarter-percentage-point interest-rate hike following their March FOMC meeting but signaled through their Summary of Economic Projections that banking-system turmoil might end its rate-rise campaign sooner than seemed likely two weeks ago. The decision Wednesday marked the Fed’s ninth consecutive rate increase and moved the benchmark federal funds rate to a range between 4.75% and 5%. The Fed upgraded its language on the labor market (“Job gains have picked up”) and removed the reference to inflation having “eased somewhat,” saying only “Inflation remains elevated.” Powell started the press conference’s prepared remarks and Q&A by immediately highlighting the “decisive actions to protect the U.S. economy and to strengthen public confidence in our banking system” that the Fed, Treasury, and FDIC had taken. He highlighted that the new Bank Term Funding Program facility and the traditional discount window “is effectively meeting the unusual funding needs that some banks have faced and makes clear that ample liquidity in the system is available.”

*The Fed has reached 5%, but markets now expect the March hike to be the final one of the cycle, given recent financial instability

The addition of tighter “recent developments are likely to result in tighter credit conditions” and “some additional policy firming may” from “ongoing” were the biggest changes to the statement

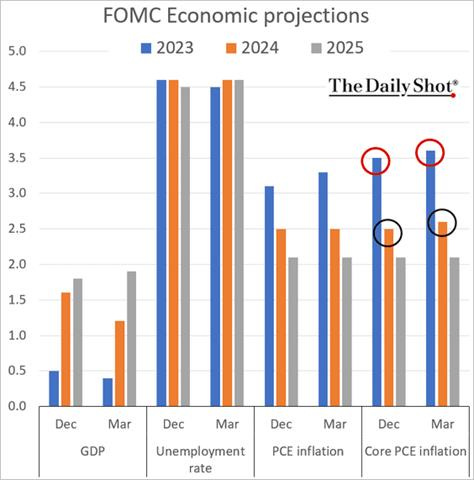

The prepared remarks again confirmed inflation was too high and that “economic indicators have generally come in stronger than expected (so far this year), demonstrating greater momentum in economic activity and inflation.” However, despite the stronger start to the year, the committee lowered its growth projection for the year to 0.4% from 0.5% due to weaker residential and business fixed investment, as well as greater uncertainty from the effects of now tighter financial conditions due to the recent financial instability. Further, Powell repeatedly noted uncertainty about the spillover effects of the banking-sector problems on lending during the Q&A part of the press conference. He also shared his impression of the speed at which events unfolded, with “a very fast run” on Silicon Valley Bank that left regulators asking themselves, two weekends back, “How did this happen?” Powell stressed the change in language in the statement to “may” and “some” from “ongoing’” was due to this new development and noted the tighter financial conditions could add up to the equivalent of a rate hike, “or perhaps more,” but repeatedly cautioned the impact on the economic outlook was highly uncertain.

*Powell mentioned tighter credit or financial conditions nine times throughout the press conference, and as a result of this, the committee downgraded their growth outlook

