MIDDAY MACRO - DAILY COLOR – 7/29/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, as yesterday’s FOMC and today’s GDP print continue to support the melt-up

Treasuries are flat, as the rate complex continues to coil in a tight range

WTI is higher, starting to break out of its post-July highs down-channel and weekly-range

Analysis:

The Russell is outperforming the Nasdaq on the week, and leadership may be starting to change slightly as today’s GDP data supports the likelihood that capped/lost Q2 growth will show up in Q3, while the Fed continues to be in no hurry to move, keeping Treasuries contained.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Value, and Momentum factors, and Consumer Discretionary, Materials, and Energy sectors are all outperforming.

S&P optionality strike levels have zero gamma level moving to 4357 while the call wall remains at 4400; technical levels unchanged with support at 4390, and resistance is 4435.

Treasury markets are eerily quiet, with FOMC, infrastructure deal, and GDP data failing to elicit much of a response, leaving us to conclude positioning is cleaner and better balanced.

Yesterday’s FOMC and today’s GDP data give us a higher conviction that second-half growth will be more substantial than expected while financial conditions will remain (highly) accommodative, favoring an (eventual return) to the reflation trade into year-end.

The combination of the Fed’s upbeat take on growth and the fading of the relatively near-term risk of a September taper is a bullish development for risk-assets generally.

Prices paid by firms (seen in business surveys), as well as used-car prices and other re-opening favorites, are starting to see the rate of price increases peak, easing earnings/margin fears that have weighed on small-caps and value factors.

Further, companies continue to note the ability to pass on cost increases to end customers in recent earnings calls, reinforcing our view that inflation is initially a positive force for earnings and overall growth.

We need to now see an increase in growth above expectations start to materialize, and given the level of both business and consumer sentiment/outlook, we expect this to occur throughout the fall as strong back-to-school buying and holiday inventory restocking materialize.

Econ Data:

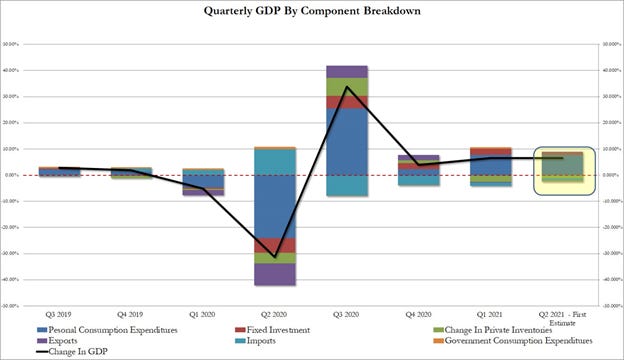

Real GDP rose 6.5% at an annual rate in the second quarter, missing expectations for an increase of 8.5%. Inventories subtracted -1.1% from the headline number. Consumer spending was an impressive 11.8% in real terms (the second-largest advance since 1952), and business fixed investment was up a solid 8.0% thanks to investments in equipment. Residential investment fell -9.8% as disruption to housing sales/production created a drag there. Finally, Core PCE prices increased 6.1%, setting up a 3.4% annualized rate.

Why it Matters: The data enforces the points we have made throughout the second quarter, supply disruptions, whether lack of materials or labor, capped growth. The weaker than expected inventory build is a positive for second-half growth now as stocks will need to be built into the holiday season, especially for autos. We also suspect the drag from residential investment will reverse, given activity should increase as supply-side disruptions there ease. Finally, the consumer is on fire, and we expect the back-to-school and general holiday buying season to be one for the records.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is higher on the week as yesterday’s FOMC and today’s GDP are supportive of second-half growth

