MIDDAY MACRO - DAILY COLOR – 9/13/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, as heavy selling at the NY cash open reversed overnight gains as confusion/concerns over fiscal (taxes) and China (policy & relations) are weighing on sentiment

Treasuries are higher, moving the 10yr yield back into the middle of its September range as traders await tomorrow’s inflation data

WTI is higher, as the entire energy complex is better bid due to electricity shortages in the U.K. and Europe, continued disruptions in U.S. production (with a new storm approaching the region) verse some improvement in Iran’s nuclear inspection posturing (allowing further negotiations)

Analysis:

Equities again gave up overnight gains at the NY-open (although attempting to bounce now), which occurred several times last week, with the S&P now finding support from a critical post-November up-trending line (at the 4450 area) and markets more generally bracing for tomorrow's inflation data.

The Russell is outperforming the S&P and Nasdaq with High Dividend, Value, and Small-Cap factors, and Energy, Real Estate, and Financials sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4507 while the call wall fell to 4500; technical levels have support 4455 and resistance 4515.

Treasuries are higher with the curve flatter as there was a better bid overnight, even with a more risk-on tone pre-NY-open.

Econ Data:

The NY Fed’s August 2021 Survey of Consumer Expectations shows that short- and medium-term inflation expectations rose to new series highs of 5.2% and 4%, respectively. Home price growth expectations continued to moderate in August but remain elevated. Households’ perceptions about their current financial situations improved, and income growth expectations rose to a new series high.

Why it Matter: We are truly in the “fog of war” period of the recovery as the Delta resurgence and continued supply-side disruptions (shortages of materials and labor) have consumers increasingly uncertain over the future of inflation. This is clearly seen in the median inflation uncertainty (or the uncertainty expressed regarding future inflation outcomes) increasing to a new series high at both the short- and medium-term horizons, with the dispersion also widening. On the flip side, the positive outlook on their financial situation and an all-time high in future income expectations show that there remains a lot of pent-up demand that can be released during the holidays (if the supply of goods and services are available).

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is higher on the week, with the outperformance of the Russell over the Nasdaq notable today

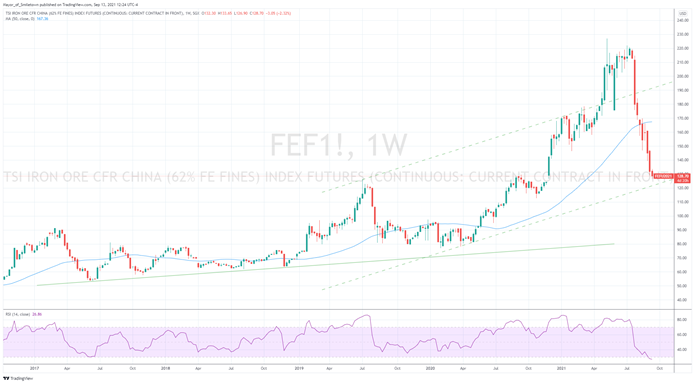

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, as the most-traded Dalian Iron Ore future hits its lowest level in a year

5yr-30yr Treasury Spread: The curve is flatter on the week, with the long-end outperforming today and the curve flatter by 1.4 bps

EUR/JPY FX Cross: The Yen is slightly stronger on the week, but little changed today even as a more risk-off tone is percolating

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

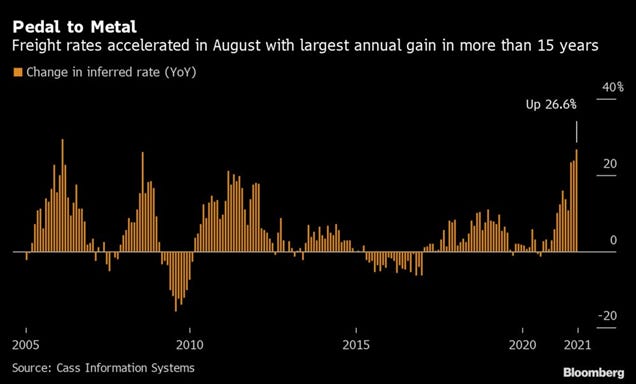

Still Rising: Freight Rates in U.S. Jump by Most in More Than 15 Years – Bloomberg

A measure of freight rates jumped 26.6% from a year earlier, the sharpest increase since February 2006. The volume of shipments by road and rail increased 12.2% from a year earlier, the smallest annual gain since March. At the same time, the group’s gauge of the amount spent on shipping freight surged 42.2% from August 2020.

Why it Matters:

Limited by capacity and a tight labor market, shipping volumes remain elevated, and prices continue to rise. There has still been no meaningful end to the disruptions we have highlighted all year. Interestingly, there is a slight decrease in volume gains, but we would not expect this to continue, given the inventory build into the holiday season.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Critical Subsidies: Biden Administration Takes Aim at China’s Industrial Subsidies – WSJ

Administration officials are considering launching an investigation into Chinese subsidies under Section 301 of the U.S. trade law, which could lead to new tariffs, according to people familiar with their plans. The White House is also looking to team up with the European Union, Japan, and other allies in Asia and rally support within the World Trade Organization to take on Chinese subsidies. China experts say it is doubtful Beijing would negotiate seriously on subsidies, which it sees as essential to its economic success.

