Renewed Disinflationary Progress Keeps Equities and Rates Supported Despite More Hawkish Fed Dots and EZ Politics

Color on Markets, Economy, Policy, and Geopolitics

Renewed Disinflationary Progress Keeps Equities and Rates Supported Despite More Hawkish Fed Dots and EZ Politics

Midday Macro – 6/14/2024

This week’s weaker inflationary readings kept the “Goldilocks” narrative alive despite a more hawkish dot plot, continued growth worries, and the ramifications of recent European election results.

It is still unclear how the shift right in the European parliament will affect policy or whether it will translate to a move right at the national level in France or elsewhere.

For now, the initial risk-negative sentiment coming out of the June FOMC and emanating from worries around the future of the Eurozone, which has reversed much post-CPI price gains in riskier assets, looks to be overdone.

We continue to believe renewed disinflationary progress and slowing but not crashing growth will support rates and a further melt-up in U.S. equities.

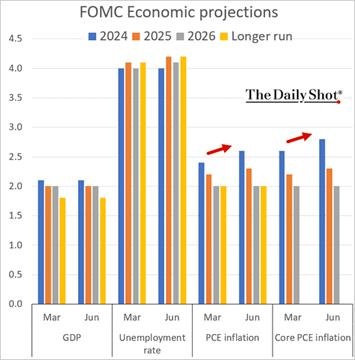

As expected, the results of the Fed’s June FOMC meeting left rates unchanged and reduced expectations to just one rate cut this year. Outside of the changes to median fed funds projections, there were relatively few changes to GDP and unemployment rate projections, while core PCE estimates were revised higher for this year and next.

In the press conference Fed Chair Powell confirmed that “the data has not given us that greater confidence” that would “warrant beginning to loosen policy at this time.” On labor markets, Powell continued to point to “a broad set of indicators suggest that conditions in the labor market have returned to about where they stood on the eve of the pandemic, relatively tight but not overheated.” Overall, the message delivered was more hawkish than markets expected, as seen in the reversal of some of the post-CPI price action.

Participants were largely split between one or two cuts this year. None thought more than 50 basis points of reductions (2 cuts) would be appropriate, while four expected no rate change this year.

When asked whether members had placed their dots before or after the inflation numbers, Powell revealed they had had the opportunity to change them, but it appeared many still didn’t move their forecasts.

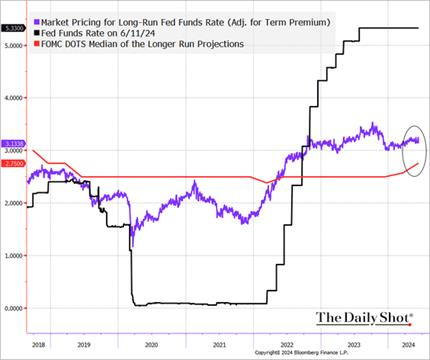

The median longer-run estimate of the Fed funds rate increased to 2.8% from 2.6%. We think there will be a continued drift higher as the Fed gradually raises the longer-run estimate of the neutral rate, which could go as high as 3.5% to 4%, as an implied 0.8% longer-run real policy rate remains well below longer-run real rates in markets.

There is a nod in the FOMC policy statement to the decline in the year-over-year core inflation rate in May, with progress toward the Fed’s 2% inflation objective now described as “modest” rather than lacking in the May statement.

In summary, Powell left the Fed’s options open, with the path of future policy still being data-dependent. A negative take is that policymakers don’t know where the economy is going, while a more positive interpretation is that the Fed's greater optionality and two-sided risk approach moving forward (with greater emphasis on labor market conditions) reduces the risk of a policy error. Either way, this week’s May inflation data was a positive step towards rate cuts later this year, likely in September. But there’s still too much unknown to go further than that, and the intent of any rate cuts this year will be to maintain an appropriately restrictive stance of policy and prevent policy from getting too tight amid moderating inflation, not to ease the stance of policy.

