MIDDAY MACRO - DAILY COLOR – 9/16/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, as a post-Retail Sales bounce failed to materialize into a sustained rally, moving indexes back to recent lows and trying to rally now

Treasuries are lower, as the curve continues to flatten as better data moves forward Fed rate hike expectations

WTI is lower, currently trying to rebound after significant gains yesterday partially reversed at the NY-open

Analysis:

Equities did not appreciate the better than expected Retail Sales data with the S&P pushing back on key technical support levels with dealer-related hedging activity heavily influencing price action into Friday’s massive quad-OPEX, while Treasuries took a more traditional negative reaction to the better data.

The Russell is outperforming the S&P and Nasdaq with Momentum, Growth, and Small-Cap factors, and Consumer Discretionary, Real Estate, and Financial sectors all outperforming.

S&P optionality strike levels have the zero gamma level at 4481 while the call wall is at 4500; technical levels have support 4430 and resistance 4480.

Treasuries are lower, with the 5s30s curve flatter by 1.5 bps with today’s data improving the growth outlook and expediating the Fed’s tightening timeframe verse a more negative feel from equities

Econ Data:

Retail Sales increased 0.7% in August, following an (upwardly revised) -1.8% fall in July and beating market expectations of a -0.8% drop. Sales rose the most for nonstore retailers (5.3%), furniture (3.7%), general merchandise stores (3.5%). The most significant areas of weakness came from a flat reading for food services and drinking places and a -3.6% drop in auto sales. As a result, retail sales excluding autos increased 1.8%.

Why it Matters: A much more favorable report than expected which showed despite the drag from material and labor shortages and Delta worries, the consumer wants to spend. The shift back to goods (generally) and online purchases (specifically) underpins a solid back-to-school shopping season and bodes well for the upcoming holidays. We also believe that the weaker service-related areas (especially Restaurants and Bars and Gasoline Stations) should see a certain amount of payback as the re-reopening continues. Bottom line, if retail sales were able to hold up this well despite the known challenges, it’s a good bet things will significantly improve into year-end, assuming a continuation in Delta case declines and growing inventories.

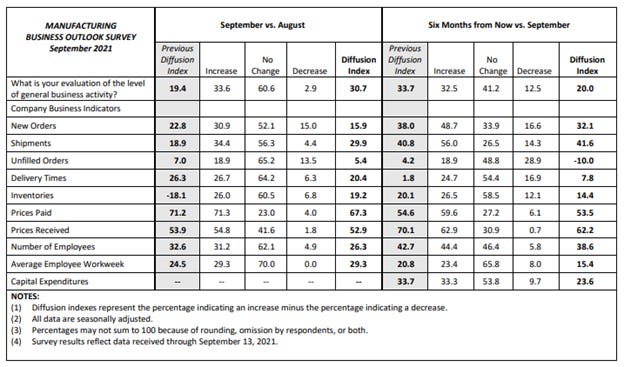

The Philadelphia Fed Manufacturing Index in the US rose to 30.7 in September from 19.4 in August, above forecasts of 18.8. Shipments and Inventories were the most significant positive contributors while New Orders and Number of Employees detracted from the headline reading. Regarding supply-side disruption-focused sub-indexes, Delivery Times and Prices Paid both decreased. Although the current General Business Index rose, the “Six Months from Now” General Business Index decreased from 33.7 to 20. Future outlook saw its most significant drag from weaker Unfilled Order and Inventory expectations. In this month’s special questions, the firms were asked to estimate their total production growth for the third quarter compared with the second quarter. The share of firms reporting expected increases in third-quarter production (70%) was greater than the share reporting decreases (18 percent), with a median response of an increase of 0 to 5 percent.

Why it Matters: Although the headline figure was significantly better than expected, the underlying sub-components pointed to slowing future demand, contrasting the NY and Philly Fed surveys earlier this week. The decrease in future outlook was also nuanced despite weakening, with the share of firms expecting increases in activity over the next six months (33%) exceeded the share expecting decreases (13%); a majority (41%) expect no change. There was also a notable decrease in future CAPEX intentions, contrasting the view we put forth yesterday. Still, there were further signs that supply-side disruption continued to wane with prices paid/received and delivery times improving. The majority of firms reported no change in their labor situation, showing the slight improvement in material shortages and logistics is still not meaningfully occurring in finding qualified labor. Finally, we take comfort in the significant increase in Inventories, re-enforcing our view that supply shortages will not meaningfully cap year-end growth potential.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the weak, as the Russell is currently outperforming today despite general weakness across equities

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, continuing their descent, down over 4% today amind the national campaign to cut steel production

5yr-30yr Treasury Spread: The curve is flatter on the week, picking up momentum following data beats today

EUR/JPY FX Cross: The Yen is stronger on the week as German election uncertainty has been weighing on Euro sentiment

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Missing One Piece: Obscure Firm's 1,219% Rise Shows Profit, Pain of Chip Crunch – Bloomberg

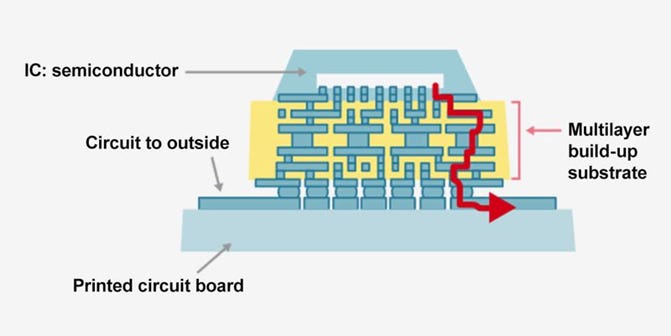

An obscure Taiwanese company makes an essential component for chipmaking that has become the latest bottleneck for automakers and electronics companies suffering from semiconductor shortages. The component goes by the unwieldy name of Ajinomoto build-up film (ABF) substrate, and it's one of the least glamorous niches in the chips industry. It's part of the packaging that protects the handful of chips needed to power your computer or car and allows communication among them.

