MIDDAY MACRO - DAILY COLOR – 7/16/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, with the Nasdaq leading losses again following the NY-open

Treasuries are lower, with the long-end underperforming but recovering from overnight lows

WTI is flat, as sharp selling at the NY open quickly reversed

Analysis:

Equities have reversed overnight gains and are sitting near their lows of the week on a July Friday OPEX as the overall narrative seems to be a bit less clear, helping to keep Treasuries near the highs of their weekly range.

The Russell is outperforming the S&P and Nasdaq with Low Volatility, Small-Cap, and Value factors, and Utilities, Real Estate, and Health Care sectors all outperforming.

S&P optionality strike levels decreased with the zero gamma strike level moving lower to 4325 while the call wall remains at 4400; technical levels unchanged with support at 4335 and resistance at 4350, then 4400.

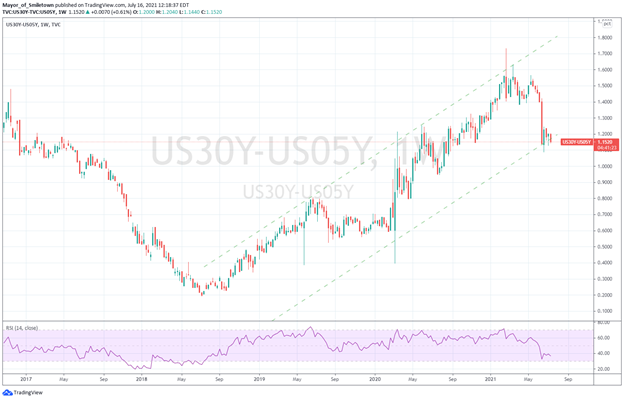

The Treasury curve continues to flatten with 10yr & 30yr yields again approaching recent lows.

Today’s Retail Sales data and this week’s data more generally did not change our belief that “peak growth” fears are misplaced, and growth lost due to unavailable supply in the 2nd quarter will move forward and create more of a plateauing of growth (at still high levels) over the 3rd quarter.

Supply-side disruptions both from logistics impairments and shortages of supplies, as well as the growing mismatch between hiring needs and available labor, were fully apparent in this week’s Industrial Production, Retail Sales, and Regional Fed’s Surveys releases this week.

The effects of these disruptions were also apparent in the higher than expected CPI and PPI data, with areas most affected by impairments dragging higher the overall index.

Bottom line, there still are no meaningful changes in the supply/demand mismatches we have highlighted for months, and as a result, this will continue to support growth and inflation moving forward.

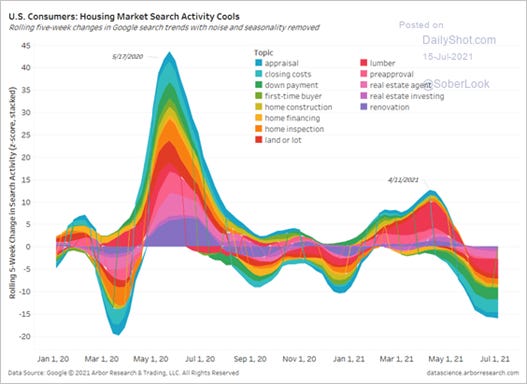

Next week will bring us a slew of housing data, which will potentially show a cooling as lower levels of pandemic-driven buying and increasing unaffordability coupled with low levels of inventories and higher building costs cap activity.

The heavy level of generally growth positive data, as well as the Chairman’s dovish two days of Congressional testimony this week, may give markets pause on the increasingly consensus “peak growth” and faster policy tightening views.

To be clear, we have yet to see this occur as the Treasury curve continues to flatten and, although potentially down on the week, growth has outperformed value for two months.

This means that even though the real data was positive this week, decreases in consumer sentiment today (discussed below) and investor sentiment more generally continue to push a more stealthy risk-off tone (even with the S&P near all-time highs) as stagflationary fears grow.

