The Trump Trade Resumes as Markets Navigate Increased Headline Volatility

Midday Macro - Color on Markets, Economy, Policy, and Geopolitics

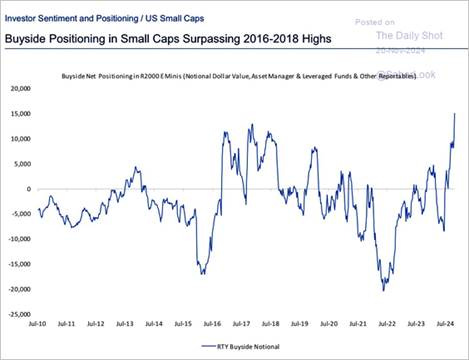

Trades that did well into and immediately following the election resumed their outperformance this week as the initial uncertainty from Trump’s cabinet picks fade

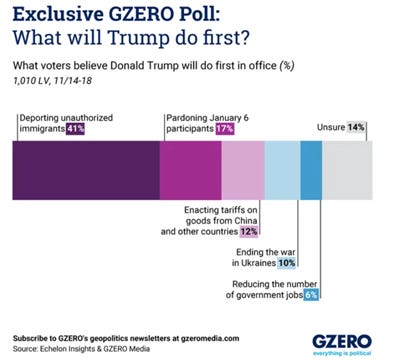

However, increased geopolitical worries will continue during the transition into Trump’s second presidency, given the high level of uncertainty surrounding what policy will be and how they will be rolled out

The Fed’s future path of policy continues to look more hawkish, but a December cut still looks likely, given our expectations for a weaker November payroll report

The Trump 2.0 trade re-engaged this week…

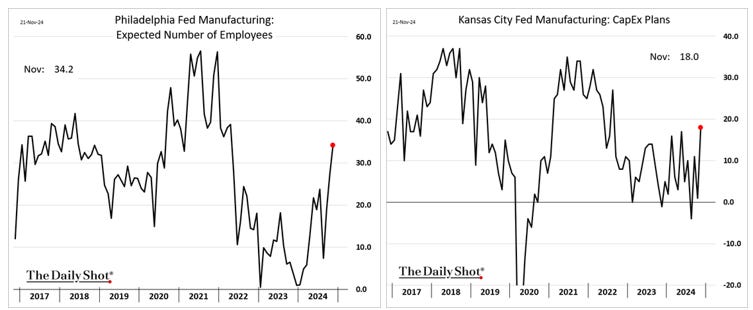

The current macro narrative is that disinflationary progress has slowed, and the labor market looks stronger than it was a few months ago. Meanwhile, the U.S. economy, which started to reaccelerate even before the election, now has greater positive “animal spirits” that may lead to increased hiring and investment by the business community following the Trump-driven red sweep.

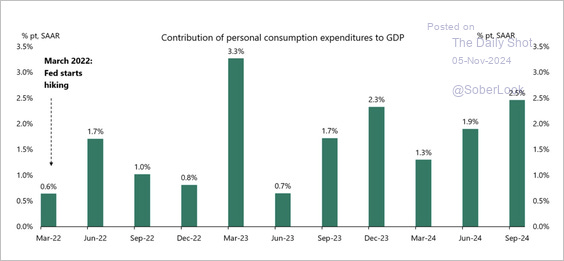

Further, despite one or two misses due more to idiosyncratic company reasons, the now-concluding third-quarter earnings season did not raise any major red flags regarding the U.S. consumer. If anything, given what retailers and financials have told us about the state of the consumer/household, along with recent official data such as retail sales and personal spending, positive momentum is expected to continue throughout the holiday period.

