MIDDAY MACRO - DAILY COLOR – 9/14/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, as a stable overnight turned into up-down price action post-CPI with key support levels on the S&P still holding

Treasuries are higher, with a strong rally following the inflation data now reversing slightly, undoing some of the flattening of the curve that occurred

WTI is slightly higher, as outages from Ida and operational problems globally (Mexico, Russia, Nigeria, and Libya) are reducing oil supply for the first time in five months, but global growth concerns persist for the EIA

Analysis:

Equities are volatile again (although VIX is contained), initially jumping higher post CPI data and then dropping back to yesterday’s lows, while Treasuries rallied higher as Fed policy tightening expectations were reduced, moving the curve (5yr30yr) to its flattest levels of the year.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Volatility, Momentum factors, and Technology, Healthcare, and Utilities sectors outperforming.

S&P optionality strike levels have the zero gamma level at 4477 while the call wall is at 4500; technical levels have support 4440 and resistance 4480.

Treasuries are higher with the curve flatter as weaker monthly inflation gains reduced the urgency of Fed tightening and also enforced a weaker growth narrative.

Today’s weaker than expected monthly increase in both headline and core inflation temporarily vindicates the Fed’s “transitory” view (but not for the reasons they hoped) and continues to confirm the drag Delta and supply-side disruptions have had on 3rd quarter growth.

We further detail the CPI report in the Econ Data section, but (basically) the consumer herd retrenched in August, favoring a more materialistic stay-at-home basket over the re-opening experience one.

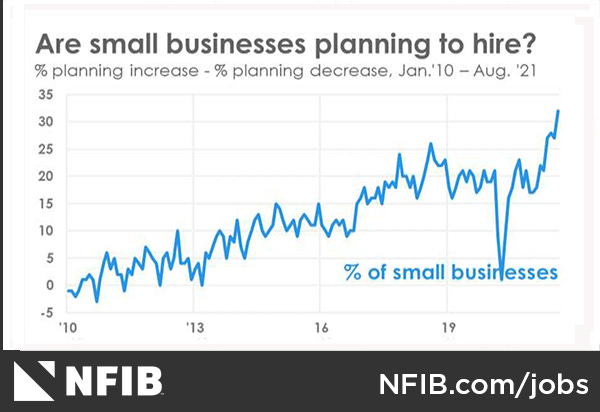

Today’s CPI data, along with the NFIB Businesses survey results, reinforces the case that 3rd quarter growth will be materially weaker than previously expected, something we admittedly got wrong (given our belief Delta and supply-side disruption would not meaningfully continue this long). As a result, investor sentiment continues to sour as this view becomes more consensus.

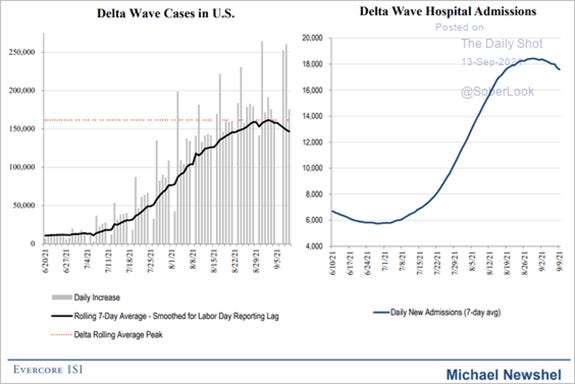

However, as the S&P sits at key levels of technical support, “hope” remains, supported by continuing confirmation that the Delta wave has peaked and a belief that the disruptions to the global supply chain (from it) have seen their worse days.

Unfortunately, and by no means unrelated to Delta, there is still no meaningful improvement in the current labor shortage situation. Still, we believe there will be a meaningful reprieve into year-end.

This will be due to both supply and demand dynamics slowly improving; with workers (supply) seeing an end to unemployment benefits, being freed of childcare due to school reopening’s, less afraid to get sick, and falling savings, while businesses (demand) are raising wages and increasing other incentives (benefits, training, and other “perks”). These factors are “all happening” in our view but unfortunately happening slowly.

As a result, we believe there will be a further handoff (as seen in today’s data) from transitory (pandemic related) inflationary forces to more structural ones (rent and healthcare) driven by rising wages. Bottom line, we still expect this head fake of lower inflation increases (which is meaningfully beginning) to morph into more persistent inflationary forces next year.

