The Fed Upgrades its “Higher for Longer” Stance While Q4 Growth Likely to Cool Quickly - Midday Macro – 9/22/2023

Color on Markets, Economy, Policy, and Geopolitics

The Fed Upgrades its “Higher for Longer” Stance While Q4 Growth Likely to Cool Quickly

Midday Macro – 9/22/2023

Market’s Weekly Narrative and Headlines:

It was a tough week for stocks, with the S&P finally having its first -1.5%+ day in quite a while yesterday as markets increasingly priced in the Fed’s double down on a “higher for longer” more restrictive policy stance. Not surprisingly, more duration-sensitive sectors/factors underperformed, given the rise in yields across the curve, and as expected, there was a general tilt away from cyclicals into more defensive names. Despite Powell’s excessive emphasis that the Fed would go cautiously, the new September SEPs removed two cuts from next year and negated the message that progress was being made on the inflation front while labor markets continued to move into a better balance. They also effectively opened the door for a higher long-run r* level. With oil continuing to stay elevated and headwinds growing for growth, markets looked less likely to believe the Fed’s more rosy outlook, and instead, there looks to be an increased stagflationary narrative developing. It was also a heavy central bank week outside the U.S., with the BoE and BoJ not rocking the boat and keeping policy unchanged. The data in the U.S. on the week showed a further cooling in housing activity, while the Conference Board’s Leading Economic Index is telling us pain is coming. However, claims jumped lower while the S&P PMI Composite was in line, near a neutral level. The dollar was higher on the week, helped by the inaction of other central banks and the perceived favorable rate differential widening moving forward thanks to a more hawkish Fed.

We discuss this week’s FOMC meeting and our views on markets in more details below…

Deeper Dive:

It is starting to look like the current pullback in stocks is more than the typical seasonal retracement/consolidation that often occurs in the August/September period. With the macro backdrop worsening, somewhat negative micro-narratives, especially for the “magnificent seven,” and technicals now bearish, we continue to want to be defensive and tactically short U.S. equities. Clearly, the Fed added to the mosaic of headwinds risk assets are facing this week by doubling down on its “higher for longer” mantra, even surprising us with the more hawkish posturing seen in the new September SEPs. Luckily, this was somewhat offset by other central banks not further tightening policy this week, keeping global yields from rising further following gains seen after Wednesday's FOMC meeting. Of course, with energy prices rising again, inflationary worries are growing despite a wide range of estimates on the passthrough effects, putting markets back on edge and renewing “stagflationary” fears. We are sympathetic to this, especially in the U.S., where growth is slowing from a stronger place but is facing a challenging Q4 outlook.

*Policy is well in restrictive territory now, as acknowledged by Chairman Powell in his press conference remarks

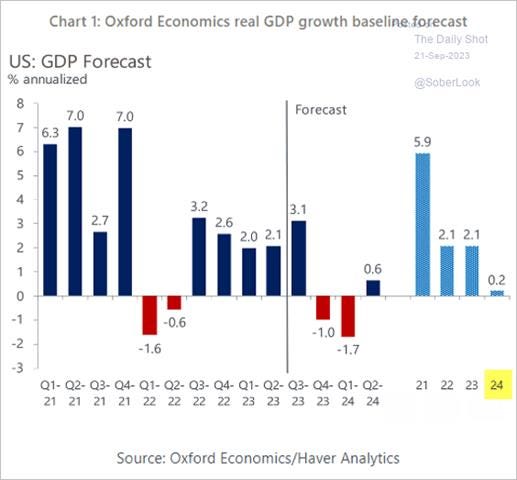

*Oxford Economics sees the next two quarters as having negative growth, something we see as highly possible

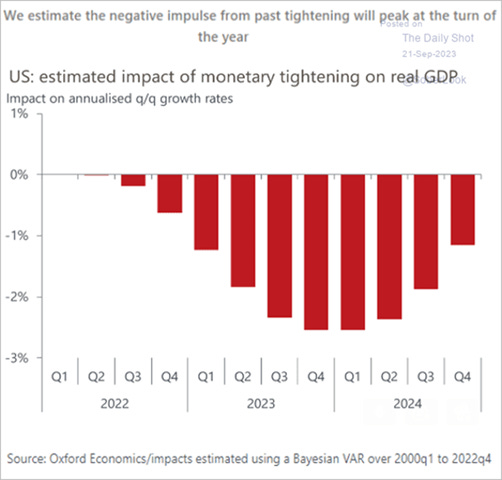

In fact, the headwinds only continue to grow for the U.S. economy with the UAW strike and now likely government shutdown, adding to the already negative effects of the recently ended childcare fiscal support and renewed student loan payments. Add in the prolonged higher gas tax consumers have been feeling for much of the year, and the “resilient” personal consumption backdrop is ending as excess savings are finally depleted and aggregate real disposable income chops sideways. This is, of course, on top of the lagged effects of cumulative monetary policy tightening and tighter credit conditions, which will increasingly hit households and businesses that, although in a more historically stable position regarding leverage due to locking in “lower for longer” financing during the pandemic period, will eventually need to roll debt at now more punitive rates. Effectively, the interest rate sensitivity of the economy increases every day, which will increasingly weigh on real economic activity. Bullard is wrong. The lagged effects of policy actually lengthened this cycle as stronger balance sheet compositions outweighed forward guidance effects. This pandemic-induced grace period before higher rates take hold is now ending. As a result, the drag on both consumption and investment will increasingly show in the data in Q4 and H1 ‘24. Again, this is on top of the idiosyncratic negative drags we mentioned from strikes, shutdowns, and the end-of-fiscal support, making what looks to be a sudden broader slowdown in activity very possible entering Q4.

*The “lagged effect of cumulatively tighter policy” is increasingly hitting while the fiscal multiplier is turning more negative

*This week’s new Conference Board Leading Economic Indicator readings continue to suggest a recession is imminent

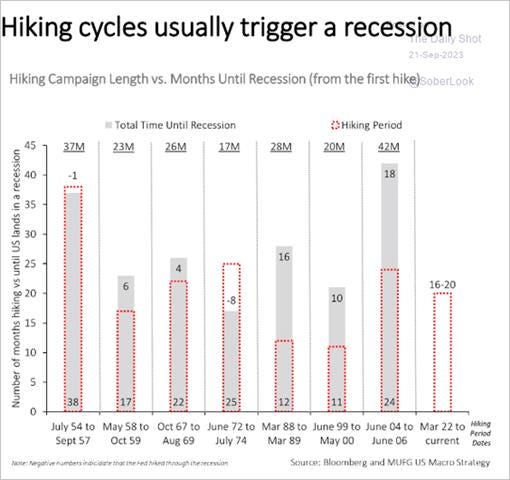

*As a reminder, it's very rare for the Fed to tighten policy and not have a resulting recession. Is this time really different?

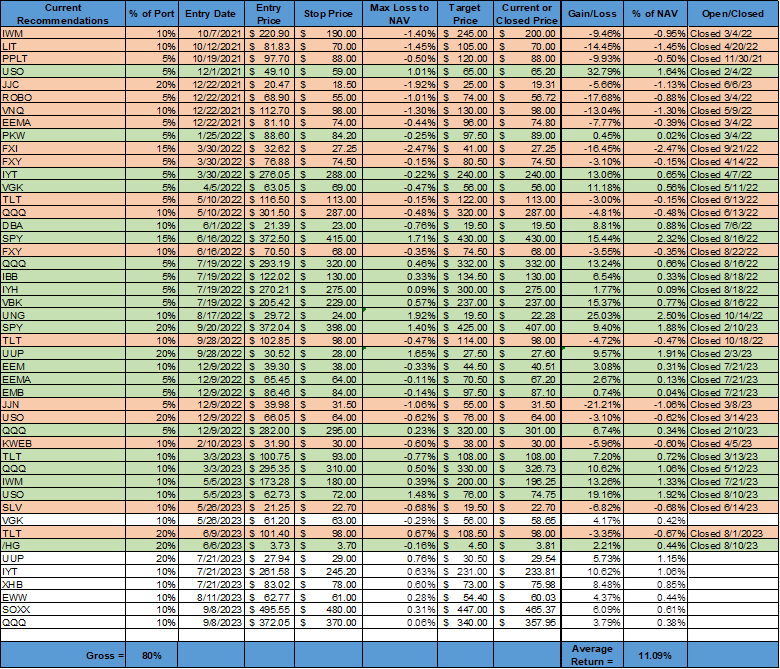

This slowdown is happening on the heels of a Q3 growth story that notably beat expectations and cemented a more hawkish Fed posturing. As a result, we have a somewhat perfect storm for risk assets potentially brewing, with a fast-moving slowdown finally hitting. At the same time, the slow-adjusting monetary policy stance is calibrated for a soft landing and continued disinflationary pulse. As a result, when looking through the macro, micro, and technical market lenses, it increasingly seems like the risk-reward is skewed to the downside for at least the remainder of the year. As a result, we continue to favor our long dollar and short equity positions in our newsletter mock portfolio. However, we have moved our stops higher to lock in profits in case this turns out to be a more seasonal pullback and not a new bear market.

*The mock portfolio’s average cumulative return is now above 11%, thanks to our long dollar and short equity positions benefiting from this week’s price action. We have moved up all our stops to stay more tactical and ensure positive returns per position.

We will be off next week due to a trip to California.

As always, thank you for reading, and please share our newsletter. Feel free to reach out with any questions or comments. - Michael Ball, CFA, FRM

Policy Talk:

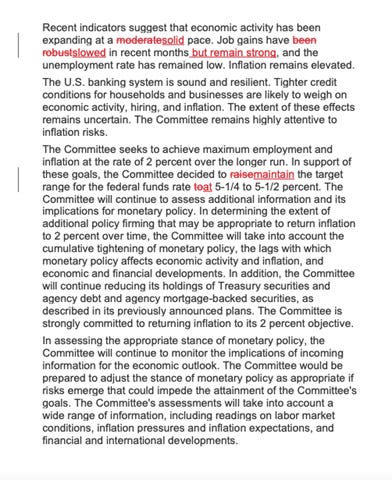

The Federal Reserve left its benchmark Fed funds rate range unchanged at 5.25% to 5.5% following this week’s September FOMC meeting with no dissents. The official policy statement’s language was little changed from the last meeting. The assessment of economic activity was upgraded to a “solid pace” from a “moderate pace.” The statement also noted, “job gains have slowed in recent months but remain strong, and the unemployment rate has remained low” and repeated that “Inflation remains elevated.” There were no other changes to the statement, which continued to state that the financial system remained “sound and resilient” while credit conditions were tightening and that the effects of this on the real economy remained uncertain.

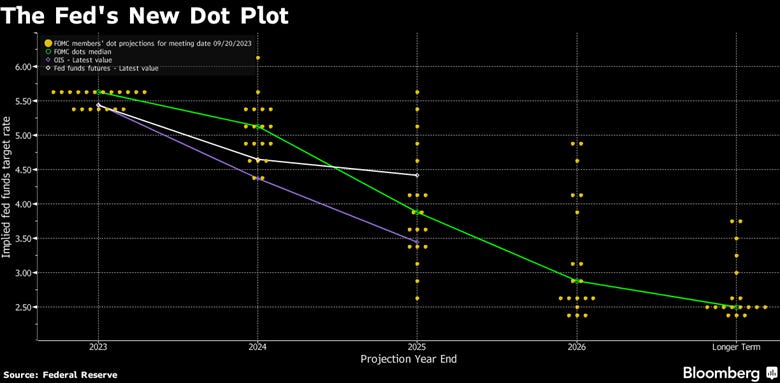

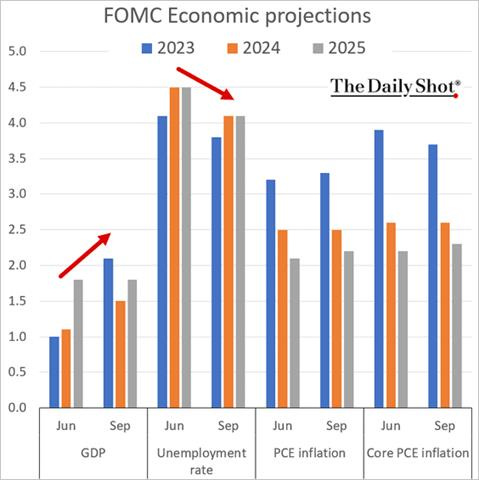

The FOMC’s new Summary of Economic Projections kept the median forecasted federal funds rate level for the end of 2023 at 5.6%, while 2024 was raised to 5.1% from 4.6%, indicating a decline of 50bps over next year rather than 100bps in June. Further, the median projection for the end of 2025 rose to 3.9% from 3.4%. Projections for GDP growth were revised notably higher for 2023, moving to 2.1% from 1%. Similarly, 2024 increased to 1.5% from 1.1%, while 2025 remained at 1.8%. The Fed lowered its 2023 core PCE inflation forecast to 3.7% from 3.9%, while 2024 projections were unchanged and 2025 rose slightly. The median unemployment rate also declined, falling to 3.8% from 4.1% for 2023 and 4.1% for 2024 and 2025, from 4.5%, respectively. The longer-run unemployment rate was unrevised at 4.0%. The Fed also published 2026 projections for the first time, and policymakers see growth, unemployment, and inflation all at their longer-run rates. However, the Fed projects the Fed funds rate at 2.9% rather than their (unchanged) longer-run rate of 2.5%. There was a slight indication in the SEPs that an increasing amount of policymakers think the neutral rate of interest may be moving higher, and although the median longer-run nominal fed funds rate was unrevised at 2.5%, the mean projected longer-run rate moved up to 2.75%.

*The new September SEPs “dots” indicated the Fed is prepared to keep rates “higher for longer” to achieve a 2% inflation target goal

*Growth was upgraded, which also meant a lower expected UER level, while inflation expectations were little changed

Chairman Powell stressed the need to “proceed carefully” in his prepared press conference remarks and following Q&A session. He again said that future policy decisions would be based on the FOMC assessment of incoming data and the “evolving outlook and risk.” He noted that economic activity had picked up, coming in above expectations, helped by an improving housing sector. At the same time, there were increasing signs supply and demand in the labor market was coming into “better balance,” with nominal wage growth easing and vacancies declining. Powell, of course, noted that inflation remained well above target and the “process of getting inflation down to 2% had a long way to go,” but said it had moderated while inflation expectations remained well anchored. Powell justified the decision not to raise rates further despite inflation still being elevated due to the committee seeing the current stance of policy as restrictive, and when coupled with “headwinds” from tighter credit conditions, would put “downward pressure on economic activity, hiring, and inflation.” He concluded that although real rates were now well above a neutral level, the committee was mindful of the “inherent uncertainties in precisely gauging the stance of policy” and could tighten policy further. He also stressed that the FOMC intended to hold policy at a restrictive level until they were confident that “inflation is moving down sustainably” toward target. During the Q&A session, Powell noted that there remains a majority of Fed officials who expect to raise rates one more time this year. However, Powell said numerous times in the press conference that the FOMC needs to “proceed carefully,” indicating he is taking a more two-sided approach to risk management despite the upgraded growth outlook expressed in the new SEPs. In summary, the Fed continued to see progress due to recent developments in the “totality” of the data but needed further evidence to reach the conclusion that policy was appropriate to move inflation back to target in an acceptable timeframe. A November hike is still very much on the table, and rate cuts should not be expected in the first half of 2024, given the current “solid level” of economic growth.

“Real interest rates now are well above mainstream estimates of the neutral policy rate, but we are mindful of the inherent uncertainties in precisely gauging the stance of policy. We are prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we are confident that inflation is moving down sustainably toward our objective.”

“We want to see that these good inflation readings that we've been seeing for the last three months, we want to see that it's more than just three months, right? We want to see, you know -- the labor market report that we received, the last one that we received, was a good example of what we do want to see. It was a combination of, you know, across a broad range of indicators, continuing rebalancing of the labor market.”

“You do see people, you don't see the median moving, but you do see people raising their estimates of the neutral rate, and it's certainly plausible that the neutral rate is higher than the longer-run rate. Remember, what we write down in the SEP is the longer-run rate. It is certainly possible that, you know, that the neutral rate at this moment is higher than that and that that's part of the explanation for why the economy has been more resilient than expected.”

“It's a good thing that the economy has been able to hold up under the tightening that we've done. It's a good thing that the labor market is strong. The only concern is it just means this. If the economy comes in stronger than expected, that just means we'll have to do more in terms of monetary policy to get back to 2 percent because we will get back to 2 percent.”

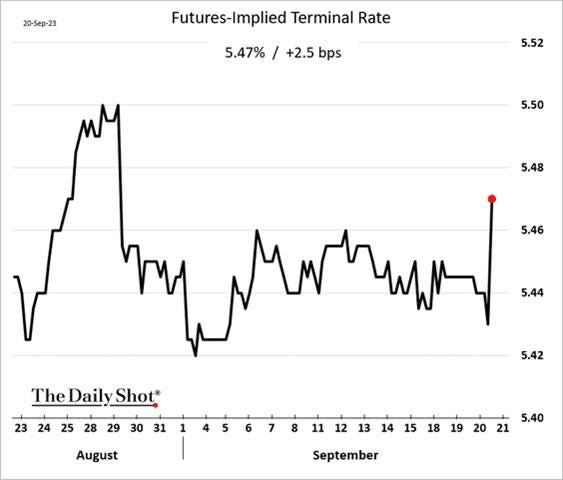

*The market implied terminal rate moved slightly higher following the September FOMC meeting but remains in a relatively tight range

*The real Fed funds rate continues to rise above the Fed’s long-run neutral real rate estimate

U.S. Economic Data:

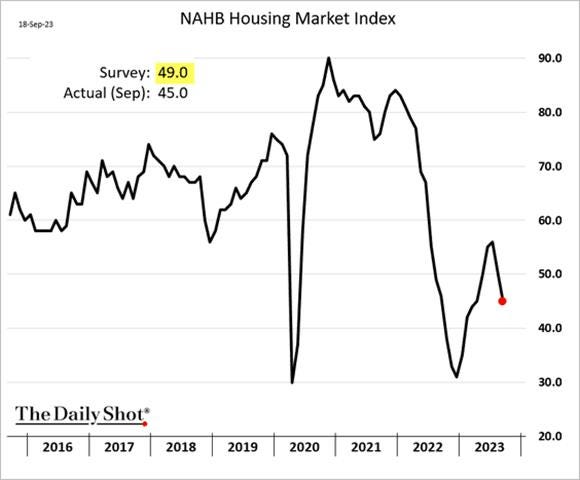

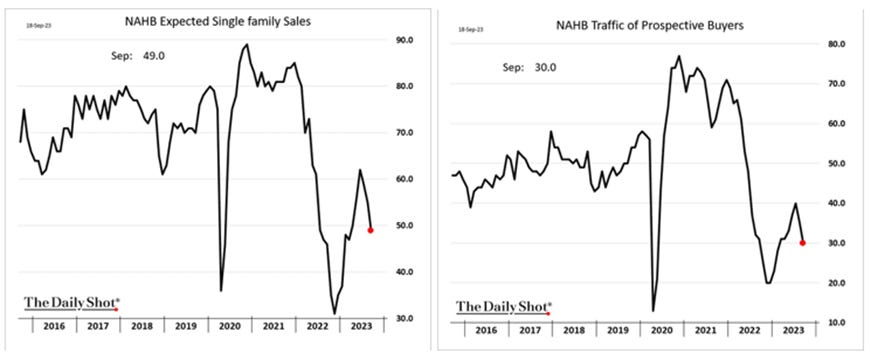

The NAHB Housing Market Index declined to 45 in September, from 50 in August and below forecasts of 50. The sub-index for current single-family home sales declined to 51 from 57, while the sub-index for prospective buyers declined to 30 from 35. Finally, the sub-index for home sales over the next six months decreased to 49 from 55. Looking at the three-month moving averages for regional HMI scores, the Northeast fell two points to 54, the Midwest dropped three points to 42, the South fell four points to 54, and the West posted a three-point decline to 47. In September, 32% of builders reported cutting home prices, the largest share of builders cutting prices since December 2022 (35%), compared to 25% in August. The average price discount remained at 6%. Further, 59% of builders provided sales incentives of all forms in September, more than any month since April 2023.

Key Takeaways: All three major sub-indexes declined in September as higher mortgage rates are weighing on builder sentiment and consumer demand. “While more pricing-out is now occurring, the lack of resale inventory at the start of 2023 has shifted the new construction buyer mix. A special question in the September HMI survey revealed that 42% of new single-family home buyers were first-time buyers on a year-to-date basis in 2023. This is significantly higher than the 27% reading from a more normalized market in 2018.” “The two-month decline in builder sentiment coincides with when mortgage rates jumped above 7% and significantly eroded buyer purchasing power,” said NAHB Chairman Alicia Huey. “And on the supply-side front, builders continue to grapple with shortages of construction workers, buildable lots, and distribution transformers, which is further adding to housing affordability woes. Insurance cost and availability is also a growing concern for the housing sector.”

*Higher mortgage rates are reducing demand and weighing on homebuilder sentiment

*All three sub-indexes and all four regions weakened in September

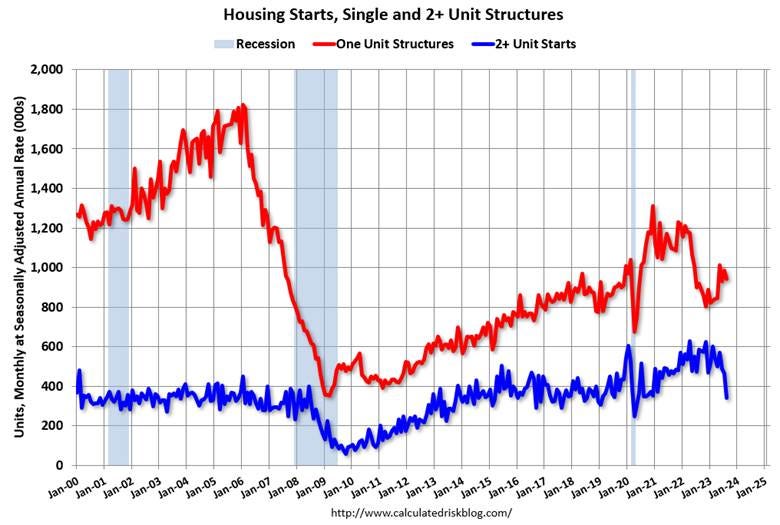

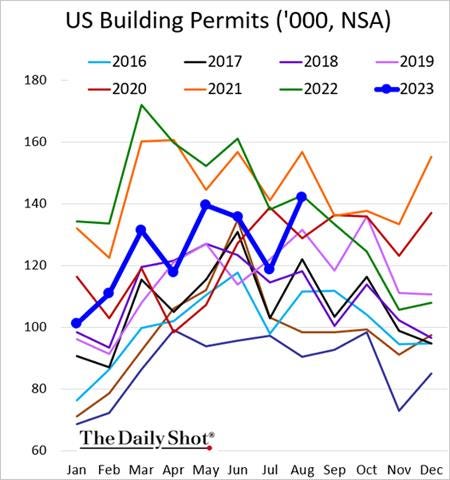

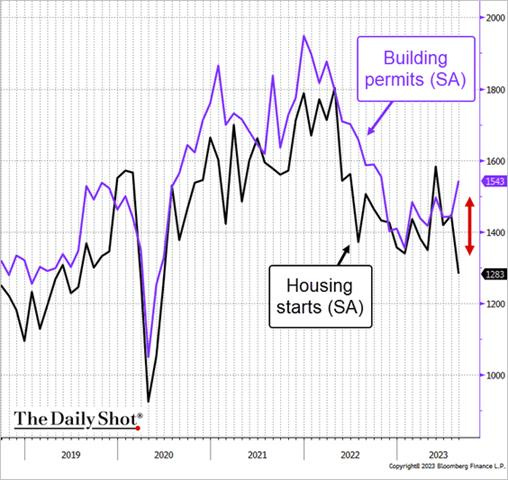

Housing starts declined by 11.3% month-over-month to 1.283 million SAR in August, the lowest level since June 2020, and well below forecasts of 1.44 million. Single-family housing starts declined by -4.3% MoM to 941K, and multi-unit starts plunged by -26.3% MoM to 334K. The most significant decline was recorded in the West (-28.9% to 281K), followed by the Midwest (-7.5% to 160K) and the South (-4.9% to 745K), while starts rose slightly in the Northeast (1% to 97K). Building permits increased by 6.9% to 1.543 million SAR in August, the highest in 10 months and beating market estimates of 1.443 million permits. Single-family authorizations rose 2% MoM, while multi-unit approvals increased by 14.8% MoM. Permits grew in the Northeast (9.3% to 118K), the Midwest (14.3% to 208K), the South (3.9% to 843K), and West (9.4% to 374K).

Key Takeaways: August saw the biggest decrease since July 2022 due to a large decline in multi-unit starts. Starts have been down year-over-year for 14 of the last 16 months (May and July 2023 being the exceptions). The massive decline in multi-unit starts continues a general trend lower since last winter, but the rise in permits means things could stabilize. However, there has been an uptick in cancelation, so the correlation between permits and starts should continue to weaken the longer financing costs stay elevated. There is also evidence that higher mortgage rates are making more and more Americans unable to afford a single-family home and will need to downsize or rent, increasing future demand for multi-unit. This theme played out well last year but stabilized due to inventory/supply issues worsening this year.

*There was a notable decrease in multi-unit starts that drove overall starts much lower than forecasted

*On the other side, permits picked up due to a larger-than-expected increase in multi-units

*The divergence in starts and permits is unusual, with permits generally leading starts

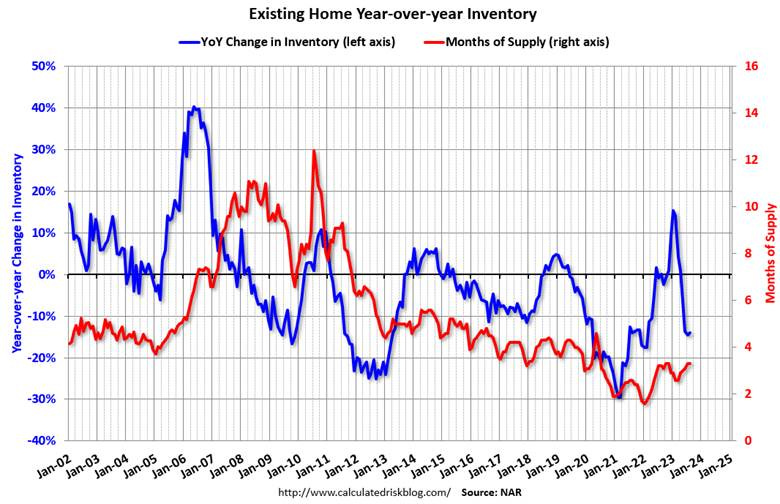

Existing-home sales declined by -0.7% MoM to 4.04 million SAR in August, the lowest level since January and below market expectations of 4.1 million. Single-family home sales declined by -1.4% to 3.6 million, while existing condominium and co-op sales rose by 4.8% to 440K. Among the four major U.S. regions, sales improved in the Midwest, were unchanged in the Northeast, and slipped in the South and West. Total housing inventory registered at the end of August was 1.1 million units, down by -0.9% from July. Unsold inventory sits at a 3.3-month supply at the current sales pace, identical to July. The median existing home price rose to $407.1K, an annual increase of 3.9%.

Key Takeaways: Sales fell for a third consecutive month, weighed by high mortgage rates and elevated home prices. "Home sales have been stable for several months, neither rising nor falling in any meaningful way," said NAR Chief Economist Lawrence Yun. "Mortgage rate changes will have a big impact over the short run, while job gains will have a steady, positive impact over the long run. The South had a lighter decline in sales from a year ago due to greater regional job growth since coming out of the pandemic lockdown." Yun further said that home prices continue to march higher despite lower home sales volumes, and supply would need to double to moderate home price appreciation effectively. Properties typically remained on the market for 20 days, the same as in July, with 72% of homes sold in August on the market for less than a month. All-cash sales remained stable at around 27%, while second-home buyers purchased 16% of homes on the month. Finally, distressed sales are still historically low at around 1%.

*Existing home sales continue to be well below average levels due to low supply levels

*Inventory is down 14.1% YoY in August with the months of supply unchanged at 3.3 months

The Philadelphia Fed Manufacturing Index fell to -13.5 in September, down from 12 in August and worse than market forecasts of -0.7. Demand and activity measures weakened with New Orders (-10.2 vs. 16), Shipments (-3.2 vs. 5.7), and Unfilled Orders (-13.6 vs. -4.8) moving into contractionary (or further contractionary) territory. Inventories (8.9 vs. -10.2) moved back into “too high” territory, while Delivery Times (-14.9 vs. -7) shortened by a more significant amount. Labor measures were little changed, with the Number of Employees (-5.7 vs. -6) still contractionary at around the same pace as seen in August, while the Average Workweek (4.7 vs. 6.3) expanded at a slightly slower rate. Inflation readings picked up for Prices Paid (25.7 vs. 20.8), while Prices Received (14.8 vs. 14.1) were little changed. The six-month ahead General Business Activity (11.1 vs 3.9) improved, thanks to increases in new orders and shipments. However, labor readings weakened while price measures fell slightly. Capex intentions improved to an expansionary level after a contractionary reading last month.

Key Takeaways: Current readings indicated a weakening in new demand, activity, and hiring activity in the Philly District in September. On balance, firms reported an increase in inflationary pressures. However, 73% and 65% of firms reported no price changes in prices paid and received, respectively. This month’s special questions asked firms to estimate their total production growth for the third quarter compared with the second quarter of 2023. The share of firms reporting an increase in production was the same as the share reporting a decrease (37%). Firms reported their current capacity utilization rate was unchanged from last year at 70% to 80%. Although many firms reported labor supply as a slight or moderate constraint to capacity utilization, 34% indicated labor was not at all a constraint. Nearly 46% of the firms reported supply chains were not a constraint to capacity utilization, up from 27% when this question was asked in June. Looking ahead over the next three months, most firms expect the impacts of various factors to stay the same, “although 24% of the firms expect the impacts of energy markets to worsen, while over one-fifth of the firms expect the impacts of financial capital to worsen.”

*Current activity readings weakened while future expectations rose

*There was a nice divergence between contracting and expanding current and future sub-indexes

*This divergence was clearly seen in current new orders contracting again while expectations for six-months ahead new orders expanded further…

*However, both current and future hiring activity readings weakened

Technicals, Positioning, and Charts:

The Nasdaq is outperforming the S&P and Russell on the day. Factor and sector performance on the week favored a more defensive tilt, as expected, with the sell-off and rise in volatility. Growth and Small Caps, along with Consumer Discretionary Real Estate, were the worst-performing factors/sectors, but there was a clear underperformance to cyclicals. As seen last week, the rise in Treasury yields on the week did not hurt higher-yielding stocks, which outperformed, although Low Volatility stocks were the best performing. Finally, Mid-Cap Growth was the best-performing size vs. value/growth combo on the week.

@Koyfin

S&P optionality strike levels have the Zero-Gamma Level at 4436 while the Call Wall is 4600 and the Put Wall is 4300. The Put Wall has rolled lower, which increases the likelihood of further downside price action. Spotgamma expects markets to trend lower next week with 4400 now major overhead resistance and where gamma would become more positive. The recent increase in the VIX was not due to increased put demand but rather a decline in the SPX level, a technical occurrence, meaning the current selloff is not driven by a “fearful” market. This means implied vol could remain mildly higher, but not really jumping, and short-dated options traders are out, actively seeking to play the countertrend (both directionally, as well as in the vol space). Spotgamma went on to say that a lot of these 0DTE's could be hedges, but if/when they turn in the prevailing market direction, volatility could increase markedly.

@spotgamma

S&P technical levels have support at 4355, then 4330, with resistance at 4380, then 4525. This week saw several major breakdowns of support levels, with the FOMC further catalyzing the seasonal bearish price action already in play. With the breakdown of the two-month-long triangle pattern following the FOMC, which had acted as support several times, it was elevator down. After the triangle failure, key support areas are now 4360, where we are now, and then 4335, with that level being the backtest of the nine-month base the S&P broke out on June 1st, which started the summer melt-up rally.

@AdamMancini4

Treasuries are higher on the day, with the 10yr yield lower by 6 bps to 4.44%, while the 5s30s curve is unchanged on the session, sitting at -5 bps.

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the day and flat on the week, with Mid-Cap Growth the best-performing size/factor on the week.

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day and the week.

5yr-30yr Treasury Spread: The curve is steeper on the week.

EUR/JPY FX Cross: The Euro is stronger on the day and the week.

Other Charts:

.

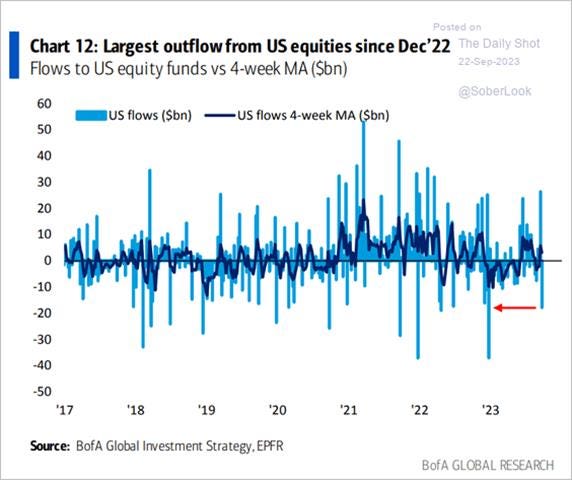

BofA reported the largest outflow from U.S. equities this last week since December 2022, although the 4-week moving average is still positive.

The percentage of S&P and Nasdaq stocks above their 50-day moving average is now around 20%, taking a notable move lower with this last week’s sell-off and moving out of an annual range.

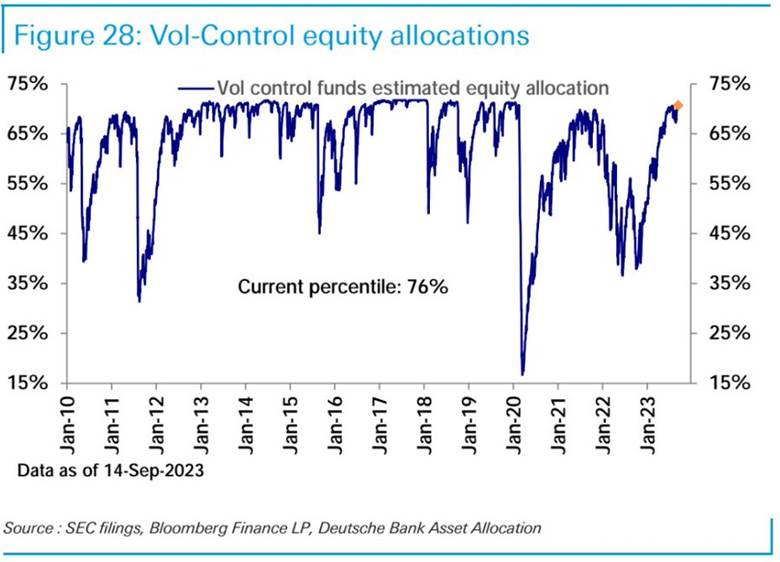

"Vol control funds increased their equity exposure [last] week to 70.7% (76th percentile) closer to the historical maximum allocation." - Deutsche Bank. This has likely started to reverse, with the VIX notably higher on this week.

Open interest in VIX call options, bets that equity volatility will rise, are near all-time highs

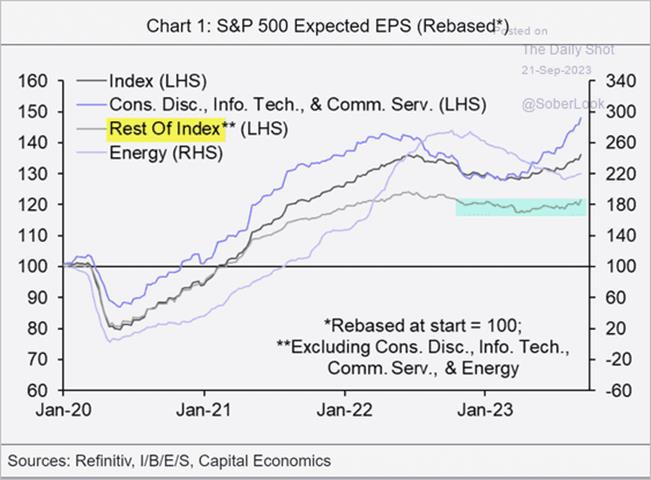

Excluding consumer discretionary, tech, and energy sectors, earnings expectations have been relatively flat. - @Dailyshot

With Treasury yields continuing to rise, the difference between the S&P dividend yield and the 10-year Treasury yield widens further.

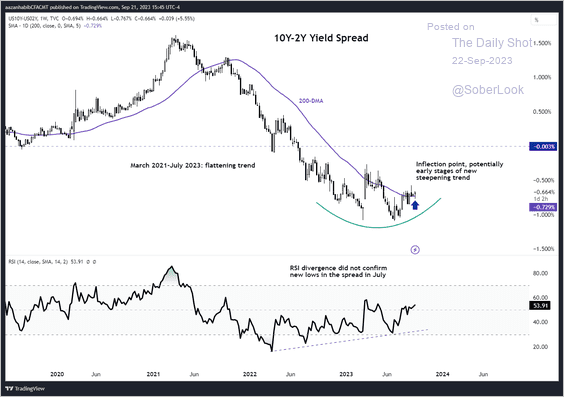

The 10s2s Treasury yield curve looks to be putting in a base and beginning to steepen meaningfully.

The amount of buyers walking away from home purchase deals after seeing the final costs is growing.

Personal interest payments amounted to 2.5% of US disposable incomes in July, the most in 15 years. Now gasoline is set to eat up a bigger share too as oil prices rise. That might take the combination of the two back to 2009-2013 levels, around 5% - @Boes_

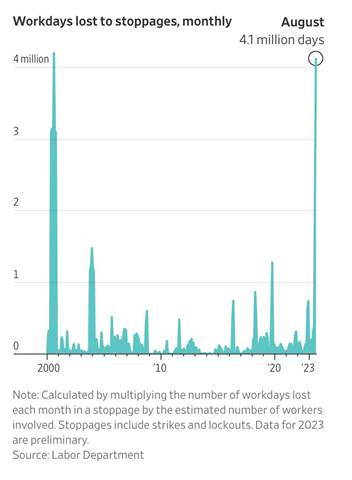

American workers are striking at a pace not seen in nearly a quarter-century. Last month, large stoppages from strikes resulted in 4.1 million missed days of work, the biggest monthly total since August 2000. - @lisaabramowicz1

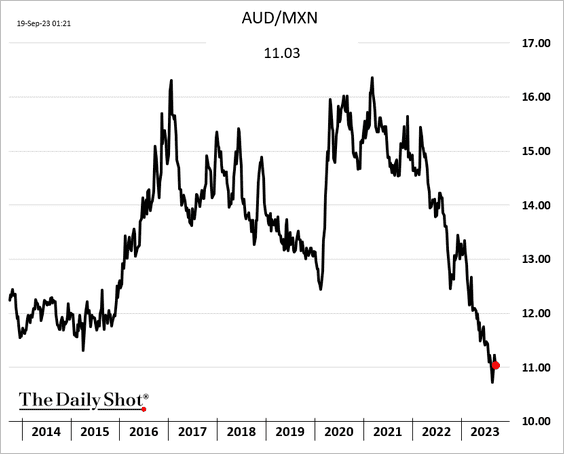

Using the AUD/MXN cross, sentiment towards the U.S. growth over China is growing.

