The Melt Up Continues: Falling Volatility Keeps Equities and Rates Well Bid

Midday Macro - Color on Markets, Economy, Policy, and Geopolitics

Falling market volatility due to more balanced data, a still dovish leaning Fed, and reduced headline noise keeps the melt-up in equities and rates alive and well

Next week’s inflation data will be less impactful to the Fed’s December rate cut decision, given November’s weaker job report and ISM Service PMI moving closer to a neutral reading

Who’s not invested in this market?

The meltup in U.S. equities continues, while rates have also rallied thanks to commentary from Fed officials leaning somewhat more dovish over the past week, suggesting recent subdued data will give them greater confidence to cut rates for a third consecutive time when they meet in two weeks, despite expectations core CPI stays sticky.

This week’s ISM reports, especially the large drop in the service PMI, have reduced worries of an overheating economy, while November’s inline NFP and weaker UER readings, received in today’s labor report, may balance out next week’s inflation data.

With Trump’s recent cabinet picks relatively more normal (and apparently all billionaires), implied vol measures for both equities and rates continue to trend lower. This has also been supported by an eventful but less negatively impactful overall geopolitical backdrop. All of these factors have produced greater discretionary and systematic buying from various market participants.

The bottom line (up front) is that there has been no material change in the macro narrative (for U.S. financial assets) since we last wrote. We continue to expect a further year-end rally in equities. At the same time, Treasuries may also continue to be methodically bid, with ten-year yields falling toward 4% given seasonal demand and a Fed set on cutting at their December FOMC meeting.

Growth momentum continues to be okay…

With the earnings Q3 season finished and recent official data (such as retail sales and consumer spending) showing no material deterioration in activity, it’s understandable why the market narrative lies between a “no landing” and “soft landing” outlook. In general, there have been “cracks” showing for some time in various places in the economy (housing, lower-income consumers, commercial real estate…), but this has not derailed what now looks to be close to a 3% annual growth rate for final domestic demand on the year.

However, over the last few months, there has been a softening in the Chicago Fed National Activity index that is worth highlighting. Driven lower mainly by production and income readings, it signals that despite numerous Fed officials commenting the economy is strong, including Powell this week while speaking with Andrew Sorkin at a DealBook Summit Event, in fact, it is cooling when considering the 85 economic indicators the Chicago Fed looks at.

Why the more optimistic views by some?

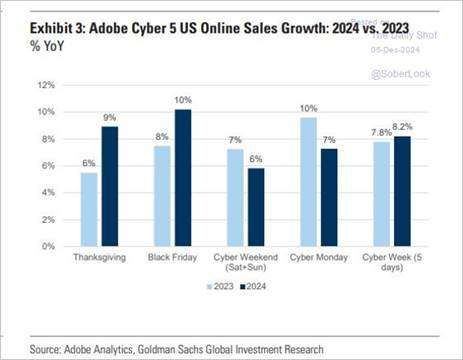

There is a belief by firms, markets, and increasingly Fed officials that the strong economic momentum seen in Q3 will continue throughout Q4 due to spending behavior seen into Thanksgiving and during Black Friday/Cyber Monday, or as it is now known, “Cyber Week.”

The official personal spending data in October was 0.4% MoM, following a 0.6% MoM increase in September. Consumer spending is more impressive when honing in on core retail sales (stripping out automotive purchases, food, and gas), showing that consumer spending on goods and services was up 5.4% from the same period in 2023. The National Retail Federation is predicting that this trend will continue, forecasting an increase of 2.5%-3.5% in retail sales in November and December.

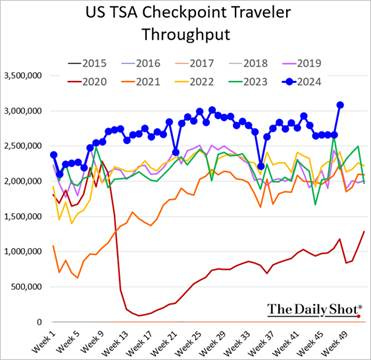

Also worth noting is that a record 3.09 million Travelers were “handled” by TSA on the Sunday following Thanksgiving. The TSA had predicted that Thanksgiving week air travel would rise 6% over the same days last year, fitting a pattern of record travel in 2024.

