MIDDAY MACRO - DAILY COLOR – 8/16/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, with the Nasdaq dropping hard following the NY-open even as weaker data out of China and domestically should be favoring growth over value, however, things are now recovering

Treasuries are higher, picking up pace following a significant miss by the Empire State Manufacturing survey but now losing momentum

WTI is lower, as China’s weaker data and continued lockdowns are further lowering the demand outlook but mid-morning headlines from OPEC rejecting Biden’s call for production increases are seeing a relief rally

Analysis:

Equities are lower (but off of the NY-open drop) with a more risk-off tone as weaker economic data and continued Delta concerns weigh on investor sentiment, helping Treasuries get a bid pre-NY-open.

The S&P and Russell are outperforming the Nasdaq with Low Volatility, High Dividend Yield, and Value factors, and Utilities, Health Care, and Consumer Staples sectors all outperforming.

S&P optionality strike levels have zero gamma level at 4415 while the call wall is 4500; technical levels have support at 4430, and resistance is 4470.

The Treasury curve is bull flattening with the long end now retracing much of last week’s selloff with the 10yr yield at 1.24, the middle of its tactical range of 1.12 to 1.37.

A bit of a messy market today on very low volumes, as big economic data misses and the emotional saga unfolding in Afghanistan are juxtaposed against the end of a strong earning season, moving sentiment more towards fear verse greed.

As discussed on Friday, consumer sentiment is dropping, and if the economic data weakens further due to Delta, investor sentiment will follow.

Tomorrow’s retail sale is forecasted to be weaker (-0.3%), but given the slowdown already seen in higher frequency credit card and mobility data, the risk is for a significant miss.

Following today’s weaker Empire State Manufacturing data and the last ISM Manufacturing survey, tomorrow's Industrial Production data will also be closely watched; however, we take comfort in the recent stronger Durable Goods data and have higher confidence IP will be in line with expectations.

Finally, it is important to highlight that vaccinations rates are back up (close to a million a day across the country), and although entirely too high (at this point in the journey), hospitalization rates are concentrated in younger-middle age people who are not vaccinated, meaning this susceptible population is shrinking, giving us hope the case-curve will peak soon.

Chinese economic data last night was much weaker than expected, showing how quickly lock-downs weighed on momentum (that was already weakening) and delaying Beijing's transition plans for growth to be increasingly domestically driven.

China’s industrial output was up 0.30% MoM, and fixed asset investment was up 0.18%, roughly half the average monthly increase year to date, consistent with the lowest monthly increase in total social finance all year (0.4%).

For the first seven months of 2021, the 2-year average growth rate for retail sales was 4.3%, well below the 5.6% growth in industrial output, showing that not only has there been no rebalancing of domestic demand, but in fact, the imbalances have gotten worsened.

So, how worried is Beijing? It is hard to say. There haven’t been any alarm bells ringing yet, and further rhetoric against the tech sector (online gaming this time) continued over the weekend.

We continue to expect a further RRR cut in the fall to support the credit impulse channel (which should start to improve). At the same time, regulators will attempt to support an orderly wind-down of the growingly insolvent real-estate sector while SOE non-performing loans may be increasingly corralled into a state-sponsored bad-loan bank.

We caution against having too much hope for additional stimulus as the inflation pressures have yet to peak, as seen in recent increases in PPI which will continue to put upward pressure on CPI.

Econ Data:

The NY Empire Manufacturing business conditions index fell to 18.3 from 43 in July, much more than expected. New order growth slowed to 14.8 from 33.2 while Shipments dropped -39.4 to 4.4. Unfilled Orders and Delivery Times also increased, showing logistical constraints continue to weigh on activity. However, the 6-month expectations on business conditions rose to 46.5 from 39.5. Finally, inflation readings moved higher with prices received increasing to 46.0 from 39.4 while prices paid were little changed.

