MIDDAY MACRO - DAILY COLOR – 9/22/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, as Evergrande fears subside and positive momentum grows globally for risk-assets

Treasuries are mixed, with the more-risk on tone not materially changing sentiment in rate markets given all eyes are on the FOMC meetings results at 2pm

WTI is higher, with EIA and API data showing a more significant than expected drawdown

Analysis:

Equities are slowly recovering from their Monday sell-off where the S&P bouncing off its 100-dma and continues to follow through post-NY-open today as worries over China weaken while expectations for a dovish FOMC meeting result are helping.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Momentum, and Value factors, and Energy, Financials, and Materials sectors all outperforming.

S&P optionality strike levels have the zero gamma level at 4433 while the call wall is at 4500, while technical levels have support 4360 and resistance 4395/4400.

Treasuries are mixed, awaiting clues on Fed tapering intentions with the 5s30s curve flatter by 1.5bps

We have finally arrived at what has been called by many as the most crucial FOMC meeting in a while, with markets looking for how strongly the Fed signals plans to begin scaling back its bond purchases and where the SEP dots moved from June.

We believe the Fed will continue to be patient, and the overall message will be dovish, as the recent drag on the economy from the Delta uptick and continued supply-side disruptions along with the latest weaker CPI report gives them cover to do so.

The Fed will attempt to find a balancing act in the Summary of Economic Projections where the median 2021 and 2022 PCE inflation projections should increase while 2021 real GDP falls (rising instead in 2022) and the 2021 unemployment rate remains the same.

Of course, the focus will be on the 2022 dots, where we expect the transitory inflation message to remain while the growth outlook improves (due to lost activity in 2021). We also expect an increase in the amount of 2022 Fed funds target dots at 0.5 but don’t expect a meaningful move forward of the number of dots into 2022 from 2023, barbelling the range further and in line with the recent (greater) division in outlook/policy observed between members (further entrenchment in views).

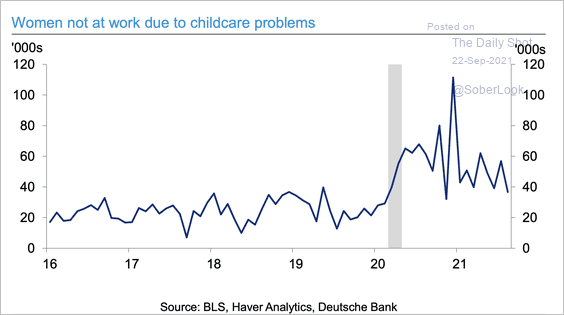

But the data is still “dirty” as the effects of back-to-school and the end of UEB have yet to be captured in the labor data, while the “transitory” belief in inflation was somewhat validated in the last CPI release. However, one data point does not make a trend, continuing to “muddy” the debate/forecast.

Putting it all together, there should be minimal changes to the statement and SEPs as the economy continues to make progress but has slowed due to recent drags reinforcing the need for patience, all of which Powell will strive to communicate in the presser.

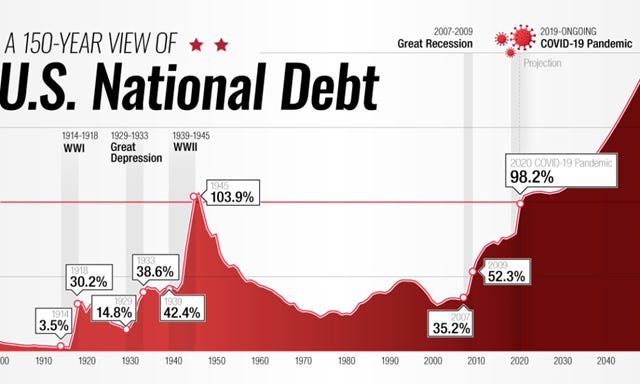

Some quick points on the chaos in DC-specific to the government shutdown and increasing debt ceiling as the deadline approaches and the risks grow.

At midnight this Thursday, authorization to fund the discretionary spending of the U.S. government expires, and the government will begin a shutdown unless Congress passes and President Biden signs a Continuing Resolution (CR) to keep the government open. The Treasury Department then, at some point between October and November, faces the potential inability to pay its bills unless the debt ceiling is raised or suspended.

