MIDDAY MACRO - DAILY COLOR – 8/30/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, with the large-cap growth/tech outperforming as weaker data and a catch-up to last week’s reflation themed rally is occurring

Treasuries are higher, as the post-Jackson-Hole rally continues, supported by the weaker domestic economic data today

WTI is little changed, as a likely weaker impact from Hurricane Ida has prices across the energy market retracing much of the overnight gains

Analysis:

Equities are back doing their old dance today with falling Treasury yields supporting the S&P/Nasdaq while the Russell retraces some of its Friday’s gains as traders brace for a heavy economic data week.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Volatility, and High Dividend Yield factors, and Technology, Health Care, and Real Estate sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4468 while the call wall remains at 4500; technical levels have support at 4495, and resistance is 4535.

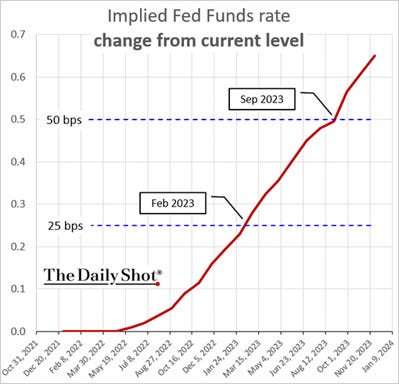

Treasuries are better bid with Powell separating tapering from hikes and removing early announcement worries in Friday’s J-Hole speech, leaving the curve little changed after initially flattening.

Today's outperformance of the Nasdaq over the Russell (following Friday’s massive rally in the Russell) shows the reflation-themed rally over the last week will need further confirmation that the economic backdrop isn’t deteriorating too quickly.

For the reflation trade to outperform, growth needs to be strong and the Fed needs to be patient.

Powell emboldened the patience part Friday, successfully separating tapering from hiking, but domestic economic data continues to deteriorate.

Today’s Dallas Fed Manufacturing Survey reinforced what has been seen in other regional surveys and increases the likelihood that we have a meaningful miss in this week's ISM Manufacturing Survey.

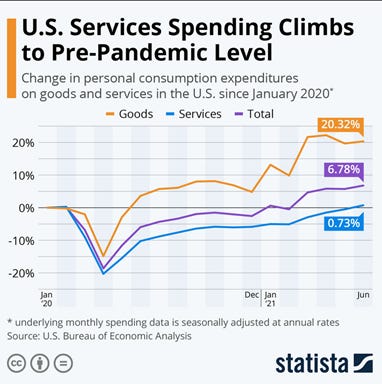

The service sector should increasingly mirror the slowing already seen in July’s manufacturing surveys despite personal consumption expenditures for service reaching pre-pandemic levels.

Drops in higher frequency mobility and credit card data, as well as the persistence of labor and material shortages, will likely lead to a notable drop in this week’s ISM Service sector PMI.

Further, the future economic outlook continues to be muddied by Delta (whether it has meaningfully peaked or will resurge as schools open).

As a result, we believe that the rally in small-caps should stall until Friday when the jobs data further clarifies how much damage has been done from the summer’s rise in Delta, either confirming the weakness we believe we will see in this week’s PMIsor opening up the opportunity for an improvement in outlook moving into the holiday season, supporting an outperformance of the reflation trade sectors and factors.

Econ Data:

Pending home sales fell -1.8 MoM (-8.5% YoY) in July, a second consecutive drop and missing expectations of a 0.4% rise. Only the West region registered a month-over-month gain in contract activity, while the other three major regions reported drops. Month-over-month, the Northeast fell 6.6% in July, a 16.9% decrease from a year ago.

Why it Matters: The housing market is still historically strong. The limited supply continues to be unable to keep up with demand from potential homebuyers, causing data like pending home sales to miss expectations. "The market may be starting to cool slightly, but at the moment, there is not enough supply to match the demand from would-be buyers," said Lawrence Yun, NAR's chief economist. "That said, inventory is slowly increasing, and home shoppers should begin to see more options in the coming months.” Listings are still garnering a good level of interest. Still, the historically high level of offers has slowed, which should be expected given the main driver of the buying activity, the pandemic is now in its later stages. This is best seen in the outsized year-over-year decreases in the North East, where pandemic-induced buying was earlier and more substantial than other regions.

