Midday Macro - 8/10/2022

Color on Markets, Economy, Policy, and Geopolitics

Midday Macro – 8/10/2022

Market Recap:

Price Action and Headlines:

Equities are higher, as its ALL ABOUT INFLATION, with today’s CPI data reducing Fed tightening expectations and hence the probability of a recession with small-cap growth outperforming on the session

Treasuries are mixed, with the curve steepening as the front-end initially reduced the ultimate terminal rate the Fed will reach, while a better growth outlook has 30yr yields higher on the day

WTI is higher, falling after the CPI report but recovering and gaining throughout today’s session following “bullish” EIA weekly inventories data, which showed gains in crude storage levels and drops in gasoline ones

Narrative Analysis:

The inflation narrative improved with today’s better-than-expected CPI data, but one month does not make a trend. However, a flat monthly move in the headline reading and lower-than-expected monthly increase in the core was enough to break equities out of their two-week range, pushing the S&P up to a critical resistance area of 4200. Consumer Discretionary and Technolgy sectors continue to be the best performers in what is still being seen as a bear market rally, but materials and financials are having a strong session thanks to a better growth outlook and a steepening curve. Treasuries were notably higher following the CPI print but have given up much of their gains, with the long-end negative on the day as traders realize we have a long way to go before the Fed can take comfort that inflation is returning to target. Oil reversed earlier losses with gasoline stocks falling more than expected and geopolitical risk rising due to pipeline shutdowns into Eastern Europe. Copper is hitting new highs since its June lows as Beijing continues to show incremental support for the property sector while more renewable energy initiatives are announced globally every day. The Agriculture complex is better bid today on declining conditions and a dry forecast in the U.S. Finally, the dollar dropped as lower inflation means less Fed tightening and all the currency appreciating effects that has with the $DXY falling below 105 before recovering slightly. The Euro finally broke above 1.03, the resistance it had faced since mid-July, while the Yen is also pushing back to recent highs.

The Russell is outperforming the Nasdaq and S&P with Growth, Small-Cap, and Value factors, and Materials, Consumer Discretionary, and Communications sectors outperforming on the day. More duration/curve sensitive and cyclical sectors and factors (Materials and Financials with Value and Growth) have outperformed over the last week.

@KoyfinCharts

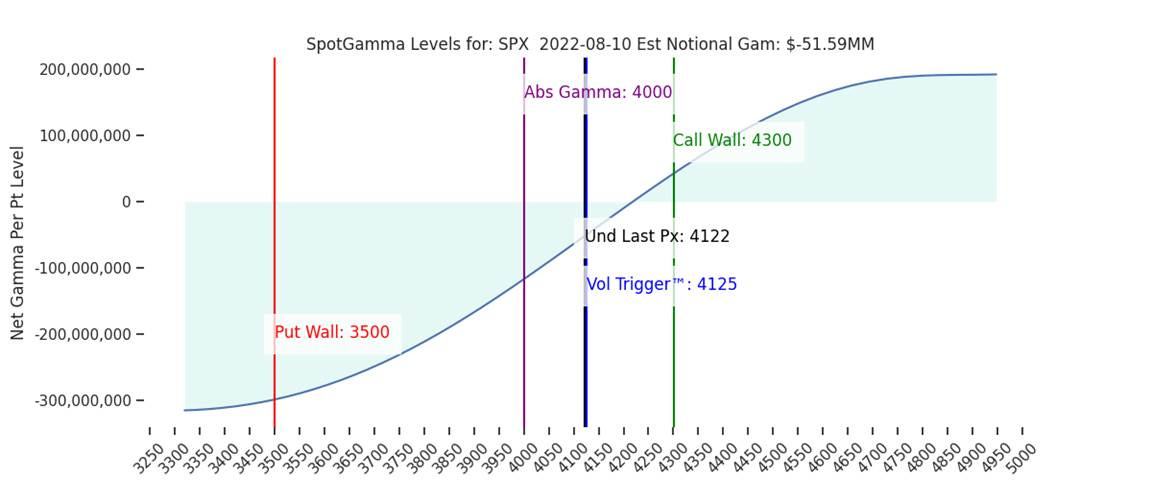

S&P optionality strike levels have the Zero-Gamma Level at 4100 while the Call Wall is 4200. Support is around 4100, with resistance at 4200. Still the same since the last writing; positive gamma is building, pressuring implied volatility, and this should remain into August OPEX. With the VIX now below 20, clearly, the positive gamma builds we highlighted for two weeks will continue with vol being further sold after today’s better-than-expected CPI data. The MOVE index now needs to fall further to help equities keep rising as 4200 has strong gravity.