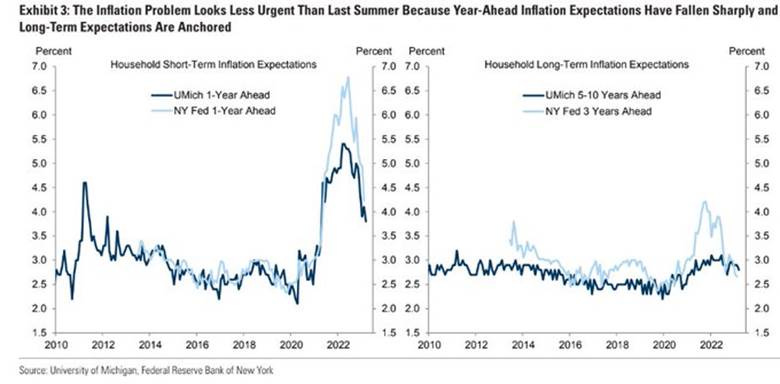

The FOMC committee continued to believe that labor markets remained tight, with high job creation and vacancies indicating that demand still exceeded supply. However, he highlighted some improvements in the labor force participation rate and wage growth slowing. Turning back to inflation, he said there was still a long way to go but took comfort that “longer-term inflation expectations appear to remain well anchored, as reflected in a broad range of surveys of households, businesses, and forecasters, as well as measures from financial markets.” He confirmed in the Q&A that he still believes that a disinflationary process is underway but highlighted that progress in the non-housing services sector continues not to show enough progress, and as a result, “the story is pretty much the same.” A large amount of the Q&A focused on whether Powell believed that tougher regulation would be warranted. He responded it was too early to tell and that Vice Chair Barr was leading an investigation. Finally, and most importantly, Powell pushed back on recent market-implied pricing that the Fed would be cutting rates towards the end of this year, simply saying the SEPs don’t show it.

“We believe, however, that events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would, in turn, affect economic outcomes. It is too soon to determine the extent of these effects and, therefore, too soon to tell how monetary policy should respond. As a result, we no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation; instead, we now anticipate that some additional policy firming may be appropriate.”

“So we published the new SEPs today; as you will have seen, it shows that basically, participants expect relatively slow growth, a gradual rebalancing of supply and demand, and labor market, with inflation moving down gradually. In that most likely case, if that happens, participants don't see rate cuts this year. They just don't.”

*The median fed funds rate projection for 2023 was unrevised at 5.1% and only one participant anticipates no more rate hikes this year, 10 projected one more rate hike, three saw two hikes, three anticipated three more hikes, and one participant projected four more rate hikes this year.

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Growth is lower on the day but higher on the week, and Large-Cap Growth is the best-performing size/factor on the week.

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day and the week.

5yr-30yr Treasury Spread: The curve is flatter on the day but steeper on the week.

EUR/JPY FX Cross: The Yen was stronger on the day and the week.

Other Charts:

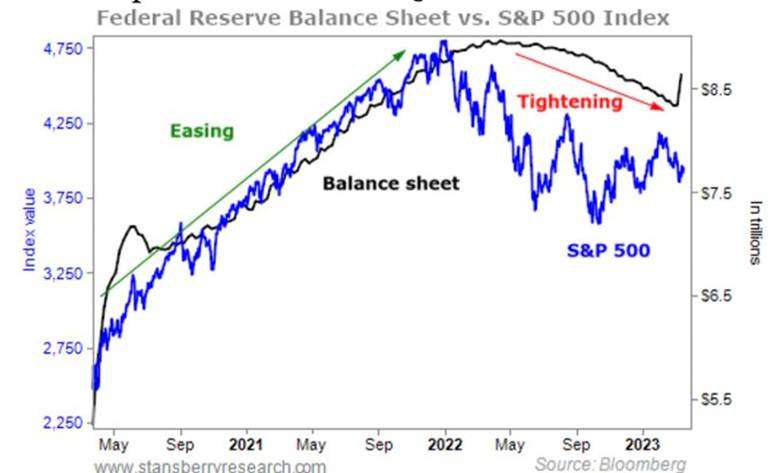

The S&P has front-run the Fed balance sheet lower, and although recent increases due to the use of lending facilities are different than asset purchases, will the optical effect of a larger BS support risk asset sentiment?

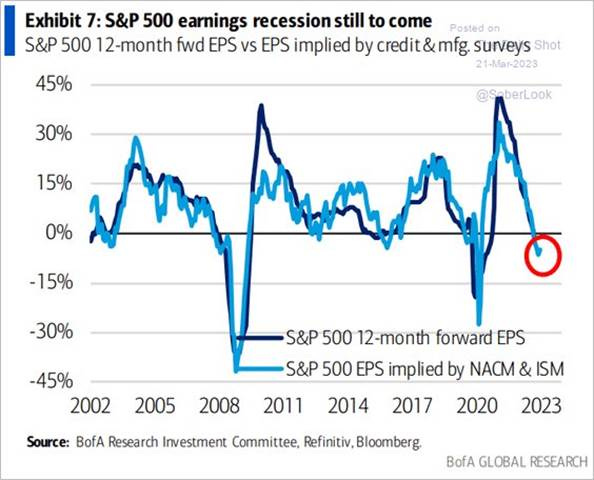

Softer data from business surveys still predicts a fall in the S&P’s forward earnings level, although recent stabilization in these surveys means a tactical bottom may be near.

