Sequential 25bps Cuts Still Modal Outcome Until Q2 2025, but Deteriorating Labor Markets Will Keep Fed Officials “Open Minded”

Midday Macro - Color on Markets, Economy, Policy, and Geopolitics

August’s jobs report and CPI/PPI data didn’t materially change the picture for the Fed, leaving a 25bps cut the most likely outcome at next week’s September FOMC meeting

However, the need for a more two-sided risk management approach to policy is increasingly apparent, improving the odds of a larger rate cut down the road if growth/labor momentum continues to cool

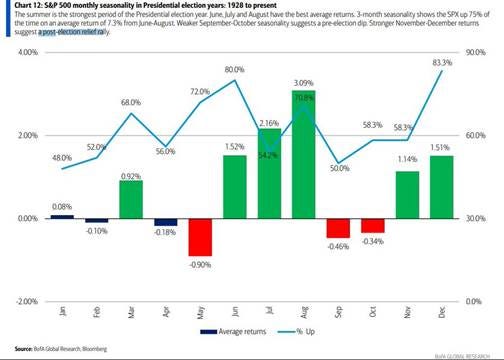

With poor seasonals, a high level of uncertainty regarding the outcome of the coming U.S. election, and a Fed that looks behind the curve, risk sentiment is likely to weaken, leaving the recent rally in equities in jeopardy, while rates and the dollar also need to adjust

The Fed is likely to cut rates by 25bps and signal similar cuts at following meetings through the SEPs…

If Powell wanted a 50bps rate cut at next week’s September FOMC meeting, this week’s inflation data didn’t help. Further, although labor markets continue to cool, August’s job report was not weak enough to instill a sense of alarm that the Fed is too far behind the curve and needs to act aggressively, as conveyed by Fed speakers following the release.

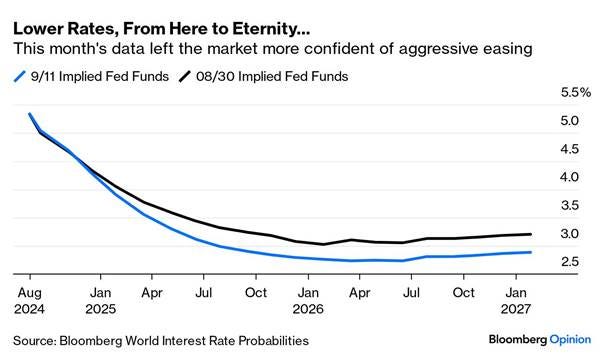

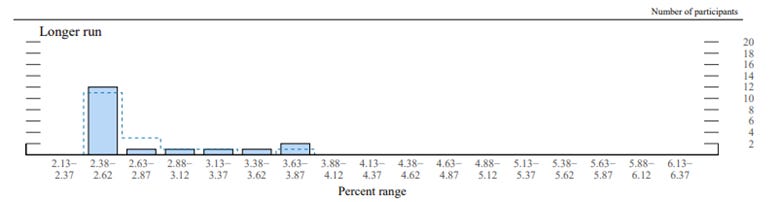

However, markets still believe the Fed will ultimately move close to their state r* level of a little under 3% by 2026. That means a lot of cuts are expected one way or another, leaving us again believing (as at the start of the year) that the market’s expectations for this easing cycle risk being too dovish.

To be clear, although we believe Chair Powell would prefer to cut by 50bps given what we gathered from his Jackson Hole speech, the majority of the FOMC, especially voting members, have indicated they favor a 25bps move.

“At this point, I don’t see any warning signs… too early to know the pace of coming rate hikes” – SF Fed President Daly

“I see a loosening labor market being driven by a lot more supply. Now, what’s the urgency? We’re not in a situation, I don’t believe, where there is this big cliff there” – Richmond Fed President Barkin

“The data that we have received in the past three days indicates to me that the labor market is continuing to soften but not deteriorate, and this judgment is important to our upcoming decision on monetary policy.” – Governor Waller

However, in the end, if Powell wants to lay the case out for 50, he will find enough people to go along with him. But we believe that this is not the case, and he is willing to be patient, delivering a more dovish press conference along with SEPs that show weaker growth and employment projections backed by an additional two cuts for 2024 (back to 4.6%) and two additional cuts in 2025 (to 3.6%).

“But it’s so simple. All I have to do is divine from what I know of you: are you the sort of man who would put the poison into his own goblet or his enemy’s?” – Vizzini in The Princess Bride (meant to be a paradoy of Powell’s phone calls to other Fed officials this week)

Unfortunately, this will likely not be enough to support risk sentiment. If the Fed forgo a jumbo cut this month, we believe equities will sell off while the Treasury curve flattens. The dollar would also be better supported, although it would be a mixed bag across various crosses given central bank activity and growth divergences elsewhere.

In the end, although a faster cutting cycle will be signaled in the updated SEPs, it will be accompanied by a weaker growth/employment outlook and not enough of a change in inflation projections downward to indicate a meaningful easing of policy (the real Fed fund rate would fall by less than nominal).

We also worry there could be a further creep higher in the long-term Fed funds rate, as seen in prior SEPs, which would complicate the attempt at delivering a “dovish” 25bp cut message (as the Hawks push back).

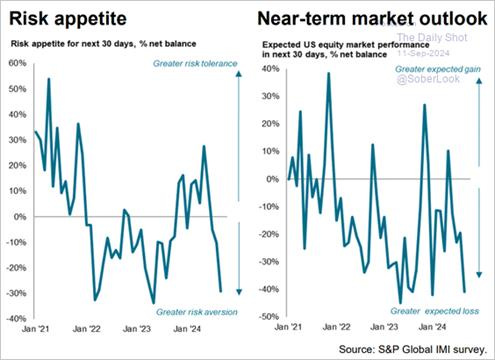

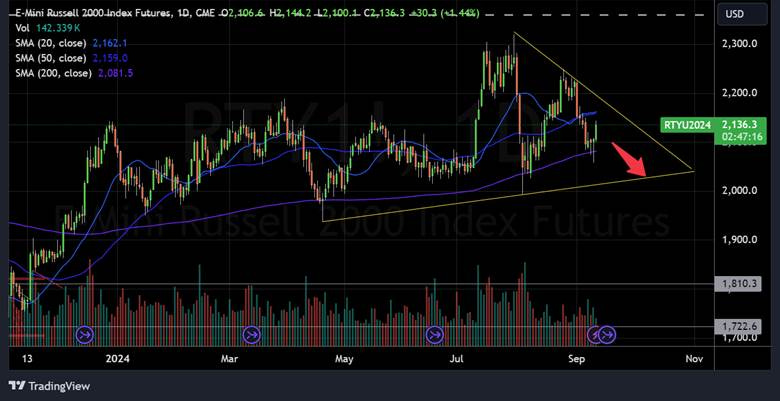

The bottom line is that worries that the Fed is behind the curve will increase market volatility into an already seasonal weak period for risk appetite, along with the higher level of uncertainty brought on by the election. As a result, we are entering a short Russell Index ($IWM) and a short GBP ($FXB) position. Since our last writing, we have been stopped out of our S&P, Nasdaq, and Semiconductor Index longs for an 8.1%, 7.1%, and 10.1% gain, respectively. Not bad for a one-month holding period.

Price Action is volatile again…

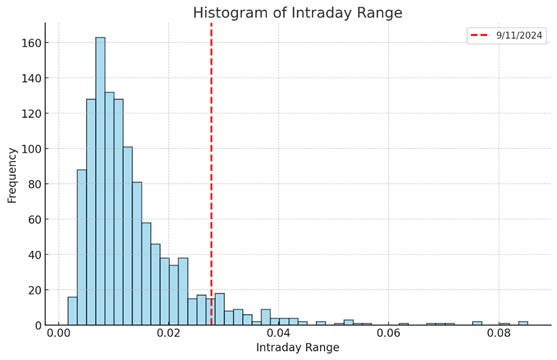

The S&P had been bouncing between 5,400 and 5,500 since August’s jobs report before breaking out yesterday primarily due to 0dte call buying on $NVDA, which led the index to experience its largest intra-day range since 8/1 and putting it in a more positive gamma zone.

Meanwhile, the VIX has broken meaningfully below 20 after spending much of September gravitating around there. Although these are positive developments, there is a lack of supportive catalysts moving forward (in our opinion), no confirmation in breadth or volume that this rally should continue, and given our worries the Fed will underwhelm in their attempt to appear dovish, we believe the S&P will likely retest 5,400 during the weaker seasonal period in the back-half of September into October.

Reduced growth expectations due to weaker labor market readings and softer data elsewhere have paused the “rotation” trade, with sector performance more nuanced but cyclicals underperforming, while growth is outperforming value, somewhat showing a more negative risk sentiment backdrop.

Given the likelihood of continued cooling in hard and softer data due to the added uncertainty (for both businesses and consumers) from the coming election (causing a drag on spending/investment activity), it is unclear if this is simply a pause in real activity that will restart in Q4 or the beginning of a more prolonged downturn.

As a result, there is no reason to believe risk sentiment will improve in the near term, leaving us wanting to be short equities, in curve flatteners, and long the dollar.

There is still a stable macro backdrop for growth to build on in the U.S…

We are more positive risk assets in the medium to longer term following the passage of the election and the start of the Fed’s easing cycle.

Firm and household balance sheets and income statement fundamentals are now more neutral in supporting growth. Still, they are far from recessionary indicating levels given no excessive leverage and negative cash flow dynamics (yet). We see a normalization of the economy that is being exacerbated to the downside faster than expected due to the current highly uncertain environment, not due to longer-term structural headwinds.

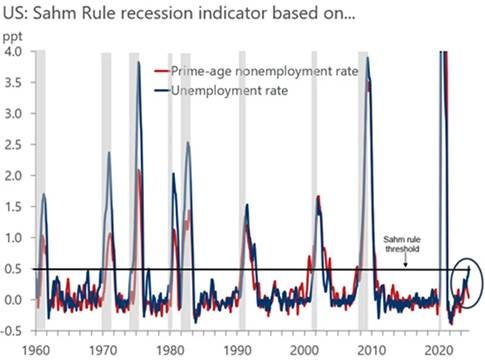

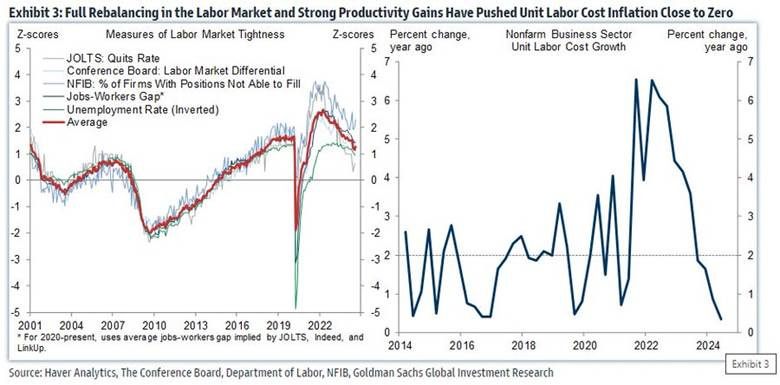

Labor markets are cooling but not crashing…

At this point, most readers are tired of hearing about the “cooling” labor market. The absence of layoffs indicates that we are in a better balance with firms replacing labor but not reducing it, leaving us lacking the red flags needed to truly set off recession fears.

While payrolls are now running at a sub-immigration absorbing level, rises in real wages are supporting consumption enough for us to believe final domestic demand will be above 2% for Q3 (even with reduced investment activity).

Further, the high participation level of prime workers reduces worries about a rising unemployment rate. Using only prime-age workers, the now popularly cited Sahm Rule is far from being triggered.

The bottom line is that there is still a lot of meat on the “labor bones,” meaning even if payrolls persist at current weaker levels, there would still be enough aggregate real income to thwart an outright downturn and instead support a below-trend period of growth, something we have believed was coming toward year-end for some time.

Further, individual labor units appear to be becoming more profitable, reducing their marginal variable cost and increasing the thresholds to which they may be laid off. As a result, although hiring may continue to stagnate in the coming months, it is also unlikely, in our opinion, that we will see a notable pickup in layoffs.

Consumer still a mixed picture…

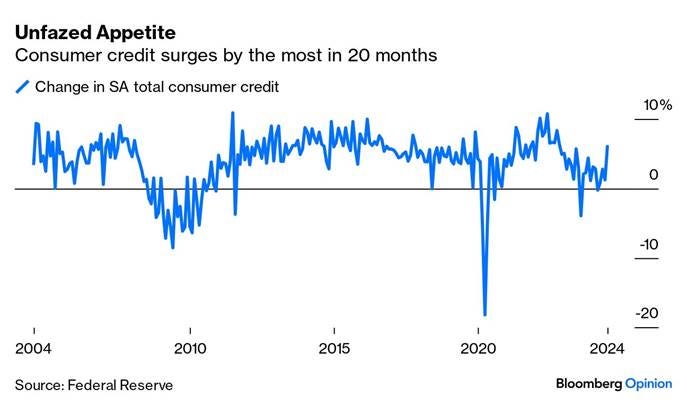

It is worth highlighting that although official spending data continues to show positive momentum (+2.7% YoY in real terms as of July), it is increasingly being driven by borrowing and not income gains or excess savings.