Why it Matters:

The planned actions come as the U.S. Trade Representative’s office winds up its months-long review of China policy. As part of its review, the USTR has decided to try to enforce China’s commitments under the Phase One accord negotiated by the Trump administration to boost purchases of U.S. goods by $200 billion over 2020 and 2021. China fell short of those targets by about 40% in 2020 and is now 30% behind its scheduled purchases for 2021. We still view the enforcement/completion of Phase I targets as unlikely and see little hope for the continuation/beginning of Phase II negotiations, where domestic subsidies were to be addressed.

Common Enemy: Japan, Vietnam sign defense transfer deal amid China worries - AP

Japan can now give defense equipment and technology to Vietnam under an agreement signed Saturday, as the two countries step up their military cooperation amid worries about China’s growing military influence. Japan’s Defense Ministry said in a statement that both sides agreed on the importance of maintaining freedom of navigation and overflight in the Indo-Pacific region, as well as cooperation in various defense areas, including cybersecurity.

Why it Matters:

The agreement comes two weeks after the U.S. Vice President Kamala Harris traveled to Vietnam to strengthen ties with the Southeast Asian nation. During the tour, Harris urged countries to stand up against “bullying” by China in the South China Sea. We would expect more cooperation between regional nations to share key defensive technologies and trade in military hardware as China maintains its “Wolf Warrior” stance.

Electrification Policy:

EV Victims: E-car chargers will turn off to prevent blackouts – The Times

In the U.K., electric car charging points in people’s homes will be preset to switch off for nine hours each weekday at times of peak demand because ministers fear blackouts on the National Grid. Under regulations that will come into force in May, new chargers in the home and workplace will be automatically set not to function from 8 am to 11 am and 4 pm to 10 pm. Public chargers and rapid chargers on motorways will be exempt.

Why it Matter:

There is an energy crisis emerging in the U.K. and Euro Zone. In recent weeks, the sudden slowdown in wind-driven electricityproduction off the coast of the U.K. whipsawed through regional energy markets. Gas and coal-fired electricity plants were called in to make up the shortfall from wind. As a result, prices are spiking, and shortages are forcing choices, such as when EV can be charged. Again, as we often point out, baby steps are needed to transition to a more renewable localized energy grid. As a result, traditional energy sources will continue to play a significant role in energy supply for some time.

Commodity Super Cycle Green.0:

Doldrums: Energy Prices in Europe Hit Records After Wind Stops Blowing – WSJ

Natural gas and electricity markets were already surging in Europe when a fresh catalyst emerged: The wind in the stormy North Sea stopped blowing. Natural-gas prices, already boosted by the pandemic recovery and a lack of fuel in storage caverns and tanks, hit all-time highs. Thermal coal, long shunned for its carbon emissions, has emerged from a long price slump as utilities are forced to turn on backup power sources.

Why it Matters:

At their peak, U.K. electricity prices had more than doubled in September and were almost seven times as high as at the same point in 2020. Power markets also jumped in France, the Netherlands, and Germany. Electricity, gas, coal, and carbon markets have a way of feeding on one another, pushing up prices. The feedback loop has the potential to ripple into the broader economy. This month, European Central Bank President Christine Lagarde referred to energy markets as one of the main forces driving higher inflation.

More Gas: California Seeks to Avert Blackouts by Burning More Gas - Bloomberg

California’s main grid operator wants the U.S. Department of Energy to suspend air-pollution rules for some natural gas-burning power plants in case their output is needed “to meet demand in the face of extremely challenging conditions including extreme heatwaves, multiple fires, high winds, and various grid issues,” according to a filing.

Why it Matters:

The emergency request highlights the conflict between California’s green aspirations and the physical reality that wind and solar thus far haven’t been able to cover power shortfalls exacerbated by the shuttering of gas-fired generators. The California Independent System Operator has warned of looming electricity shortages several times this summer.

ESG Monetary and Fiscal Policy Expansion:

Draft Proposal: House Democrats Outline Tax Increases for Wealthy Businesses and Individuals – NYT

The preliminary proposal would raise the corporate tax rate to 26.5 percent for the richest businesses and impose an additional surtax on individuals who make more than $5 million. While it is unclear whether the entire House tax-writing committee supports the proposal, it suggests plans to undo key components of the 2017 Republican tax law. However, some provisions fall short of what Mr. Biden proposed earlier this year.

Why it Matters:

The proposal would raise the corporate tax rate to 26.5 percent from 21 percent for businesses that report more than $5 million in income. The corporate tax rate would be lowered to 18% for small businesses that make less than $400,000 and remain at 21 percent for all other businesses. There is also an increase in the top tax rate for marginal income and capital gains taxes. We believe it is still too early to tell where much of this will end up given the Senate, but things are slowly moving.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.