Articles by Macro Themes:

Medium-term Themes:

China’s Post-Pandemic Life:

Uncertainty Grows: In a position paper, the European Chamber of Commerce in China called on businesses to exercise "even more caution," despite government promises of greater liberalization to boost foreign investment and trade. "Mixed messaging from the Chinese government only adds to the growing sense of uncertainty, further eroding confidence in this important market," chamber President Jens Eskelund said. The report came the same day the American Chamber of Commerce in Shanghai released its 2023 China Business Report, showing that 52% of 325 respondents expressed optimism over the business outlook in China for the next five years, down three percentage points from last year to the lowest level on record. "China is becoming more challenging for foreign investors," said Sean Stein, chairman of AmCham Shanghai. "What businesses need above all else is clarity and predictability, yet across many sectors, companies report that China's legal and regulatory environment is becoming less transparent and more uncertain." - China 'mixed messages' dent foreign business confidence: chambers - NikkeiAsia

The Chosen Ones: Beijing remains focused on pouring money into its chip industry in a tech race against the U.S. instead of funding powerful stimulus measures, further slowing its economic recovery from a real-estate-induced slump. Faced with budget constraints, the central government is focusing on economic security, such as nurturing a domestic semiconductor sector and expanding electric vehicle production. Under the "Made in China 2025" industrial modernization initiative announced in 2015, the government has stepped up subsidies to 10 key sectors, including information technology, machine tools and new-energy vehicles. Beijing announced expanded tax breaks for semiconductor and machine tool companies, offering a 120% tax deduction on research and development spending for five years. - China puts priority on tech race with U.S. over economic growth - NikkeiAsia

Longer-term Themes:

Cyber Life and Digital Rights:

Everywhere: Clorox is one of the first large U.S. companies to suffer a cyberattack since the Securities and Exchange Commission’s rigorous new cybersecurity rules went into effect Sept. 5. Since an initial notice posted on its website and one filed with the SEC on Aug. 14, Clorox has issued six more, including another 8-K filing, each adding details about operational disruptions as the episode unfolds. The company said the financial impact is still unknown. Clorox’s string of bulletins over more than four weeks shows how determining the material impact of a cyberattack is unfamiliar ground for companies. Clorox hasn’t specified which products have been affected and to what extent. A spokeswoman declined to comment on which systems were damaged or shut down, pointing to the company’s public statements. At Clorox, leaders are still evaluating the financial and business impact, but the company said that its first-quarter earnings would take a hit from the attack. - Clorox Cyberattack Brings Early Test of New SEC Cyber Rules - WSJ

“Stunningly Careless”: Five tax preparation companies have been warned by the FTC that they may face civil penalties if they use or share confidential consumer tax preparation data for unrelated purposes without consent. A significant revelation of a seven-month Congressional investigation was that certain tax preparation companies, including H&R Block, TaxAct, and TaxSlayer, were sharing sensitive taxpayer financial data with Google and Meta for years. These actions are being considered potentially illegal and could warrant severe consequences including hefty fines and possible prison terms. The FTC has declared that the application of tracking technology such as pixels and cookies to gather, analyze, and transfer personal information without the express consent of the consumers will be seen as a deceptive and unfair practice. The FTC emphasized this as it put the companies on notice, threatening them with civil penalties up to $50,120 per violation if they misuse taxpayers' personal data. - FTC warns tax preparers not to sell taxpayer data to Big Tech – The Record

Food: Security, Innovations, and Climate Change Implications:

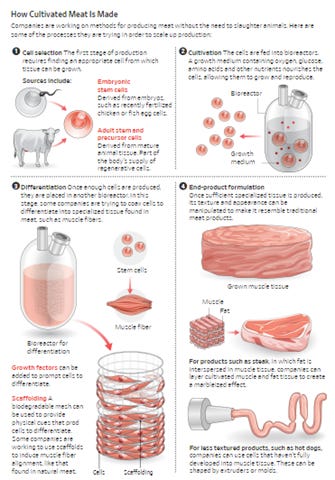

Good Meat?: The U.S. Department of Agriculture gave two California-based companies permission to market “cell-cultivated” chicken in June, marking the first time meat grown in a lab could be sold to consumers in the U.S. The production process doesn’t require slaughtering animals and could reduce the environmental costs associated with animal farming. Assuming the products become more available, how willing will consumers be to favor them over traditional meats? According to research compiled by the Good Food Institute concerns about taste and price are among the top reservations people cite regarding cultivated meat. “Multiple studies show that fewer than 25% of consumers report a willingness to pay more for cultivated meat than for conventional meat,” said Emma Ignaszewski, associate director, industry intelligence and initiatives, at GFI. - The Sticky, Pricey Process of Making Lab-Grown Meat – WSJ

Switching Sources: Egypt’s latest wheat tender has ended in dispute as an increasingly assertive Russian state tries to impose an unofficial minimum export price. The spat shows Russia, the world’s biggest wheat shipper this season, increasingly flexing its powers in the global market following its invasion of Ukraine. As well as the Kremlin periodically throttling Ukrainian shipments through a safe corridor, Russian traders are gaining more power in their home market as international players like Cargill Inc. and Louis Dreyfus Co. prepare to leave. Egypt will switch to sourcing almost half a million tons of wheat from France and Bulgaria, after Moscow blocked the supply of Russian grain. - Russia Throws Wheat Sale to Egypt Into Turmoil Over Price Floor - Bloomberg

ESG versus the World:

More to Do: Yellen has urged Congress and foreign governments in the rich world to do more to help poorer countries adapt to global warming, and thrown the Treasury behind implementing President Biden’s signature climate bill, seeking to squeeze the most from the sprawling new law. In short, no US Treasury secretary has made climate change a higher priority than has Yellen. For some that’s a great relief. But for others it’s a distinction that’s too easy to claim. Critics argue Yellen hasn’t done enough to push for better oversight of climate risks to the financial system or worked hard enough to mobilize capital in the global race to embrace clean energy. At the Treasury, Yellen stands at the center of the administration’s economic, fiscal and financial regulatory policymaking. As one of the world’s most prominent economists, she understands the power of using financial incentives, instead of government interdiction, to shape the behavior of companies and households, drawing them into the climate effort with carrots over sticks. - Yellen Pushes Treasury, World Bank to Fuller Climate Reckoning - Bloomberg

Podcasts and Videos:

Oaktree's Wayne Dahl on Credit Markets Right Now – Odd Lots - Bloomberg

Aug 2023 Market Outlook & Discussion – Variant Perception

#394 Louis-Vincent Gave: China, Energy & More – Macro Voices

Quarterly Macro Themes for Q3 2023 - Guggenheim

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION