MIDDAY MACRO - DAILY COLOR – 9/8/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, with domestic growth outlook being lowered into year-end, reduced central bank support, and continued crackdowns in China weigh on risk sentiment

Treasuries are higher, supported by the more risk-off tone and confusion over the size of the “social” infrastructure bill coming into question again following further comments from Manchin

WTI is higher, with Gulf of Mexico output still shut-in, continued uncertainty over JCPOA 2.0 negotiations with Iran, and protests in Libya limiting exports helping lower supply expectations

Analysis:

Equities are reflecting a more risk-off tone as expectations for a renewed push higher (in reflationary themed areas) following the holiday weekend have failed to materialize, with traders focused on weakening growth outlooks (from sell-side research) as well as waiting for clues on ECB’s tapering plans from tomorrow’s meeting.

The S&P is outperforming the Nasdaq and Russell with Low Volatility, High Dividend Yield, and Value factors, and Utilities, Consumer Staples, and Real Estate sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4480 while the call wall remains at 4550; technical levels have support at 4530, and resistance is 4490.

Treasuries are higher, with the curve flattening into and following the 10yr Note auction while confusion over debt limits, social spending, and infrastructure battles stand loom in the back of minds.

The economy has clearly slowed from Delta reduced consumer activity and shortages of labor and materials, capping the available supply of goods and services. Still, pent-up demand remains robust, so beware of backward-looking data that paints an overly pessimistic picture into year-end.

Initial data is showing strong Labor Day consumer activity, seen in OpenTable bookings and box office receipts. We expect to see this confirmed in mobility and travel data as it becomes available.

The back-to-school buying season looks to have been in line with high expectations and, coupled with our belief that retailers are (painfully) building inventories to meet potentially historically high holiday demand, could allow for now lowered growth outlooks to be superseded.

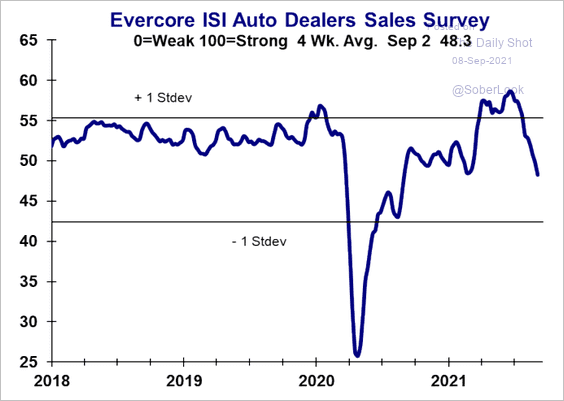

However, there has clearly been falling demand for big-ticket items (autos, appliances…) as price increases and continued shortages have materially dented consumer confidence/intentions while also simply capping the availability of goods and services (where demand has not weakened).

As a result, data released in September for August activity should continue to be weak, painting a further reduction in consumer activity/outlook already confirmed by consumer/business confidence/sentiment data, weakness in forward-looking aspects of business surveys, new orders for durable goods, and Friday’s job report, but again, this is backward-looking.

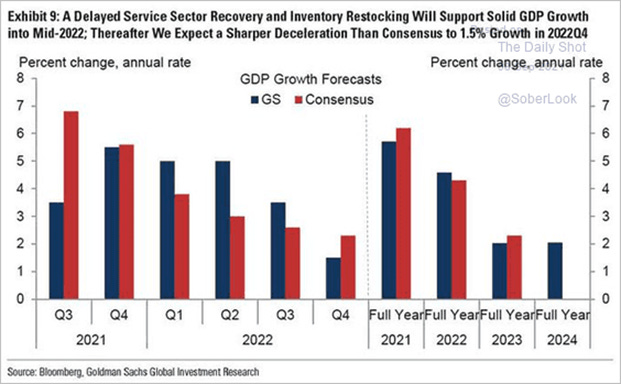

Instead of significantly reducing our growth outlook into year-end, we believe growth is being pushed forward (again) and, although too early to clearly tell whether there will be a renewed surge in Delta cases due to school reopenings, see a tail risk that expectations for the economy and subsequent earnings may become too negative for the remainder of the year. (Seen below in the downgrades occurring in the current quarter’s GDP growth level)

As a result of this growing negative sentiment, we may finally see that long-awaited -5% correction into month-end (a historically seasonally weak time for equities) that has eluded the current rally for some time.

