MIDDAY MACRO - DAILY COLOR – 8/31/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Narratives/Price Action:

Equities are flat, after overnight highs gave way to NY-open selling which has now reversed with no single narrative dominating price action

Treasuries are lower, following Eurozone price action after strong CPI prints across the Atlantic has fixed income under pressure there

WTI is lower, as traders continue to assess the damage done by Ida with flooding and power outages keeping refining capacity offline

Analysis:

Equities are bouncing back from a NY-open drop following new all-time highs for the S&P overnight as today’s data abroad and domestically continue to confirm price pressures remain persistent, giving pause to the recent rally in Treasuries.

The Russell is outperforming the S&P and Nasdaq with Value, High Dividend Yield, and Small-Cap factors, and Financials, Communications, and Real Estate sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4434 while the call wall remains at 4550; technical levels have support at 4515, and resistance is 4535.

Treasuries are under pressure into month-end, with the curve steepening, driven by selling in Gilts and Bunds overseas as traders reassess the ECB PEPP purchases commitment following stronger than expected CPI prints.

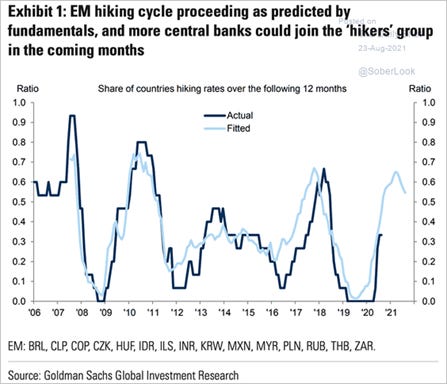

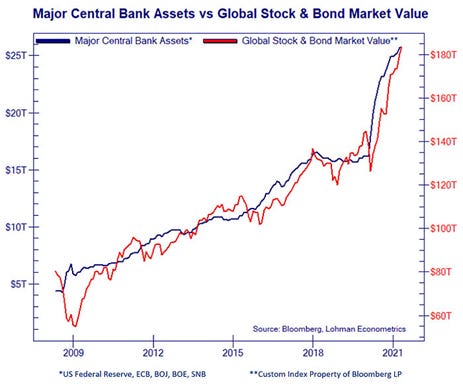

The tune is becoming more hawkish from the global central banking community as the growth/persistence of inflationary pressures continues while the resurgence of Delta has had less of a drag on the economy than previous waves.

Dutch Central Bank head Klaas Knot said today that recent Eurozone inflation data suggest the ECB should announce a slowing in pandemic emergency bond purchases (PEPP) in September and terminate the program in March next year.

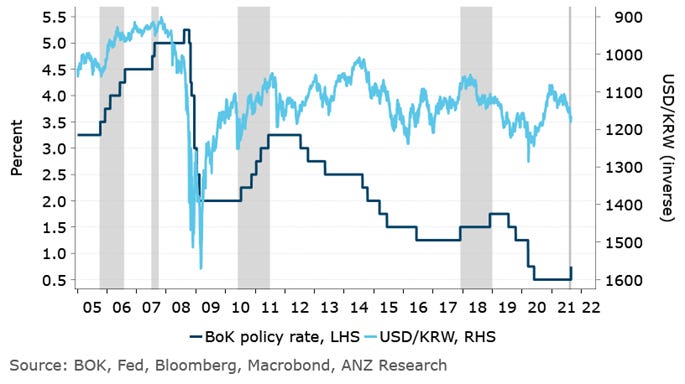

South Korea’s Central Bank raised its benchmark rate by 25bps last Thursday, becoming the first major monetary authority in Asia to do so since the pandemic began.

The Reserve Bank of New Zealand is still expected to lift rates by the end of this year despite balking at an expected hike last week in the face of a snap COVID-19 lockdown.

Norway's central bank will likely be the first G10 economy to hike rates next month despite a recent rise in infections, while Canada has reduced LSAPs.

In Eastern Europe, the Czech central bank raised interest rates twice this summer, and the Hungarian central bank delivered its third hike on Aug. 24. Elsewhere, EM central banks are responding to rising inflation (fundamentals) and continue to increasingly tighten.

Bottom Line: global increases in Delta have not meaningfully damaged the official outlook enough (yet) to deter central bank tightening plans (just delay) while inflation continues to increase, adding pressure to take action.

As a result, it looks like the CB party is still ending despite the growing uncertainty, and any further decreases in (excess) liquidity will weigh on risk assets (even if growth picks up).

Econ Data:

The S&P Corelogic Case-Shiller U.S. National Home Price Index increased 2.2% MoM or 18.6% higher on the year. Home prices rose in June in all 20 major MSAs. Prices in all MSAs were also above year-ago levels, with Phoenix recording the fastest year-over-year gain (+29.3%) and Chicago the slowest (+13.3%). Elsewhere, the average prices of single-family houses with mortgages guaranteed by Fannie Mae and Freddie Mac, or the National Home Price Index, rose 17.4% from the second quarter of 2020 to the second quarter of 2021.