Why it Matters: Not a great report and potentially foretelling of a weaker Industrial Production print tomorrow. Logistical restraints weighted more heavily on production than last month, and as a result, inflationary pressures have yet to ease. These restraints and worries over Delta have yet to materially weigh on the forward outlook, with increases in Business Conditions, New Orders, and Shipments, while Unfilled Orders and Delivery Times are expected to improve. There is still no relief in cost increases as seen by rises in the Forward-Looking Prices Paid from firms.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week as the factor is up 0.2% on the day while growth is down -0.45%

Chinese Iron Ore Future Price: Slightly higher as China's average daily crude steel output stood at 2.8 mln tonnes in July, the lowest since April 2020, down 10.5% MoM

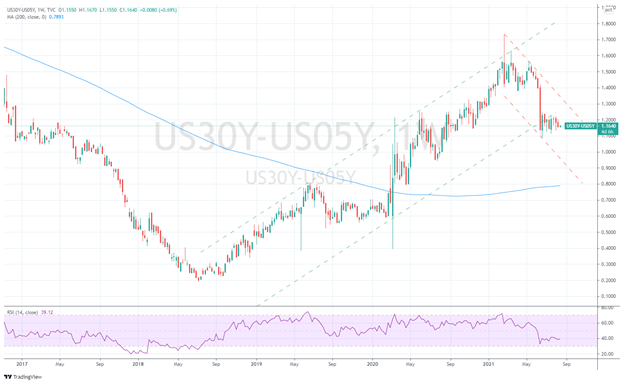

5yr-30yr Treasury Spread: The curve is steeper on the week as a more risk-off tone this morning gave the long-end a stronger bid

EUR/JPY FX Cross: Yen is higher on the week as the FX markets reflect a more risk-off tone with a higher geopolitical focus today

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

Weak Data: China economy under pressure as factory output, retail sales growth slow sharply - Reuters

China's factory output and retail sales growth slowed sharply and missed expectations in July, as new COVID-19 outbreaks and floods disrupted business operations, adding to signs the economic recovery is losing momentum. Industrial production increased 6.4% YoY in July. Analysts had expected output to rise 7.8% after growing 8.3% in June. Retail sales increased 8.5% in July from a year ago, far lower than the forecast 11.5% rise and June's 12.1% uptick.

Why it Matters:

China's economy has rebounded to its pre-pandemic growth levels, but the expansion is losing steam as businesses grapple with higher costs and supply bottlenecks. New COVID-19 infections in July also led to further restrictions, disrupting the country's factory output already hit by severe weather this summer. As America loses further credibility on the international stage due to the events unfolding in Afghanistan, we expect China to become more supportive of its economy, seizing on the moment. Higher growth (obviously) will help expedite its dual-circulation goals and strengthen the yuan’s international use.

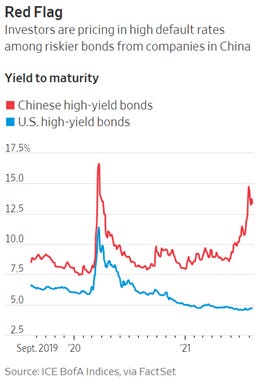

General Confusion: China’s Corporate Crackdown Adds to Junk-Bond Distress – WSJ

The widening regulatory crackdown that sparked a big selloff last month in the shares of internet-technology and education companies has also weighed on Chinese credit markets, pushing down prices of even investment-grade bonds. The three red lines policy is proving effective to push developers to reduce debt and cutting access to funds. As a result, some developers will run into default, which may bring some contagion and volatility to the overall market.

Why it Matters:

The spread between the U.S. and Chinese high-yield bonds recently hit its widest level in a decade, showing how far prices of Chinese bonds have fallen relative to their Western counterparts. Investors continue to gravitate to the idea that authorities in the country will continue to show a higher tolerance for corporate failures among state-owned and private enterprises. Recent defaulters have included a major real-estate developer, a state-backed chipmaker, and a coal producer.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Growing Fast: Tesla Battery Supplier CATL Plans $9 Billion Share Sale to Boost Capacity – WSJ

Contemporary Amperex Technology (CATL), one of the world’s largest makers of lithium-ion batteries, said Friday it expects to raise up to 58.2 billion yuan, equivalent to $9 billion, via a share placement to large investors. CATL said it plans to use most of the proceeds to increase the production of lithium-ion batteries at its facilities in China’s Fujian, Guangdong, and Jiangsu provinces. It also plans to invest in research and development and use some of the money for working capital.

Why it Matters:

The company is already a major supplier to Tesla’s Shanghai factory. The new proceeds would allow it to scale up its production of lithium-ion batteries and develop less expensive batteries to combat rising raw materials costs. The battery maker’s strategy would give CATL an edge as many automakers are trying to secure access to critical electric-vehicle components, in some cases by making batteries themselves. Finally, sales of electric vehicles in China more than doubled in July from a year earlier to more than 220,000 vehicles, according to the China Association of Automobile Manufacturers, even as overall new-car sales declined.

Electrification Policy:

Angry Work: ‘Likes’ and ‘shares’ teach people to express more outrage online – Yale News

The Yale team measured the expression of moral outrage on Twitter during controversial real-life events and studied subjects' behaviors in controlled experiments designed to test whether social media’s algorithms, which reward users for posting popular content, encourage outrage expressions. The team found that the incentives of social media platforms like Twitter really do change how people post. Users who received more “likes” and “retweets” when they expressed outrage in a tweet were more likely to express outrage in later posts.

Why it Matters:

The results suggest a troubling link to current debates on social media’s role in political polarization. “Our studies find that people with politically moderate friends and followers are more sensitive to social feedback that reinforces their outrage expressions,” Crockett said. “This suggests a mechanism for how moderate groups can become politically radicalized over time — the rewards of social media create positive feedback loops that exacerbate outrage.” She added, “Our data show that social media platforms do not merely reflect what is happening in society. Platforms create incentives that change how users react to political events over time.”

Safe City?: Huawei Accused in Suit of Installing Data ‘Back Door’ in Pakistan Project – WSJ

A long-running dispute between Huawei and a small U.S.-based contractor has escalated to U.S. federal court, with the contractor alleging Huawei stole its technology and pressured it to build a “back door” into a sensitive law-enforcement project in Pakistan. Huawei required it to set up a system in China that gives Huawei access to sensitive information about citizens and government officials from a safe-cities surveillance project in Pakistan’s second-largest city of Lahore.

Why it Matters:

Huawei is a leader in safe-cities projects, citywide surveillance systems marketed to governments as crime-fighting tools. It now looks like the ultimate goal is to take the information gathered back to China and use it to identify foreign nationals, likely as either a friend or foe to the CCP. This has long been the fear and reason why sanctions were put on the company and other Chinese firms like it. It also brings up the more significant problem of local law enforcement turning to surveillance strategies, given they may not be able to secure the data.

ESG Monetary and Fiscal Policy Expansion:

Everyone Eats: Biden to Give Biggest Permanent Boost to Food-Stamp Benefits – Bloomberg

The Agriculture Department is increasing the payments by revising the list of foods used to estimate the cost of a nutritious diet. Congressional approval isn’t needed for the change. The new maximum benefit for a family of four will increase to $835 a month, a 21% increase from pre-pandemic levels. The average benefit will rise 27%, adjusted for inflation.

Why it Matters:

The instrument for the benefit increase is an obscure U.S. Department of Agriculture shopping list used to determine food stamp benefits, known as the Thrifty Food Plan. A provision in the 2018 Farm Bill called for an update of the market basket, and Biden ordered the department to proceed with the review two days after he took office. The increase is notable but given inflation and the goal of providing more nutritious foods (which cost more), it is more of a catch-up after the previous administration made no increases to the program.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.