MIDDAY MACRO - DAILY COLOR – 9/23/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, as an inline FOMC meeting yesterday and diminishing Evergrande worries are fueling the continuation of the relief rally

Treasuries are lower, as a more hawkish dot plot and the general risk-on tone are finally weighing on the long-end, causing the curve to steepen

WTI is higher, as a lack of progress in negotiation between the U.S. and Iran during a U.N. meeting are supporting the post-Monday rally

Analysis:

Equities continue their rally today, with the S&P recapturing its 50-dma, lower implied vols allowing more systematic buying, and a flip in dealer hedging needs (to the buy-side), all keeping the post-Monday sell-offs bounce going post-NY-open.

The Russell is outperforming the S&P and Nasdaq with Momentum, Small-Cap and Value factors, and Energy, Financials, and Materials sectors all outperforming.

S&P optionality strike levels have the zero gamma level at 4428 while the call wall is at 4430, while technical levels have support 4395-4400 and resistance 4440 followed by 4460-70.

Treasuries are lower, as traders got the more hawkish FOMC message and are cueing off the general risk-on tone moving the 5s30s curve steeper by 4bps.

A generally dovish tone from yesterday’s FOMC meeting hid a moderately more hawkish message in the details, which markets surprisingly shrugged off, likely due to increased 2022 growth projections and reduced fears elsewhere (Evergrande/China).

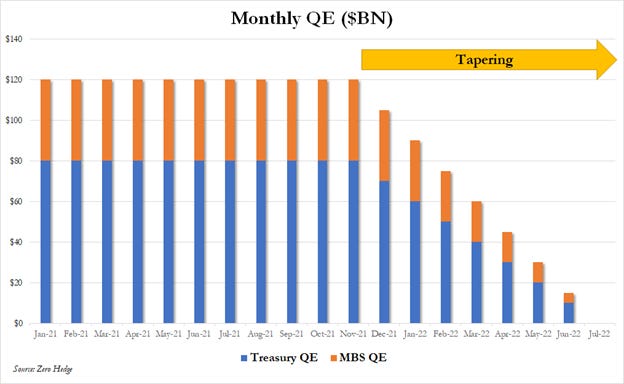

The Fed clearly signaled tapering would be announced in November “so long as the recovery remains on track,” with Powell adding that process should be concluded around the middle of next year ( a new piece of info). This means that there should be a $15 billion ($10bln Treasuries, $5bln MBS) taper a month starting in December and ending in June.

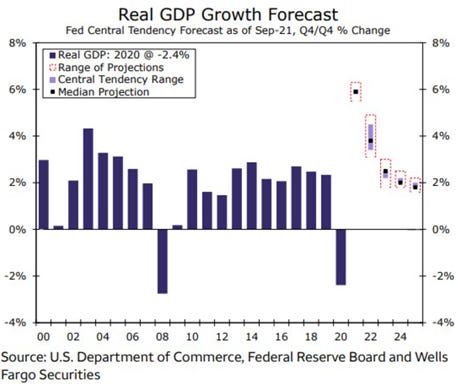

The Fed was more bullish on the economic growth next year, with the median projection moving higher to 3.8% from 3.3% in June, while core inflation was also marked higher to 2.3%, implying the transitory camp is losing some sway.

We were caught off guard by the move up in “the dots” in 2022 and 2023, with the median Fed Funds rate expectation now at 0.3% and 1% at the end of each year, respectively, indicating the first rate hike could be at the end of next year, not in 2023 (but there is a 9-9 split with the most influential members still likely in 2023).

Finally, Powell said the conditions for lift-off (rate hikes) are very different from tapering and noted the many of the employment indicators are “more than half the distance” to the maximum employment target. At the same time, the “substantial progress” test has been met on both fronts (inflation and labor) for tapering. The bottom line, markets are moving on now that there is greater clarity on policy.

Turning to China, the Evergrande saga is indicative of the challenges faced by Beijing as it tries to shift to a new consumer-driven growth model verse their historical debt-fueled fixed asset investment and export-driven one.

China has traditionally been a high saving/high investment development model, but as Beijing reached the maximum level of investment that can be productively absorbed, they didn't adjust the model.

This caused debt to surge and growth in debt-servicing costs to outweigh the growth in debt-servicing capacity, an unsustainable situation which Beijing realized years back.

Although the writing has been on the wall for some time, it has proven difficult to change the model due to vested interests that have disproportionately benefited the traditional model and blocked attempts to change away from FAI/exports.

As a result, there continue to be increasing strains in the financial system that manifest themselves as mini debt-related crises that have been occurring for years (Baoshang, various SOEs, Huarong, and now Evergrande).

Although policymakers in Beijing understand the larger problem, they have been unable to suppress debt growth sustainably, clamp down on real estate speculation, and undermine moral hazard due to the high political cost of doing so, backing down each time they tried.

