MIDDAY MACRO - DAILY COLOR – 8/6/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, with jobs data increasing the growth outlook, helping the Russell while hurting the Nasdaq

Treasuries are lower, with selling strongest in the long-end as 10yr and 30yr yields push to the top of their June downtrend channels

WTI is lower, as the overnight rally reversed at the NY-open and the futures curve continues to flatten

Analysis:

The S&P is little changed following the jobs data as “good” may now be “bad” for financial conditions given it allows the Fed to tighten sooner than previously thought. Treasuries are responding as expected given the positive data, with key technical levels now being tested.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, High Dividend Yield, and Value factors, and Financials, Materials, and Energy sectors are all outperforming.

S&P optionality strike levels have zero gamma level moving to 4386 while the call wall is at 4500; technical levels have support at 4410, and resistance is 4435, followed by 4470.

Treasuries in the long-end are notably weaker, and the 2yr-30yr spread is wider by 6.5 bps, as traders now look to next week's 10yr supply and CPI data.

Price action following the jobs report tells us two key things; growth expectations have increased while the start and duration of tapering have moved forward and shortened.

Higher growth expectations are supporting “reflationary” themed trades today as small-caps and value outperform despite no meaningful change in Delta case increases and the data being pre-Delta uptick.

The resilience of the belly verse selling in the long-end of the Treasuries curve shows that the debate is primarily on the timing and duration of tapering, while rate hike expectations are still anchored in mid-2023.

We are encouraged by the report, and it emboldens our belief that growth will beat expectation into year-end, but we are not convinced “substantial progress” will be made by the September FOMC meeting as the Fed continues to grapple with interpreting “dirty” data and forecasting the effects of increased Delta cases.

Although growth should continue to be solid and individual data releases (such as today’s job report and ISM Service PMI earlier in the week) will increasingly beat expectations (now weakening due to Delta), we acknowledge that real economic momentum cannot gain traction until case counts peak.

There are certainly signs that consumer activity is slowing seen in credit card use, reopening delays, and event cancelations while mobility activity has been stickier.

As a result, we remain cautious re-engaging in reflationary-themed trades and continue to expect a patient Fed that will announce tapering in November or December to start in January and take ten months to finish.

Econ Data:

The U.S. added 943K jobs in July compared to the 858k expected. The Household Survey reported UER dropped to 5.4% from 5.9% in June as the level of unemployed dropped by 782k to 8.7 million. The labor force participation rate was little changed at 61.6%, as female participation continues to be weak, helping the UER drop so much. The bulk of the hiring occurred in leisure and hospitality (+380k), government (+240k), and education/health (+60k). Average hourly earnings are up 4% annually, with average hourly earnings for nonsupervisory workers up 13%. Revisions to the past two months were also solid, increasing the totals by an accumulative amount of 119K.

Why it Matters: This was a positive job report, and we underestimated the seasonal adjustments, which made up much of the gains. Turning to what the Fed is focused on, we saw progress towards “substantial progress” in a few areas. Minority unemployment notably improved while the prime-age employment-to-population ratio ticked up to 77.8%. There was also a decrease in long-term unemployment, although there is still significant improvement needed there (workers may have been lost there permanently too). On the more negative/neutral side, the level of part-time workers looking for full-time remained stable, coming in at 4.5 million. Finally, 5.2 million people reported that they had been unable to work because their employer closed or lost business due to the pandemic, down from 6.2 million in June. This indicates we are still in an “emergency” labor dislocation situation (justifying the continuation of emergency measures in the eyes of the Fed). Putting it all together, it was a positive report that, if followed by a strong August report, could create the needed backdrop for a September taper announcement, but again this is not our base-case scenario.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week thanks to today’s pullback in growth following the better-than-expected jobs report

Chinese Iron Ore Future Price: Futures are lower on the week as expectations for weaker demand due to Beijing desire to cut steel output continues

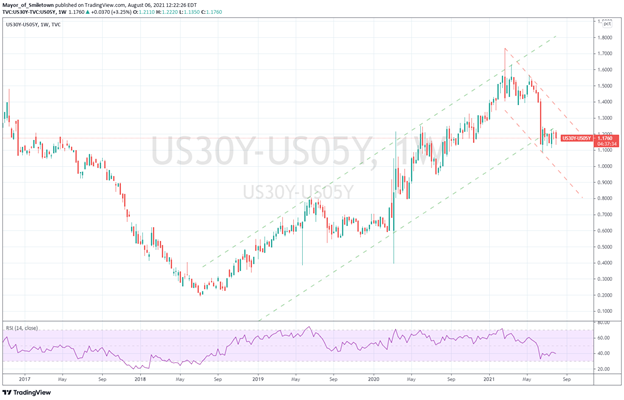

5yr-30yr Treasury Spread: The curve is flatter on the week; however, today’s steepening has retraced much of the week’s flattening

EUR/JPY FX Cross: Yen is higher on the week, with the cross little changed today

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Still Growing: U.S. Trade Deficit Widened to Record in June, Showing Strong Pre-Delta Demand – WSJ

The trade gap in goods and services expanded 6.7% from May to a seasonally adjusted $75.7 billion. Exports have grown more slowly, reflecting weaker recoveries in some other regions that have made less progress against Covid-19. Exports rose in June by just 0.6% to $207.7 billion.