@spotgamma

S&P technical levels have support at 4200, then 4170, and resistance at 4215, then 4235. The 4200 area has been a major resistance/target for weeks, and the market certainly recognizes it, chewing through heavy supply here. We broke out a 2-week base today, and now bulls must hold breakout above 4170; otherwise, we likely trap back to 4125.

@AdamMancini4

Treasuries are mixed, with the 10yr yield at 2.79%, little changed on the session, while the 5s30s curve is steeper by 10 bps, moving to 13.5 bps.

Deeper Dive:

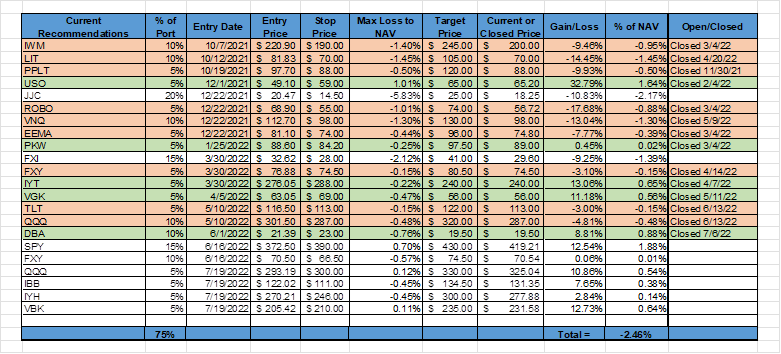

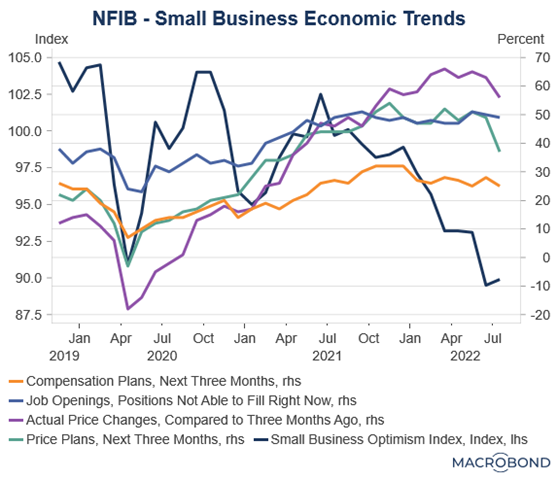

Optics matter, and today’s 0% monthly increase and significant decline in the annual headline inflation rate are notable, even if the underlying report does not materially change the inflation story for the Fed yet due to persistent pressures on core inflation. One month’s data does not make a trend, but when combined with drops in the New York Fed’s Inflation Expectation report this week, as well as the NFIB Small-Business Survey showing declines in the percent of firms expecting to raise prices now and in the future, the case for peak inflation having occurred in June continues to grow. At this point, recurring readers know our views here, and we will not know if our belief that inflation will fall faster than expected into year-end occurs, well, until year-end. We continue to believe the December FOMC meeting will be the last meeting the Fed will hike rates for this cycle. Then eyes will increasingly turn to when the Fed begins to “normalize” rate levels and how to juxtapose this against quantitative tightening. We expect tomorrow’s PPI, Friday’s import/export price data, and the University of Michigan inflation expectations to further reduce inflationary fears and lowering the expected level of September’s FOMC meeting’s rate hike, also lowering the terminal level that meetings SEPs will show. We continue to remain long equities, as seen in our mock portfolio, and are targetting a 4,300 level area on the S&P as where we want to reduce risk going into a more seasonally challenging period for the index, although this year is likely going to be very different given all the macro variables at play.

