MIDDAY MACRO - DAILY COLOR – 8/24/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, with the S&P slightly off overnight highs as a multi-day rally looks to be losing some momentum

Treasuries are slightly lower, with the long-end underperforming but price action continues to remain relatively muted compared to the more positive risk-on tone seen elsewhere

WTI is higher, with last week’s sell-off now being completely reversed in two days

Analysis:

Equities continue to favor a more reflationary-themed tilt today as factors and sectors representative of that theme outperform; however, Treasuries are notably absent again even as FX markets have become more in tune with the more positive global macro tone.

The Russell is outperforming the Nasdaq and S&P with Momentum, Small-Cap, and Value factors, and Energy, Consumer Discretionary, and Materials sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4445 while the call wall remains at 4500; technical levels have support at 4464, and resistance is 4493.

Treasuries are weaker, although little changed in the belly, as weaker manufacturing data was balanced by stronger housing data, leaving the curve slightly steeper and price action fairly muted.

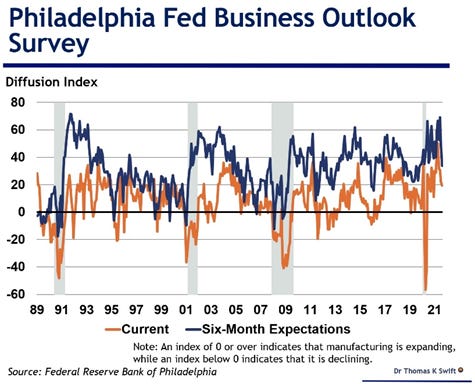

Today's Richmond Fed’s Manufacturing Survey encompasses everything we are worried about regarding negative developments in the domestic economy due to continued supply-side disruptions and Delta-related demand loses and, along with recent weaknesses seen in other regional business surveys, gives us pause on our more bullish economic growth outlook into year-end.

The Richmond survey showed a significant slowing in current and future activity with little to be optimistic about, as further explored in the below Econ Data section.

Not to be missed and furthering the worries was also a decrease in the Philly Fed’s Service Survey today, albeit from record-high levels in June, with the common theme of continued labor shortages furthering price pressures and capping growth.

So far we have seen headline index misses for July from NY, Philly, and Richmond Fed surveys, all of which are in regions less negatively affected by the Delta uptick. Demand and production disruptions are likely worse in the South and Midwest.

The growing weakness in the Fed’s regional surveys does not bode well for next week's ISM Manufacturing and Service Surveys, with expectations at around 60 and 63, respectively.

A significant miss by either/both would likely derail the (growing) consensus view around strong year-end growth and the accompanying reflation trade (that relies on solid growth and a patient Fed to work).

As a result, any further rally in reflationary themed sectors/assets, which we believe will be supported by a more dovishly toned Jackson Hole Symposium later this week, should be tightly stop-trailed into next week's data as expectations are too high.

Econ Data:

New Homes Sales increased 1% in July in line with expectations after falling a revised -2.6% in June. Sales surged 14.4% in the West, while purchases slumped more than 20% in both the Northeast and Midwest regions. The median sales price of new houses sold was $390,500. This represents an increase of 18.4% from a year earlier. The estimated inventory of new homes represents a supply of 6.2 months at the current sales rate. Some 226,000 homes were under construction, the most since 2008. The number of completed homes made up less than 10% of for-sale properties.

Why it Matters: Just a quarter of the homes sold in July were completed suggesting residential construction activity will continue to be strong in the coming months. Moving forward, a further easing in materials and worker availability should support the construction of a greater number of affordable homes, generating more sales. This aligns with what we saw in yesterday’s Existing Home Sales data, which noted demand was not being met by lower-income and first-time homebuyers due to a lack of (affordable) supply.

The Richmond Fed Manufacturing Index declined from 27 in July to 9 in August. There are sizeable drops in New Orders, Shipments, and Backlog of Orders, signaling a significant slowing in current and future activity. Local Business conditions turned negative, as did Finished and Raw Material Inventories. In looking for some positive developments, there was less of a decrease in Capital Expenditures and Equipment & Software Spending. Employment dropped while wages increased, and firms reported a worsening ability to find skilled labor. Finally, prices paid dropped slightly while prices received increased.

Why it Matters: Following weaker Empire and Philly manufacturing surveys, this was an alarming drop with really no bright spots. There were staggering drops in the three major categories (New Orders, Shipments, Backlog of Orders), and the employment and inflation picture continued to show shortages of materials and workers. Most concerning was the 35 point drop in Business Conditions, showing that outlook (which is not specifically surveyed) is likely falling fast. There is a common story being seen in the recent Fed manufacturing surveys; things are slowing due to shortages of goods and labor, and now in the Richmond region, falling demand. Further, all three surveys have seen increases in prices received, showing the inflation pulse for goods will continue. Interestingly all three surveys continue to show high levels of capital expenditure and investment, likely to improve productivity with lower levels of labor, hurting long-term employment growth.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is higher on the day, but Growth continues to outperform on the week as the reflationary themed rally is not meaningfully boosting the value factor (over growth)

Chinese Iron Ore Future Price: Iron Ore futures are higher for to days as futures on Dalian Commodity Exchange were up over 8% overnight

5yr-30yr Treasury Spread: The curve is little changed today and remains flatter on the week

EUR/JPY FX Cross: The cross is flat today, as the Euro’s momentum saw overbought conditions in its hourly RSI yesterday

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Now Malaysia: Chip shortage set to worsen as Covid-19 rampages through Malaysia – The Straights Times

The number of Covid-19 infections is high in Malaysia, threatening to aggravate shortages of semiconductors and other components that have hammered automakers for months. In recent years, Malaysia has emerged as an important center for chip testing and packaging, with Infineon Technologies AG, NXP Semiconductors NV, and STMicroelectronics NV among the key suppliers operating plants there.

Why it Matters:

The situation on the ground in Malaysia remains volatile. Factories have to shut down completely for as long as two weeks for sanitization if more than three workers contract Covid-19 under unofficial guidelines. Local firms are reporting such closures through exchange filings. STMicro and Infineon, both key auto suppliers, had to close facilities. Ford Motor Co said last week it would temporarily suspend production of its popular F-150 pickup truck at one United States plant because of "a semiconductor-related part shortage as a result of the Covid-19 pandemic in Malaysia".

China Macroprudential and Political Tightening:

Distressed Oil: 'Distressed’ Crude From Venezuela, Iran Stacks Up Off Singapore - Bloomberg

Vessels off Singapore, Malaysia, and China had about 62 million barrels last week after hitting a near three-month high earlier this month, according to intelligence firm Kpler. China, the world’s biggest crude importer, has been probing private refiners to bolster compliance with tax obligations and environmental rules. The investigations have seen import quotas cut. Last month, flows of crude into China fell to the lowest since May after the reductions, as well as the disruption caused by a typhoon. In addition, China’s oil refining tumbled to the slowest pace in 14 months in July.

Why it Matters:

As part of the prolonged clampdown, China introduced a consumption tax from June on imports of three oil-related items, including bitumen mixture, citing pollution concerns. That’s contributed to the pile-up off Asian ports as the tar-like substance used to produce road-making material was often used as a cover to mask actual flows of Iranian and Venezuelan oil into Asia. Although the Brent futures curve is in backwardation, lower demand from China has pushed it back towards contango.

In Tech’s Pocket: China’s Antigraft Watchdog Probes Party Leaders in Alibaba, Ant’s Backyard – WSJ

China’s anti-corruption watchdog is investigating top government officials in the eastern Chinese city of Hangzhou, where Alibaba Group Holding Ltd and Ant Group Co. are based, raising questions about close ties between local top-level Communist Party officials and the private sector. The announcement came two days after the disciplinary commission’s national-level body announced a probe into Zhou Jiangyong, Hangzhou’s top Communist Party official, citing suspected serious violations of discipline and law.