Why it Matters: The year-over-year gain in these prices (using not seasonally adjusted data) picked up to 19.1% in June--the largest increase on this basis on record (data are available back to January 2000) from 17.1% in May. With rents now catching up, expect the shelter component of CPI/PCE to continue to rise. Although buying activity marginally slowed recently, as seen in other housing data and new supply/inventory seems to have bottomed, demand and supply mismatch will likely continue to push up prices across the shelter complex for sometime.

The Conference Board’s Consumer Confidence Fell in August to Lowest Level since February, dropping to 113.8 in August from 125.1 in July. The Present Situation Index fell to 147.3 from 157.2, while the Expectations Index (based on consumers’ short-term outlook for income, business, and labor market conditions) fell to 91.4 from 103.8. The net labor market index slipped to a still very high 42.8 in August from 44.1, which is the second consecutive monthly decline. One-year inflation expectations rose to 6.8% from 6.6%, which ties September 2008 as the highest inflation expectation on this measure since July 2008.

Why it Matters: After holding up better than the Univ. of Michigan Consumer Confidence data, the Conference Board’s Index final notably fell. “Concerns about the Delta variant—and, to a lesser degree, rising gas and food prices—resulted in a less favorable view of current economic conditions and short-term growth prospects. Spending intentions for homes, autos, and major appliances all cooled somewhat; however, the percentage of consumers intending to take a vacation in the next six months continued to climb.” Said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. The decrease in short-term business condition outlook was notable, as only 23% of respondents believe things will improve. This mirrors the decreases in outlook we have seen from firms in the Fed’s regional surveys and shows the longevity of supply-side disruptions, as well as the persistence of Delta, are increasingly weighing on sentiment.

The Chicago PMI fell to 66.8 in August from 73.4 in July, more than expected. The new orders index declined to 67.8 from 72.2, while the production index eased back to 61.0 from 68.8. Order Backlogs climbed 11.6 points to 81.6, the highest reading since 1951, as firms reported a shortage of materials, freight inconsistencies, and insufficient staff. Supplier Deliveries shot up 6.3 points to a three-month high of 92.8, with one survey respondent reporting the worst delivery times in three years. Employment remained weak, however, with the employment index rising to 48.3 in August from 47.5 in July.

Why it Matters: A stronger report comparably to the other August regional surveys, but again, the real supply-side disruption theme worsened with price pressures and logistical difficulties increasing. As a result of the inability to get needed materials, we expect to see the demand for labor weaken, something we are beginning to see in hiring intentions. This month’s special question asked, “When do you expect the supply chain impact of COVID-19 to peak?” The majority (37.8%) expect it to peak in 2022. The second question asked, “With enhanced Unemployment Insurance benefits set to expire in September, are you forecasting an increase in your staffing levels?” The majority said they were not.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week with the ratio little changed today given somewhat muted price action

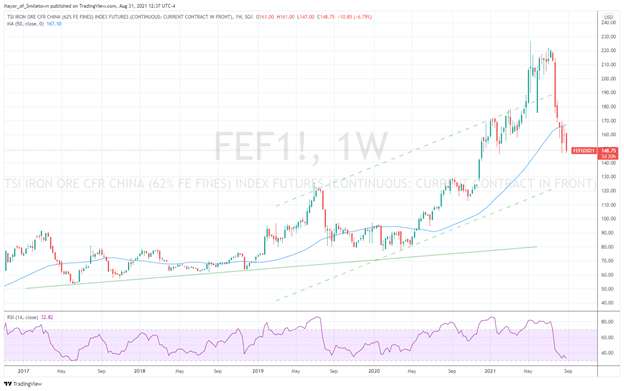

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, down -1.5% on the day

5yr-30yr Treasury Spread: The curve is steeper on the week, higher by 2.3 bps today

EUR/JPY FX Cross: The Euro is stronger on the week, surprisingly little changed today despite rising rates in Europe post-CPI data

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

One More Thing: Surfers, Swimmers, Boaters Run Into Summer-Disrupting Fiberglass Shortage – Bloomberg

Manufacturing has been hobbled by a shortage of fiberglass cloth and liquid vinyl ester resin, which have gotten scarce and expensive. “We get in a truckload of resin, and it’s all sold out immediately. It’s all pre-sold before we even receive it,” said Wooldridge, the association leader. “Then, we’re completely out until we get the next container. It’s been that way for months.”

Why it Matters:

The supply-chain snarls show how broader forces in international trade, supply, and demand have rippled through industries in the past year, leading to higher prices and slowing commerce. The U.S. produces just a fraction of the world’s fiberglass cloth and has grown reliant on cheap supplies from China. What is produced here was negatively impacted by the winter storms in Texas, and even six months later, inventories are low. Stepping back, the current situation with fiberglass supply is another example of how “shortages” are capping production and adds weight to the importance of supply chain security.