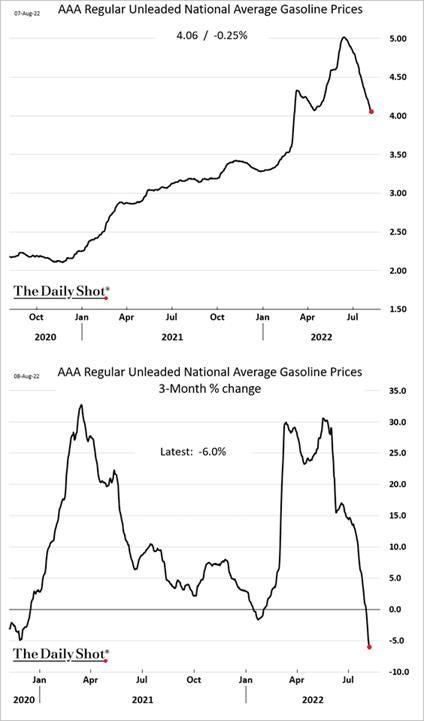

Since we have recently written about inflation at nauseam, we will keep thoughts there more contained today. It is important to note that “deflationary” pressures seen in July have continued or increased throughout August so far, leading us to believe that further decreases in monthly gains can occur in the next CPI report, one that comes out days before the Fed’s September FOMC meeting. For example, drops in gasoline are well tracked at this point, but there is increasing evidence that food prices have peaked, as first seen in commodity market pricing, and are now increasingly occurring at the shelf level. The consumer has downgraded preferences, buying store brands and choosing cheaper alternatives for proteins. We highlight this to point out that the changes in consumer behavior that increasingly occurred in the second quarter have continued and are materially weakening how much producers/providers can raise prices. It looks like you can extrapolate this “push-back” mindset to other goods and services. National and regional business surveys are showing a diminishing ability to raise prices. The psychology has changed, with consumers becoming more defensive to price increases instead of blindly accepting them, as seen earlier in the cycle, something that falling prices at the pump emboldens. This is ultimately very important regarding Fed policy as it reduces the odds of a permanently higher level of inflation and reduces fears that the Fed will have to maintain a tighter policy to combat more entrenched higher inflation expectations.

*The July CPI report was all about falling gas prices, although there was a broad deceleration in monthly price gains generally. We believe August will show a continued broad deceleration of other categories, given what we have seen in other data so far this month

*One can learn a lot from grocery market shopping trends, with consumers continuing to be more defensive and thrifty, choosing price over healthiness or luxuriousness

As a quick mock portfolio update, recent index gains and somewhat of a rebound in copper have translated into our total return since inception getting back to around -2.5%, off lows of -5.5% seen in June. We have a decision to make about our China stock longs, as fundamentals are slowly improving while the geopolitical picture has significantly worsened. For now, we are making no changes and are working on a balanced approach to highlight the good and bad there, something we are hopefully delivering in our next writing. Still, the ground keeps shifting (literally with every military drill), making it hard to see with clear eyes and no emotional and cognitive biases. We also feel better about our copper long following recent legislation passed in D.C. and other renewable energy initiatives announced globally, as well as signs that China’s property sector may continue to get greater Beijing support. Finally, we are a little disappointed in the performance of our healthcare sector long, as outflows have increased there, dampening our main thesis for performance. However, our biotech sector long position has performed well with M&A activity and inflows increasing, which is why we originally combined the two together. Overall if the S&P can reach 4300 and copper rallies back to around $4, we may be able to get closer to flat by the start of Q4, when we believe things should really get interesting into year-end.

Econ Data:

Headline Consumer prices were unchanged in July after rising at a 17-year high rate of 1.3% in June and beating forecasts of a 0.2% rise. The Core CPI index rose 0.3% MoM, decelerating from a 0.7% MoM increase in June and slightly lower than market expectations of a 0.5% rise. The annual headline increase fell to 8.5%YoY from 9.1% YoY, while the core rate was unchanged at 5.9% YoY. Gasoline fell by -7.7%, airline fares slumped by -7.8%, and prices for used cars and trucks dropped by -0.4%. On the positive side, electricity prices rose by 1.6%, food increased by 1.1%, shelter rose by 0.5%, and new vehicles increased by 0.6% in the month.

Why it Matters: Although the deceleration in the headline CPI rate was a positive sign, the underlying components of this report will not give the Fed too much comfort that they have “compelling evidence” that inflation is heading back towards target. Reopening pressures are clearly falling (as seen in falling car rentals, airfares, and hotel price pressures), but when excluding these from the core rate group, there was an increase of 0.5% on the month (not 0.3%), with the three-month average moving to 6.8%. With that said, we still think June was the peak in inflationary pressures and see the faster-reacting drops in energy and commodities as a sign that pressures will be cooling elsewhere into year-end. However, in the month of July, the slight decrease in shelter and new vehicle price increases, both with heavier index weightings, showed that supply and demand imbalances remain in the eyes of the Fed. Coupled with the increases in food, primarily driven by the “Food at Home” category, the consumer did not see much relief in staple goods outside of fuel (not energy, given electricity prices rose). However, looking at what is happening in the housing market, what we expect in labor mobility (rent pressures), improving production/supply of autos, and the drop in services price increases already occurring, we continue to have a high conviction the worst of the current inflationary pulse is behind us.

*There were positive decelerations in many categories, but nothing in this report yet confirms elevated inflation has begun to ease significantly

*The breadth of “declaration” was broad, with only food and medical care increasing their monthly rate of increases

*This feed-through of higher rents into the CPI is likely to continue, with a weight of nearly 40% in the core, but we think people are overestimating the degree rents, and hence shelter, can keep rising given the growing headwinds

The NFIB Small Business Optimism Index rose to 89.9 in July but still remained close to the near-decade low of 89.5 reached in June. Of the ten index components, four increased and six decreased:

37% of owners reported that inflation was their single most important problem in operating their business, an increase of 3 points from June and the highest level since 1979.

