MIDDAY MACRO - DAILY COLOR – 8/4/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, with mixed data and Delta fears muddying outlook and weighing on sentiment

Treasuries are mixed, chopping around post-ADP and Service PMI data with 30yr outperforming

WTI is lower, as “Delta Everywhere” fears continue to reduce the global demand outlook

Analysis:

A significant miss in the ADP jobs report that was shortly followed by the best ISM Service PMI ever on top of more lock-downs in China is creating whipsawish price action in Treasuries and subsequently the Nasdaq and Russell as traders decide what to weigh heaviest.

The Nasdaq is outperforming the S&P and Russell with Growth, Momentum, and Low Volatility factors, and Communications, Health Care, and Technology sectors are all outperforming.

S&P optionality strike levels have zero gamma level moving to 4379 while the call wall is at 4450; technical levels have support at 4385, and resistance is 4410, followed by 4435.

Treasuries are mixed with the curve flattening as the weaker ADP report pushed the first-rate hike expectations out to June ’23, verse March ’23 earlier this week and Dec ’22 a few months ago.

Earnings verse Delta: Even with 88% of S&P companies delivering a positive earnings surprise in Q2 (with around 70% having reported), propelling headline indexes to record highs, it still feels like a doom and gloom environment thanks to the resurgence of the Delta strain of Covid.

Despite costs rising due to input price increases and the supply-side disruptions (identified at nauseam here), companies have generally reported profit margins are holding up.

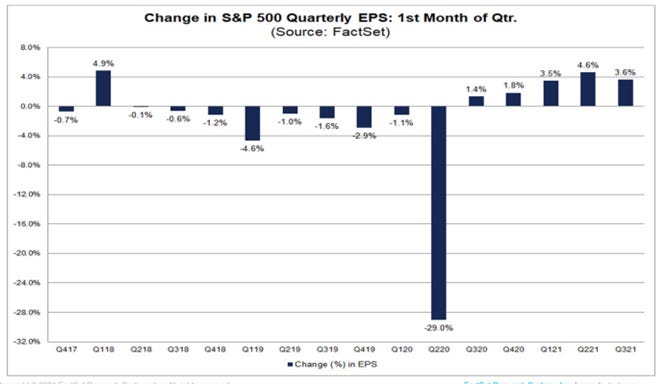

As a result, analysts have increased earnings estimates for the third quarter (so far) by 3.6%, marking the fifth straight quarter in which bottom-up earnings estimates increased, compared to an average decline of 1.7%.

At the sector level, nine sectors recorded an increase in their bottom-up EPS estimate for Q3 so far, led by the Energy (+14.0%) and Materials (+8.8%) sectors, while two sectors recorded a decline in their bottom-up estimate for Q3 during this period, led by the Consumer Staples (-2.1%).

The main takeaways are that companies have been cautious with outlook in their Q2 earnings calls, but still, analyst expectations have improved as headwinds increasing costs and reducing output are expected to subside while demand holds steady or improves.

We believe one of the most under-appreciated developments this year has been the pay down of revolving credit by consumers and the high levels of unused credit lines by businesses, something that can support 2H demand as saving rates and cash holdings normalize.

Banks noted their business clients have in recent months increased requests for credit lines that can be drawn quickly for spending on inventory, labor, or investment.

JPMorgan Chase and Bank of America, the two biggest banks in the U.S., together had nearly $1 trillion in unused corporate credit at the end of June. That is up 20% from a year ago and a quarterly record at both banks.

Outstanding revolving credit has begun to increase, rising at an annualized rate of 11.4% in May, but is still well below its pre-pandemic levels, showing that consumers can increasingly use the credit card this holiday season.

We highlight this as further support that aggregate demand will remain strong; firms are awash in capital (enabling inventory restocking and CAPEX) while household balance sheets are strong enough to absorb price increases without hurting demand.

Econ Data:

ISM Services PMI registered an all-time high of 64.1%, beating expectations of 60.1 and increasing four percentage points above the June reading of 60.1. Business activity increased an impressive 6.6 points to 67 while Employment notably increased back into expansionary territory. Prices continued to increase at a faster rate, while Inventories fell further into contractionary territory. No industry reported a decrease in activity in July.

Why it Matters: Numerous respondents continued to highlight supply chain disruptions impacting sales. The Backlog of Orders decreased, but this was offset by increases in Supplier Delivery times, showing no meaningful improvement in logistics as inventories were drawn down. We continue to believe that supply-side impairments and input costs will fall in the second half of the year but admittedly have seen little evidence yet to support this view. In the meantime, business activity is not slowing, and strong new orders, especially for exports, coupled with falling inventories, means overall growth in the service sector will continue to expand in Q3.

Policy Talk:

Vice-Chair Clarida believes the “necessary conditions for raising the target range for the federal funds rate will have been met by year-end 2022.” He said that he expects the imbalances between supply and demand pushing up prices to dissipate over time and inflation expectations to remain anchored. But, he added, ‘the risks to my outlook for inflation are to the upside.” Furthermore, he expects labor markets to reach “maximum employment” conditions by the end of 2022 as well. Finally, he noted that the Committee reviewed “for consideration” how to adjust asset purchases but will continue to do in the “coming meetings” as the economy moves towards “substantial further progress.”