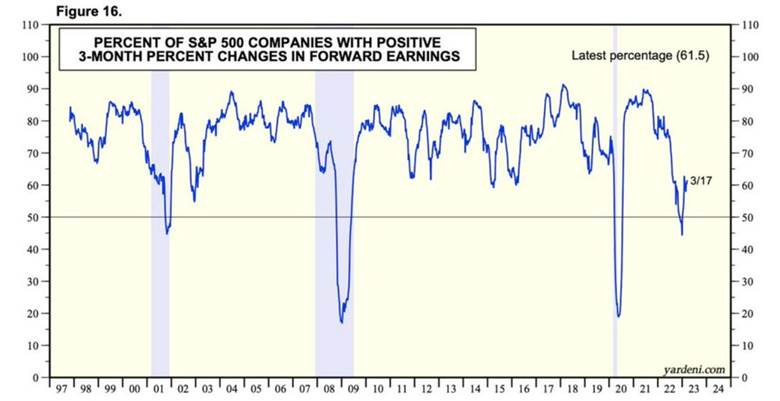

The Global Earnings Revision Ratio remained on an uptrend, unchanged in March’s most recent reading, despite recent financial instability. The ratio was driven higher recently by upgrades in Europe and by improvements in energy and tech hardware global sectors. It also remains surprisingly high for banks and diversified financials.

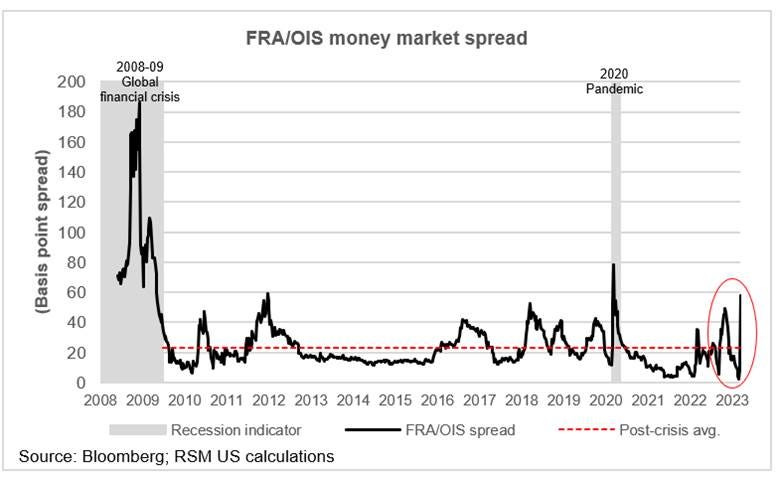

Large increases in the FRA/OIS spread or the difference between interest rates demanded by banks verse a risk-free rate represents the trends of borrowing costs and rises when lenders demand a higher risk premium.

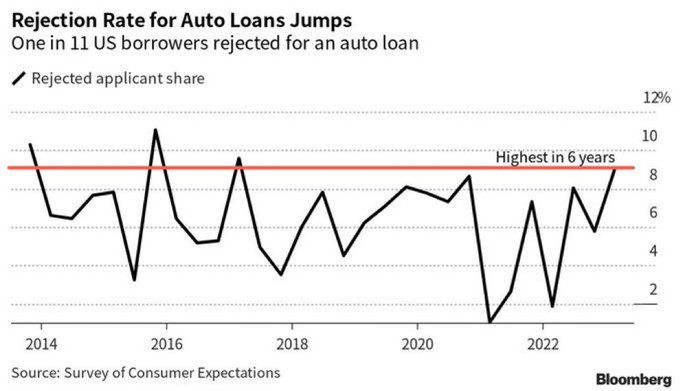

One in 11 US borrowers is now being rejected for an auto loan. Auto loan denial rate rose to 9.1% in February, a six-year high -- and up from 5.8% in October. - @SjosephBurns, @GuyDealership