-52% of owners expect better business conditions over the next six months, rising 9 points from June’s record low level for the 48-year survey.

49% percent of owners reported job openings that could not be filled, down 1 point from June.

48% reported raising compensation, unchanged from June.

56% of owners reported raising average selling prices, decreasing 7 points.

-29% of owners expect real sales to be higher, dropping 1 point from June.

The Uncertainty Index increased 12 points from last month to 67.

Why it Matters: There were positive and negative things in July’s survey. Overall optimism stabilized as future sales expectations rebounded while raising prices was becoming more challenging, lowering expected real sales. Finding qualified labor was still tough, and the level of openings was still historically high. The level of current and future Capex was relatively unchanged due to the outlook remaining challenged/negative. Current sales improved slightly while reported inventory levels rose, and there was a greater level of satisfaction with current levels. Half of the respondents reported raising compensation, with 25% planning to do so in the next three months. Credit market access was little changed from June, with most firms still not interested in borrowing. Stepping back, uncertainty worsened in July, with business owners unclear about what is coming. The general recessionary fears (due to constant news headlines), as well as price swings and shortages of needed materials, persisted, keeping the outlook trending more negatively. "The uncertainty in the small business sector is climbing again as owners continue to manage historical inflation, labor shortages, and supply chain disruptions," William Dunkelberg, NFIB's chief economist, said.

*The overall Small Business Optimism Index stabilized in July. One main positive takeaway was that inflationary pressures eased as price changes dropped while compensation plans were flat

*There is a growing disconnect between worries sales will fall and plans to grow inventory or expand the business

*The individual optimism sub-categories improved overall with expectations for the economy to improve, rebounding significantly from June lows

Non-farm labor productivity fell an annualized -4.6% in the second quarter, slightly below market expectations of -4.7% and easing from the downwardly revised -7.3% decline in the previous quarter. The level of output slid -2.1%, easing from the upwardly revised -2.5% contraction in the first quarter, while hours worked rose by 2.6% from a downwardly revised 5.3% increase last quarter. Unit labor costs rose by 10.8% in the second quarter, above market forecasts of a 9.5% jump and following an upwardly revised 12.7% gain in the previous quarter. It reflects a 5.7% increase in hourly compensation and a 4.6% decrease in productivity. Unit labor costs increased 9.5% over the last year, the most significant gain since the first quarter of 1982.

Why it Matters: We have been highlighting capacity constraints for a long time. Its something that increasingly occurs due to shortages of materials or labor. As one or more inputs for production are missing, the entire process is held up. That is why it shouldn’t be surprising that we have had two-quarters of negative productivity, marking the weakest back-to-back readings since 1947. We knew total compensation rose due to higher wages and longer hours worked as demand stayed strong in most parts of the economy in the first half of the year. As seen in past job reports, firms continue to hire and retain workers despite growing recessionary fears. As a result, lower capacity and higher levels of labor can only mean weaker productivity. The good news is, although now slowing, many firms have invested in physical/digital automation due to pandemic-driven experiences, reducing future labor needs and something that will likely increase productivity moving forward slowly. Furthermore, business surveys are also noting less backlog of orders and hence urgency and which translates into fewer hours worked/overtime in the future, while lead times and prices are dropping for inputs, indicating fewer shortages of input materials.

*We are always a little suspicious of this data series, given it was designed to measure a more manufacturing-orientated way of production, but when coupled with what we have seen elsewhere, it is clear productivity fell notably in the first half of the year

Consumer credit increased by 8.7% or $40.15 billion in June, up significantly from an upwardly revised $23.79 billion gain in the previous month and well above market expectations of a $25 billion rise. Revolving credit rose by 14.6% YoY to $1.125 trillion, while non-revolving rose by 6.9% YoY to $3.5 trillion. Motor vehicle loans at the end of the second quarter increased by about $32 billion, while student loans were up less than $1 billion.

Why it Matters: It was the biggest monthly gain in consumer credit in three months, explaining why in the face of multi-decade high inflation, the consumer remains resilient. How much more can this channel supplement negative real disposable income levels? That is the question, but with inflation peaking and wages more sticky, we expect to see purchasing power improve in the year's second half, something that already occurred slightly in Q2 with Real DPI less negative than Q1. This means we should see some reprieve in the use of credit in the second half of the year, especially revolving credit, as prices for staple goods stabilize, demand continues to weaken for discretionary goods and services, dropping prices there, with both things helping real wages rise.

