MIDDAY MACRO - DAILY COLOR – 8/10/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, as the Nasdaq is under pressure while the Russell grinds higher, with leadership changing at the NY-open

Treasuries are lower, with the long-end yields breaking above their multi-month downtrend channel

WTI is higher, recovering some of the losses seen over the past few days but still below $70

Analysis:

Somewhat of a “reflation” trade rally occurring today as value/small-cap factors and energy/materials sectors outperform while copper and oil are pushing through recent downtrends, all taking their cue from the continuation of rising yields brought on by better economic data.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, High Dividend Yield, and Momentum factors, and Materials, Energy, and Financial sectors are all outperforming.

S&P optionality strike levels have zero gamma level moving to 4398 while the call wall is at 4450; technical levels have support at 4410, and resistance is 4450, followed by 4480.

Treasuries are weaker again, with the 10yr yield breaching its 200dma yesterday and traders now positioning for tomorrow’s CPI data and 10yr auction, as well as increasing amounts of corporate debt issuance being announced as earnings season ends.

Given the supportive economic and financial conditions backdrop, it's hard to be too pessimistic (into year-end), and we believe markets will continue to grind higher as sentiment increasingly favors greed over fear.

Even though Delta worries continue, economic growth is likely to stay strong thanks to a quickly improving labor market which now has a near-record level of job openings, (growing) wage and salary increases, and business confidence/intentions that are still highly supportive (of the existing positive momentum).

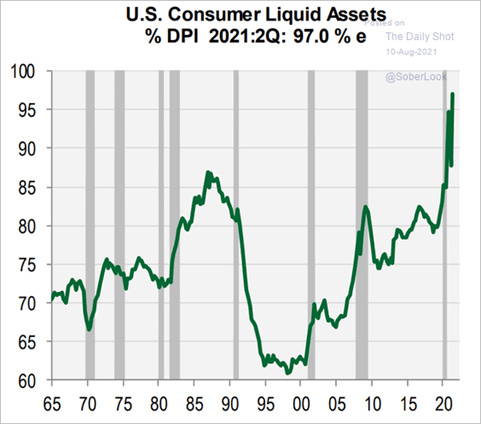

The consumer is certainly a little more shaken by the new uptick in cases and growingly frustrated by shortages and price increases, but overall consumer confidence is near-record highs, net worth has surged, savings (although lower) is above average, and credit availability is improving.

This backdrop allows for price increases to continue into year-end without demand destruction, supported by renewed pressure on supply-chains abroad (supply-push), expectations for a blockbuster back-to-school and holiday season (demand-pull), and historical level of firms increasing compensation (wage-spiral).

This supports our belief that the reflation trade is beginning to outperform and will do so further as the Fed makes evident its patience, further fiscal support ($3.5T social infrastructure) is pushed through, the economic picture in China improves, and of course the peaking of Delta cases domestically and abroad begins to occur.

Econ Data:

The NFIB Small Business Optimism Index dropped in July by 2.8 points to 99.7 as businesses continue to have trouble finding qualified works and navigating supply chain disruptions. Sales and Business Conditions expectations both decreased. Fifty-five percent of owners reported capital outlays in the last six months, up two points from June but historically a below-average reading. A net 12% of owners view current inventory stocks as “too low” in July, a 48-year record high reading. A net 46% of owners reported raising average selling prices. Finally, a net 38% of owners reported raising compensation, down one point from June’s record high of 39%. A net27% plan to raise compensation in the next three months, a 48-year record high reading.

Why it Matters: The supply-side disruptions we have highlighted for some time did not meaningfully change in July’s NFIB survey. It is beginning to look like the disruptions that capped Q2 growth will meaningfully persist throughout Q3 (caping growth to hopefully a lesser extent). Over 50% of firms are now reporting the inability to find qualified workers. As a result, there was a record-high level of firms raising compensation to attract workers. This coupled with continued supply shortages and logistical challenges, further support that inflation should meaningfully persist into year-end. On the positive side, capital spending activity and intentions increased, helping improve future productivity and supporting higher wages. It is likely owners will have to increase capital spending to acquire and improve the quality of capital available to support new hires and expand sales. However, firms have a very dim outlook on business conditions and meeting sales growth needed to support the demand for expanded capacity.

Policy Talk:

The list of Fed officials calling for the announcement of tapering in September continues to grow. Atlanta Fed President Bostic (voter) told reporters on Monday that the jobs report was encouraging. He thinks the Fed could begin tapering QE sometime in the "October-to-December range," but added he would be "open to moving it forward. At a separate event on Monday, Richmond Fed President Barkin (voter) said he would like to see further progress in the labor market, but “substantial progress” has been made on the price side. If next month's job report is again strong, he would likely support moving up the tapering timeframe. As it now stands, supporters for a September announcement now (clearly) include Kaplan, Bullard, Waller, Harker, Bostic, and Rosengren. The most hawkish are Bullard and Kaplan, who want tapering to finish by spring of next year.

Why it Matters: This year’s Jackson Hole Economic Policy Symposium is titled “Macroeconomic Policy in an Uneven Economy.” We disagree with the growing consensus that it will be used as a platform to greenlight the announcement of tapering in September. Instead, we believe it will further clarify just how much weight the Fed is placing on the full employment side of its dual mandates. We believe the Fed is still unhappy with the interpretation of the changes it made to the statement of Longer-Run Goals (released at the last Jackson Hole Symposium). As a result, it will again try to make its case that it believes fighting economic inequality is worth suffering higher inflation levels. Ironically this comes right when the markets, Congress, and consumers are increasingly concerned about inflation, and labor is entering one of the best negotiating periods it has seen in decades.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week as higher yields are supporting a movement away from Growth

Chinese Iron Ore Future Price: Futures continue to drop over worries of weaker demand as Beijing moves to cut steel output

5yr-30yr Treasury Spread: The curve is little changed today but steeper on the week as long-end yields continue their post-job report rise

EUR/JPY FX Cross: Yen is slightly higher on the week, as leadership looks to be changing slowly

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Growth Still Capped: Delta Variant Clouds Back-to-School Shopping Plans – WSJ

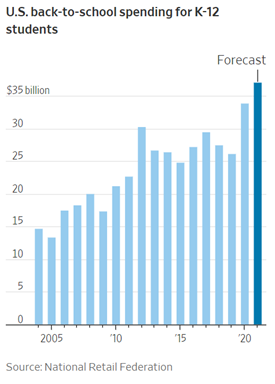

Concerns over the Delta variant and supply-chain issues are hurting back-to-school shopping plans. The National Retail Federation predicts that consumers with children in kindergarten through 12th grade will spend $37.1 billion this year, the most since the industry group began conducting its survey in 2003. Back-to-college spending is expected to total $71 billion, also a record.

Why it Matters:

Uncertainty over whether kids will go back to school is growing as Delta cases surge in certain areas. However, for now, it looks like spending is occurring (at a greater rate than last year), and retailers are reporting shortages of needed in-person learning goods. However, retailers such as Staples are giving priority to deals on supplies for remote learning.

China Macroprudential and Political Tightening:

More Stimulus Coming?: Central Bank Report Sparks Speculation on Interest Rate, Reserve Requirement Cuts - Caixin

The PBOC said in the Monday report that domestic inflationary pressure is generally controllable but warned that there could be a spillover from ultra-loose monetary policies overseas. Chinese sell-side analysts are split on whether there will be additional cuts to the reserve requirement ratio or policy interest rates. Last month, the PBOC lowered the RRR for banks by 50 basis points, but National LPRs, the de-facto interest benchmark for bank loans, have been unchanged since last April.

