MIDDAY MACRO - DAILY COLOR – 7/9/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, with reflationary themed sectors outperforming

Treasuries are lower, with the curve steepening into next week’s supply and “plethora” of new economic data

WTI is higher, recovering over half its post-OPEC sell-off as traders look for clarity from OPEC and on the Iran deal

Analysis:

Equity markets are higher as yesterday's recovery rally continues, bringing the S&P back to all-time highs, while Treasuries continue to sell off further, all in line with a general reflationary-themed tone.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Momentum, and High Dividend Yield factors, and Financials, Materials, and Industrials sectors all outperforming.

S&P optionality strike levels increased with zero gamma strike moving higher to 4315 while the call wall decreased to 4350; technical levels show support at 4320 and resistance at 4370.

Treasuries are seeing further steepening of the curve after yields hit multi-month lows yesterday in what looked like a short-squeeze that has cleaned up positioning.

The buy-the-dip mentality is alive and well today, as the overnight RRR cuts by the PBOC did not further spook traders, helping “reflationary-trade” shunned sectors bouncing back and propelling the S&P to new all-time highs.

It's an old Wall St. adage that when a trade is being declared “dead” by the financial media, it's time to double down, and that could be what is happening with the reflationary trade as position unwinding there looks to have gone too far (particularly in Treasuries).

Growth may be being capped by supply-side disruptions, and the Fed is undoubtedly beginning what we believe will be a long road to normalization (which they likely won’t arrive at before the next crisis), but growth and inflation should remain strong for at least another few quarters (supporting the trade).

Further, the factors supporting Treasuries (keeping yields low) will start to subside in the 3rd quarter as it is unlikely there will be a resurgence domestically in the Delta variant (flight-to-safety buying ↓), liquidity in the system is falling (bank buying ↓), and growth and inflation will make nominal yields at these levels increasingly unattractive (institutional buying ↓).

Next week will bring us a lot of data, and along with the beginning of earnings season, help set expectations for the 3rd quarter.

The most critical data releases are potentially CPI and PPI, with expectations for the MoM increases at 0.4% and 0.6%, respectively.

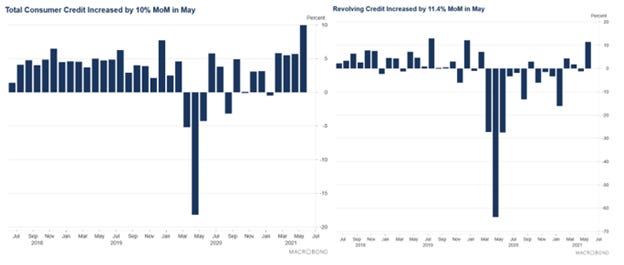

We believe this to be a fair MoM estimate as there has not been any meaningful improvement in supply-side disruptions while end-demand continues to be strong (as shown by consumer credit increases in May).

However, several business surveys did show a peaking in input prices, leaving the possibility for a downside surprise in PPI.

Opposingly, numerous surveys showed firms actively passing prices on to end consumers, increasing the risk that the MoM increase in CPI may come in higher.

NFIB, Industrial Production, and the Fed’s Beige Book will shed light on how much production/growth was capped by supply-side disruptions last month and how firms are adapting to what is now a longer-lasting problem.

We believe the drag on second-quarter growth was more significant than anticipated and look for further clarity on whether growth in the 3rd quarter will benefit as production and sales get moved forward.

In particular, we are watching two key areas: whether inventory restocking has significant catching-up to do (before the holiday season) and whether firms will be reluctant to raise wages as they see hiring disruptions as temporary.

Ending the week, we will get a better picture of the consumer and whether higher prices are starting to negatively impact activity with Retail Sales and the Michigan Consumer Survey data releases.

Also not to be missed next week is Chairman Powell’s testimony (Monetary Policy Report), 10yr & 30yr Treasury auctions, and the WASDE crop report.

Econ Data:

Consumer credit levels surged in May, with Total Consumer Credit climbing $35.3 billion or 10% from the prior month after an upwardly revised $20 billion gain in April. Revolving credit, which includes credit cards, rose $9.2 billion or 11.4% after declining in the previous month. Non-revolving credit, which includes auto and school loans, increased $26.1 billion, the most on record, supporting the increases in auto prices seen in the last months.

Why it Matters: It is our opinion that there has been an undue focus on high savings rates instead of consumer credit. The idea that savings is concentrated amongst the wealthiest households and not strongly correlated with overall consumer spending has merit to us. This is why the surge in revolving credit, primarily from credit card use, after months of flat or negative growth, is a more meaningful indicator that the consumer is only getting started. Although one data point does not make a trend, the surge in consumer credit gives us confidence that there is still significant pent-up demand and growth could exceed expectations in the 3rd quarter (especially if supply-side disruption lesson, uncapping growth, and inflation doesn’t deter activity – which we believe will both happen).

Policy Talk:

San Francisco Fed President Daly warned the spread of the Delta Coronavirus variant and low vaccination rates in some parts of the world poses a threat to the global recovery as she urged caution in removing monetary support for the US economy. Daly said the debate around “tapering” was currently warranted. Still, the central bank had to “keep our eye on the long-term goals, which are full employment and price stability, and really be patient enough and persevere enough to deliver on those commitments which we’ve made to the American people.”

Why it Matters: Daly’s comments that the Fed is fully committed to their framework, although expected, highlights the risk that dovish members will continue to use the miss on “eliminating shortfalls in employment” as a reason to be patient when the average inflation rate is well over 2% (as it likely is already). Daly is also using the increase in global Covid cases as a headwind for domestic growth in her forecasts. This is a problematic view because we have not seen a notable drag from overseas factors in the data. At the same time, Covid will likely have regional waves for some time to come still, meaning it's an unreasonable excuse to stay dovish. Daly is also on the shortlist to replace Powell, so her views may have greater weight at the table than other voters.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth Outperforming on the Week

Chinese Iron Ore Future Price: Iron Ore Lower on the Week

5yr-30yr Treasury Spread: Curve is Steeper on the Week

EUR/JPY FX Cross: Yen Higher on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Competition Needed: Biden vows to tackle competition issues in liner shipping – Splash247.com

President Biden released an executive order to promote competition in various industries. He is explicitly asking the American transportation agencies to address competition in rail and shipping. The order will ask the FMC to take all possible steps to protect American exporters from the high costs imposed by the ocean carriers and to crack down on unjust and unreasonable fees, including detention and demurrage charges. Demurrage and detention charges imposed on shippers by container lines have more than doubled over the past year.

Why it Matters:

Although the overall executive order falls more into our ESG government policy theme, the threat of regulatory action may prompt some logistical firms to preemptively lower prices in an attempt to lessen the urgency and size of any actions taken by the Biden administration. We are doubtful of that but want to highlight the development given logistical prices have yet to meaningfully peak and continue to put cost pressures across the entire global supply chain.

China Macroprudential and Political Tightening:

Credit Pulse: China’s Credit Growth Rebounds as Economic Momentum Moderates – Bloomberg

The PBOC reported that aggregate financing increased 1.9 trillion yuan on the year to 3.67 trillion yuan ($566 billion). The median estimate in a survey of economists was 2.89 trillion yuan. Financial institutions offered 2.12 trillion yuan of new loans in the month, higher than the 1.5 trillion yuan in May and exceeding the estimate of 1.85 trillion yuan

Why it Matters:

There are two essential things to watch currently, dollar liquidity and yuan liquidity. If both begin to go down too quickly, global financial assets will have a significantly harder time going up. The Fed is currently sterilizing much of the liquidity it adds through its reverse repo facility. Separately, the PBOC’s was driving the credit impulse lower to deleverage the economy. Things now look to be changing in China as more monetary stimulus may be coming, prompting speculation that second-quarter gross domestic product data, which is due next week, could be weaker than expected.