The House passed a Senate doomed CR Bill yesterday (which would need GOP support, which it does not have), leaving the potential for a temporary shutdown as very likely.

There have been many government shutdowns since the passage of the Budget Act of 1974, and they are disruptive to parts of our economy but have a minimal impact on the economy as a whole. However, there is an already large fiscal cliff approaching, so any additional drag on the margin may magnify its weight on sentiment.

The exact date when Treasury will be unable to meet their obligation (and default) is unknown, but the “X date” is estimated to be sometime between October and November. Congressional watchers say they could proceed with a standalone bill without attaching it to the broader tax-and-spending bill that is also using the reconciliation format.

Democrats are likely to strip the debt limit from the continuing resolution smoothing bipartisan passage and avoiding or ending a shutdown. As for the debt limit, there’s a backup option that would allow them to raise it with only Democratic votes, using the so-called reconciliation process that bypasses the filibuster.

However, and finally, there is a historic amount of division and ignorance in DC currently (on both sides of the aisle), and especially within parties. So although we “hope” (again with the hope) things will work out, there is an actual probability that it doesn’t. If we default, something that would likely be the mother of all black swan events, the entire global financial system would be caught off guard and take us to a very ugly place.

Econ Data:

Existing-home sales declined by -2% MoM to 5.88 million in August, below market forecasts of -1.3%. Each of the four major U.S. regions experienced declines on both a month-over-month and a year-over-year perspective, breaking a two-month streak of increases. First-time buyers accounted for 29% of sales, down from 30% in July and 33% in August 2020, and the lowest level since 2019. The inventory of unsold homes decreased by 1.5% MoM to 1.29 million, equivalent to 2.6 months of the monthly sales pace. The median existing home price for all housing types was $356,700, up 14.9% from August 2020, as prices increased in each region.

Why it Matters: A surprise decline showing the lack of inventory and recent price increases are still problematic, especially to first-time home-buyers. However (and despite consumer sentiment reported in the Univ. of Michigan survey specific to intent to purchase (homes)), there isn’t a significant drop in demand occurring. "Sales slipped a bit in August as prices rose nationwide," said Lawrence Yun, NAR's chief economist. "Although there was a decline in home purchases, potential buyers are out and about searching, but much more measured about their financial limits, and simply waiting for more inventory… A number of potential buyers have merely paused their search, but their desire and need for a home remain." With the increase in housing starts and permits seen yesterday and some marginal improvement in material costs (lumber), we believe it is likely inventory will meaningfully improve, and price appreciation will slow. This sentiment echoes the slight improvement we saw on Monday in the NAHB homebuilders survey.

Housing starts were up 3.9% in August, rebounding from a downwardly revised -6.2% fall in July and beating market forecasts of 2%. Starts of buildings with five units or more jumped 21.6%, while the single-family segment dropped -2.8%. Starts surged the most in the Northeast (+167.2% MoM) to the highest level since January. Building permits in the United States rose 6% MoM in August, the highest level since April and well above market expectations of -1.8%. The volatile multi-segment jumped 15.8%, and single-family authorizations were up 0.6%.

Why it Matters: There were significant beats in both starts and permits verse expectations, and although single-family starts dropped, the drag came from the Midwest (-12.5%) and West (-21.1%) regions. Builders continue to struggle with limited availability of land, labor, and materials, but despite the bottlenecks, housing starts remain mostly above pre-pandemic levels, which is expected to keep construction activity elevated for some time. The report showed backlogs continued to climb, with the number of single-family houses under construction but not yet completed rising to the highest since 2007. Houses that are authorized but not yet started rose to the most since 1979, further underscoring builders’ struggle to keep up with demand. Finally, Mortgage applications jumped 4.9% in the week ending September 17th, the biggest rise in 8 weeks; data from the Mortgage Bankers Association showed.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week, with the value factor higher on the day

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week, as there was a meaningful bounce today following reduced Evergrande worries

5yr-30yr Treasury Spread: The curve is flatter on the week, falling further as the long-end is better bid today into the FOMC

EUR/JPY FX Cross: The Yen is stronger on the week as a flight but weaker on the day as Euro has been performing better as of late

