MIDDAY MACRO - DAILY COLOR – 7/6/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, as weaker service data pauses the melt-up

Treasuries are higher, with the long-end outperforming

WTI is lower, following a significant reversal after hitting multi-year highs in the overnight

Analysis:

Equity markets are lower with only the tech sector in the green after the open (but now down) as Treasuries are well bid across the curve.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Volatility, and Momentum factors, and Technology, Real Estate, and Consumer Discretionary sectors all outperforming.

The Treasury curve is slightly flatter, with the 5-30s spread lower by 2bps to 1.18% after a weaker than expected service PMI brought in buyers post-NY-open.

Weaker data today from the ISM Non-Manufacturing PMI, on top of further concerns over last week’s data, gives pause to the melt-up in equities we have been experiencing post-June FOMC meeting.

The failure of the OPEC+ group to secure a deal on raising oil supplies propelled oil prices overnight to their highest level in at least three years but add confusion over future supply.

The UAE, which has been increasing production capacity over the last year, objected to the baseline used to calculate production targets as it feels it unfairly punishes them.

WTI is now off its overnight highs by almost 5% as extended positions and this morning’s weaker economic data cooled sentiment,

Much of the commodity complex took the lead from oil and is now under pressure as a stronger dollar and weaker growth outlook hurt sentiment.

Positive weather developments in the mid-west have grains under significant pressure with corn futures limit down.

We would expect price action to reverse relatively soon as the fundamentals for the oil market improve even further with no meaningful deal.

This week will be quieter on the data front, and markets will look to the release of the June FOMC’s meeting minutes tomorrow for further clarification on tapering talks.

Given the substantial and, if we are honest, problematic progress made on the inflation front, Fed officials will have to continue to convince markets that they are still far away from their full-employment mandate.

Tomorrow’s June FOMC minutes will likely not do this and may continue the current tactical risk-off market environment as confusion over the pace of policy tightening begins to increase volatility and cross-asset correlation.

Econ Data:

ISM Non-Manufacturing PMI came in 60.1, lower than the expected 65.7, and 3.9% lower than May’s all-time high reading of 64. Positive contributions only came from the Backlog of Orders and Imports sub-series. Business Activity took a notable drop while New Orders decreased slightly, although New Export Orders fell by close to 10%. Employment and Inventories entered contractionary readings.

Why it Matters: Although the survey’s headline result was still at an elevated 60 reading, the underlying subcomponents showed a significant slowing from last month. Survey respondents continued to express significant concerns about supply-side disruptions. One Retail sector respondent summed it up best by commenting, “business conditions continue to rebound; however, like everywhere, the challenges in the supply chain are numerous. We continue to see cost increases, delayed shipments, pushed-out lead times, and no clarity as to when predictive balance returns to this market.”

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth Outperforming on the Week

Chinese Iron Ore Future Price: Iron Ore Higher on the Week

5yr-30yr Treasury Spread: Curve is Flatter on the Week

EUR/JPY FX Cross: Yen Higher on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

Bailout: Suning.com Gets $1.36 Billion State-Backed, Alibaba Bailout – Bloomberg

Chinese billionaire Zhang Jindong secured a $1.36 billion state-backed bailout for the troubled retail arm of his Suning empire, marking another step in Beijing’s efforts to clean up its heavily indebted conglomerates. The retail business was weakened by a slowdown in spending during the coronavirus pandemic. The bailout means Zhang will no longer control Suning.com, marking the end of a reign during which he led Suning into an array of businesses, including ownership of the Inter Milan soccer team.

Why it Matters:

China is taking advantage of a strengthening economy and stable financial markets to clean up its corporate sector, discouraging the kind of reckless debt-fueled expansion that inflated some companies to a dangerous size. The spawning of such bloated empires created a threat to the financial system as well as a challenge to President Xi Jinping’s grip on power.

Foreign Buyers Wanted: Foreigners Go Deep Into China With Record Local Debt Binge - Bloomberg

Global investors made their biggest ever purchases of Chinese municipal debt in June. Overseas investors added 730 million yuan ($113 million) of local government notes, a still small amount of the overall outstanding amount of 13.4 billion yuan for sale. Foreign investors are likely shifting some of their long-term China bond holdings into municipal debt for the yield pickup.

Why it Matters:

Recent increased foreign interest in Chinese debt is helping pave the way for further integration into the international financial system. Beijing is also expected to launch a bond-trading channel that will allow domestic traders to invest overseas as soon as this month. However, Beijing's desire to further integrate its financial markets is putting appreciative pressure on the yuan and hurting domestic export industries.

A BRI Too Far: How A Chinese-Built Highway Drove Montenegro Deep Into Debt - NPR

The first installment of a $1 billion loan tied to a Belt and Road Initiative highway and bridge construction project in Montenegro is due in July. It is unclear whether they can pay it as their debt has climbed to more than a 100% of its GDP due to the project. If Montenegro cannot repay China's state-owned Export-Import Bank on time, the bank has the right to seize land inside Montenegro.

Why it Matters:

This BRI project is very similar to other ones occurring around the world. A rising China, eager to wield influence, gives corrupt governments more money than they can pay back for projects that enrich their cronies and create questionable infrastructure. Elsewhere in Eastern Europe, Beijing has purchased the Greek port of Piraeus, turning it into the second-largest port in the Mediterranean, and it's also constructing billions worth of highways and railways, including a planned high-speed railway connecting Belgrade and Budapest. As the debt comes due, these countries will all be more likely to lean in favor of china on the international stage.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Semi-Crown: Japan launches bid to regain its semiconductor crown - FT

In a new growth strategy launched by the government, Japan’s semiconductor industry is now seen as an economic national security interest. This suggests Japan’s plans are less about boosting output and more about the security of supply. The new strategy also takes a leaf out of the US playbook, suggesting Japan will make it harder for security rivals, most obviously China, to acquire semiconductor technology.

Why it Matters:

The new strategy will not only affect chipmakers but, more importantly, chipmaking equipment exports, where Japan has remained successful even as its chipmakers declined. Limiting the export of equipment and wafers to China due to stricter export controls could significantly affect the growth and costs experienced by their domestic industry.

Electrification Policy:

Big Brothered No More: Apple wins privacy battle in China - FT

Tech groups led by Baidu, Tencent, and ByteDance created a new way of tracking iPhones for advertising, called CAID, that would let them identify users even if they refused to let apps use Apple's official ID. Apple shortly afterward blocked updates of these Chinese apps that it had caught enlisting CAID in their software updates from its App Store.

Why it Matters:

Apple's new privacy policies are very disruptive to the traditional business model used by many app companies to sell advertisements. Although it now looks like Chinese firms will be forced to comply with Apple's rules, this battle between the two interests is likely not over. It has significant ramifications for data privacy in China and globally. We will continue to watch developments here closely as Beijing has not made its position clear.

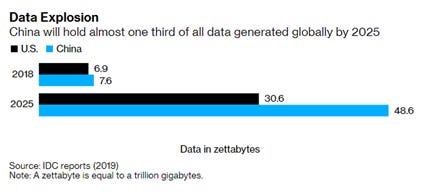

Data, Data Everywhere: Xi’s Next Target in Tech Crackdown Is China’s Vast Reams of Data - Bloomberg

Beijing is pouring money into digital infrastructure, drafting new laws on data usage, and building new data centers around the country. In the past, Chinese lawmakers mainly focused on using data to ensure security. China’s leaders are now focused on using big data to help governments provide better services. Chinese Tech firms are worried that they may lose their competitive edge if forced to hand over data or partner further with Beijing.

Why it Matters:

Many are beginning to wonder what Xi’s ultimate plan will be for the vast amounts of data Chinese tech firms hold. For now, Chinese authorities have stressed they won’t force companies to hand over data. However, policy out of Beijing can change quickly. Many western tech firms are now grappling with how to do business in China due to privacy and data security concerns on top of confusion from domestic firms.

ESG Monetary and Fiscal Policy Expansion:

Climate Action: Democrats Hope to Pass Climate Bill After Failing a Decade Ago – WSJ

Democrats are emphasizing new investments in and incentives for clean energy, measures they hope to pass through a budget process called reconciliation. Democrats are “going to have to rely very heavily on spending and tax areas for a lot of what we need to do this year, it’s hard to imagine a regulatory program being enacted in this Congress, so we’ll have to use a lot of other tools,” said former Rep. Henry Waxman (D., Calif.), who was chairman of the House Energy and Commerce Committee.

Why it Matters:

While the reconciliation package is still under construction, Democratic aides and lawmakers expect that it will include tax incentives for purchasing electric vehicles, conserving energy in buildings, and producing clean electricity. Some lawmakers and climate advocates see a political advantage in exploring a variety of different options on climate policy, as well as pairing it with measures focused on education, healthcare and antipoverty programs, as they try to build unanimous Democratic support in the Senate. Again all very in line with the more ESG focused policy front we continue to highlight.