*Consumer credit jumped higher in June, with revolving credit returning to a longer term trend after falling during the pandemic

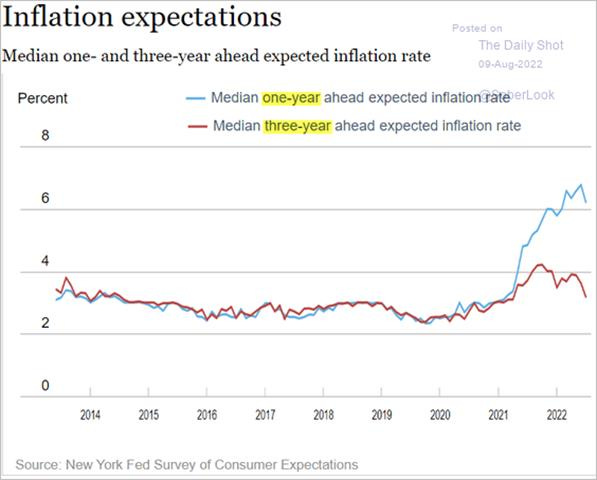

The New York Fed’s consumer inflation expectations for the year ahead fell to 6.2% in July, the lowest reading in five months, from a record high of 6.8% in June. The three-year-ahead inflation expectations declined to 3.2% from 3.6%. Expectations fell sharply for gas (-4.2 percentage points to 1.5%, the second largest drop ever) and food price changes (-2.5 percentage points to 6.7%, the biggest decline on record). There were also smaller declines in expectations about year-ahead changes in rent (to 9.9% from 10.3%), medical care (to 9.2% from 9.5%), and college education (to 8.4% from 8.7%). Meanwhile, the median household spending growth expectation fell for the second straight month to 6.9%. Also, the probability that the unemployment rate will be higher one year from now decreased by 0.2 percentage points to 40.2%.

Why it Matters: The consumer is playing ball with the Fed. Not only did inflation expectations drop, but household spending expectations also notably fell, giving the Fed comfort that consumers are changing behavior and demand will continue to cool. On the margin, increased difficulty getting credit and a weakening outlook on the household financial situation also bode well for further demand destruction. The wealth effect channel is also falling, as seen in lower trending expectations for stock prices, although there was a slight improvement here in July, correlating to the recent rally. Coupling all this with higher unemployment rate expectations and lower moving intentions, the report clearly pointed to reduced inflationary pressures from many channels.

*Notable drops in expected inflation, largely thanks to historic drops in gas and food prices, look to have the NY Fed’s Inflation Expectation data series peaking in June

*Again, the magnitude of price change expectation for Gas and Food is historical, but there were also drops in Rent, Medical Care, and College Education.

Policy Talk:

Governor Bowman gave prepared remarks last Saturday to the Kansas Bankers Association titled “Fighting Inflation in Challenging Times,” in which she ran the gambit of what was causing inflation and how the Fed was orchestrating policy to reign it in. She highlighted her belief that many of the supply-side inflationary pressures were likely to remain. She specifically cited rents and motor vehicles as areas where supply and demand imbalances persisted. She noted that food and energy prices remained very uncertain due to the situation in Ukraine as well as “added weather challenges” domestically. Overall she came across as very negative about the inflation picture improving. This outlook is why she “strongly” supported the 75 bp rate hike in July and why “similarly-sized increases should be on the table until we see inflation declining in a consistent, meaningful and lasting way.” She concluded by talking about the Community Reinvestment Act, where she voiced concerns regarding certain provisions, although she supports the overall objective of the act. She went on to discuss several other regulatory topics, including cautioning banks about activities in digital assets, that are worth reading if one is interested in such things.

“Many of the underlying causes of excessive inflation are the same as they have been over the past year or so—supply chain issues, including those related to China's COVID containment policies, constrained housing supply, the ongoing conflict in Ukraine, fiscal stimulus, and limitations on domestic energy production.”

“Growth has softened, and perhaps this is an indication that our actions to tighten monetary policy are having the desired effect, with the ultimate goal of bringing demand and supply into greater balance.”

“When considering the risks to the labor market, these risks must be viewed in the context of its current strength and with the understanding that our primary challenge is to get inflation under control.”

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the day but flat on the week. Small-Cap Growth is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day and on the week. PPI slowed while CPI rose, and property developers continue to face financing headwinds while Beijing incrementally moves to support home buying further.

5yr-30yr Treasury Spread: The curve is steeper on the day and the week as the better-than-expected inflation data reduces fed rate hiking expectations and hence recessionary fears

EUR/JPY FX Cross: The Euro is weaker on the day and the week. The better-than-expected CPI data likely is causing further Yen short covering (greater than Euro?), with both FX pairs higher on the session against the dollar by +1%.

Other Charts:

Stocks have been outperforming bonds and commodities since June, with ratios increasingly breaking out lately

EPS Consensus earning forecast continues to fall, with margin pressures being the primary driver

The Reddit gang is back, with favorite meme stocks with high levels of option volumes significantly outperforming

Global liquidity continues to tighten, providing a more challenging environment for risk assets. However, given the historically high monetary base level and high levels of “cash” holdings, the picture is potentially more muddied than in previous declines.