However, and finally, we believe if this were to occur (or not), it would be quickly bought and start a year-end rally. This would be primarily due to; reduced Delta drag on consumer behavior, supply-side disruptions for materials and labor beginning to alleviate (due to less Covid induced logistical disruption and lower levels of savings forcing workers to return), while the Fed remains patient, keeping financial conditions supportive. We lay this all out as our current baseline case for equities into year-end.

Econ Data:

The number of job openings increased to a series high of 10.9 million in July, an increase of 749K from a month earlier and well above the market expectation of around 10 million. Job openings increased in several industries, with the largest gains in health care and social assistance (+294,000); finance and insurance (+116,000); and accommodation and food services (+115,000). The openings level was up in the Northeast, South, and West regions. Meanwhile, the number of hires declined by 160,000 to 6.667 million, while total separations, including quits, layoffs and discharges, and other separations, rose by 174,000 to 5.786 million.

Why it Matter: The larger than expected number shows the labor market remains tight (as seen in the 0.6% MoM increase in average hourly earnings last week). There is clearly a longer-term structural issue at play that will complicate the Fed’s ability to make substantial progress on their maximum employment mandate. Of course, the Fed previously highlighted that the August labor market data would be muddied as the back-to-school process was only starting. However, they will need to further clarify how they are looking at what could be structural changes in things like retirements and growing participation in the gig economy when judging what the appropriate EPOP level is.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week, but little changed as the correlation between the two has grown

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week despite recent increases in coking coal and steel prices as regulation/supply continue to weigh on sentiment

5yr-30yr Treasury Spread: The curve is little changed on the week, although steeper today into and following a well-received 10yr auction

EUR/JPY FX Cross: The Euro is stronger on the week, continuing its three-week outperformance and hitting technical resistance for the cross

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Record Territory: Boxship charter rates hit unprecedented $200,000 a day – Splash247

A new report from UK consultants Shipping Strategy points out that the cost of shipping a box on average has risen sevenfold this year compared to last year. The Freightos Baltic Exchange Container Index stands at over $10,000 per teu, having broken through $2,000 per teu in January this year. “The market is still very much two-tier, with short employment being negotiated at stratospheric figures, up to $200K per day for some ships, while the more conventional 24 month and 36-month charters are commanding significantly lower, albeit historically high, rates” Alphaliner noted in its most recent weekly report.

Why it Matters:

Looking at the big picture, new analysis from Copenhagen-based Sea-Intelligence shows that the 11 global carriers that report their results recorded a combined EBIT of $24.5bn in the second quarter. Putting this in perspective, the 11 carriers were only able to muster a total combined EBIT of $6.9bn for the entire period from 2012 to 2020. Commenting on the latest record-breaking figures emanating from the container shipping space, Peter Sand, BIMCO’s chief shipping analyst, told Splash: “While $200,000 a day is no market average, it shows that tonnage providers can ask for anything, and they are likely to get it, as long as freight rates remain profitable to carriers to the present extent.”

Please Go Out Instead: Consumer demand must ease to end supply chain crisis, says Maersk executive – FT

One of the world’s largest port and terminal operators has warned the global shipping and supply chain crisis that is leaving shelves empty can only be resolved by a slowdown in consumer demand. US imported goods in July were up 20% over the previous year, and 11.5% over 2019 as consumers demand surged, with spending supported by stimulus measures since the second half of last year. Port congestion hit a peak last week at Los Angeles and Long Beach ports in California, the main gateway for Chinese goods since the pandemic started.

Why it Matters:

Although admitting ports need more investment to improve infrastructure, Morten Engelstoft, chief executive of Maersk-owned APM Terminals, said a “vicious circle” had been created by surging demand putting strain on container groups, suppliers, and logistics companies as they struggled to deliver goods. At this point, we fear inventory will not be sufficient to meet holiday demand, capping growth in the second half of the year.

China Macroprudential and Political Tightening:

Escalating Pressure: What if China’s Property Crackdown Goes Overboard Too? – WSJ

Property is arguably the most crucial industry in China. Including related businesses like construction materials and housing appliances, the sector accounted for 16.4% of China’s economy last year, according to Nomura. However, starting last year with the “three red lines” policy, capping developers’ leverage, it is clear Beijing is continuing to clamp down on speculative and “excessive” activity. As a result, secondary transactions are now dropping, and developers sold 21% fewer homes in August than the year before.

