MIDDAY MACRO - DAILY COLOR – 9/10/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, after an overnight rally reversed at the NY-open with no clear theme in today's price action as various headlines and sell-side outlook downgrades weigh on sentiment

Treasuries are lower, reversing yesterday post-30yr auction rally and moving somewhat in tandem with equities

WTI is higher, back at yesterdays levels after somewhat of a roller-coaster ride over the last 24 hours following Chinese headlines, EIA and API data, and an OPEC demand downgrade

Analysis:

Equities failed to maintain a more positive tone which developed overnight following a headline-filled evening (Biden’s call with Xi, additional vax requirements) that initially empowered a more reflationary/reopening outperformance; however, a more neutral tone is currently underway following negative developments (Apple store, China Trade Probe)

The Nasdaq is outperforming the Russell and S&P with Momentum, High Dividend, and Growth factors, and Material, Energy, and Consumer Discretionary sectors all outperforming.

S&P optionality strike levels have the zero gamma level at 4501 while the call wall remains at 4550; technical levels have support 4455 and resistance 4515.

Treasuries are lower, with the curve steeper as the high level of debt supply this week and a slight beat in headline PPI is weighing on prices.

Econ Data:

Producer prices for final demand were up 0.7% MoM in August, the lowest increase in three months, with the annual rate increasing to 8.3%, the highest level since November of 2010. The median forecasts in a Bloomberg survey of economists called for a 0.6% MoM advance in both the overall PPI and the core figure. Excluding food, energy, and trade services, core final demand prices increased 0.3% on the month, below the 0.5% estimate and the slowest rate of increase in seven months. The prices for services increased by 0.7%, with over 30% of the increase being traced to a 7.8% increase in health, beauty, and optical goods. The price of goods increased 1% MoM (food +2.9% MoM, energy +0.4%MoM), mainly boosted by an 8.5% jump in meat prices (slaughtered poultry prices increased 11%). Prices for residential natural gas, industrial chemicals, processed young chickens, motor vehicles, and steel mill products also increased notably. Prices fell for iron, steel, and diesel fuel.

Why it Matter: This report gives a cause for some “hope” (the theme of our recent posts) that we may have seen a peak in the rate of acceleration in at least core producer price inflation. However, the increase in food, specifically meats, is troubling and highlights the renewed negative impact that the Delta variant has brought to the meatpacking industry. More generally, there are still massive challenges affecting the production pipeline, all of which we have highlighted here for some time. The bottom line is we do not yet see a meaningful improvement in either material or labor shortages, and inflation is becoming more persistent. The longer this transitory inflation remains, the more likely it will change the psychology of the consumers, allowing for a more structural wave to form.

Policy Talk:

An article by Nick Timiraos at the WSJ saying the Fed will finalize plans to start tapering in November in their September meeting is making its rounds this morning. In the article, he highlights Fed officials have indicated they don’t want to be in a position where they are still increasing the balance sheet when a rate hike may be needed to keep inflation in check. He notes officials are still working out the taper details, which is likely what will be finalized in the September meeting. It is also important to highlight that the economic backdrop differs from when the Fed tapered in 2013. “It’s a different set of circumstances this time, both on inflation, on growth, on unemployment and employment,” said Mr. Williams. “There’s no necessity to follow a specific time frame or approach from before. It’s really about setting policy as appropriate for the conditions that we’re in today.” Last month, Fed Vice Chairman Richard Clarida said the risks of higher-than-projected inflation were more prominent than the risks of lower-than-anticipated inflation. He also said he thought the unemployment rate could fall to 3.8% next year with inflation running above 2.1%, which would satisfy the thresholds the Fed has laid out to raise interest rates by the end of next year.

Why it Matters: Timiraos has long been seen as a megaphone for Fed policy, having an inside track and being used by the FOMC to broadcast coming actions. Incunjuction with the various Fed speakers we have heard from already, it is now becoming clear the Fed will begin tapering before year-end. We believe the persistence of Delta will give the Fed enough of a reason to announce a longer duration taper, likely ten months. We also don’t believe in path optionality, meaning once a course is announced, it will be stuck to, despite changes in the underlying economic backdrop (given no massive shock). This means that there will be little time between the end of tapering and the first-rate hike if inflation remains persistent and labor markets continue to make progress (which we believe will happen). As a result, financial conditions could quickly tighten next year.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week, with the ratio little changed on the day as the Nasdaq and Russell are both slightly up today

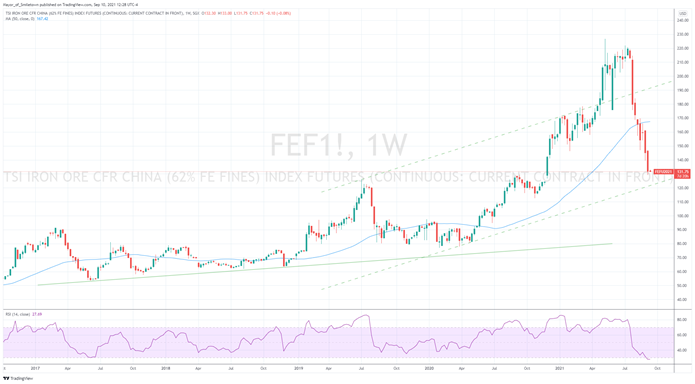

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, with no real change in sentiment despite almost every other industrial metal rallying