China Macroprudential and Political Tightening:

Them Be Fighting Words: Chinese media back diatribe calling for crackdown to be expanded – FT

A blogger’s tirade endorsed widely by Chinese state media has called for Beijing’s snowballing regulatory overhaul to target the high costs of housing, education, and healthcare while also instituting deep reforms to finance and cultural industries. “This is a transformation from capital-centered to people-centered,” the writer said, adding that those who sought to block the deep reform efforts would be “discarded.” The commentary claimed that the litany of recent “rectification actions” heralded a “profound revolution.”

Why it Matters:

Not much gets published in China without the blessing of Beijing, which these days means Xi. As a result, this is truly a troubling blog post amplified by state media. It indicates we are not close to the end of the current crackdown. On Monday, a meeting chaired by President Xi Jinping approved plans for tighter controls of monopolies and pollution. The following day, China’s top securities regulator warned of a clampdown on private equity industry funds that had diverged from supporting innovation and start-ups. Clearly expect more volatility in Chinese financial assets as investors try and figure out where the end state lies.

More Support Coming?: Covid-19 Delta Variant Pummels China’s Services Sector – WSJ

China’s official Service PMI fell to 47.5 in August, from 53.3 the prior month, according to data released Tuesday by the National Bureau of Statistics. Largely responsible for the drop in the nonmanufacturing measure was a significant fall in the services subindex, which slid to 45.2 from July’s 52.5. Subindexes showing activity in the ground and air transport, accommodations, catering, sports, and entertainment all fell into contractionary territory in August, the statistics bureau said.

Why it Matters:

The drop-in services sector activity was notable but in line with the shut-downs seen. More alarming was the decrease in manufacturing PMI to an 18 month low, dropping to 50.1. The New Orders Subindex fell to 49.6, and the New Export Orders dropped further to 46.7, a fourth straight month of contraction. The broad-based weakness on display in Tuesday’s data release, the first reading of economic activity in August, bodes ill for other monthly economic indicators that will be released in the coming days.

Big Time: The Herculean Task of Bailing Out Huarong - Caixin

The scandal-plagued state-owned bad asset manager reported a record loss Sunday of $102.9 billion yuan ($15.9 billion) for 2020. A long-expected rescue plan involving new state-backed investors may require capital injections totaling nearly 100 billion yuan from strategic investors and asset sales. The restructuring is likely to lead to an ownership change beyond what has already occurred.

Why it Matters:

Investors are closely monitoring how Huarong’s restructuring will affect its bond repayments. As of Aug. 24, Huarong’s outstanding offshore bonds totaled $20 billion, down from $22 billion in April. Overall, Huarong is nowhere near defaulting on its offshore bonds, and neither the major shareholder nor the regulators will allow that to happen, analysts say. Stepping back, the story is still developing, but the imminent systemic threat potential seems diminished.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Decoupled: Russia’s Drive to Replace Foreign Technology Is Slowly Working – Moscow Times

Russia is now one of the very few countries in which local platforms are successfully competing with American online services. For years Russia has also boasted the most advanced online banking systems in Europe. Communications watchdog Roskomnadzor is supplying the national internet infrastructure with hardware to underpin the so-called “Sovereign Internet,” Russian-made and paid by the government. Meanwhile, the Trade Ministry is twisting the arms of software developers with Russian offices to adapt their products to Russian-made processors.

Why it Matters:

The tech industry has been the fastest-growing sector of the Russian economy, the result of having the largest engineering community in the world along with an excellent nationwide technical education system. Where Russian-made solutions simply don’t exist, the Kremlin is content to go down the open-source route. For instance, it is pushing government-controlled corporations and ministries to ditch Oracle and start using solutions built on a home-grown database management system. Interesting to think of Russia as a loose template for China’s decoupling efforts moving forward.

Commodity Super Cycle Green.0:

“Detained”: The U.S. begins detaining solar panel imports over concerns about forced labor in China

U.S. officials have begun blocking the import of solar panels that they believe could be products of forced labor in China, implementing a recent ban that could slow the construction of solar-energy projects throughout the country. CBP imposed the ban in June on Hoshine Silicon, which produces raw materials used in solar panels. The agency said it had information “reasonably indicating” that Hoshine, which operates plants in China’s Xinjiang region, uses forced labor, a finding that triggered the ban because U.S. law prohibits the import of goods made by coerced workers.

Why it Matters:

The more expensive the renewable energy transition is, the longer we will rely on fossil fuels. Further, the need for a secure regional/domestic supply chain that can provide for this transition in an affordable manner will dictate trade and commerce policy. As a result, how the Biden Administration deals with human rights issuing when sourcing solar panels will be an excellent template for how they will handle the sourcing of other critical materials moving forward.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.