Econ Data:

Retail Sales increased 0.6% in June, beating expectations, and are higher 18% YoY. May’s monthly change was revised lower to -1.7% MoM. June’s gains were driven by increases in general merchandise (+1.9%), food (+0.6%), and apparel stores (+2.6%) spending, while eating and drinking establishments (+2.3) also notably increased. Auto sales were less of a drag than expected, decreasing -2% MoM.

Why it Matters: Sales gains were broad-based in June, and along with other data out this week, continue to show an economy that is running hot. Weakness in certain categories this month coupled with the downward revision to May’s data reinforces our view that consumer activity continues to be restrained by supply-side disruptions. Disrupted areas such as autos, building materials, and furniture are all weaker two months in a row now. With housing activity still robust, we believe that these areas will rebound as supply becomes more available.

Consumer sentiment from the University of Michigan’s Survey of Consumers posted a monthly decline of 5.5% in July, mainly due to less favorable prospects for the economy. This decline was caused by consumers “underestimating the economy's ability to reactivate supply lines, restore jobs, and the resulting higher inflation.” Rather than job creation, the accelerating inflation picture has now become a top concern.

Why it Matters: This was a somewhat concerning consumer survey report. Consumers' complaints about rising prices on homes, vehicles, and household durables reached an all-time record. However, as seen in the Retail Sales report, there is still no notable change in behavior due to the higher price levels ( and instead lack of supply is more impactful to growth). Moving forward, we will be closely watching whether the consumer becomes more defensive or increases spending to avoid inflationary erosion and benefit from buying-in-advance of increasing market prices.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is slightly outperforming on the week as retail data today supported value.

Chinese Iron Ore Future Price: Iron ore is higher on the week, as Chinese production continues to be limited by regulation.

5yr-30yr Treasury Spread: Curve is flatter on the week, as the long-end yields are approaching multi-month lows.

EUR/JPY FX Cross: Yen is higher on the week, and beginning to form a reversal trend.

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

More Coming: Port of Los Angeles predicts no let-up in US import boom – Port Technology

The Port of Los Angeles has predicted the pandemic-induced import surge will continue as its traffic grew by 27% YoY. Six months into the 2021 calendar year, overall cargo volume has increased 44% compared to the first half of 2020. “Even as Americans return to airline travel, vacations, and in-person events, retail sales and e-commerce remain robust,” said Gene Seroka, Executive Director, Port of Los Angeles.

Why it Matter:

Today's retail sale report supports comments made by Seroka, and we continue to believe that second-half growth will be higher than expected. This is due to pent-up demand continuing while supply-side impairments improve, uncapping growth. We will continue to highlight developments that support or refute this, such as activities at our nation's key ports.

Nuggets Needed: Popeyes Stockpiles Chicken Meat Ahead of Nationwide Nugget Debut - Blomberg

The stockpiling of chicken by Popeyes is a departure from the industry's typical lean-inventory strategy. It underscores the measures companies are taking to ensure steady supplies amid rising demand for dining out in the U.S. restaurants are reporting shortages and higher prices for chicken and other critical ingredients as supply chains struggle to catch up.

Why it Matters:

Chicken prices for producers jumped to an all-time high in May, gaining 2.1% in the eighth straight monthly increase. Processed poultry prices also increased in this week's June PPI report. With demand high and consumer spending surging, as well as the potential for increases in feed costs, we may see poultry inflation continue to fly high.

Relief: TSMC Expects Auto-Chip Shortage to Abate This Quarter – WSJ

The company is on track to increase the output of microcontrollers used in cars by about 60% this year. A shortage of semiconductors used in products including home appliances and smartphones has stymied manufacturing activity, notably in the auto industry. That shortfall should be greatly reduced for TSMC customers in the current quarter, CEO Wei said.

Why it Matters:

TSMC has pledged to spend $100 billion on increasing production over the next few years to meet surging demand for semiconductors. The company’s second-quarter net profit rose 11%, while revenue increased 20%. However, the firm’s operating margin fell 3.1%. Moving forward, the investment in new facilities and advanced technology, along with more expensive raw materials, will add to costs for TSMC’s clients, Mr. Wei said.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Data Wars: India bans Mastercard from adding new customers - TechCrunch

Reserve Bank of India has indefinitely barred Mastercard from issuing new debit, credit or prepaid cards to customers in the South Asian market over noncompliance with local data storage rules. This isn’t the first time India’s central bank has penalized a firm for noncompliance with local data-storage rules, which were unveiled in 2018 and mandated compliance within six months. The rules require payments firms to store all Indian transaction data within servers in the country.

Why it Matters:

A country’s citizens' data is a critical national security asset. As we have seen throughout history, vulnerable critical personal can be compromised and turned against the state. As a result, securing each citizen's data thwarts efforts by hostile actors to exploit personnel vulnerabilities. As a result, we continue to expect governments globally to take greater ownership and further regulate the private sector to domestically store data in a continuingly less cyber secure world.

Electrification Policy:

All About Your Data: Concern trolls and power grabs: Inside Big Tech’s angry, geeky, often petty war for your privacy - Protocol

Google announced last month that it would delay its plans to stop third-party cookies another year, to "give all developers time to follow the best path for privacy," a company blog post read. Last month, Google said that once third-party cookies are phased out, it would no longer use browsing history to target or measure ads or create "alternative identifiers" to replace cookies.

Why it Matters:

Nothing is free, and you pay for your online activity with your personal and browsing activity data. As big tech and government regulations restrict access to this data, the way “free” activity on the internet occurs will change. The article elaborates on the debate surrounding this change from the perspective of both the winners and losers.

Voices in Our Heads: Experimental Brain Implant Lets Man With Paralysis Turn His Thoughts Into Words – NPR

A man with speaking disabilties is currently limited to a vocabulary of just 50 words and communicates at a rate of about 15 words per minute. The ability comes from an experimental implanted device that decodes signals in the man's brain that once controlled his vocal tract, as researchers reported Wednesday in The New England Journal of Medicine. "This tells us that it's possible," says Edward Chang, a neurosurgeon at the University of California, San Francisco. "I think there's a huge runway to make this better over time."

Why it Matters:

So this is really happening. A device that allows people to communicate using brain circuits goes beyond helping those with disabilities. This technology, coupled with other wearable digital devices (such as VR and prosthetics), has significant military and commercial potentials. And yes, we are very early in the technologies development, but given the disruption potential to day-to-day life, we wanted to flag this development as something to keep on the radar.

Commodity Super Cycle Green.0:

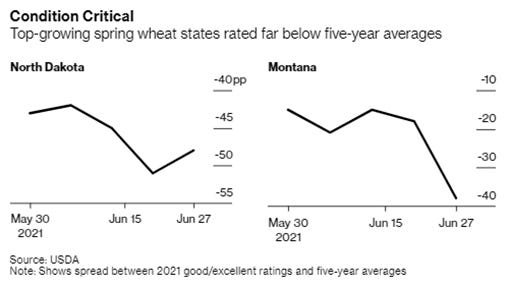

New Norms: Wild Weather Plagues North America Grain Crops as Demand Surges - Bloomberg

The U.S. and Canada are seeing unusual variability in climate, with some crops withering from severe heat and drought while others see flooding. Meanwhile, demand is surging as economies recover from the coronavirus pandemic, so much so that every grain counts. With output in major exporters like Brazil already diminished, the wild weather is contributing to more volatility in crop markets, with canola prices hitting a record and spring wheat at multiyear highs.

Why it Matters:

The world's climate is changing and getting more extreme, resulting in changing pockets of lushness and harsh dryness. As a result, certain farming areas are experiencing ideal growing conditions while others are severely impaired one season while not the next. This uncertainty makes future investment and ensuring food security harder. Technologies like indoor growing and genetically modified crops will grow as traditional farming yields potentially fall.