MIDDAY MACRO - DAILY COLOR – 7/2/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, as a varied jobs report propels the Nasdaq higher while the Russell is dropping

Treasuries are flat, with the curve initially steepening slightly but now little changed

WTI is slightly lower, as OPEC+ negotiations thought to be concluded yesterday continue

Analysis:

Equity markets are mixed while Treasuries are little changed following a somewhat unusual jobs report that had both good and bad aspects.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Volatility, Momentum factors, and Technology, Real Estate, and Consumer Discretionary sectors outperforming.

S&P optionality strike levels increased with the zero gamma strike level moving higher to 4277 while the call wall shifted higher to 4350; technical levels show support at 4305 and resistance at 4345.

The Job Report failed to move Treasuries out of their post-June FOMC trading range.

OPEC+ is still in play, as what looked like a done deal has hit impasses on how to measure production cuts correctly.

The United Arab Emirates is refusing to back a deal to raise output unless the baseline for its curbs is increased.

If the negotiations fail, the fallback position is that there will be no increase in output.

It’s not the first time the group has faced such disagreements, and more often than not, it has been able to find a diplomatic solution.

Markets had a more muted reaction to the jobs report than expected on a low-volume holiday Friday.

The main takeaways will be discussed further below, but generally, it was a “mixed” report allowing varying views to see what they wanted.

There were signs the reflation trade may have been starting to regain favor even with rates notably absent as new long positioning in commodities, specifically oil, were increasing, while factors and sectors favored in this trade had based after post-FOMC losses.

Those factors/sectors are underperforming today, while rates have certainly not changed materially, and oil awaits the OPEC+ meeting outcome.

Instead, the index level melt-up we have highlighted for weeks continues pushing up optionality positioning and tightening trading ranges.

We don’t currently have a conviction on whether the reflation trade will regain momentum and see a divergence across the street in opinion, echoing the dispersion we are seeing from Fed officials on the course of policy.

We now enter a quieter period of the year, and it will be two weeks till we have further inflationary data and Treasury supply, allowing rates to likely stay range-bound.

This may keep the rates complex absent any reflationary trade expressions while also muting moves in real rates, allowing equities to continue to melt higher.

Econ Data:

Nonfarm payrolls rose by more than forecasted, increasing 850,000 in June. The unemployment rate rose slightly to 5.9% from 5.8% as voluntary leaves increased, and the participation rate held steady at 61.6%. The U6 underemployment rate fell to 9.8% from 10.2%, thanks to a drop in part-time workers. Average hourly earnings increased by 0.3%, while hours worked increased by 0.2%. The strongest sector gains came from leisure and hospitality, which has seen 34% of the jobs deficit since November closed, while the overall payroll gap stands at 6.8 million. However, this number is likely lower as workers have accelerated retirement.

Why it Matters: A “noisy” report that had good and bad aspects, helping explain the limited price action in Treasuries as Fed “hawks” and “doves” can see what they want. To be clear, the report represents a significant improvement in the labor market. Wage increases will likely continue around the current pace for some time, emboldening our wage-spiral inflationary force beliefs. However, Fed doves can highlight that there is still an “inequitable” recovery occurring. High levels of unemployment in Black and Hispanic workers persist. There has been little improvement in the participation rate, likely due to childcare still being an impediment. As a result, we see the report as neutral regarding changes to the Fed’s current policy tightening trajectory.

Policy Talk:

Philadelphia Fed President Harker said Thursday that while an interest rate rise lies some ways in the distance, he is ready for the U.S. central bank to begin slowing the pace of its asset-buying stimulus this year. Asked if the process should start this year, Mr. Harker said “yes,” adding that, “I would like to see tapering begin. I’d like to see it happen sooner rather than later. I’d like to see it being a slow, methodical process.”

Why it Matters: Although Harker is not a current FOMC voter, it is important to highlight he has entered the growing camp of Fed officials calling for tapering to begin before year-end. We ourselves are beginning to waver slightly in our conviction. On the one hand, it would be appropriate to start tapering in the second half of this year, given the economic backdrop. However, as we have highlighted numerous times, the changes to the long-run goals allow for a greater degree of policy error. The poorly defined AIT and “full employment” mandates allow for a more socially focused Fed to continue being patient, using the “inequitable” recovery and transitory inflation forces as their reasons.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth Outperforming on the Week

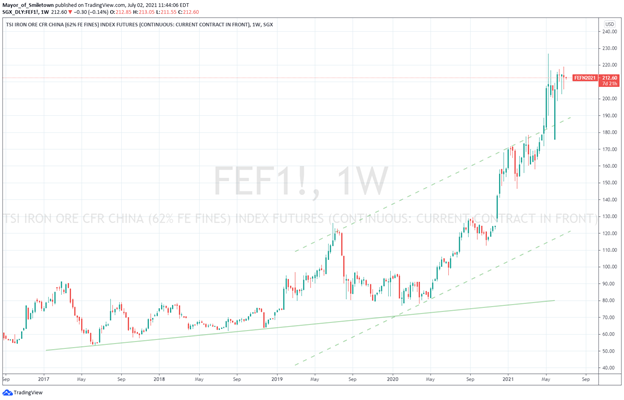

Chinese Iron Ore Future Price: Iron Ore Lower on the Week

5yr-30yr Treasury Spread: Curve is Flatter on the Week

EUR/JPY FX Cross: Yen Higher on the Week

HOUSE THEMES / ARTICLES

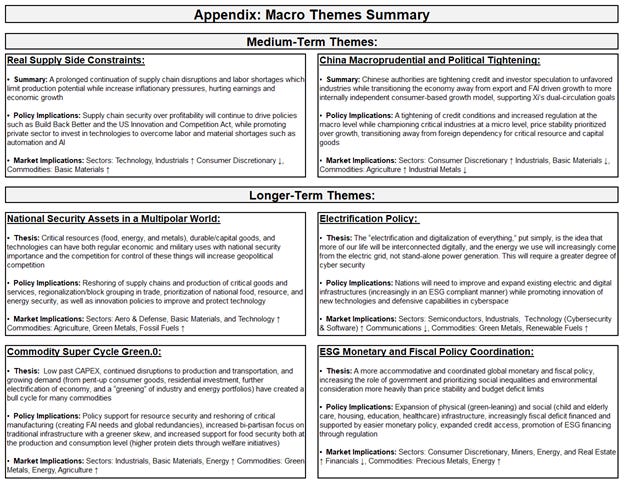

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Even the Snakes? Fireworks Demand Shoots Up as Supply Fizzles Ahead of July 4th – WSJ

Consumers can expect higher prices, as much as 25% higher for some fireworks this 4th, as well as a more limited selection, according to retailers and industry organizations. Supply is expected to be down about 30% nationwide this year due to manufacturing delays and supply-chain bottlenecks, according to the American Pyrotechnics Association.

Why it Matters:

Low inventories, higher prices, all due to supply-side issues, sound familiar? Is nothing safe? In all seriousness, we continue to experience an inflationary pulse in what we see as a death from a thousand cuts (as in it is everywhere). The root causes for the swath of items and services increasing in price are all very similar (suppl-side disruptions) and supported by the high levels of pent-up demand (especially for things like fireworks on the 4th!). Now comes labor's time to require higher real wages (0.3% MoM wage increase in the jobs report today).

Ships Needed: Boxship sales double in H1, feeder prices quadruple in the space of one year – Splash247.com

With charter and freight rates at record highs, liners have been scrambling for tonnage. Secondhand deals for red-hot containerships have jumped more than 100% in the first half of the year. The highest demand so far this year has been for feeder ships, which have seen a 165.1% increase from the first half of 2020. Noticeably for both charter and secondhand acquisitions, buyers are bidding up older ships.

Why it Matters:

We often highlighted CAPEX discipline by various industries due to concerns that current high levels of demand will wane. The opposite looks to be happening in the shipping industry. Firms are currently bidding up available tonnage (older and older ships) and making longer-term purchase plans for new ships at record levels. The current price increases and new construction will add to current inflationary pressures. At the same time, increased supply later will leave the industry with too much capacity as reshoring and regionalization could reduce shipping needs.

LONGER-TERM THEMES:

Electrification Policy:

Privacy Reg: FTC Vote Could Pave Way for New Privacy Rules - WSJ

The Federal Trade Commission is changing its approach to prescribing new rules for unfair or deceptive business practices, enabling it to regulate companies for abuses such as privacy violations more easily. The changes include shifting oversight of the process from an administrative law judge to the FTC chair, eliminating a staff report on proceedings, and cutting some public comment periods.

Why it Matters:

The FTC will take a more muscular approach to consumer protection under the Biden administration by probing large technology companies and other firms. The inability of Congress to establish national data-privacy standards has left the FTC as the key regulator policing data abuses through existing consumer-protection statutes or more narrowly tailored privacy laws. Important to watch developments here as the use and sale of data is critical to many firm's current business models.

Brute-Force: FBI, NSA: Russian military cyber-unit behind large-scale brute-force attacks – the Record

CISA, FBI, NSA, and NCSC officials said a Russian military cyber unit is behind attacks and had remained largely under the radar because APT28 worked to disguise its brute-forcing attempts via the Tor network. Per the four cybersecurity agencies, APT28’s attacks have targeted the cloud resources of a wide array of targets, including government organizations, think tanks, defense contractors, energy companies, and more.

Why it Matters:

The article is just a reminder of the ongoing war occurring in cyberspace. In Biden and Putin’s recent meeting, Biden made it abundantly clear to Putin that the attacks have to stop. Recent comments by Putin have raised the possibility that at least state-sponsored attacks could slow, given his desire to integrate Russia further with Europe and by defacto the U.S., as a counter to China. Cyber aggression will need to drop for this to occur, and we are watching for this closely, but skeptical Putin is incentivized enough yet to take meaningful action.

Commodity Super Cycle Green.0:

Meat is Murder (on the wallet): Meat Demand Is Under Threat Like ‘Never Before’ as Prices Surge - BBG

U.S. sales of meat at grocery stores are down by more than 12% from a year ago. In Europe, overall beef demand is predicted to fall 1% this year. And in Argentina, home to one of the world’s most carnivorous populations, per-capita beef consumption has dropped almost 4% from 2020. Now demand is waning across the globe in what could signal the start of a new broad shift away from animal protein.

Why it Matters:

This article highlights changing consumer behavior away from eating meat and the effects higher prices have had on accelerating this trend. This runs counter to our belief that a growing middle class in developing nations will put upward pressure on protein prices for years to come. We also see basing effects on the year-over-year declines as hoarding during the pandemic drove demand much higher. However, maybe it could mean higher demand for plant-based protein over animal-based moving forward. We will continue to watch this closely, given its impact on the agriculture complex and environmental policy (think cows, methane, and global warming).

Farm to Fork: EU Strikes Initial Deal on Farming Reform With Focus on Climate - Bloomberg

National governments, the European Parliament, and the European Commission on Friday struck a deal that would reform the bloc’s Common Agricultural Policy in 2023-2027. The CAP overhaul would include requirements for countries to funnel a quarter of farm-income payments toward ecological schemes and for farmers to set aside 3% of their arable land for biodiversity efforts, among other initiatives.

Why it Matters:

The agreement remains tentative until approved by the EU’s agriculture ministers and formally endorsed by national governments and the European Parliament before it can become law. Interestingly, Green Party members in the EU Parliament think it does not go far enough and will vote against it. Although not transferable to the U.S. agricultural industry, it is worth watching developments here, given the EZ is leading in environmental policy implementation.

ESG Monetary and Fiscal Policy Expansion:

Fair is Fair: U.S. Wins International Backing for Global Minimum Tax – WSJ

Officials from 130 countries agreed Thursday to the broad outlines of what would be the most sweeping change in international taxation in a century. Among them were all of the Group of 20 major economies, including China and India, which previously had reservations about the proposed overhaul. Those governments now will seek to pass laws ensuring that companies headquartered in their countries pay a minimum tax rate of at least 15% in each of the nations in which they operate, reducing opportunities for tax avoidance.

Why it Matters:

The agreement is in stark contrast to the usual beggar-thy-neighbor approach that has plagued international finance/tax for decades. The OECD, which is guiding the negotiations, estimates that governments lose revenue of between $100 billion and $240 billion to tax avoidance each year. That is a significant increase in potential revenues for numerous nations, mainly America, and may reduce the urgency to raises taxes elsewhere. We will be watching for the details of the final agreement.