Why it Matters:

Many of the world's most advanced semiconductors can't run without the substrates. So while giants like Intel Corp. and Taiwan Semiconductor Manufacturing Co. spend hundreds of billions trying to alleviate chip shortages, the lack of that single component could hinder production for years.

Purgatory: ‘Just Get Me a Box’: Inside the Brutal Realities of Supply Chain Hell – Bloomberg

The system underpinning globalization, production on one side of the planet, connected to consumers on the other by trucks, ships, planes, cranes, and forklifts is too rigid to absorb today’s rolling tremors from Covid-19, or to recover quickly from the jolts to consumer demand or the labor force. It’s avoided a complete collapse only through a combination of human ingenuity, painfully long hours, and recent success through strategy mixed with a stroke of luck. The article gives the perspective of a logistics manager during this trying period and her quest to get a shipping container.

Why it Matters:

It may be getting a little old how much we highlight the ongoing logistical problems plaguing the world's economy. Still, it's essential to keep an almost day-by-day watch to see if any improvement is occurring. Improvement will be best be seen in price decreases, and although we do not yet see that in shipping costs, prices paid in the NY and Philly Fed business surveys look to have peaked while PPI decreased from a monthly increase of 1% in July to 0.6% in August. Bottom line, we grow “hopeful” price increases may have peaked as holiday season inventory rebuilding is now fully underway.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Diversity Needed: EU’s Vestager Warns Against Relying on ‘Very Big Chip Producers’ – Bloomberg

EU Digital Policy chief Margrethe Vestager warns against relying on too few international semiconductor companies. This echoed comments from European Commission President Ursula von der Leyen, who called for substantial investment in the semiconductor industry. She said the European Commission would present a new European Chips Act in the coming weeks aimed at linking together research, design, testing, and production capabilities.

Why it Matters:

In a common theme heard from many national/regional leaders, the realization that too many critical things come from unreliable sources is forcing the hard choice between security/reliability and cost/efficiency. Unfortunately, it took decades for the global supply chain to emerge the way it is, and it will take decades to re-shore critical production back home (at least in Europe and the U.S., where this is possible). We highlight this simply to re-enforce the growing importance of national-security assets now have in a now more divided world.

Electrification Policy:

Flying Taxi: Flying-Taxi Hubs Planned for 65 Cities Spanning London to LA – Bloomberg

A network of flying-taxi hubs is planned for 65 cities in a tie-up between infrastructure firm Urban-Air Port and South Korean automaker Hyundai Motor Co., which is developing a vertical take-off and landing craft. “The sector is soaring, and we know that a future with electric flying vehicles and drones in cities is going to be a reality soon, but it can’t happen if we don’t have the infrastructure on the ground and in the air,” Urban-Air Port founder and Executive Chairman Ricky Sandhu said in the release.

Why it Matters:

Urban-Air Port plans to establish a network of more than 200 electric air mobility facilities worldwide in the next five years. The hubs will be modular and designed to fit into both dense urban areas and more remote locations where charging will be provided using hydrogen fuel cells. We are in very early innings here, but it is coming and will be a game-changer for how people transport themselves in a decade or two.

Playing with People: Facebook Tried to Make Its Platform a Healthier Place. It Got Angrier Instead. – WSJ

Facebook researchers discovered that publishers and political parties were reorienting their posts toward outrage and sensationalism. That tactic produced high levels of comments and reactions that translated into success on Facebook. They concluded that the new algorithm’s heavy weighting of reshared material in its News Feed made the angry voices louder. “Misinformation, toxicity, and violent content are inordinately prevalent among reshares,” researchers noted in internal memos.

Why it Matters:

It's becoming more apparent that Facebook contributes to the growing political divide in many democratic nations. It's also clear that leadership knows this and is happy to profit off it. As a result, we expect backlash both at a consumer level and, more importantly, at a regulatory level. We continue to believe the big tech is seeing its best days now, and populist movements are growing against them on many fronts globally.

Commodity Super Cycle Green.0:

Carbon Commodity: Carbon offset transactions surge despite environmental concerns – FT

Despite skepticism about the market’s green credentials, interest in carbon offsets, which are used to compensate for greenhouse gas emissions, is accelerating. Offsets from renewable energy projects have grown to become the second-largest category after forestry and land use, although demand could peak in 2021, according to a report from Ecosystem Marketplace.

Why it Matters:

The most active buyers of offsets are the energy, consumer goods, finance, and insurance sectors, but there has also been an increase in speculative buying from those looking to profit from trading offsets. But critics of the market say offsets often do not deliver the environmental benefits they promise and that the unregulated and fragmented market offers companies a license to pollute. In light of such concerns, a task force initiated by former Bank of England governor Mark Carney is designing new rules that it hopes will reform the system.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.