Econ Data:

The NFIB Small Business Optimism Index increased in August to 100.1, up 0.4 points from July. The NFIB Uncertainty Index decreased seven points to 69, the lowest level since January 2016. Owners expecting better business conditions over the next six months decreased by eight points to a net negative 28%. This indicator has declined 16 points over the past two months to its lowest reading since January 2013. Fifty percent of owners reported job openings that could not be filled, an increase of one point from July and a 48-year record high for the second consecutive month. Fifty-five percent of owners reported capital outlays in the last six months, unchanged from July and historically weak. A net-zero percent of all owners reported higher nominal sales in the past three months, down five points from July.

Why it Matter: Although the headline “Optimism Index” increased slightly, the underlying subcomponents made this a more negative-toned report. Simply put, the disruptions (materials and labor) are lasting too long, and as a result, the future outlook continues to worsen each month it continues. “As the economy moves into the fourth quarter, small business owners are losing confidence in the strength of future business conditions,” said NFIB Chief Economist Bill Dunkelberg. “The biggest problems facing small employers right now is finding enough labor to meet their demand and, for many, managing supply chain disruptions.” A net 41% of businesses reported raising compensation, which on a day that saw some reprieve in inflation growth, does not bode well for longer-term inflation dynamics.

Inflation rose by less than forecast in August, with headline inflation rising 0.3% and Core rising 0.1% on the month. Year-over-year headline CPI inflation slowed to 5.3% from 5.4%, while core CPI inflation was 4.0% year-over-year in August versus 4.3% in July. Helping slow the rate of overall inflationary increases were notable declines in airline fares (-9.1%), vehicle rental (-8.5%), used car and truck prices (-1.5%), motor vehicle insurance (-2.8%), and lodging away from home (-2.9%). Rent of primary residence and owners’ equivalent rent both rose 0.3%. Both new car prices and household furnishings & supplies jumped 1.2% mom in August, recreation commodities soared 1.0% MoM, apparel and other goods both rose 0.4% mom, and alcohol rose 0.3% mom.

Why it Matters: This report has the impact of Delta and continued supply-side disruptions all over it as the re-opening basket or transitory inflation components cooled significantly while more material orientated things increased. The broader transportation services sector fell -2.3% on the month, driven by decreases in lodging prices and airline fares. On the other hand, supply chain disruptions were evident in commodity-related items, which saw increases in new car prices, household furnishing, recreational goods, and apparel and other goods. Bottom line, a slower rate of increase in inflation due to a loss of demand (due to Delta) while supply-side disruptions continue to put upward pressure on prices. Not a great report.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: the ratio is little changed on the week, with growth outperforming today after CPI data painted a more significant drag on growth from Delta

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week but are slightly higher on the day with no material change n China’s regulatory/demand/supply fundamentals

5yr-30yr Treasury Spread: The curve is flatter on the week, pushing on its flattest level since last summer

EUR/JPY FX Cross: The Yen is stronger on the week as down-channel resistance held given a more risk-off tone to global markets

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

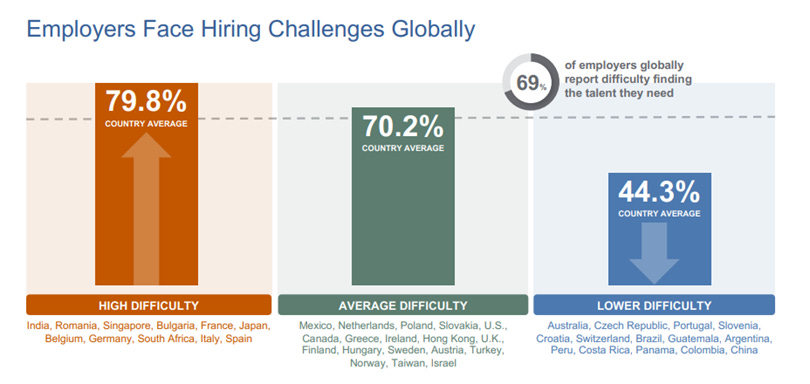

Global Problem: Two-Thirds of Businesses Around the World Are Struggling to Hire – Bloomberg

A survey of nearly 45,000 employers across 43 countries showed 69% of employers reported difficulty filling roles, a 15-year high, according to employment-services provider ManpowerGroup Inc. At the same time, 15 countries -- focused in Europe and North America -- reported their highest hiring intentions since the survey began in 1962. About 40% of respondents said they offer training and skills development to attract and retain talent.

