MIDDAY MACRO - DAILY COLOR – 9/9/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:Narratives/Price Action:

Equities are flat, as a post-ECB rally now fading after a weaker overnight session with only small-caps holding gains

Treasuries are higher, as post-job claims data selling reversed with the curve now well bid keeping curve little changed

WTI is lower, down after headlines announcing China released strategic oil reserves created a sharp sell-off that later effectively reversed and then again reversed

Analysis:

Equities are reflecting a more reflationary/reopening outperformance theme today (with small-cap growth up 1%) on little new news or data; however, Treasuries are decoupled from this, with the long-end outperforming.

The Russell is outperforming the Nasdaq and S&P with Momentum, Small-Cap, Growth factors, and Financials, Energy, and Material sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4496 while the call wall remains at 4550; technical levels have support at 4515, followed by 4490, and resistance 4530.

Treasuries are higher, with the curve little changed as the significant level of corporate issuance and Treasury debt auction supply continues to be digested well, keeping yields trending lower across the curve.

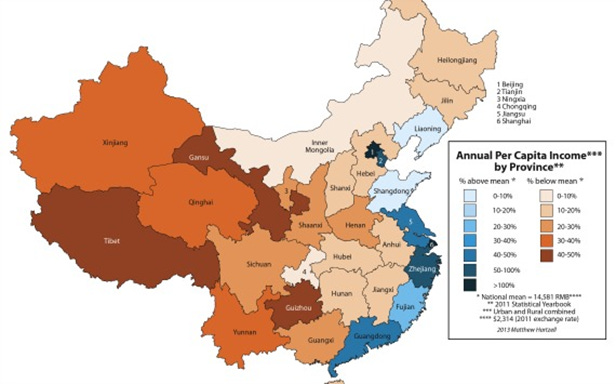

Last week we highlighted that the current rally (at the equity index level) is predicated on a significant level of “hope” that the current problems (Delta, shortages of materials and labor, and China) will simply work out. Today we take a deeper look at the probability China becomes a more positive pulse for risk assets.

The overarching “Common Prosperity” crackdowns continue and effectively encompass anything online, consumer-facing, and data involved. This, of course, is the primary driver of the significant declines in equity prices for specifically targeted sectors and is keeping investors more generally on edge and less optimistic about China’s future growth.

The primary purpose of the crackdowns has been to position the CCP/Xi as a champion of the common people, continue to consolidate power towards Beijing more broadly, and contain inflationary pressures. There is also an overarching goal of decreasing social unrest (through reducing wealth inequality) and promoting nationalism (through increased reliance on Big Brother and controlling information flow).

Domestic economic activity was severely hurt due to (wide-spread) lockdowns, although exports continue to be strong (despite weak new export order PMI readings for 4-months). Expectations are for additional macro-policy support, a pick-up in consumer activity (as reopenings last), and a turn in the credit impulse, all boosting (consumption, FAI, and export) growth into year-end and beyond.

Financial market commentary continues to gravitate towards the current Evergrande saga. Still, the Shanghai (+6.3% YTD) and Shenzhen (+7% YTD) Indexes are positive on the year despite pressure on “crackdown” sectors and rising NPLs in investment holding companies. Both current and capital flows remain in positive territory on the year and FDI continues to increase supporting financial assets (broadly) and the renminbi.

Putting everything we highlighted together, there is a significant level of hope at play that the crackdowns will ease, Beijing will be more supportive of growth (both domestically and geopolitically), and Covid cases dissipate, allowing domestic consumption to reemerge and manufacturing capacity to rise.

However, and the bottom line, we have not meaningfully seen these hoped-for positive developments fully materialize yet (certainly not in crackdowns, slightly in the other two) and, as a result, can not have too much conviction on overweighting Chinese equities or relying on China’s growth impulse to help rally global risk assets more generally. We remain neutral on this one of three “hope” areas.

= hope

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week, but little changed again today

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, although higher by around 1% on the day as coking coal continues to make record highs

5yr-30yr Treasury Spread: The curve is flatter on the week, down slightly today despite positive data and reflation-trade themed outperformance

EUR/JPY FX Cross: The Yen is stronger on the week, as ECB meeting’s recalibration" of the ECB's emergency bond purchases came inline with expectations

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Never-ending Story: U.S. Ports See Shipping Logjams Likely Extending Far Into 2022 – WSJ

Leaders of some of the busiest U.S. ports expect congestion snarling maritime gateways to continue deep into next year, as the crush of goods from manufacturers and retailers looking to replenish depleted inventories pushes past shipping’s usual seasonal lulls. The congestion has contributed to a worldwide shortage of shipping containers and spiraling costs for ocean freight.

Why it Matters:

Hundreds of thousands of containers are stuck aboard container ships waiting for a berth or stacked up at terminals waiting to be moved by truck or rail to inland terminals, warehouses, and distribution centers. When the boxes do move, they are often snarled at congested freight rail yards and warehouses that are full to capacity. The bottom line, this is not ending anytime soon. As a result, growth will continue to be capped, and it will be hard to have a meaningful decrease in inflation while logistical problems continue.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Taking an Interest: Commerce establishes National AI Advisory Committee – FedScoop

The Department of Commerce has set up a committee to advise the president and other federal agencies on artificial intelligence issues. It seeks to recruit top-level talent to serve on the new panel, which is called the National AI Advisory Committee. DOC also seeks members for a new AI and Law Enforcement subcommittee. The committee will issue recommendations on U.S. AI competitiveness, workforce equity, funding, research and development, international cooperation, and legal issues.

Why it Matters:

AI and quantum computing is the end game. Nations that can lead there will win the current cyberwars being fought. The Chinese have been acquiring/stealing large troves of domestic and foreign citizens and other data to feed their AI programs with the goal of further creating a domestic authoritarian surveillance state while also destabilizing foreign adversaries (see article below). If the U.S. hopes to secure its data and defend its ever-increasing digital and electrical (hard and social) infrastructure, it will need to invest heavily (driven by federal policy) in AI and quantum computing technology development.

Lying for a Living: Pro-China Online Network Used Fake Accounts to Urge Asian-Americans to Attend Protests, Researchers Say – WSJ

A network of fake social media accounts linked to the Chinese government has attempted to draw Americans out to real-world protests against anti-Asian-American racism and popular but unsubstantiated allegations that China engineered the virus that caused the Covid-19 pandemic, according to U.S. security firms. The activity represents the first known example of suspected China-linked actors targeting Americans with the apparent goal of encouraging them to attend real-world demonstrations. “They’re copying the Kremlin’s playbook,” said John Hultquist, vice president of analysis at Mandiant, a U.S.-based cyber intelligence firm.

Why it Matters:

The Chinese social media network has also previously pushed claims that the virus originated in the U.S., promoted narratives that China has handled the pandemic exceptionally well, and sought to promote disinformation concerning the side effects of vaccines approved in the U.S., a tactic the Biden administration has also linked to Russia. The bottom line, social media will continue to be flooded with disinformation by many (bad) actors, creating a continued challenge for nations given the division (and stupidity in action) the disinformation is creating.

Electrification Policy:

Controversial Surveillance: German police secretly bought NSO Pegasus spyware – DW.com

The German Federal Criminal Police Office bought notorious Pegasus spyware from the Israeli firm NSO in 2019, it was revealed Tuesday. Parliament sources said that the federal government informed the Interior Committee of the Bundestag of the purchase in a closed-door session. According to Die Zeit, the software was procured under "the utmost secrecy," despite the hesitations of lawyers who worried the surveillance tool could do much more than German privacy laws permit.

Why it Matters:

In July, a consortium of news organizations reported on the extensive abuses of the Pegasus technology drawn from a list of potential targets in 2016 that included more than 50,000 phone numbers. Among the targets were human rights activists, journalists, lawyers, dozen heads of state, several government ministers, and senior diplomats. The German government has been asked specifically about the use of NSO spyware three times in recent years and has largely refused to account for its use or subject itself to scrutiny for it. Expect more developments here.

Grid Batteries: Battery Makers Tied to Power Grid Attract Big Investors – WSJ

Deep-pocketed investment firms such as TPG, Apollo Global Management, and Paulson & Co. in recent months have plowed hundreds of millions of dollars into the companies, which make what is called long-duration batteries. Companies that help manage the complex task of directing energy to and from battery storage platforms also attract big investors' interest. Venture capital firms have invested $4.9 billion in rechargeable battery companies so far this year, up from $1.6 billion in all of 2020, according to PitchBook.

Why it Matters:

Unlike mobile-phone or electric-car batteries that can deliver electricity for about four hours straight, long-duration batteries can discharge for longer periods, ranging from six hours to several days, and store far more power. That allows them to overcome the major drawback of renewable energy, which arent always available. The Energy Department in July set a goal of reducing the cost of grid-scale long-duration energy storage by 90% within the decade. “We’re going to bring hundreds of gigawatts of clean energy onto the grid over the next few years,” Secretary of Energy Jennifer Granholm said in a statement. We are still in the early innings here. Expect more private and public sector support/capital here.

ESG Monetary and Fiscal Policy Expansion:

Sunny Days: Solar energy can account for 40% of U.S. electricity by 2035 -DOE – Reuters

The Biden administration on Wednesday released a report showing the United States can get 40% of its electricity from solar energy by 2035, a significant jump. The Solar Futures Study outlines how solar energy can help decarbonize the U.S. power grid and help achieve a Biden administration goal of net-zero emissions in the electricity sector by 2035.

Why it Matters:

The administration is ramping up efforts to expand renewable energy. Last month, the Interior Department announced it would begin a process to ensure easier access to vast federal lands for solar and wind energy, addressing the renewable energy industry’s voracious need for acreage. Over 700 companies sent a letter to Congress seeking a long-term extension of a solar investment tax credit, which would "ease project financing challenges" and include standalone energy storage. On the flip side, The solar industry is highly dependent on China for materials and panels. The Biden administration has kept Trump-era tariffs on Chinese solar materials that have raised industry costs and tempered its growth.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.