MIDDAY MACRO - DAILY COLOR – 7/21/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, as reflationary themed sectors and factors are outperforming for a second day

Treasuries are lower, with the reversal of the recent rally showing how impactful positioning was given little new data/news

WTI is higher, now back above $70, as today’s inventory data helped continue the overnight rally

Analysis:

The “Reflationary Trade” outperformance continues for a second day with upside momentum continuing for the Russell and oil, while Treasuries are back to levels seen a long three days ago.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Momentum, and High Dividend Yield factors, and Energy, Financials, and Materials sectors all outperforming.

S&P optionality strike levels decreased with the zero gamma strike level moving lower to 4318 while the call wall remains at 4400; technical levels unchanged with support at 4312 and resistance at 4370, then 4410.

Treasuries continue to sell-off for a second day, with the curve steepening as the 10yr yield is now 16bps higher from yesterday's lows and in the middle of its post-June-FOMC downtrend channel.

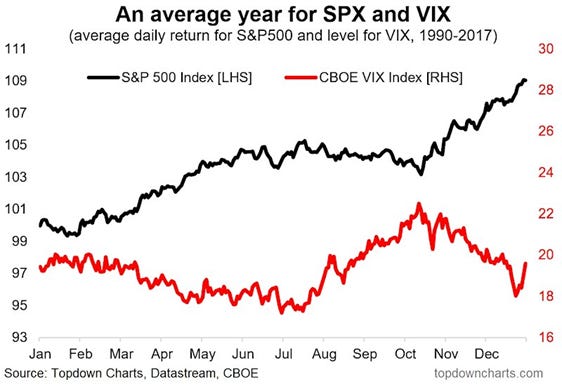

Option positioning in stocks suggests this rally could continue a bit further, but momentum is stretched, and August and September have historically had negative seasonality.

Following last Friday’s option expiration, reducing gamma levels, the market was positioned to trade in a wider range this week, which we have seen.

Significant strike levels at 4300 and 4350, as well as solid support underneath, are forcing dealers to buy into the market as it rises.

Momentum now looks stretched as indicated by the S&P Hourly RSI (approaching overbought conditions), and consolidation around current levels (where the zero gamma level around 4320 will act as support) should occur before the longer-term melt-up possibly continues into next week.

Moving into August and September, equity seasonality becomes more negative, likely further weakening the breadth of the market, which is already a bearish indicator, before what we believe will be a more favorable 4th qtr period for equities.

Although we generally remain positive risk-assets for the remainder of the year, even with the above tactical headwinds, we want to highlight a few unknowns we need further clarity on to have greater conviction.

What is really going on in China? Recent accommodative policy moves foreshadow weaker coming growth while further regulatory tightening fuels fears for critical institutional bankruptcies.

Will U.S. workers show up? Does the EPOP ratio return to a more normal level, or are we in a new world with increased labor bargaining power?

What does the rise in the Delta Variant really mean, and when will it stop spreading? Case counts are rising domestically while hospitalization levels aren’t. Certain countries are hard hit, but how impactful is that to U.S. markets given what is already priced in?

How damaging to growth is inflation going to be? Transitory pressures should ease but will more structural ones may grow as “cost of living” adjustments to wages create a more sustainably feedback loop and weaken consumption, hurting earnings growth next year.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is higher on the week thanks to a continuation in reflationary themed (value) factors

Chinese Iron Ore Future Price: Iron ore is slightly higher on the week, but disruption from flooding is likely to cool demand

5yr-30yr Treasury Spread: Curve is steeper on the week, as the long-end has reversed most of the recent gains

EUR/JPY FX Cross: Euro is higher on the week, moving the cross to the middle of its two-month downtrend

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Sharing the Cost: Salesforce projects retailers will pay $223 billion extra for goods in the second half - CNBC

Retailers are expected to pay $223 billion or 62% more for goods in the second half of this year than last year. It’s comprised of an additional $12 billion spent with suppliers, $48 billion more in wage expenses, and $163 billion extra in logistics costs. “Retailers will certainly take on some of the burden and consumers are going to feel it as well, but given the significant increase across the board from manufacturing to logistics to labor, it can’t be all passed on to the consumer,” Salesforce VP and GM of Retail Rob Garf told CNBC.

Why it Matters:

The Salesforce report found that although costs were being shared by retailers and consumers, there was enough momentum and “positivity” among people that they are likely willing to absorb the “additional cost all the way through the holidays.” As a result, it is still unclear at what point inflation becomes demand destructive. We continue to believe that firms will increasingly pass on cost increases throughout the second half, protecting margins and earnings. We, however, believe this will begin to reverse next year as the consumer becomes more defensive, putting pressure on risk assets.

China Macroprudential and Political Tightening:

User Rights: Beijing calls out Amazon, ByteDance, NetEase for violating users’ rights in latest crackdown – SCMP

The 145 named apps have until July 26 to take corrective measures or face punishment, the Ministry of Information Technology (MIIT) said on Monday. The ministry has singled out more than 1,300 apps to date for illegally collecting user information, requesting excessive permissions, or misleading customers.

Why it Matters:

Beijing continues to introduce regulations to stamp out personal privacy breaches in the world’s largest internet market. The government last year drafted the Personal Information Protection Law, followed by many additional actions this year. It’s a little ironic that a surveillance state nation that gives its citizens scores based on their behavior online and through facial recognition is so keen to strengthen consumer data protection. Beijing clearly doesn’t want to share power.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

No Fish and Chips: British ministers cut off funding to chip factory after sale to China -Reuters

UK Research and Investment (UKRI) has suspended grants to Newport Wafer Fab under government instructions after its sale to Nexperia, a Chinese-owned technology company. Earlier this month, when asked whether the sale of the semiconductor producer would go ahead to Chinese-owned Nexperia, Prime Minister Boris Johnson said he did not want to drive Chinese investment away from Britain because of "anti-China spirit."

Why it Matters:

Although PM Johnson said he didn’t want to discourage Chinese investment into the U.K., actions by the government to end grants does not support that sentiment. This will be a common theme moving forward as Chinese firms continue to buy up western firms in critical industries only to have preferable treatments changed or purchases outright blocked.

Electrification Policy:

New Sheriff in Town: Biden Names Tech Foe Jonathan Kanter as DOJ Antitrust Chief – Bloomberg

President Joe Biden plans to nominate Jonathan Kanter as head of the Justice Department’s antitrust division in the latest sign that the administration is preparing a broad crackdown on large technology companies. Kanter has “been a leading advocate and expert in the effort to promote strong and meaningful antitrust enforcement and competition policy,” the White House said in a statement.

Why it Matters:

If confirmed, Kanter would become one of the top antitrust officials in the U.S., along with FTC Chair Lina Khan. Kanter is closely aligned with Khan as well as Tim Wu, who was appointed as a White House adviser on technology and competition policy. Kanter’s nomination follows Biden’s signing of a sweeping executive order designed to promote competition across industries. We believe the market is not correctly pricing in the risks to monopolistic actors, especially big-tech, and expect significantly more negative regulatory headwinds.

Digital Trade: U.S.-Asia Digital Pact Held Up by Squabble Among Biden Officials – WSJ

National Security Council and State Department officials want to set rules for digital trade in Asia, which could include cross-border flows of information, digital privacy, and standards for the use of artificial intelligence in Asia. The proposed pact would be open to U.S. allies in the Asia-Pacific region. It would exclude China, similar to the approach the administration has taken on issues such as export controls on advanced technology. However, USTR is slowing the process as its priorities are elsewhere,

Why it Matters:

U.S. Trade Representative Katherine Tai is concerned about setting priorities in trade policy and maintaining what she calls a “worker-centered” approach. Opposingly, the National Security side wants to assert U.S. leadership in the region and that the digital-services pact would be a step in that direction. The skirmish over Asia trade comes as the administration tries to put together the economic portion of its China policy. Administration officials also say that leaders in the Asia-Pacific region continue to press the U.S. to join the Trans-Pacific Partnership. Lots going on in Indo-Pacific relations.

Commodity Super Cycle Green.0:

Not Biting: The World’s Biggest Miner Picks Profit Over Production - WSJ

Global miners are continuing to favor profit and investor returns over investment in new projects. The world’s top 40 miners are expected to report a combined net profit of roughly $118 billion in 2021, up from $70 billion in 2020 and $61 billion in 2019, making it one of the best years on record. On Tuesday, the world’s biggest mining company BHP backed up that message by forecasting a flat outlook for its output over the next 12 months.

Why it Matters:

Subdued production from large miners should support commodity prices so long as the global economic recovery holds up. But failing to invest in new projects means miners risk creating a shortfall of some commodities, particularly for materials such as cobalt, copper, and lithium used to make batteries, electric cars, and some renewable-energy products. As a result, we continue to believe we are in the beginning stages of a commodity supercycle, especially for green-orientated materials and (ironically) fossil fuels.

ESG Monetary and Fiscal Policy Expansion:

Meanwhile: What’s in Democrats’ $3.5 Trillion Budget Plan—and How They Plan to Pay for It – WSJ

Senate Democrats unveiled details last week for their $3.5 trillion bill targeting anti-poverty, education, and climate priorities. It will include paid family and medical leave, subsidized child care, broadening medicare benefits, an extension of an expanded child tax credit, universal prekindergarten, and affordable housing, among other issues. Democrats are also proposing a series of ideas to reduce carbon emissions in the electricity sector by 80% and economywide by 50% by 2030. Paying for the plan gets more challenging, but increases in the corporate and capital gains taxes are likely.

Why it Matters:

It's worth quickly revisiting what's in this bill. The Democrats won Georgia’s senate races thanks to the promise of more government support (Covid checks). The takeaway from results there and polls more generally is that most Americans want further social welfare benefits. The Democrats look to be doubling down on a political strategy to provide this. As a result, and thanks to the budget resolution process, it looks pretty likely we will see much of the above enacted, and it will likely be popular among voters.