Turning back to Evergrande and the real question, is this time different? It’s doubtful, and it is still likely Evergrande will be “resolved” in a politically appropriate way (supporting local and smaller stakeholders, hurting international and larger ones), keeping the “game” going by allowing the property market to maintain an unhealthy size, local governments to be overly leveraged (to reach growth targets), and not yet meaningfully shifting the macroeconomic model to a more sustainable less leveraged consumer-driven one.

* The former chairman of Huarong Asset Management, Lai Xiaomin, before being executed following his conviction on bribery

Econ Data:

The Chicago Fed National Activity Index fell to 0.29 in August from an upwardly revised 0.75 in July, highlighting the slowdown in growth we have been going through. Production-related indicators contributed +0.11, down from +0.40 in July. The contribution of the sales, orders and inventories category moved down to +0.03 from +0.07 in July. The contribution of the employment, unemployment, and hours category decreased to +0.12 in August from +0.38 in July. Meanwhile, the personal consumption and housing category contributed +0.03, up from –0.09 in July.

Why it Matters: As a reminder, the 85 economic indicators that are included in the CFNAI are drawn from four broad categories of data: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders, and inventories. As a result, this simply summarizes the slowdown we have seen in other data more succinctly. We quickly highlight the one area of improvement was in personal consumption and housing, something we believe will continue into year-end.

The IHS Markit Flash U.S. Composite PMI Index fell to 54.5 from 55.4 in August, a 12-month low. The manufacturing-specific PMI index fell to 60.5 from 61.1 (5-month low) last month, while the Services PMI decreased to 54.4 from 55.1 in August (a 14-month low). New order growth eased to the slowest since August 2020, and although demand conditions at manufacturing firms remained very strong by historical standards, the upturn in service sector new business slowed to a 14-month low as COVID-19 concerns persisted. Shortages of labor remained prevalent. Backlogs of work rose strongly due to limited operating capacity. The rise in outstanding business was the second-fastest in over 12 years of data collection, with a record increase seen in manufacturing. On the price front, input costs rose at a sharper pace during September (second highest on record), while output charges continued to increase markedly, continuing to rise at a pace far outstripping anything seen in the survey’s history. Optimism at private-sector firms was robust in September. The strong business confidence was often linked to continued demand and hopes that supply-chain issues would improve

Why it Matter: Both flash Manufacturing and Service PMIs were below the median consensus forecasts. Markit noted "Private sector firms in the U.S. signaled a solid expansion in output during September, albeit at the slowest pace for a year and one that was much softer than that seen at the start of the summer." Commenting on the PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said: “The slowdown was led by a cooling of demand in the service sector, linked in part to the Delta variant spread. However, while manufacturers have seen far more resilient demand, factories face growing problems in sourcing enough supplies and labor to meet orders. Supply chain delays show no signs of easing, with another near-record lengthening of delivery times in September. Hence factory output growth also weakened, and order book backlogs rose at a record pace in September. The upshot is yet another month of sharply rising prices charged for goods and services as demand outpaces supply, and higher costs are passed on to customers.”

The Kansas City Fed's Manufacturing Production Index fell to 10 in September from 22 in the previous month, the lowest since July 2020. Factory growth continued to be driven by a faster increase in durable goods, in particular primary metals, computer and electronic products, and transportation equipment, while nondurable goods manufacturing grew more modestly. Firms reported another increase in supplier delivery time, setting a survey record high. The future composite index was 35 in September, and expectations for future production matched the survey record last seen in 2003.

Why it Matters: Mirroring the Flash PMIs, the usual suspects of shortages and logistical issues were overly apparent in this month's report. Manufacturing comments noted historical challenging hiring conditions with little to no improvement in shortages, cost increases, and delivery times. The monthly special question focused on hiring and price increase plans. Around 38% of firms reported they plan to hire more than initially expected at the beginning of the summer. All survey respondents reported facing higher input costs due to elevated material or labor expenses compared to last year. Around 41% of firms indicated the ability to pass through 0-20% of those cost increases to their customers in the form of higher prices, over a third of firms reported passing through 21-80% of price increases, and nearly a quarter of firms indicated passing through 81-100% of price increases.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week, with the value factor higher again today as higher rates are causing the Nasdaq to underperform

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week, with a second day of gains due to the more risk-on tone domestically

5yr-30yr Treasury Spread: The curve is flatter on the week; however, the long-end is under pressure today, causing a 4bp steepening

EUR/JPY FX Cross: The euro is stronger on the week as the more risk on tone being increasingly reflected in FX markets, with the cross moving close to 1% today

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Shifting Down: Korea’s Exports Set to Slow in September, Early Data Show – Bloomberg

South Korea’s early trade data show exports are set to slow in September as fewer working days and headwinds from an outbreak of the delta variant weighed on the pace of growth. Exports rose 22.9% in the first 20 days of September from a year earlier, down from 41% in August’s preliminary report, data from the customs office showed Thursday.

Why it Matters:

Korea’s trade data is an early indicator of global economic activity as its manufacturers are positioned widely across supply chains. “Export momentum remains largely unchanged even though there’s a bit of a slowdown in semiconductors due to China’s tightening of regulations on big tech firms and the delta variant,” Park Sang-hyun, an economist at HI Investment & Securities, said. So far, this is not a red flag and reflects the realities on the ground we already know about, but we will be closely watching to see if there is any further weakness moving forward.