Why it Matters:

Longtime China watchers expect the government to dial back property curbs when they bite too hard in the usual on-again, off-again fashion. The risk is that in the current fevered political and regulatory environment, the “on” button might stay pressed a bit too long, causing severe consequences for financial stability and growth. The slowdown in construction is already becoming a major drag on the economy through lower demand for construction materials and retail goods like appliances. That could soon spill over to the banking system.

"Data Security": China and Big Tech: Xi's blueprint for a digital dictatorship - FT

Beijing has pushed through reams of regulations and policies designed to create a “techno-authoritarian superpower” in which people are monitored and directed to an unprecedented degree through the agency of government-controlled cyber networks, surveillance systems, and algorithms. Personal data is collected through online interactions and a whole panoply of technologies designed to socially order a society of 1.4bn people. Digital social security cards, digital money, smart cities, surveillance cameras, social credit systems, and other technologies are being rolled out across the country, creating a grand experiment for 21st-century authoritarian governance.

Why it Matters:

Beijing aims to have it both ways. It believes that technologies will shore up social control and suppress political dissent without damping the entrepreneurial vigor or the innovation that animate the world’s fastest-growing large economy. However, Xi’s data vision has always stressed control. In 2013, he said that “whoever controls data has the upper hand.” A year later, he said that control of information had become an essential aspect of the country’s “soft power and competitiveness.” The official classification of data in 2020 as a “fifth factor of production,” alongside labor, land, capital, and technology, further revealed its importance to Beijing.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Source-Security: Intel to Invest Up to $95 Billion in European Chip-Making Amid U.S. Expansion – WSJ

Intel is investing heavily in efforts to expand and reset global semiconductor supply chains. The technology giant, which already has a fabrication site in Ireland, plans to spend $95 billion to build factories at an undisclosed site in Europe. The expansion in Europe is part of Intel’s push to become a significant contract chipmaker, an effort that includes plans for a plant in Arizona.

Why it Matters:

Intel Chief Executive Officer Pat Gelsinger on Tuesday predicted that the market for car chips would more than double by the end of the decade. Semiconductors, he said, would account for more than 20% of the material costs for new premium-segment cars, up from 4% in 2019, as new driver-assistance capabilities, flashy touch screens, and other features that require more processing power become more widespread. By moving production to Europe and the U.S., Intel is ensuring supply is near demand and removing the worries associated with production in China.

Electrification Policy:

Instability Needed: Cryptocurrencies: developing countries provide fertile ground - FT

In the developing world, there are signs that crypto is quietly building deeper roots. Especially in countries that have a history of financial instability or where the barriers to accessing traditional financial products such as bank accounts are high, cryptocurrency use is fast becoming a fact of daily life. Chainalysis ranks Vietnam first for crypto adoption worldwide — one of 19 emerging and frontier markets in its top 20, with only the US among advanced economies making an appearance at number eight in 2021.

Why it Matters:

Emerging markets are fertile ground for cryptocurrencies, often because their own are failing to do their job. As a store of value, as a means of exchange, and as a unit of account, national currencies in some developing countries too often fall short. Unpredictable inflation and fast-moving exchange rates, clunky and expensive banking systems, financial restrictions, and regulatory uncertainty, especially the existence or threat of capital controls, all support the demand for using crypto.

Hardware Harmful: Cryptocurrency prices tumble and exchange trading falters as snags crop up – Reuters

The price of cryptocurrencies plunged, and crypto trading was delayed on Tuesday, a day in which El Salvador ran into snags as the first country to adopt bitcoin as legal tender. Shares of blockchain-related firms also fell as crypto stocks were hit by trading platform outages. But the primary focus was on El Salvador, where the government had to temporarily unplug a digital wallet to cope with demand.

Why it Matters:

How robust is the infrastructure backing the crypto world? If moving El Salvador, a relatively small and developing nation to becoming a Bitcoin economy, caused a crash in prices, what would happen if a larger nation did this? We continue to believe that crypto has a long way to go before it can be used by any economy as a means of transaction and storage of value.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.