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

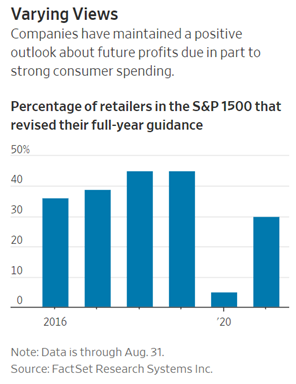

Holiday Hope: Retailers Navigate Freight Costs, Scarce Inventory and Uncertain Future – WSJ

Retailers are growing more confident about the holidays despite grappling with ongoing supply-chain disruptions that are keeping inventory low and often causing delays, forcing companies to pay premiums to accelerate shipments. Despite these obstacles, U.S. finance chiefs have maintained a positive outlook on future profits and demand for their products, due in part to strong consumer spending.

Why it Matters:

About 30% of the 108 retailers in the S&P 1500 index revised their annual guidance through Aug. 31, nearly all upward except for discount retailer Dollar Tree, according to data provider FactSet Research. That’s up 25 percentage points from the prior-year period when 5% of the retailers updated their guidance. About 8% haven’t changed their annual guidance so far this year, while the remaining 62% didn’t provide such a forecast, with some (including Burlington Stores Inc. and Victoria’s Secret & Co.) citing uncertainty as a reason. The bottom line, we believe there is strong consumer demand giving retailers strong pricing power and helping them defend profit margins in the fourth quarter. We also increasingly believe there will be goods and services available, uncapping growth, unlike the last two quarters,

China Macroprudential and Political Tightening:

Block and Re-Write: Financial blogger crackdown leaves China investors scrabbling for data - FT

China has launched a crackdown on financial blogs and social media, a move that risks exacerbating the difficulty of obtaining reliable data about the world’s second-biggest economy. Last month the Cyberspace Administration of China embarked on a “special rectification” campaign. The internet regulator is clamping down on market skeptics and those who voice pessimistic opinions about the Chinese economy — as well as misinformation and malfeasance radiating from financial news services and social media accounts.

Why it Matters:

Social media platforms are scrubbing websites and blogs, with self-regulation efforts taking place across the biggest Chinese social networks such as Tencent’s WeChat, the Twitter-like Weibo platform, and Douyin, ByteDance’s sister app to TikTok. A “number” of data series had been discontinued, including statistics on social disturbances. There were also frequent and unexplained revisions of other data sets, while “micro-data” for households and companies, critical for economic research, was also unavailable. One veteran analyst of China’s markets, who asked not to be named, said a lack of information about the country was “absolutely” creating an environment where miscalculation and misjudgment would become more prevalent.

Or Just Erase: China’s Biggest Movie Star Was Erased From the Internet, and the Mystery Is Why – WSJ

Zhao Wei spent the past two decades as China’s equivalent of Reese Witherspoon, a beloved actress turned business mogul. Today, the 45-year-old star has been erased from the Chinese internet. Searches for her name on the country’s biggest video-streaming sites come up blank. Her projects, including the wildly popular TV series “My Fair Princess,” have been removed. Following her online disappearance, a wide range of state-run media republished an essay written by a former newspaper editor amplifying the idea that the current moves against celebrities, including Ms. Zhao, were part of a broader effort by Mr. Xi to rein in the rich and address the country’s yawning wealth gap.

Why it Matters:

The Chinese government hasn’t publicly stated what prompted this sudden change to her status, raising questions among fans and observers about how far it is willing to go against her and other celebrities and why. We highlight this on a heavy China news week (due to Evergrande) to remind readers that China does not play by the same rules. People are motivated by fear and greed, something the CCP knows and uses to hold onto power more so than any other major government.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Key Tech: U.S. Commerce Nominees Vow to Keep Key Tech Out of China’s Hands – Bloomberg

Two nominees for key trade-policy positions in the U.S. Commerce Department pledged to use their roles to prevent the transfer of sensitive technologies to China and adversarial nations if appointed. Alan Estevez, Biden’s pick as undersecretary to lead the Bureau of Industry and Security that oversees export controls, said he would work to stem “malign behavior on a number of fronts” by China and other adversarial nations, strengthening controls over critical technologies, and improving the resiliency of the American supply chain, particularly for semiconductors.

