MIDDAY MACRO - DAILY COLOR – 8/19/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, with Nasdaq and S&P bouncing higher at the NY-open while Russell remains negative following a 2.5% pullback (in S&P) from recent highs two days ago

Treasuries are higher, with the long-end now off overnight highs but still well bid

WTI is notably lower, with a significant break-down occurring overnight but bullish OPEC headlines hitting the wire are now supporting prices

Analysis:

Equities have been on a roller coaster ride as the two-day pullback drove dip buyers to step in at the NY-open, reversing the negative momentum. At the same time, Treasury markets continue to see a flight to safety bid despite increased tapering concerns following yesterday’s more hawkish Fed Meeting Minutes.

The Nasdaq is outperforming the S&P and Russell with Low Volatility and Growth factors, and Technology, Consumer Staples, and Health Care sectors are all outperforming.

S&P optionality strike levels have not adjusted, and the zero-gamma level is at 4422 while the call wall is 4500; technical levels have support at 4390, and resistance is 4430.

Treasuries are better bid in the long-end today as the curve is flattening, pushing the 5-30s spread to the bottom of its post-June range.

With the continued barrage of negative news facing markets, it is easy to see why equities pulled back this week; however, with volumes low and uncertainty around headwinds still high, we expect the melt-up to continue if key technical levels can hold.

The persistence of Delta, weaker domestic data, the stickiness of inflation, a Fed that will be tapering sooner and faster, uncertainty over China’s growth, as well as the negative psychological impact of seeing our failure to exit Afghanistan are all weighing on sentiment this week. Still, things may not be as bad as many believe.

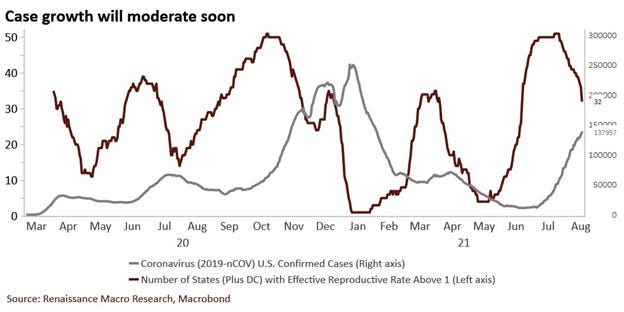

Firstly, Delta Case increases are slowing and a Labor Day peak in case counts looks plausible.

Second, it may not feel like it, but leading economic indicators are still improving, as seen by the Conference Board LEI increasing 0.9% today, which looks at changes in weekly claims, new orders, building permits, credit conditions, and consumer expectations for business conditions.

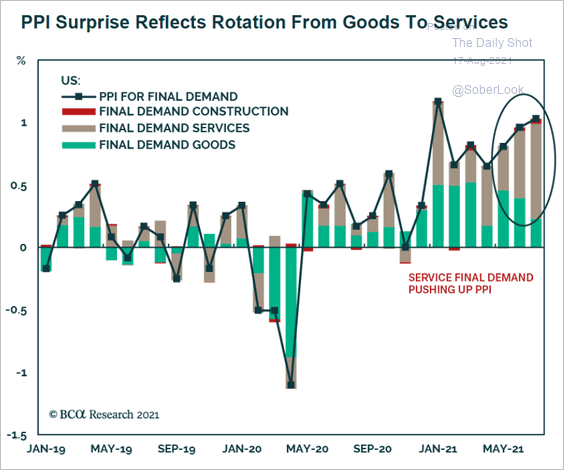

Third, “transitory” inflation is certainly more persistent, and structural forces are growing, maintaining price pressures. Still, firms have been able to pass costs on while demand has yet to be materially diminished (despite recent consumer sentiment changes). Supply-side disruptions are being navigated while labor continues to (begrudgingly) re-enter, all of which is uncapping growth potential into the holiday season.

Further, the growth picture is negatively skewed because service sector activity is arguably not captured as clearly/frequently as goods/manufacturing. Services are only a small part of Retail Sales data and remember the last ISM Services was a significant beat. As we continue to reopen further in the second half of this year, services will be the area that increasingly drives growth.