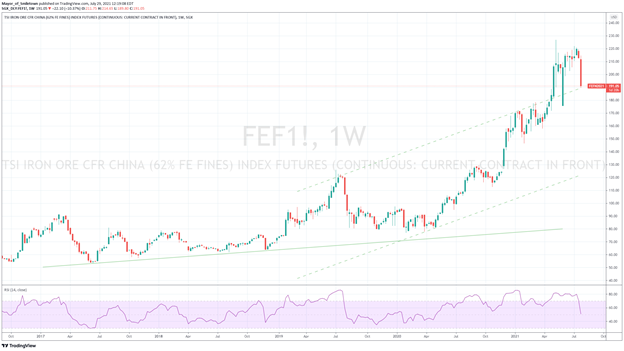

Chinese Iron Ore Future Price: Iron ore is lower, but a switch of future contracts is making price action look worse than what’s occurring

5yr-30yr Treasury Spread: The curve is flatter on the week as Treasury traders may have left early for the summer holiday period

EUR/JPY FX Cross: Euro is higher on the week, as sentiment and future growth continues to look positive there

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Wood Producers Rise: Lumber Output in Focus as Producers Look Past Record Quarter - Bloomberg

Producers are building and expanding sawmills in the southern U.S., where costs are low and timber is plentiful while boosting output on expectations that the surge in homebuilding will continue. Some analysts warn that an oversupply may be building up, even with bottlenecks and supply constraints in British Columbia, Canada’s biggest lumber exporter to the U.S.

Why it Matters:

Lumber has been the go-to for market pundits to explain why inflation is transitory. Production ramp-up relatively quickly after Covid related labor shortages abated, and now the worry is there will be too much supply, even with wildfires out west impairing logistics. Worth also noting that the lower lumber prices should increase the production of houses that were postponed due to cost increases (as well as other constraints such as other supply and labor availability), helping reduce inventory shortages slowly.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Foreign Chips: Biden to Decide on Foreign Chipmaker Grants, Raimondo Says - Bloomberg

Biden will make the determination on whether to direct funds from the $52 billion allocated to re-shore semiconductor production to only U.S.-headquartered companies after the administration’s internal policy discussions are completed, Commerce Secretary Gina Raimondo said. Geopolitical risks are part of the analysis being done to decide which companies receive government grants as well as climate change risks in its plans for a diversified, resilient supply chain.

Why it Matters:

Raimondo is working with the European Union to map out the supply-chain vulnerabilities and said the allies would come up with a coordinated approach on incentivizing domestic production of chips to ensure their efforts complement each other. The House still needs to pass the legislation to fund the grant program, but strong bi-partisan support makes passage likely.

Electrification Policy:

Mandatory Voluntary: Biden Directs Agencies to Develop Cybersecurity Standards for Critical Infrastructure – WSJ

The memorandum orders DHS to offer preliminary baseline cybersecurity standards for critical infrastructure control systems by late September, with final “cross-sector” goals to be delivered within a year. Sector-specific performance goals are also required within a year as part of a broader review of “whether additional legal authorities would be beneficial” to safeguard critical infrastructure, the vast majority of which is owned by the private sector.

Why it Matters:

“If we end up in a war, a real shooting war, with a major power, it’s going to be as a consequence of a cyber breach of great consequence,” Biden said Tuesday while visiting the Office of Director of National Intelligence. “Them be fightin words”, and although America is far behind where it should be here, it looks like the Biden Administration is waking up to the threat. He is also correct; the next wars are already being fought in cyberspace and will eventually lead to a more physical confrontation.

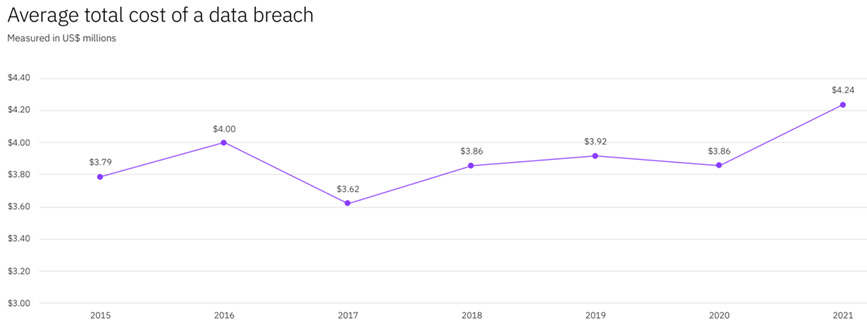

Hacker Inflation: Enterprise data breach cost reached record high during COVID-19 pandemic – ZD Net