Why it Matters:

We highlight this to show the continued bipartisan support for a tougher stance against China and the increased likelihood of further deterioration in trade relations. We do not believe there will be further meaningful progress in trade negotiations as China has not lived up to its commitments. As a result, sanction relief is unlikely, and export controls, prohibitions, and executive orders made common in use by Trump may be continued under the Biden Administration.

Electrification Policy:

And it Continues: After Biden Warning, Hackers Define ‘Critical’ as They See Fit - Bloomberg

After a furious run of ransomware attacks in the first half of the year, President Joe Biden in July warned his Russian counterpart, Vladimir Putin, that Russia-based hacking groups should steer clear of 16 critical sectors of the U.S. economy. In recent days, a Russia-linked ransomware group called BlackMatter attacked a grain cooperative in Iowa, an incident that appears to test Biden’s terms since “food and agriculture” is one of the protected sectors.

Why it Matters:

The White House didn’t immediately respond to a request for comment, and the U.S. Cybersecurity and Infrastructure Security Agency declined to comment. New Cooperative said they had contacted law enforcement and worked with data security experts to investigate and remediate the situation. The bottom line is this will continue to be an everyday occurrence, and the White House response and actions by New Cooperative will be standard as we are effectively at war now. We also question how much control Putin really has over Russian-based hacking groups. As a result, we continue to expect a growing call for physical responses to cyber intrusions and further regulation on the crypto landscape.

Crypto Sanctions: U.S. Sanctions Crypto Exchange Accused of Catering to Ransomware Criminals – WSJ

The Biden administration blacklisted SUEX OTC, a Russian-owned cryptocurrency exchange, for allegedly helping launder ransomware payments, an unprecedented action meant to deter future cyber-extortion attacks by disrupting their primary means of profit. The Treasury Department also issued fresh warnings to the private sector that businesses risk penalties and fines for paying ransoms or handling such transactions, especially if they fail to report those activities to authorities.

Why it Matters:

Deputy Treasury Secretary Wally Adeyemo said the sanctioning of SUEX should be seen as a warning to other bad actors in the digital currency marketplace, reflecting the administration’s intention to “disrupt and deter these criminals by going after their financial enablers.” As a result, and given the culture, we expect more disruption here as more mainstream actors are slow to react to the changing regulatory landscape. We also would highlight the significant increase in lobbying activity by the Crypto Industry.

Commodity Super Cycle Green.0:

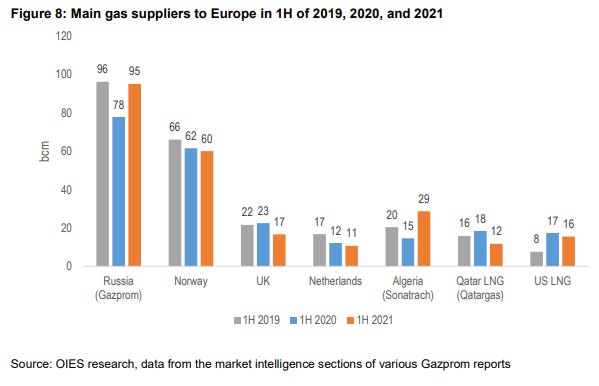

Nat Gas Needed: Big Bounce: Russian gas amid market tightness – The Oxford Institue for Energy Studies

Russian gas output has risen robustly and is close to its maximum productive capacities, but the necessity to fill the depleted domestic gas storage facilities in Q3 2021 limited the availability of Russian gas for Europe when it was most needed. Most recent reports show Russia’s gas exports to Europe (including Turkey) are up almost 20% YoY. At the same time, gas buyers have been struggling to secure supplies even at premium prices and have been concerned about gas availability and possible energy insecurity over the coming winter.

Why it Matters:

The market tightness in Europe stems from a combination of demand-side factors such as weather and economic recovery, alongside supply-side factors including declining indigenous European gas production and reduced supply from other exporters of gas to Europe (except for Algeria), including LNG. Further, gas storage levels in Europe are at historical lows at the start of the heating season, and gas prices have been testing record levels. On the other side, Russia is not running out of gas, and its prolific gas reserves will allow Russia to meet much higher overall demand, but this requires time, money, and contractual assurances of offtake. The bottom line, the current natural gas problems in Europe and Russia are unlikely to dissipate quickly.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.