“We had good back-to-school, we had a good Halloween — and it’s important to string these holidays together,” John Furner, CEO of Walmart’s U.S. Division

“The consumer was slowing down in late summer... The good news is, as we came into September and October if you look at the two months together—particularly October—it looks like it’s leveling out. The expectations of our consumers to spend more in the holiday season are up by 7%, which is good” - Brian Moynihan, CEO of Bank of America

“If you look at consumers’ liquidity position, this is retail consumer, they’re indexing 120 to pre-Covid. So they have good liquidity... If you look at some of the things that’s happening with their savings, they’re saving 100 bps more than they were saving last year. And so that’s putting the consumer in a really, really good place” - Dontá Wilson, Senior EVP at Truist Financial

As we all know by now, the developments mentioned above have caused the Fed to reaccess its path of policy. At this point, we see the odds of a December rate cut as being about 75% likely. Recent Fed speakers, including Powell, have not overly skewed hawkish or dovish in prepared remarks or interviews, although there’s largely an agreement that the number of rate cuts coming has diminished. As a result, December’s new SEPs are likely to forecast fewer rate cuts are expected next year, while the longer run Fed funds rate moves above 3%.

“.. Another rate cut in December is ‘certainly on the table, but it’s not a done deal” - Boston Fed President Susan Collins

“Estimates of neutral rate are much higher than pre-pandemic” – Fed Governor Bowman

“If you’ve got inflation staying above our target, that makes the case to be careful about reducing rates… If you’ve got unemployment accelerating, that makes the case to be more forward-leaning.” – Richmond Fed Barkin

Finally, with Trump’s pick for the Treasury likely coming soon (and looking normal) and some signs there will be limits to who Trump can put in his cabinet (and markets increasingly remembering the headline chaos that Trump brings), markets have resumed the Trump 2.0 trade this week after a notable pause following the initial election result reaction.

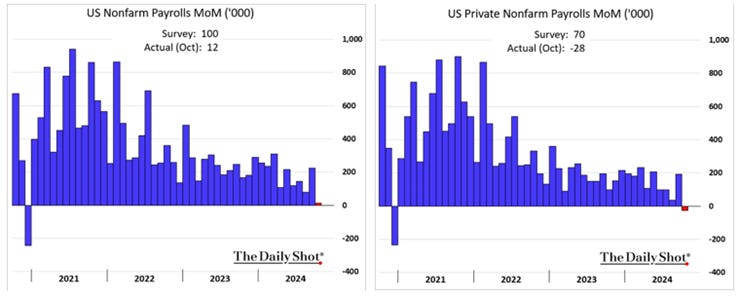

November’s jobs report should bounce back, but will it be enough to signal real growth…

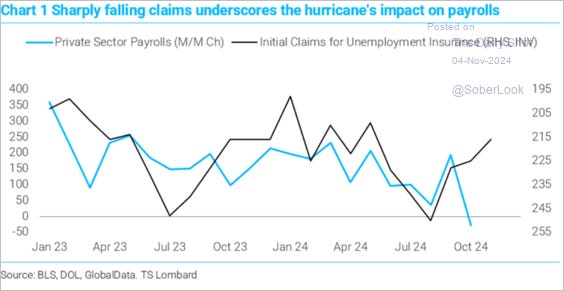

This week’s state-level payroll data showed that the significantly weaker-than-expected October payrolls report wasn’t entirely due to labor strikes and hurricane-related factors. Instead, there may be a broader cool-down at play, given how weak the report was. Adding back the around 100K of missing workers due to the Boeing strike and hurricane means that any payroll print around or below 100K would be considered a continued significant slowing in hiring, with zero “true” new jobs added, while a number around 200K would only indicate a real payroll growth of 100K.

As a result, given we believe the “true” payroll growth will be close to 100K (200K total NFP), we still see the Fed able to “recalibrate” policy with a December rate cut solely on continued cooling in the labor market (and despite the loss of disinflationary progress). Any payroll print above 200K would make the December rate cut more of a coin flip with the November CPI report than the focus, released on December 11th.

Initial claims continue to show no substantial deterioration in the labor market, giving Fed officials some comfort that the soft landing is still intact despite the noisier recent payroll reports. The four-week average of initial claims in the November employment survey week was at the lowest level since early May.