Credit funds are starting to see some positive levels of inflows, as reported by BofA’s Investment Strategy group.

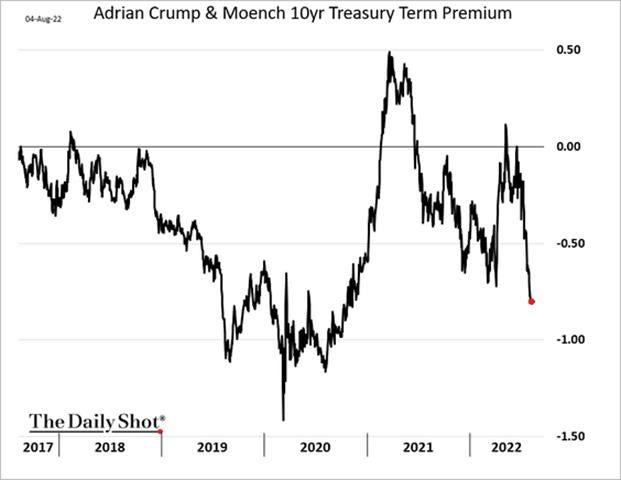

Increased recessionary fears, leading to an inverted yield curve, are reducing the level of the 10yr Treasury term premium sharply

S&P 500 companies can expect a modest hit to earnings if the Inflation Reduction Act passes in its current form, Goldman Sachs says.

During the pandemic, a flood of government support and a faster-than-expected economic recovery turned families into more-dependable borrowers than at any time in recent history. Last November, the 12-year-old S&P/Experian consumer-credit default index reached its all-time low, and it has ticked only slightly higher since then. – WSJ

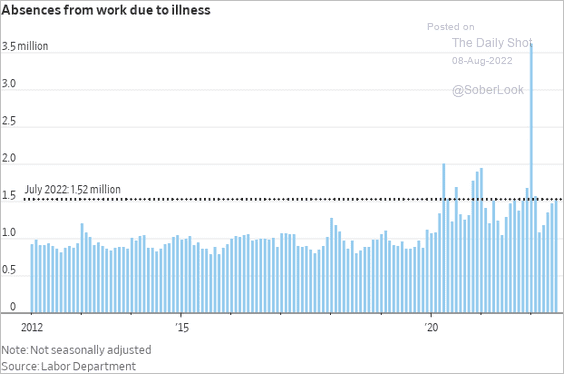

Speaking of the pandemic, Covid is still here, and as a result, childcare issues remain a drag on the labor market

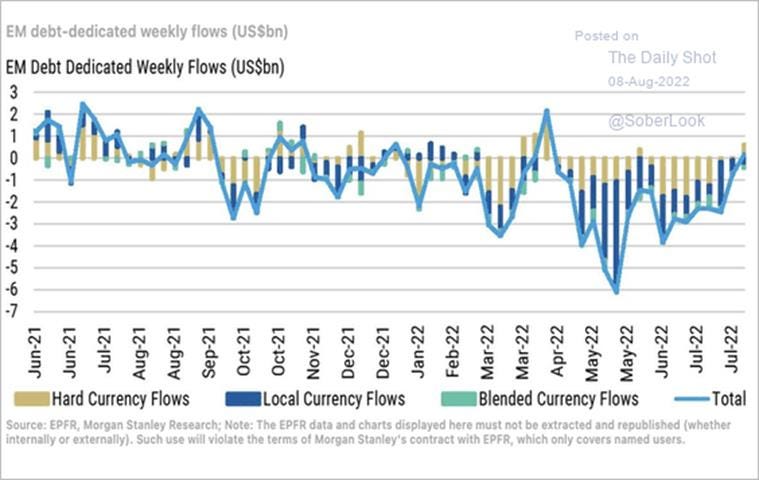

Don’t look now, and despite a stronger dollar, inflows into EM debt are turning positive after a tough Q2.