Why it Matters:

Beijing is balancing a slowing economy, made worse by increased Covid cases, with a tightening Fed limiting their ability to cut rates without putting pressure on the Yuan to weaken. Lockdowns could also increase inflationary pressures if implemented on a larger scale as supply and logistics are disrupted. The producer price index grew 9% in July from a year earlier, quickening from 8.8% in the previous month and beating the median forecast of an 8.8% gain. As long as the PPI is staying as high as it is the PBOC is somewhat limited in its options.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

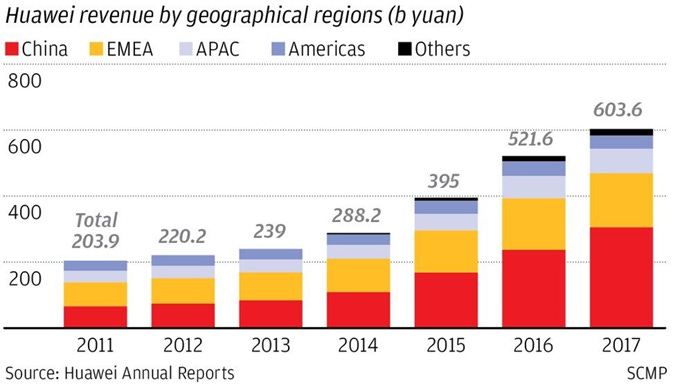

Skipping Steps: Huawei, Kunlun and China’s tech giants drive a quiet revolution in Africa’s fintech with mobile payment apps and wallets – SCMP

A digital revolution is quietly underway in Africa, as dozens of electronic wallets have sprouted on the continent for users to transfer money digitally through their smartphones, some of them powered by Chinese technology. One of the biggest is M-Pesa, a mobile money service established in 2007 by the Kenyan phone company Safaricom, using an enterprise solution provided by Huawei Technologies.

Why it Matters:

Huawei’s push into Africa’s telecommunications market is expanding beyond building the infrastructure into a broad array of enterprise solutions and services, including providing its network customers with the technology to run mobile payment applications in as many as 19 countries. Stepping back, we want to highlight changes to Huawei’s business model globally and how developing nations are challenging traditional industrial limitations through (imported) technology. It also does increase the leverage technology providers may have on local customers and eventually governments.

Commodity Super Cycle Green.0:

Teapot 2.0: China’s New Oil Giants Flourish in Xi’s Clean Energy Wave - Bloomberg

Still little known in international trading circles, companies like Jiangsu Eastern Shenghong Co. and Hengli Petrochemical Co. are now poised to become more influential in global markets. They’ve built vast refining complexes that are more environmentally conscious and focused on using crude to make plastics and chemicals. As a result, some are starting to receive tax benefits or permissions to import larger amounts of crude directly from big producers like Saudi Arabia.

Why it Matters:

Xi’s administration has cracked down on private businesses deemed as having grown too powerful or less aligned with its vision. In the energy sector, the government is now supporting firms most closely in line with its objectives while curtailing the more polluting first generation private refiners, called Teapot 1.0, that have been around for decades. The Teapots 2.0 companies have a very different business and operating model, which in theory, is better suited to China’s visions for its energy sector, integrated and efficient.

ESG Monetary and Fiscal Policy Expansion:

Not “Woke” Enough: Progressive Opposition to Jerome Powell Clouds His Chances for Second Term as Fed Chairman – WSJ

Members of President Biden’s economic team generally support nominating Powell to a second term, but there is growing resistance from progressives who are unhappy with his easing of financial regulation. In recent weeks, critics of Mr. Powell, including former Senate Democratic policy aides, have reached out to Ms. Warren, Mr. Brown, and other influential advocates to press the case that the White House should seek new Fed leadership.

Why it Matters:

WSJ reporter Timiraos (who is known for having an inside track with the Fed) believes Brainard is the leading contender if Powell’s term is not renewed, but we continue to believe that is incorrect. It is important that Brainard has dissented on many of the majority votes on reducing banking regulation, which seems to be the number one issue at play. However, we expect a greater potential for Powell to be renominated and, if not, would favor Bostic or Daly to lead internal candidates.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.