MIDDAY MACRO - 8/5/2021

Daily Color on Markets, Policy, and Geo-Politics

MIDDAY MACRO - DAILY COLOR – 8/5/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, as stronger earnings are outweighing Delta worries

Treasuries are lower, dropping after initial claims came in line with expectations

WTI is higher, as post-NY-open dip-buying looks to be occurring

Analysis:

Equities are grinding higher post-NY-open, supported by another day of solid earning beats and thoughts that increased Covid cases in China may spur Beijing to increase stimulus support.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Momentum, and Growth factors, and Energy, Financials, and Consumer Disc. sectors are all outperforming.

S&P optionality strike levels have zero gamma level moving to 4366 while the call wall is at 4450; technical levels have support at 4390, and resistance is 4435.

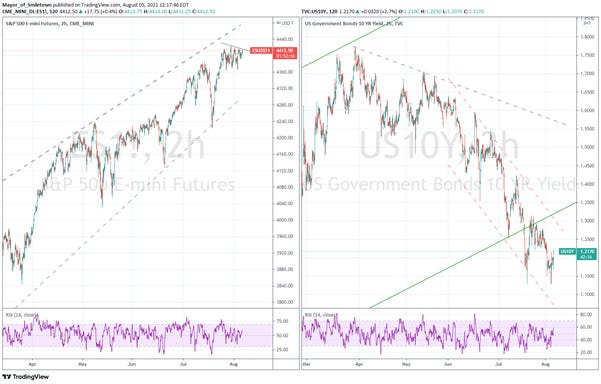

Treasuries are weaker with the long-end near it weakly lows while the belly underperforms, causing the curve to flatten as all eyes are on tomorrow’s jobs report.

Price action across assets today is generally more upbeat despite the continued increase in domestic Covid cases and China going into further lockdowns, indicating Delta fears may be ebbing and growth expectations may be stabilizing/rising.

Delta’s surge means markets are starting to expect more stimulus may be coming, both in the U.S. and abroad, as policymakers grapple with extending existing measures and delaying or reducing tightening measures.

In reality, we haven’t seen this yet, and instead, global central bankers have become more hawkish (outside of the Fed, ECB, and BoJ) while governments have yet to announce meaningful new fiscal stimulus measures and we don’t expect nearly the degree of response previously seen.

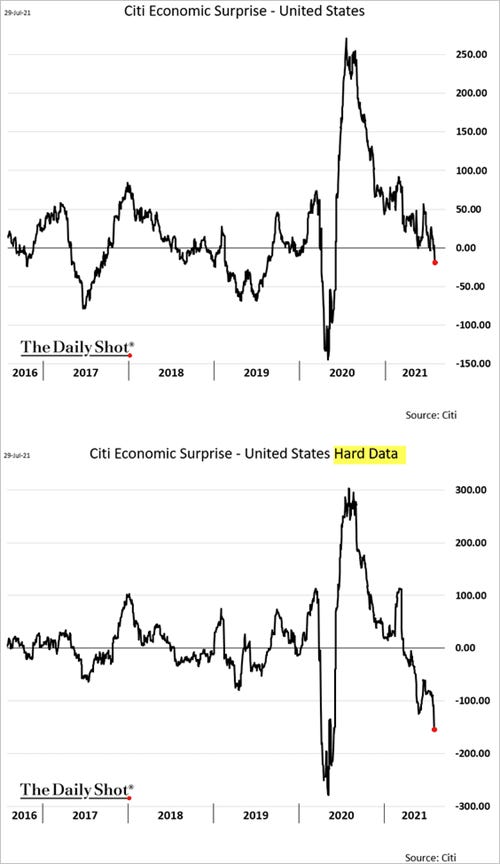

The U.S. data picked up this week, with Manufacturing PMIs (Markit and ISM) coming in line with expectations while ISM Service PMI and Factory Orders beat following last week's GDP miss that sent the Citi’s Economic Surprise index to its lowest level of the year.

Although we think tomorrow's job report expectations are too optimistic, we believe a miss of -100k to -200k would support risk assets, as it would remove September taper announcement fears and be in line with the labor market frictions we believe will persist into the fall.

Econ Data:

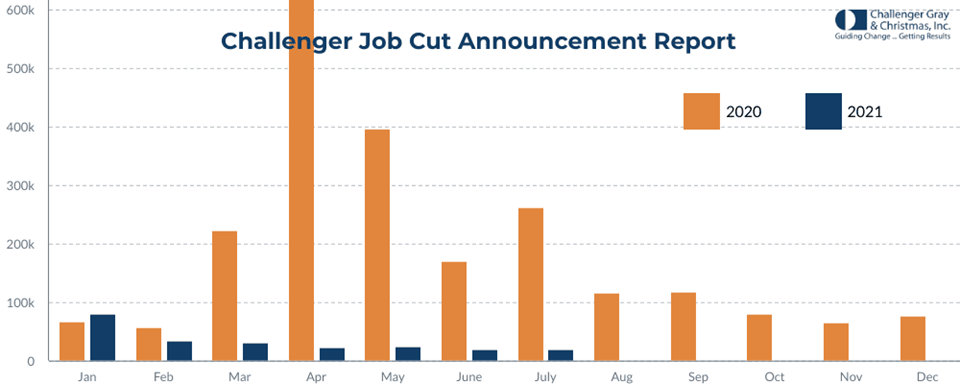

Challenger July Job cuts were the lowest since June 2000 as companies increasingly reported difficulties finding and keeping talent. July cuts were led by the Pharmaceutical sector, which announced 2,249 cuts, primarily due to diminishing demand for COVID tests and related materials, which is likely to change moving forward. So far this year, employers have announced plans to cut 231,603 jobs from their payrolls, down 87.5% from the 1,847,696 jobs eliminated through the same period last year. It is the lowest January-July total on record.