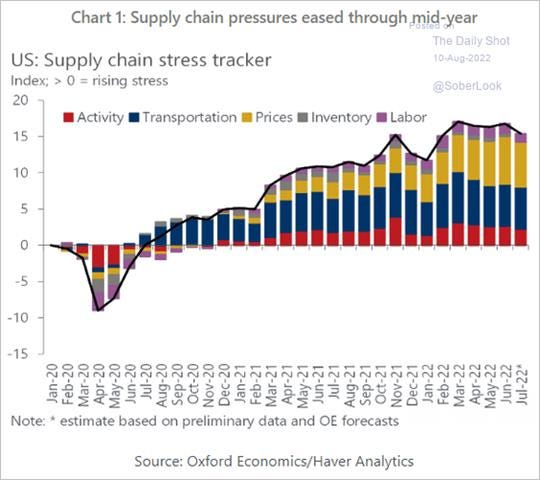

Oxford Economic’s Supply Chain Stress Index continues to ease, all be it modestly and at a slower rate than the NY Fed’s Global Supply Chain Pressure Index

Article by Macro Themes:

Medium-term Themes:

China Macroprudential and Political Loosening:

Surprise: China Orders Surprise Audit of $3 Trillion Trust Industry - Pelosi

China’s top auditor is conducting a review of the $3 trillion trust industry, paving the way for a potential overhaul of a key shadow banking sector where losses on property loans are mounting. In an unscheduled move, the National Audit Office has, for the past month, been inspecting the books of at least 20 trust firms, including the top five, to gauge the risks they pose to financial stability. The firms are being asked to report on their risky loans to developers and any plans to dispose of them. The audit office is expected to submit its conclusions to policymakers in Beijing, who may decide on the future reforms of the sector, the people said.

Why it Matters:

China’s National Audit Office is responsible for inspecting the central government’s budget implementation and reports its results to the Premier. The agency is also brought in for ad-hoc reviews of state-owned institutions, which pose a threat to the broader economic stability. Its inspection of more than a quarter of the trust industry shows the government is seeking an independent assessment of the risks involved. It also could mean further action to support that sector is coming depending on the level of systemic risks identified in the audit. The inspection comes as trust firms have more recently emerged as unlikely white knights for the embattled property sector by becoming mini-developers themselves. This may increasingly be seen as an avenue to help reshuffle debts and keep projects going to placate end buyers.

Longer-term Themes:

National Security Assets in a Multipolar World:

Research: China tops U.S. in quantity and quality of scientific papers - NikkeiAsia

China now leads the world both in the number of scientific research papers as well as most cited papers, a report from Japan's science and technology ministry shows. Research papers are considered higher quality the more they are cited by others. Chinese research accounted for 27.2%, or 4,744, of the world's top 1% of most cited papers, overtaking the U.S. at 24.9%, or 4,330. The U.K. came in third at 5.5%.

Why it Matters:

Scientific research is the driver behind competitive industries and economies. Current research capabilities will determine future market shares in artificial intelligence, quantum technology, and other cutting-edge fields and may have a direct impact on national security as well. China has quickly increased its footprint in advanced research in recent years, overtaking the U.S. in the total number of scientific papers in the 2020 report, then in the number of top 10% most cited papers in the 2021 report. We are in a tech war with China, and it looks like they continue to gain momentum, which is why the recent passage of increased scientific research funding needed to be done.

Electrification and Digitalization Policy:

e-Dollar: U.S. Lawmakers Look to Digital Dollar to Compete With China – WSJ

The bipartisan group of lawmakers has sought for the U.S. to counter global competitors launching digital versions of their currencies. The House Financial Services Committee, which both serve on, might vote on related legislation as soon as next month. Unlike private cryptocurrencies such as bitcoin, a Fed-issued central bank digital currency would be backed by the U.S. central bank, just like the Fed backs physical currency. Ms. Waters, who chairs the financial services panel, has drafted legislation that would require the Fed to study a digital dollar, building on the central bank’s existing work on the issue and creating a process for the U.S. to potentially issue one in the future.

Why it Matters:

A digital dollar could provide a new option to the way consumers pay for products and services. In addition to using a credit or debit card (or Venmo or Apple Pay), individuals would have a digital version of cash on their phones that could be used anywhere, likely through existing financial firms. That could lead to faster, cheaper, and safer payments and make paper currency obsolete. The shift could ease the movement of money across borders, reducing fees on cross-border remittances. Advocates also say it could lead to faster and safer delivery of government payments, such as stimulus checks and unemployment benefits. The last part is likely the primary motivation for Congress and the Fed, given how efficient our digital payment system is.

iTaxi: Two Chinese Cities Approve Baidu’s Unmanned Self-Driving Taxis – WSJ

China took a notable regulatory step in the field of driverless taxis, with two cities giving Baidu approval to operate ride-hailing services without a driver or a person overseeing safety in the vehicle. The Chinese search-engine giant, which already operates self-driving taxis, plans to add five unmanned cars each to the cities of Wuhan and Chongqing, it said. These vehicles will run in designated areas of those cities during the daytime when there tends to be more traffic on the road, the company said. The approvals also allow Baidu to charge users for the rides, it said. Driverless robotaxis have already been approved to run in certain areas of Beijing, but a safety person is required to sit next to the driver’s seat.