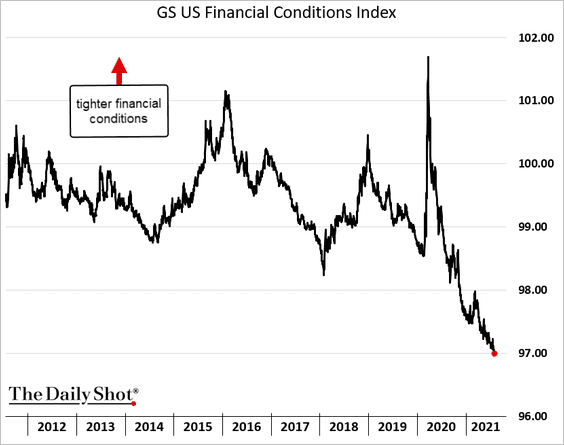

The Fed's path regarding tapering is still unclear, and even if excess liquidity falls, financial conditions are still highly accommodative while real rates remain stubbornly negative, all of which support risk-assets, so we have a while to go before monetary policy becomes restrictive.

Finally, Beijing is changing its tune, becoming more accommodative on a macro level while still being confrontational on a micro/sectorial level. We are also entering a period where their credit cycle turns positive. We should also see a reduction in “Wolf Warrior” activity as we approach next year’s Olympics. Xi would fear an international boycott bringing shame to him before next fall’s CCP vote of confidence/leadership.

Bottom line: If the current uptrend holds for the S&P, which we bounced off of last night (4340ish), the melt-up is still intact, supported by a decrease in negative headwinds moving forward that will help the outlook for growth and earnings to become more positive.

Econ Data:

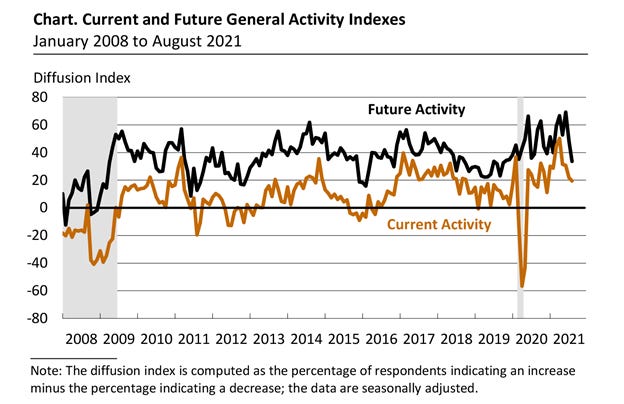

The Philadelphia Fed’s Manufacturing Survey came in weaker than expected, falling 3 points to 19.4 in August. The index for new orders increased 6 points to a reading of 22.8, while the current shipments index fell 6 points to 18.9. On balance, the firms reported increases in employment, and the current employment index increased 3 points to 32.6. Firms continued to report increases in prices for inputs and their own goods. The current prices received index increased 7 points to 53.9, its highest reading since May 1974. Over 56 percent of the firms reported increases in prices of their own manufactured goods, up from 50 percent in July. The respondents continue to expect growth over the next six months, although most of the survey’s future indexes declined. The diffusion index for future general activity decreased 15 points to 33.7 in August, its second consecutive decline after reaching a 30-year high in June.

Why it Matters: Manufacturing activity in the Philly region continues to expand, all be it at a slower pace with less enthusiasm for the future. Increases in new orders and employment contrasted against weaker current activity and shipments. The special question for the month asked firms to forecast the changes in prices they pay and receive. The median forecast for cost increases was 5%, the same as when the question was last asked in May. The firms’ actual price change over the past year was only 3%. Expectations are for wages to rise 4% over the next year, also the same as in May. When asked about the rate of inflation for consumers over the next year, the firms’ median forecast was 5%, an increase from 4% in May. The firms’ median forecast for the long-run inflation rate was unchanged at 3%. Bottom line, firms surveyed here have been able to (and continue to expect to) pass on price increases while also realized cost increase lower than expected.

Policy Talk:

Yesterday’s Fed Minutes did not provide any new information as “most” Fed officials believed it was appropriate to begin slowing the pace of bond purchases later this year. Several members favored reducing asset purchases in the coming months in order to better position the Fed to potentially raise interest rates next year. In contrast, others thought the Fed could wait until early next year due to worries the job market hasn’t fully recovered from the effects of the pandemic. Many officials think the Fed has met this threshold for its inflation objective, the minutes said. At the same time, most officials don’t think the labor market has met the “substantial further progress” threshold.

There was a more hawkish tone in the minutes; however, there is still a wide degree of opinion on the appropriate timing, speed, and structure of the upcoming tapering. We continue to believe there will be no real new news from Powell at Jackson Hole and no tapering announcement at the September meeting. Instead, we still believe there will be a November announcement with a December start. We are moving up our timeframe from eight months to six, with tapering ending in June. This allows for a cooling period before a potential 2022 fourth-quarter rate hike. However, we are reluctant to project too far out given our concerns for a more stagflationary environment next year. There are also indications that structural changes may be occurring in the labor market, which could cause the Fed full-employment mandate to become harder to define and hence achieve.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is outperforming value on the week as the Nasdaq is the clear winner today

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week as July’s drop in steel output continues into August

5yr-30yr Treasury Spread: The curve is flatter on the weak as growth concerns and Fed tightening is giving the long-end a better bid

EUR/JPY FX Cross: Yen continues to outperform the Euro as the global risk-off tone picked up pace overnight

HOUSE THEMES / ARTICLES

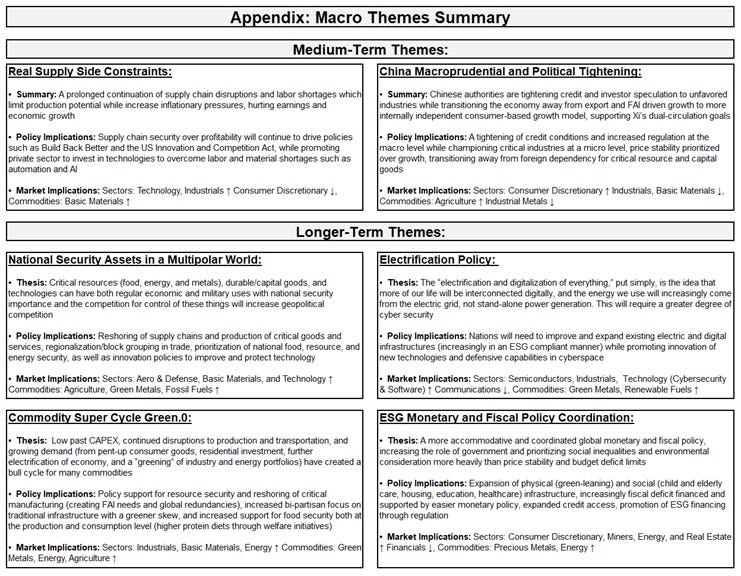

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Going it Alone: Walmart charters ships to help battle tricky peak season – Splash 247

The giant supermarket chain follows in the footsteps of Home Depot in deciding to move some of its goods on the transpacific via tonnage it controls rather than pay high rates to global liners for shipments that tend to arrive late. In an earnings call on Tuesday, Walmart’s CEO, John Furner, revealed: “We’ve chartered vessels … we’ve secured capacity for the third and fourth quarter and feel good about the inventory positioning particularly compared to last year with inventory up 20% across the segments.”

Why it Matters:

We still believe the second half of the year will be stronger than expected despite the growing more pessimistic view. This is based on a belief supply-side disruptions will increasingly abate, allowing growth in manufacturing to be uncapped while the service sector further expands (re-opens) as Delta effects subside. We gain further conviction of this when we see massive retailers like Walmart and Home Depot increasing logistical capacities to overcome current shortages and boost inventory rebuilding into the holidays.

China Macroprudential and Political Tightening:

Stepping In: China Huarong Gets State-Led Bailout After Record 2020 Loss - Bloomberg

Government-backed investors will recapitalize China Huarong Asset Management Co. after the bad-debt manager posted a record $15.9 billion loss, ending months of speculation over whether Beijing would deem the troubled financial giant too big to fail. Control of the company would shift to Citic, the people had said, though details were still being finalized and could change. Huarong said it has no plan to restructure its debt, reiterating that it’s made preparations for future bond payments.