Why it Matters: There are over 9.2 million job openings and 9.5 million unemployed, according to Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. “It remains to be seen what the Delta variant may do to job cuts if anything. At this point, companies are trying to attract and retain talent, not let them go,” said Challenger. Looking at the big picture, we still expect weaker than expected hiring activity into the fall as the impediments (childcare, UE benefits, Covid worries) have yet to change materially.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is outperforming on the week, and even with Russell outperforming today, value is underperforming on the day

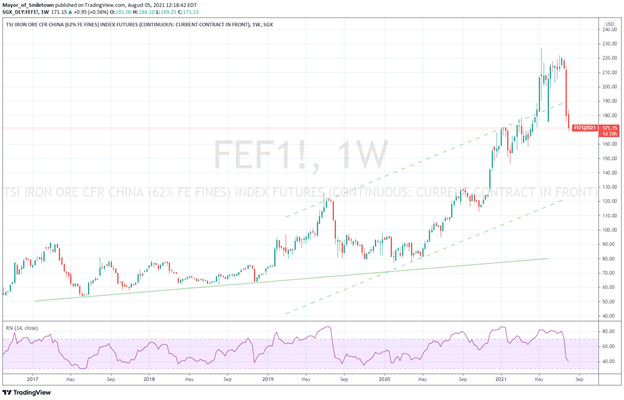

Chinese Iron Ore Future Price: Futures are lower on the week on expectations of weaker demand as Beijing moves to cut steel output

5yr-30yr Treasury Spread: The curve is flatter as the belly is underperforming again into tomorrow’s jobs report

EUR/JPY FX Cross: Yen is higher on the week, although off its highs as a more risk-on tone is taking place today

HOUSE THEMES / ARTICLES

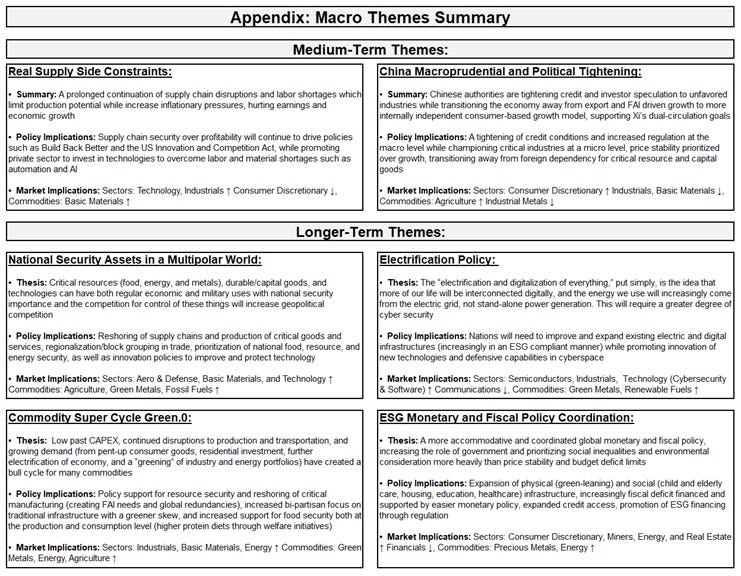

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Never-ending Story: China Typhoons Pose Latest Supply-Chain Threat as Ports Shut - Bloomberg

Yantian port in southern China’s export and industrial hub of Shenzhen temporarily stopped drop-off services of containers on Tuesday night due to a typhoon alert. Just two weeks earlier, Shanghai’s Yangshan mega-terminal facility and nearby ports evacuated ships as Typhoon In-Fa slammed into the coast, bringing widespread flooding and toppling containers stowed in the hold of a bulk carrier traveling to the U.S.

Why it Matters:

This season is expected to be heavier than usual for tropical cyclones. Each time a port is forced to close, containers pile up, adding to existing delays. However, the average waiting time for a container is now five days, down from 25 in June, showing bottlenecks have improved despite extreme weather. In other news, factories are shutting in both China and Vietnam due to Covid lockdowns being imposed.

Still Treading Water: GM Reveals Hit From Chip Shortage, Rising Costs – WSJ

Surging car sales aren’t proving strong enough to displace auto makers’ concerns over their supply chains. General Motors posted strong second-quarter earnings and raised its full-year profit guidance, but the outlook for second-half profits disappointed investors, sending shares 9% lower. The company said higher commodities costs would cut $1.5 billion to $2 billion from the bottom line in the second half of the year.

Why it Matters:

GM’s outlook highlights the divergent tracks the automotive sector is navigating. Tight dealer inventories are driving record price increases amid strong consumer demand. But GM expects to make about 100,000 fewer vehicles in North America in the second half of the year, a cutback that will echo across its supplier base. We think firms are generally too cautious in their outlook due to the renewed uncertainty of Covid and the continuation of supply-side disruptions.

Always-on-Time: NXP Semiconductors expects auto companies to pump the brakes on just-in-time – Supply Chain Dive

NXP Semiconductors expects its automotive customers will begin shifting away from just-in-time inventory management for semiconductors following the issues experienced during the current component shortage, but low levels of availability are currently holding them backing from transitioning to higher inventory levels, CEO Kurt Sievers said on the company's earnings call. He also noted that NXP is signing on to more long-term contracts with automotive customers, which are also sharing more binding long-term forecasts that help with capacity planning.

Why it Matters:

Ford is focusing on build-to-order vehicles, and Tesla rewrote the firmware for its vehicles to allow it to use chips from an alternative supplier. Despite these steps, companies have had to cut production levels and are struggling to keep up with demand. A recent forecast from IHS Markit shows that they expect there won't be enough chip capacity in the market to meet demand and fill backlog until the first quarter of 2022.

China Macroprudential and Political Tightening:

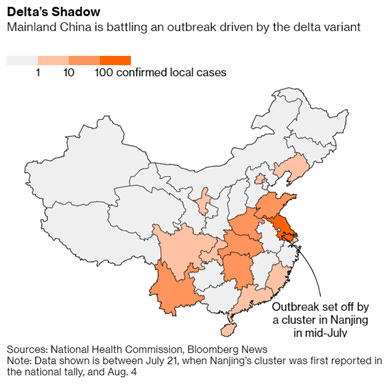

Zero-Tolerance Approach: China Imposes Restrictions as Delta Reaches Nearly Half the Country - Bloomberg

China imposed new restrictions on travel in a bid to slow a delta-driven outbreak that’s grown to more than 500 cases scattered across half the country. Public transport and taxi services were curtailed in 144 of the worst-hit areas nationwide, while officials curbed train service and subway usage in Beijing, where three new cases were reported Wednesday. Hong Kong re-imposed quarantine on travelers from the mainland, though an exception remained for the southern Guangdong province.

Why it Matters:

China is relying on an aggressive containment response to Covid outbreaks rather than rely on its high vaccination rate. Beijing seems to have little confidence in its homegrown vaccines. As a result, more stimulus will likely be used to offset drags on growth from lockdowns just as the country's credit pulse is beginning to turn higher. If the virus spread can be contained quickly and fiscal and monetary stimulus is ramped up, China’s should accelerate into year-end.

No Place Like Home: China Startups Shut Out of U.S. Face Tougher Hong Kong IPO Rules - Bloomberg

Chinese startups hungry for foreign capital are increasingly turning to Hong Kong as hurdles to list in the U.S. multiply. The Hong Kong Exchanges makes far more stringent demands on companies planning a listing than its New York peers. Firms likely to struggle listing include unprofitable startups with little revenue, such as those developing autonomous driving cars, or companies in industries including ride-hailing, which operate in a legal gray zone.

Why it Matters:

The big question is whether companies listing in Hong Kong will get valuations as compelling as in the U.S. The HKEX will raise the annual profit requirement for mainboard listings and has vowed to crack down on suspicious IPO activities such as inflating the market capitalization of firms. As a result, riskier startups will turn to other sources of capital, such as venture capital and private equity funds.

LONGER-TERM THEMES:

Electrification Policy:

Still Up to No Good: Facebook Disables Accounts Tied to NYU Research Project - Bloomberg

Facebook Inc. has disabled the personal accounts of a group of New York University researchers studying political ads on the social network. Political ads on Facebook have been a source of contention for years. The company's controversial policy against fact-checking political ads led to criticism that candidates would pay the company to spread lies through their ads.

Why it Matters:

Facebook is trying to deflect attention from selling personal information to political operatives that often spread targeted disinformation to affect voter intentions. This is what Cambridge Analytics was about, which led the FTC to fine FB $5 billion as part of a settlement with regulators, and Facebook was supposed to change behavior. Looking at the big picture, people will be reluctant to engage online and share personal data if they believe it will be sold to companies that will use it to manipulate them.

Not-Opt-Out: California Attorney General says popular, digital ad opt-outs from trade groups don’t comply with CCPA - DigiDay

For more than a year, advertisers and publishers had few clues for detecting how California regulators would enforce the state’s privacy law. Enforcement letters from the state's AG now say companies cannot rely on blanket digital ad opt-out tools from trade groups to satisfy compliance with the California Consumer Privacy Act. In other words, popular opt-out tools from the Network Advertising Initiative and Digital Advertising Alliance won’t cut it.

Why it Matters:

The CCPA requires that companies notify people of data sales and give them a choice to opt-out of it. Companies have to now provide people with options that are “more specific to a CCPA opt-out. We highlight this here to show that standards are still developing, and in conjunction with developments in Europe, will likely set a global data-privacy standard.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.