MIDDAY MACRO - DAILY COLOR – 9/1/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, after a weaker than expected ADP caused pre-NY-open selling pressures that were later reversed by a stronger than expected ISM Manufacturing Survey

Treasuries are little changed, chopping around as risk sentiment shifted to a more positive tone

WTI is lower, recovering from morning lows after headlines from the Russian Oil Minister initially spooked traders; however inline OPEC+ meeting results are now providing support

Analysis:

Equities saw an initial flight to safety post-ADP this morning, with Treasuries and the Nasdaq rallying, but a more risk-on tone is developing, helping the Russell now outperform as lightly manned desks reassess growth outlook post-ISM Manufacturing data.

The Russell is outperforming the Nasdaq and S&P with Small-Cap, Growth, and Low Volatility factors, and Real Estate, Utilities, and Communication sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4462 while the call wall remains at 4550; technical levels have support at 4515, and resistance is 4535.

Treasuries are rising after overnight weakness, with the curve steepening, as the net result of this morning's data was still a better bid with eyes now on Friday’s jobs report and ISM service report.

Econ Data:

The ISM Manufacturing PMI increased to 59.9 in August from 59.5 in July, beating forecasts of 58.6. New orders (66.7 vs. 64.9 in July) and Production (60 vs. 58.4 increased. Price pressures eased to 79.4 from 85.7, the lowest since December. On the other hand, employment contracted slightly. Inventories increased while Delivery times eased, showing a slight improvement in logistical disruptions. However, the ISM's comments suggest supply chain and cost pressures remain a significant challenge. Business Survey Committee panelists reported that “their companies and suppliers continue to struggle at unprecedented levels to meet increasing demand. All segments of the manufacturing economy are impacted by record-long raw-materials lead times, continued shortages of critical basic materials, rising commodities prices, and difficulties in transporting products. The new surges of COVID-19 are adding to pandemic-related issues — worker absenteeism, short-term shutdowns due to parts shortages, difficulties in filling open positions.”

Why it Matters: The report was significantly and suspiciously better than expected given the string of negative regional Fed manufacturing surveys. Reading through the respondent comments, we continue to see supply and production not keeping up with demand, capping growth. In the end, it is still very positive that demand is holding up despite increased prices and increased Delta cases (which could change consumer behavior). We were also encouraged to see the Backlog of Orders and New Export Orders expand as this had been a significant drag in other surveys and did not bode well for future growth. Finally, improving inventories relieves a chief concern as a lack of goods available for sale going into the year-end holiday season would materially reduce growth potential.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week, pushing towards the top of its up-channel

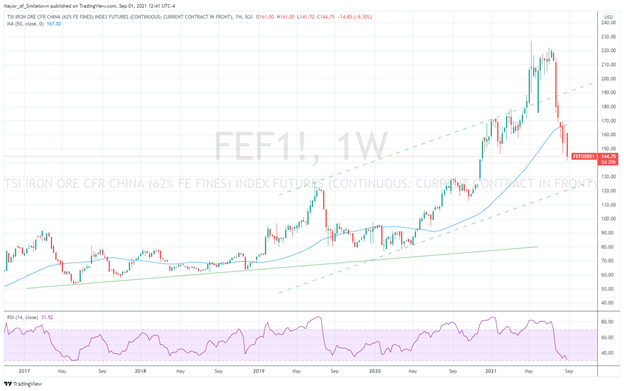

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, with the most traded future in Dalian down -8% overnight

5yr-30yr Treasury Spread: The curve is steeper on the week, moving back into the middle of its post-June range

EUR/JPY FX Cross: The Euro is stronger on the week, making significant gains and now pushing to the top of the recent downtrend channel

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Delta in the Delta: Vietnam's status as manufacturing powerhouse is shaken by Covid surge - FT

Nikkei Asia now ranks Vietnam joint last, in 120th place tied with Thailand, on its Covid-19 Recovery index, whose criteria includes countries' infection management and rollout of vaccinations, an area in which Vietnam failed to plan adequately. Brands including Nike and Adidas have had their operations disrupted, highlighting Vietnam's growing role in global supply chains. “The restrictions are seriously constraining the manufacturing capacity in the country,” says Nguyen Phuong Linh, associate director at Control Risks.