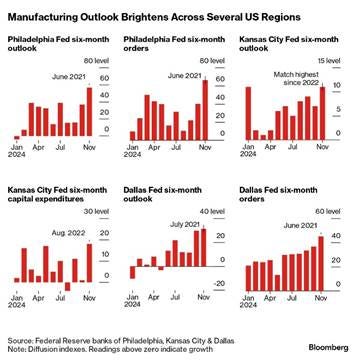

Regional Fed Business PMIs are doing what was expected with a Republican sweep…

Softer business survey data also indicates a more rosy outlook for growth in 2025, as expected, given business owner tend to lean more Republican and hence are happier when their party takes control. Although these data sets have been a poor predictor of growth over the last two years (and will likely continue to be), those making a more optimistic/bullish case for the economy are latching on to the broad improvement in outlooks seen in these PMIs to strengthen their case. We are more doubtful that meaningful increases in hiring and investment will occur until there is greater fiscal policy clarity.

However, consumer sentiment readings are not as thrilled…

Today’s University of Michigan consumer sentiment index reading for December came in stronger than expected. However, and somewhat predictably, the future expectations index was weaker entirely due to a huge drop in Democrat-leaning respondents.

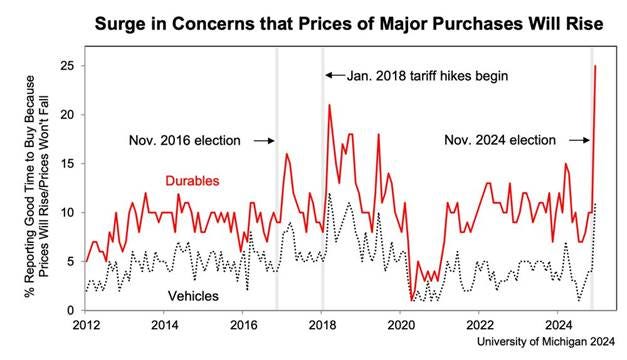

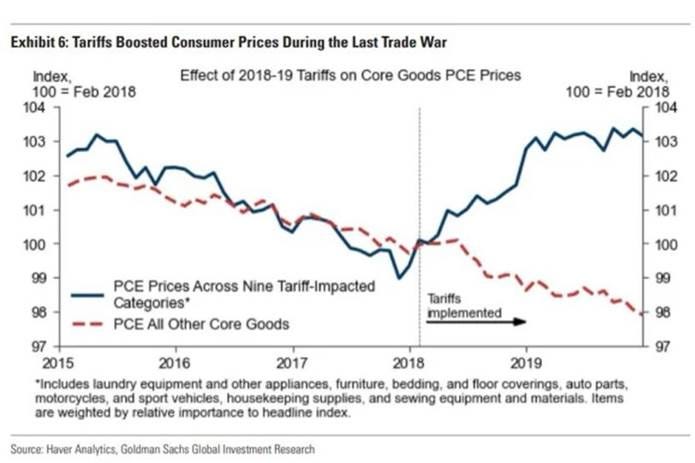

Further, there was a notable rise in one-year inflation expectations, while five- to ten-year inflation expectations changed little. Respondents also expressed concerns about the effects of expected tariffs on durable and vehicle prices, which are expected to rise in price.

A divergence between business and consumer sentiment readings could be starting as worries about higher prices have reemerged. However, we believe any further uptick in business survey readings may fade in Q1 with Trump’s policies looking less friendly than initially expected and the Fed signaling fewer rate cuts, keeping any divergence between consumer and business sentiment surveys short-lived.

The job’s report comes in just right, not too hot, not too cold…

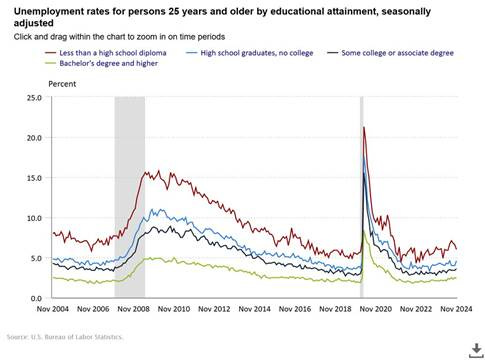

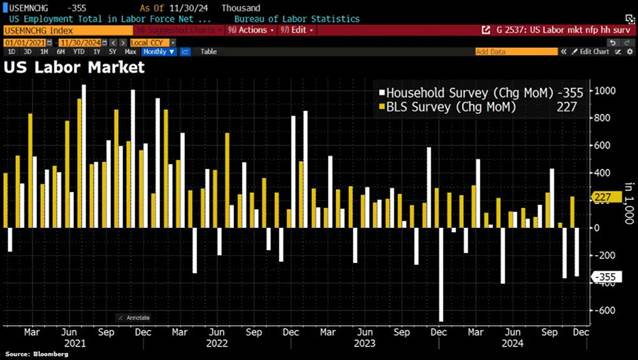

The unemployment rate, the most straightforward summary statistic for the labor market, ticked up to 4.246% in November, close to its recent July high of 4.253%. Household employment has now fallen by 723K over the last two months, while the labor force has contracted by 43K.

Meanwhile, non-farm payrolls came in at 227K, very close to the 220K consensus, with 56K of upward revisions to the past two months. The usual suspects of government, leisure & hospitality, and private education & healthcare services accounted for the majority of the gains. Moreover, when accounting for hurricanes and strike effects, the “true” payroll figure is closer to 115K. When accounting for these distortions in prior months (October and November averaged 131K), the trend of looser labor markets remains very much in tact.

Further, the disconnect between the establishment and household surveys continues. Fed officials have left the decision of the December FOMC meeting open, but many are skewing towards a cut. Following the release of today’s job report, markets are focusing more on the weaker household survey than the stronger establishment survey. They are now pricing in roughly a 90% probability of another cut.

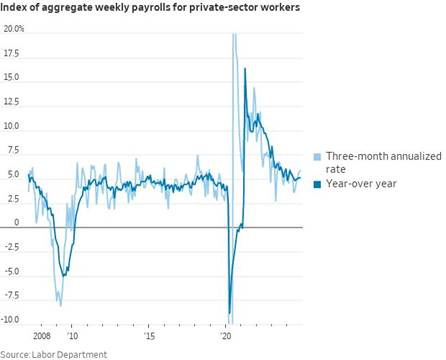

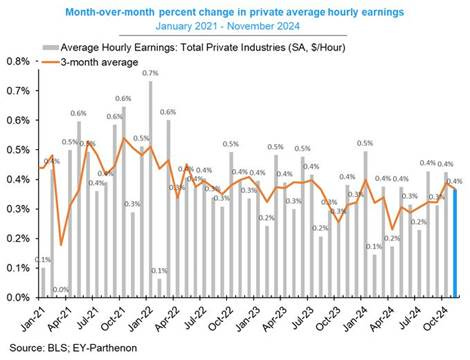

To finish our thoughts on labor markets, it is worth noting that JOLTs, Challenger, and claims data this week showed a more positive picture. The increase in the quits rate, average hourly earnings again coming in at 0.4% MoM, and anecdotal commentary across earning reports and business surveys that indicate a willingness by firms to retain workers (but not hire new ones) indicates to us that wage growth will remain persistent for some time still.

All eyes turn to next week’s inflation data, but does it matter?

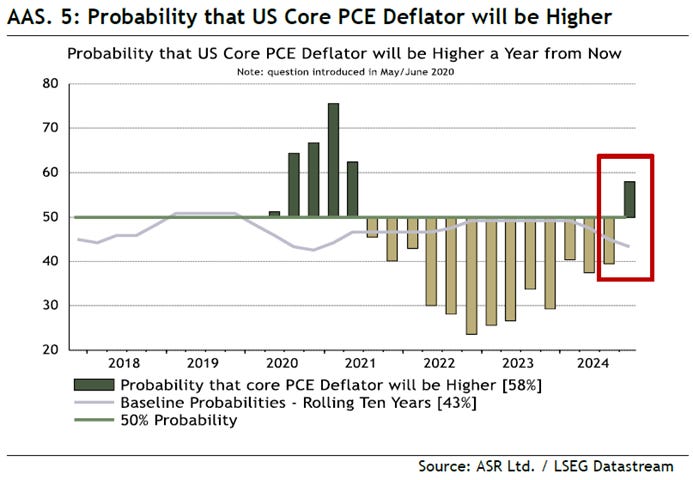

Next week’s November core PCE month-on-month increase is expected to be 0.3%, but worries are it will be higher.

At this point, it seems like it would take a notable beat to move markets and the Fed off a December rate cut. A January skip also seems all but certain. As a result, although the curve may steepen on an inline or stronger print, overall risk sentiment is likely not to change too much. Come January, when comparables become more favorable and the Trump administration policy sequencing is clearer, market sensitivity to further inflation stickiness should be greater (in theory), but for now, November’s CPI should be a non-event.

We also see the skew as changing to greater expectations for stickier inflation readings in 2025. Clearly seen in today’s inflation expectation data and teased out more unevenly in recent PMI readings and the Beige Book, the recent setback in disinflationary progress is starting to become the modal expected case by businesses, consumers, and markets moving forward.

If inflation expectations start to become de-anchored in any way, the Fed will need to move aggressively. This is an under-talked-about tail risk that may become more apparent in the second half of next year.

There were lots of Fed speakers this week…

It looks like the Fed will deliver its promised level of rate cuts (as of the Sept SEPs) for the year, but it certainly left itself optionality. There was a muddled message that the economy is in a good place, but policy is still too restrictive and needs recalibration to keep up with the disinflationary progress that has now stalled. Got it?

Overall, Fed officials look to be going through a serious Rorschach test, with everyone seeing things a little differently given whether they are focused on growth, labor markets, or inflation.

“Policy is still restrictive enough that an additional cut at our next meeting will not dramatically change the stance of monetary policy and allow ample scope to later slow the pace of rate cuts, if needed, to maintain progress toward our inflation target.” – Governor Waller

“I do not view the recent bumpiness as a sign that progress toward price stability has completely stalled.” – Atlanta Fed President Bostic

“My overall view is that monetary policy is only somewhat restrictive today ... we may not be too far from a neutral setting today.” – Cleveland Fed President Hammack

“I continue to see greater risks to the price stability side of our mandate, especially when the labor market continues to be near full employment.” – Governor Bowman

“The time may be nearing to consider slowing, pausing cuts” – St. Louis Fed President Musalem

Again, our modal outlook is for a December cut, a January pause, and another cut in March. The new SEPs should read more hawkishly, with growth and PCE slightly higher for 2025, while UER may drop to 4.2%. We expect the 2025 median Fed funds projection to rise up to 3.7, while further out dots will all rise by 0.2 percentage points.

Final Thoughts…

As we noted at the beginning of our note, this week did not change the post-election marco narrative for U.S. markets much. The drop in the ISM service PMI was notable, but the overall reading is still expansionary. Further, the mosaic of other data and Fed speakers continued to reduce market volatility, increasing buying activity across almost all asset classes.

We added a long semiconductor sector position to our mock portfolio through the iShare Semiconductor ETF ($SOXX). We still favor large-cap growth, liking the Nasdaq over the S&P and the Russell. We see semis as a sector that needs to catch up, and as a result, we believe a tactical rally into year-end makes sense. We continue to maintain our longs in U.S. biotechs and Indian equity ADRs, both of which are up over 5% since we entered them three weeks ago.

Next week, we will introduce our Costanza trades for 2025, which are anti-consensus trades that are meant to challenge how we think about current trends and expectations.

As always, thank you for reading. Please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. We are now on Bluesky at @middaymacro.bsky.social – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.