Dallas Fed Manufacturing Index in the United States decreased to 9 points in August from 27.30 points in July of 2021. There were broad-based decreases with Production (-10.2), New Orders (-11.2), Shipments (-16.4) all falling by double-digit amounts. The supply-side disruption-sensitive sub-indexes saw no improvement as delivery times increased while prices paid increased and prices received were little changed. The employment-related sub-indexes marginally decreased with Employment and Wages slightly dropping and Hours Worked staying stable.

Why it Matters: This was not a great report and continues the general weakness seen in other Fed regional manufacturing surveys. The drop in New Orders and Growth Rate of Orders does not bode well for future activity, but both remain above the series averages. This likely continued slowing is also supported by a decrease in General Business Condition Outlook and an increase in Outlook Uncertainty. However, looking through the respondent firm’s comments, there still seems to be solid demand while the continuation of labor shortages and rising material costs are impeding production and increasingly weighing on sentiment. One respondent summed it up well by saying the persistence of “rampant” inflation and labor shortages are reducing the optimism of future outlook despite being “busy now.”

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week as the Nasdaq outperforms today

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week as China’s production of crude steel, half the world’s annual total, fell in July by the widest year-on-year margin since 2008

5yr-30yr Treasury Spread: The curve is little changed on the week as Powell’s Jackson Hole speech bull steepened the curve Friday

EUR/JPY FX Cross: The Euro is stronger on the week, but little changed as momentum cools for the cross

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

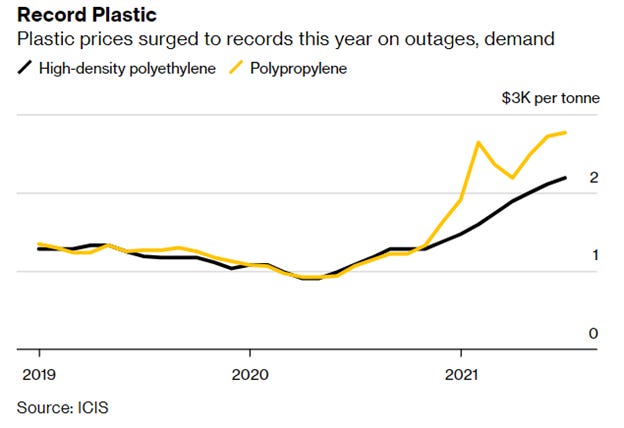

Kardashian Effect: Record Plastic Prices May Go ‘Stratospheric’ on Hurricane – Bloomberg

Record plastic prices are poised to push even higher as Ida disrupts manufacturing in a region that manufactures almost 20% of the world’s ethylene. The storm has the chance to “severely strain” supplies of PVC and chlorine. Additionally, polypropylene, which is used in furniture, cleaning products, and carpet, could jump if a significant amount of production cannot return quickly.

Why it Matters:

America’s petrochemical hub has spent much of this year trying to recover from extended shutdowns stemming from the February winter storm. The supply crunch was compounded by surging demand for manufactured goods and packaging. Global shipping constraints also hampered chemical supply chains, boosting prices. Any long-term outages from Ida would further add more inflationary pressures.

All in Asia: Aluminum Notches Decade Highs on Soaring Demand, Snarled Supplies – WSJ

Aluminum prices are reaching 10-year highs, as buyers far from storage centers in Asia compete to line up shipments for use in beverage cans, airplanes, and construction. “There’s just not enough metal inside of North America,” said Roy Harvey, Alcoa’s chief executive. On top of the price for aluminum that trades on the London Metal Exchange, buyers pay a premium that reflects freight costs, tariffs, and other expenses. Buyers in the U.S. Midwest recently were paying $761 a metric ton, the highest level in Intercontinental Exchange data going back to 2012.

Why it Matters:

There is enough aluminum to go around globally. The trouble is that much of the metal is sitting in Asia, and buyers in the U.S. and Europe have struggled to get their hands on it. Changing trade flows have added to inventories in Asia, as last year China flipped to being a net importer of primary and alloyed aluminum for the first time since 2009. Further, Russia, one of the world’s biggest aluminum exporters, imposed a tax on exports of the metal this month. That has given premiums in the U.S. and Europe an extra boost. As a result of all these factors, the price of aluminum will likely remain high for some time.