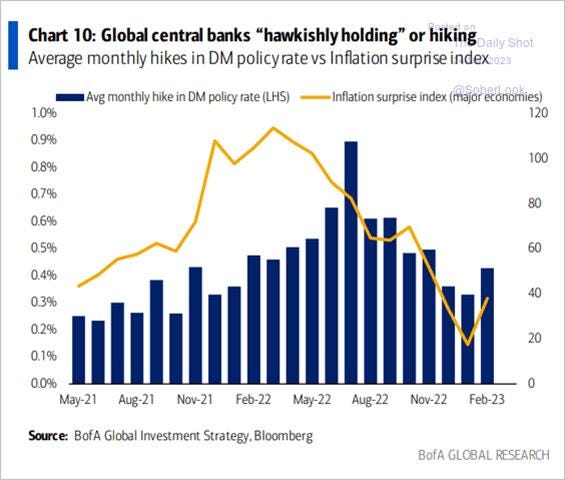

With inflation recovering at the start of this year, the average rate hike by central banks also increased.

Despite recent easing, cumulative monetary policy tightening, and now banking stress should subtract 0.6pp from G10 growth in 2023 due to tighter financial conditions, with Goldman now forecasting a 2% real global GDP growth rate this year.

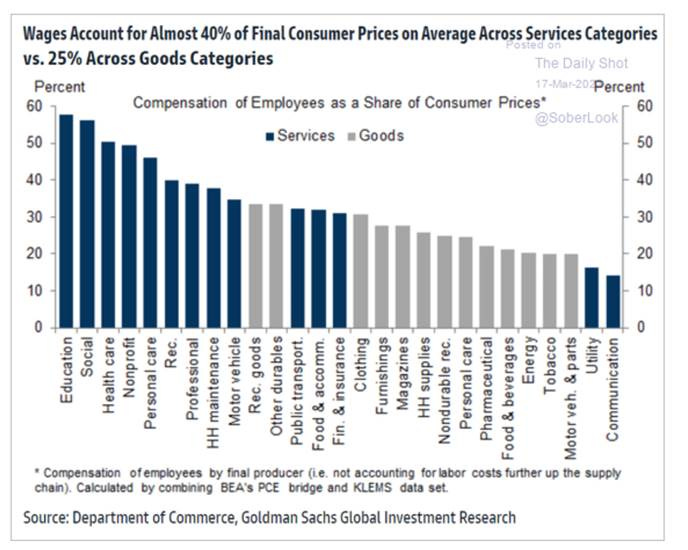

It is all about wages, and it is still our belief that labor markets are looser than official data shows, and as a result, wage pressures will continue to subside, reducing inflationary worries among policymakers and eventually driving CPI deflationary forces.

Outside of the official CPI/PCE readings, an increasing mosaic of inflationary gauges show a continued easing in input pressures as well as consumer and business expected levels

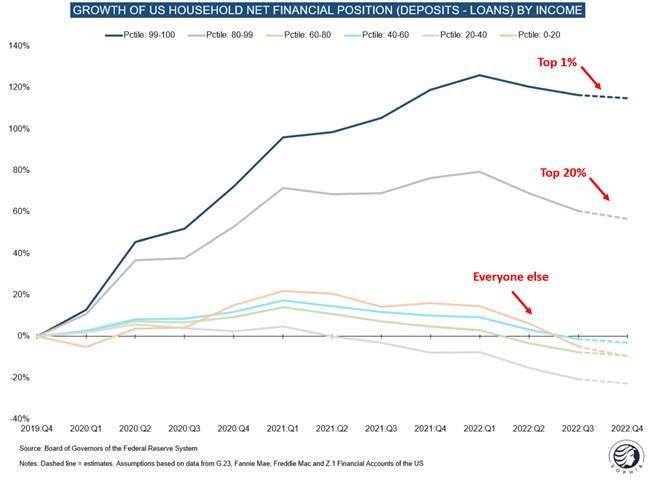

While most income brackets still hold more savings than pre-Covid, high inflation forced them to increase their debt to maintain spending. Thus, higher credit card, consumer, auto, or mortgages loans now more than offset higher cash balances