5yr-30yr Treasury Spread: The curve is flatter on the week, however steeper on the day by 1%

EUR/JPY FX Cross: The Yen is stronger on the week, but the recent trend still favors the Euro, indicating a more risk-on tone globally

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Super Secret: KFC Isn’t Advertising Chicken Tenders Because of Supply Crunch – Bloomberg

Americans are flocking to boneless chicken sandwiches. Fast-food rivals besides KFC are capitalizing on the trend include Popeyes, Burger King, and McDonald’s Corp. Earlier this year, it said its new crispy poultry sandwich was exceeding expectations in the U.S. But a shortage of workers across the supply chain, especially in poultry plants, makes it tough for companies to keep grocery shelves and restaurants fully stocked.

Why it Matters:

Shortages of chicken sandwiches are just another example of how labor shortages are affecting day-to-day life. These shortages, as we know, are not only at the production level but now increasingly at the front-line service level. It also highlights a general herd mentality our countries culture has developed, exacerbated by the interconnectivity brought on by social media. This sudden increase in demand for whatever is trending (such as crispy chicken sandwiches now or home improvements during the lockdown) overwhelms our supply chains and drives inflation spikes.

China Macroprudential and Political Tightening:

Deadline Extension: China Lets Evergrande Reset Debt Terms to Ease Cash Crunch - Bloomberg

Regulators in Beijing have signed off on a China Evergrande Group proposal to renegotiate payment deadlines with banks and other creditors, paving the way for a temporary reprieve as the cash-strapped developer struggles to come to grips with more than $300 billion of liabilities. Some lenders have indicated a willingness to be flexible on payment deadlines. Citic Trust, one of the developer’s biggest non-bank lenders, has given preliminary approval to a three-month extension on loans that were due in August.

Why it Matters:

The development suggests Evergrande has regulatory backing to negotiate with creditors on a piecemeal basis, as it tries to ease a cash crunch that has unnerved investors in China’s $12 trillion bond market. While China’s government has publicly urged the company to solve its debt problems, officials have yet to spell out whether they would allow a major debt restructuring or bankruptcy. This regulator proposed renegotiation is a sign that Beijing is leaning towards supporting a more orderly wind down.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Help Needed: Big Tech Has Made Billions Off the 20-Year War on Terror - Vice

The report lays out how tech companies have increasingly pursued federal contracts and subcontracts with America's military, intelligence, and law enforcement agencies after 9/11. Indeed, from 2004 to today, contracts between the federal government and major technology companies such as Microsoft, Amazon, Google, Facebook, and Twitter have exploded in number, the report found. Since 2004, five government agencies have spent at least $44.7 billion on services from those five technology companies.

Why it Matters:

This report takes the liberal approach that these companies are profiting off war and targetting minorities, adding to society's larger problems. We see it differently and acknowledge that war and hence the defense industry and its partnership with tech is an inevitability given human nature. There must, of course, be accountability, so give the report a read and decide for yourself. Still, the ability of the United States to partner with its private-sector tech giants to better execute its goals is an excellent example of a dual-use asset. We wanted to highlight the degree to which it is occurring.

Commodity Super Cycle Green.0:

Vaca Verde: World’s Top Beef Supplier Approves Methane-Busting Cow Feed – Bloomberg

Brazil regulators have granted full market authorization to Bovaer, a feed additive that cuts methane emissions produced by Dutch nutrition giant Royal DSM NV. The product, which will be used for beef, dairy cows, sheep, and goats, has also been approved in Chile. Latin America is the first region to grant approvals for the DSM product, which is also trying to get permission in the European Union, the U.S., and New Zealand. A trial on Brazilian beef showed Bovaer cut methane emissions from cows’ stomachs by as much as 55%, the company said.

Why it Matters:

Tackling methane emissions from livestock is one of the most critical climate challenges for meat and dairy companies. Researchers and companies have pursued a range of solutions from breeding “climate-smart” cattle to additives and even masks for cows, with most still pending commercialization and regulatory approvals. We need to see the U.S. and Europe adopt this approach for it to get global traction.

ESG Monetary and Fiscal Policy Expansion:

No Gas: Natural Gas Excluded in Democrats’ Budget Plan for Clean Energy – Bloomberg

Natural gas won’t count as clean energy under a House Democratic plan that would eventually rid the electric grid of carbon and is part of the $3.5 trillion tax-and-spending package moving through Congress. Natural gas would be excluded because only electricity with a carbon intensity of less than 0.10 metric tons of carbon dioxide equivalent per megawatt-hour will count, according to a summary provided by the committee.

Why it Matters:

The proposal by a House panel would provide $150 billion to help spur electric providers to add more clean energy through a system of payments and penalties for electric suppliers. Under the program, electricity suppliers would be eligible for a grant if they increase the amount of clean electricity supplied to customers by 4% compared to the previous year, according to the summary. Utilities that fail to increase their clean electricity percentage by at least 4% over the previous year will owe a payment to the Department of Energy.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.