MIDDAY MACRO - DAILY COLOR – 8/12/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, as stronger than expected PPI data renewed profit margin fears, hurting the Russell and helping the Nasdaq

Treasuries are flat, surprisingly little changed following the PPI beat and upcoming 30yr supply

WTI is lower, as traders expect little change from OPEC+ following Biden’s plea for help

Analysis:

Equities are taking their cue from today’s PPI beat, with small-caps under pressure post-NY-open, while Treasuries are generally uninterested; of course, we are in a low volume part of the year.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Volatility, and High Dividend Yield factors, and Health Care, Technology, Real Estate sectors are all outperforming.

S&P optionality strike levels have zero gamma level at 4398 while the call wall is 4500; technical levels have support at 4420, and resistance is 4460, followed by 4490.

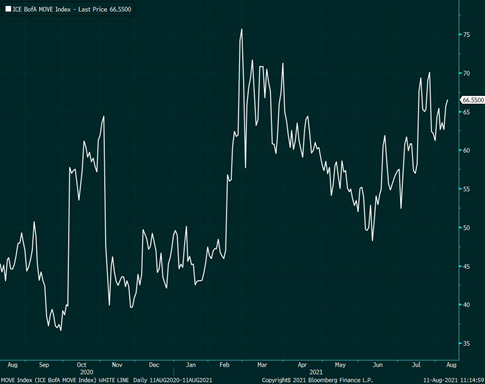

Treasuries are little changed, consolidating in a post-CPI range. However, the MOVE Index has ticked up (as expected) following the better-than-expected jobs report.

We are in somewhat of a “fog-of-war” situation with today’s significant PPI beat negating yesterday’s “weaker” CPI data, labor markets improving but still needing “further progress,” the coming Delta drag on the economy nowhere near clear, leaving a Fed that is talking more hawkish but likely less confident in their forecasts.

Yesterday’s consumer inflation data for July moderated somewhat, as the increases in core components came in lower than expected while the hotter “reopening” items cooled, resulting in reduced expectation for the Fed to bring forward and shorten its tapering plans

The positive CPI price action response juxtaposed against further hawkish remarks by additional Fed officials clarifying that the economy is on track to make “substantial progress” and tapering should begin before year-end.

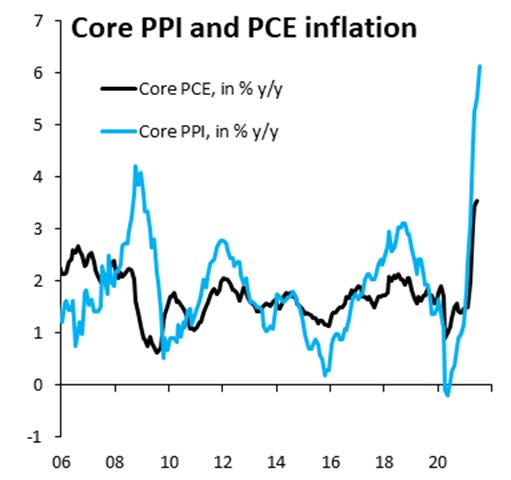

Today’s stronger than expected PPI, which saw historically high monthly increases, resets any thoughts that peak inflation has occurred and in conjunction with the increases in shelter and wages, gives us more confidence that a stagflationary environment is approaching next year.

The inflation data was pre-Delta uptick and higher frequency consumer data is showing consumer behavior changing marginally but not weakening substantially due to Covid fears, leaving us to conclude this wave will have a weaker economic impact (and likely peak faster).

Equities markets are more aligned to this narrative than a stagflationary one, with earning expectations increasing for the second half, the reopening basket outperforming (even with today's pullback), and the VIX continuing to drop, furthering the melt-up we have seen all summer.

As a result of it all, we continue to expect a patient Fed (despite this week’s hawkish-talk) due to “dirty” data/outlook, a stronger 2H, but weaker 2022, leading to a blow-off in stocks (following year-end), led by reflation themed sectors (due to the peaking of Delta cases helping a “second” reopening demand outlook/sentiment).

Econ Data:

The monthly increase in PPI for July was 1.0%, which beat expectations of 0.5%, while the core measure increased 0.9%. The annual increase for final demand prices rose to 7.8% from 7.3%, while the core inflation rate increased to 6.1% from 5.5%. The majority of the monthly increase can be attributed to the 1.1% increase in prices for final demand services. Final demand services prices are up 5.8% on a year-over-year basis in July and are now gaining at a 10.4% rate if you annualized the last three months. This is the fastest increase in the 10-year history of the measure. Most of the increase was concentrated in passenger fares and hotel rooms amid a surge in travel this summer. Wholesale auto prices have also risen sharply due to strong demand and carmakers not producing enough vehicles.

Why it Matters: There are no signs that price pressures are subsiding in today's PPI data. Monthly gains for the headline and core were the second-highest and highest since the series began. Three-month annualized rates for core finished goods is 8.8%, and we highlighted the increase in final demand for services above. The acceleration of PPI coupled with some stabilization in CPI yesterday clearly should renew profit margin worries. We continue to believe firms will successfully pass on price increases into year-end and expect continued upward pressure on CPI/PCE. Of course, with credit card data confirming recent weakness in travel and leisure & hospitality activity, and at the risk of stating the obvious, specific sectors will have less success in defending margins as demand weakens due to Delta fears. However, the pullback in equity prices in these “opening-up” sectors may already reflect peak Delta fears, leaving the tail-risk that a quicker improvement in both price pressures and Delta cases (renewed demand growth) occur moving forward.

Policy Talk:

In an interview with the Financial Times, San Francisco Fed President Mary Daly (voter), expressed confidence that the economic recovery would continue to gather momentum as more people returned to work and consumer spending remained buoyant, setting the stage for a policy pivot in the coming months. “We’re really adding enough jobs to see that we’re making progress towards our full employment goal,” said Daly. “We’re not there yet... but we’re chipping away at the hole that was dug by Covid.” Separately, Kansas City Fed President Esther George (2022 voter) commented yesterday she believed it was time to “transition from extraordinary monetary policy accommodation to more neutral settings.”

Why it Matters: Daly has long been one of the more “dovish” Fed members advocating a patient approach to withdrawing support. There are still almost six million more Americans out of work than in February 2020. Daly said she expected the shortfall would shrink as pandemic fears faded, childcare issues were resolved, and enhanced unemployment benefits were phased out. Daly's focus on childcare (as well as the loss of benefits to some extent) means she wants to see September’s labor data, released in October, before signing on to a tapering plan. We continue to believe an announcement in September is too soon (due to the data still being messy), but a faster taper path ending in six to eight months is now more probable.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week although weaker today as small-caps underperform post PPI

Chinese Iron Ore Future Price: Futures are weaker on the week as the degree of steel output being cut is still unclear

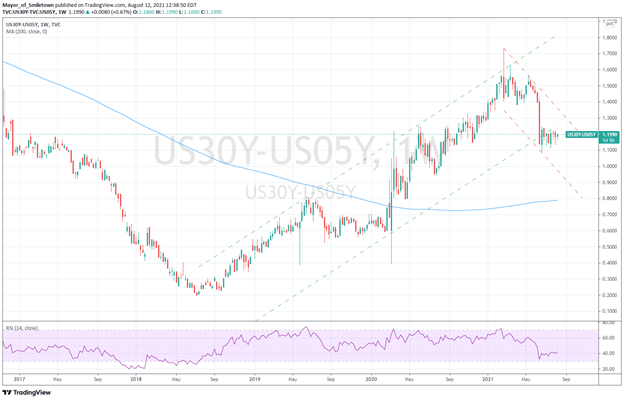

5yr-30yr Treasury Spread: The curve is steeper on the week as long-end yields have retraced post CPI moves

EUR/JPY FX Cross: Yen is slightly higher on the week; however, it is a short candle, possibly signaling momentum is changing

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Longer Lead Times: Chip Delivery Time Surpasses 20 Weeks in No Sign Shortage Easing – Bloomberg

Chip lead times, the gap between ordering a semiconductor and taking delivery, increased by more than eight days to 20.2 weeks in July from the previous month, according to research by Susquehanna Financial Group. That gap was already the longest wait time since the firm began tracking the data in 2017.

Why it Matters:

Shortages of microcontrollers, logic chips that control functions in cars, industrial equipment, and home electronics jumped in July, according to the report. Lead times for that type of chip are now 26.5 weeks, compared with a typical range of six to nine weeks. In better news for industries that rely on semiconductors, the lead times were reduced for power management chips, semiconductors that regulate the flow of electricity in everything from smartphones to solar power generation. Bottom line, we are far from out of the woods in some areas but seeing slight improvement elsewhere.

High Sea Rules: ‘Flawed’ Congress shipping regulation slammed by World Shipping Council – Port Technology

The Ocean Shipping Reform Act of 2021, a bipartisan bill, would require the Federal Maritime Commission (FMC) to establish and enforce rules regarding minimum service requirements for shippers, respond to breaches of contracts, and address excessive, unjust detention and demurrage fees. WSC argues that the bill is flawed in suggesting that ocean carriers are solely responsible for current supply chain congestion and that the legislation is infused with “fundamental unfairness.”

Why it Matters:

The WSC cast doubt on assumptions that regulation of supply chain actors would improve supply chain challenges. Separately, the FMC has launched an expedited inquiry into the timing and legal sufficiency of ocean carrier practices concerning surcharges as part of its investigation into the US maritime sector. The Bureau of Enforcement has given the ocean carriers until 13 August 2021 to provide details that confirm any surcharges were correctly instituted. Bottom line, when something breaks, as seen in many parts of our supply chain, legislation or regulatory actions always follow.

China Macroprudential and Political Tightening:

Just Starting: China Signals Its Regulatory Crackdown Will Go On for Years - Bloomberg

China released a five-year blueprint calling for greater regulation of vast parts of the economy, providing a comprehensive framework for the broader crackdown on key industries. Authorities would “actively” work on legislation in areas including national security, technology, and monopolies. At the same time, law enforcement will be strengthened in sectors ranging from food and drugs to big data and artificial intelligence.

Why it Matters:

Many of the sectors named have been mentioned in previous announcements, but food and drugs are new. “We can’t draw too much insight about enforcement and the potential shape of crackdowns from one document or another,” said Graham Webster, who leads the DigiChina project at the Stanford University Cyber Policy Center. “Much depends on what bureaucrats and their higher-ups land on in terms of priorities month after month.” As a result, volatility in Chinese equities isn’t going anywhere, and investors will continue to live or die based on criticism in state media.

LONGER-TERM THEMES:

Electrification Policy:

You Get a Rocket: Supply of small launch vehicles continues to grow – SpaceNews

The number of vehicles with “limited” payload capacities available to commercial or U.S. government customers had grown to 155 vehicles, ranging from 10 vehicles in operation to several dozen that had gone defunct due to lack of funding, according to a survey started in 2015, when about 30 vehicles were included. The number of vehicles in active development declined slightly from last year to 48, with a decrease in the number of vehicle concepts on a “watch” list that has not yet entered active development.

Why it Matters:

Among vehicles in operation or under development, the United States has the most, accounting for 22 of 58 such vehicles. However, six of the ten operational small launch vehicles are Chinese, thanks to the growth of small launch ventures there like Galactic Energy and iSpace. India is emerging as a new hotbed of launch activity, with four small launch vehicles under development by companies after government reforms backed commercial launch ventures there. We believe this sector will grow in importance as the “shovel providers” meet an increasing need for private and public sector interests to have assets in space.

Commodity Super Cycle Green.0:

Proving Your Green: Frackers, Shippers Eye Natural-Gas Leaks as Climate Change Concerns Mount – WSJ

The American gas industry faces growing pressure from investors and customers to prove that its fuel has a lower-carbon provenance to sell it around the world. That has led the top U.S. gas producer, EQT Corp., and the top exporter, Cheniere Energy Inc., to team up and track the emissions from wells that feed major shipping terminals.

Why it Matters:

Nearly every industry now faces pressure to reduce its carbon footprint, as investors focus more on ESG issues and push companies for trustworthy emissions data. Investors, policymakers, and buyers of LNG are rethinking the fuel's role in their energy mix because of concerns about methane emissions, which were highlighted this week as a significant contributor to climate change by a scientific panel working under the auspices of the United Nations.

ESG Monetary and Fiscal Policy Expansion:

Another Day of Sun: California energy commission mandates solar panels for new buildings - Axios

The California Energy Commission voted Wednesday to require solar panels and battery energy storage systems in new commercial buildings and certain multifamily residences beginning in 2023. The Energy Commission's energy plan also includes incentives to eliminate natural gas from new buildings and to add batteries to solar systems in single-family homes. The provision must now be approved by the state's Building Standards Commission.

Why it Matters:

According to the commission, homes and businesses use nearly 70% of California’s electricity and are responsible for a quarter of its greenhouse gas emissions. It said this proposal would reduce emissions over 30 years as much as if nearly 2.2 million cars were taken off the road for a year. Any increase in construction costs is expected to be minimal, the Energy Commission said. Adding solar power and storage during construction is considered more cost-effective than retrofitting. As heard in LaLa land, “just another day of sun” so this development is not surprising.

The Dilemma: U.S. Steps Up Pressure on Businesses Over Forced Labor in China – WSJ

U.S. lawmakers and Biden administration officials are stepping up pressure on American businesses to stop imports from the Western Chinese region of Xinjiang as Beijing’s alleged use of forced labor emerges as a top item on their bilateral trade agenda. Imports of cotton and tomato products have already been effectively banned since January, and penalties on purchasing some solar materials were implemented in June.

Why it Matters:

Congress is expected to approve legislation later this year prohibiting imports of all products from Xinjiang unless the importer can prove their items are free of forced labor, a high bar. The Uyghur Forced Labor Prevention Act passed the Senate by unanimous consent last month and is awaiting approval by the House, which passed a similar bill by a wide bipartisan vote last year. On top of being the right thing to do, it will have inflationary effects on consumers and complicate sourcing of certain critical materials, notably polysilicon used in solar panels.

It’s Starting Again: Fannie Mae Aims to Make Home Loans More Accessible – WSJ

Fannie Mae is making it easier to include rent-payment history as part of the mortgage approval process, a move intended to help borrowers with limited credit histories get better access to home loans. Twelve months of consistent rent payments could help applicants qualify for mortgages, but a history of missed or inconsistent payments wouldn’t penalize an applicant, Fannie Mae said.

Why it Matters:

Fannie Mae said the move to include rent payments isn’t about lowering the bar for credit approvals. Rather, consumers might not appear as financially responsible during the loan decision-making process as they would if rent payments were factored in. In cases where a borrower doesn’t have a credit score, Fannie Mae already allows lenders to use rent history when assessing the borrower’s creditworthiness. Import to watch any moves away from FICO scores, which are seen as (racially) bias by Progressives. Also important to remember that after over ten years of debate, the GSEs are still generally in the same grey zone of conservatorship and ultimately a taxpayer asset/liability.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.