Articles by Macro Themes:

Medium-term Themes:

Labor Markets Loosening:

Sticky Postings: Not all job ads are attached to actual jobs, it turns out. The labor market remains robust, with 10.8 million job openings in January, according to the Labor Department. At the same time, companies are feeling budgetary strains, and some are pulling back on hiring. Though businesses are keeping job postings up, many roles aren’t being filled, recruiters say. Hiring managers acknowledge as much. In a survey of more than 1,000 hiring managers last summer, 27% reported having job postings up for more than four months. Among those who said they advertised job postings that they weren’t actively trying to fill, close to half said they kept the ads up to give the impression the company was growing, according to Clarify Capital, a small-business-loan provider behind the study. One-third of the managers who said they advertised jobs they weren’t trying to fill said they kept the listings up to placate overworked employees. - Job Listings Abound, but Many Are Fake - WSJ

Longer-term Themes:

Cyber Life and Digital Rights:

International Cybercrime Treaty: The vague and varied definitions of “cybercrimes” or related terms in U.S. federal and state law have long troubled civil liberties advocates who see people charged with additional crimes simply because the internet was involved. And without clear, narrowly tailored, universal definitions of cybercrime, the problem may soon become a global one. The United Nations is negotiating an international cybersecurity treaty that risks enshrining the same type of broad language that’s present in US federal and state cybercrime statutes and the laws of countries like China and Iran. According to a coalition of civil liberties groups, the draft treaty’s list of “cybercrimes” is so expansive that they threaten journalists, security researchers, whistleblowers, and human rights advocates. The article highlights the importance of properly classifying what cybercrimes are so that broadly worded laws can’t be abused by authorities. - The World’s Real ‘Cybercrime’ Problem - Wired

Energy’s Midlife Crisis:

Moving Away from “One Single Country”: The EU wants to make solar power its single biggest source of energy by 2030. That would mean almost tripling its solar power generation capacity over the next seven years. Yet more than three-quarters of the EU’s solar panel imports in 2021 were from China. As a result, the European Energy commission’s response has been to introduce a Net Zero Industry Act designed to boost the manufacture of “strategic” technologies on its home turf, including solar and other renewable energy infrastructure. The law, proposed last week, states that the EU should have enough clean energy manufacturing capacity to meet at least 40% of its generation needs. European solar companies say that more funding needs to be available to bring the industry up to that level. They also say that measures in the proposed act to prioritize local production in public procurement contracts and for consumer subsidies could increase costs to the degree that affects take-up. - Solar power: Europe attempts to get out of China’s shadow - FT

Knock Knock: After years of underinvestment in North Africa’s energy infrastructure, global oil-and-gas giants from Halliburton and Chevron to Eni SpA are ramping up their presence in the region as demand from Europe grows. Executives in the industry are betting it is worth drilling again in some of the hardest places to do business in the world as Europe increasingly turns to other sources for its energy needs after shunning its main supplier, Russia, over the invasion of Ukraine. In recent months, a string of European officials has visited the region to help advance talks over potential supply deals. “North Africa has been slow to develop its potential because of political risks, either related to insecurity or bureaucracy,” said Geoff Porter, president of U.S.-based North Africa Risk Consulting Inc. But with Europe needing to replace Russian energy, “this is their moment,” he said. - Big Oil Eyes New Deals in North Africa Amid Rising Energy Demand – WSJ

Food: Security, Innovations, and Climate Change Implications:

Severely Curtailed: Ukraine expects its farmers to harvest up to 15% less grain this year than last, showing how the war is further hindering one of the world’s largest agricultural exporters. With Russia’s invasion continuing to disrupt exports, some farmers have switched to crops that are easier to get out of the country, like sunflower seeds and soy. The shift among farmers means that allowing for normal weather, production of corn, wheat, and other grains is forecast to be 10% to 15% less in 2023 than last year, Mr. Solskyi said. Ukraine’s grain harvest last season was 53 million metric tons, a 20% reduction from the average over the past five years, according to the Ministry of Agrarian Policy and Food. The country’s combined harvest of all grain, sunflower seeds, and soy came in at 63 million metric tons, a 52% drop compared with the previous year’s output. - Ukraine Warns of Further Fall in Grain Harvest – WSJ

Authoritarianism in Trouble?:

“Coordinated Efforts”: Soon after a train derailed and spilled toxic chemicals in Ohio last month, anonymous pro-Russian accounts started spreading misleading claims and anti-American propaganda about it on Twitter, using Elon Musk’s new verification system to expand their reach while creating the illusion of credibility. The accounts, which parroted Kremlin talking points on myriad topics, claimed without evidence that authorities in Ohio were lying about the true impact of the chemical spill. The accounts spread fearmongering posts that preyed on legitimate concerns about pollution and health effects and compared the response to the derailment with America’s support for Ukraine following its invasion by Russia. Regularly spewing anti-US propaganda, the accounts show how easily authoritarian states and Americans willing to spread their propaganda can exploit social media platforms like Twitter in an effort to steer domestic discourse. - Pro-Moscow voices tried to steer Ohio train disaster debate – AP

ESG versus the World:

Flat Earthers: Robert Eccles, a professor at the University of Oxford’s Said Business School who has led efforts to thrash out agreed sustainability accounting standards, has lumped people attacking ESG into two groups, the “Sustainability Taliban,” for whom no ESG factor will ever go far enough, and neither free markets nor governments can be trusted. They come up against “Sustainability Flat Earthers,” who don’t believe in climate change and also think that free markets can fix the problem if it exists. Thanks to their sway within the Republican Party, these people are the most influential in the current attack on ESG. “ESG has gone from being so marginal few people knew what it was to something that gained broad legitimacy and broad acceptance to something that got debased by naïve Advocates and cunning Opportunists to now being a bogeyman to the Flat Earthers. Something as threatening to them as abortion rights and even a modicum of gun control. While the Taliban would be happy to see ESG RIP, the Flat Earthers never will. They need it too much for their own political agenda,” Eccles writes. - The Topology Of Hate For ESG - Forbes

A First: Joe Biden issued the first veto of his presidency, rejecting legislation that would thwart a rule allowing retirement portfolio managers to weigh climate change and other environmental, social, and governance issues in their investment decisions. The Labor Department rule was created to undo a Donald Trump-era requirement mandating that workplace retirement plans focus purely on financial gains. While consideration of climate change in selecting retirement investments was still possible under former president Trump’s measure, the Biden rule made it explicitly allowed. - Biden Vetoes Bill for First Time to Block Anti-ESG Measure - Bloomberg

Cold Places (Deep Sea, Artic, and Space Colonization):

No Recordings: A growing number of countries are calling to delay plans to strip-mine the seabed for metals to make electric car batteries as U.S. defense giant Lockheed Martin, the biggest corporate player in deep sea mining, exits the nascent industry. Lockheed’s sudden departure from deep sea mining, just as the industry reaches the possible cusp of commercialization, leaves no Western mining contractor with pockets deep enough to finance the billions of dollars needed to launch a seabed mining operation. More generally, the International Seabed Authority (ISA) is currently meeting to hit a July deadline for approving regulations that would allow unique deep ocean ecosystems to be mined as soon as 2024. Tensions at the conference are rising as scientists, lawyers, and activists charge the Authority’s administrative arm with pushing a pro-mining agenda. - Deep Sea Mining Just Lost Its Biggest Corporate Backer – Bloomberg

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION