MIDDAY MACRO - DAILY COLOR – 8/26/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

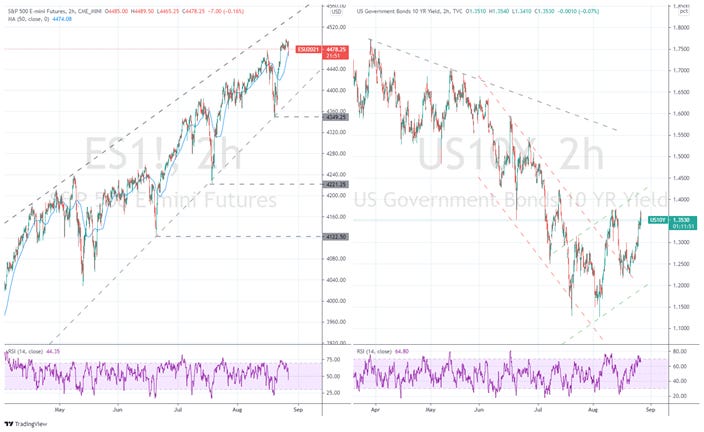

Equities are lower, after a quiet overnight consolidation and relatively range-bound morning session got disrupted by two terrorist bombings in Kabul

Treasuries are higher, with a flattening now occurring as a more risk-off tone takes place as well as three hawkish Fed officials (Kaplan, Bullard, and George) renew calls for a quicker taper

WTI is lower, forming what looks like a bull flag as EIA data yesterday failed to change the tactical narrative meaningfully

Analysis:

Equities are now recovering after a terrorist attack in Kabul caught markets by surprise; however, more notably were renewed tapering calls from hawkish Fed members more unfazed by Delta worries than previously thought, helping the Treasury curve flatten.

The Nasdaq is outperforming the S&P and Russell with Momentum, Value, and High Dividend Yield factors, and Financials, Utilities, and Real Estate sectors are all outperforming.

S&P optionality strike levels have zero gamma level at 4447 while the call wall remains at 4500; technical levels have support at 4465, and resistance is 4507.

Treasuries are better bid following the terrorist attack, however, still trending lower as the 10yr Note is hovering around its 50-day moving average.

Econ Data:

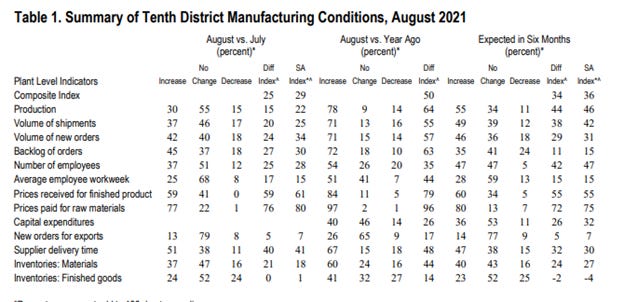

Kansas City Fed Regional Manufacturing Survey Composite Index came in at 29 in August, little changed from a reading of 30 in July. The month-over-month indexes for new orders increased at a higher rate in August, and there was an uptick for the supplier delivery time index. Materials inventories grew slightly, while finished goods inventories were largely unchanged. Backlog of orders increased, as did the number of employees, positive signs for future growth. Both prices received and prices paid continued to increase with a large increase in prices paid for raw materials. The monthly special questions focused on labor availability, and most firms noted a decrease in the flow of applicants for jobs. Thirty-five percent of firms also reported an increase in workers quitting.

Why it Matters: This was a more favorable regional business survey after a disaster of one from the Richmond Fed earlier in the week. The common supply-side disruption themes continued with increases in Delivery Times, Prices Paid and Received, as well as decreases in Average Employee Workweek, even though the Number of Employees increased. This report helps alleviate fears that U.S. manufacturing was significantly slowing due to the continued materials and labor shortages as well as Delta-related demand loss.

Policy Talk:

Kansas City Fed President Esther George believes policymakers should start the tapering process even as Delta cases increase risks to the economy. “I don’t think it changes my own calculus that it is time to begin to make those adjustments given the gains we have seen so far,” George said in a Bloomberg TV interview with Michael McKee conducted Wednesday evening, prior to the bank’s annual Jackson Hole symposium on Friday. “I think it’s important to get started and the conditions of pace, timing of when we end, I’m open-minded to listening to the debates around that,” George said. “But I am less interested in deferring that decision.”