Why it Matters:

“Continued talent shortages mean many businesses are prioritizing retaining and training workers with the skills they need to succeed as the economic recovery continues,” Jonas Prising, chief executive officer of ManpowerGroup, said in a statement. This increases the labor cost beyond the wage level as other incentives (healthcare, vacation, perks) and sunk costs of training become more prevalent. It also disadvantages smaller firms with lower access levels or the ability to improve their worker’s training/experience/rewards.

China Macroprudential and Political Tightening:

No More Fun: China’s Xi Jinping faces off against fan armies in crackdown on celebrity culture – FT

Chinese fans dedicated to Park Ji-min, one of the seven members of Korean boy band BTS, are among the latest victims of President Xi Jinping’s campaign to clean up China’s youth culture. The campaign is part of a broader crusade on China’s entertainment industry that has already targeted several prominent stars and includes a broadside against the supposedly effeminate style and fashion choices of young men. In a bid to control fan behavior and shift responsibility to the companies, Chinese authorities are now heaping pressure on celebrity agencies and media production companies.

Why it Matters:

History shows that authoritarian crackdowns eventually go too far, and the people begin to see the government increasingly negatively as more nationalistic restrictions are imposed. Will the loss of K-pop be the straw that finally breaks the camel's back? Probably not, but between limiting educational options, video game time, and now western music/culture (on top of the hundreds of other restrictions/laws), Beijing is playing a dangerous game with the youth of China. BTS is, of course, a politically active group, so they make an easy target.

Final Mile: China Evergrande Hires Financial Advisers as Protests Erupt at Its Offices – WSJ

Evergrande said it had hired a unit of Houlihan Lokey Inc., a U.S. investment bank with a reputation for handling restructuring work, and Hong Kong-based Admiralty Harbour Capital Ltd. as financial advisers. In a statement to the Hong Kong stock exchange, it said the two firms would “assess the Group’s capital structure, evaluate the liquidity of the Group and explore all feasible solutions to ease the current liquidity issue and reach an optimal solution for all stakeholders as soon as possible.”

Why it Matters:

“The status quo leaves Evergrande very few options,” Mr. Li, chief executive of Beijing BG Capital Management Ltd. said, pointing to Evergrande’s slowing apartment sales and its lack of bargaining power with potential asset buyers. “But the government must be keeping a close eye on it. If the social unrest keeps spreading, or if the financial market is roiled, the government will step in to help,” he said. We generally agree with this assessment.

LONGER-TERM THEMES:

Electrification Policy:

Comrades Online: Russia Influences Hackers but Stops Short of Directing Them, Report Says – NYT

Some American officials said there had been a lull, at least for now, in major ransomware attacks against high-profile American critical infrastructure that were attributed to Russian criminal groups, a pause that reflects Moscow’s ability to check the criminal networks operating in the country partly. While attacks have fallen off, “it's a fair bet” that the criminal networks are looking for signals from the Russian government about how they can restart their attacks, said Chris Inglis, the national cyber director.

Why it Matters:

The Russian government’s relationship with criminal hackers differs from that of other adversarial powers, like China or North Korea (which directly control groups). According to American government officials, Moscow allows oligarchs and criminal groups to follow their own plans, so long as they do not challenge the Kremlin and are generally working toward President Vladimir V. Putin’s goals. As a result, Russian control of hackers is often looser, giving Mr. Putin and other Russian officials a degree of deniability.

ESG Monetary and Fiscal Policy Expansion:

EU’s LGBTQ Problem: ‘Showing Its Teeth’: EU’s Path to a Showdown Over LGBTQ Rights – Bloomberg

Driven by several prime ministers, the bloc is harnessing powerful new budgetary tools in an unprecedented push to compel Poland and Hungary to reverse moves that undercut the rule of law or lose access to billions of euros. The EU is hoping that, with its newfound financial leverage, it will be able to reverse its paltry record on disciplining rogue members, which has made it more complicated to stand up to China and support democratic values around the world.

Why it Matters:

When the EU passed a landmark budget and stimulus package in December to boost the recovery after the Covid-19 pandemic, a new mechanism was included that makes payouts conditional on adherence to the rule of law. Over the summer, the EU’s Relief Fund commission sent shockwaves through the bloc by postponing approval of Hungary’s and Poland’s recovery plans. Hungary stands to miss out on 7.2 billion euros while Poland would forfeit 23.9 billion euros. The commission so far has disbursed about 50 billion euros to other countries from the stimulus package.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.