MIDDAY MACRO - DAILY COLOR – 9/20/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, as fears out of China set a global risk-off tone out of the gates Sunday night with no dip-buying occurring yet

Treasuries are higher, with the curve flattening further due to a flight to safety underway despite debt-ceiling concern growing

WTI is lower, and the entire energy complex under pressure despite improved supply/demand fundamentals recently

Analysis:

Equities are seeing one of their first meaningful down days in some time as the S&P gapped below its 50-dma at the Sunday Night futures open chiefly because of increased worries regarding China’s financial/property markets.

The S&P is outperforming the Nasdaq and Russell with Low Volatility, Value, and Growth factors, and Utilities, Real Estate, and Healthcare sectors all outperforming.

S&P optionality strike levels have the zero gamma level at 4450 while the call wall is at 4500; technical levels have support 4320 and resistance 4375.

Treasuries are higher, nearing last week’s highs with the 5s30s curve flatter by 1.7bps

Don’t look now but the S&P is close to a -5% pullback from its recent highs, as September’s seasonal weakness is now fully underway due to fears over Evergrande/China, fiscal stimulus/debt limits, as well as the familiar supply-side/inflation and Delta drags to growth worries, with price action being exacerbated by a more unanchored optionality backdrop.

Today’s selloff started overnight in China as their markets came under pressure due to continued concerns over Evergrande and contagion from its potential failure enhancing the general risk-off sentiment already there thanks to the ongoing “Common Prosperity” crackdowns.

We continue to believe Beijing will eventually step in and support an orderly bailout/reorg, as well as enact a more macro supportive stance/policy, as you can’t have “common prosperity” with millions losing homes and jobs despite the goal of Xi to send messages about acceptable behavior to the private sector.

Focusing on the U.S. and despite the more risk-off tone in markets, the recovery/reopening continues, and although school reopenings don’t seem to be going particularly well (given the anecdotal news), hospitalization rates across all ages are still dropping, alleviating fears of a renewed wave/shut-downs (so far).

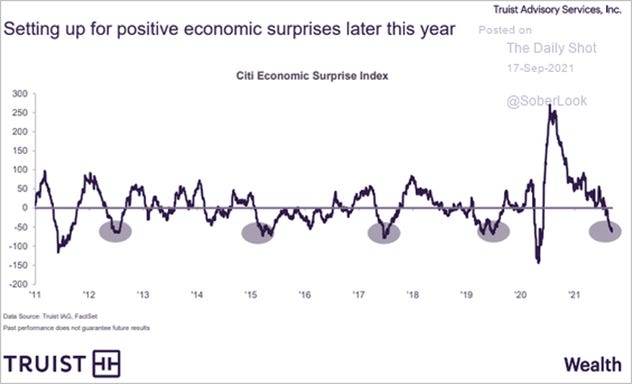

Recent data (Fed Surveys, Retail Sales, Durable Goods) has shown some improvement in supply-side disruptions and consumer resilience, and if this trend continues/improves there is the potential for growth to outperform expectations into year-end while the Fed stays patient (through a later and longer taper and a more dovish telegraphing of rate hikes in the SEPs).

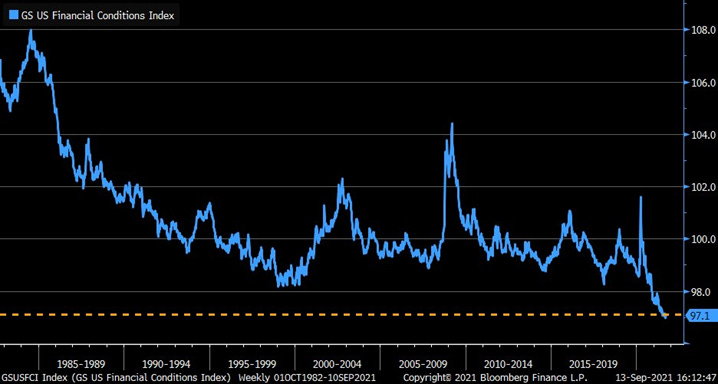

Put (overly) simply, a patient Fed would help continue to keep financial conditions (highly) supportive and allow earnings to grow further into valuations, supporting prices, as multiples begin to come under pressure from falling liquidity levels.

As a result, we see the current pullback as a technical/seasonal event rather than a meaningful change in the fundamental macro backdrop and maintain our view that growth and earnings should support a further melt-up into year-end even as liquidity conditions become less supportive (due to tapering and the end of the TGA drawdown).

Finally, markets lost gamma stability due to last week's large level of options expiration, and the reflexive volatility selling function that usually occurs is on hold due to this week’s critical FOMC meeting, implying dealers now have a lot of hedges to manage if market declines or rises, increasing volatility. Bottom line, expect higher volatility to continue into month-end or at least this week’s FOMC meeting.