Why it Matters: In true Clarida fashion, a very technical speech was given at the Peterson Institute, laying out the Vice-Chair's expectations for the economy and Fed policy. Interestingly, he identified his views as being close to the SEP medians for GDP and Unemployment in June. He noted that a core PCE inflation for the year of 3% would be viewed as more than a “moderate” overshoot of the 2% long-run target. This contrasts his more dovish overall views on the timing of tapering and rate hikes because, at this point, it is almost impossible for core inflation to be less than 3%. As a result, he did what every other dovish Fed member has to do and focused on inflation expectations still being well anchored while more work is needed to reach maximum employment. Finally, it is worth noting that he highlighted the Kansas City Fed’s Labor Market Condition Indicators to gauge progress towards maximum employment.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is outperforming on the week as the Russell underperforms today

Chinese Iron Ore Future Price: Futures are lower, decreasing 1.5% today as lockdowns increase

5yr-30yr Treasury Spread: The curve is flatter as the belly is underperforming post-ISM Service PMI while the 30yr has recovered

EUR/JPY FX Cross: Yen is higher on the week, reflecting a still more risk-off tone throughout global markets

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

Back to What You Know: China Wants Manufacturing—Not the Internet—to Lead the Economy – WSJ

Xi sees technology coming in two varieties: nice to have and need to have. Social media, e-commerce, and other consumer internet companies are nice to have but ultimately create a threat to the centrally controlled ethos the CCP thrives in. By contrast, Mr. Xi thinks the country needs to have state-of-the-art semiconductors, electric-car batteries, commercial aircraft, and telecommunications equipment to retain China’s manufacturing prowess, avoid deindustrialization and achieve autonomy from foreign suppliers.

Why it Matters:

Even as the Chinese Communist Party unleashes a multifront regulatory assault against consumer internet companies, it continues to shower subsidies, protection, and “buy-Chinese” mandates on manufacturers. While manufacturing’s share of Chinese GDP has declined, at 26%, it remains the highest of any major economy, and the Chinese government wants it to stay there. As a result, “capitalist” in certain sectors will never be fully rewarded (and instead be seen as a threat to the party) while other sectors will continue to be supported.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

iFail: Mystery surrounds Chinese private rocket launch attempt - SpaceNews

Chinese private firm iSpace conducted a launch of a Hyperbola-1 solid rocket early Tuesday, but the status of the mission remained unclear for hours after liftoff. The next day iSpace revealed that the payload fairing had failed to separate correctly, resulting in the single satellite being unable to reach its intended orbit. While the rocket and staging performed well, the issue prevented the spacecraft from reaching orbital velocity.

Why it Matters:

The first Hyperbola-1 rocket successfully sent a satellite into orbit in July 2019, making iSpace the first private Chinese launch company to achieve orbit. The second launch, in February this year, ended in failure. Galactic Energy, which became only the second Chinese company to deliver a payload into orbit in November, is currently preparing for two launches of its Ceres-1 solid rocket in the coming months, placing it in a position to demonstrate a measure of reliability. Important to watch private space travel developments (not only in America), given the critical nature of the technologies needed.

Electrification Policy:

Starts at the Top: Bipartisan report finds agencies plagued by cyber woes – The Record

A review issued on Tuesday by the Senate Homeland Security Committee found that, despite years of warnings, agencies such as the State, Education, Agriculture, and Health and Human Services departments have not established effective cybersecurity programs or complied with federal information security standards. The report concluded that only the Homeland Security Department created an effective information security program through its Cybersecurity and Infrastructure Security Agency.

Why it Matters:

It’s hard to get people to sign on to a new world of electrification and digitalization if the government tasked with protecting that world is overly incompetent itself. The report is a worrying sign that “just good enough” for government work is leaving America’s cyber infrastructure at risk. A committee aide said that a large part of why agencies are plagued with performance issues is that there is no single organization that is responsible for federal cybersecurity.

Commodity Super Cycle Green.0:

Gassed Up: Global LNG deliveries rise further in July - Argus

Worldwide LNG receipts rose from a year earlier for the fifth consecutive month in July, with strong Asian and Latin American demand continuing to draw supply away from Europe. Japan reclaimed its spot as the largest global importer last month, after falling short of China's receipts in April-June. Latin American receipts last month reached a multi-year high and were at their quickest for any month since at least January 2016, driven mainly by strong Brazilian demand.

Why it Matters:

The article highlights the various idiosyncratic regional demand stories that are playing out for LNG imports. Weather played a role in increasing Asian demand, while new supply sources in India and more pipeline gas into Europe helped reduce demand for LNG imports there. It is important to keep an eye on LNG trade as natural gas continues to replace other fossil fuels and become a growing “transitional” energy portfolio component.

ESG Monetary and Fiscal Policy Expansion:

Centralized Rules: Crypto Rules in Senate Bill Eyed for Bipartisan Rewrite – Bloomberg

Senators Ron Wyden and Pat Toomey are drafting a proposal to overhaul a cryptocurrency provision in the $550 billion bipartisan infrastructure bill that traders and investors have criticized as being overly broad and impractical. The Joint Committee on Taxation estimates the crypto reporting rules now in the bill would generate $28 billion in revenue, paying for roughly 5% of the bill’s total costs.

Why it Matters:

Regulating virtual currencies has become an area of bipartisan concern as the value has exploded in recent years. Its use has also been tied to tax evasion, money laundering, and other illicit activities. Even if this amendment does not make it into the final bill, it signals broad support to regulate further and tax crypto activity coming.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.