Why it Matters:

China, seeking to catch up to the U.S. in the field of autonomous driving, has been increasingly active in setting up regulations that allow self-driving vehicles on public roads. Establishing such a regulatory framework helps clarify rules and responsibilities and opens up roads for companies to run businesses. In the U.S., General Motors Cruise LLC in June received a permit to charge for fully driverless rides at nighttime in San Francisco, while Waymo, an Alphabet Inc. unit, earlier this year started to operate cars without any human control, also in San Francisco. Waymo’s rides are free and available only to its staff.

Rerouting: How Russia Took Over Ukraine’s Internet in Occupied Territories - NYT

Invading Russian forces in eastern and southern Ukraine are seizing control of corresponding cyberspace by re-routing internet traffic through state-controlled networks. “The first thing that an occupier does when they come to Ukrainian territory is cut off the networks,” said Stas Prybytko, who leads mobile broadband development in Ukraine’s Ministry of Digital Transformation. “The goal is to restrict people’s access to the internet and block them from communicating with their families in other cities and keep them from receiving truthful information.”

Why it Matters:

In some Russian-occupied areas of Ukraine, digital censorship is even worse than inside Russia, government and industry officials say. In the Kherson and Donetsk regions, Google, YouTube, and the messaging app Viber have been blocked, internet operators said. Restricting internet access is part of a Russian authoritarian playbook that is likely to be replicated further if they take more Ukrainian territory. The digital tactics have put those Ukrainian areas in the grip of a vast digital censorship and surveillance apparatus, with Russia able to track web traffic and digital communications, spread propaganda and manage what news reaches people.

Commodity Super Cycle Green.0:

Giddy Up: Inflation Reduction Act’s $27 Billion in Green Funds Could Be Boon for Private Sector – WSJ

The energy package recently passed by the Senate includes $27 billion for what are called “green banks” that funnel money into renewable projects, although some of the biggest beneficiaries could ultimately be private-sector investors. The legislation allocates the money to a greenhouse-gas reduction fund, with about $20 billion earmarked for national or regional funds that would be overseen by the Environmental Protection Agency. The rest of the money is designed to go to state and local recipients. Regulators will determine what projects qualify for financing and meet the criteria for lowering or eliminating emissions.

Why it Matters:

Although frequently called green banks, such vehicles are actually public investment funds set up by governments. They don’t take in deposits from consumers and have a mandate to use debt-financing techniques such as direct lending or lines of credit to back infrastructure projects meant to lower carbon emissions. The goal of such funds is to prompt private-sector banks and asset managers to put money into clean projects alongside them.

Passed: India paves way for carbon credit trading - Argus

India has passed a bill to set up carbon credit markets in the country but will not allow carbon credit exports until its climate goals are met, power minister Raj Kumar Singh said. India announced a target to achieve net zero emissions by 2070 at the Cop 26 summit in Glasgow last year, along with plans to cut carbon emissions by one billion by 2030 from 2005 levels. This compares with its pledge to reduce emissions per unit of GDP by 33-35% below 2005 levels by 2030, under the Cop 21 Paris climate accords.

Why it Matters:

Most firms in the country's carbon-intensive steel, cement and fertilizer sectors have yet to commit to any net-zero targets. The country currently awards renewable energy and energy efficiency certificates to companies that can sell these to other firms that do not meet their targets and want to avoid paying penalties. "The carbon credit scheme will combine all these into one instrument," Singh said. Further details of the carbon trading market are yet to be announced. India has set targets to boost the share of natural gas and lower dependence on coal in its energy mix, and have renewables cover 50% of its energy demand by 2030, by when it also aims to produce 5mn t/yr of green hydrogen.

ESG Monetary and Fiscal Policy Expansion:

Next?: Antitrust Bill Targeting Big Tech in Limbo as Congress Prepares to Recess – WSJ

Congress is set to depart for its August recess soon without acting on a bipartisan antitrust bill targeting the largest U.S. technology companies, in a setback for supporters who had been pushing for a vote before the busy fall election season. Senate Majority Leader Schumer plans to hold a vote on the legislation when Congress returns this fall. But the shrinking number of legislative days available plays to the advantage of the tech companies, which can declare victory if Congress doesn’t act.

Why it Matters:

If passed, the law would bar huge online platforms such as Amazon’s e-marketplace, Apple’s app store, and Google’s search engine from giving preferential treatment to the company’s own products and services, such as steering consumers to in-house products instead of competitors’ offerings in a way that harms competition. The antitrust legislation isn’t the only technology bill making its way through Congress. Privacy-focused legislation also hasn’t passed either chamber, despite efforts that advanced it further than in previous congressional sessions. The Senate Commerce Committee in July approved a bill boosting privacy protections for children and teens online, but that bill is narrower than the House Energy and Commerce Committee’s privacy bill, also approved last month.

Appendix:

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION