The Fed Cautiously Reflects on Disinflationary Progress as Some See Menacing Dragons, While Others See Beautiful Butterflies Coming for the Economy - Midday Macro – 12/1/2023

Color on Markets, Economy, Policy, and Geopolitics

The Fed Cautiously Reflects on Disinflationary Progress as Some See Menacing Dragons, While Others See Beautiful Butterflies Coming for the Economy

Midday Macro – 12/1/2023

Market’s Weekly Narrative and Headlines:

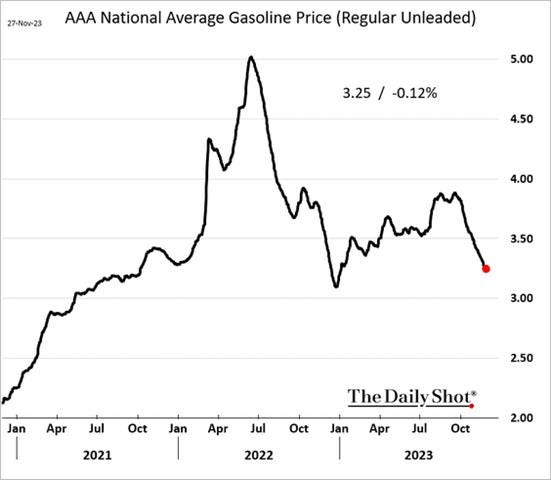

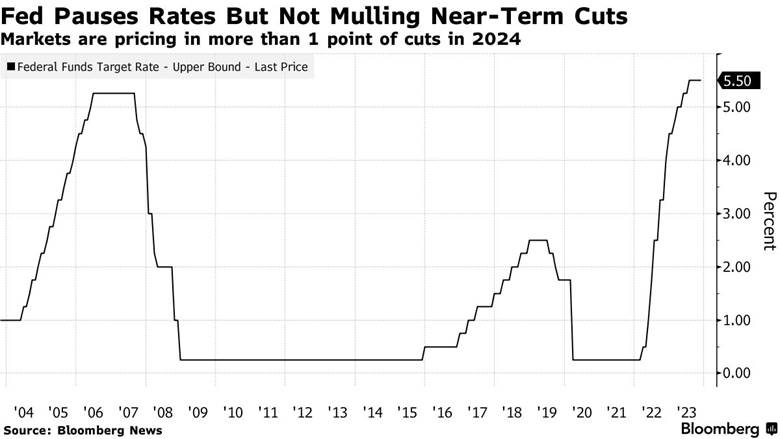

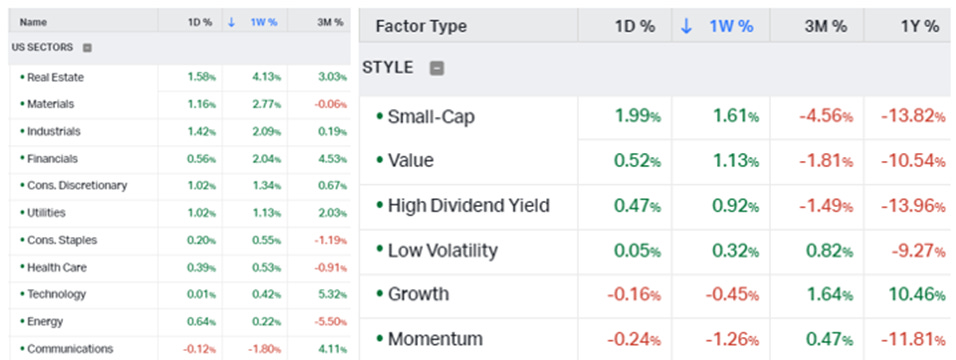

The long-awaited Powell speech today turned into a non-event, and that was all small-caps needed to launch off, with the Russell Index the clear winner on what until Friday had been a relatively range-bound week of price action. And although flatter on the day and week, the S&P and Nasdaq are close to all-time highs, as the growing disinflationary soft-landing narrative driving the recent rally in both stocks and bonds has moved both into overbought conditions. Real estate and cyclical sectors were the best performers on the week. Fed cutting expectations have come way in as well despite the consistent mission not accomplished message from almost every Fed official this week. Markets chose to instead latch on to comments from Governor Waller, who saw the “totality” of October’s data positively and teased rate cuts due to continued disinflationary trends might come earlier than expected (following a mysterious question from a back wall leaning appearance of market moving Nick Timiraos of the WSJ), all of which had more weight due to his normally hawkish somber critique of things. To be clear, increased uncertainty was also on display, both from Fed officials (although not from Bostic or Goolsbee) and in new consumer and business survey data this week. Today’s ISM Manufacturing PMI was unchanged, continuing to indicate contractionary activity with better demand offsetting broad weakness elsewhere, but respondent comments and thoughts from Mr. ISM himself, Tim Fiore, chairman there, were somewhat worrying. This increased manufacturing weakness came through in the Dallas and Richmond Fed Manufacturing reports, too, although the service sector side reports from these districts showed a better picture. House prices continued to rise despite further weakness in pending sales due to continued supply shortages. Low inventory continues to overshadow poor affordability. The PCE report showed weaker income growth and spending activity, music to the Fed’s ears, while core PCE was in line with CPI-derived expectations. Between the new data and Fed cautious but somewhat more dovish Fed speakers, Treasury yields continued to trend lower, with the curve steepening on the week. The 10yr yield is now a little over 4.20%, an almost 80bp drop from highs seen in October. Oh, how things change quickly these days. Turning to commodities, OPEC+ gave a lesson on how not to implement a production cut with markets doubting members will honor voluntary pledges. Throw in continual demand worries, rising inventory levels, and uncertainty over the effects of Brazil joining the cartel, and oil was down on the week, now near $74 after touching near $80 mid-week. Copper continues to rally, likely on cleaner inventory levels and expectations that China’s property sector has at least stopped worsening. The agg complex was higher on the week, with grains and corn beating beans despite weather worries in Brazil. Finally, King Dollar was little changed on the week, with the $DXY near 103 as the recent tactical rally lost steam today. The Euro had reached the pyscologically important level of 1.10 earlier in the week, but this too reversed. Instead, the Yen, GBP, and AUD were the best performing crosses on the week. We delve deeper into views on why inflation might remain sticky in our Deeper Dive sector and cover all the week’s Fed speakers and U.S. economic data releases below that. Thanks for reading and please recommend us to others!

Deeper Dive:

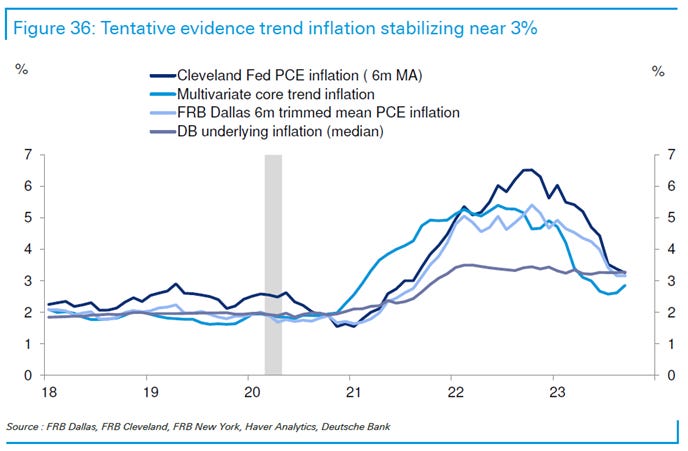

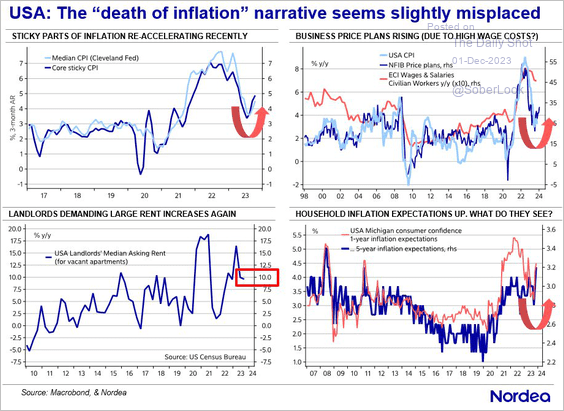

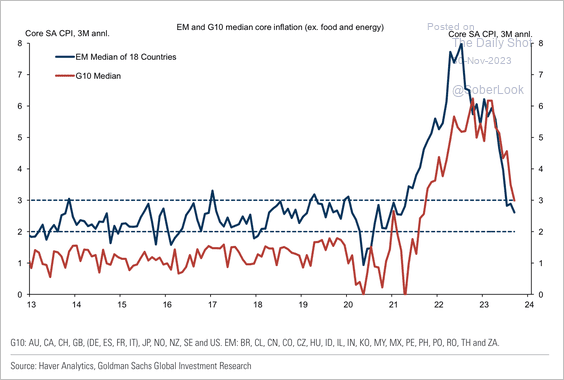

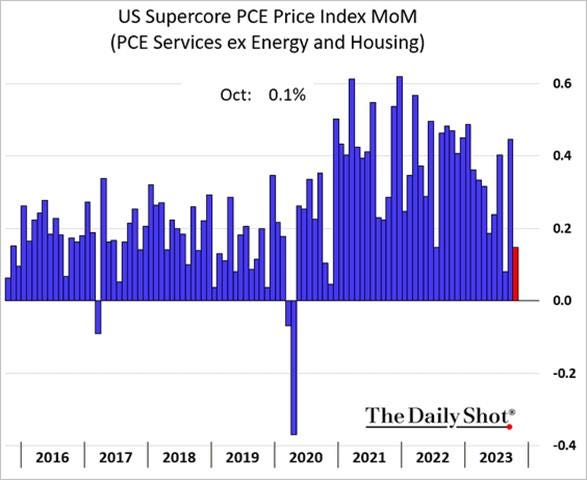

The “totality” of October’s data has given the Fed greater confidence that the economy is cooling and recent disinflationary gains are likely to continue. Given the uniqueness of declines in October’s inflationary data, rising business pricing plans, and higher consumer inflation expectations, we are less confident of this. We agree with Fed officials that supply-side impaired cost-push inflationary pressures have largely retraced, seen in declines in the cost of core goods in CPI, PCE, and PPI, as well as import prices. However, the final mile will rest on core services, including shelter, falling more forcefully. Uncertainty around whether this will occur in a “timely manner” is high, aligning Fed officials with a wait-and-see approach. This is despite an increasing acknowledgment that labor markets are loosening and wage pressures are subsiding, which, in their view, has largely been the reason for service inflation stickiness. However, given the uniqueness of the current macro backdrop and pandemic-driven inflationary pulse, it is our belief that the Fed will continue to signal that it is unlikely to cut rates anytime soon. The sequencing process the Fed will need to do to change course makes a March cut highly unlikely, in our opinion alone, given the degree of communication and market hand-holding that usually occurs, none of which has remotely started yet. It is also unlikely that labor markets will have deteriorated enough to “scare” policymakers that they misjudge the level of restrictiveness. As it stands, we still believe the economy’s pandemic recovery experience has reduced its policy-tightening sensitivity, and as a result, a glide path to below-trend growth is still our modal forecast, not a sudden lurch into recession in the next few quarters. As a result, “supercore” inflation should remain stickier, and the duration the markets believe the Fed stays restrictive can increase, weighing on the recent loosening of financial conditions and the recent rally in equities and rates, something we increasingly believe will happen after the current Santa-rally ends after year-end.

*Despite October’s better-than-expected results, recent disinflationary progress had been less broad-based and gravitating around 3%

*There are some warning signs emerging that despite lower energy prices and official progress in CPI, PPI, and import prices, inflation isn’t beaten yet

*The Fed’s inflation dashboard is still consistently red, and without labor markets and growth overtly negative, the focus will remain here

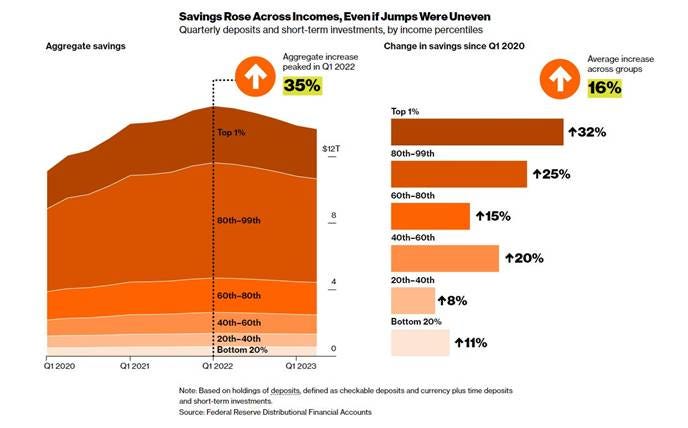

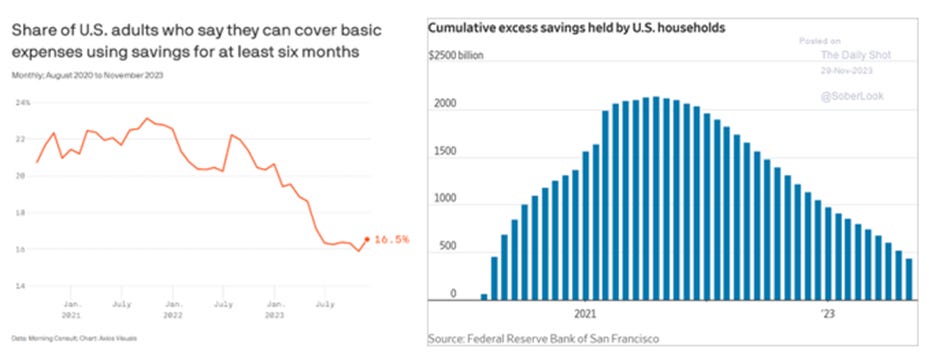

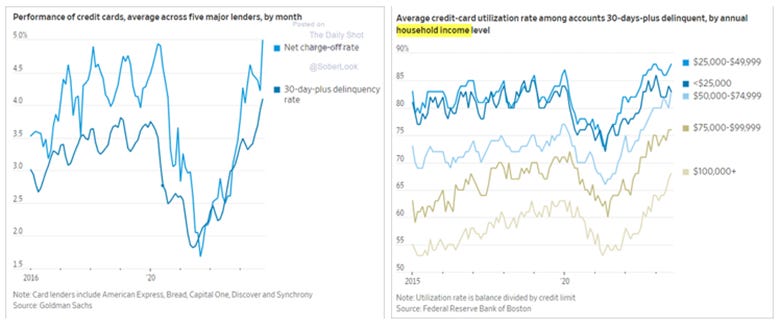

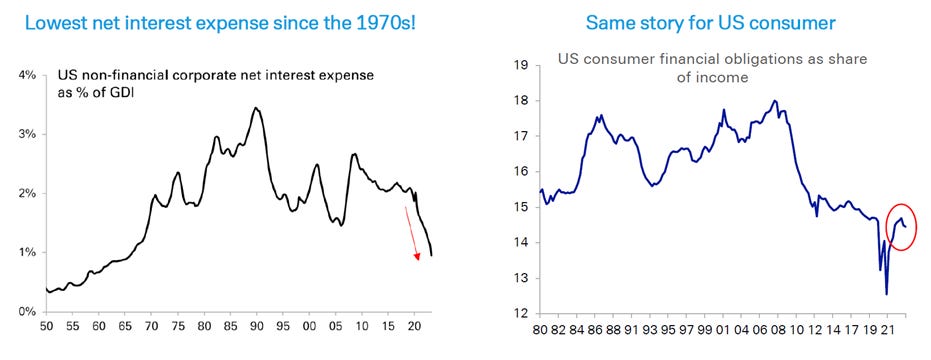

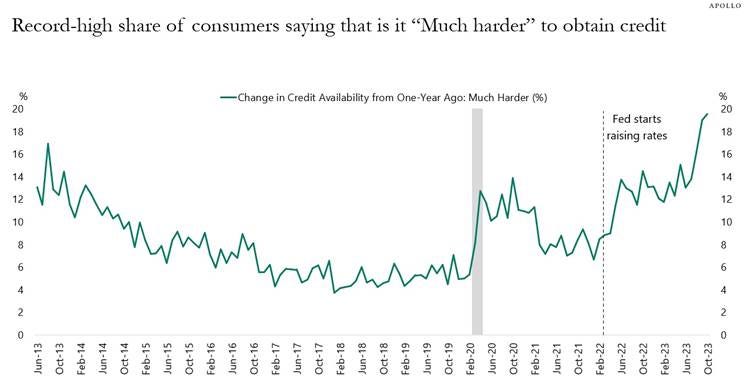

Although we expect spending on services from both consumers and businesses to fall, the multifaceted nature that tighter credit and financial conditions have affected consumer and business spending means that it will be an uneven process. We increasingly see lower-income consumer cohorts hardest hit while higher-income ones enjoy more significant real disposable income gains, better access to credit, continued excess savings and increased trade-down discretionary and staple purchasing options. This means that although weakening, on aggregate, pricing power is likely not yet at levels consistent with the Fed’s inflationary target. Whether decreases in input costs and slower wage gains change occur fast enough for firms to protect margins while dropping prices to gain market share occurs has yet to be clearly seen. The outlook for business investment is also mixed in our view. Firms are coming off a period of historically high capex spending due to increased demand and cheaper financing during the post-pandemic period. This has increased productivity but is now reducing future expansion needs due to falling demand and capacity utilization. This is clearly seen in business sentiment survey data, and although not yet contractionary, business investment should trend lower. Further, lower levels of leverage and higher cash holdings have reduced the effectiveness of higher rates in slowing business spending, with many businesses profiting from their cash holdings. When coupled together, a still positive but slowing business and consumer spending backdrop indicates that the fourth quarter should still have a slightly above trend-growth level.

*It’s becoming increasingly clear that fiscal and monetary stimulus affected consumers unevenly depending on their income/wealth levels

*Savings may be distributed unevenly, but on aggregate, it is falling and reducing future spending

*Delinquency rates are increasingly rising among lower-income borrowers

*Consumers and businesses took advantage of lower rates following the pandemic and are now less leveraged, termed out longer, and hence using less income for interest expenses

*Access to credit continues to tighten for both consumers and businesses

*Views on future job availability have begun to worsen more notably

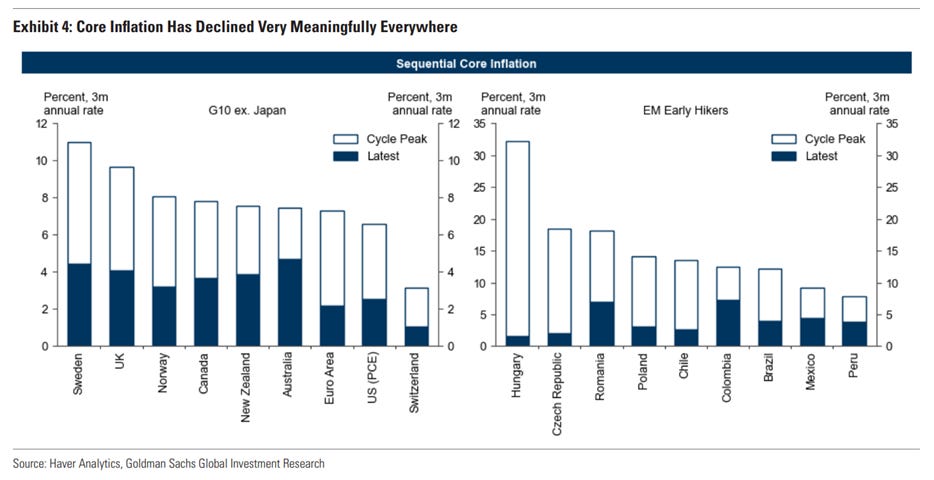

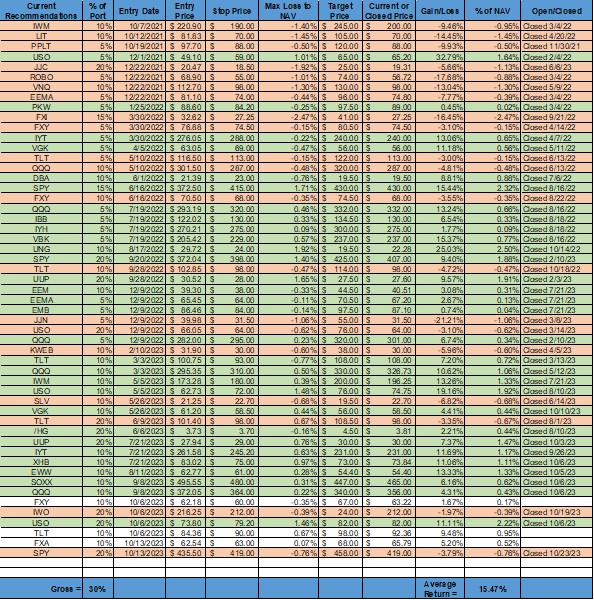

Taking the other side of the coin and looking at the global inflationary picture, it is understandable why many believe inflation has been beaten. A wide swathe of countries with different economic dynamics and policy responses to the pandemic all saw the same big inflation spike and have now all seen significant improvement. The one thing all these countries have in common is that they all experienced huge supply-side disruptions thanks to the pandemic, giving credit to the idea that the majority of inflation was cost-push driven. Further, all of these countries have seen a fading of these disruptions over time. As a result, it shouldn’t particularly matter if demand is stronger in certain countries than in others. Instead, the normalization of supplies of materials and labor has reduced input costs enough to stabilize inflation, and a recession is not needed. We have never been here before, and an open mind is warranted, leaving policymakers in an uncharted area, one where models and history lessons are less valuable. Instead, a more fluid two-sided risk approach to the totality of incoming data has emerged, and as a result, Fed communication has become more challenging, reducing the effects of forward guidance. This has increased uncertainty among economic actors still reeling from the trauma of higher prices. That uncertainty is best reflected by the divergence of softer business and consumer confidence/sentiment data reflecting a more pessimistic outlook than the harder data reflecting still growing actual economic activity. Effectively, uncertainty remains high, and although it has not yet deterred activity meaningfully, we expect it increasingly will in 2024. We will conclude by acknowledging our early entry and subsequent stop out of our long growth small cap and S&P positions (as a play on a year-end rally), which would both be notably higher, and moving the mock portfolio to a near 20% YTD gain has been very disappointing. Timing is everything, and the unseasonal pullback in October needed to be respected but proved short-lived. We have moved up our stops and on our AUD and $TLT longs to lock in gains and raised our target for $TLT. We generally see the current rally in rates and equities lasting a little longer, with the next real test being November’s CPI, as we don’t expect an out-of-consensus NFP next week. However, as we wrote, we believe the inflation story is not over, and it will eventually weigh on current price action again.

*Disinflationary progress in global and that in itself reinforces the view it will continue

*Declines in energy and good prices have largely been the driver of progress in fighting inflation

*Will consumer confidence re-correlate with lower gas price?

*Our “average return” has moved higher to 15.5% with a low gross exposure given our belief we are entering the final stage of the current rally

As always, thank you for reading, and please share our newsletter. Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

Policy Talk:

This week, an almost full slate of Fed officials communicated that they continued to see progress on their fight against inflation due to the “totality” of October’s data, which gave even more hawkish policymakers greater comfort. Of course, the hawkish caveat that more work was needed and it was too early to declare victory quickly followed dovish comments that policy was in a good place. However, all in all, the tone indicated that December’s FOMC meeting may be the first one to start discussing when cuts may be coming. We also expect a more dovish shift in inflation, and hence Fed funds projections in December’s SEPs, even as GDP and UER projections may change little.

Powell gave broader economic and policy remarks that were not particularly insightful at Spelman College in more of a fireside chat format. He stayed on script, stressing that policy was in a good place and future changes would be data-dependent. This week’s earlier headline grabber was from Governor Waller, who said he’s encouraged by a recent slowing of economic activity, which may indicate the central bank’s policy is tight enough and progress on inflation would allow for cuts next year to keep from an overtightening. New York Fed President Williams sounded less confident about his forecasts but affirmed the Fed is probably done raising rates. He stuck to the higher-rates-for-longer narrative, pouring cold water on the possibility of near-term rate cuts. Of course, this was countered by Atlanta Fed President Bostic, who said he is more confident in his forecast of a soft landing for the U.S. economy, adding that he thinks inflation will keep falling, going as far as to conclude prepared remarks by cautioning that there are dangers from prices falling too much. Richmond Fed President Barkin said he still needed to be persuaded that inflation was on track to fall toward target and was unwilling to say the Fed was done hiking. Cleveland Fed President Mester noted policy was in a good place “for policymakers to assess incoming information on the economy and financial conditions." Fed Governor Michelle Bowman, however, continued to voice a more hawkish opinion, saying she would support additional tightening of policy if progress on inflation stalled. “We should keep in mind the historical lessons and risks associated with prematurely declaring victory in the fight against inflation, including the risk that inflation may settle at a level above our 2% target without further policy tightening,” Bowman said. San Francisco Fed President Daly echoed others by commenting that interest rates are in a “very good place,” but it was too soon to declare victory and policymakers needed to be patient. Finally, Chicago Fed President Goolsbee stressed that inflation was still the focus but believed it was on track to reach the Fed’s target in a timely manner, stating there is no evidence it has stalled around 3%. We cover the speeches given by Williams, Waller, and Bostic in more detail below.

NY Fed President Williams gave prepared remarks at a NY Fed-hosted conference on Central Bank innovation titled “Restoring Price Stability.” He reiterated the well-known stance that supply and demand imbalances from the pandemic have inflation still unacceptably high despite recent progress. He reviewed his onion layer approach to understanding inflation pressures, starting with commodity prices and noting that food costs this Thanksgiving had fallen. Williams noted that goods prices benefited from improved supply chain dynamics, with core goods inflation returning to pre-pandemic levels. His outer layer, core service inflation, also showed progress, with shelter expected to fall and core services ex-shelter “beginning to move in the right direction.” He highlights that inflation expectations are at levels consistent with the FOMC’s 2% goals, while the NY Fed’s MCT inflation model had fallen to 2.9% in September. Turning to labor markets, Williams sees a “gradual return to balance” in the labor market, noting both lower demand and “meaningful improvements” in the supply side. He expects tighter credit and financial conditions to slow growth next year and inflation to continue to trend lower, with his forecast of a 2.25% PCE rate at year-end. As a result of this, he believes the Fed is at or near peak rate level, with the stance of policy “quite restrictive.” However, in a more hawkish node, he expects policy will need to be restrictive for some time “to fully restore the balance.” He warned that if the “totality” of the data changed more than expected, “additional policy firming would be needed.” He concluded by noting that the reduction of the balance sheet, lower by around $1 trillion to date, has had no adverse effect on market functioning.

“Numerous indicators point to a gradual return to balance. Job openings continue to trend downward. The quits and hires rates are back to pre-pandemic levels. So are perceptions of jobs availability and the ability to fill jobs. Wage growth, although still elevated, has slowed considerably.”

“Based on model estimates of the longer-run neutral interest rate that incorporate forecasts for the current quarter, the stance of monetary policy is quite restrictive; indeed, it is estimated to be the most restrictive in 25 years. I expect it will be appropriate to maintain a restrictive stance for quite some time to fully restore balance and to bring inflation back to our 2 percent longer-run goal on a sustained basis.”

Fed Governor Waller gave prepared remarks at the American Enterprise Institute in Washington titled “Something Appears to Be Giving.” It was a follow-up to a speech given a month earlier. Waller believes that the economy was beginning to cool, with October’s data indicating an “easing in economic activity, and the fourth quarter showing the kind of moderation that is more in keeping progress on lower inflation.” He noted a still highly uncertain outlook but believes policy is “currently well positioned to slow the economy and get inflation back to two percent.” Waller reviewed the recent economic data he viewed as weaker in October, noting it was increasingly evident that tighter policy was affecting real activity. He saw some of the contributors to the robust third-quarter growth as unsustainable, especially inventory investment, while he also highlighted the drag UAW strikes would have on Q4 growth. He noted looser labor market conditions, highlighting the rising UER, while vacancies and quits continued to fall, although he acknowledged things were still tight historically. Turning to inflation, he noted that there “was no inflation” for the month of October, and unlike previous months, the moderation was broadly distributed. He still wants to see progress in services ex-housing inflation to take comfort that things are moving back to target and notes labor costs are a significant part of that, and wage disinflation has been “encouraging,” but he has not seen “enough evidence’ to be sure this will continue. He believes the final move lower in inflation will require further demand destruction, given the supply-side impairments behind much of the recent inflationary wave have largely healed. He dismissed recent increases in productivity as something to guide policy and also noted financial conditions were still tight despite the recent loosening. All in all, Waller struck a cautiously optimistic tone, given his more hawkish nature, but ultimately said it was still too early to conclude if the Fed was done tightening. The “totality” of October’s data gave him reason to believe policy was in a good place, but he needed to see a continuation of that for several more months. In answering a suspiciously placed/timed direct question from Nick Timiraos in Q&A, Waller addressed his views on the Taylor Rule, noting it meant for potential cuts moving forward sooner than forecasted if inflation continued to fall jas that would simply keep policy from over-tightening.

“These are all signs of a loosening labor market. But for all of the measures I have mentioned, they are still at levels that, historically, would be associated with a fairly tight labor market. We have 10 months of data on job creation in 2023, and for the 5 months through May, the monthly average was 287,000. Even with the strong month in September, the average for the past five months has been 190,000, which is close to the 10-year average from 2010 through 2019.”

“Consumer price index inflation for October was what I want to see. For the month, there was no inflation, prices were virtually flat, and unlike earlier moments where improvements were concentrated in some goods and services, the moderation in inflation was broadly distributed.”

“Elevated inflation was partly the result of supply-side problems related to the pandemic, and some of the improvement in inflation that we have seen has been due to the easing of those problems. But most data indicators and anecdotal evidence suggests that supply side problems are largely behind us so they will provide little support in the future in returning inflation to our 2 percent goal. Monetary policy will have to do the work from here on out to get inflation back down to 2 percent.”

Atlanta Fed President Bostic delivered prepared remarks entitled “Rorschach Test Coming Into Focus,” in his quarterly presidential statement, where he noted economic signals remain mixed given divergences between hard and soft data readings. Despite this, he sees inflation continuing to fall, citing research and input from business leaders and a belief the economy will slow as the reason. His notes contacts are giving him confidence that “tighter monetary policy is biting harder into economic activity.” He notes that he sees clear signs business investment is falling while pricing power is diminishing, even among providers of business and consumer services. He notes wage growth is also slowing, and this will reduce costs, especially for service firms. In combination, this all points to ongoing disinflation and a measured slowing in economic activity. He noted that business contacts see activity as “decelerating but not dramatically enough to portend a destructive economic downturn.” He sees reduced savings and increased childcare and college debt costs as the primary reasons consumers will be less resilient. He highlighted that businesses were planning fewer price increases at a lower rate, giving him and the “staff” a forecast that inflation would be closer to 2.5% by the end of 2024. He concluded by saying the recent “blockbuster” growth was not sustainable in his view and looked to the Atlanta Feds GDPNow as a good gauge of where he thought growth in Q4 would be. Bostic remains one of the most dovish Fed officials, and his focus on both business contacts and survey-based data leads him to be more pessimistic about future growth.

“Relatedly, my staff and I are picking up clear signals that companies' pricing power is diminishing. That is, it is no longer easy to raise prices without resistance from customers. In that context, we're hearing reports of more and more companies sacrificing some profit margin to maintain market share. Firms are increasingly offering discounts and price promotions or otherwise swallowing cost increases rather than risk chasing away customers.”

“The median BIE survey respondent also plans to change the price of their main product or service just once in the next 12 months, versus twice in the past year. Our inflation experts label this shift in pricing plans a return to a "time-dependent" approach, meaning companies adjust prices according to a set schedule. That's fundamentally different from the "state-dependent" approach that prevailed the past couple of years, as firms increased prices frequently in response to rapidly rising costs.

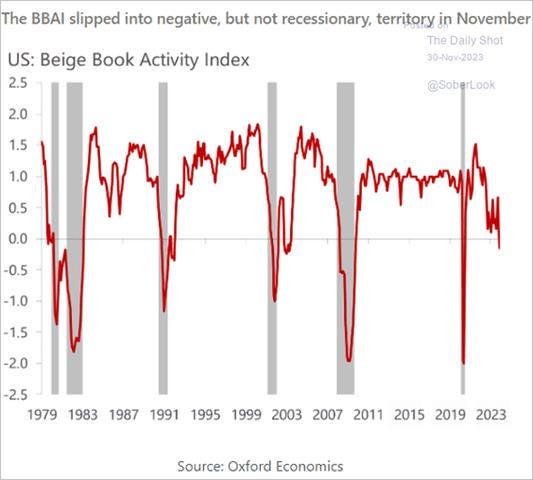

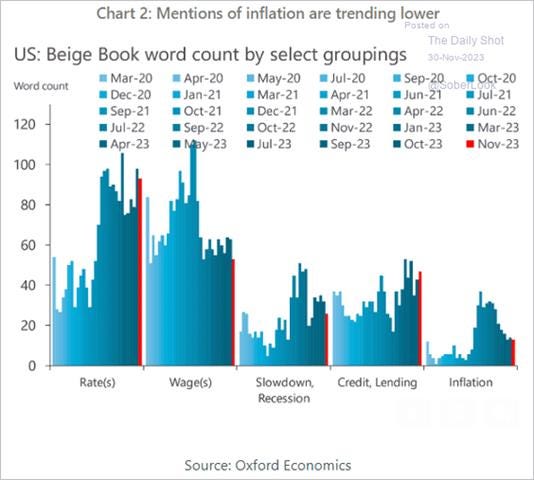

The Fed’s November Beige Book showed economic activity slowed over the month, with four districts noting modest growth, two districts little changed, and six noting slight declines in activity. Spending activity remained mixed, with discretionary items and durable goods declining as consumers became more price-sensitive. However, service-related spending remained healthy, with positive travel and tourism activity. Manufacturing activity was mixed, with the outlook weakening. Demand for business loans decreased, while consumer credit remained “fairly healthy,” although banks reported an uptick in delinquencies. Demand for real estate loans fell, with commercial real estate activity continuing to slow. Residential sales were reported to have slightly decreased even as inventories of available homes improved and multi-family activity softened.

Demand for labor was flat, with modest increases in overall employment reported. Retention of workers is improving, and more applicants are available. There was an increased report of reduction in headcount through layoffs or attrition. However, “several” districts described labor markets as remaining tight with wage growth remaining “modest,” especially for high-performing workers or ones with specialized skills. More generally, price increases moderated but remained elevated. Logistical costs continued to fall. Construction inputs were reported as declining. However, certain food, insurance, and utilities costs were reported as higher. Pricing power varied with service providers finding it easier to raise prices than manufacturers.

Labor market conditions cooled but generally remained solid. On net, employment continued to increase in the latest reporting period, edging up slightly. However, contacts reported some softening in labor demand and improvements in worker availability across the district.” – New York District

“Firms reported that increases in prices received for their own goods and services over the past year fell significantly in the fourth quarter of 2023 compared with the third quarter… Looking ahead one year, the increases that firms anticipated in the prices for their own goods fell significantly.” – Philadelphia District

“Consumer spending softened in recent weeks. Multiple general merchandisers reported declines in discretionary goods sales. Likewise, reports from restauranteurs and wholesalers tied to the restaurant industry suggested slower spending on discretionary services… Contacts across retail segments generally expected demand to remain soft in the near term, though some were hopeful that the coming holiday shopping season would boost sales.” – Cleveland District

“Home sales throughout the district remained constrained amid higher prices and volatile interest rates. Home purchases by repeat buyers contracted the most, as many who were locked in at low interest rate mortgages remained disincentivized to re-enter the market. Though moderating, house prices in most markets were at or near peak levels... Rising homeowners’ insurance premiums have become a major expense, especially for homeowners with lower and/or fixed incomes. Home builder sentiment deteriorated amid declining affordability. Builders experienced more challenges qualifying buyers. Incentive offers, such as rate buy downs, remained prevalent.” – Atlanta District

U.S. Economic Data:

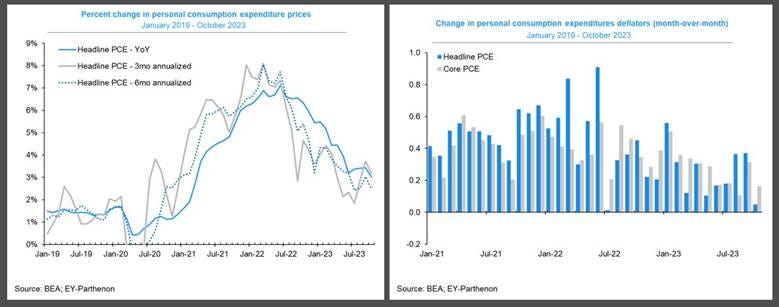

The personal consumption expenditure price index was flat in October, after a 0.4% rise in both September and August, compared to forecasts of 0.1%. This moved the annual headline PCE rate to 3% from 3.4% in September. Core PCE increased by 0.2% in October versus 0.3% in September, moving the annual core PCE rate to 3.5% from 3.7%. The price of goods declined by -0.3% MoM, with both durable and nondurable declining by that much, following a 0.2% MoM increase in September. This offset a 0.2% MoM increase in the cost of services, which slowed from a 0.5% increase in the prior month. Food costs increased by 0.2% MoM, following a 0.3% MoM increase in the prior month. Energy goods and services declined by -2.6% MoM, following a 1.7% MoM increase in September.

Key Takeaways: This was the weakest headline reading since July 2022, while core rose by 0.16%. The six-month annualized core inflation rate fell to 2.5%, now close to the Fed’s 2% target. As a result, little in this report changed the disinflationary narrative coming out of October’s CPI, and markets continue to expect that the Fed is done hiking rates. “We continue to see a good chance that the Fed will begin cutting rates in March next year, a little sooner than markets are expecting,” Andrew Hunter, deputy chief U.S. economist at research group Capital Economics, wrote in a note. “With a growing body of evidence that inflation will be close to the 2% target by mid-2024, we also think markets still haven’t gone far enough in pricing in rate cuts over the next 18 months.” We tend to push back on this, still envisioning a summer rate cut, given the totality of the data.

*After ticking higher in September, the weaker October monthly gains have re-trended Headline PCE measures lower

*”Supercore” PCE grew at a notably weaker rate during the month

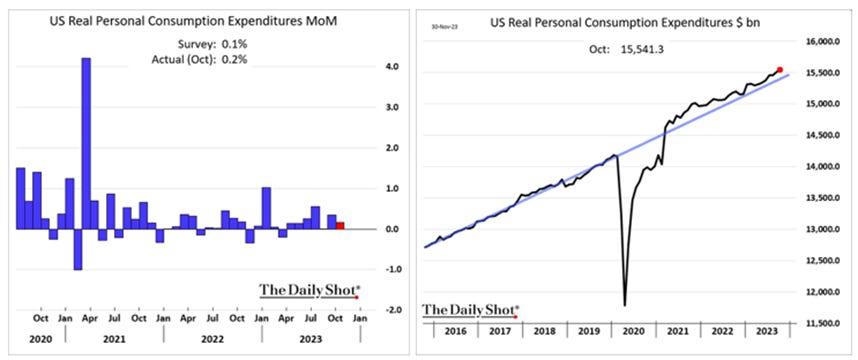

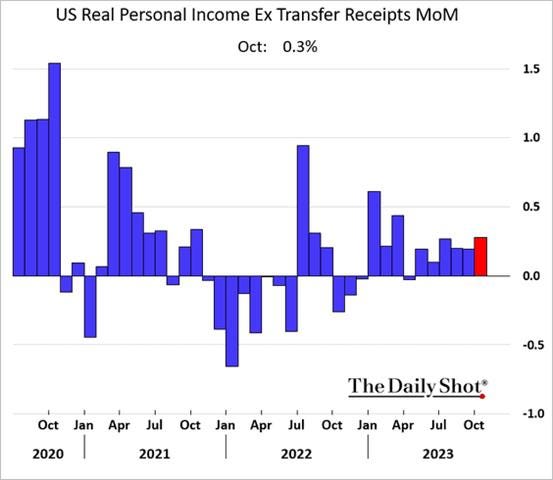

Personal income increased by 0.2% in October, the least in four months, and matching market forecasts. A slowdown was seen in compensation for employees (0.2% MoM vs. 0.4% MoM in Sept), with both wages and salaries (0.1% MoM vs. 0.5% MoM) and other associated costs (0.3% MoM vs. 0.4% MoM) rising at a slower rate than in September. Asset receipts increased at a faster pace (0.8% MoM vs 0.5% MoM), led by an increase in dividends (0.8% MoM vs 0% MoM). Personal current transfer receipts fell by -0.1% MoM, a fifth consecutive month of no gains. Personal savings was $768.6 billion in October, and the personal saving rate was 3.8%. Personal spending increased by 0.2% in October, following a 0.7% increase in September, matching market forecasts. Spending for services increased by 0.4% MoM, primarily due to rises in spending on hospital and nursing home services, housing and utilities, and international travel. Conversely, the expenditure on goods fell by -0.2% MoM, led by new motor vehicles and gasoline.

Key Takeaways: Income increases are slowing, with wages and salaries changing little during the month and moving below the 0.4% - 0.5% MoM range it held for most of the year. However, higher rates continue to support personal interest income and are now an area with the highest monthly growth rate. Personal spending also cooled, increasing at its lowest rate in five months, mainly due to expenditures on goods turning negative, while the rate of spending on services cooled. This all bodes well for the Fed, which wants to see wage pressures subside while spending also slows, moving growth below trend and better balancing supply and demand.

*Monthly personal consumption gains weakened but the growth trend is still intact

*Excluding government transfers, real personal income has risen for six consecutive months

* Personal savings as a percentage of disposable income stabilized in October

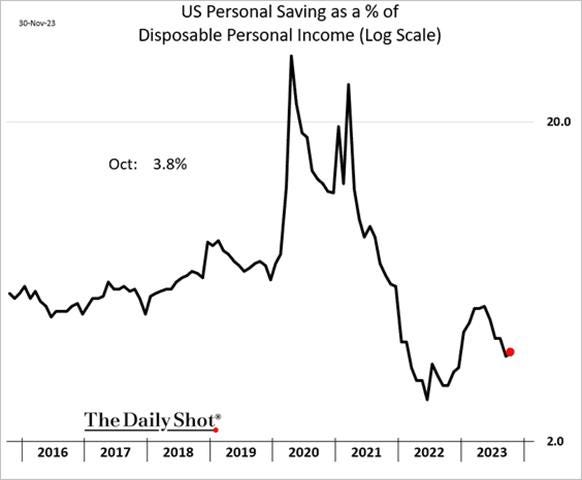

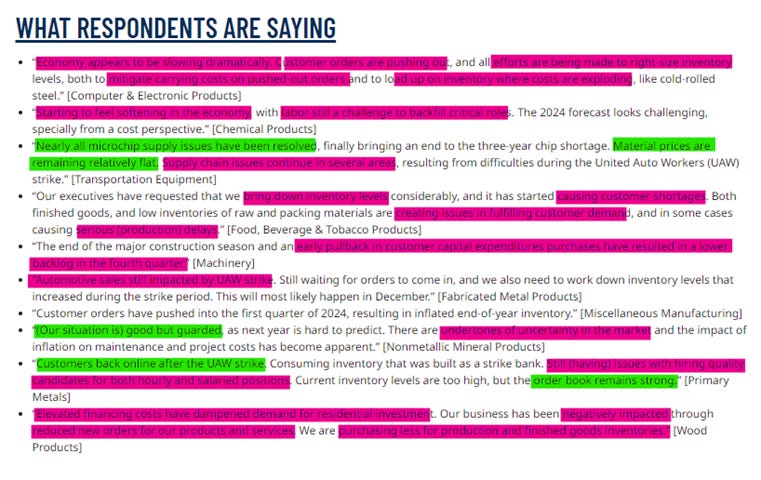

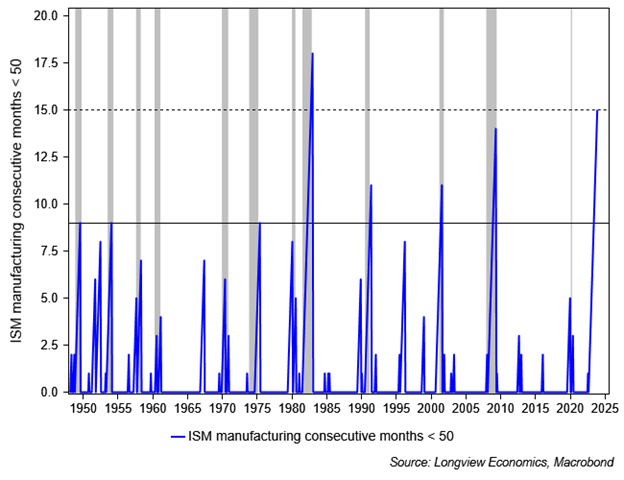

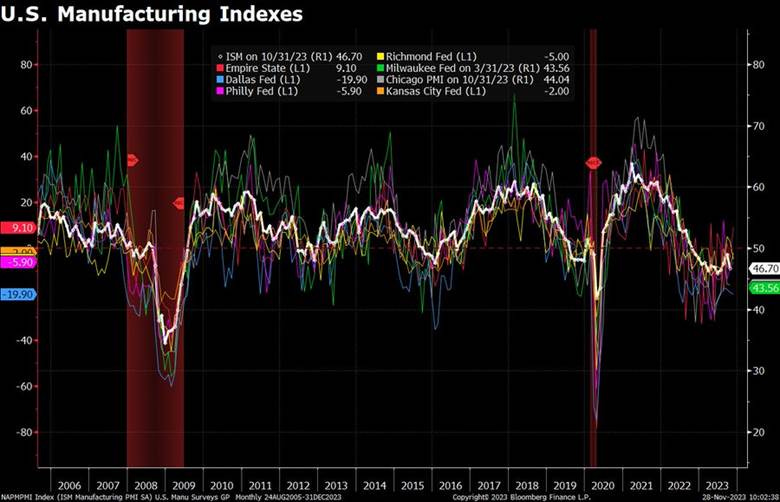

The ISM Manufacturing PMI was unchanged at 46.7 in November, the same as in October, and below forecasts of 47.6. Changes in demand and activity measures were mixed, but readings remained contractionary. New Orders (48.3 vs. 45.5) moved closer to neutral, while the Backlog of Orders (39.3 vs. 42.2) and New Export Orders (46 vs. 49.4) contracted at a faster rate. Production (48.5 vs. 50.4) fell from a neutral reading into contractionary territory, while Imports (46.2 vs 47.9) continued to show lower demand for inputs. Supplier Delivery (46.2 vs. 47.7) times shortened. However, Inventory measures on aggregate contracted slower, with Inventories (44.8 vs. 43.3) and Customers’ Inventories (50.8 vs. 48.6) moving up and the latter now neutral. Employment (45.8 vs. 46.8) contracted at a faster rate. Finally, Prices (49.9 vs. 45.1) moved back to a near-neutral reading.

Key Takeaways: The overall index was unchanged due to a reduced rate of contraction in new orders and inventories. However, even as new order levels contracted at a slower rate, there is continuing sluggishness in three capital-focused industries (Computer & Electronic Products, Machinery, and Fabricated Metal Products) that are among the seven biggest by share of manufacturing GDP. Production fell into contractionary territory, marking the last major sub-index with a prior positive reading. However, five industries still reported growth in production during the month of November. Manufacturing firms have been able to meet contracting customer demand, as demonstrated by the customers’ inventories sub-index moving higher and now indicating an ‘about right’ level. Labor hiring intentions are now contracting at a faster rate for a second month, with attrition, freezes, and layoffs to reduce headcounts increasing on the month. Panelists’ comments were equally split between companies hiring and others reducing their labor forces — a first since such comments have been tracked,” said Timothy R. Fiore, Chair of the Institute for Supply Management. “Demand remains soft, and production execution is slightly down compared to October as panelists’ companies continue to manage outputs, material inputs and — more aggressively — labor costs. Suppliers continue to have capacity. Sixty-five percent of manufacturing gross domestic product (GDP) contracted in November, down from 75 percent in October. More importantly, the share of sector GDP registering a composite PMI calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 54 percent in November, compared to 35 percent in October and 6 percent in September. Three of the top six industries by contribution to manufacturing GDP were at or below 45 percent, same as the previous month,” concluded Fiore.

*Every contributing sub-index was negative on the month, with weaker production offsetting less contraction in production

*Notable increase in price reading and inventories, while other readings were broadly more contractionary

*Comments skewed more negatively, with panelists increasingly worried about 2024

*The overall ISM Manufacturing PMI Index has been negative for 15 months

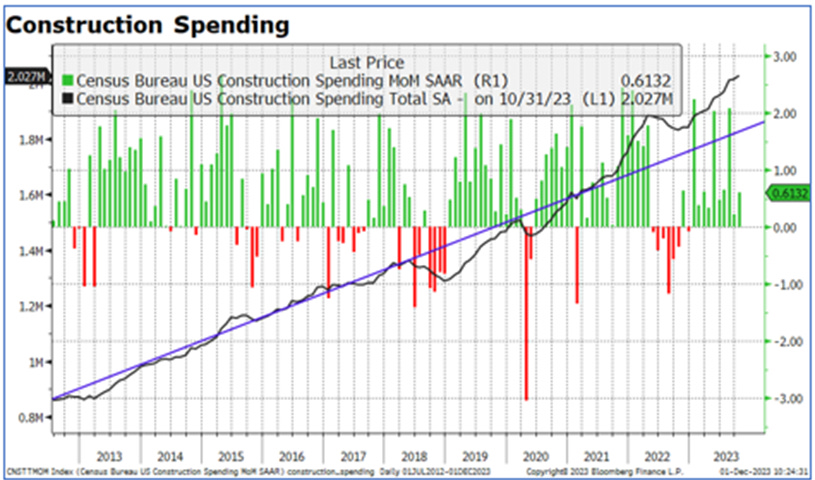

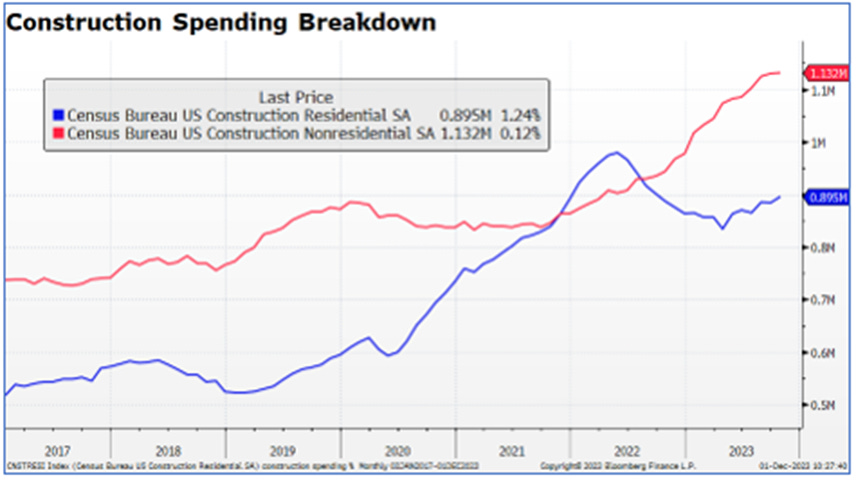

Construction spending increased by 0.6% MoM to a seasonally adjusted annual rate of $2,027.1 billion in October, following a downwardly revised 0.2% increase in September and beating market estimates of a 0.4% MoM increase. Private spending increased by 0.7% MoM, driven by a 1.2% MoM increase in the residential segment, due to single-family projects rising by 1.1% MoM, which offset a -0.1% MoM decline in multi-family housing projects. Construction spending on the non-residential segment was flat, slightly higher by 0.1% MoM, with Commercial (-1.5% MoM) and Highway and Street (-0.4%) negative, while Manufacturing (0.9% MoM) and Power (1%) increased. Meanwhile, public construction spending increased by 0.2% MoM. Total construction spending was higher by 10.7% in October.

Key Takeaways: Private construction drove the better-than-expected total construction results mainly due to single-family activity. Otherwise, the major categories were more mixed, with manufacturing picking back up and commercial again weaker. Construction of power facilities or utilities had a strong month. Public spending continues to cool, showing a reduced fiscal pulse from past legislation.

*Construction spending has been strong this year and is above its longer-term trend

*A more neutral picture in non-residential construction has been offset by increases in residential

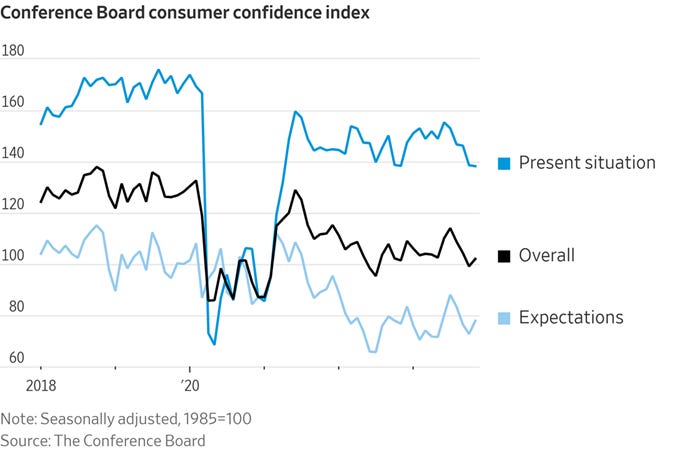

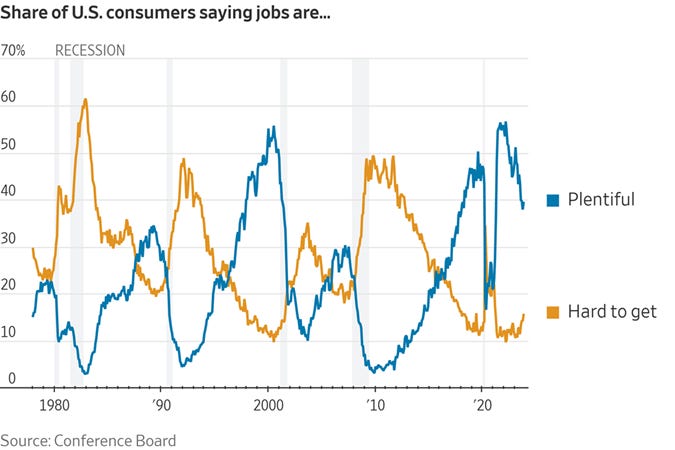

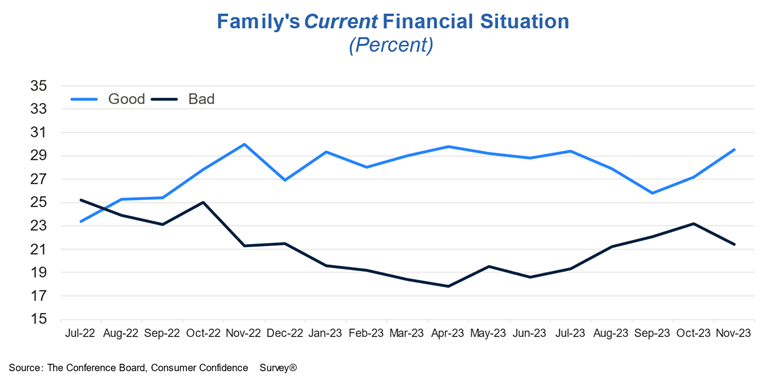

The Conference Board Consumer Confidence Index increased to 102.0 in November, up from a downwardly revised 99.1 in October. The Present Situation Index (consumers’ assessment of current business and labor market conditions) declined to 138.2 from 138.6. The Expectations Index (consumers’ short-term outlook for income, business, and labor market conditions) increased to 77.8, up from its downwardly revised reading of 72.7 in October. The average 12-month inflation expectations declined to 5.7% from 5.9%. Consumers’ assessment of current business conditions was slightly more positive in November, while views on the labor market were mixed, with more saying “plentiful” and “hard to get.” Consumers were less pessimistic about their short-term business conditions outlook, while the future outlook for labor markets was less optimistic, although income prospects improved.

Key Takeaways: The current situation assessment fell on the month due to less optimistic views on current job availability, which outweighed improvements in views on current business conditions and an improvement in expectations six months ahead. However, although more respondents said that business conditions were ‘good’ compared to last month, more also said they were ‘bad.’ Despite improvements this month, the Expectations Index remains below the 80 “recessionary” level for a third consecutive month. “While consumer fears of an impending recession abated slightly—to the lowest levels seen this year—around two-thirds of consumers surveyed in November still perceive a recession to be “somewhat” or “very likely” to occur over the next 12 months. This is consistent with the short and shallow recession we anticipate in the first half of 2024,” said Dana Peterson, Chief Economist at The Conference Board. Finally, views on current family financial conditions improved, suggesting consumer finances remain healthy heading into the holiday season.

*The overall confidence index rose slightly due to gains in expectations

*Job readings indicate the consumer is noticing a loosening in labor markets

*Consumers continue to view their financial situation more positively, correlating with recent stock market gains

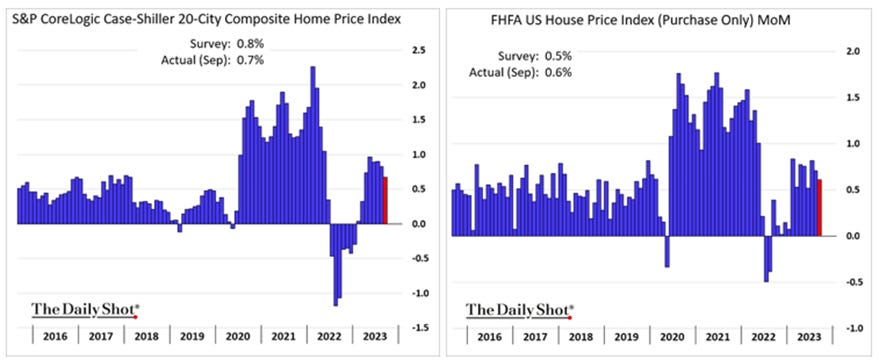

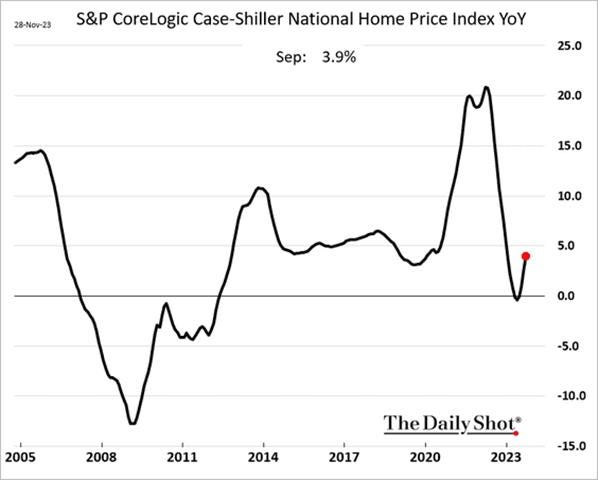

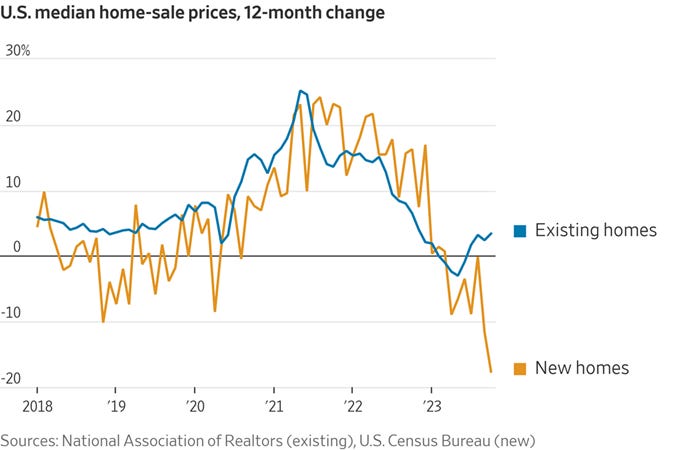

The S&P CoreLogic Case-Shiller 20-city home price index increased by 0.2% in September, following a downwardly revised 0.3% gain in August. This moved the annual rate to 3.9%, the largest year-over-year rise since December 2022, following a downwardly revised 2.1% gain in August. Three of the 20 cities reported lower prices in September versus a year ago. The Northeast (+5.3%) and Midwest (+5.0%) continue as the nation's strongest regions, while the West (-1.3%) remains the weakest. Detroit surpassed Chicago, reporting the highest year-over-year gain among the 20 cities with a 6.7% increase in September, followed by San Diego with a 6.5% increase.

Key Takeaways: It was the smallest monthly increase in seven months, but inventory shortages continue to support prices despite the increase in mortgage rates. On an annual basis, the National Composite has risen 6.1%, above the median “full calendar year” increase over the last 35 years. "We've commented before on the breadth of the housing market's strength, which continued to be impressive. On a seasonally adjusted basis, all 20 cities showed price increases in September; before seasonal adjustments, 15 rose. Prices in 17 of the cities are higher than they were in September 2022,” said Craig J. Lazzara, Managing Director at S&P DJI. He added, "Unless higher rates or exogenous events lead to general economic weakness, the breadth and strength of this month’s report are consistent with an optimistic view of future results.”

*Housing prices continue to rise, albeit at a reduced month-over-month rate

*The national index has risen to a 3.9% YoY rate after hitting negative at the beginning of the year

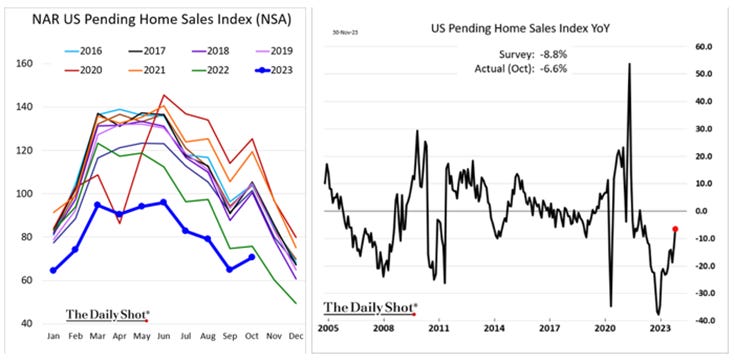

Pending home sales declined by -1.5% in October, pushing the index to 71.4, the lowest since records began in 2001, following a downwardly revised 1% rise in September, and compared to market forecasts of a -2% drop. Sales were lower in the Midwest (-0.4%), South (-1.9%), and the West (-6%) but rose in the Northeast (2.7%).

Key Takeaways: High mortgage rates and limited housing inventory are keeping housing demand from leading to sales. As a result, home sales are rising in places where more inventory is available. "Recent weeks' successive declines in mortgage rates will help qualify more home buyers, but limited housing inventory is significantly preventing housing demand from fully being satisfied. Multiple offers, of course, yield only one winner, with the rest left to continue their search", said Lawrence Yun, NAR chief economist.

*Low levels of available inventory continue to weigh on pending home sales

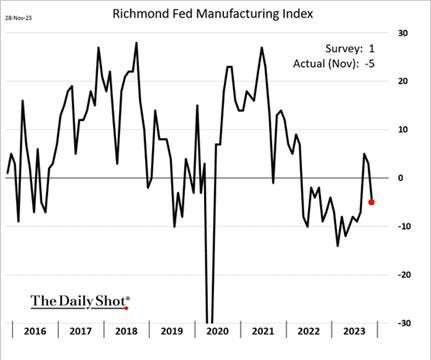

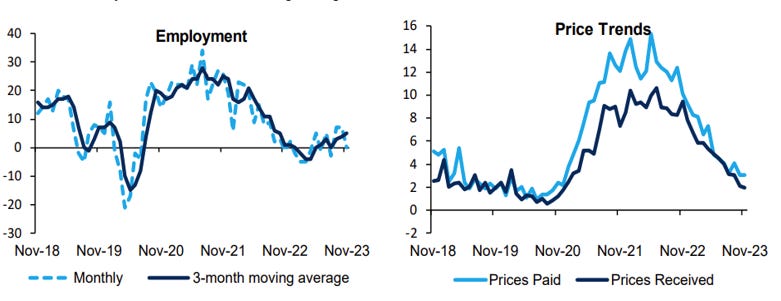

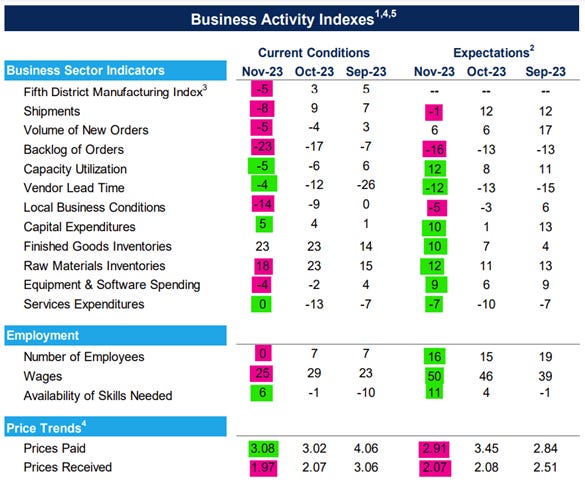

The Richmond Fed Manufacturing Index declined to -5 in November from 3 in October, missing market expectations of 1. Demand and activity measures broadly declined, now all in contractionary territory. Shipments (-8 vs. 9 in Oct) fell notably, while Capacity Utilization (-5 vs. -6) improved slightly but remained contractionary. New Orders (-5 vs. -4) and Backlog of Orders (-23 vs. -17) contracted at a stronger pace. Overall, Local Business Conditions (-14 vs. -9) worsened, while Vendor Lead Times (-4 vs. -12) moved closer to neutral. Inventories were little changed, with Finished Goods (23) unchanged, while Raw Materials (18 vs. 23) declined slightly. Employment measures were mixed, with the Number of Employees (0 vs. 7) moving to neutral, Wages (25 vs. 29) still expanding, but at a slightly slower rate, while the Availability of Skills Needed (6 vs. -1) expanded. Price measures were also mixed, with Prices Paid (3.08 vs. 3.02) rising slightly and Prices Received (1.97 vs. 2.07) falling slightly. Finally, current capital expenditure measures improved, with Capital Expenditure (5 vs. 4) expanding slightly faster, while Service Expenditures (0 vs. -13) rebounded to neutral. Forward expectations were more positive, with demand little changed while activity expectations fell. Capex and hiring intentions rose, and expected inflationary pressures fell on aggregate.

Key Takeaways: At the headline level, activity changed little in the month, but there was a weakening in current demand and activity measures, while labor and price measures were more mixed. The weakness in current readings was contrasted by a more neutral/positive change in future sub-indexes. Further, current and future capex readings improved, indicating optimism in the future despite the weakening views on local business conditions. Overall, manufacturing firms in the fifth district see declining demand, reduced capacity needs due to falling backlogs of orders, reducing their hiring intentions, and, ultimately, likely leading to further falling pricing pressures, especially for prices received, continuing a trend of tighter margin pressures.

*The overall index was driven lower by broad declines in demand and activity measures

*Employment readings turned more contractionary on the month while inflationary readings were little changed

*Current readings faired worse than expectations, with future labor readings all expanding

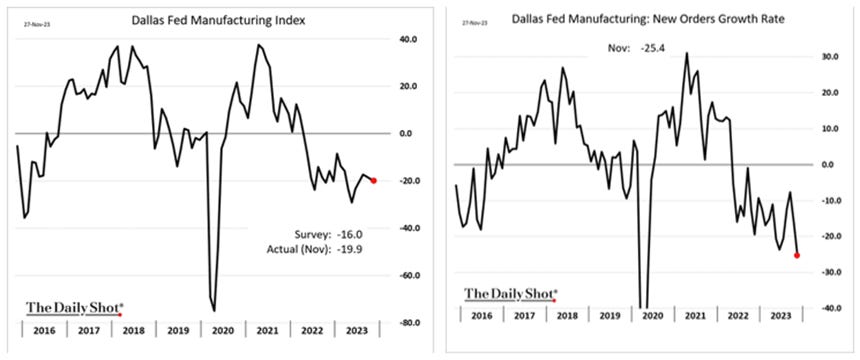

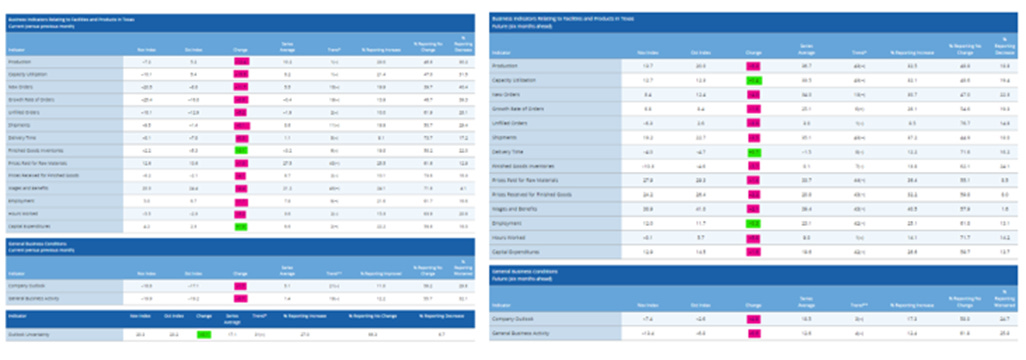

The Dallas Fed’s Manufacturing Index declined to -19.9 in November from -19.2 in October. Company Outlook (-18.8 vs. -17.1 in Oct) worsened and has been negative for 21 months. Activity and demand broadly contracted. Production (-7.2 vs. 5.2), Shipments (-9.5 vs. -1.4), and Capacity Utilization (-10.1 vs. 5.4), measurements of activity declined notably, with all three now in contractionary territory. New Orders (-20.5 vs. -8.8), Growth Rate of Orders (-25.4 vs. -16.8), and Unfilled Orders (-18.1 vs. -12.9) measures indicative of demand all moved further into contractionary territory. Delivery Times ( -8.1 vs. -7.8) shortened by a slightly faster rate while Inventories (-2.2 vs. -5.3) moved closer to a neutral reading. Price readings also declined, with Prices Paid (12.6 vs. 13.6) remaining expansionary while Prices Received (-6.2 vs. -2.1) moved further into contractionary territory. Labor readings also broadly weakened. Employment (5 vs. 6.7) and Wages (20 vs. 24.4) remained expansionary, while Hours Worked (-5.5 vs. -2.3) shortened further. Finally, Capital Expenditures (4.2 vs. 2.3) expanded further. Expectations regarding future manufacturing activity were also broadly negative, although less so than current readings, with the majority of activity and demand measures declining but remaining in expansionary territory. Future price expectations contracted slightly but remained notably in expansionary territory, while labor sub-indices were more mixed with wage growth expectations little changed, employment expanded slightly, and hours worked migrated to a neutral reading. Finally, capital expenditure intentions fell slightly but remained well in expansionary territory.

Key Takeaways: We were surprised to see the general business activity reading only down slightly, given the significant declines in almost every sub-index reading, with demand and activity measures all contracting notably. Labor readings also contracted, but employment and wages remained in expansionary territory while future hiring intentions rose slightly. Respondent comments were mixed, with chemical, transportation, and machinery manufacturers outright negative, while most other industries indicated a high level of uncertainty and a “holding pattern” approach.

*The overall index decreased by much less than the weakness at the subindex level would suggest

*There was abroad contraction of both current and future sub-index readings with an increased level of negative comments

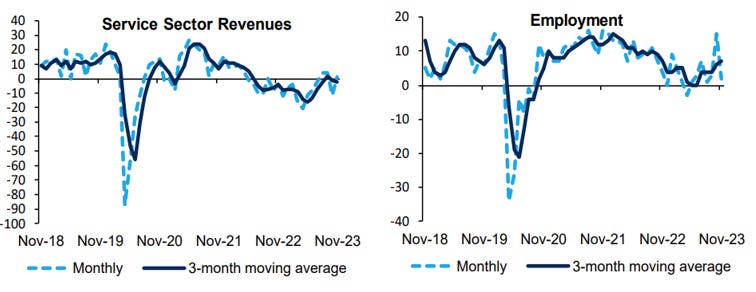

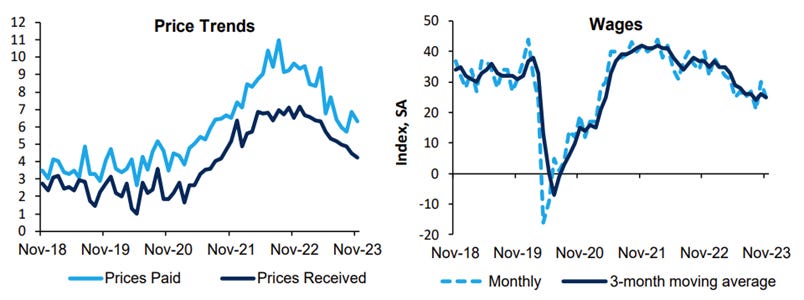

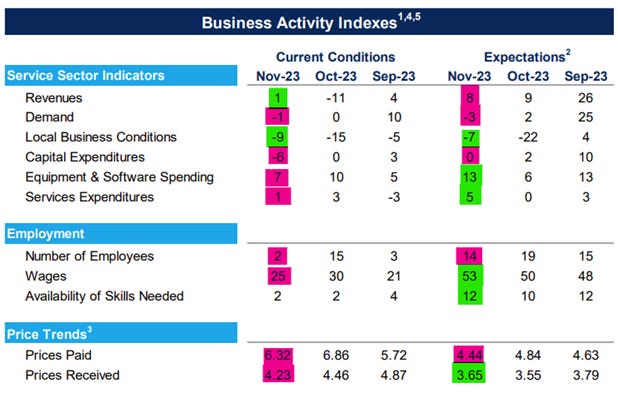

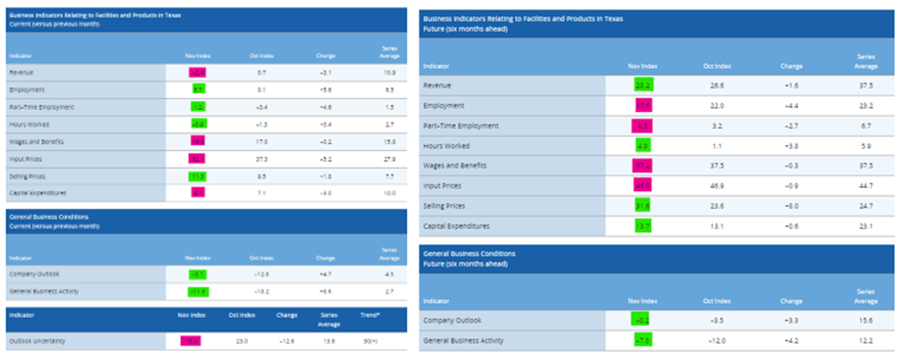

The Richmond Fed Service Sector Revenue Index increased to 1 in November from -11 in October. Demand (-1 vs. 0 in Oct) was little changed, remaining near a neutral reading. Local Business Conditions (-9 vs. -15) were viewed less pessimistically. Spending measures all weakened, with Capital Expenditures (-6 vs. 0) contracting, while Service Expenditures (1 vs. 3) moved closer to neutral, and Equipment and Software Spending (7 vs. 10) expanded at a reduced rate. Employment readings were weaker on the aggregate. The Number of Employees (2 vs. 15) sub-index fell to a near-neutral reading. Wages (25 vs. 30) expanded at a reduced rate while the Availability of Skills Needed (2 vs. 2) was unchanged. Current price measures fell, with Prices Paid (6.32 vs. 6.86) and Prices Received ( 4.23 vs. 4.46) both lower. Expectation readings showed little change in revenue, while demand was expected to contract. Similar to current readings, views on future local business conditions improved. Future labor readings showed a reduced desire to hire, but expectations wages would rise while skilled labor would continue to be needed. Finally, future price measures were mixed.

Key Takeaways: The overall reading of current revenue and demand changed little while views on business conditions became less negative. However, capex spending intentions became more negative at the current level. This was offset by increases in future spending plans. Inflationary pressures subsided slightly, while hiring and labor readings fell. All in all, this report showed a cooling in service activity in the Fifth district, but no alarm bells are ringing based on future expectations largely still expansionary/neutral.

*Revenue growth remains near neutral while employment took a notable turn down on the month

*Price and wage measures continue to trend lower, indicating a deflationary pulse continues

*Readings at the sub-index level were mixed between more contractionary current readings and more expansionary future ones

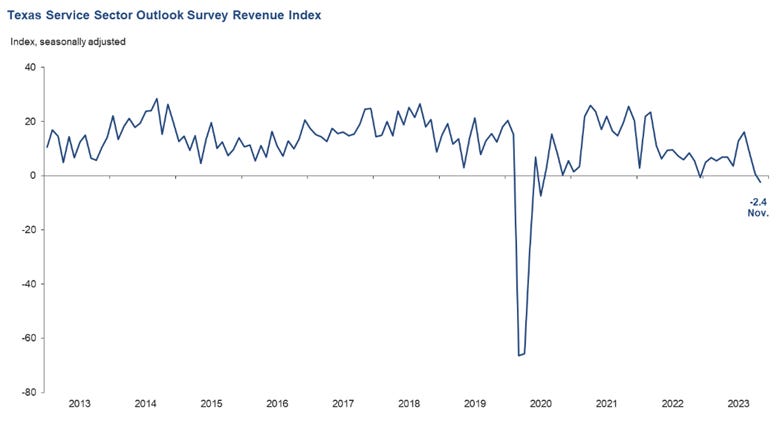

The Dallas Fed’s Service Sector General Business Activity Index increased to -11.6 in November from -18.2 in October. Company Outlooks (-8.1 vs. -12.8) were less negative, while Outlook Uncertainty (10.4 vs. 23) decreased. Revenue (-2.4 vs. 0.7) decreased to a contractionary rate. Employment (5.7 vs. 0.1) moved from neutral to expansionary, while Part-Time Employment (1.2 vs. -3.4) moved from contraction to slightly expansionary. However, Wages and Benefits (16.8 vs. 17) expanded at a very slightly reduced rate. Inflationary measures were mixed, with Input Prices (32.1 vs. 37.3) expanding at a decreased rate while Selling Prices (11.3 vs. 9.5) expanding faster. The six-month ahead outlook was mixed with general business activity expectations and company outlook improving but remaining contractionary and neutral, respectively. Revenue expectations remained well in expansionary territory while expected hiring activity weakened. Inflation expectations saw reduced cost pressures and higher pricing power. Capex plans increased slightly, remaining well in expansionary territory.

Key Takeaways: Comments

*The overall index fell into contractionary territory due to declines in revenue with outlook uncertainty falling

*Increases in employment and hours worked and improving current and future outlooks gave the report a more positive tilt despite headline contraction

Technicals, Positioning, and Charts:

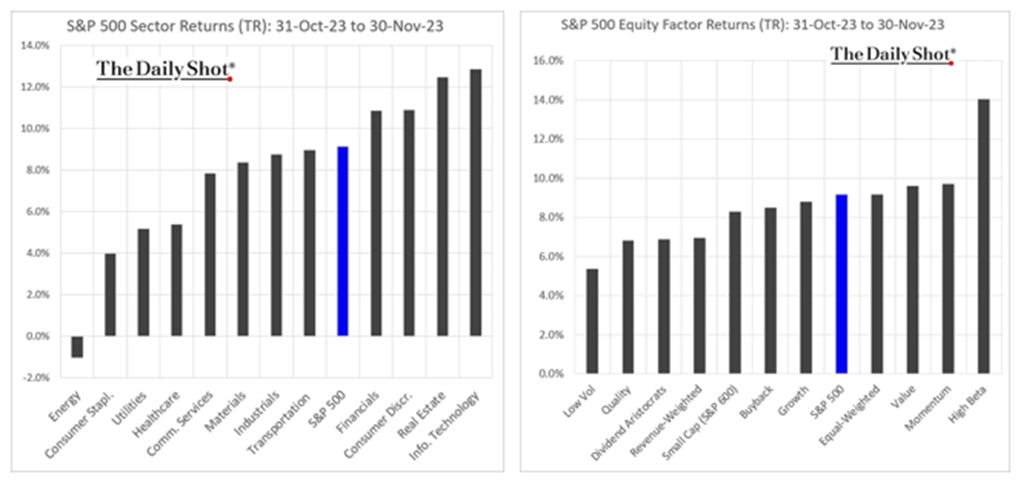

The Russell outperformed the S&P and Nasdaq on the week. Real Estate, Materials, and Industrials were the best-performing sectors, while Small-Caps, Value, and High Dividend Yields were the best-performing factors.

@Koyfin

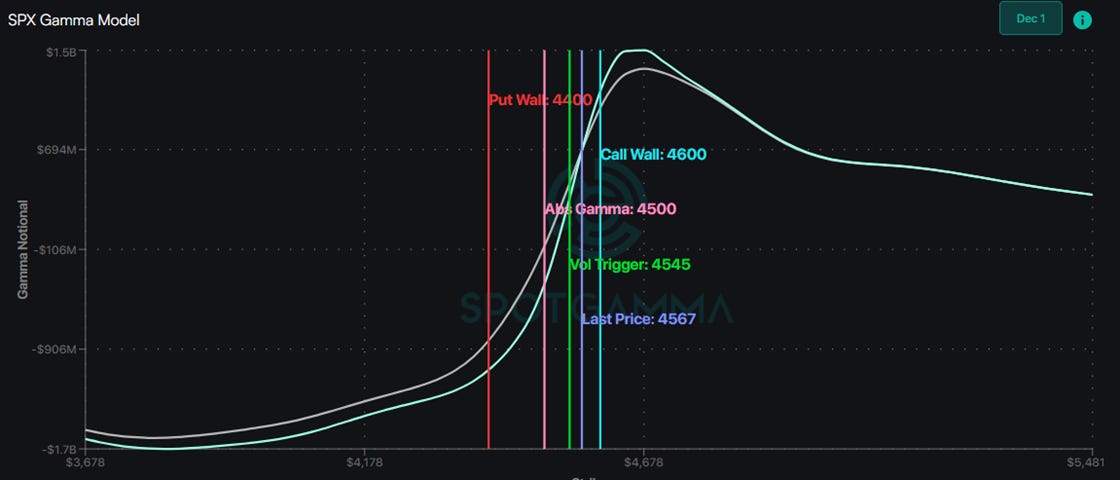

S&P optionality strike levels have the Zero-Gamma Level at 4507 while the Call Wall is 4600 and the Put Wall is 4400.

@spotgamma

S&P technical levels have support at 4580, then 4450, with resistance at 4620, then 4655.

@AdamMancini4

Treasuries are higher on the day, with the 10yr yield lower to 4.22%, while the 5s30s curve is stepper by 3bp on the session, moving to 26bps.

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the week, with Small-Cap Value the best-performing size/factor on the week.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week.

5yr-30yr Treasury Spread: The curve is flatter on the week.

EUR/JPY FX Cross: The Yen is stronger on the week.

Other Charts:

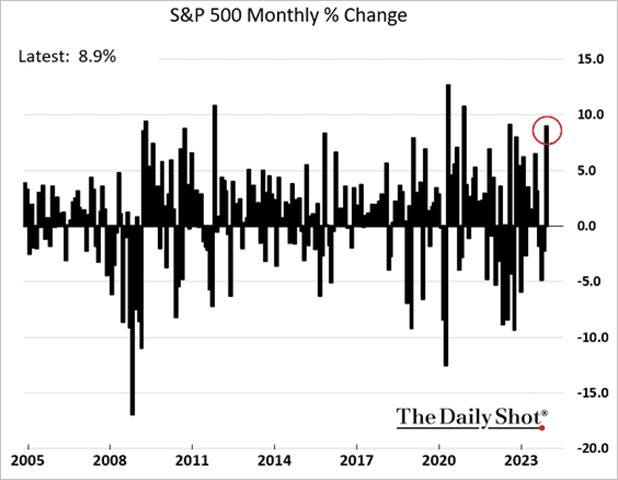

November was a historically strong month.

Sector and Factor performance was more mixed but broadly positive.

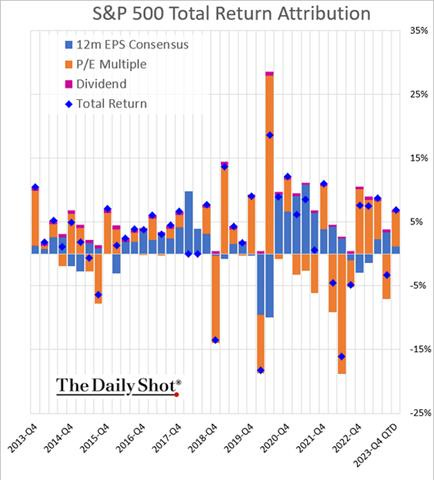

Multiple expansion was the main driver of returns on the month, although earnings consensus also rose.

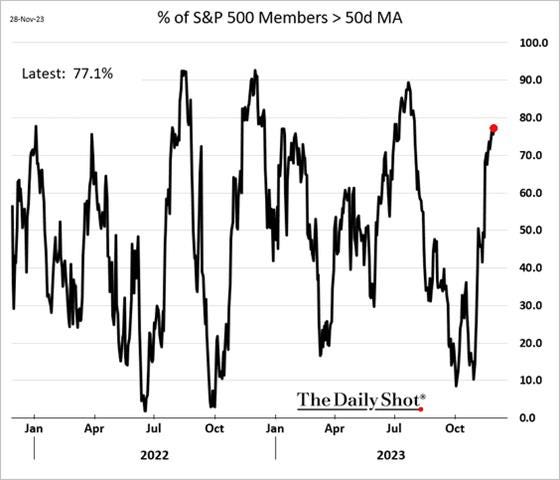

Market breadth continues to improve by most measures.

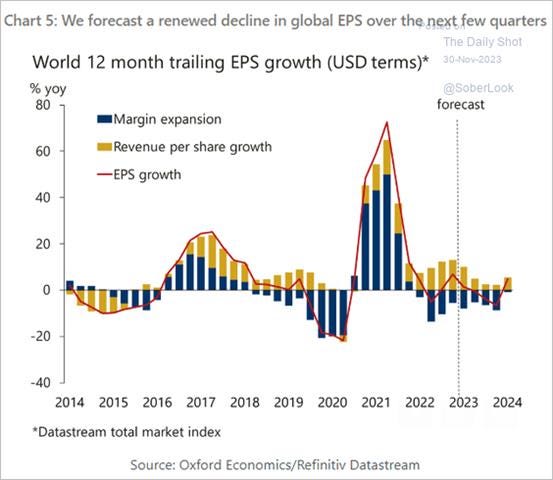

Oxford Economics expects declines in global corporate earnings due to slowing revenue growth and falling margins. We are sympathetic to this view.

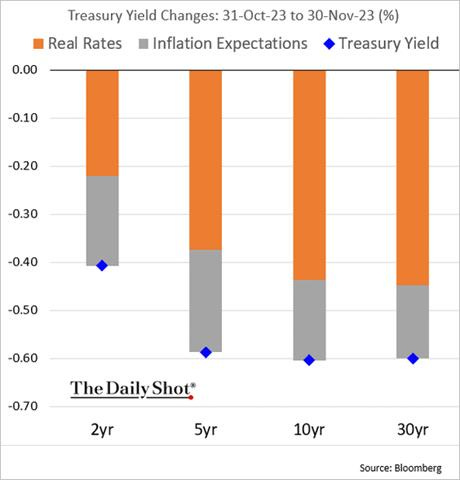

Declines in real rates were the primary driver of lower nominal yields in November.

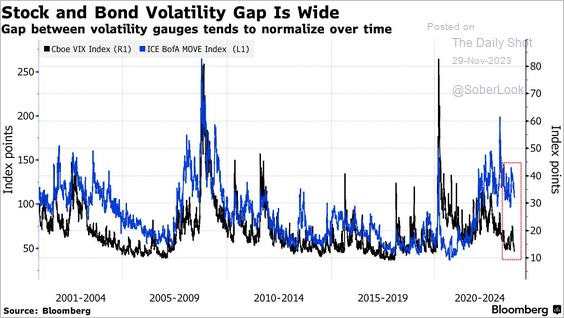

Stock market implied volatility remains low relative to rates vol.

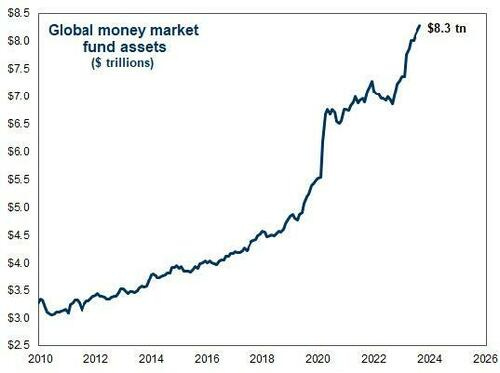

There is a record $8.3 trillion parked in global money market funds, according to Goldman

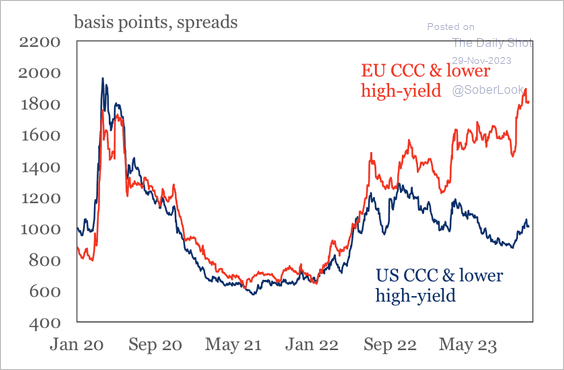

Credit spreads of stressed companies have diverged across US and European firms.

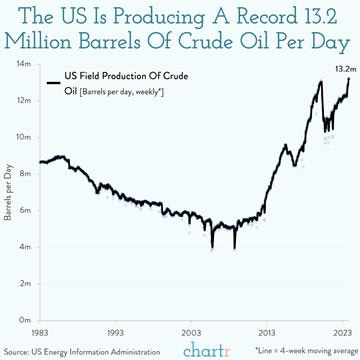

As of last year, the US accounted for nearly 15% of the world's crude oil production, with the nation’s crude oil production hit 13.2 million barrels per day, surpassing the pre-Covid peak. Texas alone contributing more than 40% of that.

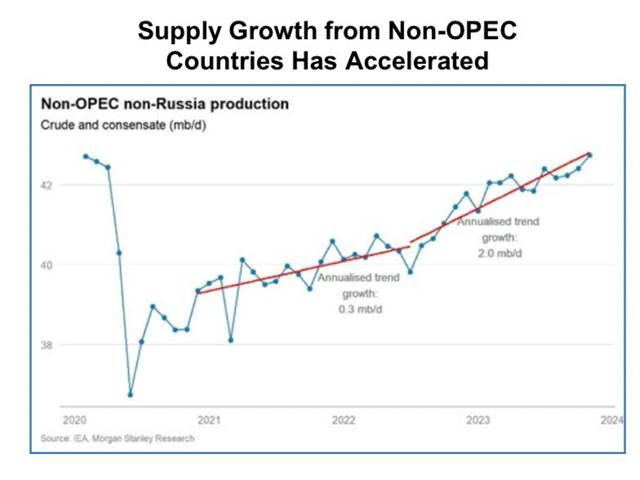

“Non-OPEC Supply Could Meet Global Demand Growth Through 2026 .. As a result, [we] see little room in the market for additional OPEC oil, and they project it to stay flat for the fourth consecutive year.” – Morgan Stanley

US Manufacturing PMIs from the ISM and regional Federal Reserve Banks have ticked lower recently.

The median new-home price in October was down almost 18% from a year earlier–the largest annual decline on record. National Association of Home Builders Chief Economist Robert Dietz said builders are making smaller homes and using incentives to keep prices down.

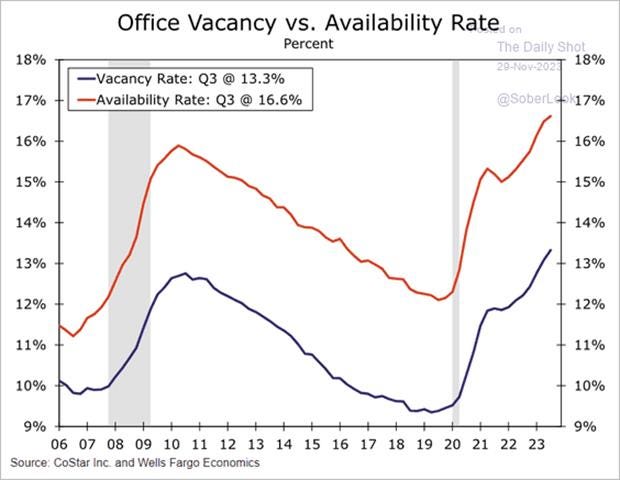

Office vacancy rates keep climbing.

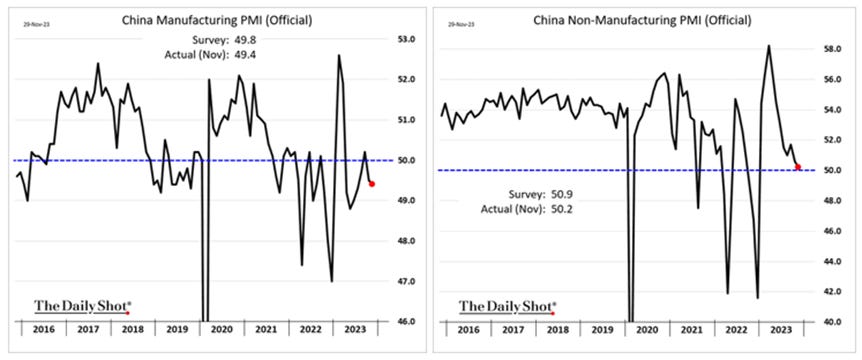

The Chinese government's official PMIs for manufacturing and service sectors continue to indicate weakness, with manufacturing moving back to contractionary territory while the service sector is at neutral.

Despite increased supportive measures by Beijing, property developer's shares continue to trend lower.

Articles by Macro Themes:

Medium-term Themes:

China’s Post-Pandemic Life:

Corruption Overhaul: China's top leadership has moved to crack down on financial corruption, with investigations of senior officials at financial institutions and government oversight agencies increasing more than fourfold in three years. Concerned about the potential destabilizing effects of troubles in the financial sector, the leadership under President Xi looks to reduce exposure to risks that could be sparked by corruption. Nikkei's tabulation of published material from the Chinese Communist Party's Central Commission for Discipline Inspection shows 67 officials under investigation this year, compared with 58 in all of 2022. This year's tally of probed officials is more than quadruple the 2020 total - China clamps down on financial graft, quadrupling probes in 3 years - NikkeiAsia

Failed Trust: Chinese authorities are taking more forceful action to contain the growing financial troubles of one of the country’s biggest shadow lenders. Police in Beijing said over the weekend that they had taken “criminal coercive measures” against multiple employees of Zhongzhi Enterprise. The privately held conglomerate operates several businesses that sold investment products to many wealthy individuals and companies in China, and has struggled for months to make promised payments to investors. Over the summer, a subsidiary Zhongrong defaulted on many of its high-yielding investment products and fueled fears of financial contagion from China’s worsening property downturn. As a result, Zhongzhi is on the brink of becoming one of China’s biggest corporate failures in years. The firm’s collapse could deal a major blow to investor confidence at a time when China’s economy is still struggling to return to health and its stock market is languishing. - China Scrambles to Contain a Looming Shadow-Bank Meltdown – WSJ

No Fiscal Discipline: Pan Gongsheng, governor of the People's Bank of China, warned on that certain financially weaker regions in the west and north of the country may have "difficulties servicing local government debts." "I understand that there are lots of concerns about China's property market," he said, amid persistent concern over weak demand and falling prices. On the local government debt issue, he acknowledged that "there are a lot of discussions" about it. Citing various statistics showing that China's share of public debt to gross domestic product is lower in relative terms than those of other economies, Pan insisted that these debts are used to finance infrastructure and are therefore "backed by tangible assets," hinting that this collateral provides a certain level of security. - China central bank chief flags regional debt servicing 'difficulties' - NikkeiAsia

Longer-term Themes:

Cyber Life and Digital Rights:

Problematic Algorithms: “When I open up my TikTok feed, two videos play one after the other. The first shows four Israeli soldiers dancing with guns, set against a blue sky. The other is a young woman speaking from her bedroom, with a prominent pro-Palestinian caption. TikTok's algorithm will determine what kind of videos I want to see and recommend similar content based on which of the two videos I watch until the end. The algorithms work in a similar way for other social media platforms, too, and it means some users are being driven towards increasingly divisive content about Israel and Gaza that only entrenches their existing views and biases. It matters because conversations on social media can shape public opinion - and normalize rhetoric that spills offline, at protests and beyond.” The article explores how social media is creating a more decisive world. - Slick videos or more 'authentic' content? The Israel-Gaza battles raging on TikTok and X - BBC

A.I. All Day:

Super AI: Sam Altman’s triumph in remaining OpenAI’s CEO was also a win for those seeking the swift development of artificial intelligence. OpenAI, and Altman himself, are at the heart of a debate about AI development: how quickly should humanity race toward building “artificial general intelligence,” that is, fully humanlike intelligence, or maybe even superhuman intelligence? According to nearly every expert covering this topic, we are nowhere near achieving artificial general intelligence, in no small part because we have such a poor understanding of how to build any intelligence, natural or artificial. Altman himself has said he wouldn’t put a date on when we’ll achieve artificial general intelligence. And yet, there are some in Silicon Valley who think we are close enough to achieving artificial general intelligence that we should at least be considering the profound and far-reaching implications of its genesis. That makes many people focused on this technology very nervous, on the theory that an AI smarter than us could go rogue and do civilization-ending things like seek the eradication or subjugation of the human race. - ‘Accelerationists’ Come Out Ahead With Sam Altman’s Return to OpenAI – WSJ

Killer Drone Swarms: Artificial intelligence employed by the U.S. military has piloted pint-sized surveillance drones in special operations forces’ missions and helped Ukraine in its war against Russia. It tracks soldiers’ fitness, predicts when Air Force planes need maintenance, and helps keep tabs on rivals in space. Now, the Pentagon is intent on fielding multiple thousands of relatively inexpensive, expendable AI-enabled autonomous vehicles by 2026 to keep pace with China. The ambitious initiative, dubbed Replicator, seeks to “galvanize progress in the too-slow shift of U.S. military innovation to leverage platforms that are small, smart, cheap, and many,” Deputy Secretary of Defense Kathleen Hicks said in August. There is little dispute among scientists, industry experts, and Pentagon officials that the U.S. will, within the next few years, have fully autonomous lethal weapons. And though officials insist humans will always be in control, experts say advances in data-processing speed and machine-to-machine communications will inevitably relegate people to supervisory roles. - Pentagon’s AI initiatives accelerate hard decisions on lethal autonomous weapons – AP News

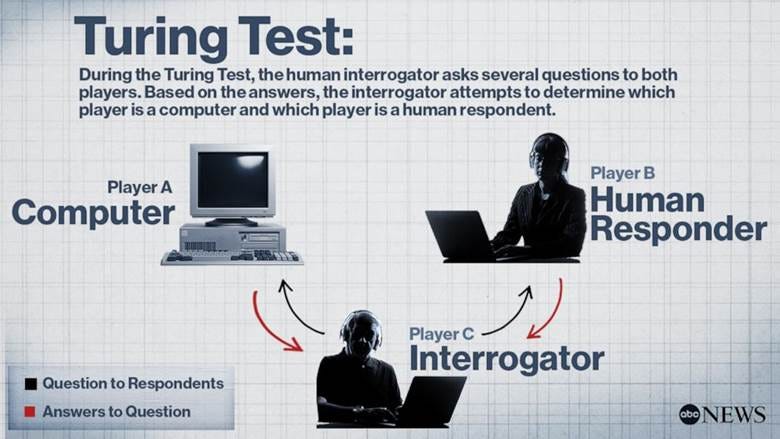

Turing Test: AI is getting better at passing tests designed to measure human creativity. In a study published in Scientific Reports today, AI chatbots achieved higher average scores than humans in the Alternate Uses Task, a test commonly used to assess this ability. The findings do not necessarily indicate that AIs are developing an ability to do something uniquely human. It could just be that AIs can pass creativity tests, not that they’re actually creative in the way we understand. However, research like this might give us a better understanding of how humans and machines approach creative tasks. - AI just beat a human test for creativity. What does that even mean? – MIT Tech Review

Energy’s Midlife Crisis:

Cheap and Efficient: In most of Europe, fitting a heat pump is one of the most powerful actions a person can take to reduce their carbon footprint. But in Norway, where clean-yet-inefficient electrical resistance heaters have long been common, upgrading to a heat pump is often a purely financial decision. Two-thirds of households in this Nordic country of 5 million people have a heat pump, more than anywhere else in the world. Norway also trained up a workforce to install them. In much of Europe, experts say, the lack of a skilled workforce is one of several bottlenecks holding the heat pump industry back. For now, heat pumps are still, in most countries, pretty small scale. The global stock meets only about 10% of the heat used in buildings, according to the International Energy Agency, and their needs to almost triple by the end of the decade to be on track for net zero emissions by 2050. Despite a boom since the recent energy crisis, when fossil gas prices soared, sales in parts of Europe and elsewhere suggest that goal is still well off-track. - ‘You can walk around in a T-shirt’: how Norway brought heat pumps in from the cold – The Guardian

Hot Rock: A first-of-its-kind geothermal project is now up and running in Nevada, where it will help power Google’s data centers with clean energy. Google is partnering with startup Fervo, which has developed new technology for harnessing geothermal power. Since they’re using different tactics than traditional geothermal plants, it is a relatively small project with the capacity to generate 3.5 MW. For context, one megawatt is enough to meet the demand of roughly 750 homes. The project will feed electricity into the local grid that serves two of Google’s data centers outside of Las Vegas and Reno. Unlike wind and solar farms that are sensitive to weather and time of day, geothermal projects can generate electricity on a more consistent basis. That’s one reason why Google is working to bring more projects like this online. - Google’s new geothermal energy project is up and running – The Verge

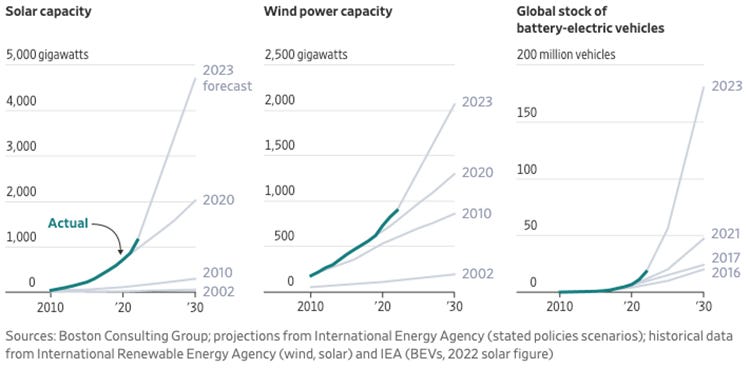

Dramatic Price Declines: Driven by falling costs and better technology, growth in renewables has consistently exceeded expectations. In 2009, the International Energy Agency predicted that solar power would remain too expensive to compete on the grid. It continued to underestimate the growth of renewable energy and EVs. Last year, more than four-fifths of the world’s new power capacity was renewables, according to the International Renewable Energy Agency. Subsidies drove early growth in wind and solar, then technology refinements and large-scale manufacturing made them cheap. Lithium-ion batteries, which power cars and store electricity on the grid, plunged in price, too. In this view, renewables, batteries, and EVs will become more popular as they get cheaper and better. Emerging green-energy technologies such as hydrogen, which is benefiting from government support and a surge in private investment, could follow the same path. - Now for Some Good News About Climate – WSJ

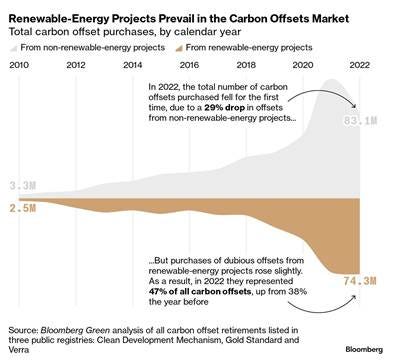

Less Offsets: Purchases of carbon offsets by banks, airlines, industrial heavyweights, and other businesses fell for the first time last year, according to Bloomberg Green’s analysis of data in three public registries covering more than 260,000 transactions since 2010. Further, the 17% drop in demand for all offsets in 2022 from 2021 doesn’t reflect the impact of more negative events this year. Within this shifting trajectory for the carbon market and growing questions about its efficacy, buyers haven’t necessarily been switching to higher-quality offsets. Even as transactions declined last year, corporate buyers increased purchases of offsets derived from particularly controversial sources such as wind, hydro, and solar projects. Most experts have written off these renewable energy credits because power from these sources is already the cheapest option in most parts of the world. That means any extra funding from the sale of carbon offsets won’t move the needle on emissions. - Companies Are Dropping Carbon Offsets, But Still Buying the Worst Ones – Bloomberg

Food: Security, Innovations, and Climate Change Implications:

Total Imbalance: The historic drought in the Brazilian Amazon has imperiled the livelihoods of small farmers and fishermen and slowed shipments of grains and goods. Experts blame a combination of the El Niño weather phenomenon combined with heating in the Atlantic Ocean, likely aggravated by the climate crisis. They say severe droughts in the Amazon and other extreme weather events, like the record flooding experienced in 2021, will likely increase and intensify as global temperatures rise, adding extra pressure to one of the world’s most challenging business environments. “What projections show is that extreme climatic events are more likely to happen in the Amazon, especially extreme droughts,” said Erika Berenguer, a climate scientist and senior research associate at Oxford University. - Parched Rivers, Withered Crops Show Dire Impact of Amazon Drought - Bloomberg

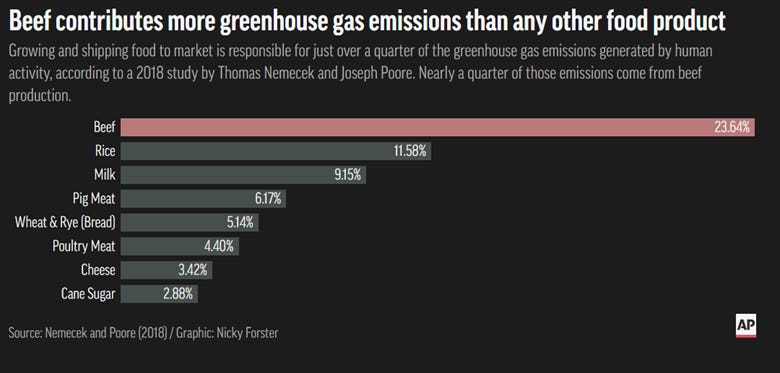

Burger Emissions: Beef is the largest agricultural source of greenhouse gasses worldwide, and it has a bigger carbon footprint than any other type of protein. Researchers and a growing number of ranchers believe there are solutions that address climate change and for a world in which people can buy, cook, and eat beef with a clear conscience. They point to efforts to change how cattle are raised to retain more carbon in the ground, to develop feed supplements that reduce gas releases, and to make genetic breakthroughs so animals digest their food without brewing up harmful gases. - Raising Better Beef – AP News

Authoritarianism in Trouble?:

Unfettered Power: Campaigning in Iowa this year, Donald Trump said he was prevented during his presidency from using the military to quell violence in primarily Democratic cities and states. “The next time, I’m not waiting. One of the things I did was let them run it and we’re going to show how bad a job they do,” he said. “Well, we did that. We don’t have to wait any longer.” Trump has not spelled out precisely how he might use the military during a second term, although he and his advisers have suggested they would have wide latitude to call up units. While deploying the military regularly within the country’s borders would be a departure from tradition, the former president already has signaled an aggressive agenda if he wins, from mass deportations to travel bans imposed on certain Muslim-majority countries. - Trump hints at expanded role for the military within the US. A legacy law gives him few guardrails – AP News

Cold Places (Deep Sea, Artic, and Space Colonization):

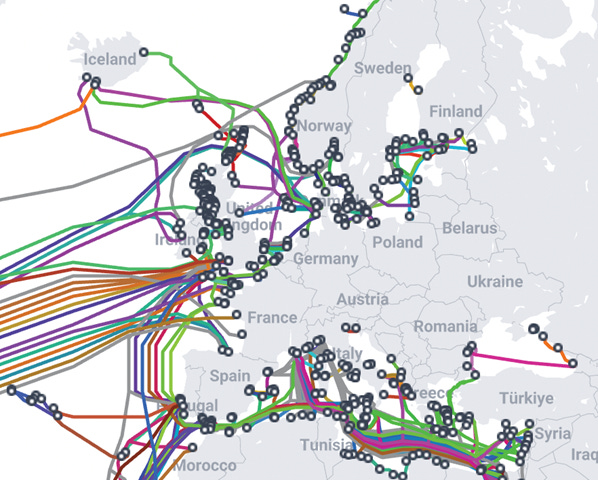

Securing the Cables: Britain said today it will send seven Royal Navy ships and a maritime patrol aircraft to take part in Joint Expeditionary Force (JEF) patrols of areas with vulnerable undersea infrastructure next month. JEF, a 10-nation military alliance of northern European countries, is focused on security in the High North, North Atlantic, and Baltic Sea region. Last month, Sweden said a Baltic Sea telecom cable connecting Sweden and Estonia was damaged at the same time as a Finnish-Estonian pipeline and cable. That followed explosions in September, 2022 that ruptured the Nord Stream pipelines under the Baltic Sea and cut Europe's supply of Russian gas. “The UK and our JEF partners will do whatever it takes to defend our mutual areas of interest, and today's display of unshakeable unity sends a powerful message of deterrence that we stand ready to meet any potential threat with force,” British Defence Secretary Grant Shapps said. - Britain to send seven Royal Navy ships to patrol areas with undersea cables - Reuters

Other Articles of Interest:

The Long Hall: Almost two years into the grinding war, this family and others around the country are coming to terms with the prospect of a much longer and costlier conflict than they had hoped for, and one that some now acknowledge they're not guaranteed to win. Ukraine's vaunted summer counteroffensive has so far failed to deliver a decisive breakthrough. Both sides are dug in along largely static front lines, and questions are being asked over whether foreign military aid will be as forthcoming as it was. Ukraine, which has said it has about 1 million people under arms, has barred military-age men from going abroad. Its constantly running mobilization program, which was declared at the start of the war, is a state secret. So are battlefield losses, which U.S. estimates put in the tens of thousands. This month, Ukraine's military chief said one of his priorities was to build up the army's reserves as he laid out a plan to prevent the war from settling into a stalemate of attritional warfare that he warned would suit Russia. The plan focuses on boosting Ukraine's aerial, electronic warfare, drone, anti-artillery, and mine-clearance capabilities. - 'At what cost?' Ukraine strains to bolster its army as war fatigue weighs - Reuters

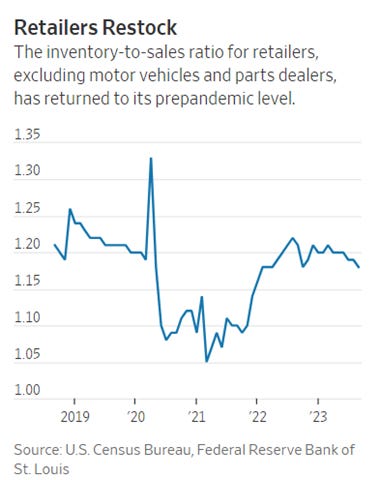

Leaner: Retailers are heading into their most crucial sales period of the year with a very different inventory strategy than they undertook in 2022. Many retailers have spent much of the year working through the stockpiles from last year and now say they have cleaned up their distribution centers and their balance sheets. Merchants from big-box retailers like Walmart and Target to more specialized sellers like Best Buy and Dick’s Sporting Goods have pared back their inventories while trying to focus their supply chains more tightly on products that shoppers want. For this holiday season, “there’s real risk to the inventory being in the wrong categories and in the wrong places,” David Bassuk from consulting firm AlizPartner said. “The fact that inventories are slightly down or slightly better than last year is not an indicator that it’s smooth sledding ahead.” - Retailers Have Cleaned Up Their Inventories for the Holidays – WSJ

Podcasts and Videos:

Solar Supply Glut Crushes Margins But Buildout Booming - Switched ON Podcast - Bloomberg

Macro Markets Podcast Episode 44: Corporate Credit Review and Preview

For Fun:

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.