MIDDAY MACRO - DAILY COLOR – 7/22/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, as the Russell gives back some of its recent gains while the S&P consolidates

Treasuries are higher, also reversing yesterday’s price action as a more cautionary tone takes hold post-NY-open

WTI is higher, break higher after overnight gains were lost and regained in the morning

Analysis:

“Too far, too fast” looks to be today’s theme as yesterday’s reflationary outperformers are today’s underperformers and Treasuries get a bid higher, although still notably below Tuesday’s highs.

The Nasdaq is outperforming the S&P and Russell with Growth and Low Volatility factors, and Healthcare, Technology, and Utilities sectors are all outperforming.

S&P optionality strike levels increased with the zero gamma level moving to 4324 while the call wall remains at 4400; technical levels unchanged with support at 4335 and resistance at 4385, then 4415.

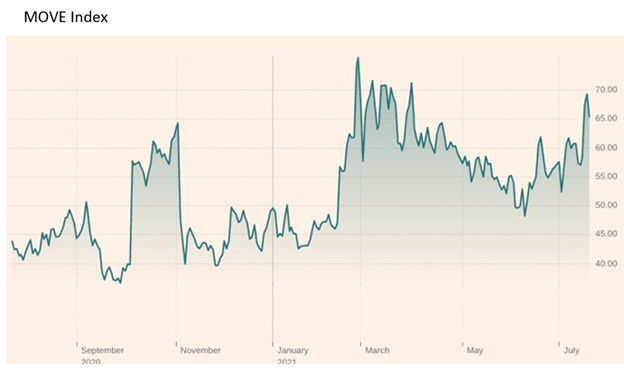

Treasuries are back in favor today with the curve flattening, but it's certainly been a volatile week, and the MOVE index is approaching highs seen in March.

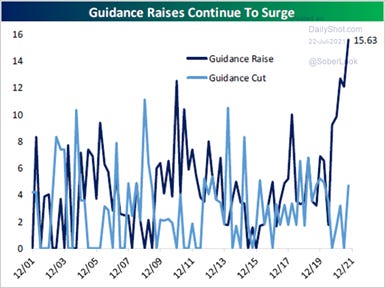

As we progress further through the current earnings season, we continue to see companies experiencing historical cost increases and testing the extent of their pricing power as they defend profit margins.

The takeaway so far is that companies have been generally successful in their ability to pass cost increases on but are concerned about the longevity of the real supply-side disruptions.

As a result, second-quarter earnings for the S&P could come in higher than expected, and unlike last earnings season, companies that beat expectations are being rewarded.

This potential better earnings outcome juxtaposes with a more negative macro backdrop due to increasing Delta cases, substantial geopolitical risks, and of course, as mentioned, uncertainty over the duration of supply-chain disruptions and labor shortages (= sustainability of current inflation).

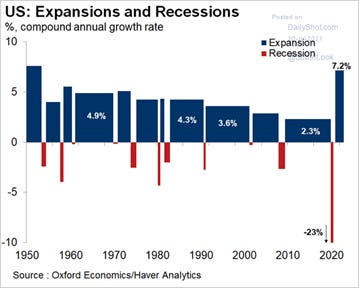

We continue to expect second-half growth to be strong and companies to defend profit margins before aggregate demand weakens next year. However, we advocate for tactical patience in re-engaging in any reflationary-themed equity positions.

In our view, recent price action has been driven more by excess positioning in Treasuries reversing versus fundamental developments altering market sentiment. Markets will need more proof that inflation is transitory and hence earnings are not at risk.

Further, there hasn’t been a 5% pullback in the S&P since October last year, one of the longest streaks ever, while the index has averaged at least three separate pullbacks per year since 1950.

As discussed in yesterday’s note, we still see a great degree of uncertainty and are now entering a weaker performance period of the year. As a result, discipline dip buying is warranted.

Econ Data:

Existing-home sales increased 1.4% in June, snapping four consecutive months of declines and in line with forecasts. Total housing inventory at the end of June increased 3.3% from May but is down -18.8% from one year ago. “Days on the Market” remained at a record-low 17 days, and 89% of homes sold in June were on the market for less than a month. Median total home resale prices were 23.4% above year-ago levels, down slightly from May’s 23.6% year-over-year pace.

Why it Matters: Today’s data coupled with NAHB Housing Market Index, Housing Starts, and Building Permits early this week show a housing market that is staying historically strong. Prices are in no danger of declining due to tight inventory conditions, but price appreciation should begin to slow as pandemic-induced buying ends and more normal conditions return. There continues to be a divergence in affordability between cash buyers of homes (mainly secondary) and first-time buyers.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week as momentum shifted today

Chinese Iron Ore Future Price: Iron ore is lower on the week due to increased supply and uncertainty over demand

5yr-30yr Treasury Spread: Curve is steeper on the week, but flattening on the day

EUR/JPY FX Cross: Euro is lower on the week, keeping the cross in the middle of its two-month downtrend

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Margin Defense: Inflation Drumbeat Reverberates on Latest U.S. Earnings Calls – Bloomberg

The outsize gains in U.S. inflation measures have been borne out in recent corporate earnings calls, with many executives highlighting greater pricing power. “This inflation cycle is much higher than anyone anticipated, and we’re continuing on a business by business basis, working to secure further selling price increases,” PPG’s Chief Executive Officer Michael McGarry said on the company’s July 20 earnings call “Price actions to date have largely matched cost increases. There’s a ton of inflation going on. There’s inflation because of disruption,” Fastenal CEO Daniel Flores said.

Why it Matters:

High levels of demand are allowing companies to defend profit margins, as seen in earning calls so far. This will likely persist for the rest of the year as demand is expected to stay strong. However, the consumer will eventually decrease demand if prices continue to increase meaningfully next year. We believe there will be a reduction in supply-side pressures next year, but more structural inflationary forces will persist, changing the nature of profit margin pressures, and reducing growth multiples.

China Macroprudential and Political Tightening:

SOE Trouble: China rushes to set up bailout funds for indebted state-run firms - FT

Public records showed that six Chinese provinces have committed at least Rmb110bn ($17bn) to the funds since the end of last year, as a cash crunch among indebted state-owned enterprises hit local economies. Distressed bonds issued by state-owned enterprises totaled Rmb119bn last year, the highest since China started allowing SOEs to default in 2014 and up from Rmb22bn in 2019.

Why it Matters:

Beijing is trying to reduce the risk of the country's $17tn credit market in the wake of several high-profile defaults. Regulators have put pressure on debt underwriters, domestic rating agencies, and auditors in an effort to encourage more timely disclosure of risks. As a result, more problems are surfacing. We are in the middle innings here, and a more systemic response will come from Beijing, which can’t afford to look weak on the international stage.

Exports Still Working: U.S.-China Trade Booms as If Virus, Tariffs Never Happened - Bloomberg

Eighteen months after the Trump administration signed the trade deal, the agreement has turned out to be a truce at best. The U.S. trade deficit hasn’t shrunk, most levies are still in place, and it hasn’t led to negotiations over other economic issues. Monthly two-way trade, which tumbled to $19 billion in February of last year amid shutdowns in Chinese factories, rebounded over the past year to new records, according to official Chinese data

Why it Matters:

Although there are problems with over-leveraged firms domestically, China’s export industry continues to grow. Tariffs also continue to add to inflationary pressures as firms pass on cost increases when they can not source goods outside China. There looks to be no change coming here, and Covid and tariffs have done little to change the relationship as measured by the trade balance.

LONGER-TERM THEMES:

Electrification Policy:

A Big Number: Greening Energy to Fight Climate Threat May Cost $92 Trillion - Bloomberg

Investment in infrastructure to accommodate energy transition will need to rise to between $3.1 trillion and $5.8 trillion annually on average until 2050, up from about $1.7 trillion in 2020. Overall, electricity generation will need to at least double by 2050 to almost 62,200 terawatt-hours, making up almost 50% of final energy consumption, compared with about 19% now.

Why it Matters:

Scaling up the role of electric power underpins all hopes for a drastic cut to greenhouse gas emissions. More than three-quarters of the potential decline in emissions this decade will likely need to come from electricity supply and the increasing use of wind and solar power. Another 14% of the drop in emissions in that period can be achieved from vehicles, homes, and industries switching to electric power from burning fossil fuels. Hydrogen will also have a significant role to play, with demand set to soar.

Iron Power: Startup Claims Breakthrough in Long-Duration Batteries – WSJ

Form Energy Inc.’s batteries are far too heavy for electric cars. But it says they will be capable of solving one of the most elusive problems facing renewable energy: cheaply storing large amounts of electricity to power grids when the sun isn’t shining and the wind isn’t blowing. In 2023, Form plans to deploy a one-megawatt battery capable of discharging continuously for more than six days and says it is in talks with several utilities about battery deployments.

Why it Matters:

A battery capable of cheaply discharging power for days has been a holy grail in the energy industry due to the problem that it solves and the potential market it creates. Form’s battery will compete with numerous other approaches in what is becoming a crowded space as an array of startups race to develop more advanced, cost-effective energy-storage techniques. However, it is starting to look like progress is being made towards greater battery capabilities.

Commodity Super Cycle Green.0:

Forrest Credits: Africa’s green superpower: why Gabon wants markets to help tackle climate change – FT

African Conservation Development Group, a company that specializes in land stewardship, wants to launch a bond that will raise up to $300m. Its underlying asset will be the forest that absorbs millions of tonnes of carbon, creating a stream of potentially marketable carbon credits. ACDG wants to clinch contracts with companies seeking carbon offsets for a total of 3m tonnes a year of carbon credits over ten years, charging a minimum of $10 a ton. ACDG would package the income stream into a bond priced at a slight premium to Gabonese sovereign debt.

Why it Matters:

The idea is simple, either companies, which have pledged to reduce carbon emissions, have to invest in technologies to reduce those emissions or buy carbon offsets. The article goes on to explain the different players involved and where the health of much of Africa’s forests is generally, which is not great. It is an interesting compromise and finds a profitable way for governments to maintain wilderness.

ESG Monetary and Fiscal Policy Expansion:

ECB Underwhelms: ECB vows to persist with negative rates in a bid to fuel inflation - FT

The ECB also said it was prepared to tolerate a moderate and transitory overshoot of its 2% inflation target as it believes that a “persistent” policy is necessary when rates are close to the lowest point at which cuts are effective, as they are now. Lagarde acknowledged there had been some divisions in the governing council over the guidance but it had been supported by “an overwhelming majority” — in contrast to the unanimous support for its new strategy.

Why it Matters:

The new wording sets a higher bar for interest rate rises than previous guidance did. However, inflation has run below the ECB’s earlier target of “close to, but below, 2%” for almost a decade, and markets remain skeptical about the likelihood that the bank will meet its new goal. “This was a bit like old wine in a new bottle; the communication has changed somewhat but in terms of substance the ECB remains very dovish, putting a cap on any tapering speculations,” said Carsten Brzeski, head of macro research at ING.

Rent’s Are Due: Treasury distributed over $1.5 billion in rental assistance in June – Axios

Congress approved more than $46 billion in rental assistance between December and March for both tenants and landlords, but getting it into their hands has proved challenging. However, funds are slowly beginning to get distributed. The number of households assisted in June grew by almost 85% over the previous month and nearly tripled since April

Why it Matters:

More than 11 million Americans, or 16% of renters, are still behind on their rent payments, according to an analysis by the Center on Budget Policy and Priorities. We believe the shelter component of inflation will continue to increase for the foreseeable future due to housing shortages and rent catch-up more generally (after a year and a half of little growth). We, however, need to see the backlog of missed rental payments cleared up first, which looks to be going slowly.