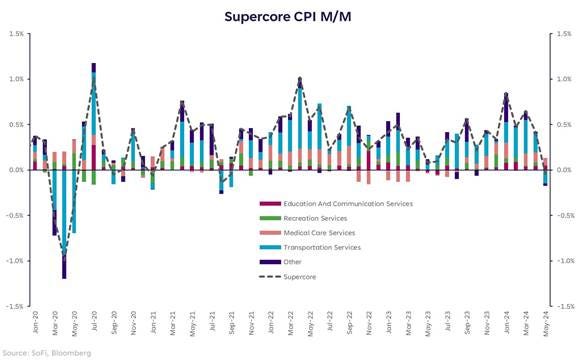

The “totality” of this week’s inflation data, although only one month’s worth of data, was encouraging.

Of the 84 detailed components of the CPI that we can track back to 1998, only 24% showed one-month annualized gains above 5% in May, down from 30% in April, an average of 38% in the first quarter of 2024, an average of 33% in 2023, 60% in 2022, and 27% in the three years ending December 2019.

Core services CPI excluding rents were unchanged in May, the most benign monthly reading since September 2021.

Atlanta Fed’s Sticky Price CPI increased by 2.4% on an annualized basis in May, while the Cleveland Fed’s Median CPI increased by 0.2% MoM, or 4.3% YoY, the lowest annual rate since January 2022.

Auto insurance is a key component keeping core services ex-shelter CPI inflation sticky. Auto insurance carries a lower weight in core PCE, and the PPI inputs that feed it have been weaker than what CPI has captured.

The owner's equivalent rent component of the CPI was buoyed by increases in the NYC and Philadelphia metro area, and this is expected to reverse next month.

Momentum in core PPI ex-trade services is indicating further disinflationary progress for core PCE.

Nonfuel Import prices declined by -0.3% MoM, with consumer goods, capital goods, and autos all contributing to the overall decline.

With most of the slowing in market rents yet to feed through to the CPI (rents accounted for most of the increase in core services prices in May) and residual seasonality now being less of a headwind, core inflation is poised to decelerate sharply in the second half of the year. When considering the increased level of consumer price sensitivity and a more balanced labor market, reducing wage pressures, given no exogenous shock to energy or trade, we see it unlikely that inflation can meaningfully accelerate.

Looking beyond the U.S., the global growth narrative has become slightly more positive, with the World Bank upgrading its 2024 outlook, while May’s global PMI data indicates that business activity is broadly improving.

The S&P Global Manufacturing PMI increased to 50.9 in April, the fourth straight month of an increasing reading, moving the index to its highest level since July 2022.

Production readings are in their fifth month of expansion, with the rate at its highest level since December 2021.

New orders for goods rose at the fastest rate in 26 months in May, as inventory rebuilding is running at one of the highest paces since the global financial crisis, supporting a rebound in global trade.

Despite the inputs purchases by manufacturers increasing at a rate not seen in nearly two years due to restocking, global supply chains showed little stress.

However, the PMI Comment Tracker data showed wages and salary cost increases picked up again in the past two months, putting some upward pressure on factory selling prices.

Looking at the May PMI readings at a more country-specific level, it is clear that a broader expansionary pulse is occurring (versus a few outsized movers driving the global PMI index higher).

Asia PMI readings notably reaccelerated…

Japan’s Jibun Composite PMI increased to 52.6 in May, the highest reading since last August, while the Japanese Tankan Index has been steady, around 9, for three months

China’s Caixin Composite PMI increased to 54.2 in May, the highest reading in a year, with a faster increase in new orders supporting the upturn, especially in the service sector.

The HSBC India Composite PMI fell to 60.5 in May, the slowest expansion in the Indian private sector since December, although growth remained notably strong.