Why it Matters:

The trade report for June covered a period before the Delta variant began its spread in the U.S. By the end of June, Covid-19 cases were still very low, but the re-emergence of the virus has cast a shadow over the broader economic outlook. However, we believe that the Delta uptick will be much less detrimental to growth and consumer demand. This assumes we will see a continuation in increased vaccination rates and behavior changes (more generally) that will slow the spread. Finally, the increase in imports suggests that logistical challenges will continue to be pressured by record demand.

Should Moderate: Container equipment prices double in the space of 12 months – Spash247

Dry box new-build prices rallied strongly in 2020 from the lows of the prior year to reach their highest level since 2011 by the fourth quarter, with a year-on-year gain of 75%. By Q2 this year, 40ft high cube containers breached the $6,500 threshold, more than doubling year-on-year, to reach their highest value since Drewry started monitoring container equipment prices back as far as 1998.

Why it Matters:

“We expect dry box prices to peak in the third quarter and to soften thereafter, easing further over subsequent years as trade normalizes,” said John Fossey, head of container equipment and leasing research at Drewry. Input cost increases, such as Corten steel and flooring material, have peaked, and disruptions across the supply chain are slowly beginning to ease, as seen in waiting times at ports and logistical sector hiring activity.

China Macroprudential and Political Tightening:

Clean-Up Needed: China Huarong Securities Unit Delays Release of 2020 Results - Bloomberg

Huarong Securities said the postponement in releasing its financial results is due to a deal related to its parent company and reiterated that its operations are normal and all bonds are paid on time. China is considering a plan to see the PBoC assume more than 100 billion yuan ($15 billion) of assets from China Huarong, helping the state-owned company clean up its balance sheet and refocus on its core business of managing distressed debt.

Why it Matters:

In early July, a regulatory directive called “Document No. 15” was circulated, telling banks to stop lending to heavily indebted local-government financing vehicles (LGFV). Then the circular vanished, along with most references to it in state media. Speculation is that regulators reversed course, worried about hurting bond markets, where LGFVs make up 10%. We have seen similar reversals elsewhere, and the belief that Beijing is now committed to quietly mopping up the NPLs across various sectors while providing new policy support to counter recent lockdowns.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Sanctions Do Work: Huawei suffers biggest-ever decline in revenue after US blacklisting - FT

Huawei suffered its biggest-ever decline in revenue in the first half of this year. Its consumer electronics arm’s revenue fell by nearly 47% from a year ago, as severed access to crucial US chips prevented the company from selling its phones. Since Washington first added Huawei to its trade blacklist in 2019, it has progressively tightened the screw, citing national security concerns, which are clearly now hurting the company.

Why it Matters:

Sanctions work and they are increasingly being used, by both the West and China. Huawei's financial results and loss of market share, as well as its forced pivot to move away from an Android OS platform, forcing them to create their own, are all in line with the original intentions of the U.S. sanctions. As a result, companies in critical sectors (especially in China) should reflect risk premiums that compensate investors for the additional risk of being sanctioned.

Electrification Policy:

Private No-More: Apple plans to scan US iPhones for child abuse imagery - FT

Apple detailed its proposed “child abuse scanning” system, known as “neuralMatch,” to some US academics earlier this week. The automated system will proactively alert a team of human reviewers if it believes illegal imagery is detected, who would then contact law enforcement if the material can be verified. The scheme will initially roll out only in the US.

Why it Matters:

The road to hell is paved with good intentions. The proposals are Apple’s attempt to find a compromise between its own promise to protect customers’ privacy and demands from governments, law enforcement agencies, and child safety campaigners for more assistance in criminal investigations, including terrorism and child pornography. However, it's not hard to imagine how bad actors can use this technology/digital infrastructure for more Orwellian purposes.

Private-Public Partners: U.S. Taps Amazon, Google, Microsoft, Others to Help Fight Ransomware, Cyber Threats - WSJ

The Cybersecurity and Infrastructure Security Agency unveiled an initiative called the Joint Cyber Defense Collaborative which will initially focus on combating ransomware and cyberattacks on cloud-computing providers. Ultimately, its goal is to improve defense planning and information sharing between the government and the private sector.

Why it Matters:

The partnership with private firms is essential given the multi-front effort needed and increased budget strains existing public resources. The Senate has included additional funding for CISA in its $1 trillion infrastructure bill that could be passed by the chamber this week. The proposed legislation includes a raft of other cybersecurity measures, such as $1 billion in funding over the next few years for a cybersecurity grant program for states and local authorities and additional money to boost energy-sector cyber defenses.

Commodity Super Cycle Green.0:

The More You Push: Coal Is a Gold Mine for Producers After Blistering Rally – WSJ

Prices for thermal coal have shot to decade highs as supplies struggle to keep pace with demand from China and elsewhere during the global economic recovery. Analysts expect prices to stay elevated because concerns about the fuel’s contribution to climate change have made it increasingly difficult for miners to obtain permits or funding to dig more thermal coal out of the ground.

Why it Matters:

As we have previously highlighted, the world's transition away from fossil fuels will continue to support the prices of coal, oil, and natural gas as new sources of supply diminish faster than demand. In turn, this also increases the incentives to switch away from those sources of energy towards renewables. We expect this dynamic to play out until renewables are finally a majority of the world’s energy portfolio and the “electrification” of society is well underway.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.