MIDDAY MACRO - DAILY COLOR – 8/3/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, with Delta headlines shaking risk sentiment throughout the morning but dip buying occurring now

Treasuries are slightly higher, hovering around recent highs made at yesterday's NY-open

WTI is lower, but recovering now as demand worries are battling geopolitical risk concerns

Analysis:

A slew of news regarding vaccination requirements this morning from companies and government officials domestically, as well as increased worries about the Covid situation in China, was cooling risk sentiment, however, the price action is now reflecting a more upbeat growth outlook with reflationary sectors outperforming on the day.

The S&P is outperforming the Nasdaq and Russell with High Dividend Yield, Value, and Low Volatility factors, and Energy, Utilities, and Materials sectors are all outperforming.

S&P optionality strike levels have zero gamma level moving to 4358 while the call wall increases to 4450; technical levels have support at 4370, and resistance is 4410, followed by 4435.

Treasuries are slightly higher as a positive beat in Factory Orders balanced increased Covid concerns, leaving yields and the curve little changed since yesterday.

Growth fears due to Covid concerns seem to be this week's theme (at the headline level), and we believe we are near "peak" fear levels (since everything is measured in peaks now), but underneath, and despite lower yields, Materials, Energy, Industrials, and Financial sectors are up on the week while value is staying even with growth at the factor level.

Although market pundits are clamoring for a 5%+ pullback in equities, which would align with the August/September seasonal weakness, we still see dips being bought and higher volatility being sold, ratcheting markets higher.

We continue to see data that reinforces our belief that growth and revenue lost in the Q2 will move into Q3, as made further evident in today's Factory Orders which now shows five consecutive months of increased unfilled orders (due to labor and material shortages).

As a result, we do not believe increased Covid cases here or abroad will meaningfully derail demand while supply-side disruptions will continue to improve, reducing earnings growth risk (especially for small-caps with less pricing power) as inflationary pressures subside in the 2H.

Bottom line, we believe this week's job report may come in weaker than expected but still be a catalyst for value to outperform growth moving forward (as traders re-enter more reflation themed positions) as the market removes any lingering concerns the Fed may tighten too fast while the growth outlook improves as Covid fears subside and focus shifts to further fiscal stimulus and (historically high) holiday consumer activity.

Econ Data:

June's Factory Orders were stronger than expected, increasing 1.5%, following a 2.3% increase in May. Durable goods increased 0.9% MoM, and there were significant increases in construction machinery and nondefense aircraft and parts. Shipments were also up, increasing 1.6%, following a 0.9% increase in May. Showing supply-side disruptions continue to cap growth, Unfilled Orders increased 1%, following the same increase in May.

Why it Matters: The better than expected report saw greater than forecasted increases in all three categories; New Orders, Shipments, and Inventories, boosting Q2 growth slightly. The most significant increase in new bookings involved commercial planes. Boeing orders surged to a 3-year high of 219 planes in June. Overall, this report showed what we have continually highlighted here; there is no shortage of demand, but growth was capped in the second quarter by shortages of labor and supplies. We believe we are starting to see signs of supply-side impairments slightly alleviating on the supplies/materials side but are awaiting Friday's job report to better gauge the labor shortage situation in the manufacturing sector.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Ratio is little changed on the week as markets debate growth outlook for 2H.

Chinese Iron Ore Future Price: Futures are lower, as authorities in China said markets might have "overreacted" in their zeal to limit steel production and that regional authorities should avoid "campaign-style" carbon reduction efforts.

5yr-30yr Treasury Spread: The curve is again little changed on the week, although yields are near recent lows

EUR/JPY FX Cross: Yen is higher on the week, reflecting a still more risk-off tone throughout global markets

HOUSE THEMES / ARTICLES

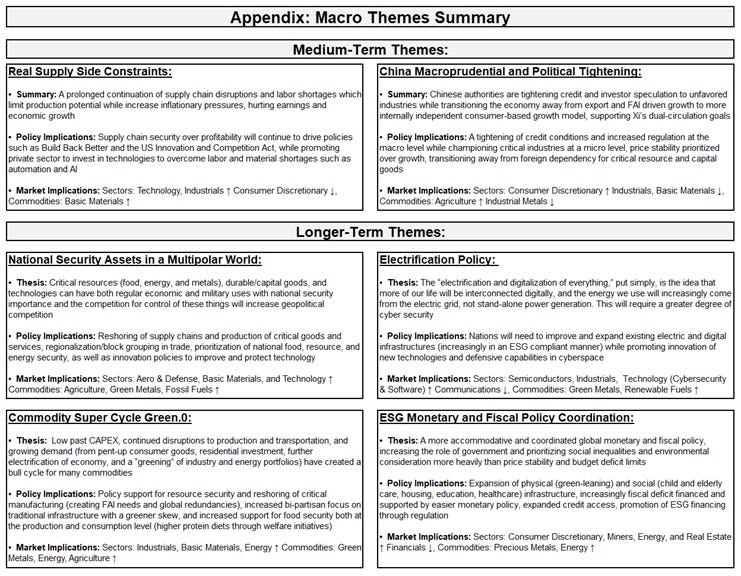

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

Opium Wars: Tencent vows fresh gaming curbs after 'spiritual opium' attack zaps $60 billion - Reuters

China's Tencent said on Tuesday it would further curb minors' access to its flagship video game, hours after its shares were battered by a state media article that described online games as "spiritual opium." The stock was on track to fall the most in a decade before trimming losses after the article vanished from the outlet's website and WeChat account, only to reappear later with the term “spiritual opium” removed and other sections edited.

Why it Matters:

The broadside re-ignited investor fears about state intervention in China after Beijing had already targeted the property, education, and technology sectors to curb cost pressures and reassert the primacy of socialism after years of runaway market growth. The fact the article disappeared and reappeared shows that Beijing is “price” sensitive, meaning they continue to assert state dominance but do not want to completely kill targeted companies/sectors for fear of the real economic cost.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Fertilizer Wars: China's major fertilizer makers to suspend exports amid tight supplies – Reuters

Some of China’s major fertilizer companies said they would temporarily suspend exports to assure supplies in the domestic market. Fertilizer prices in China have hit records this year amid stronger demand from overseas, lower production domestically, and high energy costs. The National Development and Reform Commission (NDRC) said in a statement it had summoned the fertilizer firms for a discussion against hoarding and speculation.

Why it Matters:

The move is the latest by Beijing to tackle the soaring prices of major raw materials. NDRC’s action follows comments from Premier Li Keqiang last month calling attention to high prices of key farm inputs, a potential threat to the country’s food security. This follows pressure put on basic materials elsewhere through coercion and selling off state inventories.

Electrification Policy:

Hindi Hydro: India eyes hydrogen as cleaner fuel source - Argus

The Indian government is pushing state-run firms to start using hydrogen as a fuel, helping encourage investments by some of the country's top energy companies. The requirement would be similar to the renewable energy mandate that exists in the electricity sector and which has helped encourage the use of cleaner energy, particularly solar power.

Why it Matters:

India is well placed to be a global leader in hydrogen because of its very low costs of renewable energy. India’s oil firms are actively engaged in expanding their renewable portfolios, including green hydrogen, which is not always the case in Western companies. This will help India slowly move away from a fossil fuel importer to a more energy self-sufficient nation.'

ESG Monetary and Fiscal Policy Expansion:

New Standards: Fuel-Efficiency Standards Are Set to Get Tougher. The Question Is by How Much. – WSJ

The Biden administration is expected to announce stricter fuel-efficiency standards for new cars and light trucks as early as this week. The new standards are expected to raise the miles-per-gallon performance and lower the amount of tailpipe emissions that automakers are required to meet as a fleetwide average for the next four years.

Why it Matters:

Environmental groups are pushing the Biden administration to adopt even tougher standards than those put into place by the Obama administration but face opposition from an auto industry that says it needs federal funding for electric-vehicle charging stations, consumer tax credits for EV purchases, and other measures to meet ambitious targets. We expect to see a compromise of tighter standards supplemented by fiscal incentives and tax breaks.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.