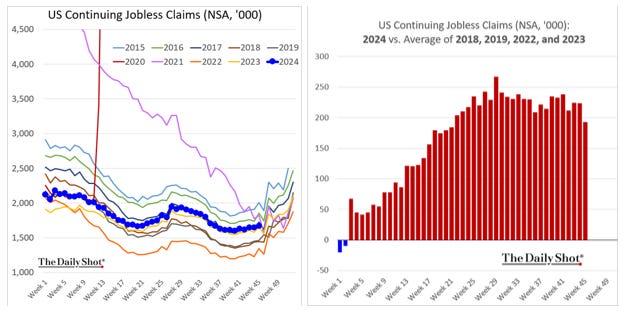

Continuing claims have trended higher, which may suggest some slowing in re-hiring, but this could also be the product of inadequate seasonal adjustment factors since, while seasonally adjusted continuing claims were at the highest level in three years, unadjusted continuing claims were little changed from their level at this time last year and only the highest since September.

Increased geopolitical uncertainty throughout the transition…

Turning to the geopolitical backdrop, we don’t see this week’s long-range strikes by Ukraine on Russia and Russia’s new nuclear declaratory policy and retaliation using an ICBM as a real escalation in the conflict. With Trump’s return, this might be an “escalation” that ultimately leads to a de-escalation, as neither side can afford to look weak and will be using the few weeks left (before Trump officially starts)to strengthen their bargaining power.

While the risk of an escalation in the Ukraine-Russia conflict, potentially leading to the use of nuclear weapons, has always existed since the beginning of the conflict, the recent increased concern by markets is due to the uncertainty around where the new and likely more volatile Trump Administration will set policy. This is not only applicable to the conflict in Ukraine but also across a number of other domains. Following the purposely low-volatility Biden administration, it makes sense that geopolitical risk sentiment/premium must now adjust.

As a result, until there is clarity on the positioning and sequencing of the Trump 2.0 policy mix, markets will likely skew more defensively to geopolitical headlines, especially regarding China, Russia, North Korea, and Iran. There will also likely be more headlines as adversaries try to get ahead of the coming storm.

This should come as no surprise to market participants who have been paying attention, but we want to highlight it all the same. We will be watching for further personnel announcements (whether Lighthizer is in the cabinet) to signal the degree of hawkishness/protectionism that may be coming. Further, what happens with foreign fighters (North Koreans) in Ukraine, as well as any further strengthening in ties between Russia and Iran/North Korea, will signal whether a real escalation in the conflict is coming.

Europe seems to have some real problems…

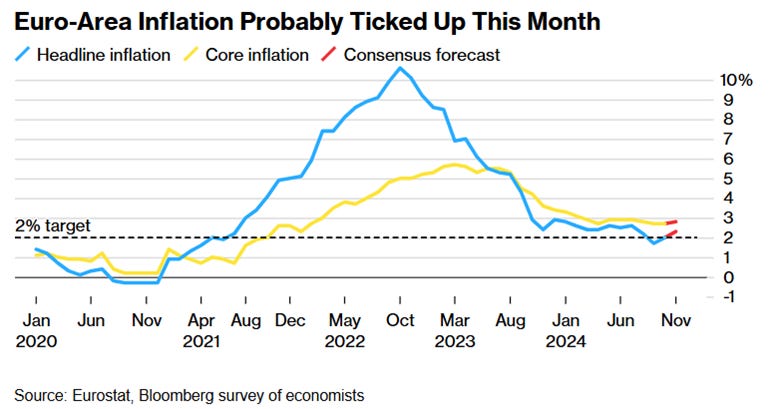

It is clear the Fed may be facing a more challenging policy decision-making backdrop next year if growth slows, but inflation remains sticky. However, we would much rather be the Fed than the ECB.