Elsewhere in Asia, South Korea’s Manufacturing PMI increased to 51.6 in May, returning to growth after two consecutive months of contraction, while Malaysia (50.2), Vietnam (50.3), Philippines (51.9), and Indonesia (52.1) manufacturing PMIs were all expansionary, as well. Further, Singapore’s Manufacturing PMI increased slightly to 50.6 in May 2024, showing an expansion for the 9th consecutive month, following a 50.5 reading last month.

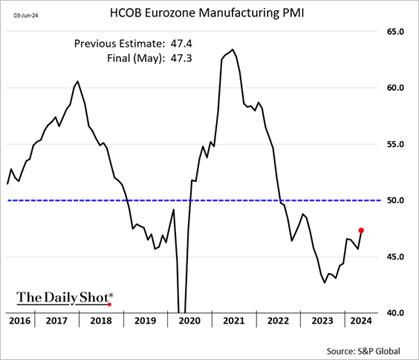

Europe and MENA PMI readings were mostly expansionary and improving…

The S&P Global UK Composite PMI was 53 in May, down slightly from April's one-year high of 54.1, indicating solid growth in private sector activity.

The HCOB German Composite PMI reached the highest level in a year, driven by new orders rising for the first time since April 2023, with the service sector seeing stronger growth and manufacturing experiencing a slower decline in new orders

The HCOB France Composite PMI was revised slightly downward to 48.9, and Although business activity dropped during the month, new orders improved for the first time in a year, driven by domestic demand.

The Nevi Netherlands Manufacturing PMI rose to 52.5, marking the strongest improvement in overall operating conditions since August 2022, with new orders at a two-year high.

The Swedbank Manufacturing PMI increased to 54, marking the third consecutive month of growth and the fastest pace of expansion since May 2022.

PMIs in Eastern Europe were more mixed. The Czech Republic Manufacturing PMI rose to 46.1, the second-weakest reading since August 2022, while the Hungarian HALPIM Manufacturing PMI stood at 51.8, unchanged from April, indicating moderate expansion. However, both Poland and Turkey saw further contractions in their manufacturing PMIs.

Although the Riyad Bank Saudi Arabia's PMI (four-month low of 56.4) and United Arab Emirates S&P PMI (eight-month low of 55.3) have both weakened, both are still in solid expansionary territory.

S&P Global South Africa PMI ticked up to 50.4 in May, the second straight month of slight improvement in business conditions, with firms increasing their inventories at the fastest rate in over nine years while job growth accelerated. However, the ABSA Manufacturing PMI dropped notably to 43.8 from 54, likely impacted by the recent election.

Finally, turning closer to home, the story is generally similar…

The U.S. S&P Composite PMI rose to 54.5 in May, up sharply from 51.3 in April and marking the strongest increase in business activity since April 2022, as growth accelerated in both manufacturing (51.3 vs. 50.3 in April) and services (54.8 vs. 51.3). While the ISM Manufacturing PMI declined back into contractionary territory, the ISM Service PMI notably increased to 53.8, the highest in nine months.

Elsewhere on this side of the pond…

The S&P Canada Manufacturing PMI dipped to 49.3 in May; however, the S&P Service PMI increased to 51.1, the first expansionary reading in nearly a year. Further, the Ivey PMI dropped to 52 from a two-year high of 63 in April, the tenth consecutive month of growth.

The S&P Manufacturing PMI for Mexico added 0.2 points from the previous month to 51.2, marking the eighth consecutive month of improvement in manufacturing operating conditions.

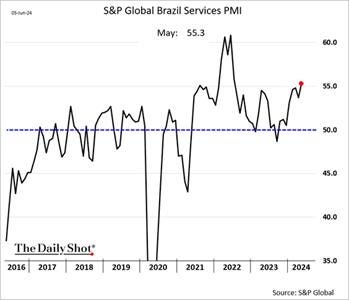

The S&P Composite PMI for Brazil fell to 54, marking a slowdown due to severe floods in Rio Grande do Sul but still reflecting the eighth consecutive month of expansion.