China Macroprudential and Political Tightening:

Actual Communism?: Common Prosperity: Decoding China’s New Populism – WSJ

Mr. Xi called for rationally “adjusting” excessive incomes and for high-income individuals and companies to contribute more to society in a speech on Aug. 17. He also called for more aggressive measures to expand the middle class and the social safety net, including health and elderly care. China has long been one of the most unequal major economies in the world, with one common measure of income inequality, the Gini coefficient, at 0.465 in 2019. Wealth inequality is higher: The top 1% hold 30.6% of the country’s wealth, according to Credit Suisse data.

Why it Matters:

The “Common Prosperity” policy is a convenient way for the government to shift the political and financial burden of dealing with social problems to private actors, forcing them to act more like state-owned enterprises, without necessarily addressing the deep structural roots of inequality and scarce opportunities for good jobs. As a result, high-net-worth individuals and internet tech firms could come under further pressure to “donate” resources to social causes and find their tax rates rising. China’s long-mooted property tax could finally become a reality, although that is less certain.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Profiling: China's Microsoft Hack May Have Had A Bigger Purpose Than Just Spying - NPR

Microsoft Exchange was hacked for nearly three months, with intruders helping themselves to everything from emails to calendars to contacts. Then they went wild and launched a second wave of attacks to sweep Exchange data from tens of thousands of unsuspecting victims. Both the White House and Microsoft have said unequivocally that Chinese government-backed hackers are to blame. Officials believe that the breach was in the service of something bigger: China's artificial intelligence ambitions and identifying key foreign agents it can leverage for its own means.

China's appetite for America's private data has been one of the biggest open secrets of modern intelligence. The Microsoft Exchange hack was the latest in a long list of Chinese-sponsored cyberattacks. The tally in just the four years between 2014 and 2018 is head-spinning. There was the Office of Personnel Management attack where 21.5 million records from the federal government's background investigation database were stolen. There was also a breach at the health care insurer Anthem Inc. in which cyber thieves swiped 78 million names, birth dates, and Social Security numbers. Two years after that, credit reporting agency Equifax Inc. announced that hackers stole the credit information of 147.9 million Americans. It is clear China wants to pick us apart at the key personnel level.

China Welcome?: Congo reviewing $6 bln mining deal with Chinese investors - Reuters

Democratic Republic of Congo's government is reviewing its $6 billion "infrastructure-for-minerals" deal with Chinese investors as part of a broader examination of mining contracts, Finance Minister Nicolas Kazadi reported. His government announced this month it had formed a commission to reassess the reserves and resources at China Molybdenum's massive Tenke Fungurume copper and cobalt mine in order to "fairly lay claim to (its) rights".

Why it Matters:

Under the deal struck with the government of Tshisekedi's predecessor, Joseph Kabila, Sinohydro and China Railway agreed to build roads and hospitals in exchange for a 68% stake in the Sicomines venture. The deal formed a key part of Kabila's development plan for the country, but critics say few of the promised infrastructure projects have been fully realized and have complained about a lack of transparency. Given how important securing critical mineral supplies are to China, it will be interesting to see how they alter their behavior, either pushing back or delivering the promised infrastructure in a more timely manner.

Electrification Policy:

Direct Connect: iPhone 13 to Feature LEO Satellite Communications to Make Calls and Texts Without Cellular Coverage – MacRumors

The iPhone 13 lineup will feature hardware that can connect to LEO satellites. If enabled with the relevant software features, this could allow iPhone 13 users to make calls and send messages without needing a 4G or 5G cellular connection. The iPhone 13 reportedly features a customized Qualcomm X60 baseband chip that supports satellite communications. Other smartphone brands are apparently currently waiting until 2022 to adopt the X65 baseband chip necessary to implement satellite communications functions.

Why it Matters:

Apple is believed to have plans to bring LEO satellite communications to more devices in the future. These may include Apple's mixed reality head-mounted display device, electric vehicle, and other IoT accessories, according to Kuo. Regarding the iPhone 13, the "simplest scenario" for providing LEO connectivity to users is if individual network operators work with Globalstar. This means that customers of a partner network operator could use Globalstar's satellite communication service on the iPhone 13 directly through their network operator with no additional contracts or payments required.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.