JP Morgan rattled markets this week with comments that credit card balances were roughly 25% above where they were pre-pandemic. With defaults trending higher, they warned that market expectations for their 2025 net interest income and expenses are too optimistic. The Fed consumer credit report also amplified this worry of growing consumer debt, which showed a notable jump in both revolving and non-revolving credit levels in July.

We also received our now weekly reminder that lower-income households are in real trouble from Dollar Tree earnings last week. It did nothing to alleviate worries that this cohort is the canary in the mine, with middle and upper-income soon to pull back on their own discretionary spending more meaningfully sooner than later.

“..a portion of the EPS miss was attributable to a comp shortfall which reflected the increasing effect of macro pressures on the purchasing behavior of Dollar Tree’s middle-& higher-income customers” - Dollar Tree CFO

Of course, this fear has been countered by reports that back-to-school spending has been robust, Labor Day leisure and hospitality activity was solid, and Q2 earning reports from the likes of Walmart and Target indicated no real step down in purchasing activity yet. All of this leaves us with a glass-half-full, half-empty view of the consumer.

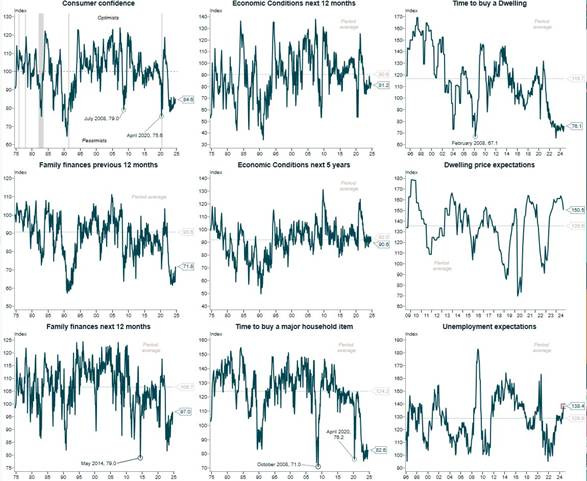

Regarding consumer sentiment, consumers are still much less buoyant about the economy than they were before the pandemic, but despite increased political uncertainty, sentiment surveys have been hanging in recently. Various factors seem to be driving that, including lower gas prices, a decline in mortgage rates, and a stock market still near all-time highs.

Finally, despite the many doom and gloom stories circulating about the consumer right now, sentiment around the consumer improved in Q2 earnings calls according to an index created by Goldman Sachs. This again emboldens our view that the narrative around the consumer is in the eye of the beholder, far from great but not yet alarming.

In summary, we are negative on risk tactically but not overly worried about a prolonged downturn in growth…

Growth concerns are justified. Labor markets are now in balance, and greater levels of layoffs will come if downward momentum in growth continues. Whether weaker investment levels and a more cautious consumer are due to the coming election or the beginning of a more prolonged downturn is still unclear to us.

What is clear is that equity markets are priced for perfection, with earning estimates and valuations very much reflecting the “Goldilocks no-to-softish” landing scenario. As a result, we are not compelled to chase this week’s rally; instead, we are looking to fade it with a tactical small-cap short into the end of September, with the catalyst lower being a Sept FOMC result that leaves markets worried the Fed is falling further behind the curve.

Rates also look overly optimistic on growth, given the recent curve steepening. As a result, we envision a flattening of the curve as a more risk-off environment takes hold over the next weeks. In our opinion, Fed cutting expectations, which are already too high, shouldn’t outperform the general flight to safety and grab for duration further out the curve.

To be clear, we have a lower conviction here, given how quickly lower the front end could move if both economic data and risk sentiment meaningfully deteriorated. However, continued concerns over growth accompanied by increased Fed policy error worries should be more supportive of the belly and long-end, in theory.

But risk sentiment should be supported over the medium and longer-term…

We believe this is still a world of normalization rather than more profound weakness due to households and firms starting the cycle in a solid position. At the same time, the Fed is eager to pivot and preserve the soft-landing outcome, leading to the more interest rate-sensitive parts of the economy to potentially recover quickly in 2025.

However, we are now entering a seasonally weak period of the year with increased uncertainty due to the coming election, loosening labor markets and what that means for expected (weaker) future growth. As a result, we want to be in a more defensive posture for a few weeks.

Next week, we will elaborate further on our dollar views and why we shorted the GBP as an expression of expected dollar strength as well as give our thoughts on the September FOMC results.

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.