MIDDAY MACRO - DAILY COLOR – 9/29/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, with an overnight relief rally losing steam even after a post-NY-open bounce

Treasuries are higher, bouncing slightly off yesterday’s lows as DC uncertainty is outweighing inflation fears today

WTI is lower, as API and EIA inventory numbers showed increasing inventory while traders believe OPEC+ will hold to the existing plan despite price increases

Analysis:

Equities are slightly off yesterday’s lows after an overnight rally has faded, with the narrative one of uncertainty over the debt-ceiling standoff and continued concern regarding the effects of higher yields and a stronger dollar.

The S&P is outperforming the Nasdaq and Russell with Low Volatility, Value, and High Dividend Yield factors, and Utilities, Consumer Staples, and Health Care sectors all outperforming.

S&P optionality strike levels have the zero gamma level at 4401 while the call wall is at 4500, while technical levels have support at 4350 and resistance at 4400.

Treasuries are higher, but off the morning highs as the 5s30s curve is flatter by 1.4bps.

Econ Data:

The S&P CoreLogic Case-Shiller 20-city home price index increased at a fresh record 19.9% YoY in July compared to market forecasts of a 20% jump. Before seasonal adjustment, the U.S. National Index posted a 1.6% MoM increase in July, while the 10-City and 20-City Composites both posted increases of 1.3% and 1.5%, respectively. Phoenix (32.4%), San Diego (27.8%), and Seattle (25.5%) continued to post the most significant increases. The National Composite Index marked its fourteenth consecutive month of accelerating prices with a record 19.7% gain from year-ago levels. New York joined Boston, Charlotte, Cleveland, Dallas, Denver, and Seattle in recording their all-time highest annual gains

Why it Matters: The last several months have been extraordinary not only in the level of price gains but in the consistency of gains across the country. In July, all 20 cities rose, and 17 gained more in the 12 months ending in July than they had gained in the 12 months ending in June. Home prices in 19 of our 20 cities now stand at all-time highs, with the sole outlier (Chicago) only 0.3% below its 2006 peak. The National Composite, as well as the 10- and 20-City indices, are likewise at their all-time highs. The strength in the housing market has undoubtedly been driven by a reaction to the pandemic but there now looks like a secular change in location preferences could be occurring

Pending home sales declined 8.3% YoY in August but jumped 8.1% MoM, rebounding after two prior months of declines and pushing the index to its highest level in seven months. Expectations were for an increase of 1.4% MoM. Sales were up in every region but notably higher in the Midwest, contrasting a decrease in new home sales data for the region as reported by the Census Bureau.

Why it Matters: Certainly a more positive monthly increase than expected as higher prices have still not meaningfully deterred demand. This contrasts consumer confidence survey data which has indicated a growing reluctance to purchase big-ticket items during the same period. "Rising inventory and moderating price conditions are bringing buyers back to the market. Affordability, however, remains challenging as home price gains are roughly three times wage growth", said Lawrence Yun, NAR's chief economist.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week, with the value factor higher again as growth is still being hurt by the rise in yields

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week, with a bottom potentially in after months of weekly lower prices

5yr-30yr Treasury Spread: The curve is steeper on the week but slightly flatter today

EUR/JPY FX Cross: The euro is stronger on the week; however, the Yen is stronger on the day due to the more risk-off tone in global markets

HOUSE THEMES / ARTICLES

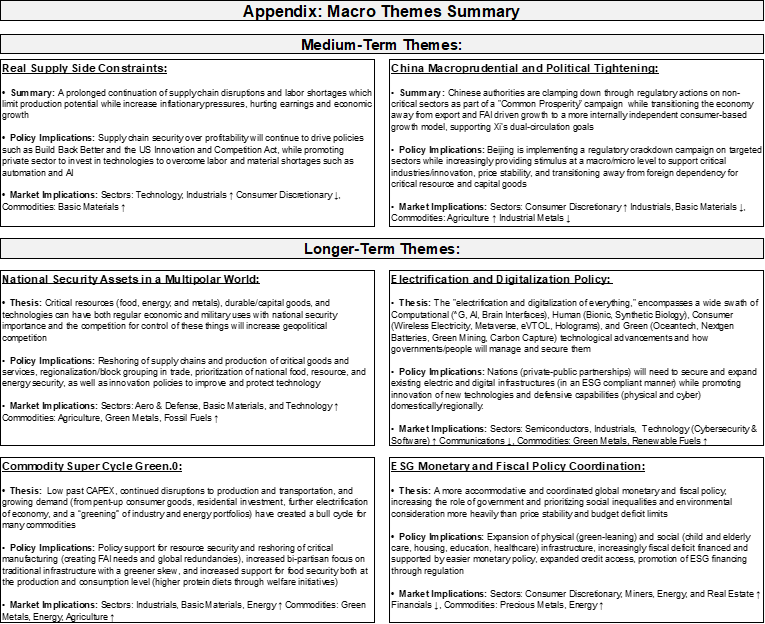

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

More Shortages: China’s Coal Shortage Means Higher Prices for the World – Caixin Global

With winter on the way for much of the world and natural gas prices at record levels, economies across the globe are competing for a finite supply of coal. At the center of the scramble is China, where stockpiles are low, and demand is at an all-time high. Inventories at six major Chinese power groups are down 31.5% from last year and at the lowest seasonal level since 2017.