Why it Matters: George joins Kaplan and Bullard, who believe that starting taper sooner with a shorter duration can always be changed if the economy notably weakens. Stepping back, LSAPs are part of an emergency response to the pandemic. Given the recent uptick in Delta, the Fed now has coverage to continue purchases further since case/hospitalization rates are at historically high levels in some areas. Hawkish members still generally note that inflation is likely transitory, although likely longer-lasting than expected, and still see inflation expectations as anchored. The more dovish members can point to increased future uncertainty (due to Delta) and still claim that there has not been enough progress in labor markets currently. The idea that the data would be “cleaner” post back to school is now in question given the chaos and likely school closures that will be occurring due to Delta spreading in children. As a result, we continue to believe the Fed will be patient in announcing, starting, and the pace it conducts LSAP tapering at. We also believe Powell’s J-Hole speech will be an addendum to the thoughts he brought forth in last year’s Jackson Hole when he announced changes to the Long-Run Goals. Our view is that the Board was never satisfied with the interpretation of the changes they made, something we saw as much more dovish than markets initially priced (of course, a lot was going on then). As a result, he will further clarify the definition of “maximum employment,” and expand on the work started with Fed Listens (aka a more community-focused Fed).

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week as the Nasdaq outperforms today following more hawkish Fed comments

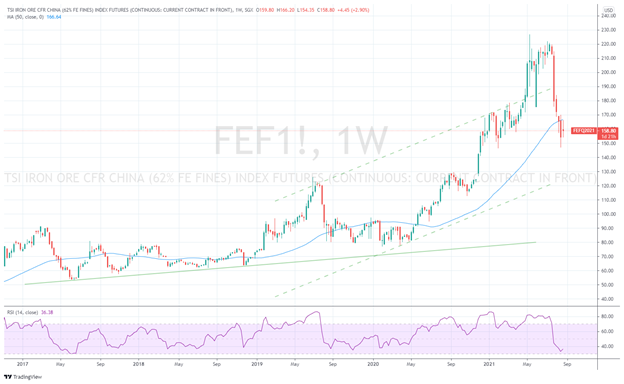

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week as Dalian futures dropped -5.5% overnight

5yr-30yr Treasury Spread: The curve is a little flatter on the week as traders await Powell’s Jackson Hole speech tomorrow

EUR/JPY FX Cross: The Euro is stronger on the week, breaking out as the more risk positive tone continues this week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

New Record: More than 40 ships waiting outside LA and Long Beach setting new record – Splash247

The number of ships at anchor, waiting for berth space to open up at America’s two largest boxports, has hit a new record today with more than 40 ships. August's Los Angeles port data showed that 90% of vessels headed straight to anchor, joining a queue averaging 7.8 days of anchor time. Longshoremen at both ports have been unable to get containers out of the port, loaded inbound as well as empties outbound fast enough.

Why it Matters:

Retailers in the US are battling record-low inventories, likely meaning the container crunch will worsen in the coming weeks. Peter Sand, the chief shipping economist at global shipowning organization BIMCO, told Splash: “Shippers, some of which are already low on inventories, are frontloading to secure goods in stock for upcoming key sales seasons such as Black Friday and Christmas.” The bottom line, get shopping early this year.

Reopening: Ningbo government unlocks Meishan terminal – Lloyd’s List

Jiang Yipeng, a vice-president of Ningbo-Zhoushan Port Group, said Meishan terminal reopened on August 25 and was on track to fully recover its services, which had been suspended since August 11. The move to restart operations at the Meishan terminal comes as congestion off Ningbo and nearby Shanghai appears to be improving, with fewer vessels queueing in the anchorage.

Why it Matters:

The closure of Meishan, which accounts for about 20% of Ningbo’s total container throughput, has led to the rerouting of vessels and further port congestion. We now watch to see if shipping costs will start to drop. Elsewhere, Mazda reported it stopped production in two factories due to shortages of parts that occurred due to delays in air cargo out of Shanghai Pudong airport. Flights from China have declined, and there are restrictions around cargo due to a Covid-19 situation there.

China Macroprudential and Political Tightening:

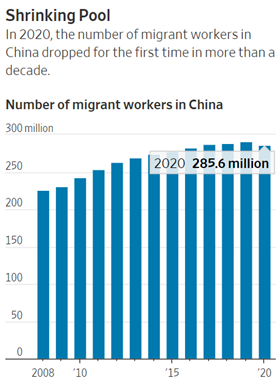

Life is Not-So-Cheap: Chinese Factories Are Having Labor Pains—‘We Can Hardly Find Any Workers’ – WSJ

Labor shortages are materializing across China as young people shun factory jobs and more migrant workers stay home, offering a possible preview of larger challenges ahead as the workforce ages and shrinks. Some migrant workers are worried about catching Covid-19 in cities or factories, despite China’s low caseload. Other young people are gravitating toward service-industry jobs that pay more or are less demanding.

Why it Matters:

China’s problems reflect longer-term demographic shifts, including a shrinking labor pool, that are legacies of the country’s decades-long one-child policy. Those trends pose a serious threat to China’s potential long-term growth rate. They will also make it harder for China to keep supplying the world with cheap manufactured goods, potentially adding to global inflationary pressures.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

All About the Consumer: China’s trade halt with Lithuania over Taiwan ties sends warning to Europe – The Guardian

China’s use of trade as a weapon in diplomatic disputes appears to be now targeted at Lithuania after the Baltic nation agreed to exchange diplomatic offices with Taiwan. Lithuania and Taiwan have agreed to establish mutual representative offices as a sign of deepening ties between the two governments. In response, Beijing recalled its ambassador from Vilnius and expelled Lithuania’s ambassador from Beijing.

Why it Matters:

Beijing’s unofficial halt to its already limited trade with Lithuania is more about sending a warning to the rest of Europe. The Chinese believe their biggest national asset is their domestic markets, with the largest middle-class consumer base in the world. As a result, and as seen with Australia, China continues to push its national security interests by using access to their markets in a carrot and stick dance. We will be watching to see if there is a more unified response from the Eurozone, similar to what was seen earlier in the year when tit-for-tat sanctions eventually led to the suspension of a comprehensive trade deal.

Pivot: U.S. approves licenses for Huawei to buy auto chips – Reuters

U.S. officials have approved license applications worth hundreds of millions of dollars for China’s blacklisted telecom company Huawei to buy chips for its growing auto component business. Auto chips are generally not considered sophisticated, lowering the bar for approval.

Why it Matters:

Huawei reported its biggest-ever revenue drop in the first half of 2021, after the U.S. restrictions drove it to sell a chunk of its once-dominant handset business and before new growth areas have fully matured. As a result, Huawei is now pivoting its focus to smart cars. It announced the intention to partner with three state-owned Chinese carmakers, including BAIC Group, to supply “Huawei Inside,” a smart vehicle operating system, at the Shanghai Auto Show earlier this year.

Secure Supply: India Urges Its Automakers to Cut Reliance on Imports From China – Bloomberg

India is trying to diversify its supply chains away from neighboring China following deadly clashes between the world’s two most-populated nations along the disputed Himalayan border last year. With the transition toward EVs now inevitable, Amitabh Kant, chief executive officer of government policymaking body Niti Aayog said, “Indian manufacturers must clearly read the writing on the wall and aim to secure a strategic position in the global value chain.” India is dependent on China for magnets used in the motors of EVs, semiconductor-based components, and other electrical parts.

Why it Matters:

The Covid-19 pandemic and global trade tensions with China have intensified the need for countries around the world to move manufacturing bases out of the country to reduce supply-chain risks. We continue to believe that markets are underappreciating the coming CAPEX cycle driven by supply-chain security needs. This re-regionalization and supply security prioritization will be a multi-decade drive. As a result, it is hard to trade tactically but will continue to increase demand for materials, industrials, and inflationary pressures. If globalization, aka the move to China, was a significant component of the deflationary forces we have felt for so long, its reversal will be the opposite.

Electrification Policy:

Paying Up: Tech’s Lobbying Push Follows Market Consolidation, Study Shows - Bloomberg

The level of lobbying dollars spent by tech companies has increased with market concentration, according to a new study that cites similar patterns in the pharmaceutical and oil industries. A recent report from American Economic Liberties Project suggests that entrenched firms face less competition and don’t have to invest as much in innovation, giving them more resources to spend influencing the democratic process.

Why it Matters:

There is a general concentration of industry currently occurring (not just in tech). Federal Trade Commission Chair Lina Khan warned last month that the U.S. economy is experiencing a “tidal wave” of mergers that threatens to overwhelm federal agencies. Companies have announced more than $3 trillion of deals so far in 2021, an unprecedented number that puts this year on track to be the most active ever, according to data compiled by Bloomberg. As a result, lobbying activity and anti-trust/monopoly legislation should increase.

Commodity Super Cycle Green.0:

Not Too Fast: China's provinces still planning over 100 GW of new coal projects – Greenpeace - Reuters

China's provinces are still planning to launch more than 100 gigawatts (GW) of new coal-fired power capacity despite a decline in new approvals in the first half of 2021. Local planning agencies approved 24 new coal-fired power plants with a total capacity of 5.2 GW in the first six months of 2021.

Why it Matters:

China is the world's biggest energy consumer and source of climate-warming greenhouse gas. It aims to bring carbon emissions to a peak by 2030 and to net-zero by 2060. However, it will not start cutting coal consumption until 2026. Up to then, the central government has pledged to "control" the number of new coal projects going into operation.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.