Why it Matters

With the Vietnams’s former zero-case strategy now moot, most of Hanoi’s focus is on containing infections and keeping business going. Some companies are employing a “three-on-site” model of having factory staff work, eat and sleep at work. But this is hard on employees and costly for companies. Stepping back, Delta is a “short-term issue because Vietnam is still an attractive option for foreign investors vis-à-vis other countries in Asia.”

Elsewhere in Asia: Delta’s Rapid Spread Weighs on Asia’s Factories as PMIs Drop - Bloomberg

Manufacturing purchasing managers’ indexes for Indonesia, Vietnam, Thailand, Philippines, and Malaysia all remained deep in negative territory in August, reflecting the disruption from lockdowns that forced factories to halt or slow production. Data from IHS Markit showed India’s manufacturing PMI fell to 52.3 from 55.3, making it an exception from the south to still post-expansion, albeit a softer one.

Why it Matters:

Worldwide goods trade, which had been a pillar of the global economy earlier in the pandemic, is now under threat from the delta-induced interruptions, on top of still-soaring shipping costs. If things arent available (especially by the holidays), then high levels of savings and available credit won’t overcome actual shortages. On a more positive note, South Korea and Taiwan have had better success in dealing with the recent Delta uptick, and hence their PMI’s are still in expansionary territory while exports have been strong.

Help Needed: Walmart Will Add 20,000 Workers to Supply-Chain Operations This Year – WSJ

The twenty thousand new hires will be permanent to support Walmart through the holiday surge and beyond. The hiring comes as retailers and logistics operators are moving their peak-season preparations forward as they grapple with a tight labor market, congested shipping networks, and surging supply-chain volatility.

Why it Matters:

Competition for workers has pushed up wages for distribution jobs as businesses rush to restock pandemic-depleted inventories and meet surging online demand. Warehousing and storage payrolls accounted for 1.44 million jobs in July, more than half a million more than the sector counted just five years ago, according to seasonally adjusted preliminary employment figures the Labor Department released last month.

LONGER-TERM THEMES:

Electrification Policy:

Viva la Fiat: New Round of Protests Against President Bukele's Bitcoin Law in El Salvador - Decrypt

Salvadorans have taken to the streets in protest against the country’s acceptance of Bitcoin as legal tender, which will take place on September 7, 2021. This is not the first set of protests. In June, Jamie Guevara, the deputy leader of El Salvador’s opposition party the Farabundo Marti National Liberation Front, filed a lawsuit in opposition to President Bukele’s Bitcoin Law and led protests against it.

Why it Matters:

A CEC survey showed that over three-quarters of Salvadorans did not support President Bukele’s Bitcoin project. The survey also found that 61% of merchants would not be willing to accept payments in Bitcoin. The bottom line, this looks like a political stunt that will not end well.

ESG Monetary and Fiscal Policy Expansion:

Something Deeper: States That Cut Unemployment Benefits Saw Limited Impact on Job Growth – WSJ

States that ended enhanced federal unemployment benefits early have so far seen about the same job growth as states that continued offering the pandemic-related extra aid, according to a Wall Street Journal analysis and economists. “If the question is, ‘Is UI the key thing that’s holding back the labor market recovery?’ The answer is no, definitely not, based on the available data,” said Peter Ganong, a University of Chicago economist, referring to unemployment insurance.

Why it Matters:

Economists caution against concluding too much from these results that expiring benefits had no effect on employment. First, they say it might be too early to detect such an effect. Second, offsetting effects from state reopenings and virus-related restrictions by local governments could be masking the impact of the expiring benefits. We always believed there it was never as simple as UEB keeping labor away, but that certainly had a part to play. It will now be interesting to see where the new Epop level settles as the expansion of the gig economy, increased retirements, and working-age migration out of the workforce are all occurring in tandem.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.