Why it Matters:

It is important to watch Xi and his tribe continue to pick off potential rivals under the guise of “corruption crackdowns” into next year's 20th Party Congress. His control will likely be further cemented, but given the recent crackdowns on various sectors, party members are being hurt financially, posing risks to his further ascent. Identifying tribal cash cows also plays into which sectors will continue to face scrutiny verse receiving state support.

LONGER-TERM THEMES:

Electrification Policy:

Public/Private: Apple’s Tim Cook, Microsoft’s Satya Nadella Plan to Visit White House - Bloomberg

The chief executive officers of Apple Inc., Microsoft Corp., and Amazon.com Inc. plan to attend a White House meeting with President Joe Biden this week to discuss efforts by private companies to improve cybersecurity following a dramatic uptick in ransomware and online attacks over the past year. The chief executives of companies including Alphabet Inc.’s Google, International Business Machines Corp., Southern Co., and JPMorgan Chase & Co. have also been invited, the senior official said.

Why it Matters:

Despite the distraction of Afghanistan, the real battle that affects everyday Americans is very much still in cyberspace. The Biden Administration, Congress, and Defense Department will continue to need private sector actors to work with the government to ensure coordination and information sharing. Progress here is significant to watch, and this meeting shows some further steps are being taken.

Global Internet Progress: SpaceX ships 100,000 Starlink terminals to customers, eyes future launches using Starship – Tech Crunch

It’s a jaw-dropping pace for the capital-intensive service, which began satellite launches in November 2019 and opened its $99/month beta program for select customers around a year later. Since that period, SpaceX has launched more than 1,700 satellites to date and, in addition to the 100,000 shipped terminals, has received over half a million additional orders for the service.

Why it Matters:

The company ultimately wants to launch around 30,000 Starlink satellites into orbit and expand its user pool to millions of customers. Currently, many of Starlink’s beta customers live in remote or rural areas, where access to conventional broadband is limited or nonexistent. The potential to sidestep broadband connections and instead use satellite-enabled internet makes a lot of the broadband spending in the current infrastructure bill questionable. Of course, in an insecure cyber world, it may be appropriate to have redundancies.

Commodity Super Cycle Green.0:

Hydro Steel: Steelmakers Grapple With How to Cut Carbon Emissions – WSJ

Sweden’s SSAB shipped what it said was the world’s first commercial shipment of steel made without fossil fuels to truck maker Volvo AB, using hydrogen instead. However, greening the industry is costly, and that is expected to make the steel used in cars, buildings, and householder appliances more expensive. As a result, there is little interest outside the western world to transition the industry into a greener alternative.

Why it Matters:

Consultants at McKinsey estimate that if European steelmakers meet their commitments, around 30% of capacity would be carbon neutral by 2030 and 100% by 2050. The U.S. could get to 30% of capacity sooner than Europe, given the higher share of electric arc furnace production in the country. Still, only around 13% of global steel production last year came from the European Union, U.K., and North America. China produces about 57% of the world’s steel, and of that, about 90% is made using blast furnaces. Steel analysts say there are fewer plans to decarbonize steel in China than in the West.

ESG Monetary and Fiscal Policy Expansion:

What Now?: Pelosi Moves to Bypass Democratic Division on Biden Agenda - Bloomberg

Pelosi is attempting to use a procedural tactic to deem the Democrat's $3.5 trillion budget blueprint adopted once the House votes for a rule governing floor debate for two other measures; a $550 billion bipartisan infrastructure bill and voting rights legislation. The maneuver, a so-called “self-executing rule,” is typically used by House leaders when they do not have the votes and want to avoid an embarrassing defeat on the floor. Structuring the budget resolution as “deemed passed” gives moderates some political cover after a public break with party leaders and progressives in recent weeks.

Why it Matters:

Pelosi is betting that moderates, who support both the voting rights legislation and the infrastructure package, would be reluctant to vote against the rule advancing other measures. House and Senate committees are already at work trying to craft portions of the spending package that will fill in the details of the budget resolution on climate change, tax hikes on corporations and the wealthy, tuition-free community college, a Medicare expansion, and more. Bottom line, there is a real chance this passes, and it would bring forth a massive change in the government's role in society.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.