The main takeaway is that global growth looks to be powering through all the known headwinds (restrictive monetary policy in many places, heightened geopolitical risks, and a global consumer and business still uncertain and less confident due to their past inflationary experience)

The sustainability of this move higher in PMI readings and the belief it is leading an uptick in overall growth, of course, is debatable, and other harder and softer data is often not as supportive as the “totality” of the May PMI picture (depending on the country/region). There has been a global restocking of inventories due to improving demand over the last few quarters, and this tailwind for growth may be fading as demand for goods and, to a lesser degree, services, at least in the U.S., may be less robust in the second half of this year.

Further, and more specifically in the U.S., higher interest rates have reduced some capital investments while certain industries are still experiencing tight labor markets.

“The majority of respondents indicate that inflation and the current interest rates are an impediment to improving business conditions.” – May’s ISM Service PMI

“Wage inflation continues to be our biggest issue. We are caught between a rock and a hard place; we have to increase wages to keep our best employees, but we also have to invest capital to improve productivity so we can eventually do more with fewer people. The combined result is substantially less free cash flow for this year and next.” – May’s Dallas Fed Manufacturing Survey

“An overarching concern among banking contacts was the high cost of capital that prevented capital expenditures and deterred many of their business clients’ investment plans.” – May’s Beige Book - Philadephia District

However, digitalization and automation are still driving capex activity globally. The JPM Capex Nowcaster continues to trend higher over the year, with capital goods production, shipments, and exports all generally confirming a growing global capital investment narrative.

The bad side to a more robust global growth picture is the worry that inflation will remain more persistent. As a result, monetary policy will remain restrictive for longer than initially thought, increasing the chance of a policy error if the economy cools quickly. Markets have been pushing back on more dovish rate cut expectations all year, as best seen here in the U.S., with the number of cuts dropping from 6 in December to start the year to now one.

We now see that trend ending with markets likely adding cuts for more developed nations (outside Japan, especially for the U.S.) and taking cuts away from EM.

Where does this leave us with asset allocation and markets?

Specific to our own mock portfolio, we are still happy being long U.S. large caps and the Nasdaq. However, we are moving up our stops in case the current risk-off sentiment in Europe and small caps start to spread. We still believe this week’s inflation data leaves the “Goldilocks” macro backdrop in place (as discussed last week) and that this coming earnings season will not negatively surprise, given the stabilization in final domestic demand spending in late April and throughout May.

Technically speaking, the “cup and handle” formation still has room to run, while the current high level of positive gamma is supportive. Seasonality is also supportive. But it’s been a strong run, with falling breadth and volume, so the current consolidation needs to be watched closely.

We have also moved up our stop in our long-end Treasuries long position. Given our views on where inflation will head in the coming months, our belief labor markets are continuing to come into better balance, and what this means for the “totality” of the data, it seems likely yields will continue to drift lower, so we continue to have high conviction in this position. Seasonals and technicals are also supportive of this.

However, we have also moved very far and quickly here and want to lock in profits in case the narrative changes. An improvement in the outlook for European politics or a stronger series of growth readings domestically or abroad, as well as the BoJ finally tightening policy more meaningfully could cause rates to retrace recent gains, and with CTAs always lurking, things can move fast.

We are willing to remain short the dollar. We hope to write further about the ultimate effects of the European parliamentary elections and tease out what it could mean for equities, rates there, and the Euro. Still, things are moving around too chaotically. With our view on U.S. rates and growth, it seems unlikely that the dollar can meaningfully break out of its recent range. Further, with our own election period fast approaching, we will be joining the circus being observed across the pond.

We have closed our oil long for a little over a 3% gain. Fundamentals for oil are deteriorating quickly, with inventories rising on softer demand. The high run rate by refineries, which has supported the price, seems unlikely to persist given yields. Geopolitical risk premium has also fallen, but this could always quickly bounce back.

Finally, we remain patient with our EM exposure through our long China and Turkey equity positions. We still owe our readers a further explanation of why and hope to produce that in our next writing (in two weeks).

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it. We will be off next week.

Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.