IBM Security released its annual "Cost of a Data Breach" report, which estimates that in 2021, a typical data breach experienced by companies now costs $4.24 million per incident, with expenses incurred now 10% higher than in 2020 when 1,000 -- 100,000 records are involved. So-called "mega" breaches impacting top enterprise firms responsible for the exposure of between 50 million and 65 million records now also come with a higher price tag, reached an average of $401 million to resolve.

Why it Matters:

The most common attack was compromised credentials, either taken from data dumps posted online, sold on, or obtained through brute-force attacks. Once a network was infiltrated, customer data was stolen in close to half of the cases. IBM estimates that roughly 60% of organizations moved to the cloud to keep their businesses running, but ramping up security controls did not necessarily follow. This should begin to change as the monetary and reputational costs incurred from a breach are only increasing while new regulatory pressures increase incentives.

Surf’s Up: World’s most powerful tidal turbine starts generating power – Splash247

Developed by the Scottish-based floating tidal turbine technology firm Orbital Marine Power, the 2MW offshore unit is expected to operate in the waters off Orkney for the next 15 years with the capacity to meet the annual electricity demand of around 2,000 UK homes. The 74 m long turbine, named O2, provides power to EMEC’s onshore electrolyzer to generate green hydrogen that will be used to demonstrate decarbonization of wider energy requirements.

Why it Matters:

Although in its early stages, the harnessing of tidal power is an interesting area to watch. It has sizeable growth potential and, when coupled with green hydrogen or ammonium production, gets to the core of our electrification theme. We don’t claim to be experts here but wanted to highlight it as further development and expansion of the renewable energy portfolio.

Commodity Super Cycle Green.0:

Got a Nickel?: China's nickel sulphate prices hit new high - Argus

China's domestic nickel sulphate prices rose to a new high, with import prices also surging amid burgeoning demand from the new energy vehicle (NEV) and battery sectors and tight local supply. Supply concerns over nickel matte, an intermediate product of nickel sulphate production, arose after a 6.2 magnitude earthquake on Monday struck off Sulawesi island, Indonesia, where Vale Indonesia's nickel matte plant is located.

Why it Matters:

China and the world more generally are racing to increase their NEV fleets. The supply of materials needed for new energy batteries may increasingly lag demand and the time for construction of new facilities and production to ramp up is long. As a result, supply/demand balance will likely worsen, capping how many vehicles can be produced.

ESG Monetary and Fiscal Policy Expansion:

New Requirements: SEC Weighs Making Companies Liable for Climate Disclosures – WSJ

SEC Chairman Gary Gensler said Wednesday he had asked agency staff to consider whether climate-related disclosures should be filed in companies’ annual reports. For companies, climate change can involve both physical risk, such as extreme weather events that can cause unexpected losses, as well as transition risk, which includes government policies that force a move away from fossil fuels. Current SEC guidelines suggest both types of risks might need to be disclosed in federal filings. But the guidance doesn’t spell out specific, required disclosures, and companies decide what to say about risks.

Why it Matters:

Energy firms, airlines, and groups, including the U.S. Chamber of Commerce, have argued in comments filed to the SEC that the agency should allow climate-related disclosures outside of regulatory filings. Advocates of stricter disclosure rules warn that, in the absence of third-party audits and potential liability for company officers, some companies will continue to either play down their climate-related risks or exaggerate their sustainability efforts. We believe the SEC will eventually push forth new reporting requirements, but we are still in the earlier innings here.