Continually Capped: Europe’s Economic Recovery Loses Steam as Supply Shortages Bite - Bloomberg

Shortages of parts and raw materials proved a major obstacle in Germany and France, and activity in both countries eased more than forecast in IHS Markit’s monthly survey of purchasing managers. German services also slowed considerably after a sharp bounce back over the summer. The overall measure of private-sector activity in Europe’s largest economy, the composite PMI, fell to 55.3 in September, while economists had expected a reading of 59.2. In France, where services were more stable, the gauge slipped to 55.1, compared to an estimate of 55.7.

Why it Matters:

We highlight this to stress a few things (you often hear from us). First, the global economy continues to have its achievable growth level capped from materials and labor shortages. Two, there are still lockdowns or Covid related disturbances occurring, delay any full recovery. Finally, this is a global event which makes the inflationary pulse occurring more synced, and potential stickier as not only are there real reasons for price increases (due to cost increases) but also a greater herd mentality to accept inflation and demand higher offsetting compensation (enforcing a wage-spiral feedback loop).

China Macroprudential and Political Tightening:

Be Warned: China Makes Preparations for Evergrande’s Demise – WSJ

Chinese authorities are asking local governments to prepare for the potential downfall of the China Evergrande Group. The officials characterized the actions being ordered as “getting ready for the possible storm,” saying that local-level government agencies and state-owned enterprises have been instructed to step in to handle the aftermath only at the last minute should Evergrande fail to manage its affairs in an orderly fashion.

Why it Matters:

Local governments have been ordered to assemble groups of accountants and legal experts to examine the finances around Evergrande’s operations in their respective regions, talk to local state-owned and private property developers to prepare to take over local real-estate projects, and set up law-enforcement teams to monitor public anger and so-called “mass incidents,” a euphemism for protests, according to the people. Despite this somewhat alarming story from the WSJ this morning, markets generally shrugged it off, showing that contagion fears have subsided, and international markets are increasingly viewing this as a China real-estate-specific risk.

LONGER-TERM THEMES:

Commodity Super Cycle Green.0:

Less Supply – More Demand: Investors Bet Environmental Fears Will Crunch Commodity Supply, Lifting Prices – WSJ

With producers of commodities under pressure from investors to minimize environmental damage, many are limiting spending on new output. This growing reluctance comes after years of declining investments in production that were driven by lackluster commodity prices and a focus on returning money to shareholders. Spending on oil and gas exploration and production is now forecast to edge higher in the coming years but stay below 2019 levels and about 40% to 50% under a 2014 record. Likewise, annual spending by mining companies is projected to remain about 30% or more below a 2012 peak each of the next five years.

Why it Matters:

While environmental concerns aren’t new for companies that consume large amounts of power and water and often contribute to local pollution, commodity investors say the global scope of the recent push is unprecedented. Some argue that commodities are moving into a cycle defined by erratic supply and volatile prices as the capacity to boost production dwindles. There are also fewer “market makers” such as the traditional commodity houses that are willing to take the risk due to changing dynamics there

ESG Monetary and Fiscal Policy Expansion:

Hot Disclosures: SEC Asks Dozens of Companies for More Climate Disclosures – WSJ

The SEC published Wednesday a list of requests that SEC staff have been sending to chief financial officers in connection to a 2010 guidance document on climate-change disclosures. The requests focus on the material impacts on companies from pending or existing climate-change laws, from floods or other physical effects of climate change, and from indirect consequences of regulations or business trends stemming from climate change.

Why it Matters:

Like other top officials tapped by President Biden, SEC Chairman Gary Gensler has made the fight against climate change a priority for his agency. The SEC’s main lever, which Democrats have said it should use more aggressively, is its authority to mandate disclosures by public companies. The requests from SEC staff in the recent letters focus on impacts that are expected to be important to a “reasonable” investor.

Top Cop: Biden Expected to Nominate Wall Street Critic as Top Banking Regulator – WSJ

President Biden is expected to tap Saule Omarova, a Cornell University law professor, to become the Comptroller of the Currency, which oversees national banks. She would likely work to help fulfill Mr. Biden’s campaign push to expand access to banking services in underserved communities. As part of that effort, she would help lead a planned overhaul of the rules for the Community Reinvestment Act, a decades-old law governing hundreds of billions of dollars in lending and investment in low-income areas.

Why it Matters:

The OCC is an independent bureau of the Treasury Department. It oversees about 1,200 banks with total assets of $14 trillion, some two-thirds of the total in the U.S. banking system, making it one of the most powerful regulators alongside the Fed and the Federal Deposit Insurance Corp. In academic writing, Ms. Omarova has called for a shift of consumer banking deposits from private firms to the Federal Reserve and called to “effectively end banking as we know it.” The same 2020 paper endorsed steps to “radically redefine the role of a central bank as the ultimate public platform for generating, modulating, and allocating financial resources in a democratic economy—the People’s Ledger.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.