Why it Matters:

While China mines half of the world’s coal, its supply hasn’t been able to keep up with its breakneck demand. Thermal power generation in the year through August is 14% higher than last year, while coal production is up 4.4%, in large part because of safety crackdowns after a spate of high-profile deadly accidents. Imports have risen more than 20% since the start of June but given no china and shut-downs elsewhere, there is little available, likely keeping prices rising.

China Macroprudential and Political Tightening:

Stepping In: Evergrande Losing Control of Bank Unit in $1.5 Billion Deal – Bloomberg

According to a filing to the Hong Kong stock exchange on Wednesday, the real estate conglomerate will sell about $1.5 billion non-publicly traded domestic shares in Shengjing Bank. Shengjing Bank demanded that the net proceeds be used to settle relevant liabilities owed to it by the developer. If Evergrande defaults on its debt, Shengjing Bank would need a state bailout, based on its exposure to the developer, according to a July report by UBS Group AG analysts led by May Yan.

Why it Matters:

The transaction underscores the mounting pressure on billionaire Hui Ka Yan to spin off and sell assets to pay down a mountain of debt. Evergrande’s original 36% stake in Shengjing Bank was among its most valuable financial assets, worth about $2.8 billion. That holding has become less appealing as regulators toughen oversight on dealings such as preferential lending and bond purchases between banks and their largest shareholders.

Leverage: ‘Hidden debt’ on China’s Belt and Road tops $385bn, says new study – FT

New research suggests that many countries’ financial liabilities linked to President Xi Jinping’s hallmark Belt and Road Initiative have been systematically under-reported for years. This has resulted in mounting “hidden debts”, or undisclosed liabilities of $385 billion that governments might be obliged to pay.

Why it Matters:

More than 40 lower- and middle-income countries now have levels of debt exposure to China higher than 10% of their national gross domestic product, the report estimated. The report was released as international debate rages over fears that China has pushed developing countries into so-called debt traps, which could ultimately result in Beijing seizing assets when debts are not repaid. It also means that China will have leverage over numerous nations, helping them pass/block policy in places like the United Nations and other international organizations.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Tech Partnerships: EU says U.S. trade, tech council to boost its clout, set rules for 21st century - Reuters

Washington and Brussels are set to convene in Pittsburgh for the inaugural meeting of the U.S. - EU Trade and Technology Council (TTC), which aims to expand and deepen trade and transatlantic investment ties. The TTC features ten working groups focused on technology standards, green technology, supply-chain security, data governance, export controls, investment screening, and global trade issues, among others.

Why it Matters:

The TTC will provide a critical venue for the two governments to coordinate and promote sound policies that strengthen collective supply chain resiliency and spur industry growth and innovation in critical sectors. "There is real strategic and geopolitical importance to this new platform as a way in setting standards and rules for the 21st century. So we need this Council to amplify our status," Dombrovskis told reporters.

Electrification and Digitalization Policy:

Meet the Jetsons: Say Hello to Astro, Alexa on wheels – The Verge

Amazon’s Astro is the company’s long-rumored home assistant robot. Amazon sees Astro as the next level of how Alexa can integrate into your home. On top of the normal things Alexa currently does, it can roam around your home delivering items and patrolling when you are not around.

Why it Matters:

As ambitious as the Astro is, it still is very much a first cut at what a home assistant robot could be. This is why Amazon is doing a limited release as they have much to figure out. The Astro is designed to track the behavior of everyone in your home to help it perform its surveillance and helper duties, according to leaked internal development documents and video recordings of Astro software development meetings obtained by Motherboard. We highlight this product release as a further step towards a world that records more and more of your personal activity/data.

Commodity Super Cycle Green.0:

U-Turn: Japan’s potential new premier supports nuclear power – Argus

The ruling Liberal Democratic Party of Japan (LDP) picked ex-foreign minister Fumio Kishida as its new party head and imminent Japanese premier, who is in favor of restarting safe nuclear reactors and considering replacing aging reactors to push ahead with the country's 2050 carbon-neutral goal.

Why it Matters:

During the election campaign, Kishida has emphasized that Japan's clean energy menu should be well balanced with a combination of sources such as renewable, hydrogen, carbon recycling, and nuclear to ensure stable supplies and cost competitiveness amid digitalization and rising electricity use. Yesterday we highlighted the U.K.’s move to increase nuclear power use and wanted to highlight the global trend further underway.

ESG Monetary and Fiscal Policy Expansion:

Opposing Interests: Industry Lobbyists Aim to Pick Apart Democrats’ $3.5 Trillion Spending Bill – WSJ

Lobbyists for drug, oil, and gas, tobacco companies, and other U.S. industries are pressuring allies in Congress to gut measures that would help pay for the bill by raising billions of dollars from their industries. Private-equity firms such as Blackstone and the Carlyle Group are fighting changes that would cost the industry more than $1 billion a year, mainly by lengthening the investment period needed to qualify for preferential tax treatment.

Why it Matters:

To be sure, the industry lobbying efforts are far from the biggest problems the bill faces as Republican opposition and infighting between the centrist and progressive wings of the Democratic Party are causing expectations of the final size and pay-fors to be reduced significantly. However, this division also gives lobbyists more power as they only have to convince a few Democrats to change their support/goals.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.