Today’s broadly weaker EZ PMI readings were a reminder that growth sentiment continues to be stagnant and indicative of a further loss of momentum moving forward. The market is now starting to price in a 50bp ECB rate cut in December and bake in a sub-neutral 1.75% ECB policy rate for next summer despite the recent rise in wage-growth indicators and expectations of inflationary readings to move sideways.

Despite European equities offering attractive valuations and the Euro looking oversold, it is too early to take a more constructive view of the EZ. With trade wars potentially lurking, the Ukraine invasion still in full swing, and overall growth expectations continue to trend weaker, so the knife is still falling. We highlight this because we do believe we are nearing a policy pivot (Q1 or Q2 ’25), where fiscal initiatives will become more supportive (on top of an easing ECB), and hence, risk sentiment may turn more positive, allowing for a reversal in real economic activity which would support equities and the Euro.

Where are U.S. markets going, given this increased uncertainty…

Turning back to U.S. markets, the S&P has been trading between 5,850 and 6,000 since the election. The much anticipated NVDA earnings release failed to change the market narrative materially. While yesterday was a rather volatile session, the SPX ultimately recovered last week’s pre-OPEX highs and now looks to be cleared to move higher as implied volatility falls (due to the passage of these events) as equities get a vanna-based lift.

According to SpotGamma, from an “absolute gamma perspective (gamma from raw OI), SPX 6,000 has re-established itself as the largest gamma strike on the board. This is currently our major upside target. If that level can be overcome, eyes will quickly turn to 6,055, where the December JPM collar strike is.”

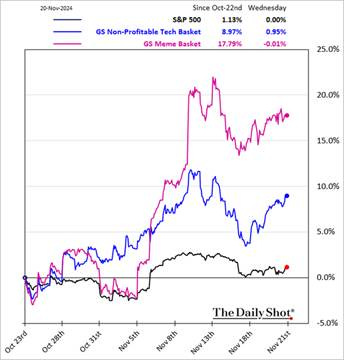

Stepping back, despite a tighter expected Fed policy backdrop, speculative trades continue to outperform more broadly. We are all aware of the parabolic move in crypto, but specific to equities, “meme” and no-profitable tech firms have been outperforming the broader market. We are closely watching this outperformance, as well as the generally increased breadth of performance (across equities), to gauge whether the Trump trade may pause again. As of now, it is not.

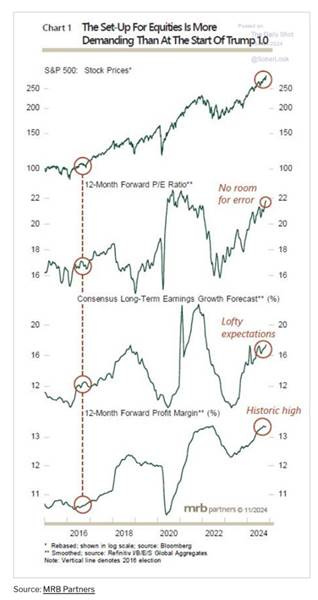

In the end, we still believe a Santa rally can occur after the more seasonal negative period around Thanksgiving, as underperformers gross up to try to catch up to higher annual index returns. However, markets are priced to perfection, with valuation metrics indicating a “rich” level of pricing by almost any measure. This doesn’t bode well for 2025 returns.

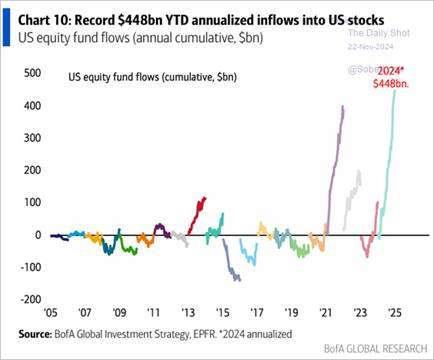

Also, asset allocators should be closer to overweight in equities than not, given the degree of inflows into equities this year and the returns realized, both of which increased following the election. This all leaves us mixed on how far we see the current rally going once the new year begins.

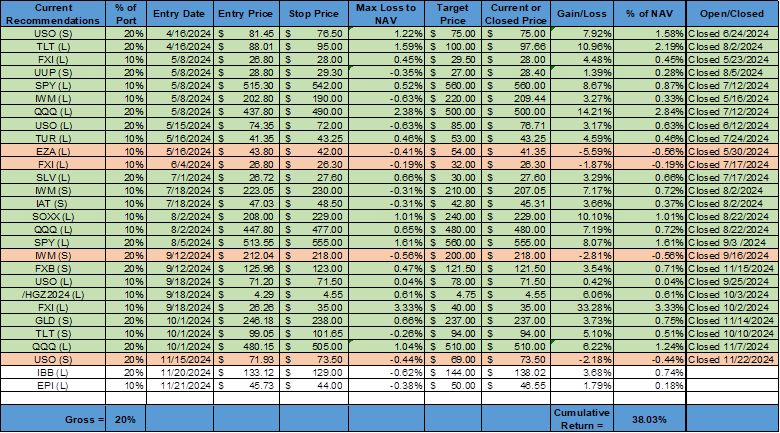

As a result, instead of taking a position in the broader equity market (through the S&P), we will tactically play the expected year-end rally through a long position in the biotech index through the iShares Biotechnology ETF ($IBB). Our view is that the knee-jerk negative reaction to the RFK nomination was overdone. With a still aging and generally unhealthy population alongside a governmental healthcare system unlikely to change much, biotech companies can do just fine. Not being an expert in any single-name stocks, we instead chose to trade the sector to capture what we believe will be a higher beta play into year-end.

Again, path and sequencing of policy needed…

Outside of equities, rates look likely to be more range-bound until we get further policy clarity regarding trade, taxes/deficits, regulation, energy, and overall geopolitics. This leaves us unwilling to get too involved (currently), given our skepticism on how the sequencing of the new Trump policy will be perceived by markets for growth and inflation, and hence Fed policy. As we wrote last week, we may have a more stagflationary environment in the second half of 2025, and this will flatten the curve again as markets calculate the effects of announced policies in Q1.

It’s not hard to see why the dollar has been so strong. U.S. rates are expected to remain higher as the market decreases the pricing of future Fed rate cuts. Further, FX volatility in 2025 should be higher. Trump’s protectionism is different than it was in 2018/19. We are now looking at a global trade war and not just protectionism against China. Currently, these two factors, along with increased geopolitical instability during the transitions (and maybe after), are supporting the dollar. There’s no reason to believe this will change in the medium term.

We were stopped out of our long oil position for a loss of a little over 2%. We are honoring what was a tight stop level despite our belief that oil prices will fall over 2025 due to supply surplus and reduced geopolitical risk premium.

Finally, we are entering a long position in Indian equities (through the WisdomTree India ETF $EPI), although it will be on the smaller side (10%). We will further expand on why we like this trade in coming writings but saw the recent pullback on the Adani corruption charges as a good entry point. Despite persistent inflation complicating the RBI policy path, we see this corner of EM as oversold and the strong Modi-Trump relationship as keeping India out of any negative policy crosshairs.

In conclusion…

The fog of war is thick, with uncertainty high as we transition into Trump 2.0. Markets continue to attempt to sniff out winners and losers from the tectonic macro shift that is underway due to Trump’s ascension back to the White House, but details are still missing to make properly informed decisions.

At this point, we are willing to take some risk in places where we see the market as off due to misinterpretations or overreactions due to the coming (perceived) changes in policies. However, until we actually get those policies and see how they are layered into effect, our ability to forecast growth, inflation, and Fed policy is more impaired than usual, leaving us driving somewhat blinder than usual. This keeps us more defensive and tactical (especially given how far many asset prices have moved). We suggest the same for you.

As always, thank you for reading. Please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. We are now on Bluesky at @middaymacro.bsky.social – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.