Econ Data:

The NAHB Housing Market Index went up to 76 in September, rebounding slightly from a one-year low of 75 in August, and beating market forecasts of 74. The current single-family sub-index increased to 82 from 81 in the previous month, and the gauge for prospective buyers rose to 61 from 59. Meanwhile, the home sales over the next six months sub-index was unchanged at 81.

Why it Matters: There looks to be a stabilization in housing activity after a notable decline in August. The slight increase in “Traffic of Prospective Buyers” is the most significant positive in the report as that area took a hit last month, likely from Delta fears. Activity still declined in every region but the Midwest, where it was stable. The rest of this week will give us a further look at housing with Existing and New Home Sales as well as Case-Shiller Home Prices next week.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week, as the value factor is slightly higher on the day despite the risk-off tone

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, as further production restrictions were announced over the weekend

5yr-30yr Treasury Spread: The curve is flatter on the week, falling further as the long-end is well bid today

EUR/JPY FX Cross: The Yen is stronger on the week as a flight to safety bid is picking up momentum

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

CPTPP: China Formally Applies to Join Asian Trade Deal Trump Abandoned - Bloomberg

According to a statement late Thursday from Beijing, China submitted a formal application letter to join the deal, known officially as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. The application is the result of months of behind-the-scenes discussions after President Xi Jinping said in 2020 the nation was interested in joining. China is the second country to apply to join the 11-nation deal after the U.K. asked to become a member earlier this year.

Why it Matters:

China has shown a willingness to embark upon new trade liberalization efforts as part of its negotiations to conclude the Regional Comprehensive Economic Partnership (RCEP), a $26.2 trillion free-trade pact among China and 14 other Pacific nations. The bid from China to join CPTPP was made less than a day after Australia, the U.S., and the U.K. announced they would form a more cohesive defense arrangement to offset China’s rising military prowess. China attacked that agreement, but it will now need to negotiate with Australia and probably the U.K. about CPTPP accession.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Quad Chips: 'Quad' countries to agree on secure microchip supply chains-media - Reuters

Leaders of the United States, Japan, India, and Australia will agree to take steps to build secure semiconductor supply chains when they meet in Washington next week, the Nikkei business daily said on Saturday, citing a draft of the joint statement. The draft says that in order to create robust supply chains, the four countries will ascertain their semiconductor supply capacities and identify vulnerability.

Why it Matters:

The draft does not name China, but the move aims to prevent China from utilizing technologies/production to gain negative political leverage. It is further evidence of continued decoupling and regionalization. The reshoring or secure supply chain initiatives are becoming more and more common in individual nations and trading blocs. This will create a CAPEX cycle that will eventually create redundancy in global manufacturing capacity. We are still in the early inning of this multi-decade occurrence.

Electrification Policy:

Ad-Free?: The Battle for Digital Privacy Is Reshaping the Internet - NYT

There is a battle occurring between tech titans, Madison Avenue, and disrupted small businesses as a profound shift in how people’s personal information may be used online is having sweeping implications for the ways that businesses make money digitally. If personal information is no longer the currency that people give for online content and services, something else must take its place. Many are choosing to make people pay for what they get online by levying subscription fees and other charges instead of using their personal data.

Why it Matters:

Businesses that do not keep up with the changes risk getting run over. Increasingly, media publishers and even apps that show the weather are charging subscription fees. Some e-commerce sites are considering raising product prices to keep their revenues up. It is crucial to keep an eye on developments here, given the level of disruption occurring and the weight parties involved have on overall equity indexes.

ESG Monetary and Fiscal Policy Expansion:

Technical Default: Democrats Press Ahead With Debt-Limit Vote Amid Standoff With GOP – WSJ

A partisan fight over raising the government’s borrowing limit is expected to ratchet up this week. House Democrats plan to hold a vote this week on a measure to suspend the debt limit and a short-term measure extending the government’s funding beyond its expiration at month’s end. Democratic leaders haven’t yet said whether the debt-limit suspension would be attached to the spending patch, although aides have indicated that is likely. The Treasury would likely be able to keep making payments on its obligations until late October and possibly early November.

Why it Matters:

The timing of this could not be worse, adding to the list of risks that the market is trying to price. Democrats voted with Republicans to suspend the debt limit three separate times during the Trump administration, including in the fall of 2017, when the GOP sought to advance tax cuts using budget reconciliation. “The full faith and credit of the United States of America should not be compromised on the altar of politics,” said House Majority Whip Clyburn on CNN on Sunday. However, the politics in this country have changed, and the risk of a technical default is more likely than ever.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.