MIDDAY MACRO - DAILY COLOR – 8/2/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, with leadership changing following the open but all indexes up marginally

Treasuries are higher, with the long-end getting a better bid post-NY-open thanks to slightly weaker ISM manufacturing and construction data

WTI is sharply lower, dropping over 3% at the NY-open on no new news

Analysis:

The positive correlation between lower yields and an outperforming Nasdaq are on display today as the Russell was again unable to defend NY-open gains while Treasuries are being supported by weaker global ISM prints.

The Nasdaq is outperforming the Russell and S&P with Momentum, High Dividend Yield, and Growth factors, and Utilities, Financials, and Consumer Discretionary sectors are all outperforming.

S&P optionality strike levels have zero gamma level moving to 4377 while the call wall increases to 4500; technical levels unchanged with support at 4375, and resistance is 4430.

Treasury markets price action today again looks to be driven more by positioning and technicals, as a slight miss in today’s headline data prints does not justify the change in yields/curve, although overall economic data globally came in weaker.

A little unclear why a generally positive ISM Manufacturing and Construction Spending data print elicited such a strong reaction in Treasuries, but we suspect “September Taper” shorts are covering as we moved out of a two-week range.

The idea that growth and inflation have peaked is now consensus, as is the announcement of tapering in November, and there would need to be a series of meaningful beats or misses in core economic data to change these views.

There is also a view that we have seen peak Covid in Europe, and things are stable in Asia while increases in cases domestically were not meaningfully highlighted as a risk by the Fed last week.

As a result, the Fed has the backdrop it needs to remain patient and coupled with lower debt issuance expectations as well as no indications of changes in behavior from banks and pensions during the second half of this year, Treasuries are likely to remain well supported until the tapering path is laid out.

Econ Data:

The July Manufacturing PMI registered 59.5, a decrease of 1.1 from June. Business panelists reported that their companies and suppliers continue to struggle to meet increasing demand levels. As we enter the third quarter, all segments of the manufacturing economy are impacted by near record-long raw-material lead times, continued shortages of critical basic materials, rising commodities prices, and difficulties in transporting products. Worker absenteeism, short-term shutdowns due to parts shortages, and difficulties filling open positions continue to be issues limiting manufacturing growth potential. Optimistic panel sentiment remained strong, with 13 positive comments for every cautious comment. Inventories remain at very low levels, and the Backlog of Orders Index is at a very high level. The Employment Index returned to expansion after one month of contraction. The Prices Index fell notably from multi-decade highs in June, indicating we may have seen peak pricing pressures.

Why it Matters: Although this was a weaker report than last month, demand and optimism continue to be very strong despite cost increases and delays due to the supply-side disruptions. Much of the headline drop came from decreases in supplier delivery time, indicating logistical bottlenecks are easing. The report bodes well that there will be a substantial inventory build in the third quarter. We also expect labor shortages to ease as hiring bonuses and wage increases increasingly attract holdouts running low on stimulus checks and savings. To summarize, business optimism is high, supply-side disruptions are still problematic but improving, and input cost pressures have weakened slightly while labor shortages continue.

Policy Talk:

Governor Brainard assessed the economy and gave her thoughts on the appropriate path of policy last week at the Aspen Economic Strategy Group. She is in line with Powell on Fed’s current monetary policy stance, saying the central bank needs to see a further notable improvement in the labor market before starting to scale back its bond purchases. Brainard highlighted that the employment-to-population (EPOP) ratio was still 3.2% points below pre-pandemic levels for prime-age workers. She further highlighted that it was even worse for Black and Hispanics. Finally, Brainard said she’s much more inclined to use regulatory tools to head off financial excesses like asset bubbles than the Powell-led central bank has been.

Why it Matters: We don’t believe Brainard will be tapped to replace Powell, as she is not popular among Biden’s inner circle. However, her comments on the inequality of the labor market recovery and belief inflation is transitory are seemingly somewhat Fed consensus right now, echoing what was seen in last week's FOMC statement. Overall, the speech as in line with what we believe is currently the core view/message of Fed policymakers. Finally, we continue to advise increased focus on EPOP and other labor metrics over inflationary metrics when assessing Fed policy.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week as lower yields are supporting the Nasdaq to outperform

Chinese Iron Ore Future Price: Iron ore is lower, as China’s Iron and Steel Association sees slower steel demand and deeper crude steel output cuts for the rest of year

5yr-30yr Treasury Spread: The curve is flatter on the week as the long-end was well bid at today’s NY-open

EUR/JPY FX Cross: Yen is higher on the week, as the week starts with a more risk-neutral tone

HOUSE THEMES / ARTICLES

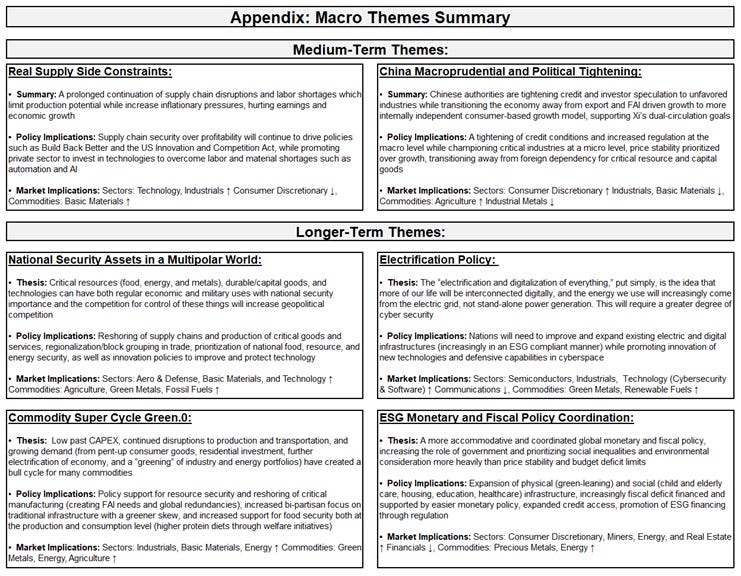

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Stop and Go Traffic: Ports, rail yards, and warehouses are straining to meet roaring consumer demand as the economy recovers - FT

Retailers are scrambling to secure enough products to sell for the holiday season, with big chains ordering larger amounts of inventory than normal, hoping at least some of it arrives on time. “The global supply chain was not built for this,” said Brian Bourke, chief growth officer at Seko Logistics in suburban Chicago. “They were built for seasonal surges of demand annually. When you have 12 peak seasons in every mode, things begin to break down.”

Why it Matters:

With costs on the rise, companies that make everything from tissues to salad dressing have been raising prices to help make up the difference. While strong demand has given companies the leeway to raise prices, it remains to be seen how long people will be willing to pay up. The ramp-up in inventory building into back-to-school and the holiday seasons means there will likely be no improvements in supply chains till next year.

China Macroprudential and Political Tightening:

Who Will Blink: China Seeks More Communication With U.S. on Overseas IPOs - Bloomberg

China’s securities regulator called for talks with its American counterpart after the SEC increased disclosure requirements for initial public offerings of Chinese companies amid nearly a $1 trillion share selloff last week. China had earlier proposed new rules requiring virtually all companies wanting to list in a foreign country to undergo a cybersecurity review, a move that would vastly increase oversight over its private enterprises.

Why it Matters:

Beijing’s change in tone towards the SEC is an additional sign that Chinese authorities have become uncomfortable with the current selloff in stocks. State-run media have published a series of articles suggesting the route is overdone, while some analysts have speculated government-linked funds have begun intervening to prop up the market. We believe that Beijing allowed its “emotions” to get the better of it, with its clampdown on Didi and the education sector, and will now back peddle given its desire to attract foreign capital and be a global financial market leader.

Ever-Sold-Down: Evergrande Gets More Assets Frozen as Creditors Sue Over Missed Payments - Caixin

Debt-plagued China Evergrande Group has had more assets frozen in the wake of a series of lawsuits filed by creditors over the property giant’s missed loan payments and other financial disputes. It also plans to sell more of itself, starting with its internet unit for $418 million to ease funding pressure. As a result, Evergrande’s stock price rose as much as 8.6% in Hong Kong trading on Monday, paring a 65% year-to-date drop as of last week.

Why it Matters:

Evergrande has resorted to offloading assets as it tries to reassure investors about its financial health and meet China’s so-called “Three Red Lines,” requirements that curb developer debt ratios. Local courts are also freezing units of its real estate development companies as collateral for any exposure state-owned building partners may have. We continue to expect the company to shrink in an orderly fashion without becoming a systemic issue to the property market or economy more generally.

Zombie Uprising: China backs state-owned enterprises with $32bn in rescue funds – Nikkei Asia

In March, China's State Council cabinet issued guidelines addressing the debt risk of companies owned by provinces or municipalities. The council called on regional governments to reduce the risk, citing the default fund set up by China and the centrally controlled companies as a model. Since then, numerous provinces have created their own funds following this template and will increasingly inject capital into SOEs.

Why it Matters:

The funds focus more on maintaining local employment, which props up "zombie" companies and further delays managerial reforms at state-owned companies. It is important to highlight the development of these bailout funds, given the pace of reform will always be secondary to the stability of society, which with renewed Covid lockdowns and falling asset prices, is weakening. This is why we believe further stimulus will be coming either through more targeted injections of capital or reduction in regulatory burden.

LONGER-TERM THEMES:

Electrification Policy:

All-Electric: Towns Trying to Ban Natural Gas Face Resistance in Their Push for All-Electric Homes – WSJ

Massachusetts is emerging as a key battleground in the U.S. fight over whether to phase out natural gas for home cooking and heating, with fears of unknown costs and unfamiliar technologies fueling much of the opposition to going all-electric. More towns around Boston are debating measures to block or limit the use of gas in new construction, citing concerns about climate change.

Why it Matters:

The Massachusetts debate encapsulates the challenges many states face in pursuing aggressive measures to reduce greenhouse gas emissions that may directly impact consumers. The cost of fully electrifying buildings varies widely throughout the country and has ignited debates about who should potentially pay more or change their habits in the name of climate progress. Important to watch developments here, especially under an administration that could tie GSE housing finance access to “green” standards.

Commodity Super Cycle Green.0:

No New Coal: Coal Projects in Asia Face Dwindling Financing as Climate Pressure Mounts – WSJ

Asian financiers provide the bulk of funding for new coal projects in countries such as Vietnam and Bangladesh after U.S. and European lenders largely stopped greenlighting coal deals over carbon-emissions concerns. But most key financiers in Japan and South Korea, as well as some in China, have signaled in recent months that they are planning to stop or slow the flow of money for projects outside their borders.

Why it Matters:

China and India are building new coal-power capacity at a significantly slower pace than a few years ago, and the rest of Asia is following suit. China didn’t provide financing or investments to any Belt and Road Initiative coal projects in the first half of 2021. Further, more than half of the $160 billion in coal-fired plants China announced as part of Belt and Road since 2014 has been canceled or shelve. As a result, yes, coal will be around for decades, but we may be seeing some of the last coal power plants being built currently.

Clouded Solar Power: Behind the Rise of U.S. Solar Power, a Mountain of Chinese Coal – WSJ

For years, China’s low-cost, coal-fired electricity has given the country’s solar panel manufacturers a competitive advantage, allowing them to dominate global markets. Chinese factories supply more than three-quarters of the world’s polysilicon, an essential component in most solar panels. Polysilicon factories refine silicon metal using a process that consumes large amounts of electricity, making access to cheap power a cost advantage.

Why it Matters:

Producing a solar panel in China creates around twice as much carbon dioxide as making it in Europe. Scientists say, however, that installing Chinese-made panels almost always results in a net reduction in carbon dioxide emissions over time because the panels are usually replacing electricity generated from fossil fuels. We highlight this to show the West’s dependency on China for critical materials and point out that properly de-carbonizing the world is an expensive endeavor. Instead, it is our view that most nations will likely keep using fossil fuels to build out renewables and power EVs for some time.