Why it Matters:

We predicted this here a while back as Huarong is simply too big to fail. In 2020, regulators were planning to set up a holding company to oversee the four large asset management companies (AMCs) to ring-fence the finance ministry from more risks. In the government's eyes, Huarong and the AMCs must not become a further problem along with the toxic debt they were supposed to dissolve. A restructuring with deep haircuts for everyone who enabled Huarong's bad behavior should be expected at this point.

LONGER-TERM THEMES:

Electrification Policy:

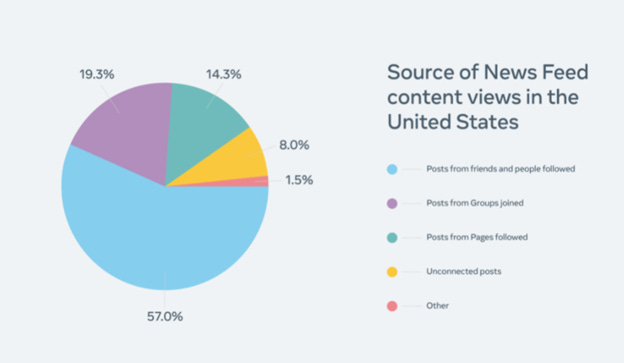

Opening up the Books: Facebook is sharing data to prove it’s not a political hellhole - Protocol

Facebook released a Q2 widely Viewed Content Report to show just what the most shared things are on the network in an effort to increase transparency. According to the report, some 87% of content on News Feed doesn't include a link, meaning it wouldn't be represented in the Facebook top 10 list. As a result, this report is skewed to the more innocent content side and does not capture/reflect what users see regarding politics.

Why it Matters:

While Shapiro and Bongino regularly top the U.S. list of pages sharing posts with links on Facebook, they're nowhere to be found in Facebook's own list of most-viewed pages in the U.S. last quarter. That list includes instead pages like Kitchen Fun With My 3 Sons, The Dodo, and LADBible. It also includes UNICEF and the World Health Organization, which Facebook has been promoting to counter COVID-19 misinformation. Bottom line, this report is a poor attempt by Facebook to address many of the concerns that it is an echo chamber for political propaganda.

Commodity Super Cycle Green.0:

Tree Power: Carbon Offset Deal Helps Michigan Cash In on Its Trees—by Not Cutting Them Down – WSJ

Michigan’s Department of Natural Resources has agreed to limit logging in the Lower Peninsula forest known as the “Big Wild” over the next four decades to create carbon offsets, a climate change. DTE Energy, Michigan’s largest energy company, has agreed to buy the offsets and is marketing smaller carbon footprints to customers of its natural gas business who are willing to pay a monthly fee to go green.

Why it Matters:

The pact between Michigan and the Detroit-based utility is the first involving state land. It could open up a significant new source of so-called voluntary offsets, particularly around the Great Lakes, where states that control vast tracts of timber and mills have a hard time competing with those operating among the Northwest’s giant evergreens and the highly productive pinelands of the South. Around 1.3 million DTE gas customers have signed up for some level of green gas program involvement, and it is expected larger commercial and industrial customers will increasingly come on board, showing there is an appetite for this type of product.

ESG Monetary and Fiscal Policy Expansion:

Potential U-turn: Germany’s Baerbock sets out sharp break with Merkel era for Greens - FT

In a rare interview with the foreign press, Annalena Baerbock, the Green candidate for chancellor, called for looser limits on EU member states’ budget deficits and debt levels. She was also tougher on foreign policy than her main rivals, suggesting the EU impose import duties on state-backed Chinese companies and apply sanctions on the real estate assets of individuals connected with the regime of Russia’s Vladimir Putin.

Why it Matters:

Baerbock, a 40-year-old MP with no government experience, made history in April when she was nominated as the Greens’ first candidate for chancellor. Her ratings have since sagged, but the election remains wide open, and the Greens, polling at about 20%, could still play an important role in the coalition government that will set Germany’s course post-Merkel. Her party’s signature policy is a root-and-branch transformation of the German economy to achieve carbon neutrality within 20 years.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.