Is it Working?: China Inflation Cools but Beijing Worries Economy Is Losing Heat – WSJ

China’s PPI rose 8.8% in June from a year earlier, edging down from May’s lofty 9.0% increase. CPI rose 1.1% in June from a year earlier, slightly lower than economists forecast for a 1.2%. Despite the slowdown in price increases this month, Beijing continues to be uneasy about the short-term cost pressures on Chinese manufacturers, as well as the unbalanced nature those cost increases are having of the longer-term recovery.

Why it Matters:

The PBOC cut reserve requirements today following comments from China’s State Council on Wednesday that authorities should use monetary-policy tools to offset the negative impact of rising raw material prices. Two important points here, first the policy easing actions are meant to support smaller firms with less access to credit, not the overall economy. Second, this potentially puts the PBOC on a diverging monetary policy path as it eases slightly while the Fed begins to tighten. We need to wait and see how much further each side goes, but this divergence would change the dynamics of the impossible trinity between the two nations and should weaken the Yuan.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Rare U.S. to E.U. Trade: Energy Fuels starts US-EU rare earth shipments to Neo - Argus

US uranium producer Energy Fuels has sent an initial shipment of 20 tons of mixed rare earth carbonate to Canadian firm Neo Performance Materials' separation plant in Estonia, creating the first US to Europe rare earth supply chain in decades. "This will supplement Neo's existing rare earth supply chain from our long-time Russian supplier and help us to ramp up rare earth production just as Europe accelerates vehicle electrification and other initiatives aimed at mitigating climate impacts," chief executive Constantine Karayannopoulos said.

Why it Matters:

In recent years, China has been the only large-scale producer of rare earths from monazite. Monazite contains all the light and heavy rare earths used in the high-performance neodymium-iron-boron magnets needed for electric vehicle motors, offshore wind farms, and other electronics. The development of production outside of China is important to watch and should reduce China’s bargain power in trade negotiations.

Electrification Policy:

Batteries included: China's power battery output rises further in May - Argus

China's production and newly installed capacity for power batteries rose by 165% from a year earlier in May, driven by rapid growth in the country's new energy vehicle (NEV) industry. The total output of power batteries rose to 59.5GWh in January-May 2021, up by 227% from the previous year. China's NEV sales are forecast by CAAM to hit 2.4mn units, up by 70% compared with 2020, in a potential boost for future battery production this year.

Why it Matters:

China continues to be the world’s battery factory. In 2019, Chinese companies accounted for not only the bulk of battery production but also more than 80% of the world’s output of battery raw materials. Among the battery plants to be created in the next eight years, the majority will be based in China. The U.S. is finding itself not just behind China but also Europe too which has ramped up investment there. We expect the U.S. Government’s support for the industry to increase, similar to what we see with semiconductors, as battery technology and supply become an increasing national security priority.

ESG Monetary and Fiscal Policy Expansion:

You get a Check: Why Have Initial Unemployment Claims Stayed So High for So Long? - FEDS Notes

A recent posting on FEDS Notes shows that the expansions of UI eligibility and persistence of claims are mainly due to the Pandemic Unemployment Assistance. The PUA program supports self-employed workers and others ineligible for traditional UI benefits has kept claims higher than expected at this point in the recovery. Other changes in UI policy have also kept claims abnormally elevated this far into the recovery. Supplemental benefits of $300 per week (formerly $600) have given unemployed and underemployed workers unusually strong incentives to apply for UI. The waiving of job search requirements due to caregiver responsibilities and fears of infection, which only recently ended, gave a higher degree of leniency.

Why it Matters:

The current dislocation between unemployed and job openings is one for the history books. In the posting, the author adjusts the data (by adjusting PUA claims and making other assumptions) and finds that total claims should be 20% lower without the discussed additions/changes. The fact that these findings were posted on the Fed’s Board blog is in itself interesting. Numerous Fed officials continue to say there is no evidence that extra unemployment benefits are causing labor shortages. However, if the findings are accepted by Fed officials, it means a further labor recovery could occur much faster than currently forecasted and hence brings a more hawkish tilt to future projections, moving dots higher faster.